Fillable Quitclaim Deed Document for Ohio

The Ohio Quitclaim Deed form is an essential tool used in the transfer of property rights, primarily focusing on a swift and simple process. Unlike other more complex forms of property transfer, the quitclaim deed primarily serves to pass whatever interest the grantor (the person transferring the property) has in the property to the grantee (the recipient of the property), without making any warranties or promises about the quality of the property title. This form is particularly favored in situations where property is transferred between family members or to clear up title issues, as it requires less paperwork and incurs lower costs compared to traditional property transfers. However, its simplicity also means that the grantee gets no guarantee on the clearness of the title, making a thorough investigation into the property’s history and potential encumbrances a wise step before proceeding. Understanding the nuances of the Ohio Quitclaim Deed form, including its appropriate usage, risks, and the specific procedures required by Ohio law for its execution, is crucial for anyone looking to navigate property transfer in the state smoothly and effectively.

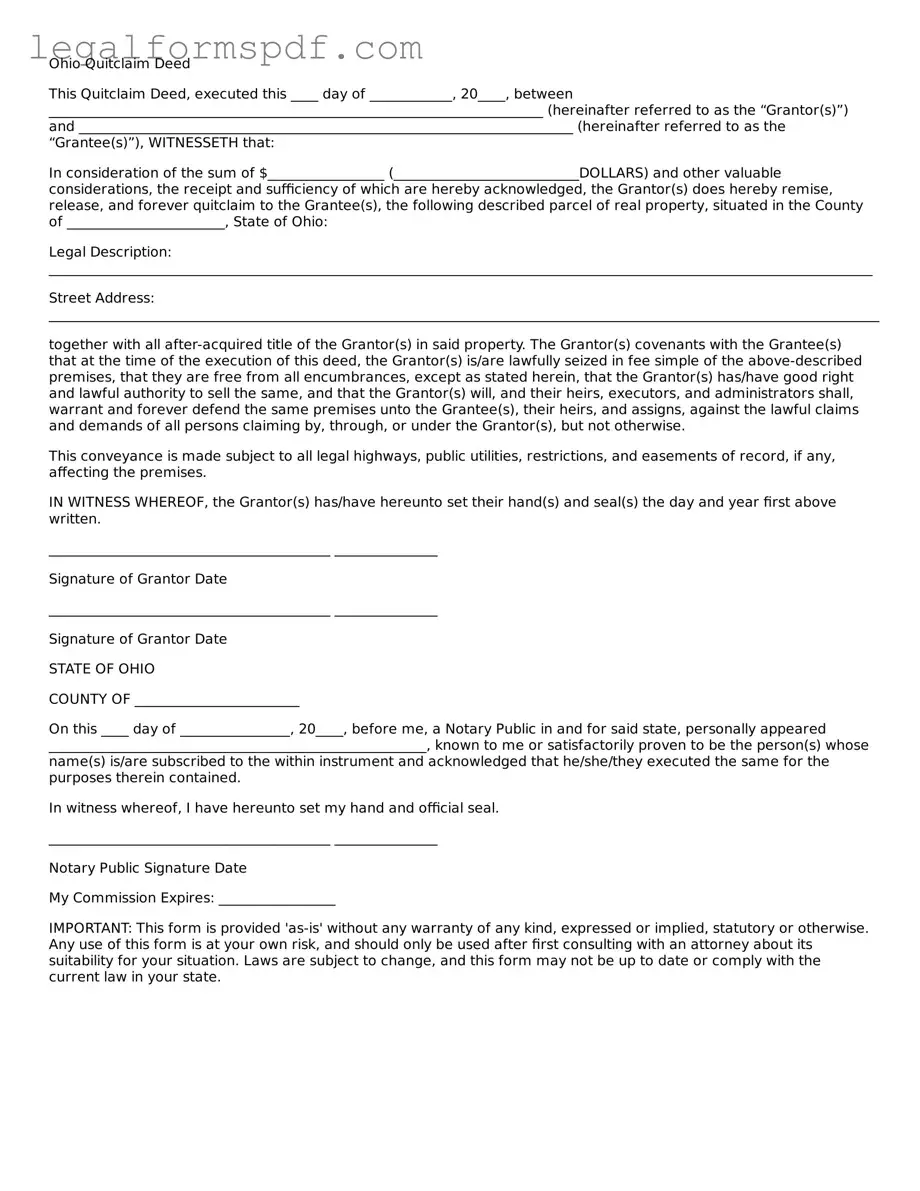

Document Example

Ohio Quitclaim Deed

This Quitclaim Deed, executed this ____ day of ____________, 20____, between ________________________________________________________________________ (hereinafter referred to as the “Grantor(s)”) and ________________________________________________________________________ (hereinafter referred to as the “Grantee(s)”), WITNESSETH that:

In consideration of the sum of $_________________ (___________________________DOLLARS) and other valuable considerations, the receipt and sufficiency of which are hereby acknowledged, the Grantor(s) does hereby remise, release, and forever quitclaim to the Grantee(s), the following described parcel of real property, situated in the County of _______________________, State of Ohio:

Legal Description: ________________________________________________________________________________________________________________________

Street Address: _________________________________________________________________________________________________________________________

together with all after-acquired title of the Grantor(s) in said property. The Grantor(s) covenants with the Grantee(s) that at the time of the execution of this deed, the Grantor(s) is/are lawfully seized in fee simple of the above-described premises, that they are free from all encumbrances, except as stated herein, that the Grantor(s) has/have good right and lawful authority to sell the same, and that the Grantor(s) will, and their heirs, executors, and administrators shall, warrant and forever defend the same premises unto the Grantee(s), their heirs, and assigns, against the lawful claims and demands of all persons claiming by, through, or under the Grantor(s), but not otherwise.

This conveyance is made subject to all legal highways, public utilities, restrictions, and easements of record, if any, affecting the premises.

IN WITNESS WHEREOF, the Grantor(s) has/have hereunto set their hand(s) and seal(s) the day and year first above written.

_________________________________________ _______________

Signature of Grantor Date

_________________________________________ _______________

Signature of Grantor Date

STATE OF OHIO

COUNTY OF ________________________

On this ____ day of ________________, 20____, before me, a Notary Public in and for said state, personally appeared _______________________________________________________, known to me or satisfactorily proven to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I have hereunto set my hand and official seal.

_________________________________________ _______________

Notary Public Signature Date

My Commission Expires: _________________

IMPORTANT: This form is provided 'as-is' without any warranty of any kind, expressed or implied, statutory or otherwise. Any use of this form is at your own risk, and should only be used after first consulting with an attorney about its suitability for your situation. Laws are subject to change, and this form may not be up to date or comply with the current law in your state.

PDF Specifications

| # | Fact | Detail |

|---|---|---|

| 1 | Purpose | Used to transfer property rights quickly without guaranteeing clear title. |

| 2 | Governing Law | Ohio Revised Code Section 5302.11 permits the use of Quitclaim Deeds. |

| 3 | Recording Requirement | Mandatory to record the deed with the county recorder's office where the property is located. |

| 4 | Witness Requirement | Ohio law does not require witnesses for Quitclaim Deeds, but notarization is mandatory. |

| 5 | Notarization | The grantor’s signature must be notarized for the deed to be valid. |

| 6 | Preparation | Information needed includes the grantor and grantee's legal names and the property's legal description. |

| 7 | Transfer Tax | Ohio does not impose a state transfer tax on Quitclaim Deeds, but local taxes may apply. |

| 8 | Dower Rights | Ohio recognizes dower rights, affecting how property is transferred if a spouse has not formally relinquished their rights. |

| 9 | Exemptions | Certain transfers, like those between family members, may be exempt from conveyance fees. |

| 10 | Importance of Legal Description | A clear legal description is crucial for identifying the property being transferred. |

Instructions on Writing Ohio Quitclaim Deed

Preparing an Ohio Quitclaim Deed is a critical step for individuals looking to transfer their right or interest in a property without making any warranties about the title. This type of deed is commonly used among family members, in divorce settlements, or in other situations where the parties know each other well. It is important to complete the form accurately to ensure the legality of the transaction and to protect all parties involved. Below are detailed instructions that will guide you through each step of filling out the Ohio Quitclaim Deed form.

- Begin by identifying the preparer of the document. This can be the grantor (the person transferring the interest), the grantee (the person receiving the interest), or a legal professional acting on behalf of either party. Write the preparer's name and address in the designated section.

- Next, enter the name and address of the individual who will receive the completed form. This is typically the grantee or their legal representative.

- Indicate the county where the property is located. Ohio law requires the deed to be filed in the county recorder’s office of the county where the property is situated.

- Fill in the date of the transaction. This signifies when the transfer of right or interest in the property becomes effective.

- Clearly write the name(s) of the grantor(s), including the marital status if applicable. Ensure the names are spelled correctly and match the names on the current property deed.

- Include the name(s) of the grantee(s). As with the grantor(s), accuracy in spelling and marital status is crucial for the legal transfer of the property interest.

- Enter the consideration amount, which is the value of what the grantee is giving to the grantor in exchange for the property interest. Even if the property is being gifted, a nominal amount such as $1 must be mentioned to satisfy legal requirements.

- Describe the property being transferred. This should include the legal description of the property, which can be found on the current deed or property tax documents. It may include lot numbers, subdivision name, and boundaries.

- The grantor(s) must sign and date the form. Ohio requires the grantor’s signature to be notarized, so it should be signed in the presence of a notary public. The notary will also need to sign and provide their seal or stamp.

- Finally, submit the completed and notarized quitclaim deed to the county recorder’s office where the property is located. Each county may have a filing fee, so it is advisable to contact the office beforehand to verify the amount.

After successfully completing and recording the deed, the grantee holds whatever interest the grantor had in the property. Remember, this deed does not guarantee a clear title; it only transfers the grantor's rights, if any, to the grantee. For peace of mind and the protection of all parties, it's recommended to consult a legal professional throughout this process.

Understanding Ohio Quitclaim Deed

What is a Quitclaim Deed form in Ohio?

A Quitclaim Deed form in Ohio is a legal document used to transfer ownership of real estate from the grantor (the person selling or giving the property) to the grantee (the person receiving the property) with no warranties regarding the title of the property. It is often used among family members or to clear up a title issue.

When should one use a Quitclaim Deed form in Ohio?

This form is primarily used when the property is being transferred without a traditional sale. Common scenarios include transferring property between family members, adding or removing someone’s name from the property title, or transferring property to a trust. It is also used to resolve ambiguity in the property’s legal title.

Does an Ohio Quitclaim Deed form guarantee a clear title?

No, the form does not guarantee a clear title. It only transfers whatever interest the grantor has in the property without any guarantee of the title's validity or freedom from encumbrances. A title search is recommended to verify clear title.

How can one obtain an Ohio Quitclaim Deed form?

The form can be obtained from legal forms providers, attorneys, or online resources that specialize in legal documents. Ensure the form meets Ohio's current legal requirements to be valid.

Is legal assistance necessary to complete the form?

While not strictly necessary, consulting with a legal professional can provide valuable guidance to ensure the document is completed accurately and meets all legal requirements, thus protecting the interests of all parties involved.

What information is needed to fill out a Quitclaim Deed form in Ohio?

Information necessary includes the names and addresses of the grantor and grantee, a legal description of the property, the county in which the property is located, and the consideration (if any) being provided for the transfer.

How is a Quitclaim Deed form in Ohio made official?

The form must be signed by the grantor in the presence of a notary public. Once notarized, it must be recorded with the county recorder in the county where the property is located. Recording fees will apply, and the requirements can vary by county.

Are there any tax implications when using a Quitclaim Deed in Ohio?

Yes, there could be tax implications, including potential conveyance fees or transfer taxes and capital gains taxes for the grantor. It is advisable to consult with a tax professional to understand any financial impacts before proceeding with the transfer.

Common mistakes

Filling out the Ohio Quitclaim Deed form can seem straightforward, but errors can lead to significant complications down the line. One common mistake is neglecting to verify the accuracy of the property description. This part of the deed must be precise, including lot numbers, subdivision names, and any applicable parcel numbers. An incorrect description can invalidate the transfer or cause disputes in the future.

Another misstep is failing to include all necessary parties in the transaction. In the case of the Quitclaim Deed, this means both the grantor (the person giving up their claim on the property) and the grantee (the person receiving it). If a property is owned jointly, for instance, and only one owner signs the deed without the consent or acknowledgment of the other, the deed might not be legally effective.

Some individuals incorrectly assume that a Quitclaim Deed guarantees that the grantor has a valid ownership interest in the property. However, these deeds do not come with any warranty of the grantor's title. Not understanding this nuance can lead to surprises if title issues arise after the transfer.

Not having the deed properly notarized is yet another oversight. Ohio law requires that the Quitclaim Deed be notarized to be valid. Sometimes, people complete the form without realizing the necessity of this legal formality, which can lead to the document being rejected when trying to record it.

Speaking of recording, failing to record the deed with the appropriate county office is a mistake that can render the transaction invisible to future title searches. This can impact the grantee's ability to prove ownership or sell the property later. Even though an unrecorded deed may be valid between the parties involved, it can pose significant risks relative to third-party claims.

Overlooking the need for a Transfer on Death designation is another error. If the property owner wishes the property to bypass probate and go directly to a named beneficiary upon their death, they need to include this designation. A Quitclaim Deed without such a provision does not automatically transfer property in this manner.

Incorrectly handling the form when there are mortgage obligations tied to the property can also lead to misunderstandings. A Quitclaim Deed transfers only the ownership interest of the grantor, without affecting any mortgages. Thus, if not managed correctly, the grantee might unknowingly assume responsibility for existing debts without the proper legal agreements with the lender.

Additionally, the grantor and grantee often misunderstand the tax implications of the transfer. Not consulting with a tax advisor or lawyer to understand the potential tax consequences, such as gift taxes or capital gains taxes, can lead to unexpected financial liabilities.

Using a template that does not comply with Ohio's specific requirements is a further common error. Real estate laws can vary significantly from one jurisdiction to another, and using a generic form might mean important state-specific provisions are missing.

Last but not least, failing to include contact information and mailing addresses for both the grantor and the grantee can complicate future communications or legal notices. This information is essential for any follow-up actions required after the deed is executed.

By paying attention to these details, individuals can avoid common pitfalls and ensure their Quitclaim Deeds are filled out correctly and effectively, safeguarding their interests and intentions in the property transfer process.

Documents used along the form

The Ohio Quitclaim Deed form is commonly utilized in the conveyance of property rights from one party to another, often without warranties on the title's condition. This specific type of deed is a pivotal document in various real estate transactions, primarily used to transfer ownership quickly or to change the name on the title, such as between family members or in the modification of co-ownership situations. In conjunction with this form, several other documents are frequently required to ensure that the process complies with legal standards and to provide a comprehensive understanding of the property's status. These additional documents not only support the transaction but also often fulfill legal requirements or provide essential information to the interested parties.

- Real Property Transfer Form: This form, often mandated by local or state governments, records the transfer of title or interest in real property from one party to another and is used for assessment and taxation purposes.

- Title Search Report: A document that outlines the history of ownership, including any liens, encumbrances, or easements on the property. It is essential for ensuring clear title before the transfer of property.

- Plat Map: Shows the property's divisions, its exact dimensions, and its relation to surrounding properties. It's crucial for understanding the property's boundaries and geographical context.

- Mortgage Statement: If the property has a mortgage, a current mortgage statement may be required to show the outstanding balance. This is important for understanding financial encumbrances on the property.

- Homestead Exemption Forms: In some cases, particularly where a primary residence is involved, homestead exemption forms may accompany the quitclaim deed to protect the property from certain types of creditors.

- Property Tax Receipts: Current property tax receipts can be necessary to prove that all taxes on the property have been paid up to date. This helps to ensure that no tax liens exist on the property.

In the process of using an Ohio Quitclaim Deed for property transfer, careful attention should be given to these accompanying forms and documents. They play crucial roles in providing transparency, ensuring legality, and protecting the interests of all parties involved in the transaction. It is advisable for parties to consult with legal professionals to understand the importance of each document and to ensure all paperwork is accurately completed and filed.

Similar forms

The Ohio Quitclaim Deed form is similar to a Warranty Deed in that both are used in the process of transferring property rights. However, the Warranty Deed differs because it comes with a guarantee from the seller (grantor) regarding the clear title of the property, meaning it is free of liens and encumbrances. The Quitclaim Deed offers no such assurances, making it a less secure option for the buyer (grantee) but a quicker choice for situations where speed is necessary and the parties know each other well, such as between family members.

Comparable to a Grant Deed, the Quitclaim Deed facilitates the transfer of one's interest in a property to another. The Grant Deed, though, carries with it an implication that the grantor holds the title to the property and has not previously sold the property to someone else. This document, like the Quitclaim Deed, is used in real estate transactions but provides more protection to the buyer because it assures that the property title is free from any undisclosed encumbrances.

Similar to the Quitclaim Deed, a Trust Transfer Deed is used to change the title of a property. This type of deed is often utilized in the context of a living trust, transferring ownership of the property from an individual's name into their trust. While the Trust Transfer Deed serves a specific purpose in estate planning, the mechanism of transferring title mirrors that of the Quitclaim Deed, though the Quitclaim Deed is more versatile and not solely used for trust-related transfers.

The Quitclaim Deed also shares characteristics with a Deed of Trust, which is commonly employed in securing a mortgage on a property. Though their purposes differ significantly—the Quitclaim Deed for transferring title without warranty, and the Deed of Trust for creating a security interest in the property—they both involve detailed legal descriptions of the property and need to be filed with the county recorder. However, the Deed of Trust involves three parties (borrower, lender, and trustee) and is more complex, involving the borrower's obligation to the lender, unlike the straightforward title transfer of a Quitclaim Deed.

Dos and Don'ts

When completing an Ohio Quitclaim Deed form, it is important to follow a clear set of do's and don'ts to ensure the process is done correctly and legally. The following lists provide guidance on the best practices to adopt, as well as common pitfalls to avoid.

Do's:

- Ensure all the parties' names are spelled correctly and match the names on the official property records.

- Clearly describe the property being transferred, including its full address and any identifying numbers or legal descriptions.

- Check that the form complies with Ohio's legal requirements, including specific language or clauses that may be necessary.

- Sign the Quitclaim Deed in the presence of a notary public to validate the document.

- Keep a copy of the notarized Quitclaim Deed for your records before filing it with the county recorder's office.

- Verify which county the property is located in and file the Quitclaim Deed in that specific county's recorder's office.

- Pay any applicable filing fees required by the county recorder to officially record the document.

Don'ts:

- Do not leave any sections of the form blank; incomplete forms may be rejected or cause legal issues in the future.

- Do not guess on any information. If unsure, it's important to verify the correct details through property records or legal advice.

- Do not use nicknames or shortened names; always use the full legal names of all parties involved.

- Do not forget to have the document notarized; an unnotarized Quitclaim Deed might not be considered valid.

- Do not neglect to check the current filing requirements and fees with the county recorder, as these can change.

- Do not delay filing the Quitclaim Deed with the county recorder's office after it has been executed and notarized.

- Do not disregard state-specific forms; ensure the form used is specific to Ohio, as requirements can vary by state.

Misconceptions

When it comes to transferring property rights in Ohio, the Quitclaim Deed form is often misunderstood. Here, we aim to clarify some common misconceptions and provide accurate information:

- Misconception #1: A Quitclaim Deed guarantees a clear title.

This is not true. In fact, a Quitclaim Deed does not guarantee that the grantor (the person transferring the property) has clear title to the property. It merely transfers whatever interest the grantor has in the property, if any, to the grantee (the person receiving the property) without any guarantees.

- Misconception #2: Quitclaim Deeds are only used between strangers.

Contrary to this belief, Quitclaim Deeds are more commonly used between family members or close friends. This is because of the inherent trust level required due to the lack of warranty on the title. They are often used to transfer property in cases of marriage, divorce, or inheritance.

- Misconception #3: A Quitclaim Deed immediately transfers property rights.

This statement can be misleading. While it's true that a Quitclaim Deed can be executed quickly, the actual transfer of rights is not complete until the deed is delivered to, and accepted by, the grantee. Furthermore, the deed must be properly recorded with the local county to ensure legal protection of the grantee's newly acquired interest.

- Misconception #4: Quitclaim Deeds can solve all property disputes.

This is unfortunately not the case. Quitclaim Deeds can be useful tools in certain situations, such as clearing up a previously clouded title. However, they are not a catch-all solution for all types of property disputes and may not be appropriate in cases where the property title is under significant legal challenge.

Understanding these misconceptions can help individuals make more informed decisions when considering the use of a Quitclaim Deed in Ohio. It's always recommended to consult with a legal professional to thoroughly understand the implications of using this or any legal document.

Key takeaways

When dealing with the Ohio Quitclaim Deed form, it's important to understand both the document's significance and the correct way to fill it out. This form transfers property rights from the grantor to the grantee without any guarantees about the property title's quality. Here are nine key takeaways to consider:

- Before you start, verify that a Quitclaim Deed is the appropriate document for your needs, as it transfers property rights without warranties.

- Ensure all parties involved clearly understand the implications of the deed, particularly that the grantor isn't promising the property is free from other ownership claims.

- Accurately identify the grantor(s) and grantee(s) in the deed, including full legal names and contact information.

- Legal descriptions of the property must be meticulously detailed, not merely the property's address, to avoid any ambiguity regarding the transferred property.

- Ohio law requires the Quitclaim Deed to be signed by the grantor in the presence of a notary public to be legally valid.

- Check if your county has additional requirements, such as specific forms or attachments, that need to be submitted along with the Quitclaim Deed.

- Be prepared to pay any applicable recording fees when you submit the deed to the county recorder's office—it's a crucial step to make the document legally binding and public record.

- Retain a copy of the recorded deed for your records. It’s proof of your compliance with the law and the change in property ownership.

- Consider consulting with a legal professional if you have any uncertainties about the process or if your situation involves complex legal issues. Some situations might require more comprehensive legal advice.

Completing the Ohio Quitclaim Deed correctly ensures a smoother transfer of property rights and helps avoid potential legal complications down the road. Each step, from understanding the document's limitations to properly recording it, plays a crucial role in the process.

More Quitclaim Deed State Forms

How to Do a Quick Claim Deed - This document is useful in situations where property is transferred as a gift, as it simplifies the process without extensive title searches.

Kalamazoo Register of Deeds - Often used in informal property transfers, where a thorough investigation of the title history is not undertaken.

Quit Claim Deed Illinois - Using this deed offers a streamlined approach but doesn't include a title search or insurance.