Official Quitclaim Deed Document

In the realm of property transactions, the Quitclaim Deed form represents a simplified but significant document for transferring interest in real estate without making any guarantees about the property's title. This approach to property transfer is particularly favored in situations where speed and simplicity are paramount, such as between family members or to clear up title issues. Despite its straightforward nature, understanding the implications of using a Quitclaim Deed is critical for both the grantor, the party relinquishing ownership rights, and the grantee, the recipient of these rights. Unlike traditional warranties of title, this form does not assure the grantee of a clear title, meaning it doesn't guarantee that there are no liens, claims, or encumbrances against the property. This characteristic underscores the importance of a thorough investigation into the property's history and a clear grasp of the potential risks by the parties involved. Thus, while the Quitclaim Deed form simplifies the transfer process, it necessitates a careful consideration of the circumstances under which it is employed, ensuring all parties are fully aware of its implications.

State-specific Information for Quitclaim Deed Forms

Document Example

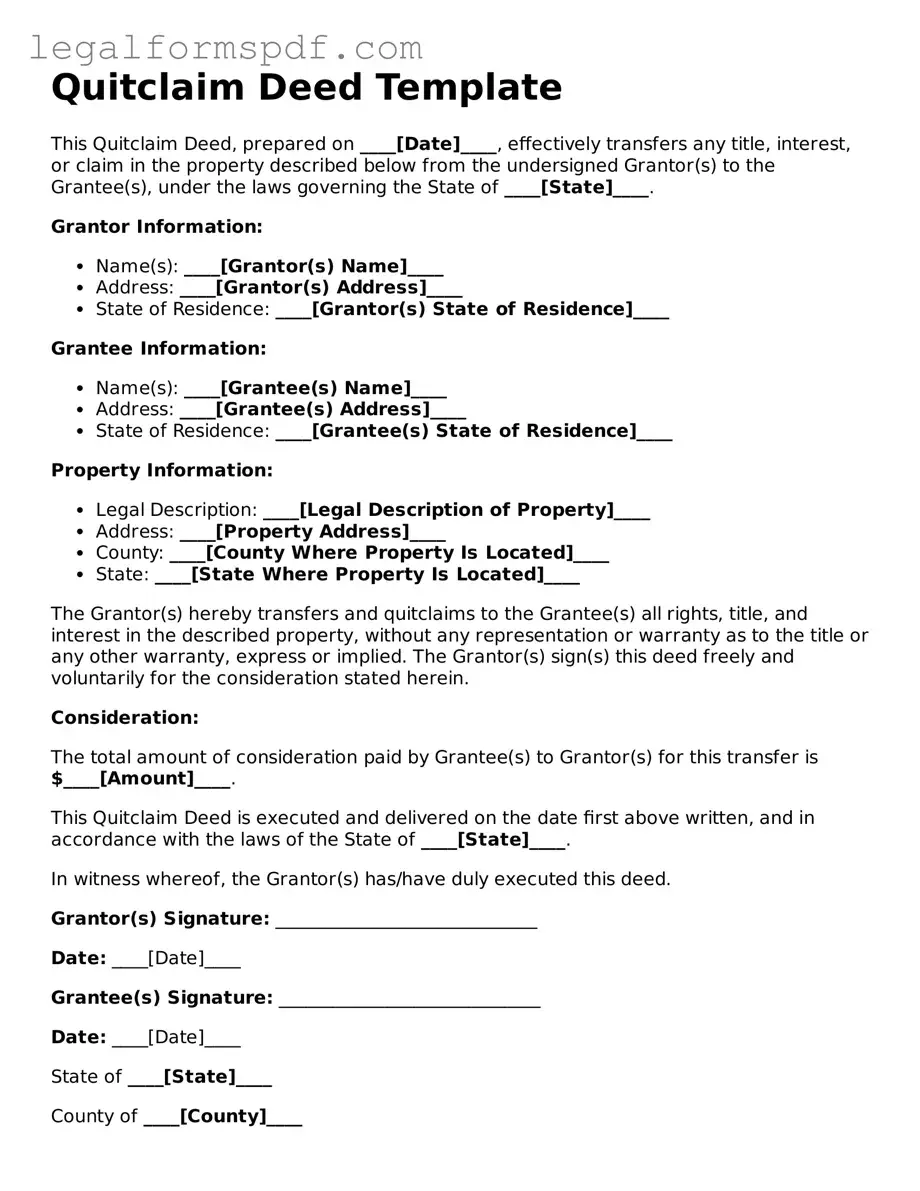

Quitclaim Deed Template

This Quitclaim Deed, prepared on ____[Date]____, effectively transfers any title, interest, or claim in the property described below from the undersigned Grantor(s) to the Grantee(s), under the laws governing the State of ____[State]____.

Grantor Information:

- Name(s): ____[Grantor(s) Name]____

- Address: ____[Grantor(s) Address]____

- State of Residence: ____[Grantor(s) State of Residence]____

Grantee Information:

- Name(s): ____[Grantee(s) Name]____

- Address: ____[Grantee(s) Address]____

- State of Residence: ____[Grantee(s) State of Residence]____

Property Information:

- Legal Description: ____[Legal Description of Property]____

- Address: ____[Property Address]____

- County: ____[County Where Property Is Located]____

- State: ____[State Where Property Is Located]____

The Grantor(s) hereby transfers and quitclaims to the Grantee(s) all rights, title, and interest in the described property, without any representation or warranty as to the title or any other warranty, express or implied. The Grantor(s) sign(s) this deed freely and voluntarily for the consideration stated herein.

Consideration:

The total amount of consideration paid by Grantee(s) to Grantor(s) for this transfer is $____[Amount]____.

This Quitclaim Deed is executed and delivered on the date first above written, and in accordance with the laws of the State of ____[State]____.

In witness whereof, the Grantor(s) has/have duly executed this deed.

Grantor(s) Signature: _____________________________

Date: ____[Date]____

Grantee(s) Signature: _____________________________

Date: ____[Date]____

State of ____[State]____

County of ____[County]____

This document was acknowledged before me on ____[Date]____ by ____[Name(s) of Signatory(ies)]____.

Notary Public Signature: _____________________________

Date: ____[Notary Expiration Date]____

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose of Quitclaim Deed | Used to transfer property without any warranty on the title. |

| Warranty on Title | Provides no guarantee about the title's status. |

| Common Uses | Often utilized in transferring property between family members or to clear up title issues. |

| Form Requirements | Varies by state; typically requires details of the grantor, grantee, legal description of the property, and the signature of the grantor. |

| Recording the Deed | Must be filed with the local county recorder or registrar's office to be effective. |

| Governing Law | Subject to the specific real estate laws and regulations of the state where the property is located. |

Instructions on Writing Quitclaim Deed

Completing a Quitclaim Deed form is a critical step in transferring property ownership from one party to another without any warranties regarding the title's condition. This method is commonly used among family members or to add/remove someone's name from the property title, often after a marriage or divorce. It’s vital to ensure that every field on the form is filled out correctly to avoid any potential legal issues. After completing the form, the next step involves having it notarized, and then, depending on the jurisdiction, filing it with the local county recorder’s office. The process for this can vary, so it’s important to check the specific requirements of your local jurisdiction.

Steps for Filling Out the Quitclaim Deed Form:

- Identify the preparer of the document - this could be the grantor (the person transferring the property), the grantee (the person receiving the property), or a legal professional.

- Fill in the date when the Quitclaim Deed will be executed.

- Provide the full legal name and address of the grantor(s).

- List the full legal name and address of the grantee(s).

- Enter the amount of money, if any, being exchanged for the property. This could be nominal (e.g., $1) to simply fulfill the requirement of consideration in the contract.

- Include the legal description of the property. This is not the same as the property’s address and can usually be found on the current deed or by contacting a local property records office.

- Ensure the grantor(s) sign(s) the document in the presence of a notary public. Depending on your state, witnesses may also be required.

- Have the form notarized to authenticate the signatures and make the document legally binding.

- File the completed and notarized Quitclaim Deed with the local county clerk or recorder’s office. There might be a filing fee, which varies by jurisdiction.

Once these steps are followed carefully, the property ownership transfer process will be well on its way to completion. Proper diligence and attention to detail in filling out the Quitclaim Deed can help ensure a smooth and dispute-free transfer of property ownership.

Understanding Quitclaim Deed

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer interest, ownership, or rights in real property from one person or entity (the grantor) to another (the grantee) without any warranty. It is most commonly used between family members, during divorce proceedings, or in other informal transactions where the property’s history is well known to both parties.

When should I use a Quitclaim Deed?

A Quitclaim Deed is ideal for non-commercial property transactions where the parties know each other and want a simple transfer. Examples include transferring property between family members, adding or removing a spouse’s name from the title post-marriage or divorce, or clearing up a title issue. However, it's not recommended for sales where the buyer requires protection, as it offers no guarantees about the property's title.

Does a Quitclaim Deed mean the property is free of liens or encumbrances?

No, a Quitclaim Deed does not guarantee that the property is free of liens or encumbrances. It simply transfers the grantor’s interest in the property as-is, which means any existing financial obligations or legal issues transfer to the grantee. Prospective buyers or grantees should conduct a thorough title search to uncover any potential issues.

How is a Quitclaim Deed different from a Warranty Deed?

The main difference between a Quitclaim Deed and a Warranty Deed is the level of protection afforded to the grantee. A Warranty Deed guarantees that the grantor holds a clear title to the property, free of liens or encumbrances, and is legally authorized to sell it. Conversely, a Quitclaim Deed offers no such assurances, merely transferring whatever interest the grantor may have without warranty.

What are the necessary steps to file a Quitclaim Deed?

Filing a Quitclaim Deed involves several steps: ensure the deed is correctly drafted to meet your local government’s requirements, include all necessary legal descriptions of the property, sign the deed in the presence of a notary public, and finally, file the deed with the local county clerk’s or land records office. Requirements for filing can vary by location, so it’s advisable to consult local regulations or a professional.

Is a Quitclaim Deed effective immediately after signing?

While a Quitclaim Deed is legally effective as soon as it's signed and notarized, it's not fully enforceable against third parties until it's recorded with the appropriate governmental authority, typically the county recorder's office. Failing to record the deed can lead to complications, as the transfer might not be acknowledged in public records, affecting the grantee's rights.

Can a Quitclaim Deed transfer property to more than one person?

Yes, a Quitclaim Deed can be used to transfer property to multiple grantees. When the property is transferred to more than one person, they can hold the property in several forms, such as joint tenants or tenants in common, depending on their intentions and the laws of the state where the property is located. It’s important to specify the type of joint ownership in the deed.

Does the grantor need an attorney to create a Quitclaim Deed?

While it's not legally required to have an attorney create a Quitclaim Deed, consulting with one can be highly beneficial, especially to understand the consequences of the transfer and to ensure the deed meets all legal requirements. An attorney can provide valuable advice and help prevent potential legal issues down the road.

Are there any fees associated with filing a Quitclaim Deed?

Yes, there are usually filing fees associated with recording a Quitclaim Deed, which vary by jurisdiction. Additionally, some locations may require payment for supplemental forms or taxes at the time of filing. It’s wise to inquire about the specific fees in your area with the local county clerk's or land records office.

Can a Quitclaim Deed be revoked once it's filed?

Once a Quitclaim Deed is filed and recorded, it cannot be unilaterally revoked by the grantor. If the parties agree that the deed was made in error or wish to reverse the transaction, a new deed – typically another Quitclaim Deed in the reverse direction – would need to be executed and filed.

Common mistakes

Filling out a Quitclaim Deed form can seem straightforward, but mistakes are common and can lead to significant problems down the line. One of the biggest errors is not checking the legal description of the property. The legal description is more than just the address; it includes detailed information about the property's boundaries and is essential for the deed to be valid. Simply using an address or an incorrect description can invalidate the document.

Another mistake involves not understanding the difference between a Quitclaim Deed and other types of deeds. A Quitclaim Deed transfers whatever interest the grantor has in the property without any warranties. If the grantor doesn't actually own the property or if there are issues with the title, the grantee may receive nothing. Mistakenly using a Quitclaim Deed when a Warranty Deed or Special Warranty Deed is more appropriate can lead to unexpected results.

Not obtaining the necessary signatures is also a common error. Depending on the state, this may include not only the grantor's signature but also the grantee's. Moreover, some states require witnesses and/or a notary public to validate the signatures. Overlooking these requirements can render the deed unenforceable.

Incorrectly filing or not filing the deed with the county recorder’s office is another key mistake. After the deed is signed, it must be filed with the appropriate local office to be effective and to put the public on notice. Failure to file, or filing in the wrong office, means the deed might not be recognized, and the transfer could be challenged.

Failing to provide adequate consideration can also be problematic. While "consideration" can sometimes be nominal (such as $10) and a Quitclaim Deed may even be executed as a gift, stating this incorrectly or not at all may raise questions about the deed's validity. Clear language about the consideration or the intention behind the transfer is important.

Overlooking tax implications is another frequent misstep. Property transfers can have tax consequences for both the grantor and grantee. Without considering these implications, parties may find themselves with unexpected liabilities. It’s crucial to understand and address any potential tax consequences before completing the deed.

Not consulting a professional when necessary is also a major oversight. Quitclaim Deeds involve legal rights and can have long-lasting implications. When there are complications or significant assets at stake, consulting with a real estate attorney can prevent costly errors and ensure the deed accomplishes what it's supposed to.

Last but not least, neglecting to retain copies of the fully executed deed can cause issues down the road. Both parties should keep a copy in a safe place in case there are any future disputes about the property or its ownership. Without access to the original document, proving the specifics of the property transfer becomes much more difficult.

Documents used along the form

When dealing with property transactions, a Quitclaim Deed form is often not the only document required to ensure a smooth transfer of property rights. This form is particularly used to convey the seller's interest in a property to a buyer without making any warranties about the property title's quality. However, to complete the process efficiently and protect all parties involved, several other forms and documents are typically used in conjunction with the Quitclaim Deed. Each of these documents serves a distinct purpose, contributing to the legality and security of the property transaction.

- Warranty Deed: Although serving a different purpose than the Quitclaim Deed, a Warranty Deed is also used in real estate transactions. It provides a guarantee from the seller to the buyer that the property title is clear of any claims or liens, offering greater protection to the buyer.

- Title Search Report: This document outlines the history of the property, including previous owners, and reveals any encumbrances or liens against the property. It is essential for ensuring that the property title is clear before the transaction.

- Property Disclosure Statement: Sellers use this form to disclose any known issues or defects with the property. While it is not a warranty, it requires honesty from the seller about the property's condition and can include details about repairs, damages, and material defects.

- Mortgage Documents: If the property is being financed, mortgage documents are pivotal. They outline the terms of the loan, including interest rates, repayment schedule, and other conditions tied to the financing of the property.

- Closing Statement: This comprehensive itemization clarifies all costs associated with the transaction, paid by either the buyer or the seller. It includes the final sale price, legal fees, property taxes, and other related expenses.

- Homeowners Association (HOA) Documents: For properties within an HOA, these documents detail the association's rules, regulations, and financial condition. They are crucial for the buyer to understand any additional obligations or fees associated with the property.

Together, these documents ensure the property transaction is conducted transparently, with all parties fully informed of their rights and responsibilities. While the Quitclaim Deed transfers interest in the property, the additional documents provide necessary protections and information, making the process more secure and trustworthy for everyone involved.

Similar forms

One document similar to a Quitclaim Deed is the Warranty Deed. Unlike the Quitclaim Deed, which does not guarantee the grantor's ownership of the property, the Warranty Deed does. It offers the grantee (the person receiving the property) a guarantee that the title is clear of any encumbrances (like liens or other claims) and that the grantor has the right to sell the property. This document provides a higher level of protection to the buyer than a Quitclaim Deed.

Another document resembling the Quitclaim Deed is the Special Warranty Deed. This document, like the Warranty Deed, offers a guarantee to the buyer about the title. However, the guarantee in a Special Warranty Deed is limited to the period during which the seller owned the property. It does not cover potential issues that might have arisen before the grantor's ownership. This deed represents a middle ground between the assurance provided by a Warranty Deed and the lack of guarantees with a Quitclaim Deed.

The Deed of Trust is also akin to the Quitclaim Deed but serves a different purpose. This document involves three parties: the borrower (trustor), the lender (beneficiary), and the trustee. The borrower transfers the real property to the trustee, who holds it as security for the loan from the beneficiary. If the loan is not repaid, the trustee can sell the property to pay off the debt. This differs from a Quitclaim Deed, which is typically used to transfer ownership without any attached conditions related to loans or security interests.

The Grant Deed is another document similar to the Quitclaim Deed, as it is used to transfer real property. However, a Grant Deed comes with certain assurances that a Quitclaim Deed does not. Specifically, the grantor of a Grant Deed guarantees that the property has not been sold to someone else and that there are no undisclosed encumbrances during their period of ownership. These guarantees provide the grantee with a higher level of protection compared to a Quitclaim Deed.

A Real Estate Transfer Declaration is related to the process of transferring property, much like a Quitclaim Deed. However, it is a document often required by local or state government to capture information about the transfer for tax assessment purposes. This declaration usually includes details on the sale price, property description, and the parties involved. It's more about informing governmental bodies of the transaction rather than the actual transfer of title.

The Gift Deed, similarly to the Quitclaim Deed, is used to transfer property without a monetary exchange. Instead of selling the property, the person transfers it as a gift. However, unlike a Quitclaim Deed, which offers no warranty about the grantor's title to the property, a Gift Deed may offer some assurances regarding the grantor's right to gift the property and the absence of undisclosed encumbrances, depending on the jurisdiction and the specific terms of the deed.

A Mortgage Agreement, while largely a financial document outlining the borrower's promise to repay a loan used to purchase property, bears relevance to the discussion as well. Though its primary function is not to transfer ownership, like a Quitclaim Deed, it involves a legal claim against the property. If the borrower fails to repay the loan according to the agreement's terms, the lender may foreclose on the property, affecting ownership transfer.

Lastly, the Life Estate Deed is somewhat related to a Quitclaim Deed in that it transfers property rights. A Life Estate Deed allows a person (the life tenant) to reside in or use the property during their lifetime, after which the property passes to another (the remainderman) upon the life tenant's death. The key difference is that a Life Estate Deed specifies the duration of the grantee's interest in the property, which is not the case with a Quitclaim Deed.

Dos and Don'ts

Filling out a Quitclaim Deed form correctly is crucial for ensuring the smooth transfer of property rights. Here are important dos and don'ts to consider:

Dos:- Verify the accuracy of all names: Ensure that the names of the grantor (person transferring the property) and the grantee (person receiving the property) are spelled correctly and match their legal documents.

- Complete every section: Don’t leave any blanks. If a section does not apply, fill it with “N/A” (not applicable) to indicate it was not overlooked.

- Include a legal description of the property: This description goes beyond the address, often incorporating lot, block, and subdivision details, or a metes and bounds description, as found in your property’s current deed or tax documents.

- Check for witness or notarization requirements: Different states have varying rules about whether quitclaim deeds must be witnessed and/or notarized. Verify these requirements to ensure your deed is legally valid.

- Review for errors: Before signing, go over the document carefully to correct any mistakes. An error-free quitclaim deed helps prevent legal complications.

- File the deed with the county recorder’s office: After signing, the deed must be filed or recorded with the appropriate county office to make the property transfer public record.

- Use informal names: Always use the full legal names of all parties involved, avoiding nicknames or abbreviations that could question the deed’s validity.

- Guess on property details: If unsure about the property’s legal description, refer to existing property documents or seek professional help rather than guessing.

- Sign without understanding: Transferring property rights is a significant legal action. Ensure all parties fully understand the implications before signing the deed.

- Overlook joint tenancy implications: If the property is owned in joint tenancy, understand how a quitclaim deed affects survivorship rights.

- Forget to check for liens or encumbrances: The presence of liens or other encumbrances can complicate or invalidate the transfer. Verify the property’s title status beforehand.

- Assume it changes your mortgage: A quitclaim deed transfers property ownership but does not affect mortgage obligations. The original borrower remains responsible for the loan.

Misconceptions

When it comes to transferring property ownership, the Quitclaim Deed is a common document used. However, there are several misconceptions about its use and effects. Understanding these misconceptions is key to navigating property transactions wisely.

It guarantees a clear title: A common misconception is that a Quitclaim Deed ensures the grantor holds a clear title to the property. In reality, this form of deed makes no guarantees about the title's status. It simply transfers whatever interest the grantor has in the property, if any, without making any promises about encumbrances or liens.

It settles disputes over property ownership: Some believe that using a Quitclaim Deed can resolve conflicts regarding who owns a property. Actually, this deed transfers the grantor's rights to the grantee without addressing any existing disputes. If the grantor has no rightful claim, the grantee gains no better claim to the property.

It transfers property between strangers effectively: Given that Quitclaim Deeds do not guarantee a clear title, they are not the best choice for transactions between strangers. These deeds are more appropriately used between family members or trusted individuals where there is confidence in the property's ownership history.

It eliminates the need for a title search: Another misconception is that receiving property through a Quitclaim Deed negates the need for a title search. Regardless of the deed used, a title search is crucial to uncover any existing issues with the property's title.

It's only for transferring property to family: While commonly used among family members, Quitclaim Deeds are not exclusively for this purpose. They can be used in various situations, such as transferring property to a trust or changing the ownership status for legal reasons. However, due to the lack of title guarantee, careful consideration is advised.

It protects the grantee from future claims: Some people mistakenly believe that a Quitclaim Deed offers protection against future claims on the property. The truth is, since the deed does not guarantee a clear title, it offers no protection to the grantee from potential future legal challenges.

It serves the same purpose as a warranty deed: A significant misunderstanding is that Quitclaim and Warranty Deeds serve the same purposes. Unlike a Quitclaim Deed, a Warranty Deed provides the grantee with guarantees against the claims of previous owners and ensures a clear title, making it a safer option for property transfers where no prior relationship exists between the parties.

Understanding the limitations and appropriate context for using a Quitclaim Deed is essential in making informed decisions in real estate transactions. Always consider consulting with a legal expert to navigate these matters effectively.

Key takeaways

When dealing with a Quitclaim Deed form, understanding the specifics can greatly assist anyone in managing real estate transactions more efficiently. Whether you're transferring property between family members or clearing up title issues, these key takeaways can serve as a proactive guide to navigate this process smoothly:

- Accuracy is paramount: Ensure all the information is accurate, including the legal description of the property, the names of the grantor (the person transferring the property) and grantee (the person receiving the property), and the respective addresses. Errors can invalidate the deed or cause legal issues down the line.

- Understand the legal implications: A Quitclaim Deed transfers only the grantor's interest in the property and doesn't guarantee a clear title. It's vital to know what rights are being transferred or if there are any encumbrances on the property.

- Notarization is required: To be valid, most states require the Quitclaim Deed to be signed by the grantor in the presence of a Notary Public. This formalizes the document, making it legally binding.

- Consider the need for witness signatures: Some states also require witnesses to sign the Quitclaim Deed. Checking the specific requirements of your state is crucial to ensure compliance and validity of the deed.

- File the completed form promptly: After the Quitclaim Deed is signed and notarized, it should be filed with the local county clerk’s office or land records office. This public recording is necessary for the deed to be acknowledged as valid and to put others on notice of the transfer.

- Understand tax implications: Transferring property can have tax consequences for both the grantor and the grantee. It's wise to consult with a tax professional to understand any potential tax liability or benefits resulting from the transaction.

- Know when to use a Quitclaim Deed: Quitclaim Deeds are commonly used among family members, in divorce proceedings where one spouse grants their interest in the property to the other, or to clear up a cloud on title. They are not the best option for transactions where the buyer requires a warranty of clear title.

- Seek legal advice if unsure: If there's any doubt about how to complete the form or the implications of using a Quitclaim Deed, consulting with a lawyer can offer clarity and peace of mind. Understanding all the legal ramifications ahead of time can prevent unintended consequences.

Tackling real estate transactions with a well-prepared approach can eliminate numerous obstacles. By keeping these key takeaways in mind, anyone dealing with a Quitclaim Deed can navigate the process more effectively and with greater confidence.

Consider More Types of Quitclaim Deed Forms

Corrective Deed California - It is a necessary step for property owners to correct errors that might lead to legal complications.