Fillable Quitclaim Deed Document for California

In the realm of property transactions within the Golden State, the California Quitclaim Deed form emerges as a pivotal document that plays a significant role. Tailored to facilitate the expedient transfer of property rights without the guarantees typically associated with traditional property sales, this form is utilized by individuals wishing to convey their interest in a property rapidly. It is especially relevant in scenarios where property is transferred between family members, settled in a divorce, or cleared of title claims. The form, by design, lacks assurances regarding the title's status, making it a unique tool that underscores the importance of trust between the parties involved. Its simplicity and efficiency in transferring property rights, without the encumbrances of warranties, render it a favored option in specific circumstances. For anyone navigating the nuances of property transactions in California, understanding the Quitclaim Deed form's utilization and implications is indispensable.

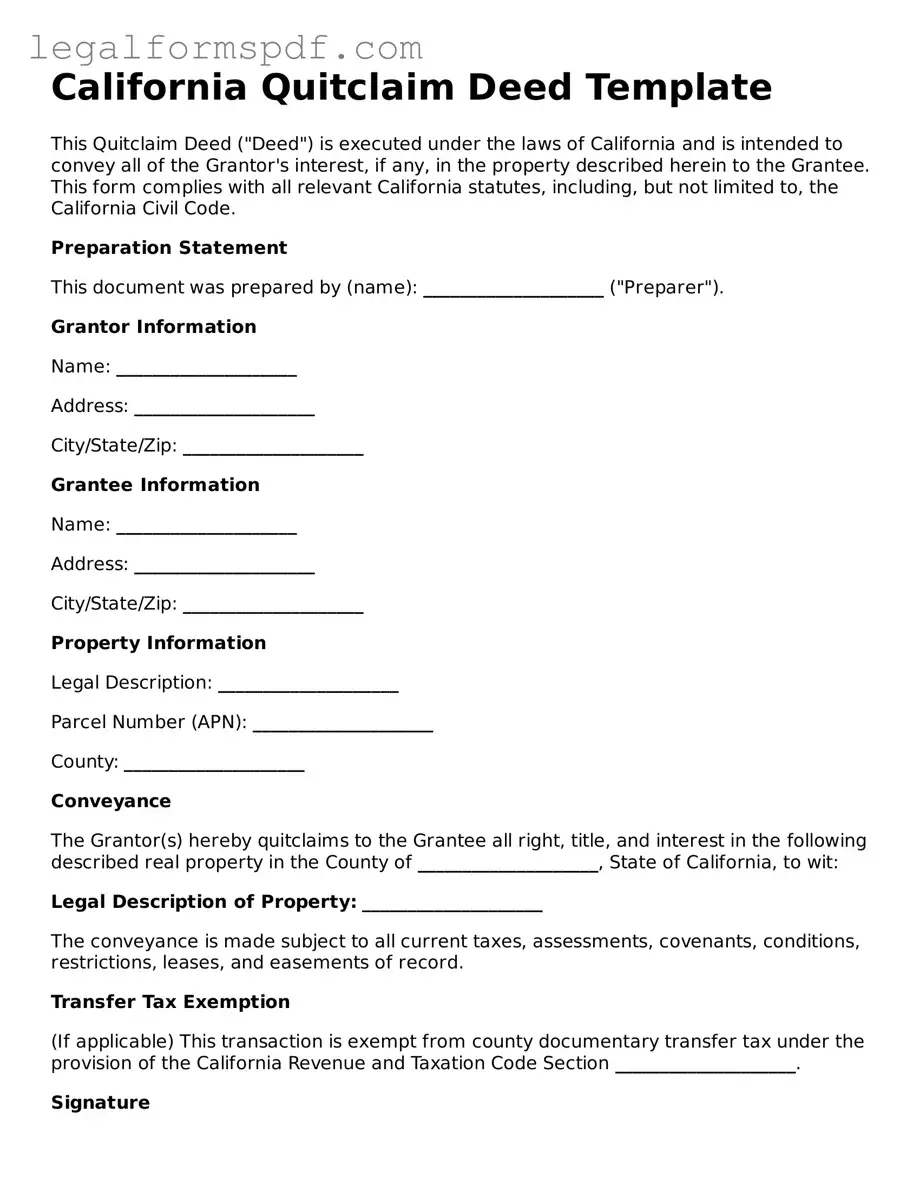

Document Example

California Quitclaim Deed Template

This Quitclaim Deed ("Deed") is executed under the laws of California and is intended to convey all of the Grantor's interest, if any, in the property described herein to the Grantee. This form complies with all relevant California statutes, including, but not limited to, the California Civil Code.

Preparation Statement

This document was prepared by (name): ____________________ ("Preparer").

Grantor Information

Name: ____________________

Address: ____________________

City/State/Zip: ____________________

Grantee Information

Name: ____________________

Address: ____________________

City/State/Zip: ____________________

Property Information

Legal Description: ____________________

Parcel Number (APN): ____________________

County: ____________________

Conveyance

The Grantor(s) hereby quitclaims to the Grantee all right, title, and interest in the following described real property in the County of ____________________, State of California, to wit:

Legal Description of Property: ____________________

The conveyance is made subject to all current taxes, assessments, covenants, conditions, restrictions, leases, and easements of record.

Transfer Tax Exemption

(If applicable) This transaction is exempt from county documentary transfer tax under the provision of the California Revenue and Taxation Code Section ____________________.

Signature

Signed this ___ day of ____________, 20__.

Grantor's Signature: ____________________

Grantor's Name Printed: ____________________

Grantee's Signature: ____________________

Grantee's Name Printed: ____________________

Acknowledgement

This document was acknowledged before me on ___________ (date), by ___________ (name(s) of signatory(ies)).

Notary Public Signature: ____________________

Notary Public Name Printed: ____________________

Witnesses (If required)

Witness #1 Signature: ____________________

Witness #1 Name Printed: ____________________

Witness #2 Signature: ____________________

Witness #2 Name Printed: ____________________

PDF Specifications

| Fact | Description |

|---|---|

| Definition | A California Quitclaim Deed is a legal document used to transfer interest, or 'quit' a claim, in real property from a grantor to a grantee with no warranties of title. |

| Governing Law | California Civil Code sections 1092, 1105, and the California Revenue and Taxation Code dictate the rules and requirements for quitclaim deeds in California. |

| Warranty | The quitclaim deed does not offer any warranty about the title's quality, only transferring whatever interest the grantor has, if any. |

| Filing Requirement | Once signed, the quitclaim deed must be filed with the County Recorder’s Office in the county where the property is located to be effective. |

| Document Recording | The deed requires a preparer's statement, a complete legal description of the property, and payment of the applicable recording fees at the time of filing. |

| Transfer Tax Implication | Transfer may be subject to a documentary transfer tax unless exempt under California Revenue and Taxation Code 11922-11930; exemptions must be stated on the document. |

Instructions on Writing California Quitclaim Deed

Filling out a California Quitclaim Deed form is a straightforward process, but it's important to do it correctly to ensure the transfer of property goes smoothly. This guide will walk you through each step necessary to complete the form accurately. Following these steps will help avoid any delays or issues with your property transfer.

- Gather the necessary information: You'll need the legal description of the property, the names and addresses of the grantor (the person transferring the property) and the grantee (the person receiving the property), and the Assessor's Parcel Number (APN).

- Enter the name and address of the person preparing the document at the top of the form.

- Write the name and address of the person to whom the document will be returned after recording just below the preparer's information.

- On the indicated line, fill in the amount of money being exchanged for the property, if any. Write "0" if no money is being exchanged.

- Insert the grantor's name(s) and how they will hold title (if applicable).

- Enter the legal description of the property. This information can be found on a previous deed for the property or by contacting the county recorder's office.

- List the APN, which is found on tax statements or by contacting the county assessor's office.

- Have the grantor(s) sign the form in the presence of a notary public. The grantor's signature must be notarized.

- Verify all information is correct and complete. Double-check the spelling of names, addresses, and the legal description of the property.

- File the completed form with the county recorder's office in the county where the property is located. There may be a filing fee, so it's advisable to contact the recorder's office beforehand to verify the amount.

Once the form is filed, the property transfer is considered complete. The county recorder's office will return the Quitclaim Deed to the address you provided after it's recorded. Keep this document in a safe place for your records. Should you need further assistance, consider consulting with a real estate attorney or a professional familiar with California property laws.

Understanding California Quitclaim Deed

What is a California Quitclaim Deed form?

A California Quitclaim Deed form is a legal document used to transfer interest, ownership, or rights in real property from one person (the grantor) to another (the grantee) without any warranties of title. This means the grantor does not guarantee that they legally own the property or that the title is clear of liens or encumbrances. It is most commonly used among family members, or to add or remove someone’s name from the title, for example, after a marriage or divorce.

When should I use a California Quitclaim Deed?

You should use a California Quitclaim Deed when you want to transfer property without a traditional sale or without guaranteeing the state of the property’s title. It is suitable for transfers between family members, to a trust, or in other situations where both parties understand and agree that the grantor is not providing any warranty on the title.

What information do I need to fill out a California Quitclaim Deed?

To fill out a California Quitclaim Deed, you need the legal description of the property being transferred, the name and address of the grantor and the grantee, and the amount of consideration being exchanged, if any. The form must also be signed by the grantor in the presence of a notary public to be valid.

Is a California Quitclaim Deed form legally binding?

Yes, once signed and notarized, a California Quitclaim Deed is legally binding. It officially transfers the grantor's interest in the property to the grantee. However, it is important to remember that the deed does not guarantee a clear title, and any existing liens or encumbrances remain with the property.

Do I need a lawyer to execute a California Quitclaim Deed?

While you do not necessarily need a lawyer to execute a California Quitclaim Deed, consulting with one is highly recommended, especially if the property transfer involves complex issues or significant value. A lawyer can help ensure that the deed is properly executed and handle any potential legal issues that might arise.

How do I file a California Quitclaim Deed?

After the California Quitclaim Deed is filled out, signed, and notarized, it must be filed with the County Recorder’s Office in the county where the property is located. The document becomes part of the public record once it is filed. There may be a filing fee, which varies by county.

Are there any tax implications when using a California Quitclaim Deed?

Transferring property using a California Quitclaim Deed may have tax implications, including the reassessment of property taxes and potential capital gains taxes. It is important to consult with a tax professional to understand the specific implications for your situation.

Can a California Quitclaim Deed be reversed?

A California Quitclaim Deed is permanent once filed, and reversing it would require the grantee to agree to transfer the property back to the original grantor using another Quitclaim Deed or a different form of deed. It is crucial to be certain about transferring property rights before executing a Quitclaim Deed.

What makes a California Quitclaim Deed invalid?

A California Quitclaim Deed could be considered invalid if it is not filled out correctly, not notarized, or not filed with the appropriate county. Additionally, if the grantor is not legally able to transfer the property or if the deed was signed under duress or with fraudulent intent, it may also be invalidated.

Common mistakes

When filling out a California Quitclaim Deed form, it's crucial to ensure accuracy and completeness to avoid any potential legal or financial issues in the future. One common mistake is not providing the correct legal description of the property. This description is more detailed than just the address and includes the boundaries and dimensions specified in the property's official records. If this section is filled out incorrectly, it can lead to disputes over what property was actually transferred.

Another error that is often made is failing to list the grantor's and grantee's information accurately. The names and addresses of both parties must be clearly and correctly stated to ensure the deed is legally binding. Any mistake in this area can make it challenging to enforce the deed or could result in the transfer of property to the wrong person.

Not having the document notarized is also a frequent oversight. In California, a Quitclaim Deed must be notarized to be considered valid. This means that the grantor must sign the document in the presence of a notary public. Skipping this step can invalidate the entire document, making the property transfer ineffective.

Individuals often forget to file the Quitclaim Deed with the county recorder’s office after completion. Filing is a crucial step because it puts the public on notice of the property transfer. If the deed is not officially recorded, future buyers could challenge the grantee's ownership.

Avoiding the habit of using generic or incorrect forms can also prevent complications. California has specific requirements for a Quitclaim Deed that might not be met by a generic form used in another state. It's essential to use the correct, state-specific form to ensure all legal criteria are met.

Lastly, overlooking the need for legal advice is a common mistake. People often complete and file Quitclaim Deeds without consulting a legal professional. Since each property and situation is unique, getting tailored advice can help avoid errors difficult to correct later. Understanding the consequences and ensuring the deed is properly completed and filed can safeguard against future legal issues.

Documents used along the form

When handling property transactions in California, specifically when using a Quitclaim Deed form, there are several other forms and documents that are often required to complete the process effectively. The Quitclaim Deed is primarily used to transfer interest in real property from one person to another without any warranty regarding the title's quality. However, to ensure the transaction complies with state laws and fully captures the deal's specifics, additional documents are frequently necessary. These documents serve various purposes, from confirming the property's tax status to officially recording the transaction in public records.

- Preliminary Change of Ownership Report (PCOR): This document provides the county assessor's office with information on the property and the parties involved in the transaction. It helps in assessing if the property transfer is subject to reassessment under current tax laws.

- Transfer Tax Affidavit: Many California counties require this form to determine if the transfer is subject to local transfer tax and, if so, the amount of tax due. It must be submitted along with the Quitclaim Deed for recording.

- Notary Acknowledgement: A notarial act where a Notary Public certifies that the parties signing the Quitclaim Deed have appeared before them, proven their identity, and acknowledged that they signed the document willingly. This step is crucial for the document to be considered valid and recordable.

- Title Report: Although not always required, a Title Report can be valuable to the recipient of a quitclaim deed. It provides a comprehensive history of the title, revealing any liens, easements, or other encumbrances on the property.

- Recording Cover Sheet: Some county recorders may require a specific cover sheet to accompany documents submitted for recording. This sheet often includes essential recording information and may vary by county.

Together with the Quitclaim Deed, these forms and documents ensure the property transfer is conducted smoothly and in compliance with state regulations. While the Quitclaim Deed itself facilitates the actual transfer of interest without warranty, the additional documents provide necessary information to various entities involved in the process, from local tax assessors to potential lien holders. By properly completing and submitting these forms, individuals can help secure a more transparent and straightforward property transfer process.

Similar forms

The California Quitclaim Deed form shares similarities with the Warranty Deed form in that both are used to transfer property rights. However, the main contrast lies in the level of protection offered to the buyer. A Warranty Deed provides the buyer with guarantees that the title is clear and free from any encumbrances, which is not the case with a Quitclaim Deed. The Quitclaim Deed offers no warranties, making it a quicker but riskier option for transferring property rights.

Similar to the Grant Deed, the Quitclaim Deed in California is a non-probate instrument for transferring property ownership. While both documents serve to convey property, the Grant Deed goes a step further by assuring the recipient that the property has not been sold to someone else, and there are no undisclosed liens or encumbrances against it. This assurance is absent in a Quitclaim Deed, making the Grant Deed a more secure option for property transfer.

The Trust Transfer Deed also has similarities to the Quitclaim Deed, as both are utilized in transferring property. The Trust Transfer Deed is specifically designed for transfers into or out of a trust, often used for estate planning purposes. Like the Quitclaim Deed, it does not offer any guarantee about the title's quality. However, it implies that the transfer may be part of a broader financial planning strategy, rather than the more straightforward property right transfer associated with Quitclaim Deeds.

Another related document is the Deed of Trust, which also pertains to property transactions but serves a different purpose compared to the Quitclaim Deed. The Deed of Trust is used in some states, including California, as a means of securing a loan against real property. It involves three parties—the borrower, the lender, and the trustee—and places the property as collateral for the loan. Unlike the Quitclaim Deed, which transfers ownership rights, a Deed of Trust involves the financial aspect of property to secure a debt.

The Interspousal Transfer Deed shares common purposes with the Quitclaim Deed in that it is often used in divorce proceedings to transfer property ownership from one spouse to another without a sale taking place. It is specifically designed to transfer property between spouses and often excludes the property from reappraisal under certain state laws. While similar in their function to transfer property swiftly, the Interspousal Transfer Deed is tailored for marital property transfers, distinguishing it from the more universally applied Quitclaim Deed.

A Power of Attorney is a document that authorizes an individual to act on another's behalf in legal and financial matters, which can include the signing of a Quitclaim Deed. While not a deed in itself, a Power of Attorney is crucial in situations where the property owner cannot execute the Quitclaim Deed due to absence, illness, or other reasons. The relationship between these documents lies in their ability to enable property transactions under special circumstances, albeit through different mechanisms.

The Beneficiary Deed, known in some jurisdictions, allows property owners to designate a beneficiary who will receive property upon the owner's death, bypassing the probate process. Unlike the Quitclaim Deed, which transfers property rights immediately and without guarantees, the Beneficiary Deed takes effect upon death and provides a straightforward path for property transfer in estate planning. This prearrangement aspect sets the Beneficiary Deed apart from the immediate transfer nature of the Quitclaim Deed.

Lastly, the Lady Bird Deed, similar to the Beneficiary Deed, enables property owners to retain control over their property during their lifetime but automatically transfer it to a named beneficiary when they pass away. This deed, not universally available in all states, offers both the benefits of avoiding probate and the option for the original owner to change their mind at any time. While the Quitclaim Deed facilitates immediate property transfer without guarantees, the Lady Bird Deed provides a flexible tool for future planning.

Dos and Don'ts

Filling out a California Quitclaim Deed form accurately is crucial in ensuring a smooth transfer of property. The following are key dos and don'ts to keep in mind during the process:

Do:

- Double-check the legal description of the property. This information must match exactly what's on the current deed or title to avoid confusion or invalidation of the document.

- Clearly print or type all information to prevent any misunderstandings or misinterpretations.

- Include all necessary parties in the deed. If the property is owned jointly, you'll need to make sure everyone involved is listed and signs the deed.

- Have the deed notarized. In California, a quitclaim deed must be notarized to be considered valid and legally binding.

- Use the correct form that complies with California's specific requirements to ensure that the document is legally valid.

Don't:

- Leave any blanks on the form. If a section does not apply, write "N/A" (not applicable) to show that you didn't overlook it.

- Forget to file the deed with the county recorder's office. Once signed and notarized, the deed must be officially filed to complete the property transfer.

- Mistake a quitclaim deed for a warranty deed. Unlike a warranty deed, a quitclaim deed does not guarantee that the property is free of liens or other encumbrances.

Misconceptions

When it comes to transferring property rights in California, many people consider using a Quitclaim Deed. However, misconceptions about this form can lead to unexpected outcomes. It's important to understand what a Quitclaim Deed does and doesn't do before deciding to use one.

A Quitclaim Deed guarantees a clear title: Contrary to popular belief, a Quitclaim Deed does not guarantee that the grantor actually owns the property or that the title is clear of liens and other encumbrances. It only transfers whatever interest the grantor has at the time of the transfer, which could be none at all.

Completing a Quitclaim Deed form is all you need to do: Just filling out the form doesn't complete the process. The deed must be signed, notarized, and then filed with the county recorder's office where the property is located to make it official.

Quitclaim Deeds are only for transferring property to a family member: While often used for this purpose, Quitclaim Deeds can transfer property ownership to anyone. They're commonly used between family members because of the trust factor, as there's no warranty of title.

It creates a joint tenancy: Simply using a Quitclaim Deed does not create a joint tenancy or any other form of co-ownership structure unless explicitly stated in the deed itself. Ownership type must be clearly specified.

Quitclaim Deeds can clear up title issues: This is a misconception. A Quitclaim Deed transfers interest without making any promises about the property's title. It will not clear up title problems or liens against the property.

Using a Quitclaim Deed avoids property taxes: This isn't true. The transfer of property rights can trigger reassessment of property value and potentially increase property taxes. It's important to check with local tax laws before proceeding.

A Quitclaim Deed allows you to transfer property without notifying your mortgage lender: If there's an existing mortgage on the property, transferring property does not change the responsibility for the mortgage. Most mortgages have a due-on-sale clause, requiring the mortgage to be paid in full if the property is transferred. The lender should be notified to avoid any legal complications.

Understanding the realities of Quitclaim Deeds in California can help you make informed decisions about property transfer. Always consider consulting with a legal professional to guide you through the process and ensure that your rights and interests are protected.

Key takeaways

Understanding the nuances of the California Quitclaim Deed form is crucial for anyone looking to transfer property quickly and without the guarantees typically involved in a traditional property sale. This simplified conveyance process can be especially useful in situations involving transfers to family members or into a living trust. Below are key takeaways to guide you in filling out and using this form:

- Correctly Identify the Grantor and Grantee: The person transferring the property (the grantor) and the recipient of the property (the grantee) must be accurately identified. This includes full legal names and correct identification of their interest in the property being transferred.

- Accurate Description of the Property: The legal description of the property must be thorough and precise. This goes beyond the street address to include the lot number, subdivision name, and any other detail that distinguishes the property. Errors here could lead to significant legal complications.

- Signature Requirements: The Quitclaim Deed must be signed by the grantor in the presence of a notary public to be considered valid. This step is crucial to authenticate the document officially.

- Filing with the County Recorder: After the notarization, the Quitclaim Deed must be filed with the County Recorder’s Office in the county where the property is located. This process makes the transaction a matter of public record, which is essential for the grantee’s protection.

- Understanding No Guarantees: One of the most critical aspects of a Quitclaim Deed is that it transfers the grantor's interest in the property without any warranties. This means if the grantor does not actually own the property, or if there are any undisclosed liens or encumbrances, the grantee receives no protection or recourse through this deed.

By paying close attention to these details, individuals can navigate the process of using a California Quitclaim Deed with greater confidence and accuracy. Remember, while this document can facilitate a straightforward property transfer, the lack of guarantees means due diligence is always recommended.

More Quitclaim Deed State Forms

How to Gift a House to a Family Member - It offers a fast and effective way for parents to gift property to their children, bypassing the complexities of the conventional selling process.

Quitclaim Deed Form Texas - For those updating or clarifying ownership records, this deed type offers a direct approach to documenting such changes legally.

Georgia Deed Transfer Forms - It's a practical choice for transferring property between trusts, or into a trust.