Fillable Deed Document for Texas

In the realm of real estate transactions, the documentation used to transfer property rights can significantly impact the legality and smoothness of the process. Among such documents, the Texas Deed form stands out as a crucial legal instrument employed within the state of Texas. This form, pivotal in its function, facilitates the conveyance of ownership from one party to another. It encompasses various types, each tailored to meet different legal requirements and circumstances surrounding a property transaction. The form requires detailed information about the property being transferred, including legal descriptions and the identification of both the grantor and grantee. Not only does the form serve as a record of sale, but it also plays a critical role in the public recording of property ownership changes, ensuring legal protection and clarity for all parties involved. Understanding the nuances and legal implications of the Texas Deed form is essential for anyone involved in real estate transactions within the state.

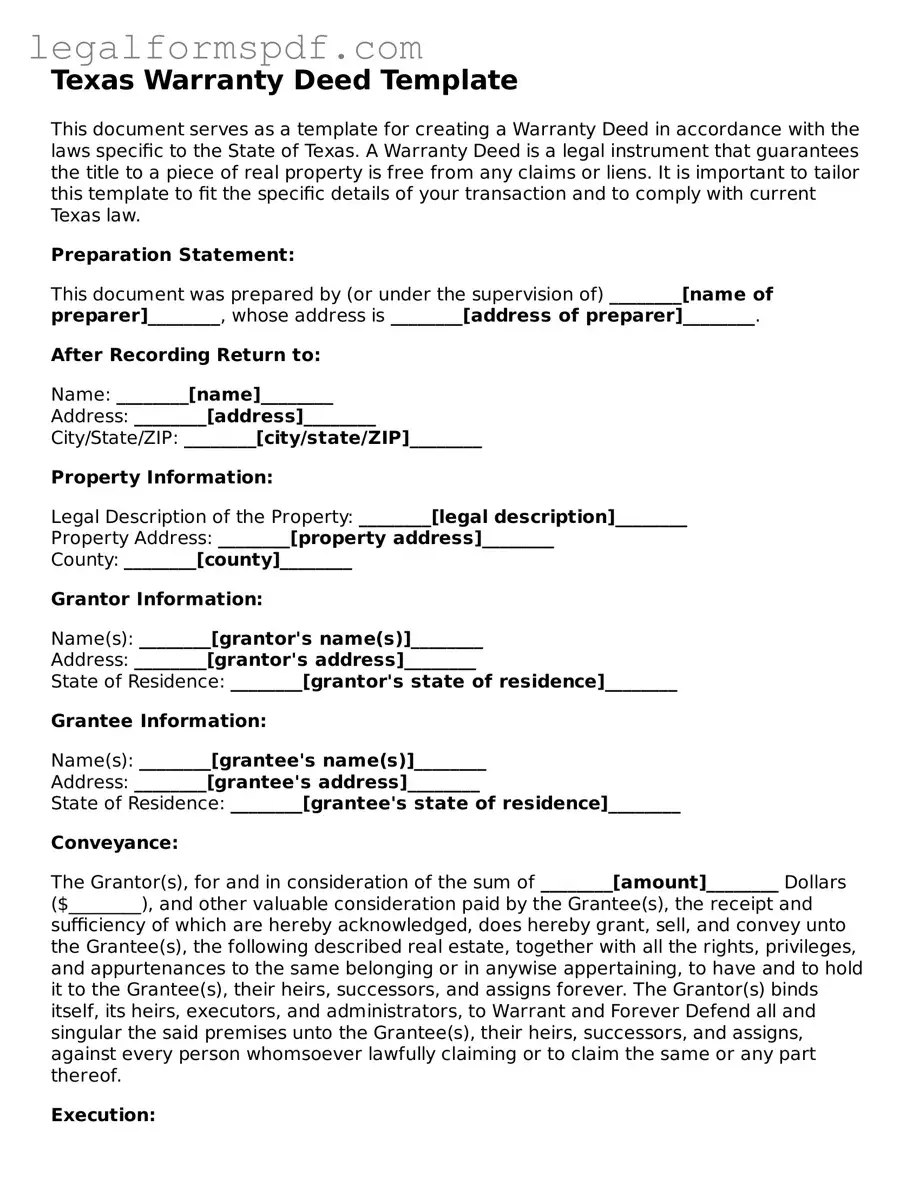

Document Example

Texas Warranty Deed Template

This document serves as a template for creating a Warranty Deed in accordance with the laws specific to the State of Texas. A Warranty Deed is a legal instrument that guarantees the title to a piece of real property is free from any claims or liens. It is important to tailor this template to fit the specific details of your transaction and to comply with current Texas law.

Preparation Statement:

This document was prepared by (or under the supervision of) ________[name of preparer]________, whose address is ________[address of preparer]________.

After Recording Return to:

Name: ________[name]________

Address: ________[address]________

City/State/ZIP: ________[city/state/ZIP]________

Property Information:

Legal Description of the Property: ________[legal description]________

Property Address: ________[property address]________

County: ________[county]________

Grantor Information:

Name(s): ________[grantor's name(s)]________

Address: ________[grantor's address]________

State of Residence: ________[grantor's state of residence]________

Grantee Information:

Name(s): ________[grantee's name(s)]________

Address: ________[grantee's address]________

State of Residence: ________[grantee's state of residence]________

Conveyance:

The Grantor(s), for and in consideration of the sum of ________[amount]________ Dollars ($________), and other valuable consideration paid by the Grantee(s), the receipt and sufficiency of which are hereby acknowledged, does hereby grant, sell, and convey unto the Grantee(s), the following described real estate, together with all the rights, privileges, and appurtenances to the same belonging or in anywise appertaining, to have and to hold it to the Grantee(s), their heirs, successors, and assigns forever. The Grantor(s) binds itself, its heirs, executors, and administrators, to Warrant and Forever Defend all and singular the said premises unto the Grantee(s), their heirs, successors, and assigns, against every person whomsoever lawfully claiming or to claim the same or any part thereof.

Execution:

IN WITNESS WHEREOF, the Grantor has signed and sealed this deed, on the date of ________[date]________.

Grantor's Signature: ________[grantor's signature]________

Printed Name: ________[grantor's printed name]________

State of Texas

County of ________[county]________

This document was acknowledged before me on ________[date of acknowledgment]________ by ________[name(s) of person(s)]________.

Notary's Signature: ________[notary's signature]________

Printed Name: ________[notary's printed name]________

My commission expires: ________[commission expiration date]________

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition of a Deed | A legal document transferring title or an interest in real property from one party to another. |

| Types of Texas Deeds | Includes Warranty Deeds, Special Warranty Deeds, and Quitclaim Deeds, each serving different purposes and levels of protection. |

| Governing Law | Texas deeds are governed by the Texas Property Code, which outlines the legal requirements for executing a valid deed. |

| Execution Requirements | Must be signed by the grantor(s), notarized, and, in some counties, may require additional witness signatures. |

| Recording | To be effective against third parties, the executed deed must be recorded in the county clerk’s office of the county where the property is located. |

| Consideration | A deed must state the consideration, whether monetary or otherwise, to inform the transaction's legitimacy and purpose. |

| Legal Capacity | Parties signing the deed must have the legal capacity to contract, ensuring the transfer is valid and enforceable. |

Instructions on Writing Texas Deed

When it comes time to transfer ownership of real estate in Texas, a deed form is an essential document. This legal instrument officially documents the transfer of the property title from the seller to the buyer. Although the process might seem complex, with careful attention to detail, anyone can complete it correctly. The steps outlined below are designed to guide you through filling out the Texas Deed form accurately, ensuring a smooth transition of property ownership. Make sure to have all necessary information readily available before you begin to avoid any delays.

- Gather the necessary information, including the legal description of the property, the names and addresses of the seller (grantor) and the buyer (grantee), and any specific terms of the property transfer.

- Enter the date of the deed at the top of the document.

- Write the full legal name and mailing address of the grantor(s) in the designated space.

- Provide the full legal name and mailing address of the grantee(s).

- Insert the legal description of the property. This description can often be found on the current deed or property tax documents. This section might include lot numbers, subdivision names, and any other details that legally identify the property.

- If there is any consideration being paid for the property (the purchase price), this amount should be clearly stated.

- Some deeds include specific warranties being offered by the seller regarding the title. Identify the type of deed being executed and any applicable warranties.

- The grantor(s) must sign the deed in the presence of a notary public.

- The deed must be filed with the county clerk in the Texas county where the property is located to officially record the transfer.

Completing the Texas Deed form is a critical step in the process of property transfer. By following these steps carefully, you can help ensure that the document is accurate and compliant with Texas law. Remember, while filling out the deed form is a doable task, consulting with a legal professional can provide guidance tailored to your specific situation, especially in complex cases. After the deed is filled out and filed, the property will be legally transferred, bringing the transaction to its conclusion.

Understanding Texas Deed

What is a Texas Deed form?

A Texas Deed form is a legal document used to transfer ownership of real estate in Texas from one person or entity (the grantor) to another (the grantee). The specifics of the form, such as the property description, the names of the parties involved, and the type of deed being executed, are essential for a valid transfer of property rights.

Are there different types of Deeds in Texas?

Yes, in Texas, there are several types of Deeds, each serving different purposes. The General Warranty Deed provides the grantee with the highest level of protection, guaranteeing against any past defects in title. The Special Warranty Deed offers limited protection, covering only the period during which the grantor owned the property. The Quitclaim Deed transfers any interest the grantor may have in the property without any warranties or guarantees. Choosing the correct type of deed depends on the circumstances of the property transfer and the level of protection desired.

What information is required to fill out a Texas Deed form?

To fill out a Texas Deed form, several pieces of information are necessary: the legal description of the property being transferred, the names and addresses of the grantor and grantee, the consideration (the value exchanged for the property), and the specific type of deed being executed. The form must be signed by the grantor and notarized to ensure its legality.

Do I need a lawyer to create a Texas Deed?

While it's not a legal requirement to have a lawyer create a Texas Deed, it's highly recommended. A lawyer can ensure that the deed complies with Texas law, address any complex issues related to the property transfer, and provide peace of mind that the deed accurately reflects the agreement between the parties. Given the significant legal and financial implications of transferring real estate, consulting a professional can be a wise choice.

How is a Texas Deed form finalized and effective?

A Texas Deed form is finalized once it's properly signed by the grantor, notarized, and, importantly, filed with the county recorder's office in the county where the property is located. Filing the deed is a critical step; until it's recorded, the transfer of ownership is not complete. Once filed, the deed becomes part of the public record, officially noting the change of ownership.

Can a Texas Deed be changed or revoked after it's filed?

Once a Texas Deed has been filed with the county recorder's office, it cannot be changed or revoked by the grantor unilaterally. Any modifications or revocations of the deed would require a new deed to be created and filed, reflecting the change. This process typically involves agreement from all parties affected by the original deed, highlighting the importance of ensuring accuracy and satisfaction with the terms before filing.

Common mistakes

In filling out the Texas Deed form, people often overlook the crucial step of providing complete and accurate legal descriptions of the property. This includes not only the street address but also the lot, block, and subdivision or the survey name and abstract number as recorded in the county records. Since the property's legal description is its unique identifier for legal purposes, inaccuracies or omissions can lead to disputes over property boundaries or even invalidate the deed.

Another common mistake is failing to specify the precise type of deed being executed. Texas recognizes several types of deeds, including general warranty deeds, special warranty deeds, and quitclaim deeds, each providing different levels of protection to the buyer. Failing to explicitly state the type of deed can lead to confusion over the rights conveyed and the warranties provided, if any, by the seller.

Many also mistakenly believe that a notary's acknowledgment is optional. However, for a deed to be valid and to put subsequent purchasers on notice, it must be acknowledged before a notary public or other individuals authorized by law to take acknowledgments. This means the signers of the deed must affirmatively acknowledge that they executed the deed as their voluntary act. A deed without this acknowledgment may face challenges when being recorded or may not be recorded at all, affecting the transfer of title.

There is also frequent confusion over the necessity of having all necessary parties sign the deed. If the property is owned jointly, as is often the case with spouses, then both must sign the deed to effectively transfer the property. Omitting a necessary party's signature can nullify the transaction, leaving the title to the property in question.

Finally, inadequate attention to the deed filing process constitutes a significant misstep. Once a deed is completed, it must be filed with the county recorder's office in the county where the property is located. Failure to properly record the deed does not necessarily invalidate it between the parties involved in the transaction but can jeopardize its enforceability against subsequent purchasers or creditors who do not have constructive notice of the transaction. Ensuring the deed is recorded promptly protects the buyer's interests and secures the chain of title.

Documents used along the form

When transferring property in Texas, the process is often supplemented by a collection of forms and documents besides the deed itself. These additional documents are essential in ensuring that the conveyance is legal, thorough, and in compliance with state and local regulations. They cover a range of purposes, from affirming the legal capacity of the parties involved to guaranteeing that the property's description is accurate and detailed. Understanding these forms can simplify the transaction process, making it more transparent and secure for all parties involved.

- Promissory Note: This document outlines the terms under which the buyer agrees to pay the seller for the property over time, if the purchase is not made outright. It includes information about the loan amount, interest rate, repayment schedule, and what happens in case of default.

- Loan Agreement: Similar to a promissory note, a loan agreement is a more detailed contract between the borrower and the lender (often a financial institution). It covers the terms of the mortgage loan being used to purchase the property, including collateral, late fees, and the consequences of failing to make payments.

- Property Tax Statements: These provide a record of the property taxes assessed and paid on the property. Buyers should review these statements to understand any outstanding obligations and the property's tax history.

- Title Insurance Policy: This document offers protection against financial loss from defects in title to real property. It ensures that the buyer receives clear title to the property, safeguarding against legal disputes over ownership.

- Closing Statement: Also known as a HUD-1 settlement statement, this document itemizes all the costs associated with the property transaction. Both the buyer and seller receive this document for review before finalizing the sale, ensuring transparency in the financial aspects of the transfer.

By considering these documents in conjunction with the Texas Deed form, parties to a real estate transaction can ensure they are fully informed and prepared for property transfer. These documents collectively provide a clear picture of the financial, legal, and administrative details of the transaction, helping to prevent misunderstandings and disputes. It's always advisable for individuals to consult with real estate professionals or legal advisors to navigate the complexities of these documents and the transfer process itself.

Similar forms

A Warranty Deed is one document that bears similarity to the Texas Deed form. This type of deed guarantees that the property title is clear and the seller has the right to sell the property. It provides the strongest level of protection for the buyer among all deed types because it explicitly warrants against any liens or claims on the property not disclosed in the deed. Both Warranty Deeds and Texas Deed forms serve the purpose of transferring property rights, but the former offers additional assurances regarding the state of the property title.

Another document comparable to the Texas Deed form is the Quitclaim Deed. Unlike the Warranty Deed, the Quitclaim Deed does not guarantee that the property title is clear of claims or that the property owner has the right to sell the property. It simply transfers whatever interest the seller has in the property, if any, to the buyer without any warranties. This makes it a common tool for transferring property between family members or into a trust, where the risk of title issues is minimal. Both the Quitclaim Deed and the Texas Deed form facilitate property transfer, albeit with different levels of protection for the buyer.

The Grant Deed is yet another document similar to the Texas Deed form. It falls somewhere between the Warranty and Quitclaim Deeds in terms of protection for the buyer. A Grant Deed transfers ownership and implies certain guarantees—that the seller has not already conveyed the title to another person, and that the property is not burdened with undisclosed encumbrances. Like the Texas Deed form, a Grant Deed is used to transfer an interest in real property, offering a moderate level of assurance to the buyer regarding the property's title.

Finally, a Trust Deed is similar to the Texas Deed form in that it involves the transfer of property, but its purpose and function differ significantly. A Trust Deed, also known as a Deed of Trust, involves three parties: the borrower (trustor), the lender (beneficiary), and the trustee. This document secures a loan on a property, giving the lender the right to take possession of the property if the borrower fails to comply with the terms of the loan agreement. While a Texas Deed form is used to transfer property rights, a Trust Deed establishes a lien on the property as security for the repayment of a debt.

Dos and Don'ts

When preparing to fill out the Texas Deed form, understanding the correct steps and avoiding common mistakes can significantly impact the process's smoothness and legal validity. Below are essential dos and don'ts to guide you through this process.

Do:

- Thoroughly review all provided instructions to ensure clarity on every requirement.

- Use black ink or type the information to maintain legibility and official appearance.

- Verify all parties' legal names and double-check spelling to prevent future disputes or confusion.

- Clearly specify the property description, adhering to legal standards for identifying real estate in Texas.

- Consult with a legal professional to understand the implications of different deed types (e.g., General Warranty, Special Warranty, Quitclaim).

- Ensure all parties involved sign the deed in the presence of a notary public to validate the form.

- File the completed deed with the appropriate county clerk's office to record the transfer officially.

Don't:

- Rush through the form without verifying each piece of information for accuracy.

- Overlook the requirement for notarization, as failing to do so will make the deed legally ineffective.

- Ignore the need to identify all relevant attachments that must accompany the deed form.

- Use vague or incorrect property descriptions that could invalidate the deed or cause legal disputes.

- Forget to check the local county requirements that may have specific rules for deed filing.

- Assume all responsibility for understanding legal jargon without seeking expert advice.

- Delay the filing of the deed with the county clerk, as this can impact the effective date of property transfer.

Misconceptions

Texas Deed forms are essential documents in the conveyance of property, but there exist several misconceptions about their use and legal implications. Correcting these misunderstandings is key to ensuring that property transactions are conducted properly and that both buyers and sellers are adequately protected under the law.

One size fits all. Many believe that a single Texas Deed form is suitable for all types of property transactions. In reality, Texas law recognizes various forms of deeds—such as general warranty, special warranty, and quitclaim deeds—each serving different purposes and providing varying levels of protection to the buyer.

Legal assistance is unnecessary. A common misconception is that preparing a deed is straightforward and doesn’t require legal guidance. While it's possible to create a deed without a lawyer, professional help ensures the document complies with Texas law, accurately reflects the agreement, and properly records the transaction.

Deeds and titles are the same. Another misunderstanding is equating deeds with titles. A deed is a legal document that transfers property from one person to another, while a title is a legal term that signifies ownership. One cannot obtain a title to property without a proper deed.

Filling in a form is enough. Simply completing a deed form does not complete the property transfer. The deed must be signed, notarized, and, most importantly, filed with the county clerk in the county where the property is located to be legally effective.

No consideration is needed. Some believe that a Texas Deed does not require consideration, meaning something of value must be exchanged. Although deeds can transfer property as a gift, mentioning consideration—whether nominal or significant—ensures the deed's validity and enforceability.

All debts transfer to the buyer. There's a false notion that when property is transferred, all associated debts automatically transfer to the buyer. Liens or mortgages tied to the property must be addressed in the deed or through separate agreements to ensure the buyer is not unjustly burdened.

Witnesses are mandatory for all deeds. While some states require witnesses for the execution of a deed, Texas law does not generally mandate witnesses for the signing of a deed. However, having a notary public acknowledge the signature(s) is crucial for recording purposes.

Electronic signatures are not valid. With the advent of digital technology, there’s a misconception that electronic signatures on deeds are not legally binding. Texas law recognizes electronic signatures, provided they meet specific requirements and the deed is properly filed.

A deed guarantees a clear title. Finally, people often mistakenly believe that a deed guarantees that the title is clear of liens or other encumbrances. A title search and title insurance are recommended to ensure the property is free from unseen legal issues.

Understanding these misconceptions and seeking knowledgeable assistance when dealing with Texas Deed forms can prevent legal issues and ensure a smooth property transaction process for all parties involved.

Key takeaways

When it comes to handling a Texas Deed form, understanding the process and requirements is crucial for a smooth transfer of property. Below are key takeaways that should be kept in mind:

- The correct type of deed must be chosen to match the specific situation and intentions behind the property transfer. Common types include General Warranty Deeds, Special Warranty Deeds, and Quitclaim Deeds, each providing different levels of protection and guarantees about the property's title.

- Accurate and complete information is essential for all parties involved in the transaction. This includes the precise legal description of the property, which is more detailed than just the address and can be found on previous deed documents or at the county recorder's office.

- The deed must be signed by the grantor(s) (the person or people selling or transferring the property) in the presence of a notary public. Depending on the deed type and local regulations, additional witnesses may also be required.

- Some counties in Texas may have specific requirements or forms that need to be included with the deed. It is important to check with the local county clerk’s office to ensure all necessary documents are prepared and submitted.

- Submitting the deed for official recording is a vital step. Once signed and notarized, the deed must be filed with the county recorder’s office where the property is located. This formalizes the transfer of ownership and is necessary for the deed to be legally binding.

- Consider consulting a professional if there's any uncertainty. Dealing with property and legal documents can be complex, and seeking advice from a legal professional or a real estate expert can prevent potential issues and ensure that the process adheres to all applicable laws and regulations.

By keeping these key points in mind, individuals can navigate the process of filling out and using a Texas Deed form more confidently and efficiently, ensuring a legitimate and successful property transfer.

More Deed State Forms

Quick Claim Deeds Georgia - Plays a key role in the legal and administrative aspects of property transactions.

Broward County Property Search by Owner Name - This form is an indispensable tool in real estate transactions, encapsulating the transfer's legal essence.

What Does a House Deed Look Like in Pa - It serves as the final step in the real estate transaction process, signifying the completion of the transfer.