Fillable Quitclaim Deed Document for Illinois

Transferring property ownership in Illinois can be accomplished through various legal instruments, one of the simplest being the Quitclaim Deed form. This straightforward document plays a pivotal role in Illinois real estate transactions when the grantor (the person transferring the property) does not want to provide any warranties regarding the property's title to the grantee (the recipient). Unlike warranty deeds, these particular forms signify a transfer of ownership without making any promises about the property's lien or claim status, making them especially suitable for transactions between trusted parties, such as family members. The form's contents generally include the names of the grantor and grantee, the legal description of the property, and the date of transfer, all of which must comply with Illinois state laws to ensure the document's validity. Essential for a smooth and legally sound transfer, understanding the aspects and implications of the Illinois Quitclaim Deed form is paramount for parties engaged in property transactions within the state.

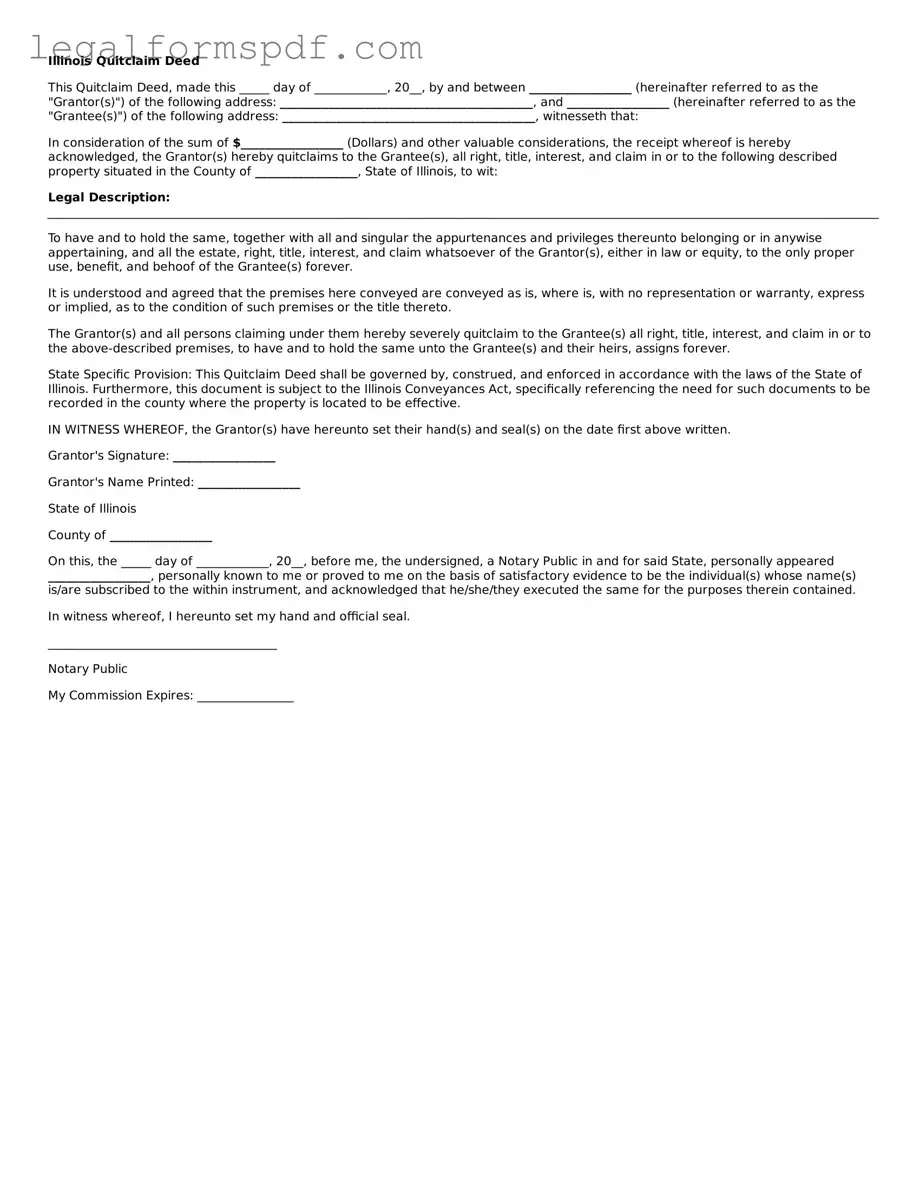

Document Example

Illinois Quitclaim Deed

This Quitclaim Deed, made this _____ day of ____________, 20__, by and between _________________ (hereinafter referred to as the "Grantor(s)") of the following address: __________________________________________, and _________________ (hereinafter referred to as the "Grantee(s)") of the following address: __________________________________________, witnesseth that:

In consideration of the sum of $_________________ (Dollars) and other valuable considerations, the receipt whereof is hereby acknowledged, the Grantor(s) hereby quitclaims to the Grantee(s), all right, title, interest, and claim in or to the following described property situated in the County of _________________, State of Illinois, to wit:

Legal Description: __________________________________________________________________________________________________________________________________________

To have and to hold the same, together with all and singular the appurtenances and privileges thereunto belonging or in anywise appertaining, and all the estate, right, title, interest, and claim whatsoever of the Grantor(s), either in law or equity, to the only proper use, benefit, and behoof of the Grantee(s) forever.

It is understood and agreed that the premises here conveyed are conveyed as is, where is, with no representation or warranty, express or implied, as to the condition of such premises or the title thereto.

The Grantor(s) and all persons claiming under them hereby severely quitclaim to the Grantee(s) all right, title, interest, and claim in or to the above-described premises, to have and to hold the same unto the Grantee(s) and their heirs, assigns forever.

State Specific Provision: This Quitclaim Deed shall be governed by, construed, and enforced in accordance with the laws of the State of Illinois. Furthermore, this document is subject to the Illinois Conveyances Act, specifically referencing the need for such documents to be recorded in the county where the property is located to be effective.

IN WITNESS WHEREOF, the Grantor(s) have hereunto set their hand(s) and seal(s) on the date first above written.

Grantor's Signature: _________________

Grantor's Name Printed: _________________

State of Illinois

County of _________________

On this, the _____ day of ____________, 20__, before me, the undersigned, a Notary Public in and for said State, personally appeared _________________, personally known to me or proved to me on the basis of satisfactory evidence to be the individual(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

______________________________________

Notary Public

My Commission Expires: ________________

PDF Specifications

| Fact Number | Fact |

|---|---|

| 1 | The Illinois Quitclaim Deed form is used to transfer property quickly without a warranty. |

| 2 | It does not guarantee that the title is clear, meaning the seller does not guarantee they own the property free and clear of other claims. |

| 3 | This form is often used between family members or to transfer property into a trust. |

| 4 | Illinois law requires the property's legal description to be included in the Quitclaim Deed. |

| 5 | The deed must be signed by the grantor(s) in the presence of a notary public to be valid. |

| 6 | Once completed, the Quitclaim Deed should be recorded with the county recorder’s office where the property is located. |

| 7 | Recording the deed provides public notice of the change in ownership and protects the grantee’s interest in the property. |

| 8 | The grantor is responsible for paying the state and county transfer taxes, if applicable. |

| 9 | Under Illinois law, a Quitclaim Deed must specify the consideration given for the property, even if it is minimal. |

| 10 | The Illinois Real Property Transfer Act governs the creation and recording of quitclaim deeds in the state. |

Instructions on Writing Illinois Quitclaim Deed

Filing a quitclaim deed in Illinois is a necessary step for individuals looking to transfer ownership of property without the warranties typically associated with a general warranty deed. This document legally transfers the grantor's (seller's) interest in a piece of real estate to the grantee (buyer), but it doesn't guarantee that the property's title is clear of claims. It's crucial for those involved in this transaction to understand that, once filed, the deed changes the legal ownership of the property. Therefore, filling out the quitclaim deed form accurately is imperative. Below are the steps needed to complete the form properly.

- Begin by downloading the official Illinois quitclaim deed form from a reliable source. Ensure the form is specific to the State of Illinois, as requirements may vary by state.

- Enter the preparer's information, including name and address, at the top of the form. This detail specifies who completed the document.

- Fill in the "Return to" section with the name and address of the individual who should receive the deed after it is recorded.

- Provide the consideration paid for the property transfer. This amount, often nominal, symbolizes the transfer of ownership.

- Include the full legal name and address of the grantor(s) and grantee(s) in the designated areas. It's crucial to spell all names correctly and to specify any grantors or grantees accurately.

- List the legal description of the property. This should be exact and may include lot numbers, subdivision names, and measurements. Property tax identification numbers should also be included if available.

- Have the grantor(s) sign and date the document in the presence of a notary public. The notary will also need to fill out their section, confirming the identity of the signee(s).

- Finally, file the completed quitclaim deed with the county recorder’s office in the county where the property is located. A filing fee will be required, and the amount can vary by county.

After these steps have been followed, and the document is filed, the ownership of the property is officially transferred to the grantee. The county recorder's office will process the quitclaim deed and return a copy to the designated recipient. It's important for both the grantor and grantee to keep a copy of the recorded deed for their records. Successfully transferring property through a quitclaim deed requires attention to detail and an understanding of the process. Following these steps carefully ensures a smoother transition of ownership.

Understanding Illinois Quitclaim Deed

What is a Quitclaim Deed in Illinois?

A Quitclaim Deed in Illinois is a legal document used to transfer property without any warranties about the property title's condition. This means the seller, known as the "grantor," transfers their ownership interest to the buyer, or "grantee," but does not guarantee that the property is free of claims or liens. It's often used between family members or to clear up title issues.

How is a Quitclaim Deed different from a Warranty Deed?

Unlike a Quitclaim Deed, a Warranty Deed provides the buyer with warranties that the property is free of other claims, such as liens or encumbrances. Essentially, a Warranty Deed assures the buyer of a clear title, which is not the case with a Quitclaim Deed. Quitclaim Deeds are thus suited for low-risk transactions between parties who trust each other.

What information is required to complete a Quitclaim Deed in Illinois?

To complete a Quitclaim Deed in Illinois, you need the legal description of the property, the names of the grantor and grantee, and the amount of consideration if any. The deed must be signed by the grantor in front of a notary public and then filed with the appropriate county recorder's office to be valid.

Do I need an attorney to prepare a Quitclaim Deed in Illinois?

While it's not legally required to have an attorney prepare a Quitclaim Deed, consulting with one can help ensure that the deed accurately reflects the agreement and is properly executed. An attorney can offer valuable advice on the implications of the transfer and ensure that the property description is correct and the document complies with all Illinois laws.

Is a Quitclaim Deed immediately effective in Illinois?

Yes, a Quitclaim Deed becomes effective immediately upon signing and notarization. However, for the transfer to be enforceable against third parties, the deed must be recorded with the county recorder's office where the property is located. Recording the deed provides public notice of the transfer.

Can a Quitclaim Deed be revoked in Illinois?

Once a Quitclaim Deed has been executed and delivered to the grantee, it generally cannot be revoked without the grantee's consent. If both parties agree, the grantee can execute a Quitclaim Deed back to the grantor to return the property interest. Legal advice should be sought in any attempt to revoke or reverse a Quitclaim Deed.

Common mistakes

One common mistake people make when filling out the Illinois Quitclaim Deed form is not correctly identifying the grantor and grantee. The grantor is the individual who is transferring the property, while the grantee is the person or entity receiving the property. It's crucial that names are spelled correctly and match the names on the official records. Incorrect or incomplete names can lead to disputes over property ownership and might require legal action to correct.

Another error occurs with the property description. The legal description of the property must be accurate and complete. Generally, this includes the lot number, subdivision name, and any relevant measurements or boundaries. A mistake in the legal description can lead to confusion over what property is actually being transferred. It’s different from a street address, which, on its own, is not sufficient for legal purposes.

Many people also forget to have the deed notarized, which is a critical step in the process. In Illinois, a quitclaim deed must be signed by the grantor in the presence of a notary public. Without proper notarization, the deed might not be considered valid, which can prevent the transfer of the property title to the grantee.

Failure to verify that all necessary parties have signed the deed is yet another mistake. If the property is owned jointly, for example, both owners must sign the deed for the transfer to be valid. Overlooking the requirement for all parties to sign can invalidate the deed, making it necessary to redo the process.

An oversight often made by individuals is not recording the deed with the county recorder's office after it is completed. In Illinois, for the deed to be effective against third parties, it must be recorded in the county where the property is located. Failure to record the deed does not affect the validity of the transfer between the grantor and grantee, but it does leave the grantee vulnerable to future property disputes.

Last but not least, failing to consult with a legal professional for advice and review of the quitclaim deed before finalizing it can be a significant mistake. Legal professionals can help ensure the accuracy and completeness of the deed, advise on any potential legal issues, and ensure that the transaction aligns with the parties’ intentions. Skimping on this step can result in errors that may lead to legal and financial consequences down the road.

Documents used along the form

When handling property transactions in Illinois, specifically with the use of a Quitclaim Deed form, it's essential to understand the supplementary documents that often accompany it. These documents are crucial for a thorough and legally sound transfer of property ownership. They support the Quitclaim Deed by providing detailed information, ensuring compliance with state laws, and verifying the parties' identities and rights.

- Title Search Report: Before transferring property, a title search is conducted to confirm the property's legal owner and identify any liens, mortgages, or claims against the property. This ensures the grantor has the right to transfer ownership.

- Real Estate Transfer Declaration (PTAX-203): This document provides information about the property sale, including the sale price and property description, necessary for tax assessment purposes.

- ALTA Statement: The American Land Title Association (ALTA) statement is a comprehensive disclosure that provides details about the property, including zoning laws, restrictions, and easements, ensuring all parties are informed of the property's conditions.

- Mortgage Payoff Statement: If there’s an existing mortgage on the property, this statement outlines the outstanding balance that must be paid off at or before closing, ensuring clear title transfer.

- Homestead Exemption Application: For residential properties, this form may be filed to reduce property taxes by declaring the property as the owner's primary residence.

- Notary Acknowledgement: A notarized document that verifies the identities of the parties involved in the transaction, confirming that they signed the deed voluntarily.

- Property Disclosure Statement: Sellers provide this statement to disclose the condition of the property, including any known defects or issues, ensuring buyers are fully informed before the purchase.

In conclusion, the Quitclaim Deed form is just one part of a complex process involved in transferring property ownership in Illinois. The additional documents listed provide a network of legal protection and assurance, ensuring that both the buyer and seller are well-informed and that the transaction complies with state laws. Understanding and properly executing these documents ensures a smooth and transparent property transaction.

Similar forms

The Illinois Quitclaim Deed form shares similarities with the Warranty Deed form. Both are instruments used in the transfer of property ownership, but they differ significantly in the level of protection offered to the buyer. The Warranty Deed comes with guarantees from the seller about the clear title and their right to sell the property, providing more security to the buyer. Conversely, the Quitclaim Deed offers no warranties, merely transferring any interest the grantor may have in the property, making it a quicker option with less assurance for the buyer.

Similar to the Illinois Quitclaim Deed, the Grant Deed is another type of deed used in real estate transactions to transfer property from one person to another. The key difference lies in the level of protection for the buyer; the Grant Deed guarantees that the property has not been sold to someone else and that there are no undisclosed liens or encumbrances. This provides a medium level of assurance compared to the Quitclaim Deed’s minimal guarantees and the Warranty Deed’s extensive guarantees.

The Trustee’s Deed is another document similar to the Illinois Quitclaim Deed, as they both involve property transfers. The Trustee's Deed is used when a property held in a trust is being transferred. It involves a trustee, who manages the trust, transferring property to a grantee. Like the Quitclaim Deed, the level of warranty in a Trustee’s Deed can vary, but it is typically used in more specific circumstances, such as managing estate plans or investment properties.

The Illinois Quitclaim Deed also shares attributes with the Special Warranty Deed. Both are used in real estate transactions to convey property rights from one party to another. However, the Special Warranty Deed offers limited protection to the buyer; it only covers the period during which the seller owned the property. This stands in contrast to the Quitclaim Deed, which provides no warranties, making the Special Warranty Deed a middle ground between the Quitclaim Deed and the full protection of a General Warranty Deed.

The Deed of Trust is another document related to the Illinois Quitclaim Deed as it pertains to property transactions. Unlike a traditional Quitclaim Deed, which transfers ownership rights, a Deed of Trust involves three parties and is used to secure a loan on a property. It grants a trustee the power to take control of the property if the borrower defaults on the loan, making it a security instrument rather than a straightforward property transfer document.

Much like the Illinois Quitclaim Deed, the Correction Deed is used to modify or correct information in previously recorded deeds. It serves to correct errors such as misspellings, incorrect property descriptions, or omission of important details without providing any warranty. While the purposes of both documents are different, they are similar in that they both deal with clarifying or altering rights and interests in a property without guaranteeing title status.

The Bargain and Sale Deed, akin to the Illinois Quitclaim Deed, is used in real estate transactions. This type of deed does not provide the buyer with any warranties against encumbrances on the property. The Bargain and Sale Deed may sometimes come with covenants that protect the buyer against claims by the seller, offering a slightly higher level of assurance than a Quitclaim Deed, but still much less than a Warranty Deed.

Finally, the Executor’s Deed bears a resemblance to the Illinois Quitclaim Deed as both facilitate property transfers under specific circumstances. An Executor's Deed is used when an executor of an estate is authorized to sell the property of a deceased person. While the Executor’s Deed may carry some warranties depending on the jurisdiction, its primary purpose is similar to a Quitclaim Deed, transferring ownership without extensive guarantees about the property’s title.

Dos and Don'ts

When filling out an Illinois Quitclaim Deed form, it's important to understand the do's and don'ts to ensure the process is completed correctly. Here are some essential tips to help guide you.

Do's:

- Clearly print or type all information to prevent any misunderstandings or misinterpretations.

- Verify the correct legal description of the property is included; this is crucial for the deed's validity.

- Ensure the grantor (the person transferring the property) signs the deed in front of a notary public to validate the signature.

- Include all necessary parties in the deed; this may include spouses or co-owners.

- Record the quitclaim deed with the county recorder’s office where the property is located after it’s signed to make it official.

Don'ts:

- Don’t leave any blanks on the form; incomplete forms may be considered invalid.

- Don’t use a quitclaim deed to transfer property if you’re unsure of the title's status; this form doesn't guarantee the title is clear.

- Don’t forget to check if documentary stamps or transfer taxes are required in your county when recording the deed.

- Don't neglect to provide the grantee (the person receiving the property) with a copy of the recorded deed for their records.

- Don’t attempt to use a quitclaim deed to avoid creditors or legal obligations; it could result in legal consequences.

Misconceptions

Regarding the Illinois Quitclaim Deed form, a number of misunderstandings commonly arise. Here are five misconceptions, explained to set the record straight:

- A quitclaim deed guarantees a clear title. Many believe that when you receive a property through a quitclaim deed, the title to the property is clear of any liens or claims. However, a quitclaim deed only transfers the grantor's interest in the property, without any warranties regarding the title's status. Essentially, the buyer takes the property "as is," assuming any risks of title issues.

- Quitclaim deeds are only for transferring property between strangers. In reality, quitclaim deeds are most often used between family members, close friends, or in a divorce settlement to transfer property swiftly without a sale. They simplify the transfer process when the parties trust each other and do not require a formal warranty of title.

- The process is the same as other property sales. This misconception overlooks the simplicity of a quitclaim deed. Unlike traditional property sales, which involve title searches, warranties, and often a mortgage, quitclaim deeds involve a straightforward document that, once executed (signed, notarized, and recorded with the county), transfers whatever interest the grantor has in the property. The process sidesteps many of the steps involved in a standard real estate transaction.

- Recording the deed is optional. While technically, a quitclaim deed is legal once signed by the grantor and notarized, failing to record it with the appropriate county office can lead to complications. Without recording, there's no public record of the transfer, making it challenging to defend against future claims to the property by third parties.

- All you need is a quitclaim deed to transfer property. Though a quitclaim deed is indeed a critical document for transferring a grantor's interest in a property, it's not the only step in the process. Depending on the situation, other requirements may include settling outstanding mortgages, addressing tax implications, and satisfying any other liens or encumbrances on the property. Overlooking these steps can lead to financial and legal headaches down the road.

Key takeaways

When dealing with the Illinois Quitclaim Deed form, it's important to gather all necessary information before beginning. The form requires details about both the grantor (the individual transferring the property) and the grantee (the recipient of the property). Specific information includes names, addresses, and the legal description of the property being transferred. Ensure accuracy in this step to prevent issues during or after the process.

Understand that the Illinois Quitclaim Deed does not guarantee the title of the property. It simply transfers any interest the grantor might have in the property to the grantee. This means that if the grantor does not legally own the property, the grantee might not gain legal ownership. It's crucial for the grantee to conduct thorough research or obtain a title search on the property.

The preparation of the Illinois Quitclaim Deed requires notarization. Once the form is filled out, both the grantor and grantee should sign it in the presence of a notary public. This step is mandatory for the document to be legally binding and recognized under Illinois law.

After the completion and notarization of the Quitclaim Deed, it must be recorded with the county recorder's office where the property is located. Recording the deed is a public declaration of the change in property ownership. It protects the grantee's interests and establishes a chain of title, making future transactions involving the property more straightforward.

- Accuracy is paramount: Double-check names, addresses, and the property's legal description. Errors can complicate or invalidate the deed.

- Understand the limitations: Be aware that a Quitclaim Deed transfers interest without any warranty. It's wise to perform due diligence on the property's title.

- Notarization is required: The Quitclaim Deed must be signed before a notary to be valid in Illinois, emphasizing the seriousness of the document.

- Recording is essential: Filing the deed with the county recorder makes the transfer public and offers protection to the grantee.

Fees associated with the recording process vary by county. It's advisable to contact the local recorder's office in advance to inquire about the current fees and acceptable forms of payment. Preparing for these costs ensures a smooth transaction process.

Finally, it might be beneficial to consult with a professional before completing a Quitclaim Deed. Legal advisors or title companies can provide valuable insights, especially regarding title searches and potential implications of the transfer. This step can help minimize risks and clarify any doubts about the process.

More Quitclaim Deed State Forms

Quitclaim Deed Form Texas - This form is not recommended for transactions between strangers due to the lack of title guarantees.

Georgia Deed Transfer Forms - It's useful for property transactions where both parties know and trust each other.

How to Do a Quick Claim Deed - Recording a Quitclaim Deed with the local county office is essential for making the document legally binding and public record.

Kalamazoo Register of Deeds - It is commonly used in cases where properties are transferred as gifts between family members.