Fillable Quitclaim Deed Document for Texas

In the realm of property transactions within Texas, the Quitclaim Deed form emerges as a pivotal document, though its application and implications are often misunderstood. Unlike traditional warranty deeds, a Quitclaim Deed does not guarantee the grantor holds a clear title to the property; instead, it merely transfers whatever interest the grantor may have in the property, if any, to the recipient without any warranties. This characteristic makes it a common tool in situations where property is transferred without a sale, such as within a family or between divorcing spouses. For individuals looking to streamline property transfer processes in Texas, understanding the nuances of the Quitclaim Deed, including its preparation, execution, and filing, is essential. Missteps in any of these areas can lead to complications, underscoring the importance of attention to detail and, in many cases, the advice of a legal professional. Though straightforward in concept, the Quitclaim Deed carries significant legal and financial implications, signaling the need for a thorough comprehension of its role and ramifications in property transactions.

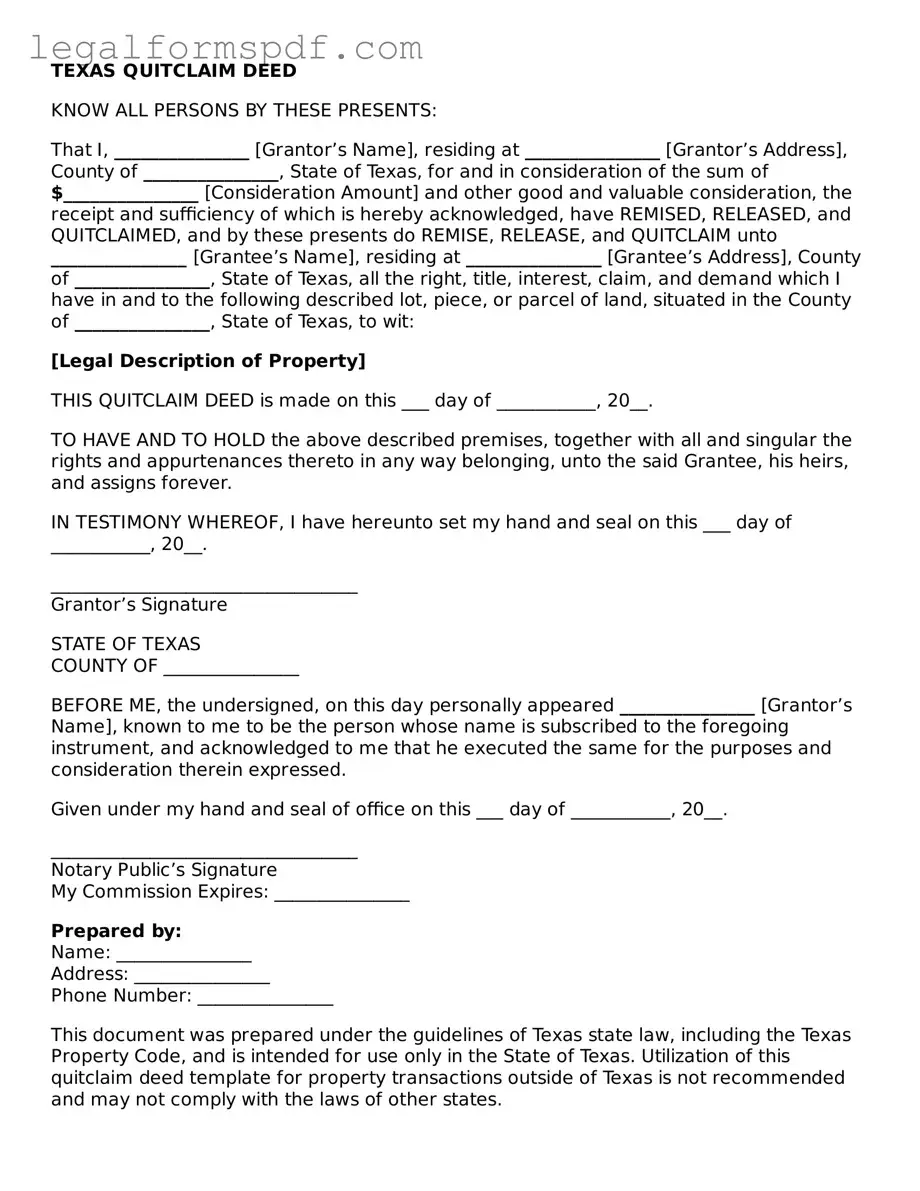

Document Example

TEXAS QUITCLAIM DEED

KNOW ALL PERSONS BY THESE PRESENTS:

That I, _______________ [Grantor’s Name], residing at _______________ [Grantor’s Address], County of _______________, State of Texas, for and in consideration of the sum of $_______________ [Consideration Amount] and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, have REMISED, RELEASED, and QUITCLAIMED, and by these presents do REMISE, RELEASE, and QUITCLAIM unto _______________ [Grantee’s Name], residing at _______________ [Grantee’s Address], County of _______________, State of Texas, all the right, title, interest, claim, and demand which I have in and to the following described lot, piece, or parcel of land, situated in the County of _______________, State of Texas, to wit:

[Legal Description of Property]

THIS QUITCLAIM DEED is made on this ___ day of ___________, 20__.

TO HAVE AND TO HOLD the above described premises, together with all and singular the rights and appurtenances thereto in any way belonging, unto the said Grantee, his heirs, and assigns forever.

IN TESTIMONY WHEREOF, I have hereunto set my hand and seal on this ___ day of ___________, 20__.

__________________________________

Grantor’s Signature

STATE OF TEXAS

COUNTY OF _______________

BEFORE ME, the undersigned, on this day personally appeared _______________ [Grantor’s Name], known to me to be the person whose name is subscribed to the foregoing instrument, and acknowledged to me that he executed the same for the purposes and consideration therein expressed.

Given under my hand and seal of office on this ___ day of ___________, 20__.

__________________________________

Notary Public’s Signature

My Commission Expires: _______________

Prepared by:

Name: _______________

Address: _______________

Phone Number: _______________

This document was prepared under the guidelines of Texas state law, including the Texas Property Code, and is intended for use only in the State of Texas. Utilization of this quitclaim deed template for property transactions outside of Texas is not recommended and may not comply with the laws of other states.

PDF Specifications

| Fact | Description |

|---|---|

| Governing Law | The Texas Property Code governs quitclaim deeds in Texas. |

| Purpose | Used to transfer property without any warranties regarding the title. |

| Recording Requirement | Must be filed with the County Clerk's office in the county where the property is located. |

| Notarization | The signature on the deed must be notarized for the document to be valid. |

| Consideration | A statement of consideration is not required but is recommended to be included. |

| After Recording | The original document should be returned to the grantee after recording. |

Instructions on Writing Texas Quitclaim Deed

When transferring property ownership in Texas, a Quitclaim Deed is often used to expedite the process, especially among family members or in situations where the property is not being sold for fair market value. Unlike other deeds, a Quitclaim Deed conveys only the interest that the grantor has in the property, without any warranty of title. It is crucial to fill out this form accurately to ensure the transfer is recognized legally. The following steps guide you through completing a Texas Quitclaim Deed.

- Begin by identifying the preparer of the document. Enter the full name and address of the individual completing the form.

- Specify the mailing address where the official records will send the recorded deed. This is often the address of the new property owner.

- Include the full legal name(s) of the grantor(s) (the current owner(s) of the property), along with their mailing address.

- State the name(s) and address(es) of the grantee(s) (the individual(s) receiving the property interest).

- Indicate the consideration. While Quitclaim Deeds often transfer property without a traditional sale, it is necessary to mention any money exchanged or the statement of love and affection, if applicable.

- Provide a legal description of the property. This information can be found on the current deed or property tax documents and must include lot numbers, subdivision names, and any other details that legally describe the property.

- Ensure the grantor(s) sign(s) the deed in the presence of a notary. This step is critical as it authenticates the identities of the parties involved.

- The final step is to file the completed Quitclaim Deed with the county clerk’s office in the county where the property is located. This action makes the document a matter of public record, officially documenting the transfer of interest.

Completing a Texas Quitclaim Deed requires attention to detail to ensure the accurate transfer of property rights. It is an effective tool for conveying interest in property but does not provide the grantee with any warranty on the title. Individuals are encouraged to consult a legal professional to understand fully the implications of using a Quitclaim Deed and to ensure the form is filled out correctly.

Understanding Texas Quitclaim Deed

What is a Texas Quitclaim Deed?

A Texas Quitclaim Deed is a legal document that allows a property owner to transfer their interest in a property to another party without making any warranties or guarantees about the property's title. This means the recipient receives whatever interest the grantor has in the property, which might be full ownership or none at all. It's commonly used among family members or to clear up title issues.

When should I use a Quitclaim Deed in Texas?

A Quitclaim Deed is appropriate in situations where property is being transferred without a traditional sale. Examples include transferring property between family members, adding or removing a spouse from the title, transferring property into a trust, or clearing up a cloud on the title. It is not recommended for use in transactions where the buyer expects a guarantee of clear title.

Does a Texas Quitclaim Deed guarantee clear title to the property?

No, a Texas Quitclaim Deed does not guarantee clear title. It transfers only whatever interest the grantor has in the property—if any—without making any representation or warranty about the title's validity or legal status. Buyers should conduct a thorough title search to understand any potential issues or limitations.

What information is required to complete a Texas Quitclaim Deed?

To complete a Texas Quitclaim Deed, you'll need to include accurate information about the grantor (the person transferring the property), the grantee (the recipient), the legal description of the property, the date of the transfer, and the conveyance consideration (if applicable, such as a dollar amount). Both the grantor and grantee must sign the deed, and it must be notarized and filed with the county clerk's office where the property is located.

How is a Texas Quitclaim Deed filed?

After the Quitclaim Deed is signed and notarized, it needs to be filed with the County Clerk's office in the county where the property is located. There may be a filing fee, which varies by county. The deed becomes part of the public record once filed, completing the transfer process.

Is a Quitclaim Deed in Texas the same as a warranty deed?

No, a Quitclaim Deed and a Warranty Deed serve different purposes. While a Quitclaim Deed transfers whatever interest the grantor has without any warranty, a Warranty Deed guarantees that the grantor holds clear title to the property and has the right to transfer it. A Warranty Deed offers greater protection to the buyer than a Quitclaim Deed does.

Can a Quitclaim Deed be revoked in Texas?

Once a Quitclaim Deed has been executed, notarized, and filed with the proper county clerk's office, it cannot be revoked without the consent of the grantee. If the grantee agrees to relinquish their interest back to the grantor, they would need to do so with another quitclaim or legal document.

What are the tax implications of transferring property using a Quitclaim Deed in Texas?

The tax implications for transferring property with a Quitclaim Deed can vary. Generally, if the property is transferred without any consideration, there might not be immediate tax implications, but it could affect the grantee's basis in the property for future sales or tax assessments. Property and gift taxes might also apply, depending on the circumstances. It is recommended to consult with a tax professional or attorney to understand the specific implications based on your situation.

Common mistakes

One common mistake individuals make when filling out the Texas Quitclaim Deed form is not double-checking the legal description of the property. This description is crucial because it delineates the exact boundaries and location of the property being transferred. Incorrect or vague descriptions can lead to disputes and complications in the property's title down the road. It’s essential that this information matches exactly what is on record to avoid any potential issues.

Another error often made is failing to use the correct legal names of the parties involved, both the grantor (the person transferring the property) and the grantee (the recipient). People sometimes use nicknames or omit middle names, which can lead to confusion about the deed's legality and enforceability. For a quitclaim deed to be legally binding, full legal names must be used as they appear on government-issued identification.

Not having the deed notarized is a significant oversight. In Texas, like in many other states, a quitclaim deed must be notarized to be valid. This step is vital as it confirms the identity of the parties signing the document and their understanding and willingness to participate in the transaction. A deed without this official stamp might not be recognized by the county clerk’s office or considered legally effective.

Many individuals mistakenly believe a quitclaim deed also releases them from their mortgage obligations. However, this type of deed only affects the title and ownership of the property, not any financial liabilities attached to it. Therefore, if a grantor has an existing mortgage on the property, they remain responsible for it even after the transfer. This misconception can lead to financial and legal complications.

Failing to file the quitclaim deed with the county clerk’s office promptly is another frequent error. Once the quitclaim deed is signed and notarized, it needs to be filed, or "recorded," with the clerk’s office in the county where the property is located. This step makes the transfer public record, which is crucial for the grantee's protection and the validity of the deed. Delaying this process can jeopardize the grantee’s claim to the property.

Some people neglect to verify whether any taxes or dues are outstanding on the property before completing the quitclaim deed. Overlooking this detail can result in the grantee assuming responsibility for unpaid taxes or homeowners’ association dues, which can be a significant financial burden. It’s wise to conduct a thorough investigation of the property's financial standing before proceeding with a quitclaim deed.

Incorrectly assuming that a quitclaim deed conveys a warranty of title is another common mistake. Unlike warranty deeds, quitclaim deeds do not guarantee that the grantor has clear title to the property. They simply transfer whatever interest the grantor has in the property, if any, without promising that the title is clear of liens or other encumbrances. This misunderstanding can lead to unexpected legal troubles for the grantee.

Overlooking the need for witness signatures, in addition to the notarization, is a slip-up that can make the deed legally void. While not all states require witnesses for the signing of a quitclaim deed, it's important to understand and comply with the specific requirements of Texas law, which might differ from those in other jurisdictions.

Using a generic quitclaim deed form without regard for Texas-specific provisions can invalidate the deed or cause legal complications. Texas laws have unique requirements for quitclaim deeds, and utilizing a one-size-fits-all approach without ensuring it meets state-specific criteria can be a grievous error. Customizing the deed to fit Texas statutes is essential for its legal effectiveness.

Last but not least, some people try to navigate the quitclaim deed process without seeking legal advice. This oversight can result in a flawed deed due to misunderstandings about the law or the specific requirements needed for a valid quitclaim deed in Texas. Consulting with a legal professional who is knowledgeable about Texas real estate law can help avoid these common mistakes and ensure that the quitclaim deed is correctly executed and recorded.

Documents used along the form

When engaging in property transactions in Texas, particularly when utilizing a Quitclaim Deed, various supplementary forms and documents often come into play. Each serves a distinct purpose, ensuring the process is thorough and legally sound. Below is a list of documents frequently used alongside the Texas Quitclaim Deed, providing a comprehensive approach to property transfer or adjustment.

- Warranty Deed – While a Quitclaim Deed transfers property without any warranties regarding the title's quality, a Warranty Deed does the opposite. It guarantees the seller holds a clear title to the property, offering more protection to the buyer against future claims.

- Property Disclosure Statement – This document requires the seller to disclose any known issues or defects with the property. It's an essential form that informs the buyer about the property’s condition, helping them make an informed decision.

- Title Search Report – Before transferring property, a Title Search Report is often obtained to verify the seller's right to transfer the property and identify any encumbrances like liens or easements that could affect the transaction.

- Loan Payoff Statement – If there's an existing mortgage on the property, a Loan Payoff Statement will be necessary. It outlines the remaining balance on the mortgage, ensuring all parties know what needs to be paid off at closing.

- Transfer Tax Declaration – Although Texas does not impose a state transfer tax on real estate transactions, some local governments may require a declaration. This document details the transaction for tax assessment purposes, if applicable.

Together, these documents play crucial roles in the conveyance process, offering clarity, protection, and legal compliance to all parties involved. Whether you're selling, buying, or simply adjusting property ownership, ensuring you have the right paperwork in order can streamline the process and prevent future disputes. Notably, while some documents provide security to the buyer, others ensure that the seller fulfills legal obligations, thereby solidifying the integrity of the transaction for both parties.

Similar forms

A Warranty Deed, much like a Texas Quitclaim Deed, is used in real estate transactions but offers more protection to the buyer. It asserts that the seller holds clear title to the property and has the right to sell it, guaranteeing the buyer against future claims to the property. While both documents are pivotal in the transfer of property ownership, the Warranty Deed ensures a safety net against liens or encumbrances not disclosed at the sale.

A Grant Deed also shares similarities with the Quitclaim Deed, as both serve the purpose of transferring property titles. However, a Grant Deed provides the recipient with two main guarantees: that the property has not been sold to someone else, and that the property is not burdened by undisclosed encumbrances. This makes the Grant Deed slightly more reassuring for the grantee than a Quitclaim Deed, which does not guarantee a clear title or claim to the property.

The Special Warranty Deed, while similar to the Quitclaim Deed in its function to transfer property rights, offers a limited warranty. This warranty covers only the period during which the seller owned the property, assuring that there have been no encumbrances during that time, unlike the Quitclaim Deed, which makes no such assurances. This document strikes a balance between the Quitclaim Deed's lack of guarantees and the full protection offered by a General Warranty Deed.

A Trustee’s Deed is another document used in property transactions, particularly when property is held in a trust. Similar to a Quitclaim Deed, it involves the transfer of property rights. However, the Trustee’s Deed is executed by a trustee rather than the property owner and typically guarantees that the trustee has the authority to sell the property, offering a bit more security to the buyer than a Quitclaim Deed.

The Deed of Trust represents a different aspect of property transactions. Like the Quitclaim Deed, it involves the transfer of real property but is used specifically for securing a debt with the property acting as collateral. While the Quitclaim Deed transfers ownership without warranties, the Deed of Trust involves a borrower, a lender, and a trustee, creating a lien on the property until the debt is paid.

A Fiduciary Deed is used to transfer property when the grantor is acting in a fiduciary capacity, such as an executor of an estate or a trustee. This deed is akin to the Quitclaim Deed in its purpose to convey title but differs in that it guarantees that the fiduciary has the authority to transfer the property. It offers a higher level of assurance to the grantee, similar to other deeds that provide warranties.

The Transfer on Death Deed (TODD) allows property owners to name beneficiaries who will inherit the property upon the owner’s death, bypassing probate. While it serves a completely different purpose from the Quitclaim Deed, it shares the characteristic of facilitating the transfer of property rights. However, the TODD is unique in that it does not take effect until the death of the property owner, and it allows the owner to retain full control over the property while alive.

Last, the Executor’s Deed is utilized during the process of settling an estate. This deed allows an executor or personal representative of the deceased to transfer property as specified in a will or by the court. It is similar to a Quitclaim Deed in terms of transferring property rights but is specifically geared towards the circumstances of dealing with an estate, providing assurance that the transfer is pursuant to the decedent’s wishes or legal requirements.

Dos and Don'ts

When filling out the Texas Quitclaim Deed form, it's important to follow best practices to ensure the process is completed correctly and efficiently. Here's a list of dos and don'ts to assist individuals in navigating this task.

Do:

- Review the entire form before you begin to understand what information is required.

- Ensure that the Grantor (the person transferring the property) and Grantee (the person receiving the property) are correctly identified with their full legal names and addresses.

- Use the legal description of the property from the current deed or property tax statement to avoid mistakes. This description includes the lot, block, and subdivision or the metes and bounds description.

- Check the county requirements where the property is located for any specific formatting or notarization requirements.

- Sign the deed in front of a notary public to validate the identity of the parties involved.

- Confirm that all parties involved understand that a quitclaim deed transfers only the ownership interest the Grantor has in the property, without any warranty of title.

- Make copies of the completed quitclaim deed for all parties involved.

- File the executed deed with the county clerk's office in the county where the property is located to make it official.

- Be prepared to pay any filing fees required by the county clerk’s office.

- Consult with a legal professional if there are any questions or concerns about the quitclaim deed process.

Don't:

- Fail to use the precise legal description of the property, as a general description could lead to disputes about what property was intended to be transferred.

- Overlook the importance of having the document notarized, as failure to do so can result in the deed being invalid.

- Assume that a quitclaim deed removes your responsibility for a mortgage or any other liens on the property. A quitclaim deed transfers only the owner's interest in the property and does not affect any debts or obligations secured by the property.

- Forget to verify that all necessary information is included and all sections of the form are completed. Incomplete forms may not be accepted by the county clerk.

- Delay in recording the deed with the appropriate county office, as this could affect the legal efficacy of the conveyance.

- Ignore local and state tax implications. It’s important to understand if the transfer will trigger any tax obligations.

- Assume the process is the same in every county. Local jurisdictions may have unique requirements.

- Mistake a quitclaim deed for a warranty deed. The two serve different purposes and offer different levels of protection to the Grantee.

- Overlook consulting with a professional if the situation is complex or if there are co-owners involved.

- Use outdated forms. Always ensure the form is current and meets Texas state requirements.

Misconceptions

Many people have misconceptions about the Texas Quitclaim Deed form. Understanding the facts can help you make informed decisions. Here are seven common misconceptions:

- Quitclaim deeds are the same across all states. Each state has its own requirements and specifications for quitclaim deeds. The Texas Quitclaim Deed form is tailored to meet Texas state law, which may differ significantly from the laws in other states.

- Quitclaim deeds guarantee a clear title. Unlike warranty deeds, quitclaim deeds do not guarantee that the property title is clear of liens or other encumbrances. They simply transfer whatever interest the grantor has in the property, which might be none at all.

- Quitclaim deeds can resolve property disputes. While they can be used to transfer interests in a property, quitclaim deeds are not a tool for resolving disputes or ensuring that the grantee has exclusive ownership rights.

- Filing a quitclaim deed changes who is responsible for the mortgage. Quitclaim deeds transfer property rights but do not affect mortgage liability. Unless the mortgage is formally assumed or refinanced, the original borrower remains responsible for the mortgage.

- Quitclaim deeds are only for transferring rights between strangers. In fact, quitclaim deeds are often used between family members or close acquaintances to transfer property without a formal sale.

- Using a quitclaim deed can help avoid taxes. While the transfer of property via a quitclaim deed may have tax implications, it does not inherently avoid taxes. Property taxes, capital gains taxes, and other tax considerations remain applicable.

- A quitclaim deed offers immediate protection. The effectiveness of a quitclaim deed depends on proper execution and recording. Until the deed is officially recorded with the appropriate county office in Texas, the transfer of interest is not fully enforceable.

Key takeaways

The Texas Quitclaim Deed form is a legal document used to transfer interest in real property from one person (the grantor) to another (the grantee) without any warranties. This means that the grantor does not guarantee that they own the property free and clear of any claims. Here are six key takeaways to consider when filling out and using this form in Texas:

- The form must be completed with accurate information about the grantor, grantee, and the property being transferred. This includes the full legal names of the parties involved and a detailed description of the property.

- It's crucial to understand that a Quitclaim Deed transfers only the interest the grantor has in the property, if any. There’s no guarantee that the title is clear or that the grantor has rights to the property to begin with.

- Signing requirements in Texas dictate that the Quitclaim Deed must be signed by the grantor in the presence of a notary public to be legally valid.

- The document needs to be filed with the County Clerk's Office in the county where the property is located. This step is necessary for the deed to be effective and to put the public on notice of the transfer.

- There may be filing fees associated with recording the Quitclaim Deed, which can vary by county. It’s advisable to check with the specific County Clerk's Office for the current fees and requirements.

- Using a Quitclaim Deed is most common among family members or close associates, as it’s often used to transfer property without a formal sale. Examples include adding or removing a spouse’s name from the title or transferring property to a trust.

When considering the use of a Texas Quitclaim Deed, individuals should carefully assess their situation and possibly consult with a legal professional. This ensures that this type of deed meets their needs and that the process is completed correctly.

More Quitclaim Deed State Forms

Florida Quit Claim Deed Rules - Its expedient nature allows for rapid changes to property ownership under specific conditions.

Quitclaim Form - It's a go-to document for rearranging real estate holdings among family members, especially in estate planning and settlement scenarios.