Fillable Quitclaim Deed Document for Florida

Transferring property ownership in Florida is a process that can be streamlined with the use of a Quitclaim Deed form. This legal document is particularly favored for its simplicity and expedience in conveying property rights from one party to another without the guarantees typically associated with a general warranty deed. The form is extensively utilized in instances where property is transferred between family members, added to a living trust, or corrected on a previously recorded deed. It stipulates the essential details such as the names of the grantor and grantee, a legal description of the property, and the county where the property is located. A signature from the grantor, acknowledged by a notary public, is mandatory to execute the document. Once completed, it is filed with the local county clerk's office to finalize the transfer. Although the Quitclaim Deed form simplifies the transaction process, it is crucial for individuals to understand its implications thoroughly, notably that it does not assure the grantee of a clear title, leaving room for potential future disputes.

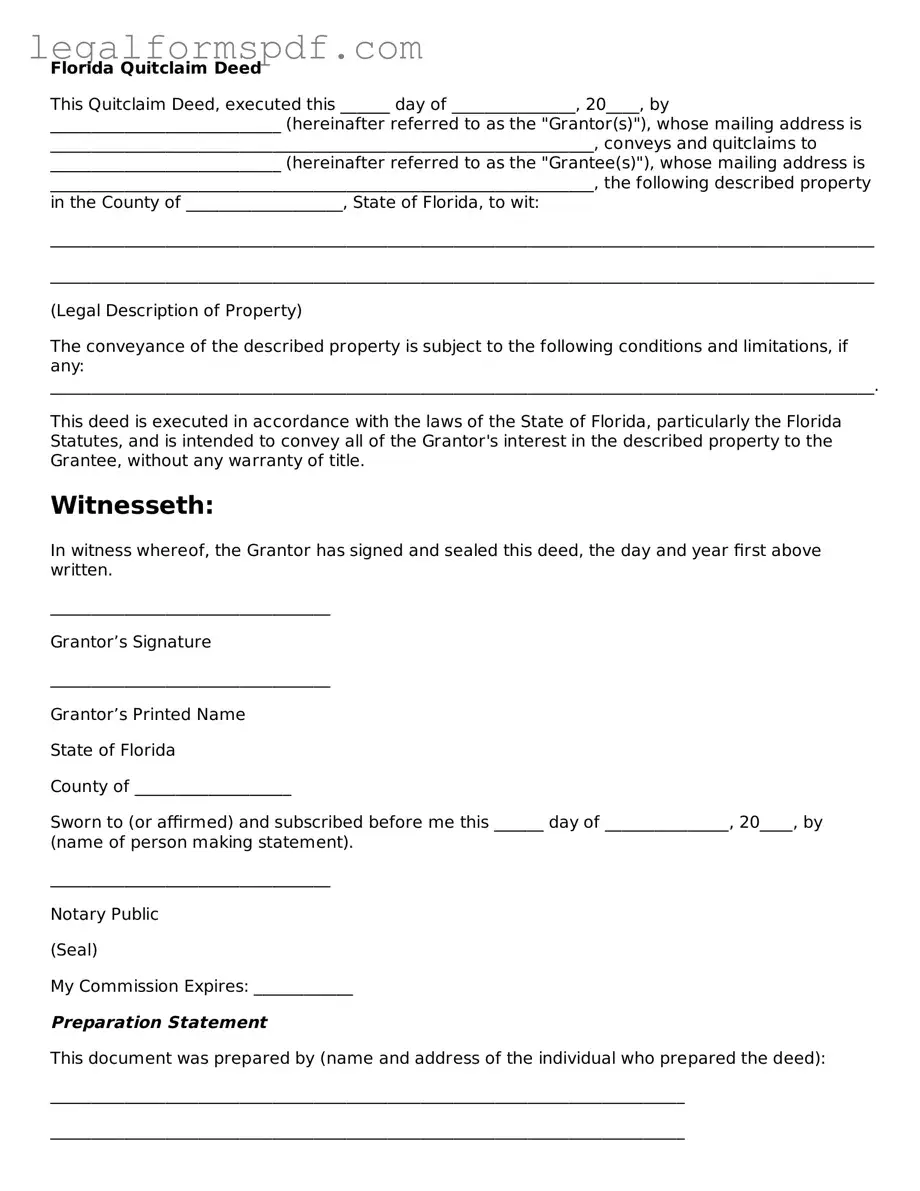

Document Example

Florida Quitclaim Deed

This Quitclaim Deed, executed this ______ day of _______________, 20____, by ____________________________ (hereinafter referred to as the "Grantor(s)"), whose mailing address is __________________________________________________________________, conveys and quitclaims to ____________________________ (hereinafter referred to as the "Grantee(s)"), whose mailing address is __________________________________________________________________, the following described property in the County of ___________________, State of Florida, to wit:

____________________________________________________________________________________________________

____________________________________________________________________________________________________

(Legal Description of Property)

The conveyance of the described property is subject to the following conditions and limitations, if any: ____________________________________________________________________________________________________.

This deed is executed in accordance with the laws of the State of Florida, particularly the Florida Statutes, and is intended to convey all of the Grantor's interest in the described property to the Grantee, without any warranty of title.

Witnesseth:

In witness whereof, the Grantor has signed and sealed this deed, the day and year first above written.

__________________________________

Grantor’s Signature

__________________________________

Grantor’s Printed Name

State of Florida

County of ___________________

Sworn to (or affirmed) and subscribed before me this ______ day of _______________, 20____, by (name of person making statement).

__________________________________

Notary Public

(Seal)

My Commission Expires: ____________

Preparation Statement

This document was prepared by (name and address of the individual who prepared the deed):

_____________________________________________________________________________

_____________________________________________________________________________

Two Witnesses Requirement

In accordance with Florida Statutes, this Quitclaim Deed must be signed in the presence of two witnesses, who must also sign the deed.

Witness #1 Signature: ____________________________________

Witness #1 Printed Name: _________________________________

Witness #2 Signature: ____________________________________

Witness #2 Printed Name: _________________________________

PDF Specifications

| Fact Number | Description |

|---|---|

| 1 | The Florida Quitclaim Deed transfers interest in real property from the grantor to the grantee with no warranties of title. |

| 2 | It is often used between family members or to transfer property into a trust. |

| 3 | The Florida Statutes Title XL, Chapter 695 is the governing law for the preparation and recording of Quitclaim Deeds. |

| 4 | A Quitclaim Deed in Florida must be signed in the presence of two witnesses and a notary public to be valid. |

| 5 | Before recording, the deed needs to have the grantee’s mailing address and the property’s legal description. |

| 6 | Recording the deed with the County Recorder’s Office where the property is located is necessary for the deed to be effective against third parties. |

| 7 | Documentary stamp taxes may be required to be paid when recording the deed, based on the consideration paid for the transfer. |

| 8 | No standard state form exists for a Quitclaim Deed; parties often use templates or attorney-created documents. |

| 9 | The grantor of a Quitclaim Deed does not guarantee that the title is clear of claims or encumbrances. |

| 10 | It is advisable to conduct a thorough title search prior to the execution of a Quitclaim Deed to understand any potential title issues. |

Instructions on Writing Florida Quitclaim Deed

Filling out a Florida Quitclaim Deed form is a straightforward process, but it's essential to pay careful attention to detail to ensure the transaction is completed correctly. A Quitclaim Deed is used to transfer property ownership without making any warranty about the title. This means the seller, known as the grantor, does not guarantee they hold a clear title to the property. Once completed, this document changes the property's ownership, so ensuring accuracy during the filling process cannot be overstated. Here are detailed steps to accurately fill out the Florida Quitclaim Deed form.

- Begin by identifying the grantor's name and address. Ensure the grantor's name is spelled correctly and matches the name on the current deed.

- Next, specify the grantee's name and address. The grantee is the person receiving the property. As with the grantor, double-check the spelling and information accuracy.

- Provide the legal description of the property. This information can be found on the current deed or at the county recorder's office. Be precise, as errors can invalidate the deed.

- Indicate the county where the property is located. This is crucial for filing purposes and determines where the document will be recorded.

- State the consideration amount. This refers to the value exchanged for the property's transfer, which can often be a nominal amount like $10.

- Include any additional clauses or restrictions. Sometimes, specific agreements between the grantor and grantee are noted in the deed.

- Have the grantor sign the deed in front of a notary public. The notary will verify the identity of the signer and ensure the document's voluntary signing.

- Record the deed with the appropriate county office. An official recording fee will be required, and the fee structure varies by county.

Following these steps precisely is crucial for the lawful and intended transfer of property rights. Remember, while a Quitclaim Deed might seem simple, it's always a good idea to consult with a legal professional to navigate any complexities and ensure the document is executed correctly. Once the deed is filled out, signed, notarized, and recorded, the property ownership is officially transferred.

Understanding Florida Quitclaim Deed

What is a Florida Quitclaim Deed form?

A Florida Quitclaim Deed form is a legal document used to transfer interest, ownership, or rights in real property from one party to another without any warranties of title. This means the seller, known as the grantor, does not guarantee that they hold clear title to the property. It is often used between family members or to clear up a title issue.

How does a Quitclaim Deed differ from a Warranty Deed in Florida?

The main difference between a Quitclaim Deed and a Warranty Deed in Florida lies in the level of protection provided to the buyer. A Warranty Deed guarantees that the property title is clear of any liens or claims, meaning the seller guarantees they own the property outright and have the legal right to sell it. Conversely, a Quitclaim Deed offers no such warranties, merely transferring whatever interest the grantor may have in the property, if any.

What are the legal requirements for a Quitclaim Deed to be valid in Florida?

For a Quitclaim Deed to be considered valid in Florida, it must contain specific elements: the legal names and addresses of the grantor and grantee, a complete legal description of the property being transferred, the signature of the grantor, and the deed must be notarized. Additionally, to officially record the transfer of property, the completed deed must be filed with the local county recorder's office where the property is located, along with any required filing fees.

Can a Quitclaim Deed be used to transfer property to a family member in Florida?

Yes, a Quitclaim Deed is commonly used to transfer property between family members in Florida. This method is often chosen for its simplicity and the minimal legal hurdles involved. It is particularly useful in scenarios such as adding or removing someone’s name from a property title during a marriage or divorce, transferring property to a trust, or gifting property to a family member.

Is it possible to reverse or cancel a Quitclaim Deed once it has been filed in Florida?

Reversing or canceling a Quitclaim Deed after it has been recorded is challenging and usually requires the agreement of both the grantor and grantee. In situations where both parties agree to reverse the deed, a new deed must be executed. However, if one party is unwilling or the deed was executed under fraudulent circumstances, it may be necessary to pursue legal action through the courts to contest the validity of the deed. It is advisable to seek legal counsel in such circumstances.

Common mistakes

One common mistake when filling out the Florida Quitclaim Deed form is not checking for the correct legal description of the property. This description goes beyond just the address; it includes the lot number, subdivision, and more detailed information that identifies the property officially. If this part is filled out inaccurately, it can cause significant issues in transferring property correctly.

Another oversight is failing to include the grantor's full legal name and marital status. It's vital to specify whether the grantor is married, as this can affect the transfer of property rights. This detail might seem minor but overlooking it can lead to disputes or complications in the property's ownership down the line.

People often misunderstand who should sign the Quitclaim Deed. Depending on the situation, it might require not just the grantor's signature but also the spouse's, even if the spouse isn't a direct party to the transaction. This step ensures that all potential interests in the property are correctly relinquished.

There's also a common error of not having the form notarized. In Florida, the Quitclaim Deed needs to be notarized for it to be valid. Notarization confirms the identities of the signatories and their understanding and willingness to execute the deed. Skipping this step can nullify the entire document.

Lack of adequate witnesses is another pitfall. Florida law requires the presence of two witnesses for the signing of a Quitclaim Deed. These witnesses must sign the deed themselves, affirming that they observed the grantor sign the deed. Without this validation, the deed may be challenged or deemed invalid.

Incorrect or missing information about the grantee aspect, such as not providing the full legal name or failing to include the grantee's address, is a frequent error. The grantee's information must be precise to ensure the property transfer is directed and recorded accurately. Ambiguities here can lead to legal complications.

A number of individuals also forget to file the deed with the county clerk’s office after completing it. Even though the deed might be fully signed and notarized, it won't officially transfer the property until it's recorded with the local county. This oversight can lead to a "gap" in the property's legal title, complicating future transactions.

Lastly, a subtle, yet crucial error, is the omission of consideration in the Quitclaim Deed. Even if no money is exchanged, for tax and legal purposes, the document should state "for the sum of $10.00 and other valuable considerations" or a similar nominal consideration to denote the transaction's validity under the law.

Documents used along the form

In the process of transferring property rights with a Quitclaim Deed in Florida, several additional documents and forms may be necessary to ensure the transaction is comprehensive, compliant with state laws, and properly recorded. These documents support the Quitclaim Deed by providing detailed information, legal assurances, and tax implications related to the property transfer. Below is a list of documents often used alongside the Florida Quitclaim Deed form to facilitate a smooth and legally sound transaction.

- Warranty Deed: Sometimes used in conjunction with or as an alternative to a Quitclaim Deed, a Warranty Deed provides a higher level of buyer protection by guaranteeing that the property title is clear of liens and encumbrances.

- Title Search Report: This document outlines the history of the property's title, revealing any issues, liens, or encumbrances that could affect the transfer.

- Florida Documentary Stamp Tax Form: When transferring property, Florida law requires the payment of documentary stamp taxes, and this form calculates the tax due based on the property's sale price or value.

- Property Appraisal Report: This provides an estimate of the property's market value through an in-depth inspection and analysis, often required for tax and financing purposes.

- Closing Statement: This document summarizes the transaction's financial details, including prices, fees, and credits, and is reviewed during the closing process.

- Flood Zone Statement: Important in coastal areas, it informs about the property's flood risk, which could affect insurance requirements and costs.

- Survey: A property survey outlines the boundary lines, structures, and other significant features of the property, ensuring that there are no encroachments or issues.

- Homeowners Association (HOA) Documents: For properties in HOA-managed communities, these documents provide the regulations, fees, and any transfer approvals required by the association.

- Lead-Based Paint Disclosure: Necessary for homes built before 1978, this federally required disclosure outlines any known presence of lead-based paint.

- Power of Attorney: If one party cannot be present to sign the Quitclaim Deed or related documents, a Power of Attorney can grant another individual the authority to act on their behalf.

While the Quitclaim Deed form is sufficient to transfer a property owner's interests, the above-listed documents ensure that all aspects of the property and its transfer are legally addressed, documented, and recorded. Professionals involved in the transaction, such as real estate attorneys, can provide guidance on which documents are necessary for a particular situation, ensuring adherence to Florida laws and regulations.

Similar forms

The Florida Quitclaim Deed form is similar to a Warranty Deed, as both are used in the process of transferring property. However, a Warranty Deed differs in that it provides the buyer with guarantees about the title's status and the property's ownership. This means that the seller assures the buyer that the property is free from any liens or claims, offering a higher level of protection to the buyer than a Quitclaim Deed does.

Another document resembling the Quitclaim Deed form is the Grant Deed. Used in some states more frequently than others, a Grant Deed, like a Quitclaim Deed, involves the transfer of property ownership. However, it provides the grantee (the buyer) with certain guarantees, such as the promise that the property has not been sold to someone else, and that it is not burdened by undisclosed encumbrances, making it slightly more assuring than a Quitclaim Deed.

The Special Warranty Deed shares similarities with the Quitclaim Deed form in transferring property titles. Unlike the Quitclaim Deed, the Special Warranty Deed provides the buyer with a guarantee that the seller only safeguards against title defects or claims that occurred during their period of ownership, offering a middle ground between the assurance of a Warranty Deed and the lack of guarantees in a Quitclaim Deed.

Trust Deed forms bear a resemblance to Quitclaim Deeds in that they are part of real estate transactions. A Trust Deed involves three parties – the borrower, lender, and a trustee – and is used to secure a loan on real property. While a Quitclaim Deed changes the property's ownership, a Trust Deed functions as security for a loan using the property as collateral.

The Transfer-on-Death (TOD) Deed, also known as a beneficiary deed, offers a way to transfer property similar to a Quitclaim Deed but with a significant difference: it only takes effect upon the death of the owner. This allows property owners to bypass probate court, similar to how a Quitclaim Deed can be used to transfer property swiftly, but with the distinct feature of posthumous enactment.

Similar to the Quitclaim Deed, a Deed of Trust helps facilitate property transactions. This agreement involves a lender, a borrower, and a trustee, and secures real estate transactions, particularly loans. The Deed of Trust, however, places the legal title of the property in the hands of a trustee until the loan is paid in full, differing from the Quitclaim Deed's outright transfer of ownership.

A Corrective Deed is akin to a Quitclaim Deed, with its primary purpose being to correct errors in a previously recorded deed, such as a Quitclaim Deed. It addresses mistakes such as misspellings, incorrect property descriptions, or erroneous recording information, ensuring the accurate reflection of intentions in public records. Both types of deeds deal with the titles to properties but serve unique purposes.

The Life Estate Deed, similar to a Quitclaim Deed, is a mechanism for transferring property. It creates a life estate where the original owner retains possession and enjoyment of the property during their lifetime, and upon their death, the property automatically transfers to the named remainderman. This tool offers a way to manage and pass on property, differentiating itself with the life estate feature while accomplishing a transfer like a Quitclaim Deed.

Joint Tenancy Agreement forms share a similarity with Quitclaim Deeds in the realm of property transfer, establishing a joint ownership of property among two or more individuals with the right of survivorship. This means that if one owner dies, their interest in the property automatically passes to the surviving owner(s), akin to the immediate transfer nature of a Quitclaim Deed, but specifically designed for co-ownership situations.

Lastly, the Declaration of Homestead is comparable to a Quitclaim Deed in its relation to property ownership. This legal document allows homeowners to protect a portion of their home's value from creditors, differing in purpose by focusing on protection rather than transfer. While it doesn't transfer property, it impacts ownership rights and protections, showing its relevance in the spectrum of property-related documents.

Dos and Don'ts

Filling out a Florida Quitclaim Deed form properly is essential for a smooth transfer of property rights. This document, used to convey a property owner's interest in the property to another party without warranties, requires attention to detail. Below are the guidelines for what you should and shouldn't do when completing this form.

Things You Should Do

- Verify the legal description of the property. It's crucial to ensure that the property being transferred is accurately described according to its legal identification used in public records, including lot number, subdivision, and any applicable boundaries.

- Include all necessary parties. Make sure to list all individuals or entities that hold an interest in the property being transferred, as well as those receiving the interest.

- Sign in the presence of a notary. Florida law requires that the Quitclaim Deed be signed by the grantor (the person transferring the property) in the presence of a notary public to be legally binding.

- Record the deed promptly. After the form is filled out and signed, it should be recorded with the county clerk’s office in the county where the property is located to make the deed a matter of public record.

Things You Shouldn't Do

- Leave blank spaces. Ensure no sections or spaces are left blank, as incomplete documents may be considered invalid or lead to disputes later.

- Misidentify the grantor or grantee. Be precise when identifying the parties involved. Incorrect spellings or leaving out necessary legal names can create confusion and could potentially invalidate the transfer.

- Forget to check local regulations. Some counties may have specific requirements beyond those at the state level. It is important to verify any additional requirements and include them within the form or as attachments.

- Delay recording the deed. Avoid waiting to record the deed with the appropriate county office, as failure to promptly record the deed might affect the grantee's rights to the property.

Misconceptions

Many people have misconceptions about the Florida Quitclaim Deed form. Understanding these can help clarify its purpose and limitations.

It guarantees a clear title: A common misconception is that a quitclaim deed ensures the property is free of liens or claims. However, this form simply transfers the grantor's interest in the property without any guarantees regarding clear title.

It’s only for transferring property to family: While often used for transferring property among family members due to its simplicity, a quitclaim deed can be used between any parties, including strangers or business entities.

It settles property disputes: Some believe filing a quitclaim deed settles property disputes. In reality, it only changes the ownership according to the grantor's current rights, without addressing or resolving underlying legal disputes.

It overrides a will: People sometimes think a quitclaim deed can override a will's terms. However, if the property is bequeathed to someone else in a will, the deed's legal effectiveness could be challenged.

It transfers property immediately: Though a quitclaim deed can facilitate a quick change in ownership, the actual transfer isn't instant. The deed must be signed, notarized, and, most importantly, filed with the local county recording office to be effective.

It avoids probate: Another common belief is that transferring property via a quitclaim deed will bypass the probate process. While it can simplify transferring property outside of probate under certain conditions, it doesn’t inherently avoid probate for all property transfers.

It's universally accepted by all lenders: Some people think that all lenders accept quitclaim deeds for refinancing or taking out a mortgage. In truth, many lenders are hesitant or may require a warranty deed instead, which provides guarantees about the title.

It absolves the grantor of mortgage responsibility: Lastly, there is a misconception that if a grantor transfers their property using a quitclaim deed, they are no longer responsible for the mortgage. The transfer does not affect the mortgage, and the grantor remains responsible unless the lender agrees otherwise.

Key takeaways

The Florida Quitclaim Deed form is a legal document used to transfer property without any guarantee or warranty. Understanding its implications and proper use is crucial. Here are some key takeaways to guide you through filling out and using this form.

- Verification of Form Version: Ensure you are using the latest version of the Florida Quitclaim Deed form. Laws and regulations change, and using an outdated form can lead to issues.

- Accurate Information: Double-check all entered information for accuracy. Mistakes can render the document invalid or lead to disputes.

- Legal Description of Property: You must include a complete legal description of the property. This is more detailed than just an address and typically includes lot numbers, block numbers, subdivision names, and measurements.

- No Warranty: Understand that a quitclaim deed transfers only the interest the grantor has in the property, if any, without any warranty. The buyer receives no guarantee about the quality of the title or ownership.

- Consideration: The form requires you to mention the consideration, which is the value exchanged for the property transfer. Even if the property is a gift, a nominal amount like $10 should be stated to fulfill this requirement.

- Signing Requirements: The Florida Quitclaim Deed must be signed in the presence of two witnesses and a notary public. All signatures are necessary for the document to be valid.

- Recording: After signing, the deed must be recorded with the county clerk's office in the county where the property is located. This makes the transfer public record and protects the new owner's interest.

- Possible Taxes: Be aware of potential taxes or fees associated with the transfer. Consulting with a tax advisor or the county clerk's office can provide specific details related to your situation.

- Legal Advice: Considering the lack of guarantees with a quitclaim deed, seeking legal advice is advisable. A legal professional can offer guidance tailored to your circumstances, ensuring the deed meets your needs.

More Quitclaim Deed State Forms

How to Do a Quick Claim Deed - It is crucial to accurately describe the property in the deed to prevent potential disputes or confusion about what is being transferred.

How to Gift a House to a Family Member - Property investors might employ Quitclaim Deeds when buying or selling rights in real estate without conducting a traditional sale.

Quitclaim Form - Homeowners looking to transfer property into a trust often opt for a Quitclaim Deed for its straightforward approach.

Quick Deed Ohio - When dealing with a Quitclaim Deed, it is essential for the grantee to understand that they receive no warranty on the title, exposing them to potential future claims.