Fillable Quitclaim Deed Document for Pennsylvania

In Pennsylvania, property ownership can change hands in various ways, one of which involves using a Quitclaim Deed form. This document, crucial for certain real estate transactions, offers a simplified method for transferring property without the warranties typically provided in a traditional sale. While commonly used among family members or close associates to transfer property quickly, it's important for both parties involved to understand its implications fully. The form doesn't guarantee the grantor holds clear title to the property; it merely transfers whatever interest the grantor has at the time of the transfer. Given its specific characteristics, individuals considering this form of property transfer in Pennsylvania should be well-informed about its purpose, the process of completing and filing the document, and the potential ramifications of its use.

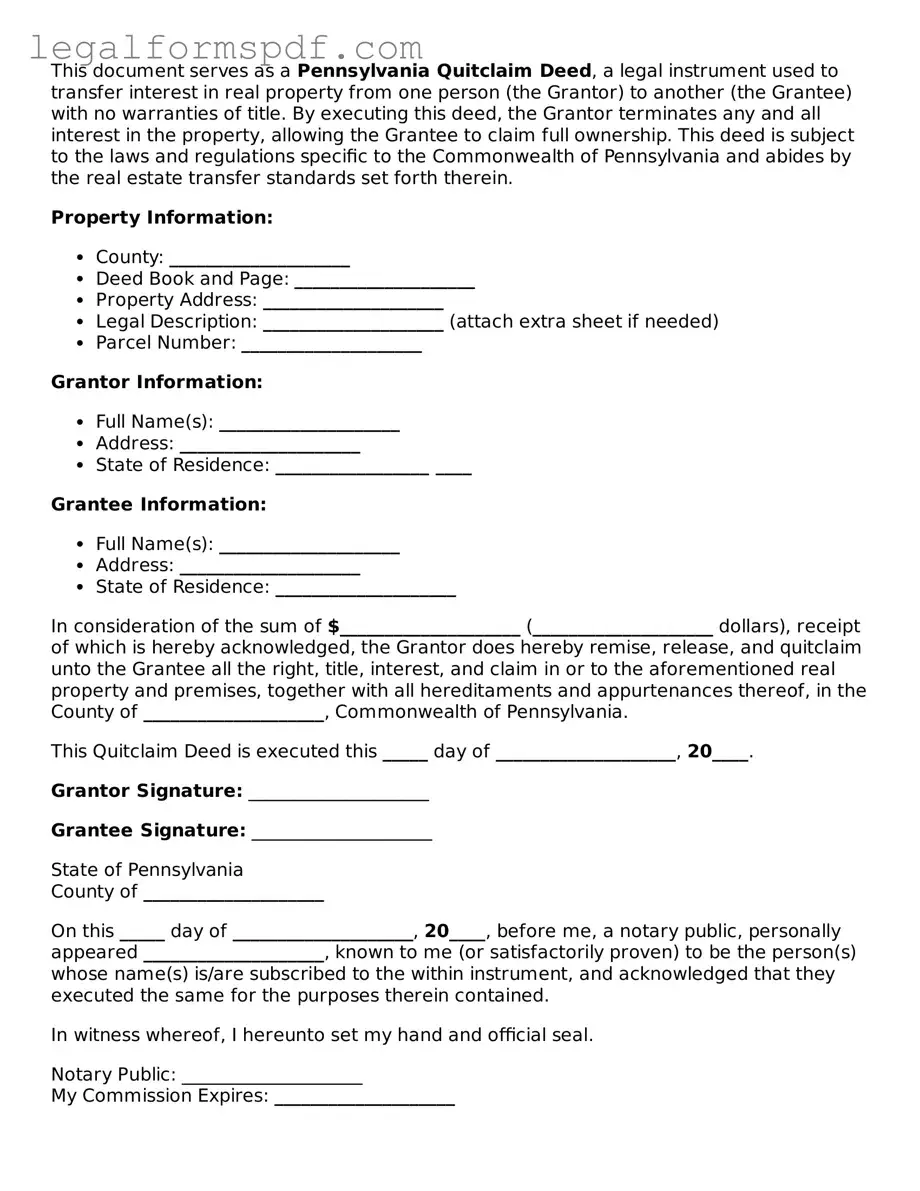

Document Example

This document serves as a Pennsylvania Quitclaim Deed, a legal instrument used to transfer interest in real property from one person (the Grantor) to another (the Grantee) with no warranties of title. By executing this deed, the Grantor terminates any and all interest in the property, allowing the Grantee to claim full ownership. This deed is subject to the laws and regulations specific to the Commonwealth of Pennsylvania and abides by the real estate transfer standards set forth therein.

Property Information:

- County: ____________________

- Deed Book and Page: ____________________

- Property Address: ____________________

- Legal Description: ____________________ (attach extra sheet if needed)

- Parcel Number: ____________________

Grantor Information:

- Full Name(s): ____________________

- Address: ____________________

- State of Residence: _________________ ____

Grantee Information:

- Full Name(s): ____________________

- Address: ____________________

- State of Residence: ____________________

In consideration of the sum of $____________________ (____________________ dollars), receipt of which is hereby acknowledged, the Grantor does hereby remise, release, and quitclaim unto the Grantee all the right, title, interest, and claim in or to the aforementioned real property and premises, together with all hereditaments and appurtenances thereof, in the County of ____________________, Commonwealth of Pennsylvania.

This Quitclaim Deed is executed this _____ day of ____________________, 20____.

Grantor Signature: ____________________

Grantee Signature: ____________________

State of Pennsylvania

County of ____________________

On this _____ day of ____________________, 20____, before me, a notary public, personally appeared ____________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public: ____________________

My Commission Expires: ____________________

PDF Specifications

| Fact Number | Detail |

|---|---|

| 1 | The Pennsylvania Quitclaim Deed does not guarantee the quality of the property title. |

| 2 | It transfers property rights from the grantor to the grantee without warranties. |

| 3 | Effective upon signing by the grantor and delivery to the grantee. |

| 4 | Recording the deed with the local county office is crucial for protection against claims. |

| 5 | Governed by Pennsylvania Consolidated Statutes, Title 21 P.S. Real and Personal Property. |

| 6 | A legal description of the property must be clearly indicated on the form. |

| 7 | Witnesses or notarization may be required, depending on county requirements. |

| 8 | The grantor's signature(s) must be acknowledged before a notary public if the deed is to be recorded. |

| 9 | The document requires payment of a Document Recording Fee, differing by county. |

Instructions on Writing Pennsylvania Quitclaim Deed

Filling out a Pennsylvania Quitclaim Deed form is a straightforward process if you know what you’re doing. This document is used when a property owner wants to transfer their interest in a property to someone else without making any guarantees about the property title. To make sure everything goes smoothly, you'll need to follow each step carefully. The process includes gathering necessary information, completing the form accurately, and then taking the right steps to make it official. Don’t worry; we will guide you through each step.

- Start by collecting all the necessary information, including the full legal names of both the grantor (the person selling or giving the property) and the grantee (the person receiving the property), the legal description of the property, and the parcel number. This information is crucial for accuracy and must match public records.

- Next, obtain a Pennsylvania Quitclaim Deed form. You can usually find this form online through legal sites or your local government website.

- Begin filling out the form by entering the date at the top. This indicates when the transfer is taking place.

- Write the grantor’s full legal name, followed by the grantee’s full legal name. Be very careful with spelling and use the names exactly as they appear in public records.

- Include the amount of money being exchanged for the property, if any. Even if there's no sale happening and the property is a gift, you might need to write “$1” or “no consideration” to comply with legal requirements.

- Add the legal description of the property. This description can be found on the current deed or by contacting your local county recorder’s office. It includes details like lot number, subdivision name, and measurements. A street address by itself is not enough.

- If applicable, include any special agreements or conditions of the transfer in the provided space. This step is often optional and may not apply to your situation.

- Have the grantor(s) sign the form in front of a notary public. The requirement for notarization helps prevent fraud and confirms that the grantor is transferring the property of their own free will.

- Make sure the notary public puts their seal on the deed, further validating the document.

- Lastly, file the completed form with the county recorder’s office where the property is located. There might be a filing fee, which varies by county.

After these steps are completed, the quitclaim deed process in Pennsylvania is essentially done. Keep in mind that each county might have small differences in how they handle filings or require additional forms. Always check with your local office to be sure you're in compliance with all local regulations. Once your deed is filed, the property transfer is official, and you have taken a big step in managing your property rights.

Understanding Pennsylvania Quitclaim Deed

What is a Quitclaim Deed in Pennsylvania?

A Quitclaim Deed in Pennsylvania is a legal document used to transfer a person's rights, if any, in a piece of property to another person, without guaranteeing the clear title of said property. Essentially, the person transferring the property (the grantor) makes no promises about the property's ownership status and is simply passing on whatever interest they may have to the recipient (the grantee).

When should I use a Quitclaim Deed in Pennsylvania?

Quitclaim Deeds are commonly used in Pennsylvania to transfer property within a family, such as between spouses or from parents to children, during a divorce settlement, or to clear up a title. They are also utilized in transactions where the property is gifted or transferred without a traditional sale.

Is a Quitclaim Deed in Pennsylvania the same as a Warranty Deed?

No, a Quitclaim Deed differs significantly from a Warranty Deed. A Warranty Deed includes guarantees from the seller about the clear title of the property and its freedom from any claims, such as liens or mortgages. In contrast, a Quitclaim Deed offers no such guarantees or warranties about the property’s title status.

What information is required on a Pennsylvania Quitclaim Deed?

To properly execute a Quitclaim Deed in Pennsylvania, you need the legal description of the property, the names and addresses of the grantor and grantee, and the deed must be signed by the grantor in front of a notary public. The deed then needs to be recorded with the county recorder's office where the property is located.

How do I file a Quitclaim Deed in Pennsylvania?

After ensuring the Quitclaim Deed is correctly filled out, signed, and notarized, it must be filed with the county recorder's office or registry of deeds in the county where the property is located. A recording fee will be required, and the amount can vary by county.

Is a notary required for a Quitclaim Deed in Pennsylvania?

Yes, for a Quitclaim Deed to be legally valid in Pennsylvania, it must be signed by the grantor in the presence of a notary public. The notary's seal or stamp is also necessary to officially notarize the document.

Can I use a Quitclaim Deed to transfer property to a trust in Pennsylvania?

Yes, in Pennsylvania, it is possible to use a Quitclaim Deed to transfer property from an individual to a trust. This is a common practice when individuals are managing their estate planning and wish to move their real estate assets into a trust.

Are there any tax implications with using a Quitclaim Deed in Pennsylvania?

Transferring property through a Quitclaim Deed can have tax implications, including potential realty transfer taxes unless specific exemptions apply. Additionally, there could be federal and state tax consequences for the grantor and grantee. It's advisable to consult with a tax professional to understand the full impact.

Does a Quitclaim Deed ensure I'm buying property free and clear of issues in Pennsylvania?

No, a Quitclaim Deed does not ensure that you are buying a property free from any issues regarding the title, liens, or other encumbrances. It only transfers whatever interest the grantor has in the property, if any, with no warranties. For full protection, a title search and Warranty Deed may be necessary to ensure clear ownership.

Common mistakes

When dealing with real estate transactions in Pennsylvania, such as transferring property rights without warranty, it's not uncommon for individuals to turn to a Quitclaim Deed form. Despite its supposed simplicity, the path to filling out this document is fraught with potential missteps that can lead to significant legal hiccups down the line. One common mistake is neglecting to provide a complete legal description of the property. Instead of merely noting the address, the form requires a detailed legal description, which could include lot numbers, boundary descriptions, and more, as found in the property's deed.

Another frequently encountered issue is failing to include the grantor's (the person transferring the property) full legal name and details. Similarly, forgetting the grantee's (the person receiving the property) full legal name and specifics can also derail the process. These details are crucial, and any discrepancy can invalidate the deed or complicate future transactions. Not securing a notary's services further complicates matters. In Pennsylvania, a notarized signature is mandatory for the document to be considered valid and legally binding. Skipping this step is not just a minor oversight; it's a fundamental flaw that could nullify the document.

Incorrectly listing the consideration or omitting it altogether is yet another pitfall. Though Quitclaim Deeds often involve transfers without a traditional sale, denoting the nature and amount, even if nominal or as a gift, is essential for tax purposes and legal clarity. Misunderstanding the role and necessity of witnesses provides additional challenges. In Pennsylvania, having witnesses to the signing beyond the notary may not be mandatory, but overlooking their potential significance, especially in contentious situations, could be a mistake.

Moreover, a common mistake is not filing the completed deed with the county recorder's office. Once all parties have signed the document, and it's been notarized, the final step in making the deed official involves recording it with the appropriate county. Failure to do this means the document doesn't officially transfer the property rights. Likewise, underestimating the importance of seeking legal advice can lead to dire consequences. Individuals often assume filling out a Quitclaim Deed is straightforward, but overlooking the complexities and potential legal ramifications of transferring property rights is a significant gamble.

Assuming that a Quitclaim Deed resolves all ownership issues is a misconception that often trips people up. This form of deed transfers only the interest the grantor has in the property at the time of the transfer, without guaranteeing clear title. Therefore, it’s vital to understand the limitations of what is being transferred. Lastly, not properly considering the tax implications of transferring property via a Quitclaim Deed can lead to unexpected surprises. Whether it's gift taxes or reassessments of property value, the financial impact of this seemingly simple document can be profound.

In summary, each of these mistakes underscores the importance of approaching the Quitclaim Deed process in Pennsylvania with care, attention to detail, and, when needed, professional guidance. By sidestepping these common pitfalls, parties can ensure smoother transactions and protect their rights and interests in the process.

Documents used along the form

In the realm of real estate transactions within Pennsylvania, the Quitclaim Deed form is a widely utilized document. This form facilitates the transfer of any interest in property from a grantor to a grantee without warranties regarding the quality of the title. However, to ensure a comprehensive and legally sound transaction, various other forms and documents often accompany the Quitclaim Deed. These additional documents serve to clarify, validate, and legally safeguard the transfer process.

- Statement of Value: This document provides a detailed statement regarding the value of the property being transferred. It is essential for assessing potential taxes and fees associated with the transfer. The Statement of Value must be filed with the Quitclaim Deed in certain situations, particularly when the deed is exempt from transfer tax or when the transaction value is not clearly stated on the deed itself.

- Real Estate Transfer Tax Declaration of Estimated Tax: This form is used to calculate and declare the amount of transfer tax due on the real estate transaction. It is a critical component for ensuring that the correct amount of tax is paid to the state and, if applicable, local municipalities.

- Parcel Identification Number (PIN) Form: The PIN is essential for identifying the specific piece of land being transferred. This form ensures that the property's precise location and boundaries are accurately recorded in public records.

- Property Disclosure Statement: Although not always required in transactions involving a Quitclaim Deed, this document is vital when a seller must disclose known defects or issues with the property. It helps protect the buyer by providing them with a comprehensive understanding of the property's condition.

- Title Search Report: A title search is conducted to uncover any liens, encumbrances, or claims against the property that could affect the buyer's ownership. While the Quitclaim Deed does not guarantee a clear title, this report provides essential information for the buyer's protection.

- Mortgage Satisfaction Letter: If the property being transferred is subject to a mortgage that has been paid off, this letter from the lender confirms that the mortgage has been satisfied. It is crucial for clearing the title and ensuring a smooth transfer process.

- Homeowners' Association (HOA) Compliance Certificate: For properties governed by an HOA, this certificate verifies that the property is in compliance with all HOA rules and that any fees or dues have been paid. It aids in preventing future disputes and ensuring that the transfer adheres to all relevant regulations.

While the Quitclaim Deed is a fundamental document for transferring property rights swiftly, the accompanying forms and documents play no lesser role in the process. Together, they ensure that both parties are well-informed and protected, with the transaction adhering to Pennsylvania's legal standards. Understanding and properly executing these additional documents is essential for a comprehensive approach to property transfers within the state.

Similar forms

The Pennsylvania Quitclaim Deed form shares similarities with the Warranty Deed form in that both are used to transfer property rights. However, the Warranty Deed comes with a guarantee that the seller holds a clear title, free of liens or claims, offering more protection to the buyer than a Quitclaim Deed does. The Quitclaim Deed transfers any ownership the seller has in the property, if any, without any guarantees, making the Warranty Deed a more secure option for property buyers who want assurance about the status of the property title.

Another document similar to the Quitclaim Deed is the Grant Deed. Like the Quitclaim Deed, a Grant Deed is used to transfer interest in a property. The key difference lies in the level of protection to the buyer; a Grant Deed includes a promise that the property has not been sold to someone else and is free from undisclosed encumbrances, which is not guaranteed in a Quitclaim Deed. This slight variation provides more security to the buyer but less so than a full Warranty Deed.

The Deed of Trust is also akin to the Quitclaim Deed in its role in real estate transactions, but it functions differently. A Deed of Trust involves three parties: the borrower, the lender, and a trustee, and it secures the property as collateral against a loan. Unlike the Quitclaim Deed, which merely transfers whatever interest the grantor has in the property without warranties, the Deed of Trust is used in financing real estate transactions, ensuring that the lender can recover their investment if the borrower defaults on the loan.

The Special Warranty Deed bears resemblance to the Quitclaim Deed as it is also used for transferring property rights. However, it provides an intermediate level of guarantee compared to the Quitclaim and Warranty Deeds. The Special Warranty Deed only guarantees against claims or liens that arose during the period the grantor owned the property, not before. This offers more protection to the buyer than a Quitclaim Deed but less than a full Warranty Deed, situating it in the middle ground between the two in terms of the assurance it extends to the buyer.

Finally, the Transfer-on-Death (TOD) Deed, while serving a different primary purpose, shares a fundamental similarity with the Quitclaim Deed. Both are mechanisms for transferring property interest, but the TOD Deed allows property owners to name beneficiaries who will receive the property upon the owner’s death, bypassing the probate process. Unlike a Quitclaim Deed, which takes effect immediately upon signing, the TOD Deed only comes into effect upon the death of the property owner, providing a seamless transfer of ownership without the guarantees associated with traditional deed transfers.

Dos and Don'ts

When it comes to transferring property, a Pennsylvania Quitclaim Deed form is a practical tool. However, ensuring accuracy and legality is crucial. Here’s a straightforward guide with dos and don'ts to help you through the process:

- Do double-check the legal description of the property. This information must match the description on the current deed to avoid any discrepancies.

- Do confirm the county where the property is located. The deed needs to be recorded in the same county.

- Do verify the grantor’s (the person selling or transferring the property) and the grantee’s (the person receiving the property) information. Full legal names and addresses should be accurately listed.

- Do ensure that all parties involved sign the deed in the presence of a notary public. This step is essential for the deed to be legally binding.

- Do keep a copy of the completed deed for your records. After recording, it’s wise to have your own copy for future reference.

- Don't leave any fields blank. Unfilled spaces can lead to misunderstandings or questions about the deed’s validity.

- Don't guess on any information. If you’re unsure about a detail, it's better to seek clarification than to make assumptions.

- Don't use this form without understanding its impact. A Quitclaim Deed transfers ownership without any warranty, meaning the grantee receives no guarantee about the property title’s quality.

- Don't forget to record the deed at the local county office. Failing to do so won't affect the validity of the transfer between the parties, but it’s crucial for establishing the public record.

Following these guidelines can help you complete the Pennsylvania Quitclaim Deed form correctly and ensure a smooth property transfer.

Misconceptions

Understanding the Quitclaim Deed form in Pennsylvania involves clearing up some common misconceptions. Here, we will highlight and explain the top eight misconceptions to ensure you have the right information.

A Quitclaim Deed guarantees a clear title. Many people mistakenly believe that when they receive a property through a quitclaim deed, they are guaranteed a clear title. In reality, this form of deed transfers only the interest the grantor has in the property, if any, without any guarantees about the property being free of liens or other encumbrances.

Quitclaim Deeds are only for transferring property between strangers. Actually, quitclaim deeds are most commonly used between family members, friends, or in divorce settlements to transfer property quickly without the assurances provided by a warranty deed.

Recording a Quitclaim Deed is optional. Some people think that recording the deed with the county is a choice. However, in Pennsylvania, as in other states, recording the quitclaim deed at the county recorder's office is necessary to make the deed effective against third parties.

Quitclaim Deeds can clear up title issues. Another common belief is that these deeds can be used to clear up any title issues a property might have. But quitclaim deeds do not affect liens or other encumbrances on the title; they merely transfer the grantor's rights, or lack thereof, to the grantee.

Creating a Quitclaim Deed is complicated. The process might seem daunting, but creating a quitclaim deed in Pennsylvania is relatively straightforward. While legal advice is recommended, especially in complex situations, the form itself is simpler than other real estate transfer documents.

The grantee becomes responsible for any mortgages on the property. This is a misunderstanding. Unless specifically agreed upon, accepting a property via a quitclaim deed does not automatically make the grantee responsible for existing mortgages or debts tied to the property.

All parties must be present for the signing. It's a common misconception that all parties involved must be physically present together to sign the deed. In reality, as long as the deed is properly signed, notarized, and delivered, the parties do not need to be in the same location.

A Quitclaim Deed immediately transfers property. While the legal transfer of interest happens once the deed is properly executed and delivered, the actual process of recording can take some time. Moreover, the transfer is not "complete" in the eyes of the law until the document is recorded with the appropriate county office.

Clearing up these misconceptions is crucial for anyone involved in a real estate transaction using a quitclaim deed in Pennsylvania. Always ensure you have accurate information and, when in doubt, consult with a professional to guide you through the process.

Key takeaways

A Pennsylvania Quitclaim Deed form is used to transfer property quickly without guaranteeing title. It's a straightforward method for a grantor to convey their interest in a property to a grantee.

When preparing a Quitclaim Deed in Pennsylvania, it's essential to ensure the accuracy of all property descriptions. This includes legal descriptions that detail the property's exact boundaries.

Both parties involved—the grantor (seller) and grantee (buyer)—must have their information accurately filled out on the form, including full legal names and addresses.

Signing the Pennsylvania Quitclaim Deed requires witnesses and notarization to comply with state laws. This process adds a layer of legal validity to the document.

The document must be filed with the appropriate county's Recorder of Deeds office. Filing fees vary by county, so it's important to check the current rates to complete the process.

Unlike a warranty deed, a Quitclaim Deed does not provide the grantee with any warranty on the title. The grantee accepts the property "as is," including any potential title issues or claims.

Before executing a Quitclaim Deed, conducting a title search on the property is advisable to understand any existing encumbrances or issues.

Consideration, or the value exchanged for the property, must be stated in the deed. While often nominal, accurately reporting this figure is necessary for record-keeping and tax purposes.

For tax purposes, it's important to report the transaction if required by local or state tax authorities. The Quitclaim Deed could have implications for both the grantor and grantee's tax situations.

Legal advice is recommended when dealing with any property transfer, especially in complex situations. A legal professional can provide guidance specific to Pennsylvania law and ensure all aspects of the transfer are appropriately handled.

More Quitclaim Deed State Forms

Quitclaim Deed Form Texas - When transferring ownership rights to corporate entities, these deeds serve to simplify the transaction.

Quick Deed Ohio - The Quitclaim Deed is commonly utilized in divorces to transfer the ownership of a marital home to one party.