Fillable Quitclaim Deed Document for Georgia

In Georgia, the Quitclaim Deed form plays a crucial role in the transfer of property ownership, presenting a simple yet powerful tool for both grantors and grantees. By choosing to use this form, an individual can effectively transfer their interest in a property without making any warranties or guarantees about the property's title, which stands in contrast to other types of deed forms that offer varying levels of protection and assurance regarding the title's status. This straightforward document is particularly favored for transactions among family members or close acquaintances, where the level of trust is high and the need for extensive legal protections is low. Furthermore, it is vital for parties utilizing a Quitclaim Deed in Georgia to understand its implications fully, including its execution requirements and how it impacts property rights. The ease of executing a Quitclaim Deed, alongside its potential ramifications, underscores the importance of comprehending its specifics before proceeding with a property transfer.

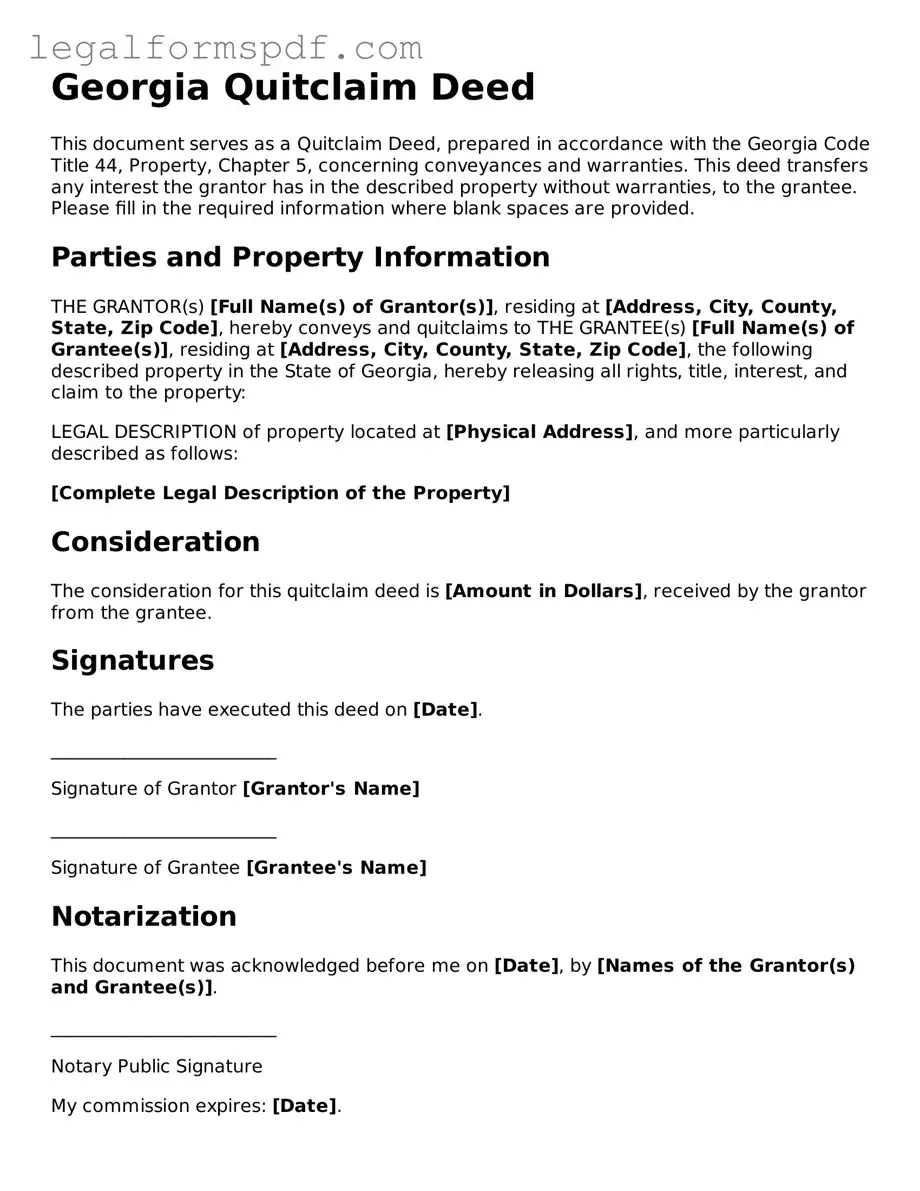

Document Example

Georgia Quitclaim Deed

This document serves as a Quitclaim Deed, prepared in accordance with the Georgia Code Title 44, Property, Chapter 5, concerning conveyances and warranties. This deed transfers any interest the grantor has in the described property without warranties, to the grantee. Please fill in the required information where blank spaces are provided.

Parties and Property Information

THE GRANTOR(s) [Full Name(s) of Grantor(s)], residing at [Address, City, County, State, Zip Code], hereby conveys and quitclaims to THE GRANTEE(s) [Full Name(s) of Grantee(s)], residing at [Address, City, County, State, Zip Code], the following described property in the State of Georgia, hereby releasing all rights, title, interest, and claim to the property:

LEGAL DESCRIPTION of property located at [Physical Address], and more particularly described as follows:

[Complete Legal Description of the Property]

Consideration

The consideration for this quitclaim deed is [Amount in Dollars], received by the grantor from the grantee.

Signatures

The parties have executed this deed on [Date].

_________________________

Signature of Grantor [Grantor's Name]

_________________________

Signature of Grantee [Grantee's Name]

Notarization

This document was acknowledged before me on [Date], by [Names of the Grantor(s) and Grantee(s)].

_________________________

Notary Public Signature

My commission expires: [Date].

Preparation Statement

This document was prepared by [Name and Address of Individual who prepared the document].

Additional Provisions or Remarks

[Any additional provisions or remarks]

PDF Specifications

| Fact Number | Fact Detail |

|---|---|

| 1 | The Georgia Quitclaim Deed is used to transfer property rights quickly without warranties. |

| 2 | This form doesn't guarantee the grantor holds a clear title to the property. |

| 3 | It's often used between family members or to clear title defects. |

| 4 | The deed must be filed with the county's Clerk of the Superior Court where the property is located. |

| 5 | Georgia law requires a notary public to witness the grantor(s) signing the deed. |

| 6 | The deed must include a legal description of the property. |

| 7 | Recording the deed provides constructive notice of the ownership change to the public. |

| 8 | A transfer tax may apply unless an exemption is claimed under Georgia law. |

| 9 | The form must comply with all requirements set by Georgia statutes to be considered valid. |

| 10 | Governing Law: Official Code of Georgia Annotated (O.C.G.A.) §§ 44-2-14 through 44-5-80. |

Instructions on Writing Georgia Quitclaim Deed

In the state of Georgia, when a property owner wishes to transfer their rights or interest in a property to another party without the warranties typically seen in a general warranty deed, a Quitclaim Deed is often employed. This document is particularly useful in scenarios where property is transferred between family members, or to clear up a title without the formal warranty of title. Completing this form with accuracy and thoroughness is paramount to ensuring the legal transfer of property rights. The steps below are designed to guide through this process.

- Start by identifying the Preparer of the document. This is typically the person who is completing the form, which may be an attorney, the grantor, or the grantee. Include the name and address of the Preparer in the designated section.

- Enter the Return Address. This should be the address where the recorded deed will be sent after the transaction is complete. Often, it is the address of the grantee.

- Provide the County where the property is located. Georgia Quitclaim Deeds must be filed with the county recorder’s office where the property exists.

- Include the Consideration amount. This is the value being exchanged for the property. Even if the property is a gift, a minimal monetary amount must be stated to satisfy legal requirements.

- List the Grantor(s)' detailed information, including their full legal name(s) and current address(es). The term "Grantor" refers to the party releasing their interest in the property.

- Detail the Grantee(s)' information in the same manner: full legal names and addresses. The "Grantee" is the party receiving the interest in the property.

- Provide a Legal Description of the property. This is a detailed description that is more comprehensive than just an address and may include lot numbers, subdivision names, and other details found on the property's current deed or property tax bill.

- Have the Grantor(s) sign the document in the presence of a Notary Public. The Grantor’s signature is what officially transfers the property interest to the Grantee. Georgia law requires this signature to be notarized.

- Ensure the Quitclaim Deed is Notarized. The Notary Public will fill out their section, verifying the Grantor's identity and their signature. This step is crucial for the document to be legally binding and recordable.

- Finally, Record the completed Quitclaim Deed with the County Recorder’s Office where the property is located. Recording the deed makes it part of the public record, completing the legal transfer process.

Once these steps are meticulously followed and the Quitclaim Deed is filed accordingly, the document serves as a legal record of the transfer of interest in the property from the Grantor to the Grantee. It is important to retain copies of the recorded deed for personal records and future reference, ensuring all parties have evidence of the transaction.

Understanding Georgia Quitclaim Deed

What is a Georgia Quitclaim Deed?

A Georgia Quitclaim Deed is a legal document used to transfer a property owner's interest in a piece of property to another person without any warranties. This means that the seller does not guarantee they hold clear title to the property. It's typically used between family members or in other situations where the parties know each other and the condition of the property title is clear and agreed upon.

How is a Georgia Quitclaim Deed different from a Warranty Deed?

A major difference between a Quitclaim Deed and a Warranty Deed in Georgia is the level of protection offered to the buyer. A Warranty Deed guarantees the buyer is getting a clear title free of liens or other encumbrances. On the other hand, a Quitclaim Deed transfers ownership with no guarantees, meaning the buyer receives whatever interest the seller has in the property, which might be none at all.

What are the necessary steps to file a Quitclaim Deed in Georgia?

To file a Quitclaim Deed in Georgia, one must first complete the deed, ensuring it contains all the necessary legal descriptions and signatures. It must then be notarized. Following notarization, the Quitclaim Deed should be filed with the Clerk of the Superior Court in the county where the property is located. A recording fee will be required, and fees vary by county.

Who is responsible for the recording fees of the Quitclaim Deed in Georgia?

Typically, the grantee, or the person receiving the property, is responsible for paying the recording fees when filing a Quitclaim Deed in Georgia. However, the grantor and grantee can agree on a different arrangement. All recording fees should be paid at the time of filing to ensure the deed is promptly recorded.

Can a Georgia Quitclaim Deed be revoked after it is filed?

Once a Quitclaim Deed is executed and filed with the appropriate county office in Georgia, it cannot be revoked by the grantor (the person who transferred the property). Any change or revocation would require the consent of the grantee (the person who received the property), typically necessitating another deed transfer back to the original owner or to another designated party.

Common mistakes

One common mistake people make when filling out the Georgia Quitclaim Deed form is not providing the full legal description of the property. This includes not only the street address but also the lot and block number or the metes and bounds description, if applicable. The complete legal description is crucial for correctly identifying the property being transferred.

Another error is failing to obtain signatures from all necessary parties. In Georgia, not only does the grantor need to sign the deed, but so does every owner of the property. This means if the property is co-owned, each co-owner must sign the deed for the quitclaim to be valid. Furthermore, it's important to remember these signatures must be notarized to ensure the deed is legally binding.

Some individuals incorrectly believe a lawyer must always prepare the Quitclaim Deed. While it's highly recommended to consult a legal professional to avoid errors, it's not a legal requirement. Self-preparation is an option, but one should proceed with caution and thorough research to ensure the deed complies with all Georgia laws and requirements.

Another common oversight is forgetting to file the deed with the county recorder's office. Simply signing and notarizing the Quitclaim Deed does not complete the process. For the property transfer to be officially recognized, the deed must be recorded with the local county in which the property is located. Failure to do so can result in legal complications down the line.

People often mistakenly leave out pertinent details, such as including any restrictions or easements on the property. This oversight can lead to disputes and legal issues for the buyer. Accurately disclosing the property's condition, including any limitations, is essential for a transparent and fair transfer.

A frequent error is misidentifying the grantee. The grantee is the person receiving the property, and their legal name needs to be spelled correctly and match their government-issued identification. Any discrepancy can complicate or invalidate the transfer of the property title.

Many fail to consider the tax implications of transferring property via a Quitclaim Deed. It's important to understand that even if money doesn't change hands, there may still be tax consequences for both the grantor and the grantee. Consulting with a tax professional can clarify these implications and help avoid unexpected liabilities.

Last but not least, some people overlook the requirement for the grantee to accept the transfer officially. Although often assumed, acceptance is not automatic. The grantee must explicitly accept the deed, which is typically done by accepting, signing, and recording the deed. This final step ensures the property transfer is legally recognized and effective.

Documents used along the form

When executing a Quitclaim Deed in Georgia, several other forms and documents might be required or are commonly used to ensure the process is completed correctly and legally. These additional documents can vary depending on the specific circumstances surrounding the property transfer, including whether it's a simple transfer between family members or a more complex transaction. Below is a brief description of five documents often used alongside the Georgia Quitclaim Deed form. These supporting documents help clarify the transfer, protect the interests of all parties involved, and comply with state law.

- Georgia Real Estate Transfer Tax Form (PT-61): This mandatory form is filed with the county recorder's office alongside the Quitclaim Deed. It provides details necessary to calculate and pay the state transfer tax, which is based on the property's sale price or value.

- Warranty Deed: While not always used in conjunction with a Quitclaim Deed, a Warranty Deed might be necessary if the property's ownership is transferred again in the future. It provides a guarantee to the buyer about the clear title to the property, which is not covered by a Quitclaim Deed.

- Title Search Report: Before accepting a Quitclaim Deed, a buyer or recipient might request a title search report. This document outlines the history of the property, including any liens, easements, or encumbrances that could affect ownership.

- FIRPTA Affidavit (Foreign Investment in Real Property Tax Act): If any party involved in the Quitclaim Deed is a non-resident alien or foreign entity, this affidavit is necessary to confirm their tax status and any applicable withholding requirements.

- Homestead Exemption Forms: After the transfer of property via a Quitclaim Deed, the new owner may need to file homestead exemption forms with their local tax office. This exemption can provide significant property tax savings by reducing the taxable value of the home, but eligibility requirements must be met.

Each of these documents plays a critical role in the conveyance process, offering clarity, security, and compliance with Georgia's legal and taxation requirements. It is advisable for parties involved in property transfers to familiarize themselves with these forms, understanding that specific situations may require additional or alternative documentation. Consulting with a legal professional can ensure that all paperwork is correctly completed and filed, facilitating a smooth and lawful property transfer.

Similar forms

The Georgia Quitclaim Deed form is similar to a Warranty Deed in that both are legal documents used in the transfer of real estate. However, while a Quitclaim Deed does not guarantee that the property title is clear of claims, a Warranty Deed provides the buyer with guarantees against any claims to the property, offering a higher level of protection.

Similar to a Grant Deed, the Quitclaim Deed facilitates the process of transferring property rights. The primary difference lies in the level of protection: Grant Deeds include guarantees that the property has not been sold to someone else and is free from encumbrances, which is not assured with Quitclaim Deeds.

The Quitclaim Deed shares similarities with a Trustee's Deed in terms of its function in property transfer, specifically in a trust administration context. While Trustee's Deeds are executed by trustees to transfer property held in a trust, Quitclaim Deeds can be used by anyone to transfer their interest in a property without making any guarantees about the property's title.

Similar to a Deed of Trust, a Quitclaim Deed involves the conveyance of real estate. However, a Deed of Trust is used in some states to secure a loan on real estate, involving three parties (borrower, lender, and trustee), unlike the Quitclaim Deed, which simply transfers whatever interest the grantor has in the property without involving a loan.

The Quitclaim Deed resembles a Transfer-on-Death (TOD) Deed in its mechanism for transferring property, but with different implications for ownership. A TOD Deed allows property owners to name a beneficiary to receive the property at the owner’s death without going through probate, whereas a Quitclaim Deed transfers ownership immediately, without any warranties or provision for the grantor's death.

Just like an Executor’s Deed, which is used to transfer property from an estate, the Quitclaim Deed enables the transfer of property rights. The crucial difference is that an Executor’s Deed is specifically used in the context of settling an estate after someone passes, often providing guarantees about the estate's title, whereas Quitclaim Deeds do not.

The Correction Deed, which is used to amend errors in previously recorded deeds, shares the Quitclaim Deed’s purpose in title transfer with an emphasis on correction. While Quitclaim Deeds may be used to clear up title issues due to incorrect information, Correction Deeds are specifically tailored for the purpose of correcting errors.

Comparable to a Life Estate Deed, where the grantor transfers property but retains rights to use it during their lifetime, the Quitclaim Deed transfers interest in property immediately. However, unlike a Life Estate Deed, which establishes a future interest for the remainderman, Quitclaim Deeds do not inherently contain any provisions about future rights or interests.

The Georgia Quitclaim Deed is analogous to a Partition Deed in that both deal with the distribution of property among parties. However, while a Partition Deed is specifically used to divide property among co-owners, often as a result of a court order or agreement, a Quitclaim Deed may be used by a single party to transfer whatever interest they have in a property without dividing it.

Dos and Don'ts

When completing the Georgia Quitclaim Deed form, it's crucial to adhere to specific guidelines to ensure the process is done correctly and efficiently. Following the right steps can prevent costly mistakes and potential legal complications in the future. Below, find a compiled list of actions you should and should not do when filling out this form.

Things You Should Do

- Verify all parties' names are spelled correctly. The accuracy of names is crucial as it reflects the identities of the grantor (the person transferring the property) and the grantee (the recipient).

- Ensure the legal description of the property is precise. This description includes the boundary lines, dimensions, and any other details that identify the property uniquely. It should match the description used in the official property records.

- Sign the document in the presence of a notary public. Georgia law requires the quitclaim deed to be notarized to be valid. The notary verifies the identity of the signers and their understanding and willingness to sign the document.

- Record the deed with the county recorder's office. After the deed is properly executed and notarized, the final step is to file it with the local county office where the property is located. This recording gives public notice of the transfer.

Things You Shouldn't Do

- Do not leave any sections blank. Incomplete forms may be rejected or may not accurately convey the intended property rights. Make sure to fill out every required field.

- Do not use informal property descriptions. Refrain from using non-legal descriptions of the property, such as common names or landmarks. Always use the legal property description found in previous deeds or property records.

- Do not forget to check for specific county requirements. Some counties may have additional filing requirements or fees. It's important to check with the local county recorder’s office to ensure all local regulations are met.

- Do not neglect to keep a copy of the recorded deed. Once the quitclaim deed is filed with the county, ensure you obtain and securely store a copy for your records. This copy serves as proof of the property transfer.

Misconceptions

When it comes to transferring property in Georgia, the Quitclaim Deed form is often mentioned. However, there are several misconceptions surrounding its use and implications. Understanding these can help ensure that property transactions are conducted with clear expectations.

Guarantees a Clear Title: A common misconception is that a Quitclaim Deed guarantees the buyer that the title to the property is clear of any liens or claims. In fact, Quitclaim Deeds do not offer any warranties about the condition of the property title. They simply transfer whatever interest the grantor has in the property, which might be none at all.

Can Remove Names from a Mortgage: Another misunderstanding is that filing a Quitclaim Deed can remove an individual’s name from the mortgage on the property. This is not accurate. A Quitclaim Deed affects only ownership and claims to the property, not the financial obligations attached to it, such as a mortgage. The individual’s financial responsibility remains until the mortgage is formally renegotiated with the lender.

Is Only Used Between Family Members: While it's true that Quitclaim Deeds are often used to transfer property between family members due to their simplicity, they are not restricted to such transactions. These deeds can be used between any parties as long as both agree to the terms. Their use extends to a variety of situations, including but not limited to correcting a title or transferring property to a trust.

Offers Immediate Transfer: Some believe that a Quitclaim Deed results in an immediate transfer of property. While the deed can be executed and delivered quickly, the actual recordation of the deed may take some time. Moreover, the transfer is subject to any conditions or stipulations outlined in the deed itself. Additionally, proper filing with the appropriate municipal or county office is required to complete the transfer process legally.

Understanding these misconceptions about Georgia Quitclaim Deeds can help individuals navigate property transactions more effectively, setting realistic expectations about what these deeds can and cannot do.

Key takeaways

A Georgia Quitclaim Deed form is a legal document used to convey interest in real property from the grantor (the person transferring the property) to the grantee (the person receiving the property) without any warranty of title.

It's essential for individuals to ensure that their name and the name of the grantee are spelled correctly and match identification documents to avoid complications.

The specific legal description of the property, not just the address, must be included in the document to accurately identify the property being transferred.

All parties involved should carefully read the entire form before signing to understand fully the implications of the transfer and the absence of any warranties.

The form must be signed in the presence of a notary public and, depending on county requirements, may also need to be witnessed by one or two individuals.

After it has been correctly filled out and signed, the Quitclaim Deed must be filed with the appropriate county recorder’s office to be effective and to put the public on notice of the transfer.

Recording fees vary by county in Georgia, so it's advisable to contact the specific county recorder’s office to determine the exact cost of filing the Quitclaim Deed.

Use of a Quitclaim Deed is common in non-sale property transactions, such as adding or removing someone’s name from a property title, gifting property, or transferring property in a divorce settlement.

Consulting with a legal professional is recommended to ensure the Quitclaim Deed is completed accurately and that its use is appropriate for the intended purpose of the property transfer.

More Quitclaim Deed State Forms

Quick Deed Ohio - This document offers a no-frills approach to property transfer, often resulting in a less complicated and faster process.

Quit Claim Deed Form New York Pdf - It is imperative to comply with state-specific requirements for the form to be legally binding.

How to Do a Quick Claim Deed - Landlords may employ Quitclaim Deeds to clear up title issues, ensuring smooth operations of rental properties.

Quit Claim Deed Illinois - It provides a non-warranty transfer option, standing in contrast to deeds that guarantee a clear title.