Fillable Quitclaim Deed Document for Michigan

When individuals or entities decide to transfer property rights in Michigan without the guarantees that come with a warranty deed, the Michigan Quitclaim Deed form becomes a significant tool. This legal document is designed to expedite the transfer process, making it straightforward for both the grantor (the person who is transferring the property) and the grantee (the recipient of the property) to transfer ownership. Unlike traditional property deeds, the quitclaim approach does not guarantee that the title is free and clear of liens or other encumbrances; it simply transfers whatever interest the grantor has in the property, if any. This peculiarity makes it particularly useful in transactions between family members or close acquaintances where trust is not an issue, and in situations where speed and simplicity are valued over the assurances of a warranty deed. It’s essential for both parties to understand the implications of using a quitclaim deed, including the lack of protection for the grantee, and to undertake due diligence to ensure the transaction aligns with their interests. Proper completion and filing of this form with the appropriate county office in Michigan are crucial steps to legally effectuate the property transfer and ensure the transaction is recorded in public records, providing notice of the change in ownership.

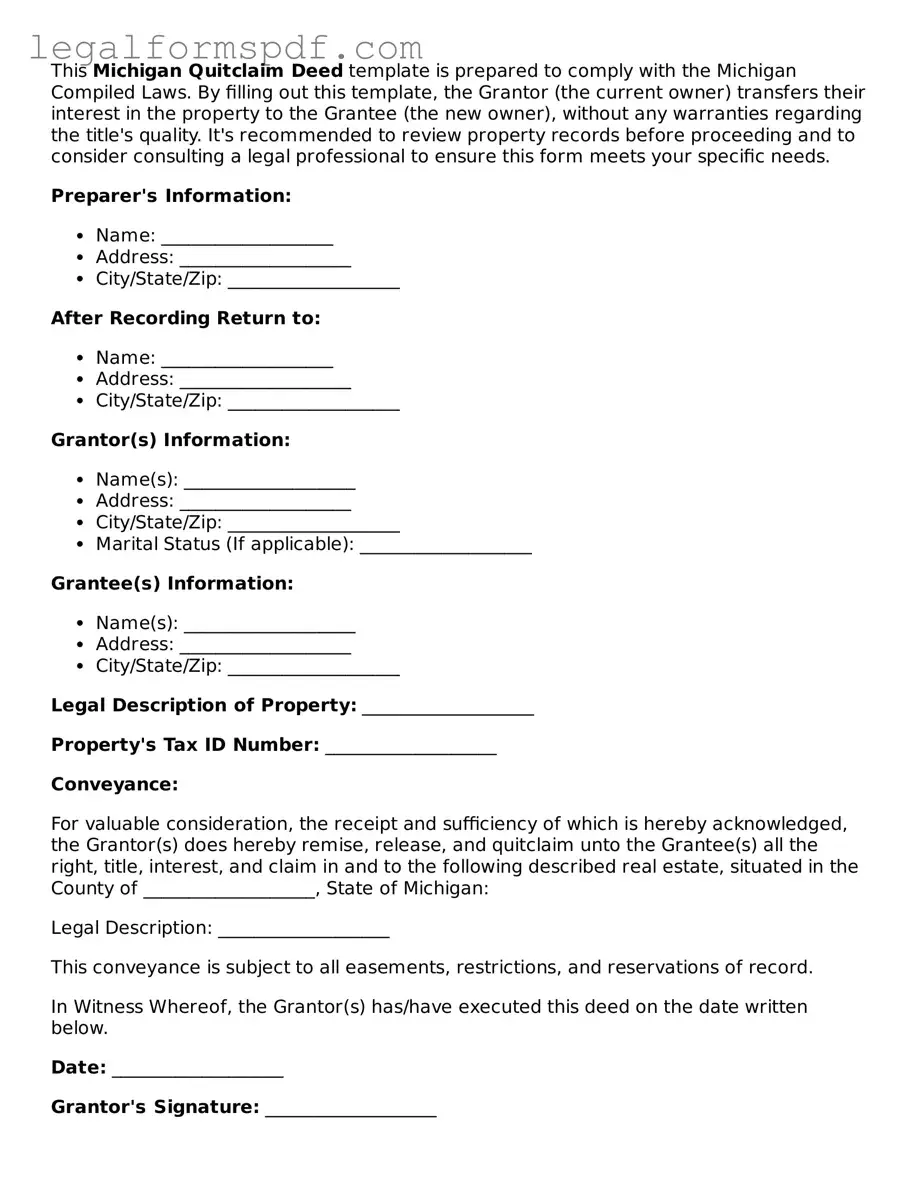

Document Example

This Michigan Quitclaim Deed template is prepared to comply with the Michigan Compiled Laws. By filling out this template, the Grantor (the current owner) transfers their interest in the property to the Grantee (the new owner), without any warranties regarding the title's quality. It's recommended to review property records before proceeding and to consider consulting a legal professional to ensure this form meets your specific needs.

Preparer's Information:

- Name: ___________________

- Address: ___________________

- City/State/Zip: ___________________

After Recording Return to:

- Name: ___________________

- Address: ___________________

- City/State/Zip: ___________________

Grantor(s) Information:

- Name(s): ___________________

- Address: ___________________

- City/State/Zip: ___________________

- Marital Status (If applicable): ___________________

Grantee(s) Information:

- Name(s): ___________________

- Address: ___________________

- City/State/Zip: ___________________

Legal Description of Property: ___________________

Property's Tax ID Number: ___________________

Conveyance:

For valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Grantor(s) does hereby remise, release, and quitclaim unto the Grantee(s) all the right, title, interest, and claim in and to the following described real estate, situated in the County of ___________________, State of Michigan:

Legal Description: ___________________

This conveyance is subject to all easements, restrictions, and reservations of record.

In Witness Whereof, the Grantor(s) has/have executed this deed on the date written below.

Date: ___________________

Grantor's Signature: ___________________

Printed Name: ___________________

State of Michigan

County of ___________________

On this day, before me, ___________________ (Notary Public/Attorney at Law), personally appeared ___________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that he/she/they executed the same for the purposes therein contained.

In Witness Whereof, I hereunto set my hand and official seal.

Date: ___________________

(Notary Public/Attorney at Law) Signature: ___________________

Printed Name: ___________________

My Commission Expires: ___________________

PDF Specifications

| Fact | Description |

|---|---|

| Purpose | Michigan Quitclaim Deed forms are used to transfer property rights from one person (the grantor) to another (the grantee) without warranties. |

| Governing Law | These deeds are governed by Michigan Compiled Laws, specifically within sections 565.151 to 565.154. |

| Recording Requirement | The deed must be recorded with the Register of Deeds in the county where the property is located to be effective against third parties. |

| Signature Requirements | The grantor must sign the quitclaim deed in the presence of a notary public or two witnesses for it to be valid under Michigan law. |

| Consideration Statement | A statement of consideration is required, indicating the value exchanged for the property, though Michigan law does not require a specific minimum consideration. |

Instructions on Writing Michigan Quitclaim Deed

Filling out a Michigan Quitclaim Deed form is an important step in the process of transferring property ownership from one person to another without making any warranties about the title. This document is typically used when transferring property between family members or close friends, in divorce settlements, or when clearing up a title issue. The process can seem daunting, but by following these step-by-step instructions, you can complete the form accurately and efficiently.

- Begin by entering the preparer's information at the top of the form, including the name and address of the individual who is preparing the Quitclaim Deed.

- In the "After Recording Return To" section, fill in the name and address of the person or entity to whom the recorded deed should be returned.

- Enter the date of the transaction in the designated space.

- In the "Grantor(s)" section, write the name(s) and address(es) of the current owner(s) of the property who is transferring the interest in the property.

- In the "Grantee(s)" section, provide the name(s) and address(es) of the recipient(s) of the property interest.

- Include the consideration amount, which is the value being exchanged for the property interest, if applicable.

- Describe the property being transferred. This should include the legal description of the property, which can be found on a previous deed, tax bill, or other documents related to the property. Include any parcel or identification numbers if available.

- Ensure the Grantor(s) sign and date the form in the presence of a notary public. The notary will also need to fill in their section, including their signature, the date, and affix their official seal.

- Review the entire form for accuracy and completeness before finalizing the document.

- Record the Quitclaim Deed with the appropriate county's Register of Deeds office to complete the transfer process. A recording fee will likely be required.

Once the Michigan Quitclaim Deed form is properly filled out, signed, notarized, and recorded, the property transfer process is legally completed. Transferring property can significantly impact all parties involved, making it crucial to carefully complete each step with attention to detail. This ensures the transition is smooth and legally binding, protecting everyone's interests.

Understanding Michigan Quitclaim Deed

What is a Michigan Quitclaim Deed form?

A Michigan Quitclaim Deed form is a legal document used to transfer interest, ownership, or rights in a property from one party (the grantor) to another (the grantee) without any warranties of title. It is most commonly utilized between parties who know each other and are looking for a quick and simple property transfer, such as between family members or close associates.

When should I use a Quitclaim Deed in Michigan?

You might use a Quitclaim Deed in Michigan in situations where the property transfer is not traditional, such as adding or removing someone’s name from a property title, transferring property to a trust or from a trust, settling property after a divorce, or transferring property as a gift to a family member. It's important when the grantor does not need to guarantee the title's status to the grantee.

What are the legal requirements for a Michigan Quitclaim Deed?

In Michigan, a Quitclaim Deed must include the names of the grantor and grantee, a legal description of the property, the amount of consideration (if applicable), and the grantor’s signature, which must be notarized. Furthermore, the deed needs to be filed with the county register of deeds where the property is located to be effective as per state law.

Does a Michigan Quitclaim Deed guarantee a clear title?

No, a Quitclaim Deed in Michigan does not guarantee a clear title. It only transfers whatever interest the grantor has in the property—if any—without warranties. This means the grantee receives the property "as-is," possibly including any title defects or liens that exist at the time of transfer.

How is a Quitclaim Deed different from a Warranty Deed in Michigan?

A Quitclaim Deed and a Warranty Deed are both used to transfer property, but the key difference lies in the level of protection offered to the new owner. A Warranty Deed guarantees that the property title is free and clear of any claims, providing the grantee with legal recourse if issues arise. In contrast, a Quitclaim Deed offers no such assurances, transferring only the rights the grantor has at the time of the transfer.

What are the tax implications of using a Quitclaim Deed in Michigan?

Transferring property using a Quitclaim Deed in Michigan might have tax implications, including potential property tax reassessment and gift tax considerations. Since situations vary widely, it is advisable to consult with a tax professional to understand the specific implications in your case.

Can a Michigan Quitclaim Deed be revoked?

Once executed and delivered to the grantee, a Quitclaim Deed in Michigan is generally irrevocable. This underscores the importance of being certain about your decision to transfer property rights before executing the deed. If both parties agree, a new deed can be executed to reverse the transaction.

How do I file a Quitclaim Deed in Michigan?

After completing and notarizing the Quitclaim Deed, it must be filed with the register of deeds in the Michigan county where the property is located. An appropriate filing fee will be required. The county clerk can provide information on the current fee structure and any additional filing requirements specific to the county.

What should I do if I need help with a Quitclaim Deed in Michigan?

If you need assistance with a Quitclaim Deed in Michigan, it's wise to consult with a legal professional who specializes in real estate law. They can provide legal advice, help draft the deed to ensure it complies with state laws, and guide you through the filing process to ensure the transfer is executed properly.

Common mistakes

Many individuals, when filling out the Michigan Quitclaim Deed form, overlook the significant detail of not clearly printing or typing the names of the grantor(s) and grantee(s). Accuracy in the transcription of names is critical since it ensures the deed accurately reflects who is relinquishing any interest in a property and who is receiving it. Error in this detail can lead to legal complications and confusion regarding the property’s rightful ownership.

Another common mistake is not providing a complete legal description of the property. A Quitclaim Deed requires specifics beyond just an address; it needs a legal description that can usually be found on the current deed or at the county recorder’s office. This description often includes lot numbers, subdivision name, and other details that precisely identify the property. Failure to include a complete legal description can render the deed invalid or ineffective for its intended purpose of transferring property rights.

Individuals also frequently forget to obtain or properly execute the necessary witnessing and notarization that Michigan law requires for a Quitclaim Deed to be legally valid. The deed must be signed in the presence of a notary and, in some cases, additional witnesses. This formalizes the document, attesting to the identity of the signatories and the voluntary nature of the act. Without this, the document may be challenged or not recognized by courts or title companies.

It's common for people to mishandle the recording process of the Quitclaim Deed with the county. After completing the form, the document needs to be filed with the county clerk’s office in the county where the property is located. This step is crucial because it places the document into the public record, providing notice of the transfer to future purchasers and creditors. Failure to record the document can lead to disputes about property ownership and can jeopardize the grantee's legal rights to the property.

Some individuals mistakenly believe that a Quitclaim Deed guarantees a clear title to the property. However, this type of deed transfers only the grantor's interest in the property, without any warranties regarding the condition of the property title. Failing to comprehend this critical distinction can result in the grantee unknowingly accepting liability for any title problems or encumbrances that exist.

Finally, a significant oversight is not consulting with a legal or real estate professional before filling out the Quitclaim Deed form. This lack of professional advice can lead to several of the above mistakes. Professionals can provide valuable guidance on the specific legal requirements in Michigan, help ensure the accuracy of the form, and advise on any implications the property transfer may have regarding taxes or estate planning. This professional insight can be invaluable in avoiding common pitfalls and ensuring that the property transfer achieves its intended outcomes.

Documents used along the form

When it comes to transferring property in Michigan, the Quitclaim Deed form is commonly used due to its simplicity and efficiency. However, this process often requires additional forms and documents to ensure everything is legally binding and comprehensively recorded. Below, we discuss several other forms and documents that are frequently utilized alongside the Michigan Quitclaim Deed to facilitate a smooth transfer of property. These ancillary documents serve various functions, from confirming the property's tax status to ensuring compliance with local regulations.

- Property Transfer Affidavit: This document is required by Michigan law whenever real estate ownership is transferred. It ensures that local assessing officers are informed of the change in property ownership, which is crucial for tax assessment purposes.

- Real Estate Transfer Tax Valuation Affidavit: Used to calculate and document state and county transfer taxes on the conveyance of real property, this affidavit must be filed with the county register of deeds.

- Title Insurance Policy: Often obtained in real estate transactions, this policy protects both buyers and lenders against potential losses due to defects in the title that were not discovered during the title search.

- Warranty Deed: In certain cases, alongside or in lieu of a Quitclaim Deed, a Warranty Deed might be used for the transfer of property. This deed provides the buyer with guarantees about the title and its condition.

- Mortgage Discharge Documents: If there was a mortgage on the property, discharge documents are necessary to show that the mortgage has been fully paid off and that the lien on the property has been released.

- Environmental Disclosure Statement: Depending on local regulations, this document may be required to disclose environmental conditions of the property being transferred.

- Homeowners Association (HOA) Compliance Agreement: For properties within an HOA, this agreement is needed to confirm that the property is in compliance with all HOA rules and regulations, and that there are no outstanding fees or dues.

In conclusion, transferring property in Michigan involves more than just the Quitclaim Deed. A thorough understanding and preparation of the aforementioned documents are essential in ensuring a legally sound and efficient property transfer. Each document plays a specific role in establishing the rights, responsibilities, and the status of all parties involved in the transaction. It's always recommended to consult with a legal professional who can provide guidance and ensure that all necessary paperwork is correctly completed and filed.

Similar forms

The Michigan Quitclaim Deed form shares similarities with the Warranty Deed in terms of its purpose to transfer property ownership. However, unlike a Quitclaim Deed, which conveys a property with no guarantees about the title's clarity, a Warranty Deed assures the buyer that the title is free and clear of any liens or claims, providing greater protection to the purchaser.

Similar to the Quitclaim Deed, a Grant Deed is used to transfer property ownership. A Grant Deed, like a Warranty Deed, provides the buyer with assurances that the property has not been sold to someone else and is free of encumbrances, except those stated explicitly. This is more protective than a Quitclaim Deed, which offers no such assurances.

The Trustee’s Deed is another document related to property transactions, and it becomes relevant when property held in a trust is being transferred. The Trustee’s Deed guarantees that the trustee has the authority to sell the property, similar to how a Quitclaim Deed transfers ownership interest, however, often with some assurances about the trustee's authority.

A Deed of Trust is an agreement used in some states as an alternative to a mortgage. This document involves three parties: the borrower, the lender, and the trustee. It is similar to the Quitclaim Deed in that it deals with property rights. However, its function is for securing a loan against real estate rather than transferring ownership with no guarantees.

The Special Warranty Deed shares a purpose with the Quitclaim Deed in transferring property titles but limits the scope of the seller's warranties. It assures the buyer against any defects in clear title that may arise during the seller's period of ownership, unlike the Quitclaim Deed which offers no such assurances.

A Transfer-on-Death Deed, while serving the purpose of transferring property ownership, operates uniquely since it only takes effect upon the death of the owner. This deed allows property owners to name beneficiaries who will receive the property without going through probate. Like a Quitclaim Deed, it simplifies the process of transferring property, though with a different triggering condition.

The Correction Deed is employed to amend a previously recorded deed that contained errors, such as misspellings or incorrect property descriptions. It is related to the Quitclaim Deed as it pertains to the transfer of property rights, though its specific purpose is to correct inaccuracies in the legal documents representing those rights.

A Fiduciary Deed is used when a property is transferred by a trustee, executor, guardian, or any fiduciary under a court order. Like a Quitclaim Deed, it involves the transfer of property ownership but is distinguished by the fiduciary's legal and ethical obligation to act in the best interest of the beneficiary or estate, often providing some level of assurance to the buyer similar to a Warranty Deed.

The Partition Deed is an agreement used to divide property among co-owners, allowing them to dissolve their joint ownership without selling the property. This deed is closely related to the Quitclaim Deed in that it also deals with the transfer of property rights among parties, but it is specifically designed for the amicable separation of property among owners.

Dos and Don'ts

When dealing with the Michigan Quitclaim Deed form, certain practices can ensure the process is completed efficiently and accurately. Below are lists of things you should and shouldn't do when filling out this form:

Things You Should Do:

- Ensure all parties involved have a clear understanding of the quitclaim deed's purpose and the implications of transferring property without warranties.

- Verify that the legal description of the property is accurate. This description can often be found on the current deed or by consulting a property survey.

- Include all necessary parties in the transaction. If the property is owned jointly, for example, all owners should sign the quitclaim deed.

- Check for any specific filing requirements in the county where the property is located, as these can vary.

- Use black ink and a legible handwriting or font to ensure the document is clear and readable, which is critical for official records.

- Have the quitclaim deed notarized, as this is a legal requirement for the document to be valid and recordable.

- Provide accurate contact information for both the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Review the entire document for accuracy before signing, paying special attention to names, property description, and the date.

- Record the quitclaim deed with the appropriate county office after signing, as this makes the transfer of property public record.

- Keep personal copies of the recorded quitclaim deed for all parties involved for future reference and legal documentation.

Things You Shouldn't Do:

- Do not leave any sections blank or incomplete, as this could void the document or cause legal issues later on.

- Do not use the quitclaim deed to transfer property if you are unsure of the title's status, as it does not guarantee clear title.

- Do not fail to consult with a legal professional if there are any questions or concerns about the quitclaim deed process or its implications.

- Do not forget to verify the form's compliance with local and state regulations, as failing to do so could result in the document being rejected.

- Do not neglect to discuss the tax implications of transferring property with a tax professional, as this can have significant consequences for both parties.

- Do not utilize a quitclaim deed without understanding that it only transfers the grantor's interest in the property and does not warrant against any encumbrances.

- Do not overlook the necessity of obtaining other parties' consent if required, such as a spouse or co-owner.

- Do not input incorrect information intentionally, as this can lead to legal repercussions including fraud.

- Do not avoid recording the quitclaim deed, as an unrecorded deed might not protect the grantee's interest in the property.

- Do not mishandle the original recorded quitclaim deed, as it is an important legal document that might be needed for future transactions or verification.

Misconceptions

Many people have misconceptions about the Quitclaim Deed form in Michigan. Understanding these misconceptions can help clarify what Quitclaim Deeds do and do not do.

- A Quitclaim Deed guarantees clear title to the property. One common misconception is that Quitclaim Deeds ensure the grantor has a clear title to the property being transferred. However, Quitclaim Deeds do not make any guarantees about the title. They simply transfer whatever interest the grantor has, if any, at the time of the transfer.

- Quitclaim Deeds can resolve property disputes. Another misconception is that Quitclaim Deeds can be used to resolve property disputes or clear up title issues. In reality, these deeds transfer ownership without addressing liens, claims, or other encumbrances on the title. It's essential to resolve disputes through other means before or after the deed transfer.

- Quitclaim Deeds are only for transferring property to family members. While it's true that Quitclaim Deeds are commonly used to transfer property among family members, they can be used between any individuals. Their simplicity makes them attractive for intra-family transactions, but they're not limited to such uses.

- There are no tax implications with Quitclaim Deeds. People often think that transferring property via a Quitclaim Deed does not involve tax obligations. However, property transfers can have tax implications, including potential income tax, gift tax, or estate tax considerations, depending on the specific circumstances of the transfer.

- Using a Quitclaim Deed immediately transfers property ownership. While it's true that a Quitclaim Deed transfers interest upon execution, the transfer is not official until the deed is properly recorded with the local county recorder's office. This step is crucial for the deed to be recognized legally and to notify third parties of the change in ownership.

- Quitclaim Deeds protect the buyer. Finally, there's a misconception that Quitclaim Deeds offer protection to the buyer. In contrast to warranty deeds, Quitclaim Deeds offer no warranties or guarantees about the property's title, leaving the buyer with no recourse against the seller if problems with the title arise after the transfer.

Key takeaways

When dealing with the Michigan Quitclaim Deed form, it is essential to pay close attention to specific details to ensure a smooth transaction. Here are key takeaways for completing and utilizing this form properly:

- Verify the accuracy of all names and addresses on the form. It's crucial that the grantor (the person transferring the property) and the grantee (the person receiving the property) are correctly identified.

- Include a complete legal description of the property. This description goes beyond the street address, incorporating lot, block, and subdivision or metes and bounds descriptions, as applicable.

- Don't forget to add any relevant attachments if the space provided on the form is insufficient for a full legal description.

- Ensure that the grantor signs the deed in the presence of a notary public. The notarization process is a legal requirement for the deed to be considered valid.

- Check if witness signatures are required. Michigan law doesn't typically require witnesses for a quitclaim deed, but it's crucial to verify if local ordinances dictate otherwise.

- Remember to file the executed deed with the appropriate county register of deeds office. The property won't legally change hands until this step is completed.

- Prepare to pay any necessary recording fees at the time of filing. These fees can vary, so it's advisable to contact the local register's office in advance to determine the exact amount.

- Consider consulting with a legal professional before proceeding. Quitclaim deeds have significant legal effects, potentially affecting property rights and obligations.

More Quitclaim Deed State Forms

Quit Claim Deed Illinois - This form of deed is straightforward in its approach but must be handled with careful consideration of its limits.

Quick Deed Ohio - Lawyers often recommend Quitclaim Deeds for rectifying minor errors in property deeds, such as misspelled names or incorrect property descriptions.