Fillable Quitclaim Deed Document for New York

When property changes hands in New York, the details matter. Among the various ways to transfer property rights, the Quitclaim Deed form stands out for its simplicity and speed. This document is key for those wanting to transfer property without the warranties typically involved in more complex real estate transactions. It is particularly favored among family members or close acquaintances where trust is high, and the need for detail regarding the property’s condition is less critical. However, its simplicity doesn't negate its importance or its potential complications. Utilized often for adjusting names on titles, transferring property into a trust, or clarifying a property’s heirship, this form has multifaceted applications. Each party involved should understand the implications, the exact nature of the rights being transferred, and how this form's use could affect their interest in the property. The New York Quitclaim Deed form, therefore, is not just a document but a pivotal legal tool in real estate that demands careful consideration and, often, guidance from a legal professional to navigate its subtleties effectively.

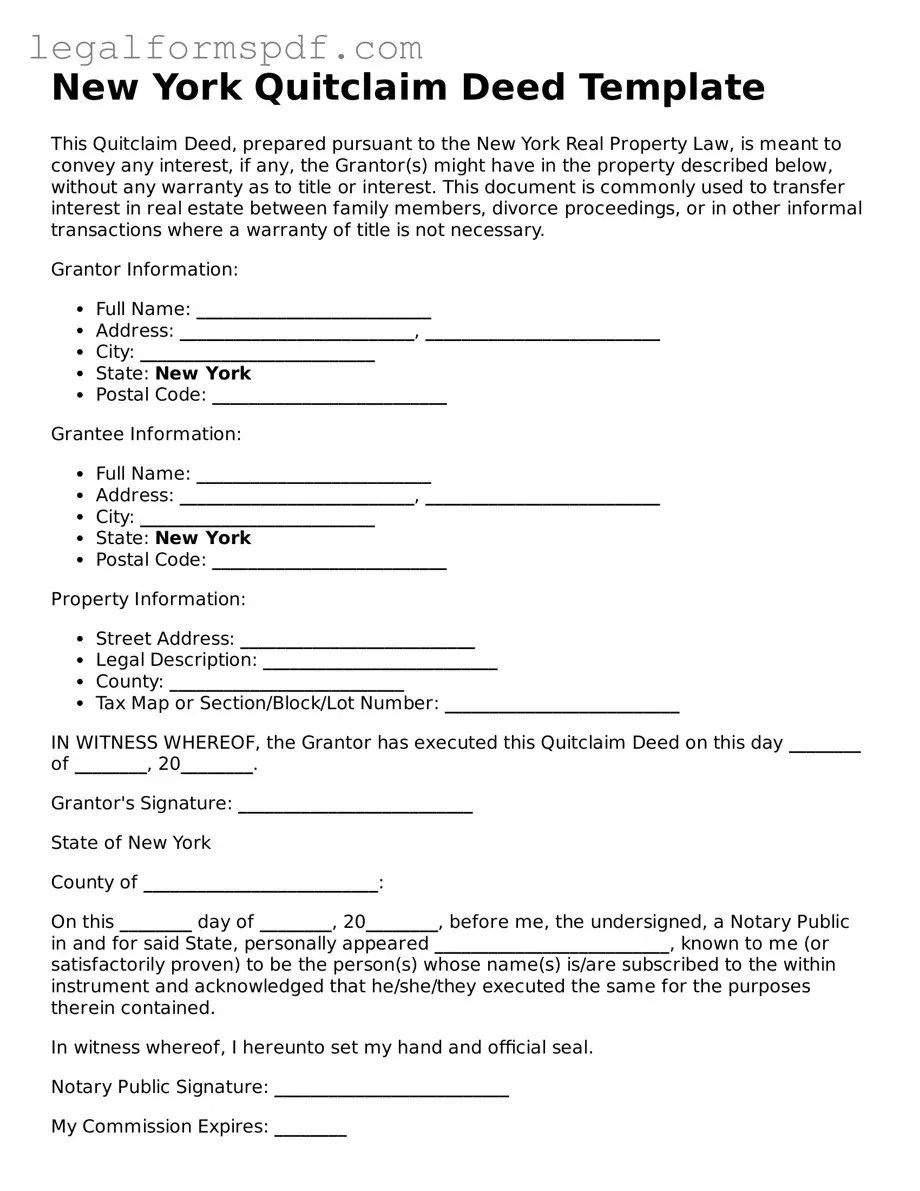

Document Example

New York Quitclaim Deed Template

This Quitclaim Deed, prepared pursuant to the New York Real Property Law, is meant to convey any interest, if any, the Grantor(s) might have in the property described below, without any warranty as to title or interest. This document is commonly used to transfer interest in real estate between family members, divorce proceedings, or in other informal transactions where a warranty of title is not necessary.

Grantor Information:

- Full Name: __________________________

- Address: __________________________, __________________________

- City: __________________________

- State: New York

- Postal Code: __________________________

Grantee Information:

- Full Name: __________________________

- Address: __________________________, __________________________

- City: __________________________

- State: New York

- Postal Code: __________________________

Property Information:

- Street Address: __________________________

- Legal Description: __________________________

- County: __________________________

- Tax Map or Section/Block/Lot Number: __________________________

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed on this day ________ of ________, 20________.

Grantor's Signature: __________________________

State of New York

County of __________________________:

On this ________ day of ________, 20________, before me, the undersigned, a Notary Public in and for said State, personally appeared __________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public Signature: __________________________

My Commission Expires: ________

PDF Specifications

| Fact | Detail |

|---|---|

| Purpose | Transfers property ownership without warranties. |

| Warranties | None. The grantor does not guarantee a clear title. |

| Common Use | Transferring property between family members or into a trust. |

| Notarization Required | Yes, to be legally valid. |

| Governing Law | New York Real Property Law |

| Filing | Must be filed with the local county clerk's office where the property is located. |

Instructions on Writing New York Quitclaim Deed

When a property owner wants to transfer their interest in a piece of real estate quickly and without the warranties that come with a standard warranty deed, a Quitclaim Deed can be a suitable tool. This document is particularly useful among family members or close acquaintances where there's already a level of trust regarding the property's condition. Preparing this deed requires careful attention to ensure that all the necessary parts are correctly filled out. Here is a step-by-step guide on how to fill out the New York Quitclaim Deed form to facilitate a smooth transition.

- Identify the preparer of the deed, typically the person completing the form, and include their name and address in the designated area.

- Enter the name and address of the individual who will receive the filed deed in the “After Recording Return to” section.

- Specify the county in New York where the property is located at the top of the document.

- Fill in the consideration amount, which is the value being exchanged for the property's interest.

- List the name(s) of the grantor(s) (the person(s) giving away their interest) and include their address(es).

- Specify the name(s) of the grantee(s) (the person(s) receiving the interest) along with their address(es).

- Provide a legal description of the property. This can often be found on the previous deed or by contacting a local assessor's office.

- Include any additional declarations or stipulations concerned with the transfer of the property, if applicable.

- Have the grantor(s) sign the Quitclaim Deed in the presence of a notary public.

- Ensure the deed is notarized, with the notary public signing and affixing their official seal.

- Finally, file the completed Quitclaim Deed with the appropriate county clerk’s office and pay any necessary filing fees.

Filling out the Quitclaim Deed form accurately is paramount, but what comes next ensures the document achieves its purpose. Once all the steps have been completed and the form has been filed with the appropriate county clerk's office, the property interest has been officially transferred. However, it's important to understand that a Quitclaim Deed does not guarantee the grantor actually has the property title or rights they're claiming to transfer. Therefore, it's recommended to conduct a thorough property history review and potentially consult with a professional for advice before proceeding.

Understanding New York Quitclaim Deed

What is a Quitclaim Deed form in New York?

A Quitclaim Deed form in New York is a legal document used to transfer the ownership of property from one person (the grantor) to another (the grantee) without any warranty about the title of the property. This means the grantor does not guarantee that they own the property free of claims or that there are no other ownership issues. It is often used among family members or to clear up a title issue.

How does a Quitclaim Deed differ from a Warranty Deed in New York?

Unlike a Quitclaim Deed, a Warranty Deed provides the grantee with guarantees from the grantor that the title is clear of any liens or claims. This means the grantor assures the grantee of their legal right to transfer the property and that no other parties have interests in the property. A Quitclaim Deed, on the other hand, offers no such warranties, making it a less secure option for buyers unaware of potential title issues.

What are the necessary steps to file a Quitclaim Deed in New York?

To file a Quitclaim Deed in New York, the grantor must complete the form by including details such as the names and addresses of the grantor and grantee, a legal description of the property, and the deed’s consideration (if any). The deed must be signed by the grantor in the presence of a notary public. After notarization, it should be filed with the county clerk's office in the county where the property is located, along with the required filing fee. It is also important to check if additional documents, like a Real Property Transfer Report, are needed for the filing.

Are there any specific considerations for New York City residents when using a Quitclaim Deed?

For residents of New York City, it's important to be aware that local regulations may require additional steps or documents for the transfer of property. This could include specific tax forms or filings beyond those required by the state of New York. It's advisable to consult with a local legal professional to ensure all local requirements are met and to understand any potential tax implications of transferring property using a Quitclaim Deed in New York City.

Common mistakes

One common mistake people make when filling out the New York Quitclaim Deed form is not double-checking the legal description of the property. This description often includes lot numbers, subdivision names, and sometimes metes and bounds. If the legal description is inaccurate or incomplete, it can lead to disputes about what property was actually transferred. This description must match the one used in previous deeds to ensure continuity and clarity in property records.

Another error occurs when individuals inadvertently leave out or miswrite the grantor's or grantee's name. The grantor is the person transferring the property, while the grantee is the recipient. Names must be written exactly as they appear in public records, including middle names or initials if applicable. This precision is crucial for the deed to be valid and for future transactions to proceed without legal hitches.

A number of people neglect to specify the form of ownership when multiple grantees are involved. In New York, there are several ways co-owners can hold title, such as tenants in common or as joint tenants with rights of survivorship. Failing to state the form of ownership can result in confusion and possibly litigation between co-owners in the future about rights to the property or what happens upon the death of one owner.

Occasionally, individuals forget to sign or notarize the document as required. In New York, the Quitclaim Deed must be signed by the grantor in the presence of a notary public. A deed without a proper signature or notarization is not legally effective. This oversight can be easily overlooked but has critical legal implications, rendering the transfer of property incomplete.

Forgetting to file the deed with the county clerk’s office is another mistake. After notarization, the Quitclaim Deed needs to be filed in the office of the county clerk where the property is located. Filing the deed is essential for it to be considered valid and to put the public on notice of the change in property ownership. Failure to file means the deed won’t be part of the public record, potentially complicating future transactions.

Some mistakenly believe that a Quitclaim Deed guarantees a clear title. This type of deed transfers only whatever interest the grantor has in the property without any warranty that the title is clear and without liens. Parties should conduct due diligence before transferring property to understand any potential encumbrances or issues with the title.

Another error involves miscalculating the New York State transfer tax or not adhering to local requirements. Transfer taxes can vary, and in some cases, additional local taxes may apply. Incorrectly calculating or failing to submit the correct amount can delay the recording of the deed and result in penalties and interest.

Not obtaining the necessary permits or approvals for the transfer is an oversight some make, especially in regulated areas or when the property has unique characteristics. Certain transfers might require approval from local or state agencies, or even homeowners’ associations. Ignoring these requirements can void the deed or cause legal issues down the line.

People sometimes use a general Quitclaim Deed form that might not comply with New York specific requirements. State-specific aspects, such as specific wording or additional declarations, might be necessary for a deed to be legally valid in New York. Using an incorrect or too general form can lead to the deed being rejected or deemed invalid.

Lastly, assuming that a Quitclaim Deed can resolve ownership disputes is a misconception. This deed type is most suitable for transfers between family members or close associates where there is trust and a clear understanding of the property’s status. If there are disputes or uncertainty about ownership, using a Quitclaim Deed without resolution can complicate legal matters instead of providing a clear transfer of property rights.

Documents used along the form

When dealing with property transactions in New York, specifically with a Quitclaim Deed, various other forms and documents often support and complement the process. A Quitclaim Deed is typically used to transfer property without a traditional sale, often between family members or to clear up a title issue. Surrounding this form, a set of documents help ensure the transaction is clear, legal, and complete. These forms might cover aspects from tax implications to confirming the exact boundaries of the property in question.

- Real Property Transfer Report (RP-5217): This document is filed with the county clerk and New York State Department of Taxation and Finance. It provides detailed information about the property and the transaction, and it's necessary for most real estate transfers, including those involving quitclaim deeds.

- Transfer Tax Affidavit (TP-584): Required for recording the deed, this affidavit is used to calculate the state and local transfer taxes on the conveyance. It must be completed by the seller and accompanies the deed upon filing.

- Combined Real Estate Transfer Tax Return: In some cases, especially involving significant properties, a more comprehensive tax form is required to cover both state and local real estate transfer taxes in more detail than the TP-584.

- Title Search Report: While not a form, a title search report is often crucial when dealing with quitclaim deeds. This report outlines the history of the property, including any previous liens or claims, to ensure that the grantor has the right to transfer the property.

- Property Survey: This document outlines the physical boundaries and dimensions of the property. A current property survey might be necessary to resolve any disputes or clarify the exact area being transferred with the quitclaim deed.

- Mortgage Payoff Statement: If there is an existing mortgage on the property, a statement indicating the payoff amount is necessary. This ensures that all parties know the remaining balance that must be cleared at the time of transfer.

- New York State Equalization Form: Though not always required, this form might be necessary for properties in certain areas to ensure that state and local taxes are correctly assessed and equalized across different municipalities.

Utilizing a quitclaim deed to transfer property interest in New York involves navigating several legal and procedural steps. Alongside the deed itself, these additional documents play critical roles in ensuring that the transfer is valid, transparent, and in compliance with all state and local regulations. They provide a framework that helps to avoid future disputes and legal complications, making the process smoother for all involved parties.

Similar forms

The New York Quitclaim Deed form shares similarities with a Warranty Deed, mainly in its function to transfer property ownership rights from one party to another. However, the distinction lies in the level of protection offered to the buyer. While a Quitclaim Deed provides no warranties regarding the title's clearness or freedom from liens, a Warranty Deed offers comprehensive guarantees that the seller owns the property free and clear of all encumbrances.

Similarly, the Grant Deed is akin to the Quitclaim Deed as both serve the purpose of property transfer. The key difference, however, hinges on the promises made; the Grant Deed implicitly assures that the property has not been sold to someone else and is not burdened by undisclosed encumbrances, differing from the Quitclaim Deed’s lack of any such guarantees.

A Trustee’s Deed bears resemblance to the Quitclaim Deed in that it involves property transfer. Used often in foreclosure sales or when a property is held in a trust, a Trustee’s Deed, unlike the Quitclaim Deed, may offer certain guarantees about the title based on the trustee's authority to sell the property, marking a significant distinction in the conveyance of title and potential warranties.

The Deed of Trust, another document pertaining to real estate, parallels the Quitclaim Deed in facilitating real estate transactions. However, it differs significantly in purpose; a Deed of Trust involves three parties and acts as a security for a loan on the property, whereas the Quitclaim Deed is a straightforward transfer of property ownership without involving loans or security interests.

Similar in intent, a Special Warranty Deed and the Quitclaim Deed both facilitate property transfers. The Special Warranty Deed, unlike its counterpart, provides limited assurances, only covering the period during which the seller held ownership of the property. This contrasts with the Quitclaim Deed, which offers no warranties at all regarding the quality of the property title.

The Correction Deed is frequently used to amend errors in previously recorded deeds, sharing this rectifying feature with the Quitclaim Deed, which might also serve this purpose informally. Despite this commonality, their primary intentions diverge: the Correction Deed focuses on clarifying inaccuracies in the property’s legal description or clerical mistakes, unlike the broader aim of transferring property rights seen with Quitclaim Deeds.

Life Estate Deeds are designed to transfer property ownership while allowing the original owner (or another designated individual) to retain the right to use the property until death. This approach to property transfer shares the basic premise of changing ownership like the Quitclaim Deed but diverges in offering a lifelong use assurance to a specific individual, a feature absent in Quitclaim Deeds.

The Transfer on Death Deed, like the Quitclaim Deed, facilitates the passing of property ownership without the need for probate court proceedings. However, it stands apart by allowing the property to automatically transfer to a beneficiary upon the owner's death, offering a clear path of succession that Quitclaim Deeds, which become effective immediately upon execution and delivery, do not provide.

Dos and Don'ts

When filling out a New York Quitclaim Deed form, it's important to pay close attention to the details to ensure that the document accurately reflects your intentions and complies with state law. Here are some do's and don'ts that can help guide you through the process:

Do:- Ensure all parties' names are spelled correctly and match any existing records or identification documents. This includes the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide a complete and accurate description of the property being transferred. This should include the physical address, legal description, and any other identifying information required by local laws.

- Sign the document in front of a notary public. Notarization is essential for the document to be legally binding and properly recorded.

- Check if witness signatures are required. Some jurisdictions may need witnesses in addition to notarization, so it’s crucial to adhere to these rules.

- Record the deed with the county clerk’s office in the county where the property is located. This public record notifies others that the property has been transferred.

- Retain copies of the notarized deed for your records and for the grantee. It's always good practice to have backup copies of important legal documents.

- Consult with a real estate attorney if you have questions or need advice specific to your situation. They can provide valuable insights that align with state laws and personal circumstances.

- Leave any fields blank on the form. Incomplete forms may be rejected or cause legal issues down the line.

- Assume a quitclaim deed releases you from your mortgage obligations. Quitclaim deeds transfer property ownership but do not affect any existing mortgages or liens.

- Forget to update your estate plan after transferring property. This transfer may impact your overall estate planning strategy.

- Mistake a quitclaim deed for a warranty deed. Warranty deeds provide the grantee with guarantees about the title and property condition, while quitclaim deeds do not.

- Ignore local filing fees or requirements. Each county has specific requirements and fees associated with recording deeds, so be sure to understand these before submitting.

- Use a generic form without verifying it meets New York standards. State-specific details are crucial for the form’s validity.

- Rush through the process without carefully reviewing every detail on the form. Mistakes can be difficult and potentially costly to correct after recording.

Misconceptions

When it comes to transferring property ownership in New York, the Quitclaim Deed form is often mentioned. However, there are several misconceptions surrounding its use and implications. Understanding these can help in making informed decisions.

A Quitclaim Deed guarantees a clear title: This is a common misunderstanding. In reality, a Quitclaim Deed does not guarantee that the title is free from claims or liens. It simply transfers whatever interest the grantor has in the property, without any warranties regarding the clearness of the title.

It only applies to residential property: Another misconception is that Quitclaim Deeds are only used for residential properties. In fact, they can be used to transfer many types of real estate interests, not just residential ones, including commercial properties and land.

It resolves all ownership disputes: Some believe that a Quitclaim Deed can resolve ownership disputes. This is inaccurate. It transfers the grantor's interest to the grantee without addressing any potential disputes. Legal advice may be necessary to resolve ownership issues.

The process is complicated: The perception that the process to complete a Quitclaim Deed is complex and time-consuming can deter some. Indeed, the process is relatively straightforward, especially with proper guidance and the correct information at hand.

Use of a Quitclaim Deed avoids taxes: This is a misconception. The transfer of property via a Quitclaim Deed might still be subject to federal and state taxes. Consulting with a tax advisor is recommended to understand the tax implications fully.

It offers the same protection as a warranty deed: Some confuse the protection offered by a Quitclaim Deed with that of a warranty deed. However, unlike a warranty deed, a Quitclaim Deed does not provide any warranties about the property title's status.

Clearing up these misconceptions can guide individuals in making decisions that align with their needs and expectations related to property transactions in New York.

Key takeaways

When dealing with property transactions in New York, using a Quitclaim Deed is a common method for transferring ownership without making any warranties about the title's quality. Below are several key takeaways to consider when filing out and using the New York Quitclaim Deed form:

- A Quitclaim Deed transfers interest in real property from the grantor to the grantee without warranties. It's crucial for the grantee to conduct a thorough title search to understand the property's history.

- Ensure all parties understand a Quitclaim Deed only affects ownership and does not guarantee clear title, meaning it doesn't assure the property is free from other claims or liens.

- Accurately identifying all parties by their full legal names and including their addresses is essential for clarity and to avoid future disputes.

- The legal description of the property on the Quitclaim Deed must be precise. This includes the lot number, block number, and any other identifiers used in public records.

- Both the grantor and grantee must sign the Quitclaim Deed in the presence of a notary public to ensure the document is legally binding.

- In New York, the Quitclaim Deed must be filed with the County Clerk's Office in the county where the property is located, following the signing and notarization.

- Payment of a filing fee is required when submitting the Quitclaim Deed. The amount varies by county, so it's advisable to check the local County Clerk's fee schedule.

- It is recommended to provide the grantee with a copy of the filed Quitclaim Deed for their records, which serves as proof of ownership.

- If the property being transferred is subject to a mortgage, the parties should be aware that a Quitclaim Deed does not relieve the grantor of their mortgage obligations unless otherwise agreed upon with the lender.

- Consulting with a legal professional experienced in real estate transactions is wise to ensure the Quitclaim Deed accurately reflects the agreement and complies with New York state law.

Taking these steps when completing a New York Quitclaim Deed can help facilitate a smoother property transfer and protect the interests of all parties involved.

More Quitclaim Deed State Forms

Kalamazoo Register of Deeds - When considering a property transfer between trusted parties, this deed offers a viable and efficient solution.

How to Do a Quick Claim Deed - Real estate planning strategies often incorporate Quitclaim Deeds to manage assets and ensure smooth succession planning.

Georgia Deed Transfer Forms - It’s a quick way to transfer property, but it doesn’t guarantee the seller has clear title.

Florida Quit Claim Deed Rules - Often preferred for its speed and straightforwardness in property interest transfers.