Fillable Deed Document for North Carolina

In North Carolina, transferring property is a process that requires precision, legal knowledge, and the right documentation. At the heart of this process is the North Carolina Deed form, a document designed to legally transfer ownership of real estate from the seller (grantor) to the buyer (grantee). This form not only signifies the change of ownership but also plays a crucial role in ensuring the transaction is recognized by law. The creation and handling of this form must adhere to specific state regulations, including the necessary content details, signing requirements, and filing procedures with the appropriate county office. With various types of deeds available—such as warranty, special warranty, and quitclaim deeds—choosing the right one depends on the level of protection the grantor is willing to provide and the grantee desires. Understanding the nuances and legal implications of each type is essential for a smooth and secure transfer of property.

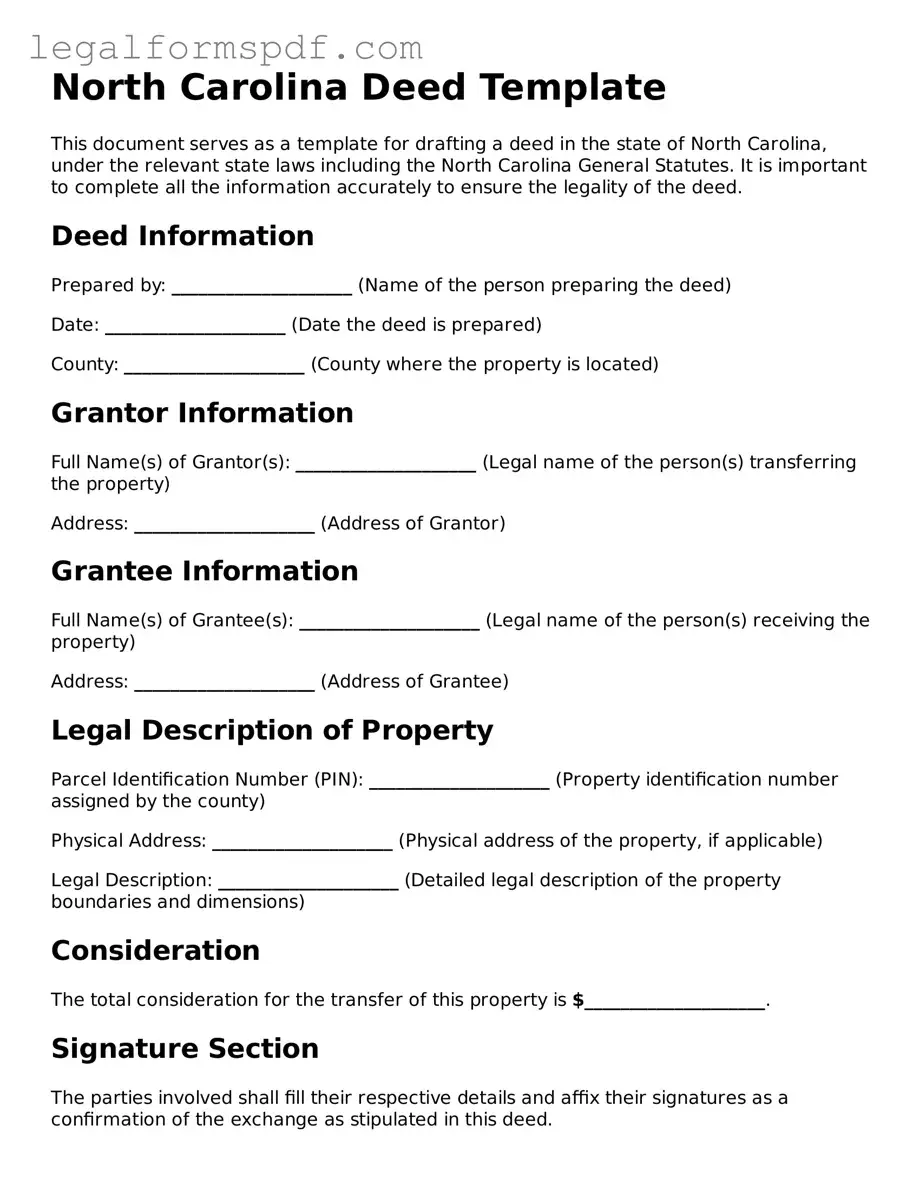

Document Example

North Carolina Deed Template

This document serves as a template for drafting a deed in the state of North Carolina, under the relevant state laws including the North Carolina General Statutes. It is important to complete all the information accurately to ensure the legality of the deed.

Deed Information

Prepared by: ____________________ (Name of the person preparing the deed)

Date: ____________________ (Date the deed is prepared)

County: ____________________ (County where the property is located)

Grantor Information

Full Name(s) of Grantor(s): ____________________ (Legal name of the person(s) transferring the property)

Address: ____________________ (Address of Grantor)

Grantee Information

Full Name(s) of Grantee(s): ____________________ (Legal name of the person(s) receiving the property)

Address: ____________________ (Address of Grantee)

Legal Description of Property

Parcel Identification Number (PIN): ____________________ (Property identification number assigned by the county)

Physical Address: ____________________ (Physical address of the property, if applicable)

Legal Description: ____________________ (Detailed legal description of the property boundaries and dimensions)

Consideration

The total consideration for the transfer of this property is $____________________.

Signature Section

The parties involved shall fill their respective details and affix their signatures as a confirmation of the exchange as stipulated in this deed.

Signature of Grantor(s): ____________________ (Signature of the person(s) transferring the property)

Date: ____________________

Signature of Grantee(s): ____________________ (Signature of the person(s) receiving the property)

Date: ____________________

Witness and Notarization

This deed must be witnessed and notarized according to the laws of North Carolina. Ensure that a notary public witnesses the signing of this document.

Witness Signature: ____________________ (Witness signature)

Date: ____________________

Notary Public: ____________________ (Notary public name)

Commission Expiration: ____________________ (Expiration date of notary commission)

Recording

Upon completion and notarization, this deed should be recorded with the Register of Deeds in the county where the property is located to ensure legal recognition of the transfer.

PDF Specifications

| Fact Name | Description |

|---|---|

| Type of Document | North Carolina Deed Form |

| Purpose | Used to legally transfer property from the grantor (seller) to the grantee (buyer) |

| Required Signatures | Must be signed by the grantor in the presence of a notary public |

| Witness Requirement | Requires at least two disinterested witnesses to the signing |

| Governing Law | Governed by North Carolina General Statutes |

| Recording Requirement | Must be recorded with the County Recorder’s Office in the county where the property is located |

Instructions on Writing North Carolina Deed

Completing the North Carolina Deed form is a necessary step in the process of transferring property ownership. This legal document must be accurately filled out and recorded to ensure the change in ownership is officially recognized. Below are the detailed steps to fill out the form properly. By following these instructions, you will be able to submit the deed confidently, knowing that all necessary information has been correctly provided.

- Begin by identifying the preparer of the document. Include their full name and address in the designated section.

- Fill in the effective date of the transfer. This is the date on which the property ownership is officially changed.

- Enter the name(s) of the grantor(s) – the current owner(s) of the property – as well as their mailing address.

- Provide the name(s) of the grantee(s) – the new owner(s) receiving the property. Include their mailing address as well.

- State the legal description of the property. This includes the physical address, parcel number, and any other identifier recorded in public records.

- List the consideration amount – the value of the transaction. This could be in the form of a sale price, gift, or other types of value exchange.

- Input any additional terms and conditions that apply to the transfer. These could include rights, covenants, or obligations that will accompany the ownership of the property.

- Have the grantor(s) sign the deed in the presence of a notary. This officially authorizes the change in ownership.

- The notary should then complete their section, including their signature, seal, and the date of notarization.

- Finally, submit the completed form to the appropriate county office for recording. This office varies by location but is typically the County Recorder or Register of Deeds.

Once the form is filled out and submitted, the property transfer process moves into the recording phase. During this phase, the county office will review the document for completeness and accuracy. If approved, the deed will be officially recorded, finalizing the transfer of ownership. It's crucial to maintain a copy of the recorded deed for your personal records. This document serves as legal proof of the property's change in ownership.

Understanding North Carolina Deed

What is a deed form used for in North Carolina?

In North Carolina, a deed form is a legal document used to transfer ownership of real property from one party (the seller or grantor) to another (the buyer or grantee). This document is critical in ensuring the legal transfer of property rights and is required to be filed with the County Register of Deeds.

Are there different types of deeds used in North Carolina?

Yes, North Carolina recognizes several types of deeds, including warranty deeds, which provide the buyer with guarantees about the title; special warranty deeds, which only guarantee against claims made by the seller; and quitclaim deeds, which transfer any ownership the seller has without any guarantees about the title.

What are the key components of a North Carolina deed form?

A North Carolina deed form typically includes the legal names of the grantor(s) and grantee(s), a legal description of the property, the signature of the grantor(s), and acknowledgment by a notary public. In certain circumstances, the deed may require additional endorsements or disclosures.

Do I need to hire an attorney to prepare a deed in North Carolina?

While it is not legally required to use an attorney to prepare a deed in North Carolina, consulting with an attorney is highly recommended. An attorney can ensure that the deed complies with state law, addresses any complex issues, and properly protects your interests.

How is a deed filed in North Carolina?

After the deed is prepared and signed, it must be filed with the Register of Deeds in the county where the property is located. The filing process involves submitting the original deed along with any required fees. The Register of Deeds will then record the document, making it part of the public record.

What fees are associated with filing a deed in North Carolina?

Filing fees for a deed in North Carolina vary by county. Generally, fees are based on the number of pages being recorded and any additional services required, such as indexing multiple properties. It's advisable to contact the local Register of Deeds for specific fee information.

Is a witness required for a deed to be valid in North Carolina?

North Carolina law does not require a witness for the signing of a deed. However, the deed must be notarized to be recorded and considered legally valid. A notary public serves to verify the identity of the person signing the deed and ensure that the signature is made willingly and under no duress.

Can a deed be revoked once it has been filed in North Carolina?

Once a deed is filed and recorded with the Register of Deeds, it generally cannot be revoked without the consent of the grantee. In cases where both parties agree to revoke the deed or in certain legal situations, such as fraud, a new deed may be executed to transfer the property rights back or to another party.

What happens if a deed is not properly filed in North Carolina?

If a deed is not properly filed with the Register of Deeds, the transfer of property might not be legally recognized. This situation can lead to potential disputes about the ownership of the property, challenges in proving ownership, and complications in future transactions involving the property. It is crucial to ensure that the deed is correctly prepared, executed, and filed to avoid such issues.

Common mistakes

In the process of transferring property ownership in North Carolina, individuals often overlook the importance of accurately completing deed forms. One common mistake is failing to ensure that the names of the grantor and grantee are correctly spelled and fully listed. This oversight can create significant confusion, potentially causing legal disputes or delays in the property transfer process.

Another frequent error involves the legal description of the property. This section must be filled out with the utmost precision, as it delineates the exact boundaries and size of the property being transferred. Generic or inaccurate descriptions can lead to uncertainties about what is actually being bought or sold, possibly resulting in legal challenges.

Additionally, the acknowledgment section, which requires notarization, is often mishandled. Some individuals either neglect to have the deed notarized or fail to ensure that the notarization is performed correctly according to North Carolina laws. This mistake can render the deed invalid, preventing the legal transfer of property ownership.

Many also neglect to specify the type of deed being executed, whether it’s a warranty deed, special warranty deed, or quitclaim deed. Each type of deed offers different levels of protection and guarantees about the property’s title, and failing to select the appropriate deed type can inadvertently leave the grantee with unforeseen vulnerabilities.

The consideration stated in the deed, typically the amount paid for the property, is another area where errors occur. Some mistakenly believe that underreporting this value can save on taxes, not realizing this can lead to penalties or legal complications. Transparency in reporting the consideration is crucial for a smooth transaction process.

Errors in signing the document also pose significant hurdles. North Carolina law requires that all parties sign the deed in the presence of a notary. Occasionally, individuals will sign the document outside of a notary’s presence or neglect to have all required parties sign, which invalidates the document.

Forgetting to record the deed with the appropriate county office is another common oversight. Filing the deed is a critical step that formalizes the transfer of ownership. Without this process, the transaction may not be legally recognized, leaving the grantee without a clear title to the property.

Many people are not aware that certain encumbrances and claims against the property, such as liens or easements, must be disclosed in the deed. Failing to make these disclosures can lead to legal disputes and financial liabilities for the grantee after the transfer is complete.

Another mistake involves not checking for statutory compliance. Each deed must comply with North Carolina’s state statutes, including specific wording or clauses required by law. Overlooking these requirements can make the deed legally unenforceable.

Lastly, missing out on the opportunity to consult with a legal professional before finalizing the deed is a critical mistake. Legal experts can identify and rectify errors or omissions that laypersons might not notice, ensuring the deed meets all legal standards and truly represents the parties’ intentions.

Documents used along the form

When transferring property in North Carolina, the deed form is crucial but not the only document needed to ensure a smooth and legally compliant process. Alongside the deed, several other forms and documents are often used to cover various legal, procedural, and financial aspects of the transaction. These supporting documents help clarify the rights and obligations of the parties involved, provide necessary disclosures, and facilitate the official recording of the property transfer. Below is an overview of some of these important documents.

- Real Estate Excise Tax Declaration: This form is required for recording a deed and assesses the tax based on the property's sale price. It is a critical document for the taxation process in real estate transactions.

- Title Insurance Policy: To protect against claims or legal fees that may arise from disputes over the property title, buyers often obtain a title insurance policy. This document outlines the terms, coverage, and conditions of the policy.

- Mortgage Agreement or Deed of Trust: If the property purchase is financed, this document secures the loan by using the property as collateral, detailing the loan's terms, repayment schedule, and the lender's rights in case of default.

- Property Disclosure Statement: Sellers provide this form to disclose the condition of the property, including any known defects or issues, ensuring that buyers are fully informed before completing the purchase.

- Flood Zone Statement: This statement indicates whether the property is located in a federally designated flood zone, affecting insurance requirements and informing buyers of potential risks.

- Homeowners' Association (HOA) Documents: For properties within an HOA, these documents outline the association’s rules, fees, and any other obligations the new owner must adhere to.

- Closing Disclosure: This document provides a detailed breakdown of all financial transactions and fees involved in the property transfer, required by law to be given to the buyer at least three days before closing.

- Loan Payoff Statement: If the seller has an outstanding mortgage, this statement details the exact payoff amount needed to clear the lien on the property as part of the sales process.

- Survey or Plat Map: A survey or plat map is often required to delineate the property's boundaries accurately, identify any easements, and ensure the physical description matches the deed.

Together, these documents form a comprehensive framework that supports the deed form, ensuring each party's rights are protected and the legal requirements are met. Buyers and sellers are encouraged to familiarize themselves with these forms and seek professional advice to navigate the complexities of real estate transactions in North Carolina successfully.

Similar forms

The North Carolina Deed form shares similarities with a Warranty Deed in several key aspects. Both documents serve the vital role of transferring property ownership. However, a Warranty Deed packs an additional assurance that the grantor (seller) holds clear title to the property and has the right to sell it, free from any liens or encumbrances. This resemblance highlights their shared goal of ensuring a secure and transparent transfer of real estate from one party to another.

Comparable to the aforementioned forms, a Quitclaim Deed is another document closely related to the North Carolina Deed form. The Quitclaim Deed also facilitates property transfer but does not guarantee the grantor’s ownership or that the property is unencumbered. This document is most commonly used between family members or to clear a title, and it emphasizes the procedural similarity of transferring real estate interests, albeit with varying levels of warranty.

The Grant Deed, much like the North Carolina Deed form, is instrumental in real estate transactions. It ensures that the property has not been sold to anyone else and that the property is not burdened with undisclosed encumbrances, offering a medium level of assurance to the grantee. The functional commonality lies in their role in transferring title to real estate while providing certain protections to the buyer.

Trust Deeds also closely resemble the North Carolina Deed form in their function within the sphere of property transactions. This document involves a trustee, who holds the property's legal title as security for a loan. While it directly relates to financing rather than outright ownership exchange like a traditional deed, its pivotal role in the control and eventual transfer of title based on the loan’s status draws parallels between them.

The Special Warranty Deed is another document akin to the North Carolina Deed form, offering a specific type of promise. It guarantees the grantee against any title defects or encumbrances that may have arisen during the grantor's ownership period but not before. This document’s similarity is in its partial reassurance about the property's title, mirroring the deed's role in property transactions albeit with limited warranty scope.

Similarly, the Deed of Trust enters the domain of property transfer documents close in nature to the North Carolina Deed form. Functioning somewhat like a mortgage, this document places a piece of real estate into a trust to secure the repayment of a loan. The involvement in transferring properties, though contingent upon loan repayment, places it within the family of deeds.

A Life Estate Deed is another variety closely related to the North Carolina Deed form. It allows the original owner (grantor) to remain on the property until death, after which the property automatically transfers to a designated remainderman. This type of deed emphasizes the adaptable nature of property transfer documents, allowing for posthumous transfer without the need for probate, showcasing its shared concern with the seamless transition of real estate ownership.

Lastly, the Transfer on Death Deed (TODD) shadows the North Carolina Deed form’s purpose in the realm of estate planning. This document allows property owners to name a beneficiary who will receive the property upon the owner's death, bypassing the probate process. While it focuses on post-death transfer, its mechanism for ensuring direct transition of property mirrors the underlying intention of the North Carolina Deed form to facilitate clear property transfers, albeit with a futuristic perspective.

Dos and Don'ts

When filling out the North Carolina Deed form, attention to detail and understanding the specific requirements are vital. Both what you should do and shouldn't do play a crucial role in ensuring the process is smooth and legally sound. Here’s a comprehensive guide to assist in the completion of this important document:

Things You Should Do

Verify the type of deed you need: Ensure you are utilizing the correct form for your transaction, like a Warranty Deed or a Quitclaim Deed, as North Carolina recognizes different types.

Consult a real estate attorney: Given the legal implications of a deed, seeking legal counsel can help prevent errors and ensure that the deed complies with North Carolina law.

Use the legal description of the property: The legal description is more precise than an address and is necessary for properly identifying the property in the deed.

Clearly state the grantor(s) and grantee(s): The persons transferring and receiving the property interest must be accurately identified, including their full legal names.

Sign in the presence of a notary: North Carolina law requires that deeds be notarized to be valid. Ensure all the parties sign the deed in front of a notary public.

Record the deed with the county: Once the deed is executed, it needs to be recorded at the Register of Deeds in the county where the property is located to be effective against third parties.

Retain a copy for your records: Keep a copy of the recorded deed for your records as proof of ownership and for future reference.

Things You Shouldn't Do

Don't leave blank spaces: Unfilled sections or blanks can lead to misunderstandings or misinterpretations of the deed’s intentions. Fill out the form completely.

Don't use non-legal language to describe the property: The deed should use the legal description of the property, not colloquial terms or vague descriptions.

Don't forget to check for specific county requirements: Some North Carolina counties may have additional requirements for recording a deed, so be sure to verify these before submitting.

Don't neglect to verify the spelling of names and accuracy of details: Errors in names or other details can create legal issues and affect the validity of the deed.

Don't sign without a notary present: A deed must be notarized to be legally valid in North Carolina, so signing without a notary present is a mistake.

Don't ignore recording the deed promptly: Delaying the recording of the deed can leave the property vulnerable to claims from third parties.

Don't fail to seek legal advice if unsure: The preparation and execution of a deed have significant legal consequences. If in doubt, seek professional advice.

Misconceptions

When dealing with the North Carolina Deed form, several misconceptions commonly arise. Understanding these misconceptions is crucial for anyone engaging in property transactions within the state. These include misunderstandings about what the form is, how it's used, and its implications on property ownership and rights. Let’s clarify some of these misconceptions.

- All deeds are the same. Many people mistakenly believe that all deeds function identically, regardless of their type. However, North Carolina recognizes several different types of deeds—such as warranty deeds, quitclaim deeds, and special warranty deeds—each offering different levels of protection and guarantees concerning the property's title.

- A North Carolina Deed form automatically transfers ownership. Simply filling out and signing a deed form does not complete the transfer of property. In North Carolina, the deed must be delivered to and accepted by the grantee (the person receiving the property), and it must be properly notarized and recorded with the county register of deeds to be considered valid and to effectively transfer ownership.

- No need to check for encumbrances. An encumbrance is a claim, lien, or liability attached to the property. Some may think that the deed form alone can assure them of a clear title, but a thorough title search is necessary to identify any potential encumbrances before transferring property. Overlooking this step can lead to complex legal issues for the new owner.

- Filling out a deed form is easy and error-free. While deed forms may seem straightforward, errors in filling them out, such as incorrect names, legal descriptions, or notary errors, can invalidate the entire document. Careful attention to detail and sometimes legal assistance are crucial to ensure that the deed form accurately reflects the intended transaction.

- A notary’s seal is all the verification needed. While a notary's seal is essential for verifying the signer's identity and ensuring that the signers are executing the document voluntarily, it is not the sole verification needed for a deed. Legal validation also requires adherence to state-specific requirements, such as witness signatures (where applicable) and recording with the appropriate county office.

- Electronic signatures are not permitted on North Carolina Deed forms. Contrary to this belief, North Carolina law has adapted to the digital age, allowing for electronic signatures on deeds and other legal documents, provided they meet specific requirements and standards for electronic transactions. This adaptation facilitates smoother, faster property transactions, aligning with modern technological capabilities.

Understanding and correcting these misconceptions ensures that parties involved in property transactions in North Carolina can navigate the process more effectively and with confidence in the validity of their legal documents.

Key takeaways

When dealing with the North Carolina Deed form, understanding its intricacies is crucial for a smooth transaction. Here are key takeaways to consider:

- Complete Accuracy: Every detail on the form must be filled out with complete accuracy to prevent legal complications.

- Correct Formatting: The form requires specific formatting, including the correct legal description of the property.

- Signature Requirements: All parties involved must sign the deed in the presence of a notary.

- Witness Presence: North Carolina law typically requires the presence of at least two witnesses during the signing.

- Type of Deed: Identifying whether the deed is a warranty, special warranty, or quitclaim deed influences the legal protections for the buyer and seller.

- Clerk of Court Filing: The completed deed must be filed with the Clerk of Court in the county where the property is located.

- Recording Fees: Prepare to pay recording fees at the time of filing, which vary by county.

- Property Tax: Ensure property taxes are up-to-date since outstanding taxes can complicate the transaction.

- Title Search: Conducting a title search before finalizing is advisable to uncover any liens or encumbrances on the property.

- Legal Review: Having a legal professional review the deed before submission can prevent errors and legal issues later on.

More Deed State Forms

Warranty Deed Form - Documentation formally recording the conveyance of property rights to a new owner.

What Does House Title Look Like - It is filed with a local government office to record the change in property ownership officially.