Official Transfer-on-Death Deed Document

Navigating the complexities of estate planning can seem daunting, but understanding the options available for passing on one’s property can relieve much of that burden. One tool in the estate planning toolkit is the Transfer-on-Death (TOD) Deed, a straightforward form that allows homeowners to designate a beneficiary to inherit their real property upon their death without the property having to go through probate. This means that when the property owner passes away, their home can pass directly to their named beneficiary quickly and without the need for court intervention. The TOD Deed, which is only operational upon the death of the property owner, ensures that the property doesn’t become tangled in lengthy and often costly probate proceedings, offering a sense of peace and certainty for both the property owner and the beneficiary. Despite its benefits, it’s important for property owners to understand how the TOD Deed fits within their broader estate planning strategy and to be mindful of the legal requirements and implications in their specific state to make the most out of this estate planning tool.

State-specific Information for Transfer-on-Death Deed Forms

Document Example

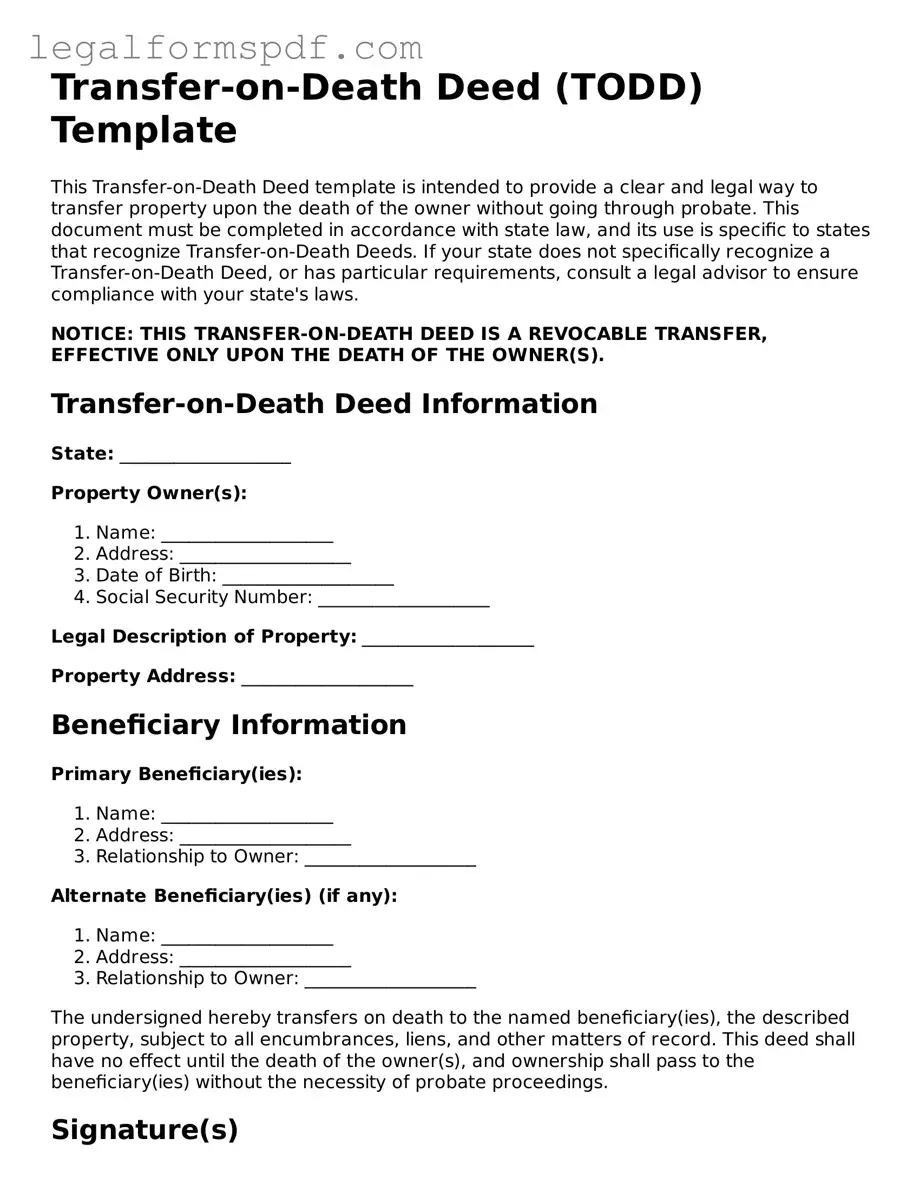

Transfer-on-Death Deed (TODD) Template

This Transfer-on-Death Deed template is intended to provide a clear and legal way to transfer property upon the death of the owner without going through probate. This document must be completed in accordance with state law, and its use is specific to states that recognize Transfer-on-Death Deeds. If your state does not specifically recognize a Transfer-on-Death Deed, or has particular requirements, consult a legal advisor to ensure compliance with your state's laws.

NOTICE: THIS TRANSFER-ON-DEATH DEED IS A REVOCABLE TRANSFER, EFFECTIVE ONLY UPON THE DEATH OF THE OWNER(S).

Transfer-on-Death Deed Information

State: ___________________

Property Owner(s):

- Name: ___________________

- Address: ___________________

- Date of Birth: ___________________

- Social Security Number: ___________________

Legal Description of Property: ___________________

Property Address: ___________________

Beneficiary Information

Primary Beneficiary(ies):

- Name: ___________________

- Address: ___________________

- Relationship to Owner: ___________________

Alternate Beneficiary(ies) (if any):

- Name: ___________________

- Address: ___________________

- Relationship to Owner: ___________________

The undersigned hereby transfers on death to the named beneficiary(ies), the described property, subject to all encumbrances, liens, and other matters of record. This deed shall have no effect until the death of the owner(s), and ownership shall pass to the beneficiary(ies) without the necessity of probate proceedings.

Signature(s)

I/We, the undersigned owner(s), declare that I/we execute this document as my/our TRANSFER-ON-DEATH DEED, dated this _____ day of _______________, 20__.

Owner's Signature: ___________________

Date: ___________________

Owner's Signature (if co-owned): ___________________

Date: ___________________

State of ___________________

County of ___________________

This document was acknowledged before me on (date) ___________________ by (name(s) of signer(s)) ___________________.

Notary Public: ___________________

My commission expires: ___________________

This Transfer-on-Death Deed must be recorded with the county recorder's office prior to the owner's death in order to be effective.

Please note: This template is provided for general informational purposes and should not be considered legal advice. Consult a legal advisor in your state to ensure this document meets all legal requirements and is suitable for your specific needs.

PDF Specifications

| Fact | Description |

|---|---|

| Definition | A Transfer-on-Death (TOD) Deed allows property owners to name a beneficiary who will inherit their property after their death, without needing to go through probate court. |

| Revocability | The property owner can change their mind and revoke a TOD Deed at any time before their death, without needing the beneficiary's consent. |

| Beneficiary Rights | The beneficiary has no legal rights to the property until the owner's death. |

| State-Specific Forms | TOD Deeds are governed by state law, and the requirements, as well as the effectiveness of these deeds, vary by state. |

| Probate Avoidance | One of the main benefits of a TOD Deed is that it allows the property to bypass the probate process, facilitating a smoother and faster transfer to the beneficiary. |

Instructions on Writing Transfer-on-Death Deed

Filling out a Transfer-on-Death (TOD) Deed form enables property owners to designate a beneficiary who will receive the property upon the owner’s death, bypassing the often lengthy and costly probate process. This legal document offers a straightforward way to manage the transfer of real estate assets. Completing this form correctly is crucial to ensure its validity and to convey your property according to your wishes. Follow these steps to accurately fill out a TOD Deed form.

- Start by entering the date at the top of the form. This indicates when the TOD deed is being executed.

- Next, fill in your full legal name as the grantor – the person currently owning the property and executing the TOD deed.

- Identify the designated beneficiary(ies) with their full legal names and addresses. These are the person(s) who will receive the property upon your death.

- Provide a legal description of the real estate property. This includes the address, and may also include the legal lot, subdivision, and any other information that uniquely identifies the property. You can find this information on your current deed or property tax bill.

- Verify that all information provided is accurate and reflects your wishes. The TOD deed must accurately describe the property and the intended beneficiary to be effective.

- Sign and date the form in the presence of a notary public. The TOD deed is not valid unless it is properly notarized.

- Finally, file the completed and notarized TOD deed with the appropriate county recorder’s office where the property is located. This step is essential for the TOD deed to be legally effective and recognized.

After these steps are completed, the TOD deed will be in effect. It is important to keep a copy of the filed document for your records and to inform the designated beneficiary of the TOD deed. Remember, the TOD deed can be revoked or changed at any time before the grantor's death, as long as the changes are completed following the legal requirements.

Understanding Transfer-on-Death Deed

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TODD) is a legal document that allows individuals to designate a beneficiary, or beneficiaries, who will inherit their real property upon the individual's death without the need for probate. It is completed and recorded with the county recorder's office while the property owner is still alive.

How does a Transfer-on-Death Deed differ from a traditional will?

Unlike a traditional will, a Transfer-on-Death Deed is specifically designed for the transfer of real estate and does not go through probate. This means that the property can be transferred to the beneficiary more quickly and with fewer legal hurdles. However, a traditional will can cover a broader range of assets beyond real estate.

Can a Transfer-on-Death Deed be revoked or changed?

Yes, as long as the property owner is alive and competent, they can revoke or change a Transfer-on-Death Deed. This can be done by preparing and recording a new deed that revokes the previous one or designates a new beneficiary. It's important to ensure that any changes are properly recorded to be legally effective.

What happens if the designated beneficiary predeceases the property owner?

If the designated beneficiary on a Transfer-on-Death Deed dies before the property owner, the deed usually becomes ineffective unless an alternate beneficiary is named. The property owner should then execute a new Transfer-on-Death Deed naming a new beneficiary to ensure that the property is transferred according to their wishes upon their death.

Are there any tax implications for using a Transfer-on-Death Deed?

The tax implications for using a Transfer-on-Death Deed can vary. In general, the beneficiary may be responsible for estate or inheritance taxes, depending on the laws of the state where the property is located. Additionally, the value of the property at the time of the owner's death may be reflected in the beneficiary's basis for capital gains tax purposes. It is advisable to consult with a tax professional to understand the specific implications.

Do all states recognize Transfer-on-Death Deeds?

Not all states recognize Transfer-on-Death Deeds. As of now, a majority of states have adopted statutes that allow for the use of TODDs, but it is important to verify whether your state is one that permits them. Laws can change, so it's also wise to consult with a legal professional in your area.

What steps should be taken to create a valid Transfer-on-Death Deed?

To create a valid Transfer-on-Death Deed, it is necessary to comply with the specific legal requirements of your state. This typically includes drafting the deed with specific language, including the legal description of the property, naming the beneficiary clearly, and having the deed signed and notarized. Finally, the deed must be recorded with the county recorder's office where the property is located. Consulting with a legal professional to ensure that all steps are properly followed is highly recommended.

Common mistakes

One common mistake when filling out the Transfer-on-Death Deed form is not verifying the legal description of the property. Many people simply write the address, assuming it suffices. However, the legal description may include lot, block, and subdivision names, which are critical for accurately identifying the property. This can lead to confusion and potential disputes about what property is actually being transferred upon death.

Another error often made is neglecting to name an alternate beneficiary. While it's natural to choose a primary beneficiary, circumstances can change, and the primary beneficiary might predecease the grantor. If no alternate beneficiary is named, the property could end up going through probate, defeating the purpose of the Transfer-on-Death Deed, which aims to bypass the probate process.

Individuals sometimes forget to sign the document in the presence of a notary. This oversight might seem minor, but it's a crucial step for the deed to be valid. The notarization process verifies the identity of the signer and confirms that the signature was made willingly and without duress. Without notarization, the deed may not be legally enforceable.

A frequent oversight is failing to file the deed with the county recorder's office. Simply completing and signing the form is not enough; it must be officially recorded to be effective. This step ensures that the transfer on death is recognized and the beneficiary can take ownership smoothly upon the grantor's death.

People often misunderstand the impact of debts and liens on the property. A Transfer-on-Death Deed transfers property to a beneficiary, but it does not necessarily free the property of debts or liens. Beneficiaries receive the property subject to these encumbrances, which can significantly affect the value of the inheritance.

Some individuals attempt to use the form for properties located in states that do not recognize Transfer-on-Death Deeds. Laws regarding these deeds vary significantly from state to state, and not all states have adopted laws that allow for the use of Transfer-on-Death Deeds. This mistake can result in the transfer being invalidated and the property having to go through probate.

Last but not least, a mistake made is not discussing the plan with the named beneficiary. While not a legal requirement, communicating your intentions with the beneficiary can prevent surprises and potential conflicts among heirs. It allows the beneficiary to understand their rights and responsibilities regarding the property ahead of time.

Documents used along the form

When planning for the future of one's estate, a Transfer-on-Death (TOD) Deed can be an essential tool, simplifying the process of passing real estate to a beneficiary without the need for probate. However, to ensure a comprehensive approach to estate planning, several other forms and documents might be used alongside a TOD Deed. Each document plays a vital role in ensuring that one's wishes are carried out smoothly and efficiently. Here's a list of some of the most commonly used forms and documents in conjunction with a TOD Deed.

- Last Will and Testament: This is a crucial document that outlines how one’s assets should be distributed after death. Even with a TOD Deed in place, a Will covers any assets not included in the TOD Deed.

- Durable Power of Attorney: This legal document allows someone else to manage your affairs if you become incapacitated. It can cover both financial and health care decisions, depending on how it is set up.

- Health Care Proxy: Also known as a medical power of attorney, this document grants someone authority to make health care decisions on your behalf if you're unable to do so.

- Living Will: This outlines your wishes regarding medical treatment in situations where you cannot communicate your decisions. It often includes your preferences about life support and other critical medical care.

- Revocable Living Trust: A trust can help manage your assets while you are alive and distribute them after your death. While similar to a TOD Deed for real estate, it can cover a broader array of assets.

- Beneficiary Designations: Forms for retirement accounts, life insurance policies, and other financial accounts to designate beneficiaries directly, bypassing the probate process similarly to a TOD Deed.

- Letter of Intent: A document that provides additional instructions or wishes that aren't legally binding but can guide executors and beneficiaries in managing your estate.

- Funeral Directives: These instructions can be standalone documents or part of your will, detailing your wishes for your funeral arrangements and the handling of your remains.

- Property Inventory List: A comprehensive list of valuable personal and real property not covered under the TOD Deed, which can be referenced in a will or trust.

Together with a TOD Deed, these documents provide a robust framework for estate planning, ensuring that all aspects of one’s financial and personal wishes are respected and followed. Utilizing these tools, individuals can create a clear and effective estate plan that eases the burden on loved ones and ensures that their legacy is preserved according to their wishes.

Similar forms

One document similar to the Transfer-on-Death (TOD) Deed form is a Last Will and Testament. Like a TOD deed, a Last Will dictates the distribution of an individual's assets upon their death. However, while a TOD deed is specifically for real estate and automatically transfers property to a named beneficiary without going through probate, a Last Will covers a broader range of assets and must go through probate before beneficiaries can inherit.

A Living Trust is another document akin to the TOD Deed form. Both allow for the transfer of assets upon the grantor's death and can help avoid the time-consuming and costly probate process. However, a Living Trust is more comprehensive, enabling a person to manage their assets during their lifetime and designate successors for various types of property, not just real estate.

The Beneficiary Deed, which is used in some states, closely resembles the TOD Deed form. Both documents allow a property owner to name someone to inherit real estate upon their death, avoiding probate. The primary difference is terminological; the term "Beneficiary Deed" is preferred in certain jurisdictions, while "Transfer-on-Death Deed" is used in others.

A Payable-on-Death (POD) account designation is akin to a TOD Deed form but for bank and financial accounts. It allows an account holder to designate a beneficiary who will receive the assets in the account upon the holder's death, bypassing probate. While a TOD Deed concerns real estate properties, a POD designation applies to financial assets.

Finally, the Joint Tenancy with Right of Survivorship agreement shares similarities with the TOD Deed form, as it facilitates the transfer of property upon death. In a Joint Tenancy, when one owner dies, their interest in the property automatically passes to the surviving owner(s), bypassing the probate process. However, unlike a TOD Deed, which involves a sole owner naming a beneficiary, a Joint Tenancy involves shared ownership from the start.

Dos and Don'ts

When preparing a Transfer-on-Death (TOD) Deed, certain practices can significantly impact the process, ensuring clarity and avoiding potential legal complications. Here is a concise list of actions to embrace and avoid for a smooth transaction:

Do:

- Correctly identify the property by including the legal description found on your deed. This description avoids any ambiguity regarding the property being transferred.

- Ensure the beneficiary’s name is spelled correctly and matches their legal identification to prevent any disputes or confusion over who the intended beneficiary is.

- Sign the deed in the presence of a notary public to ensure it is legally binding and recognized by law.

- File the deed with the county recorder's office where the property is located to make it effective. Until recorded, the deed may not be recognized as valid.

- Consult with a legal professional if there is any uncertainty about how to fill out the deed correctly to avoid costly mistakes or omissions that could affect the transfer.

Don't:

- Leave any sections incomplete. Every field on the form should be filled out to ensure the deed’s validity and prevent any legal challenges.

- Add or alter terms after the deed has been notarized. Any changes made after notarization could invalidate the document.

- Forget to consider how this deed fits into your broader estate plan. A TOD deed is just one part of managing your assets for the future.

- Mistake a TOD deed for a substitute for a will or living trust. While useful, it does not replace these documents and their broader estate planning functions.

- Ignore state-specific requirements. Some states have unique rules regarding TOD deeds, so it is vital to ensure compliance with local laws.

Misconceptions

Transfer-on-Death (TOD) Deeds allow property owners to designate beneficiaries who will inherit their property without the need for probate court proceedings upon their death. Despite their utility, there are several common misconceptions about TOD Deeds that need to be clarified.

- It replaces a will: A common misconception is that a TOD Deed can replace a will. While it can transfer real estate, it does not cover other personal assets or provide directions for guardianship or other wishes that a will can.

- It avoids all taxes: Another misconception is that property transferred through a TOD Deed avoids all taxes. Beneficiaries may still be responsible for estate or inheritance taxes, depending on the state and the value of the estate.

- It's irreversible: Some believe once a TOD Deed is executed, it cannot be changed. In reality, the property owner can revoke or modify the deed as long as they are mentally competent to do so.

- It's available in all states: Not all states recognize TOD Deeds. The availability and regulations surrounding these deeds vary significantly from one state to another.

- It provides immediate transfer of property: A misconception is that the property is transferred immediately upon execution of the deed. The transfer actually occurs upon the death of the property owner.

- It's a tool for managing complex estates: While TOD Deeds can be a valuable estate planning tool, they may not be the best option for those with complex estates or wishes, such as conditions on the property use or multiple beneficiaries with varying interests.

- It automatically circumvents probate: While TOD Deeds can help avoid probate for the specific asset it covers, it does not eliminate the need for probate on other assets that are not designated by such a deed or other beneficiary designations.

- Beneficiaries can't be changed: Contrary to some beliefs, the property owner can change the beneficiary or beneficiaries as long as the deed allows for it and the owner is competent to make such changes.

- It's free of creditor claims: Some people mistakenly believe that property transferred via a TOD Deed is not subject to creditor claims. Beneficiaries may still face claims against the property for debts of the deceased.

Key takeaways

When dealing with estate planning, one tool that often comes into play is the Transfer-on-Death (TOD) Deed form. This document allows property owners to designate beneficiaries to receive their property upon death, without the need for the property to go through probate. Here are key takeaways to understand when filling out and using the Transfer-on-Death Deed form:

- Eligibility: Not all states recognize the Transfer-on-Death Deed. Before proceeding, ensure that it is a legally accepted option in your state. This is crucial because the effectiveness of the TOD deed is governed by state law.

- Property Type: The TOD deed typically applies to real estate only. This means it can be used for homes, buildings, and land. Understanding the type of properties that can be included will guide you in making an effective estate plan.

- Beneficiary Designation: Clearly identifying the beneficiary or beneficiaries is essential. If more than one beneficiary is named, include instructions on how the property should be divided. Ambiguities in beneficiary designation can lead to disputes or legal challenges after the property owner's death.

- Revocability: The Transfer-on-Death Deed is revocable. This means that the property owner can change their mind at any point during their lifetime. They can modify or revoke the TOD deed without needing consent from the named beneficiary.

- Execution Requirements: Like any legal document, the TOD deed must meet specific requirements to be valid. These typically include the property owner’s signature, attestation by witnesses, and notarization. Check your state's specific requirements to ensure your deed is legally binding.

- Filing: After completion, the TOD deed must be filed with the appropriate local government office, such as the county recorder or land records office. Filing is a critical step to validate the deed and officially record the intended transfer upon death.

- Impact on Probate: One of the primary benefits of a TOD deed is its ability to bypass the probate process for the property specified in the deed. This can save time and money for the beneficiaries, as probate can be a lengthy and costly process.

- No Impact on Current Ownership: Using a TOD deed does not affect the property owner's current rights and control over the property. The owner retains the ability to use, rent, sell, or mortgage the property as before. The transfer of ownership only occurs upon the death of the owner, ensuring they maintain complete control over the property during their lifetime.

Understanding these key aspects of the Transfer-on-Death Deed can help individuals effectively plan for the future of their estate. It's a powerful tool that provides clear benefits in terms of simplifying the transfer of property upon death. However, given the legal and procedural nuances involved, it may be wise to consult with a legal professional specializing in estate planning to ensure the TOD deed is correctly executed and fulfills its intended purpose.

Consider More Types of Transfer-on-Death Deed Forms

Wuick Claim Deed - It's a favored tool for modifying interest in property without complex legal procedures.

Sample Deed in Lieu of Foreclosure - This document records an agreement where a homeowner hands over their property to the mortgage holder to clear their debt.