Fillable Quitclaim Deed Document for North Carolina

In North Carolina, the transfer of property ownership without warranties regarding the title's quality is facilitated through the use of a Quitclaim Deed form. This document is particularly important in scenarios where the property is gifted between family members or transferred in a divorce settlement, allowing the grantor (the person transferring the property) to convey their interest in the property to the grantee (the recipient) with no guarantee that the title is free of claims or liens. It is crucial for both parties to understand that this form differs significantly from warranty deeds, which do provide guarantees about the title's status. While the Quitclaim Deed form simplifies the transfer process by omitting the assurance of a clear title, it requires precise completion and adherence to state laws to ensure its validity. This necessitates a clear understanding of its implications, the necessary steps for its proper execution, and its legal effect on property rights in North Carolina.

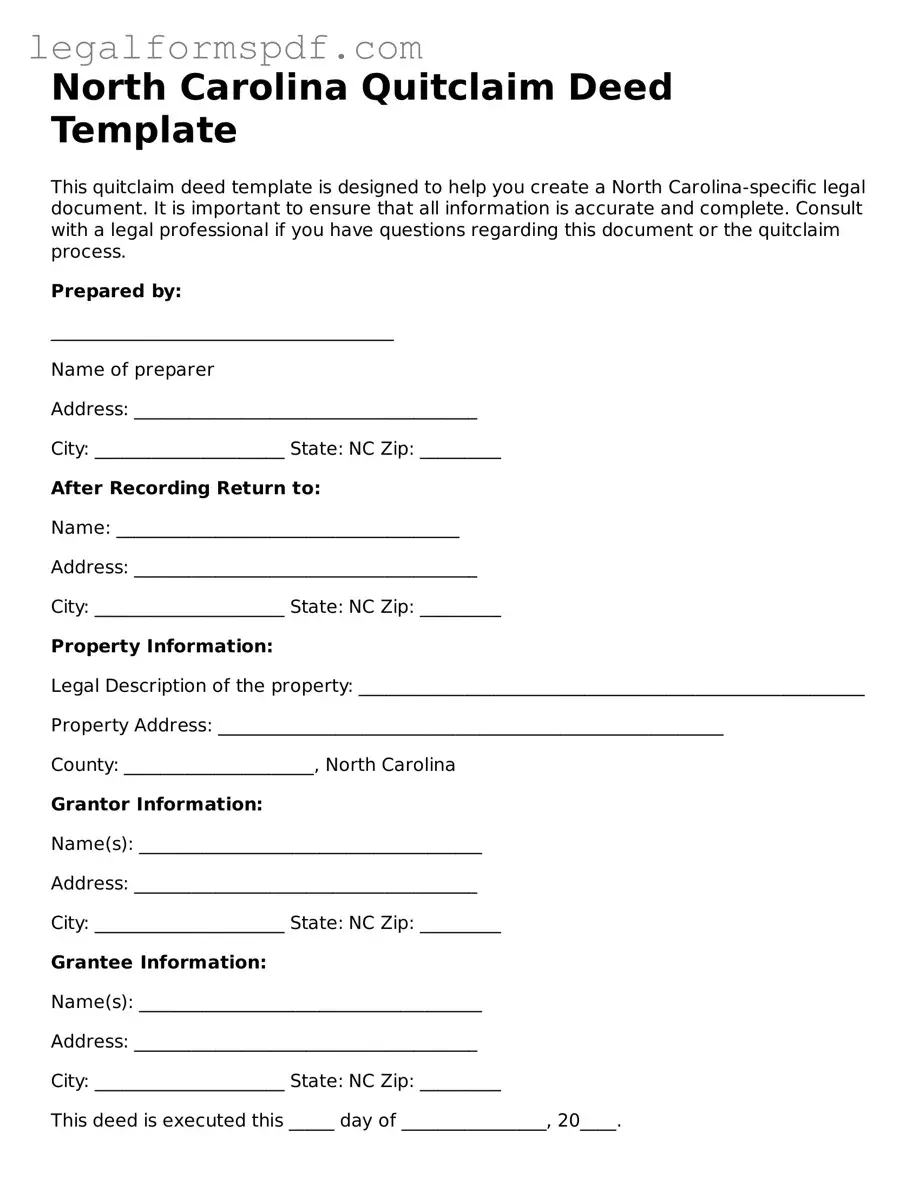

Document Example

North Carolina Quitclaim Deed Template

This quitclaim deed template is designed to help you create a North Carolina-specific legal document. It is important to ensure that all information is accurate and complete. Consult with a legal professional if you have questions regarding this document or the quitclaim process.

Prepared by:

______________________________________

Name of preparer

Address: ______________________________________

City: _____________________ State: NC Zip: _________

After Recording Return to:

Name: ______________________________________

Address: ______________________________________

City: _____________________ State: NC Zip: _________

Property Information:

Legal Description of the property: ________________________________________________________

Property Address: ________________________________________________________

County: _____________________, North Carolina

Grantor Information:

Name(s): ______________________________________

Address: ______________________________________

City: _____________________ State: NC Zip: _________

Grantee Information:

Name(s): ______________________________________

Address: ______________________________________

City: _____________________ State: NC Zip: _________

This deed is executed this _____ day of ________________, 20____.

For valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Grantor(s) hereby quitclaims to the Grantee(s) all rights, title, interest, and claim in the property described above, situated in ______________ County, North Carolina.

Grantor's Signature: ______________________________

Date: _______________________

Grantee's Signature: ______________________________

Date: _______________________

State of North Carolina

County of _______________

On this, the _____ day of ________________, 20____, before me, a Notary Public in and for said state, personally appeared ______________________________________, known to me (or proved to me on the oath of ________________________________) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public: ______________________________________

My Commission Expires: _______________

PDF Specifications

| Fact Name | Detail |

|---|---|

| Purpose | Transfers property interest from one person to another without warranties. |

| Governing Law | North Carolina General Statutes Chapter 47 - Recordation of Instruments. |

| Recording Requirement | Must be recorded with the county Register of Deeds where the property is located. |

| Witness Requirement | North Carolina law requires the signature of at least two witnesses. |

| Notarization Requirement | The form must be notarized to be valid and recordable. |

| Consideration Statement | A statement of consideration is required, specifying the value exchanged for the property. |

Instructions on Writing North Carolina Quitclaim Deed

Filling out a North Carolina Quitclaim Deed form is an essential step for those who wish to transfer property rights without the guarantees typically included in a traditional warranty deed. This document is typically used between family members or close acquaintances where there is a high level of trust and a desire to expedite the transfer process. It’s important to approach this task with attention to detail to ensure the form is completed accurately and legally.

- Gather all necessary information about the property, including its legal description and parcel number, before starting the form.

- Enter the date of the transfer at the top of the deed.

- Write the full name and address of the grantor (the person transferring the property) in the designated space.

- Provide the full name and address of the grantee (the person receiving the property) in the indicated section.

- In the section provided, insert the legal description of the property being transferred. This information can be found on the current deed or by contacting the county recorder’s office.

- Specify the county in North Carolina where the property is located.

- Both the grantor and grantee must sign the deed in front of a Notary Public. Ensure the notary also signs the document and affixes their seal to validate the quitclaim deed.

- Make a copy of the completed quitclaim deed for both the grantor and grantee’s records.

- Submit the original signed quitclaim deed to the county recorder’s office in the county where the property is located. A recording fee will likely be required, so it’s advisable to verify the amount with the office beforehand.

After these steps are completed, the property rights will have been officially transferred. The grantee should then receive confirmation from the county recorder’s office once the quitclaim deed has been recorded. This marks the completion of the property transfer process using a quitclaim deed in North Carolina.

Understanding North Carolina Quitclaim Deed

What exactly is a North Carolina Quitclaim Deed form?

A North Carolina Quitclaim Deed form is a legal document that allows a property owner to transfer their interest in a piece of real estate to another party without providing any warranties or guarantees about the property's title. This type of deed is often used between family members or to clear up title issues because it transfers property quickly but does not assure the buyer of a clear title.

How does a Quitclaim Deed differ from a Warranty Deed in North Carolina?

The primary difference between a Quitclaim Deed and a Warranty Deed in North Carolina lies in the level of protection offered to the buyer. A Warranty Deed provides the buyer with guarantees that the title to the property is clear of any other claims, such as liens or encumbrances. On the other hand, a Quitclaim Deed offers no such assurances, meaning the buyer accepts the property "as is", potentially with all the risks associated with the title.

What information is required to fill out a North Carolina Quitclaim Deed form?

To correctly fill out a North Carolina Quitclaim Deed form, the following pieces of information are needed: the names and addresses of both the grantor (seller) and grantee (buyer), a legal description of the property being transferred, the county where the property is located, and the date of the transfer. Additionally, the document must be signed by the grantor and notarized to be considered valid.

Where do I file a completed North Carolina Quitclaim Deed form?

Once a Quitclaim Deed form has been correctly filled out and notarized, it must be filed with the Register of Deeds office in the North Carolina county where the property is located. Filing this document officially records the transfer and is necessary for the deed to be recognized as valid. It's important to check if the local Register of Deeds requires any additional forms or fees to accompany the Quitclaim Deed upon filing.

Common mistakes

When handling the North Carolina Quitclaim Deed form, completing it accurately is vital to ensure the smooth transfer of property ownership. A common mistake people make is not thoroughly verifying the legal description of the property. This description includes boundaries, lots, block numbers, and any other details that uniquely identify the property. An incorrect legal description can lead to disputes over property boundaries and can complicate future sales or transfers. It's crucial that the legal description on the quitclaim deed matches exactly with that on the official property records.

Another pitfall is neglecting to verify the grantor's (the person transferring the property) legal capacity to make the transfer. Individuals must have the legal right and capacity to transfer the property. For example, if the property is owned jointly, consent from all parties is necessary. Failure to confirm this can render the deed void or voidable, potentially leading to legal challenges down the line. Always double-check who holds the title to the property and ensure that all necessary parties are involved in the transfer process.

People often overlook the importance of obtaining the signature of the grantee (the recipient of the property) on the deed. While North Carolina law does not expressly require the grantee’s signature on a quitclaim deed, including it can provide clear evidence of the grantee’s acceptance of the deed and the transfer of the property. Without this acceptance, the enforceability of the deed could be questioned, leading to potential legal complications.

Many individuals mistakenly think that once the quitclaim deed is filled out, the process is complete. However, the deed needs to be notarized to be valid. The presence of a notary public during the signing of the deed adds a layer of legal protection, confirming that the signatures on the deed are legitimate. Failing to have the deed notarized is a significant oversight that can invalidate the entire document.

Lastly, a frequent error is failing to record the deed with the county Register of Deeds in North Carolina after it has been notarized. Recording the deed is the final step in the property transfer process and serves as public notice of the change in ownership. If the deed is not recorded, future searches of the public record may not reflect the current owner, leading to potential disputes and problems with future conveyances of the property.

Documents used along the form

In the context of transferring property, a North Carolina Quitclaim Deed is a legal instrument used to convey the grantor's interest in a piece of real estate to a grantee without any warranties of title. While this form is crucial for the conveyance process, several other documents are often utilized in conjunction to ensure a smooth and legally sound transaction. Here are some of the forms and documents commonly used alongside the North Carolina Quitclaim Deed:

- Real Estate Excise Tax Declaration: This form is required in many jurisdictions to report the sale of property for tax assessment purposes. It helps determine if any excise tax is due on the property transfer.

- Warranty Deed: Unlike a Quitclaim Deed, a Warranty Deed provides the grantee with guarantees about the title and the right to possess the property, ensuring it is free from any claims.

- Title Search Report: A title search report outlines the history of ownership, liens, and any encumbrances on the property. It is crucial for identifying potential issues with the property's title before transfer.

- Loan Payoff Statement: For properties under mortgage, a loan payoff statement is needed to determine the outstanding balance. This statement is essential to ensure that the mortgage is fully paid off during the property transfer process.

- Property Tax Statement: Current property tax statements are necessary to confirm that all taxes on the property have been paid up to the date of transfer.

- Homeowners Association (HOA) Statement: This document outlines any HOA fees or assessments owed on the property. It's important for properties in developments with a homeowners association.

- Flood Zone Statement: This statement indicates whether the property is in a flood zone, affecting insurance requirements and costs for the new owner.

- Lead-Based Paint Disclosure: For homes built before 1978, a lead-based paint disclosure is required by federal law. It informs the buyer about the presence of any known lead-based paint or hazards on the property.

These documents play a pivotal role in ensuring transparency, legal compliance, and protection for both parties involved in the property transfer. Each form or document serves a specific purpose, contributing to the overall integrity and efficiency of the transaction. Understanding and utilizing these documents appropriately can significantly aid in the successful transfer of property through a Quitclaim Deed in North Carolina.

Similar forms

A Warranty Deed, much like the Quitclaim Deed, is used in real estate transactions to transfer property from a seller to a buyer. However, unlike the Quitclaim Deed, which offers no guarantees about the property title, a Warranty Deed provides the buyer with assurances that the title is clear and free of any claims or liens. This document ensures the buyer is protected against future claims to the property.

The Grant Deed is another document similar to the Quitclaim Deed, serving to transfer real estate ownership. The key difference lies in the level of protection offered to the new owner. While a Quitclaim Deed offers no warranties, a Grant Deed implies certain guarantees, such as the seller not having sold the property to someone else and that the property is free from undisclosed encumbrances.

A Special Warranty Deed, like the Quitclaim Deed, is utilized to transfer property rights. However, it only guarantees the title against defects arising during the seller's ownership period. This contrasts with the Quitclaim Deed, which makes no assurances about the property's title, leaving the buyer to accept the property "as is," including any potential issues or defects.

The Trustee’s Deed is used to transfer property held in a trust, akin to how a Quitclaim Deed is used for broader property transfers. The difference is in the specificity of the Trustee's Deed, which is executed by the trustee of a trust, transferring property out of that trust without any warranties about the title's status, offering minimal protection to the buyer, much like the Quitclaim Deed.

An Executor’s Deed, similar to the Quitclaim Deed, is involved in transferring property. It is specifically used to convey property from an estate, being executed by the executor of the estate based on a will's instructions or a court's decision. Despite their different contexts, both deeds may transfer property without warranties, depending on the circumstances and how the deed is drafted.

The Deed of Trust is indirectly related to the Quitclaim Deed by its involvement in real estate transactions. Instead of transferring property rights between seller and buyer, it involves a borrower, lender, and trustee. The borrower conveys the property to the trustee as collateral for a loan, with reversion upon payment completion, differing in purpose but similar in involving property transfer.

A Land Contract is a financing agreement for the purchase of real estate, where the seller finances the purchase price for the buyer, unlike the immediate property transfer in a Quitclaim Deed. Over time, the buyer makes payments based on the terms until full payment is made, at which point the seller transfers the property title to the buyer, often utilizing a Quitclaim Deed for this final transfer.

The Transfer on Death Deed (TODD) allows property owners to designate a beneficiary who will receive the property upon the owner’s death, bypassing the probate process. While it serves a distinct purpose from the Quitclaim Deed, both are mechanisms for transferring property titles—TODD does so upon death without going through court, and Quitclaim does so immediately, without warranties.

Affidavit of Heirship is a document used to establish ownership of property by heirs after a property owner dies without a will. It is not a deed but serves to clear the title by identifying the legal heirs. While it facilitates property transfer indirectly by solidifying ownership claims, similar to how a Quitclaim Deed transfers interest in property, it does so under the presumption of intestacy, without direct sale or explicit transfer of rights.

Dos and Don'ts

When you're preparing a Quitclaim Deed in North Carolina, there are certain practices that can help ensure the process is smooth and legally sound. Paying attention to detail and avoiding common pitfalls will make the transaction easier and more secure for everyone involved. Here is a list of things you should do, as well as things you shouldn’t, when filling out a Quitclaim Deed form in North Carolina:

Do:- Review the form thoroughly before you start filling it out to understand all the required information.

- Use black ink or type the information to ensure clarity and legibility for official records.

- Include all required information, such as the full names and addresses of both the grantor (person transferring the property) and grantee (person receiving the property).

- Ensure accuracy in the legal description of the property. This may include lot number, subdivision name, and other pertinent details that identify the exact piece of land being transferred.

- Check for any specific North Carolina requirements, like witnessing or additional forms that might be needed.

- Sign in the presence of a notary public as North Carolina law requires notarization for the deed to be valid.

- Keep personal copies of the completed and notarized deed for both the grantor and grantee’s records.

- File the deed with the county recorder’s office where the property is located. This makes the deed part of the public record.

- Verify filing fees before submission to ensure the correct amount is paid and avoid processing delays.

- Seek legal advice if there are any uncertainties. A legal professional can provide guidance tailored to your specific situation.

- Use generic forms without verifying they meet North Carolina’s specific legal requirements.

- Overlook any sections of the form; even if not applicable, note that clearly.

- Forget to date the document. The deed is not legally binding until the date is written.

- Rush through the process without checking for errors in spelling, especially names and addresses.

- Assume the Quitclaim Deed transfers property rights immediately. The process is complete only after recording the deed with the county.

- Ignore tax implications. There can be tax consequences for both the grantor and grantee, and it’s important to understand these.

- Sign in the wrong places or not in the presence of a notary public.

- Skip obtaining a property title search. While not a requirement, a title search can reveal if there are any liens or claims on the property.

- Assume it covers more than it does. Quitclaim deeds only transfer the grantor's interest in the property and do not guarantee that the title is free and clear.

- Fail to follow up on the recording status of the deed with the county recorder’s office.

Misconceptions

When understanding the North Carolina Quitclaim Deed form, it's critical to clear up common misconceptions that may cloud one's perception of its use and implications. Below are seven frequently misunderstood aspects of this legal document:

Guarantees Property Ownership: Many believe a Quitclaim Deed guarantees the grantor actually owns the property being transferred. However, this deed simply transfers whatever interest the grantor has in the property, without any guarantee of clear title.

Clears Title Issues: Another misconception is that executing a Quitclaim Deed will clear any title issues. In reality, it does nothing to affect liens or other encumbrances on the title.

Only for Transferring to Strangers: People often think Quitclaim Deeds are primarily used for transactions between strangers. Actually, they're more commonly used between family members or close associates to transfer property quickly without a title search.

Same as Warranty Deed: Some confuse Quitclaim Deeds with Warranty Deeds. Unlike Warranty Deeds, Quitclaim Deeds do not provide any warranty on the title, making them far less protective for the buyer.

Eliminates Previous Claims: There's a false belief that a Quitclaim Deed can eliminate any previous claims against the property. However, all existing claims or liens remain intact until properly addressed or resolved.

Mortgage Transfer: It's incorrectly assumed that transferring property via a Quitclaim Deed will also transfer responsibility for any mortgage on the property. Responsibility for the mortgage remains with the original borrower unless formally changed with the lender.

Immediate Change in Ownership: Some people think that once a Quitclaim Deed is signed, the change in ownership is instant. The deed must be delivered to the grantee and, in North Carolina, recorded with the county to complete the transfer process.

Clearing up these misconceptions is vital for anyone involved in a property transfer in North Carolina. A Quitclaim Deed is a powerful tool when used correctly but understanding its limitations and implications is crucial for a successful transaction.

Key takeaways

In North Carolina, utilizing a Quitclaim Deed form is a specific procedure that transfers property rights from one individual to another. It's crucial for those involved in such transactions to pay close attention to the details to ensure the process is completed correctly. Here are five key takeaways regarding the completion and use of the North Carolina Quitclaim Deed form:

- A thorough understanding of the document is paramount. The Quitclaim Deed form doesn't warrant the title's quality; it simply transfers the interest the grantor has in the property—if any—to the grantee. This distinction is significant and underlines the importance of knowing the extent of what is being transferred.

- It's essential to have all relevant information accurately filled out. This includes the legal description of the property, the names of the grantor and grantee, and the parcel identification number. Mistakes in this information can invalidate the deed or cause legal complications down the line.

- The deed must be signed in the presence of a notary public. This step is not just a formality; it's a legal requirement for the document to be considered valid in the eyes of North Carolina law. The notary public must attest to the signing, which adds a layer of verification to the process.

- Following the signing, the Quitclaim Deed needs to be filed with the county's Register of Deeds. The location for filing is determined by where the property is situated. The actual filing secures the transaction into public record, making it official and offering protection to the grantee.

- There may be tax implications arising from the transfer of property via a Quitclaim Deed. Both parties should be aware of potential state and federal taxes that might be due as a result of the deed's execution. Consulting with a tax professional is advisable to navigate these complexities effectively.

Understanding these elements can greatly simplify the process of using a Quitclaim Deed form in North Carolina. Taking the time to ensure everything is done correctly can prevent numerous problems and expedite the transfer of property rights.

More Quitclaim Deed State Forms

Quick Deed Ohio - Despite its limitations in guaranteeing title quality, this deed is efficient for transactions that don't require a thorough title search or insurance.

Georgia Deed Transfer Forms - This document can help avoid probate by transferring property before someone's death.

Quitclaim Form - This document is a simple way for a property owner to give up their interest in a piece of real estate, allowing the recipient to assume ownership.