Fillable Deed Document for Pennsylvania

In the realm of property transactions within Pennsylvania, the deed form serves as a pivotal legal document, instrumental in transferring ownership of real estate from one party to another. Ensuring accuracy and adhering to state-specific requirements are crucial steps in this process, as they safeguard the interests of all involved parties. The Pennsylvania deed form, in its essence, encapsulates several major aspects that participants must navigate carefully. Among these are the precise identification of the grantor (the seller) and the grantee (the buyer), a comprehensive description of the property being transferred, and the inclusion of necessary legal statements and signatures that validate the exchange legally. Moreover, the form's acknowledgment by a notary public is imperative for its official recognition. This document also varies in type, such as warranty deeds or quitclaim deeds, each providing different levels of protection and guarantees concerning the property's title. As individuals embark on the significant undertaking of transferring property in Pennsylvania, understanding the manifold components and the critical importance of the deed form cannot be overstated.

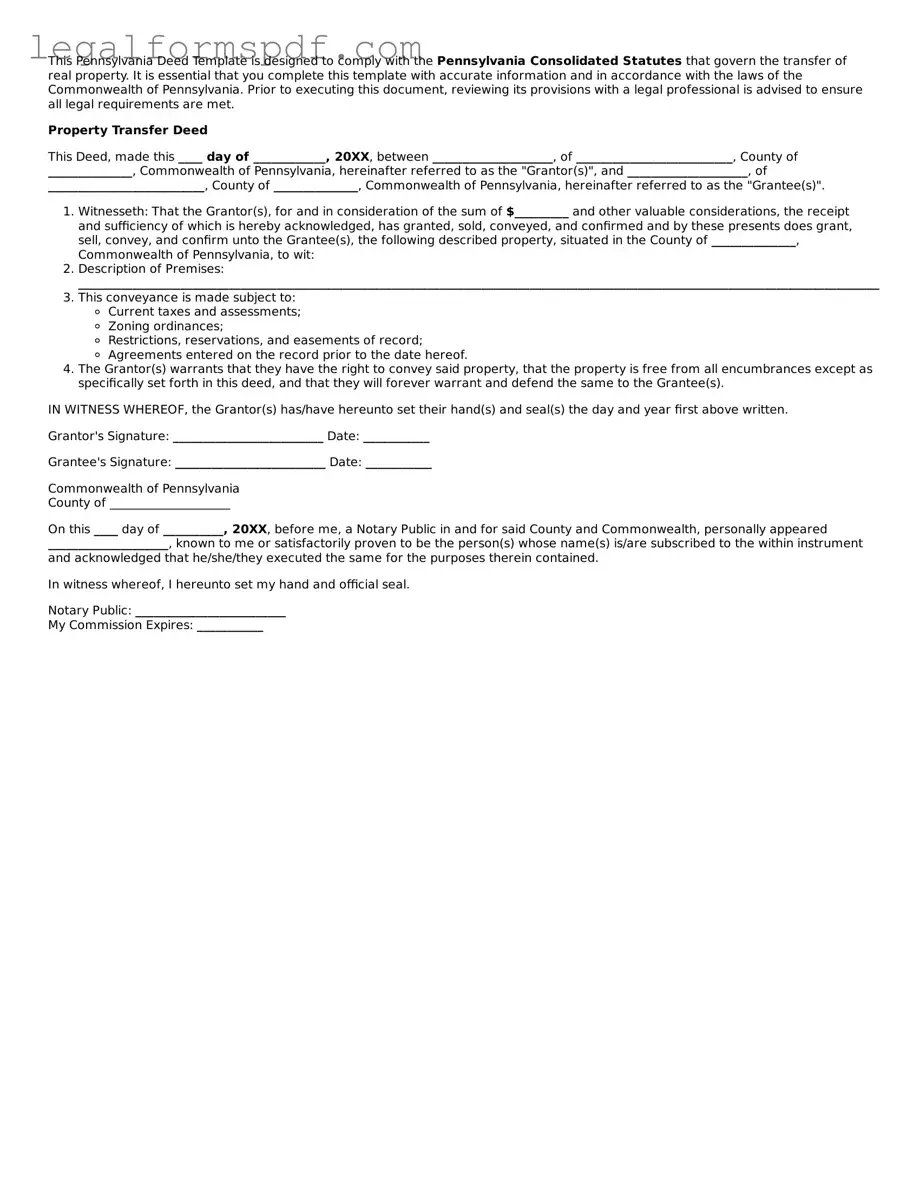

Document Example

This Pennsylvania Deed Template is designed to comply with the Pennsylvania Consolidated Statutes that govern the transfer of real property. It is essential that you complete this template with accurate information and in accordance with the laws of the Commonwealth of Pennsylvania. Prior to executing this document, reviewing its provisions with a legal professional is advised to ensure all legal requirements are met.

Property Transfer Deed

This Deed, made this ____ day of ____________, 20XX, between ____________________, of __________________________, County of ______________, Commonwealth of Pennsylvania, hereinafter referred to as the "Grantor(s)", and ____________________, of __________________________, County of ______________, Commonwealth of Pennsylvania, hereinafter referred to as the "Grantee(s)".

- Witnesseth: That the Grantor(s), for and in consideration of the sum of $_________ and other valuable considerations, the receipt and sufficiency of which is hereby acknowledged, has granted, sold, conveyed, and confirmed and by these presents does grant, sell, convey, and confirm unto the Grantee(s), the following described property, situated in the County of ______________, Commonwealth of Pennsylvania, to wit:

- Description of Premises: ____________________________________________________________________________________________________________________________________________________________________

- This conveyance is made subject to:

- Current taxes and assessments;

- Zoning ordinances;

- Restrictions, reservations, and easements of record;

- Agreements entered on the record prior to the date hereof.

- The Grantor(s) warrants that they have the right to convey said property, that the property is free from all encumbrances except as specifically set forth in this deed, and that they will forever warrant and defend the same to the Grantee(s).

IN WITNESS WHEREOF, the Grantor(s) has/have hereunto set their hand(s) and seal(s) the day and year first above written.

Grantor's Signature: _________________________ Date: ___________

Grantee's Signature: _________________________ Date: ___________

Commonwealth of Pennsylvania

County of ____________________

On this ____ day of __________, 20XX, before me, a Notary Public in and for said County and Commonwealth, personally appeared ____________________, known to me or satisfactorily proven to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public: _________________________

My Commission Expires: ___________

PDF Specifications

| Fact Number | Detail |

|---|---|

| 1 | Pennsylvania Deed forms are legal documents used to transfer property ownership within the state of Pennsylvania. |

| 2 | The form must include a comprehensive description of the property, including its address and parcel number. |

| 3 | It's critical to specify the type of deed being executed, such as Warranty, Special Warranty, or Quitclaim, as this determines the level of protection for the buyer. |

| 4 | Under Pennsylvania law, all deeds must be signed by the grantor(s) in the presence of a notary public. |

| 5 | The Pennsylvania Department of Revenue requires a Statement of Value form if the deed is exempt from transfer tax or if the consideration is not clearly stated. |

| 6 | All deeds transferring property in Pennsylvania are subject to state and local transfer taxes, unless exempt. |

| 7 | Recording the deed with the county recorder's office where the property is located is necessary for the deed to be effective against third parties. |

| 8 | Governing laws for Pennsylvania Deeds include the Pennsylvania Consolidated Statutes, Title 21 (P.S.) §§ 1-6301 et seq., addressing the legal requirements for deeds in the state. |

Instructions on Writing Pennsylvania Deed

Filling out a Pennsylvania Deed form is a necessary step in the process of transferring property ownership within the state. This document is vital for the legal conveyance of real estate from one party to another. It must be completed accurately to ensure the transfer is valid and recognized by law. The following steps are designed to guide you through this process, making it manageable and straightforward.

- Gather all necessary information, including the full legal names of both the grantor (seller) and grantee (buyer), the exact address of the property, and its legal description. The legal description can usually be found on a previous deed or tax bill.

- Identify the type of deed being used. Common types in Pennsylvania are General Warranty, Special Warranty, and Quitclaim Deeds. Each serves different purposes in terms of the level of protection and warranty provided to the buyer.

- Complete the date section at the beginning of the deed form, ensuring to use the formal month, day, and year format.

- Fill in the grantor's name(s) and address(es) in the designated section. It’s important the grantor's information matches the public record precisely.

- Input the grantee's name(s) and address(es). Like the grantor's information, accuracy is crucial to avoid future disputes or confusion regarding property ownership.

- Write down the consideration paid for the property. This refers to the purchase price or the value exchanged for the property transfer.

- Include the complete legal description of the property. This step is critical as it specifies the exact land being transferred. A mistake here can lead to legal complications.

- Have the grantor(s) sign the deed in the presence of a notary public. The signatures must be notarized to be legally valid.

- Check if witness signatures are required. Pennsylvania law may not require witnesses for the deed to be valid, but it’s advisable to verify based on county requirements.

- Record the deed at the county recorder’s office where the property is located. There may be a filing fee, and the deed must be recorded to be enforceable against third parties.

After completing the above steps, the process of legally transferring property ownership through a deed in Pennsylvania will be complete. This deed serves as a permanent record of the transfer and must be maintained to protect the rights of the new property owner. It's advisable to keep a copy of the recorded deed for personal records and future reference.

Understanding Pennsylvania Deed

What is a Pennsylvania Deed form?

A Pennsylvania Deed form is a legal document used to transfer ownership of real estate in Pennsylvania from one party, known as the grantor, to another, called the grantee. This form contains detailed information about the property and the terms of the transfer.

Who needs to sign the Pennsylvania Deed form?

The person or entity transferring the property, also known as the grantor, must sign the deed. Depending on the type of deed, witnesses and/or a notary public may also need to sign the form to validate the transfer.

What types of Deed forms are available in Pennsylvania?

There are several types of Deed forms used in Pennsylvania, including General Warranty Deeds, Special Warranty Deeds, Quitclaim Deeds, and others. Each type provides different levels of protection and guarantees regarding the property's title.

Is a lawyer required to complete a Deed form in Pennsylvania?

While Pennsylvania law does not require a lawyer to complete a Deed form, consulting with a legal professional can ensure the document is properly executed and addresses all legal concerns, especially given the complexity of real estate transactions.

How do I file a Pennsylvania Deed form?

After the Deed form is completed and signed, it must be filed with the Recorder of Deeds in the county where the property is located. Filing fees will apply, and the amount can vary by county.

Can I use a Pennsylvania Deed form to transfer property to a family member?

Yes, a Pennsylvania Deed form can be used to transfer property to a family member. It's crucial to choose the correct type of deed to ensure the transfer meets your legal and financial expectations.

What happens if a Pennsylvania Deed form is not properly filed?

If a Pennsylvania Deed form is not properly filed with the appropriate county office, it may not be considered legally effective, potentially affecting the property's ownership and causing legal issues down the line.

Are there any penalties for filing a Pennsylvania Deed form late?

While there aren't generally penalties for filing a Deed late, delaying filing can lead to complications, such as disputes over ownership or challenges to the deed's validity.

What information is needed to complete a Pennsylvania Deed form?

To complete a Pennsylvania Deed form, you'll need detailed information about the property, including its legal description, the names and addresses of the grantor and grantee, and the type of deed being used for the transfer.

Can a Pennsylvania Deed form be changed once it's filed?

Once a Pennsylvania Deed form is filed with the county, changes cannot be made to the filed document. To alter the terms of the property transfer or correct errors, a new deed must be prepared and filed.

Common mistakes

When transferring property ownership in Pennsylvania, filling out the deed form correctly is crucial. However, many people make mistakes that can complicate or invalidate the process. One common error is not providing the complete and correct legal description of the property. This description includes more than just the address; it encompasses the boundary lines, parcel number, and any legal easements or rights of way. An incomplete or inaccurate description can lead to disputes over the property's boundaries.

Another mistake made is failing to use the correct form of deed. Pennsylvania law recognizes several types of deeds—such as warranty deeds, special warranty deeds, and quitclaim deeds—each serving different purposes and offering different levels of protection to the buyer. Choosing the wrong type can unintentionally affect the buyer's rights to the property.

Often, individuals neglect to ensure that all the required parties sign the deed. If the property is owned jointly or if there’s a lien or mortgage on the property, all owners and lienholders may need to sign the deed for the transfer to be legally valid. Overlooking this step can result in a transfer that is not legally binding.

Not having the deed notarized is also a common mistake. In Pennsylvania, a deed must be notarized to be recorded. Without notarization, the county may refuse to record the deed, which could affect the new owner’s ability to prove ownership or to sell the property in the future.

Some people fail to file the deed with the appropriate county office after signing and notarizing it. This step is essential as it makes the deed part of the public record, protecting the new owner’s rights. Failing to file can lead to potential legal challenges down the road.

Misunderstanding the tax implications can also lead to issues. Transferring property can trigger local and state taxes, and the deed form may require specific tax statements or acknowledgments. Overlooking these details can result in unexpected tax liabilities for the buyer or seller.

Incorrectly identifying the grantor (seller) or grantee (buyer) is another common error. Using nicknames or failing to use the individuals’ full legal names can create confusion about who exactly is involved in the transaction, potentially leading to legal challenges.

Leaving out any relevant encumbrances, such as easements, restrictions, or liens, from the deed can also be problematic. These details affect the buyer’s use and enjoyment of the property and must be clearly stated to ensure a transparent transfer of ownership.

Lastly, many make the mistake of not consulting with a legal professional. While it may seem straightforward, transferring property is a legal process that can have long-term implications. A lawyer or other professional can offer guidance to ensure that the deed is filled out correctly and that all legal requirements are met.

Documents used along the form

When transferring property in Pennsylvania, the deed form is paramount. However, to complete this process effectively and ensure that all legal bases are covered, several other forms and documents often accompany the deed. These documents serve various purposes, from affirming the legal capacity of the parties involved in the transaction to guaranteeing the accuracy of the property description. Understanding each of these forms can provide clarity and streamline the process of property transfer.

- Statement of Value (SOV) - This form is required in some Pennsylvania counties when recording a deed. It helps in the assessment of the property for stamp duty purposes by providing the sale price or the property's value.

- Title Search Report - Before finalizing any property transaction, a title search is conducted to ensure the property is free of any encumbrances or liens. This report is a comprehensive look at the title's history, confirming the legal owner and revealing any potential issues.

- Property Disclosure Statement - This document is completed by the seller. It discloses the condition of the property, including any known defects or problems. This requirement helps protect buyers from purchasing properties with undisclosed issues.

- Mortgage Documents - If the property is being purchased with a mortgage, the lender will require several documents, including a loan application, agreement, and sometimes a mortgage note that outlines the terms of the loan.

- Closing Disclosure - This is a detailed document provided to the buyer and seller at least three days before closing. It includes the final loan terms, projected monthly payments, and details of closing costs.

- Deed Transfer Tax Forms - When property ownership is transferred, Pennsylvania levies a transfer tax. These forms are used to calculate and remit the correct amount to the state and local taxation authorities.

- Settlement Statement - This document outlines all costs related to the property transaction. Both the buyer and seller receive the statement for review before the closing day, ensuring transparency of all fees and charges.

- Flood Zone Statement - For properties located in or near flood zones, a flood zone statement may be required. This document indicates whether the property is in a flood zone, affecting insurance requirements and costs.

- Homeowners Association (HOA) Documents - For properties within an HOA, the buyer must review the HOA covenants, conditions, and restrictions (CC&Rs), bylaws, and financial statements. These documents outline the rules of the community and any potential financial liabilities.

- Warranty of Habitability - While not always formally required, a warranty of habitability can be included in the transaction documents. This guarantees that the property meets basic living and safety standards.

Each of these documents plays a crucial role in the legal transfer of property in Pennsylvania, ensuring that rights are protected, obligations are clear, and the transfer process is executed smoothly. Having a comprehensive understanding of these documents not only aids in compliance with state laws but also in safeguarding the interests of all parties involved in the property transaction. In the complex world of real estate, being well-prepared with the right documentation is key to a successful property transfer.

Similar forms

The Pennsylvania Deed form is closely related to the Warranty Deed, which is used in many states to transfer property ownership. Both documents serve the essential purpose of legally moving the title of a property from the seller to the buyer. However, a Warranty Deed explicitly guarantees that the seller holds a clear title, free of liens or claims, providing more protection to the buyer.

Similarly, the Grant Deed is another document akin to the Pennsylvania Deed form. Grant Deeds also transfer property ownership, with the added assurance that the property has not been sold to someone else and that there are no undisclosed liens or encumbrances. This document, like the Pennsylvania Deed, is a formal declaration making property ownership official and public.

The Quitclaim Deed, while used for transferring ownership rights in property, differs in protection. It carries no warranties about the property's title, meaning it’s a quicker, riskier way to transfer property where the buyer receives whatever interest the seller has. This makes it less secure compared to the Pennsylvania Deed form, which is used for more formalized and secure transactions.

A Trust Deed is another document with similarities to the Pennsylvania Deed form, primarily used for securing a real estate transaction involving a loan. Although it transfers legal title to a trustee until the borrower repays the loan, its purpose parallels the Deed's role in property transactions, emphasizing the legal framework required for these exchanges.

The Mortgage Agreement shares goals with the Pennsylvania Deed form by facilitating property transactions, often by outlining the borrower’s obligations under a mortgage loan. Unlike a Deed, which signifies ownership transfer, the Mortgage Agreement secures the loan with the property as collateral, underscoring the financial aspect of property transactions.

Land Contracts resemble the Pennsylvania Deed form in that they also concern property sales. However, this agreement allows the buyer to pay the seller over time, with the deed transferring upon the final payment. This incremental transfer of ownership contrasts with the immediate effect a Deed has once signed and delivered.

The Title Insurance Policy might be seen as complementary rather than similar to a Deed. While a Deed facilitates the transfer of property, a Title Insurance Policy protects the buyer (and lender) from losses arising from disputes over property ownership or problems with the title that were not known at the time of sale.

Property Tax Statements, while administrative, are related to the transactional nature of the Pennsylvania Deed form. After ownership transfer, these statements are crucial for the new owner, who becomes responsible for property taxes. This document underscores the ongoing financial responsibilities following a deed transfer.

The Real Estate Purchase Agreement precedes the usage of the Pennsylvania Deed form, laying out the terms of a property's sale, including price and conditions, to be finalized with a deed. It’s the blueprint for the transaction, guiding the details that will be solidified in the deed.

Lastly, the Disclosure Statement, required in many property transactions, shares a purpose of transparency with the Deed form. While a Disclosure Statement provides detailed information about the property’s condition, aiding the buyer's informed decision, the Deed legally ratifies the outcome of those decisions. Both documents are integral to the transparency and fairness of property transactions.

Dos and Don'ts

When filling out the Pennsylvania Deed form, it is crucial to adhere to specific guidelines to ensure the document is correctly completed and legally valid. Below are lists of recommended actions (do's) and actions to avoid (don'ts) during this process.

Do:

- Double-check all entered information for accuracy, including names, addresses, and legal descriptions of the property.

- Use black ink and a legible handwriting style or type the information to ensure clarity.

- Have all parties to the deed sign in the presence of a notary public to validate the document.

- Confirm you are using the correct deed form that matches your transaction type (e.g., warranty deed, quitclaim deed).

Don't:

- Leave any fields incomplete; if a section does not apply, denote it with “N/A” (not applicable) instead of leaving it blank.

- Forget to date the document. The date is crucial for recording purposes and establishes the timeline of ownership transfer.

- Omit including a legal description of the property, which may differ from the physical address and is usually found in previous deed documents.

- Fail to file the completed deed with the appropriate county recorder's office, as failure to do so can affect the legal transfer of the property title.

Misconceptions

When discussing the Pennsylvania Deed form, several misconceptions commonly arise. Understanding these inaccuracies is critical for anyone involved in property transactions within the state. Below are four widespread misunderstandings and their clarifications:

One Size Fits All: Many believe that a single deed form is applicable for all types of property transactions within Pennsylvania. This is incorrect. Pennsylvania law recognizes several types of deeds, including warranty deeds, special warranty deeds, and quitclaim deeds, each serving different purposes and providing varying levels of protection to the buyer.

Notarization Isn't Necessary: This is a dangerous misconception. For a deed to be legally operative and eligible for recording in Pennsylvania, it must be signed by the grantor (the person selling or transferring the property) in the presence of a notary public. Notarization certifies the authenticity of the signature, helping to protect against fraud.

Verbal Agreements Are Sufficient: Some may believe that verbal agreements can serve in place of a written deed form in Pennsylvania. This is not the case. The Statute of Frauds requires real estate sales and transfers to be in writing to be enforceable. A verbal agreement to sell or transfer real estate is not binding.

Legal Assistance Is Optional: While it's true that individuals can fill out and file a deed form without hiring a lawyer, obtaining legal advice is strongly recommended. Real estate transactions involve complex legal requirements and significant financial implications. A lawyer can ensure that the deed conforms to Pennsylvania law, the transaction is legally sound, and the individual's rights are protected.

Understanding these misconceptions about the Pennsylvania Deed form is crucial for anyone entering into real estate transactions within the state. Misunderstandings can lead to legal complications, additional costs, and delays in the property transfer process. Accurate knowledge ensures smoother, more secure transactions.

Key takeaways

Completing and utilizing the Pennsylvania Deed form is a critical step in the process of transferring property ownership. It is essential to understand the key takeaways to ensure the process is conducted accurately and legally. Here are ten crucial points to consider:

- Identification of parties: Clearly identify the grantor (seller) and grantee (buyer), including their full legal names and addresses, to avoid any confusion.

- Type of deed: Determine the type of deed being used, such as warranty, special warranty, or quitclaim, as each has different levels of protection and guarantees regarding the title.

- Legal description of the property: Include a precise legal description of the property being transferred. This description goes beyond the street address and may include lot, block, and subdivision, or metes and bounds.

- Consideration: Document the consideration, or purchase price, being exchanged for the property. Even if the property is a gift, a nominal consideration should be stated to satisfy legal requirements.

- Signing requirements: The grantor must sign the deed in the presence of a notary public to ensure its validity. In Pennsylvania, it is also recommended for the grantee to sign the deed, although not legally required.

- Witnesses: While Pennsylvania law does not require witnesses for the deed to be legally valid, having one or two witnesses can add a layer of authenticity and may be helpful for record-keeping purposes.

- Acknowledgment: Ensure that the deed is properly acknowledged before a notary public. This step is crucial for recording the deed with the county.

- Recording the deed: Once the deed is completed and signed, it must be recorded with the Recorder of Deeds in the county where the property is located. This step is essential for the transfer to be legally recognized and to protect the grantee’s interest.

- Transfer tax: Be aware of and prepared to pay any applicable state and local transfer taxes, which can vary by location. The responsibility for these taxes can be negotiated between the grantor and grantee.

- Additional documents: Depending on the situation, additional documents such as a Declaration of Estimated Tax for Real Estate Transfers (Form REV-183) may be required. Always check current requirements with local authorities.

Proper attention to these key points can significantly streamline the property transfer process in Pennsylvania, ensuring legal compliance and reducing the potential for future disputes.

More Deed State Forms

Quick Claim Deeds Georgia - Can be used to correct a previously recorded deed or document errors.

Property Owners Search - When property is sold under a land contract, the deed form is often transferred only after the full payment is received.

Release of Dower Rights Ohio Form - Vitally important for maintaining an organized public record of property ownership.

Life Estate Deed New York Form - A deed form is a document that legally transfers ownership of real property from one party to another.