Fillable Deed Document for Ohio

In the process of buying or selling property in Ohio, a crucial document is the Ohio Deed form. This form serves as a legal instrument that transfers property ownership from the seller to the buyer. Its importance cannot be overstated, as it not only signifies the change of ownership but also provides a clear record of the transaction for both parties and the state. The Ohio Deed form encompasses various types, each suited to different circumstances and requirements of both the buyer and the seller. Understanding the specifics of this document, including how to properly fill it out, the implications of each section, and the legal requirements for validation, is fundamental. The form must be completed with accuracy and filed with the appropriate county office to ensure the transfer is recognized by the state. This introduction aims to guide you through the major aspects of the Ohio Deed form, equipping you with the knowledge to navigate this critical step in property transactions within the state confidently.

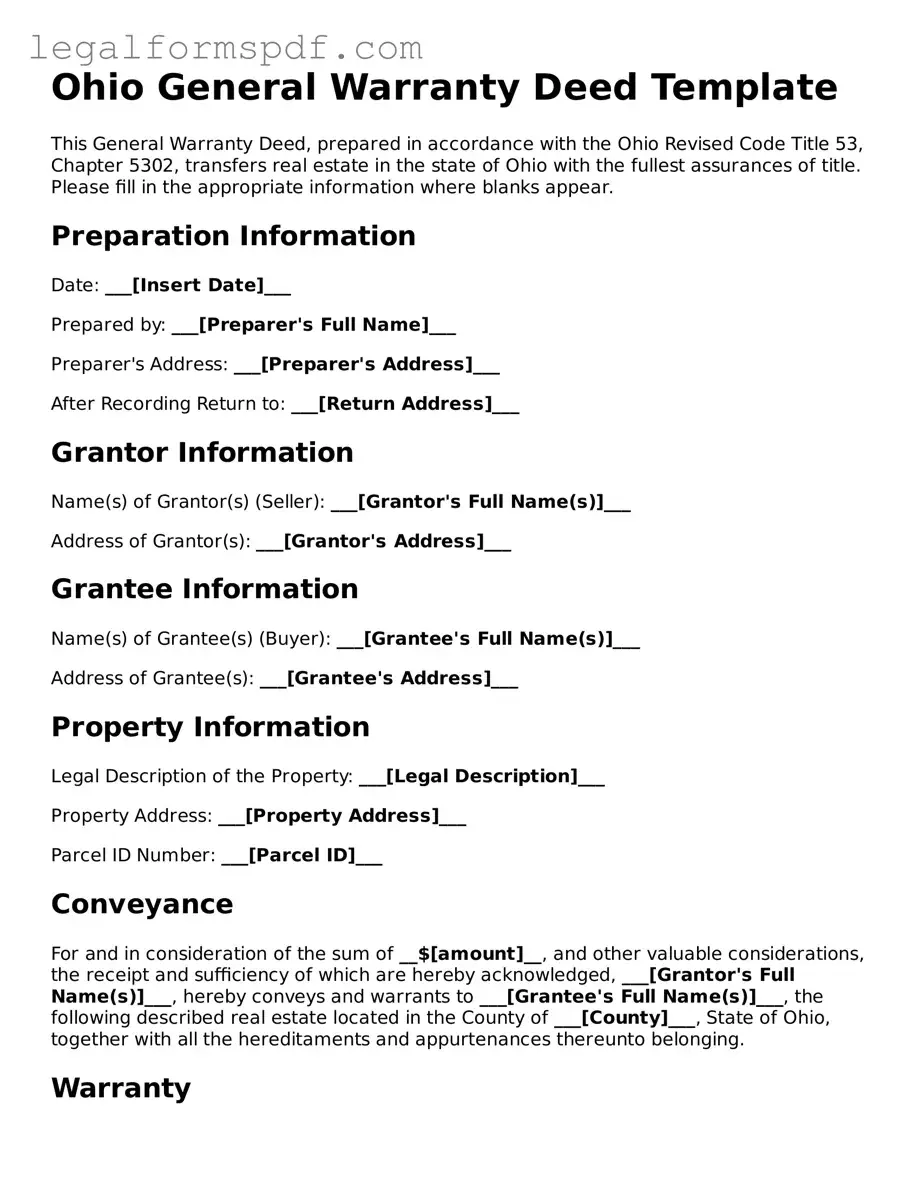

Document Example

Ohio General Warranty Deed Template

This General Warranty Deed, prepared in accordance with the Ohio Revised Code Title 53, Chapter 5302, transfers real estate in the state of Ohio with the fullest assurances of title. Please fill in the appropriate information where blanks appear.

Preparation Information

Date: ___[Insert Date]___

Prepared by: ___[Preparer's Full Name]___

Preparer's Address: ___[Preparer's Address]___

After Recording Return to: ___[Return Address]___

Grantor Information

Name(s) of Grantor(s) (Seller): ___[Grantor's Full Name(s)]___

Address of Grantor(s): ___[Grantor's Address]___

Grantee Information

Name(s) of Grantee(s) (Buyer): ___[Grantee's Full Name(s)]___

Address of Grantee(s): ___[Grantee's Address]___

Property Information

Legal Description of the Property: ___[Legal Description]___

Property Address: ___[Property Address]___

Parcel ID Number: ___[Parcel ID]___

Conveyance

For and in consideration of the sum of __$[amount]__, and other valuable considerations, the receipt and sufficiency of which are hereby acknowledged, ___[Grantor's Full Name(s)]___, hereby conveys and warrants to ___[Grantee's Full Name(s)]___, the following described real estate located in the County of ___[County]___, State of Ohio, together with all the hereditaments and appurtenances thereunto belonging.

Warranty

The grantor(s) covenants with the grantee(s) that the grantor(s) is/are the lawful owner(s) of the said property and has/have the right to convey the same; that the property is free from all encumbrances, except as specifically set forth herein; and that the grantor(s) will, and hereby does, warrant and forever defend the same unto the grantee(s) against the lawful claims and demands of all persons whomsoever.

Acknowledgement

This deed was executed at ___[Location of Execution]___, on ___[Date of Execution]___.

Signatures

In witness whereof, the parties to this deed have set their hands and seals this ___[Date]___.

Grantor(s) Signature(s):

___[Grantor's Signature]___

___[Grantor's Printed Name]___

Grantee(s) Signature(s):

___[Grantee's Signature]___

___[Grantee's Printed Name]___

Notarization

State of Ohio, County of ___[County]___.

On ___[Date]___ before me, ___[Notary's Full Name]___, a Notary Public, personally appeared ___[Person Appearing]___, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

___[Notary's Signature]___

___[Notary's Printed Name]___

My Commission Expires: ___[Expiration Date]___

PDF Specifications

| Fact | Detail |

|---|---|

| Governing Law | The Ohio Deed form is governed by the laws of the State of Ohio, specifically referencing statutes within the Ohio Revised Code. |

| Types of Deeds | In Ohio, there are several types of deeds including General Warranty Deeds, Limited Warranty Deeds, and Quit Claim Deeds, each serving different purposes and levels of guarantee. |

| Signature Requirements | All parties involved in the transaction must sign the Ohio Deed form in front of a notary public for it to be legally binding. |

| Recording | After signing, the deed must be recorded with the county recorder's office in the county where the property is located to be effective against third parties. |

| Transfer Tax | The State of Ohio may require a transfer tax to be paid upon recording a deed, with the amount depending on the county and the value of the property transferred. |

Instructions on Writing Ohio Deed

Filling out a deed form in Ohio is a critical step in the process of transferring property ownership. It is essential to approach this task with attention to detail to ensure the transfer is executed correctly and legally binding. This document must be completed with accurate information about the property and the parties involved in the transfer. The following steps are designed to assist individuals through the process, making it more manageable and less prone to errors.

- Gather necessary information, including the legal description of the property, the current owner's name(s), and the new owner's name(s).

- Identify the type of deed being used for the transfer (e.g., Warranty Deed, Quit Claim Deed) as Ohio law provides for different types, each serving a unique purpose.

- Enter the date of the deed transfer. This is the date when the ownership officially changes hands.

- Write the full legal name(s) of the grantor(s) (the current owner(s)) as stated in the current deed or property title.

- Include the full legal name(s) of the grantee(s) (the new owner(s)) who will take possession of the property.

- Record the legal description of the property. This typically includes the street address, city, county, and a detailed description from the current deed or property records.

- If applicable, fill in the consideration amount, which is the price paid for the property.

- The grantor(s) must sign the deed in the presence of a notary public. The notary will then verify the identity of the signatories and affix their seal, making the document legally binding.

- Check if your county requires any additional forms or disclosures to be submitted with the deed. This may include a Real Property Conveyance Fee Statement of Value and Receipt or a DTE Form, depending on the property's location.

- File the completed deed with the County Recorder's office in the county where the property is located. A filing fee will be required, which varies by county.

Once the deed is properly filled out, signed, notarized, and filed with the appropriate county office, the transfer of property ownership is considered complete. It is crucial to retain copies of the filed deed for personal records and future reference. This marks a significant milestone in the property transfer process, securing the rights of the new owner(s). Should any concerns or uncertainties arise during the completion of the form, consulting with a legal professional experienced in Ohio property law is advisable to ensure compliance and peace of mind.

Understanding Ohio Deed

What is an Ohio Deed form?

An Ohio Deed form is a legal document used to transfer ownership of real property from one party (the seller or grantor) to another (the buyer or grantee) in the state of Ohio. This form is a crucial document in the property transaction process, ensuring the legal transfer of the title and the rights associated with the property.

Are there different types of Deed forms in Ohio?

Yes, there are several types of Deed forms used in Ohio, including the General Warranty Deed, Limited Warranty Deed, Quitclaim Deed, Survivorship Deed, and Transfer on Death Designation Affidavit. Each type serves a specific purpose, offering varying levels of protection and warranties to the buyer concerning the title of the property.

What is the difference between a Warranty Deed and a Quitclaim Deed in Ohio?

A Warranty Deed, whether general or limited, provides the buyer with guarantees from the seller that the property title is free of any claims or liens. A General Warranty Deed offers the broadest protection, while a Limited Warranty Deed may offer guarantees only against claims arising during the seller's period of ownership. On the other hand, a Quitclaim Deed offers no warranties about the title's quality, only transferring the seller's interest in the property, if any, to the buyer.

Why is it important to use a state-specific Deed form like Ohio's?

It’s important to use a state-specific Deed form, such as Ohio's, because real estate laws can vary dramatically from one state to another. Using a form tailored to Ohio's legal requirements ensures that the deed complies with local statutes and regulations, which is crucial for the document to be valid and legally enforceable within the state.

How do I know which Ohio Deed form to use for my transaction?

Determining the appropriate Ohio Deed form for your transaction depends on several factors, including the nature of the property, the level of protection the buyer seeks, and any specific conditions of the sale. Consulting with a real estate attorney or a professional experienced in Ohio property law can help clarify which form is most suitable for your situation.

What are the main parts of a Deed form in Ohio?

The main parts of a Deed form in Ohio typically include the names of the grantor (seller) and grantee (buyer), a legal description of the property, the signature of the grantor, and an acknowledgement by a notary public. Additional clauses may be included depending on the type of Deed, specifying warranties or limitations regarding the property title.

Is notarization required for a Deed to be legal in Ohio?

Yes, notarization is a requirement for a Deed to be considered legal and valid in Ohio. The grantor’s signature must be notarized to authenticate the identity of the signer, ensuring the document's legitimacy and enforceability.

How is a Deed form recorded in Ohio?

After being properly executed and notarized, the Deed form must be recorded with the County Recorder’s Office in the county where the property is located. Recording the Deed provides public notice of the property transfer and is essential for protecting the interests of all parties involved.

Can changes be made to an Ohio Deed after it's recorded?

Once an Ohio Deed is recorded, it cannot be altered or changed. If errors are discovered or if amendments to the terms are needed, a new Deed must be prepared, signed, notarized, and recorded. This process ensures that the public record consistently reflects the most current and accurate information regarding property ownership.

Common mistakes

Filling out the Ohio Deed form incorrectly can lead to numerous complications, ranging from delays in processing to legal disputes over property ownership. One common mistake is neglecting to provide the complete legal description of the property. This description is crucial as it delineates the exact boundaries and dimensions of the property being transferred. A vague or incomplete description can void the document, resulting in uncertainties regarding the extent of the property conveyed.

Another error often seen involves incorrect or missing signatures. For a deed to be considered valid in Ohio, it must be signed by all parties involved, including the grantor(s) (the person or entity transferring the property) and, in some cases, the grantee(s) (the recipient of the property). Furthermore, witnesses or a notary public must acknowledge these signatures for the document to be legally binding. Overlooking this requirement can invalidate the whole transaction.

A third mistake is failing to properly record the deed with the relevant Ohio county office after it's been completed. Recording is vital as it publicizes the change in property ownership, protecting the grantee's interest against claims from third parties. If the deed is not recorded, future transactions involving the property may be jeopardized.

Individuals often misuse the different types of deeds available in Ohio, such as warranty, quitclaim, or survivorship deeds, each serving different purposes and offering varying levels of protection to the grantee. Selecting the incorrect type can inadvertently strip the grantee of certain rights or fail to provide the expected level of warranty against title defects.

Incorrectly listing the parties involved is another prevalent mistake. This includes misspellings, omitting middle names or initials, or failing to indicate a grantee's capacity (e.g., trustee, individual, joint tenants). Accuracy in party identification ensures the deed's enforceability and clarity in ownership records.

Not specifying the form of ownership for the grantee, especially in cases of multiple grantees, can create confusion about how the property can be used, sold, or transferred in the future. Ohio law recognizes several forms of joint ownership, such as tenancy in common or joint tenancy with right of survivorship, and the deed must clearly state the chosen form.

Calculating the conveyance fee incorrectly is another error. In Ohio, the conveyance of real property is subject to a fee based on the property's sale price or value. Misstating this fee can lead to legal and financial repercussions, including penalties and additional taxes.

Lastly, failing to consult with a legal professional when unsure about any part of the deed preparation process can compound these mistakes. While many individuals attempt to complete these forms on their own to save on costs, the complexity and legal implications of real property transactions often necessitate professional guidance to ensure compliance with Ohio laws and to safeguard the interests of all parties involved.

Documents used along the form

When engaging in property transactions in Ohio, the Deed form plays a central role. However, it's rarely the only document required to ensure a smooth, legally compliant transfer of real estate. A suite of additional forms and documents often accompanies the Deed, each serving a distinct purpose in the overall process. From tax disclosures to identity verification, understanding these companion documents is essential for anyone involved in real estate transactions in Ohio. Let's explore some of the most commonly used forms and documents that accompany an Ohio Deed form.

- Real Property Conveyance Fee Statement of Value and Receipt (DTE Form 100): Required for documenting the sale price of the property to determine the conveyance fee.

- Statement of Reason for Exemption from Real Property Conveyance Fee (DTE Form 100EX): Used when a real estate transaction is exempt from conveyance fees, detailing the reason for exemption.

- County Auditor's Real Estate Transfer Tax Declaration (DTE Form 101): A document for reporting the transfer to the county auditor, including tax declarations related to the transaction.

- Ohio Residential Property Disclosure Form: Sellers must complete this form, disclosing any known material defects of the property to potential buyers.

- Mortgage Loan Disclosure Statement: Provides details about the mortgage loan, if applicable, including terms, rates, and fees.

- Title Insurance Policy: Offers protection to buyers and lenders against financial loss from defects in title to real property.

- Homeowners' Association (HOA) Documents: If the property is within an HOA, buyers should review the community's rules, regulations, and financial statements.

- Flood Zone Statement: Identifies whether the property is in a flood zone, impacting insurance requirements and costs.

- Lead-Based Paint Disclosure: Mandatory for homes built before 1978, disclosing the presence of lead-based paint.

While the Deed form is the cornerstone of property transfers, these auxiliary documents ensure transparency, compliance with state laws, and the smooth execution of real estate transactions. Whether you're buying or selling property in Ohio, being prepared with the correct forms and understanding their purposes can significantly ease the transaction process. This comprehensive approach not only safeguards the interests of all parties involved but also helps in navigating the complexities of real estate dealings efficiently.

Similar forms

The Ohio Deed form closely resembles the Warranty Deed form in many respects. Both serve the purpose of officially transferring ownership of property from one party to another. The key similarity lies in the fact that each provides a form of guarantee regarding the status of the property title. Specifically, both assure the recipient that the title is clear of any claims or liens, thus safeguarding the buyer’s interests. However, the Warranty Deed typically offers a more comprehensive assurance, covering the entire history of the property, not just the period during which the seller held the title.

Similarly, the Ohio Deed form shares similarities with the Quitclaim Deed. The Quitclaim Deed is another tool for transferring property rights, albeit without any warranties regarding the quality of the property title. This means that while both documents facilitate the transfer of ownership, the Quitclaim Deed does so without assuring the buyer of a lien-free and claim-free title, making it a less protective option than the Ohio Deed form when it comes to title quality.

Another document akin to the Ohio Deed form is the Grant Deed. Like the Ohio Deed, a Grant Deed transfers property rights from one party to another. It also provides a level of assurance to the buyer; however, this assurance is limited to specific guarantees. These promises include that the seller has not already conveyed the property to someone else and that the property is not burdened by any undisclosed encumbrances at the time of transfer, which closely aligns with the functions of the Ohio Deed form, albeit with slightly differing guarantees.

The Special Warranty Deed, much like the Ohio Deed form, is a legal instrument for property transfer. It also offers a warranty to the buyer, but this warranty is more limited compared to that provided by a standard Warranty Deed. The seller using a Special Warranty Deed only guarantees against defects in the title that may have arisen during their period of ownership. This makes it somewhat similar to the Ohio Deed, as both aim to protect the buyer to a certain extent, but with limitations on the coverage of that protection.

The Trustee’s Deed bears resemblance to the Ohio Deed form in its function of transferring property, although it specifically involves a trustee acting on behalf of a trust to either convey or sell property. Like the Ohio Deed, it officially documents the shift in ownership. The assurance level regarding the title varies depending on the type of Trustee’s Deed but generally includes some form of protection for the buyer, aligning it in purpose with the Ohio Deed form.

The Transfer on Death (TOD) Designation Affidavit shares a fundamental objective with the Ohio Deed form: transferring property interests. However, the TOD Designation Affidavit does so upon the death of the property owner, automatically transferring the property to a named beneficiary without the need for probate. While the mechanisms of transfer and the timing differ greatly, both documents ultimately facilitate the passage of property rights, signifying a core similarity in their objectives.

Lastly, the Executor’s Deed is similar to the Ohio Deed form in that it is used in the context of a property sale or transfer, but specifically by an executor of an estate. This deed type is employed when an executor is authorized to sell estate property as part of probate proceedings. It guarantees that the executor has the legal authority to sell the property, thereby securing the buyer’s interest much like the Ohio Deed form aims to ensure the buyer is acquiring title without undisclosed issues.

Dos and Don'ts

When dealing with the Ohio Deed form, it's essential to approach the process with careful attention to detail and an understanding of what is required. The following guidelines help to ensure that you complete the form correctly and avoid common pitfalls.

Things You Should Do:

- Double-check all information for accuracy, including the legal description of the property, to ensure it matches the description on the title.

- Use black ink or type the information to maintain the form's readability after it is scanned or photocopied.

- Ensure that all parties required to sign the deed are present and sign it in front of a notary public to legally acknowledge the document.

- Consult with a legal professional if you have any questions or doubts about the form to avoid any legal issues.

Things You Shouldn't Do:

- Don’t skip required fields; leaving necessary information blank can invalidate the deed or delay the process.

- Do not alter the form after it has been notarized, as any changes may void the document.

- Avoid using pencil or erasable ink, which can easily be tampered with or fade over time, potentially creating legal complications.

- Do not rely solely on generic advice; property laws can vary significantly by jurisdiction, so local legal advice may be necessary.

Misconceptions

When navigating the quagmire of property transactions in Ohio, understanding the deed form is paramount. A deed, in its essence, is a legal instrument that transfers property rights from one entity to another. However, misconceptions are rife, often leading to confusion and missteps. To clear the fog, let's debunk some of the most common misconceptions surrounding the Ohio deed form.

All Ohio Deed Forms Are the Same: A prevalent misconception is the belief that all deed forms in Ohio serve the same purpose and convey property in the same manner. In reality, there are several types of deeds, each with its own set of legal implications and requirements. For instance, warranty deeds offer the grantee a high level of protection, whereas quitclaim deeds transfer only the interest the grantor has in the property, without any guarantees.

Signing a Deed Transfers the Property Immediately: Many assume that the mere act of signing a deed results in the immediate transfer of property. This overlooks a critical step - the recording of the deed. In Ohio, for a deed to officially transfer property rights, it must be recorded with the county recorder’s office where the property is located. Failure to do so can lead to disputes and challenges to the property's title.

Deeds Must Be Notarized by an Ohio Notary: It's a common belief that only an Ohio notary can notarize deeds for property located in Ohio. While it's true that the deed needs to be notarized, the notarization can be performed by any notary public who is authorized to act within the jurisdiction where the notarization takes place. This includes out-of-state notaries, provided the notarization fulfills the legal requirements.

A Deed is the Only Document Needed to Convey Property: Another misunderstanding is the notion that the deed itself is the sole document required in a property transfer. While the deed is indeed pivotal, other documents may be necessary to complete the transaction legally and securely. These can include a title search to verify ownership, a property survey, and various disclosures, depending on the specific circumstances of the transfer.

Electronic Deeds Are Not Legally Valid in Ohio: With the digital age upon us, the authenticity of electronic deeds has been a topic of debate. However, electronic deeds can be legally valid in Ohio, provided they meet the state's requirements for electronic signatures and recording. The e-recording process facilitates the submission, receipt, and processing of documents, including deeds, in an electronic format, offering a modern alternative to traditional paper filings.

Understanding these facets of the Ohio deed form illuminates the path to a more informed and effective property transaction. With accurate knowledge, parties involved in conveyancing can navigate the process with greater confidence and security, ensuring a smoother transition of property rights.

Key takeaways

Filling out and using an Ohio Deed form is an important process for legally transferring property. Whether you are buying, selling, or simply transferring property between family members, understanding the key aspects of this form is crucial. Below are ten key takeaways to help guide you through the process.

- Identify the Type of Deed: Ohio law recognizes several types of deeds, including warranty deeds, limited warranty deeds, and quitclaim deeds. Each serves different purposes and offers varying levels of protection to the buyer.

- Correctly Identify the Parties: The form must clearly state the names and addresses of the seller (grantor) and the buyer (grantee). Double-check the spelling and ensure accuracy.

- Legal Description of the Property: This is a detailed description of the property being transferred, not just its address. It should include lot numbers, subdivision names, and any other details that appear on the property's current deed.

- Signatures: Ohio law requires the seller (grantor) to sign the deed. Depending on the type of deed, witness signatures may also be required.

- Notarization: The grantor’s signature on the deed must be notarized. Ensure you visit a notary public to complete this step properly.

- Transfer Tax and Fees: Verify if you are responsible for paying any transfer tax or recording fees associated with the deed. These costs can vary by county in Ohio.

- File with the County Recorder: After the deed is completed, it must be filed with the County Recorder’s office in the county where the property is located. This makes the change of ownership public record.

- Consideration Statement: Ohio deeds often need to include a consideration statement, which details the amount paid for the property or states that the deed is a gift.

- Preparation Statement: This is a declaration of who prepared the deed, which is a legal requirement in Ohio. It usually includes the name and address of the individual or entity that filled out the deed.

- Review by a Professional: Before submitting the deed, consider having it reviewed by a legal professional. Real estate transactions can be complex, and a lawyer or real estate professional can ensure all legal requirements are met.

Filling out an Ohio Deed form requires attention to detail and an understanding of the legal requirements involved. By following these key takeaways, you can ensure a smoother and legally sound transfer of property.

More Deed State Forms

Nc Deed Transfer Form - Once recorded, a Deed form offers a public record of property ownership, critical for future transactions involving the property.

Warranty Deed Form - A tool utilized in real estate transactions to assign ownership of property.

Broward County Property Search by Owner Name - By clarifying property boundaries and ownership details, it helps prevent conflicts and disputes.