Fillable Deed Document for New York

When considering purchasing or transferring property in New York, the deed form emerges as a pivotal document, outlining the specifics of the property transaction. This legal instrument does not merely signify the transfer of ownership; it delineates the exact nature of the rights being passed from the seller to the buyer, encapsulating any conditions or warranties associated with the sale. To ensure the legitimacy and fluidity of this significant procedure, the State of New York requires precise adherence to the protocols set forth in completing and filing the deed form. With various types of deeds available, ranging from warranty deeds that provide the buyer with extensive protection against claims, to quitclaim deeds used often between family members with a minimal guarantee, understanding the implications and requirements of each option is crucial. Moreover, the meticulous procedure of recording the deed with the appropriate county office cannot be understated, as this public declaration is what officially vests the title in the new owner and protects their rights to the property. This introduction to New York's deed form is designed to navigate the complexities and legalities involved, providing a guiding light for both first-time buyers and seasoned investors in the property market.

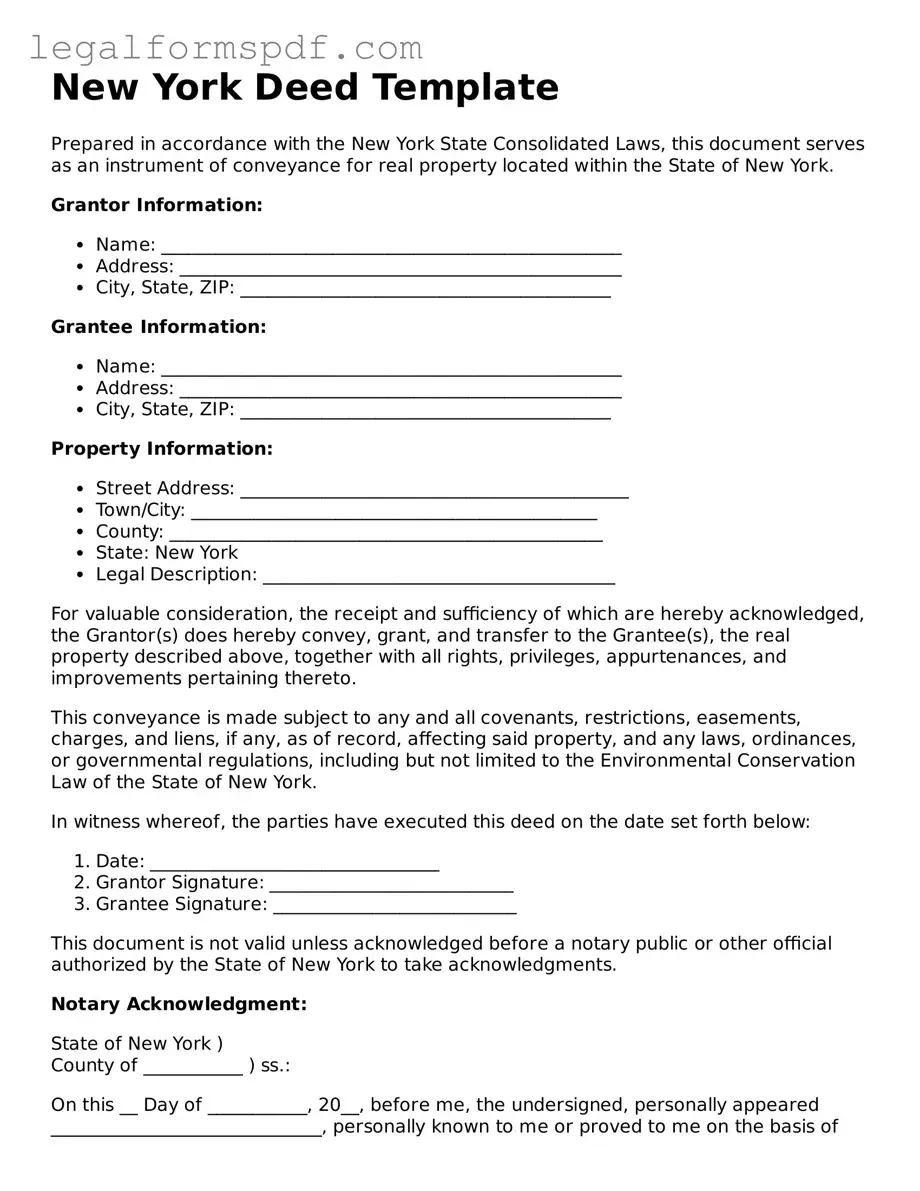

Document Example

New York Deed Template

Prepared in accordance with the New York State Consolidated Laws, this document serves as an instrument of conveyance for real property located within the State of New York.

Grantor Information:

- Name: ___________________________________________________

- Address: _________________________________________________

- City, State, ZIP: _________________________________________

Grantee Information:

- Name: ___________________________________________________

- Address: _________________________________________________

- City, State, ZIP: _________________________________________

Property Information:

- Street Address: ___________________________________________

- Town/City: _____________________________________________

- County: ________________________________________________

- State: New York

- Legal Description: _______________________________________

For valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Grantor(s) does hereby convey, grant, and transfer to the Grantee(s), the real property described above, together with all rights, privileges, appurtenances, and improvements pertaining thereto.

This conveyance is made subject to any and all covenants, restrictions, easements, charges, and liens, if any, as of record, affecting said property, and any laws, ordinances, or governmental regulations, including but not limited to the Environmental Conservation Law of the State of New York.

In witness whereof, the parties have executed this deed on the date set forth below:

- Date: ________________________________

- Grantor Signature: ___________________________

- Grantee Signature: ___________________________

This document is not valid unless acknowledged before a notary public or other official authorized by the State of New York to take acknowledgments.

Notary Acknowledgment:

State of New York )

County of ___________ ) ss.:

On this __ Day of ___________, 20__, before me, the undersigned, personally appeared ______________________________, personally known to me or proved to me on the basis of satisfactory evidence to be the individual(s) whose name(s) is(are) subscribed to within this instrument and acknowledged to me that he/she/they executed the same in his/her/their capacity(ies), and that by his/her/their signature(s) on the instrument, the individual(s), or the entity upon behalf of which the individual(s) acted, executed the instrument.

Notary Public: _______________________________

Commission Expires: _________________________

PDF Specifications

| Fact Number | Description |

|---|---|

| 1 | Forms of Deeds: New York primarily recognizes Warranty Deeds and Quitclaim Deeds among others for real estate transactions. |

| 2 | Governing Law: New York Real Property Law Section 240 governs the creation and execution of deeds in the state. |

| 3 | Acknowledgment Required: A deed must be properly acknowledged before a notary public or other authorized official to be valid. |

| 4 | Recording of the Deed: Once executed, a deed must be recorded with the County Clerk’s Office where the property is located to be effective against third parties. |

| 5 | Property Description: A valid deed must include a detailed legal description of the property being conveyed. |

| 6 | Witness Requirement: New York State law requires at least one witness for the signing of a deed. |

| 7 | Consideration: The deed should state the consideration, or the value being exchanged for the property. |

| 8 | Grantee’s Address: A New York deed must include the address of the grantee to whom the property is being transferred. |

Instructions on Writing New York Deed

When it comes time to transfer ownership of real estate in New York, the deed form is an essential document that needs to be carefully filled out. This form is a legal document that ensures the property is transferred from the current owner (the grantor) to the new owner (the grantee) in a lawful manner. The process might seem daunting, but with step-by-step instructions, you can complete the form accurately. Ensuring that each section is filled out correctly is crucial for the document to be legally binding and for the property transfer to proceed smoothly.

- Start by entering the date of the transfer at the top of the deed form.

- Fill in the full legal name(s) of the grantor(s) (the current owner(s) of the property) and provide their marital status.

- Write the full legal name(s) of the grantee(s) (the new owner(s) of the property) along with their marital status and address(es).

- Specify the consideration, which is the amount of money being exchanged for the property. If the property is a gift, indicate this by stating the relationship between the grantor and grantee and the reason for the transfer.

- Enter the legal description of the property being transferred. This information can typically be found on a previous deed for the property, a tax assessment document, or by contacting the local county clerk’s office.

- Include any covenants, clauses, or conditions that are part of the transfer. These must be stated clearly to ensure both parties are aware of any agreements or restrictions on the property.

- The grantor(s) must sign and date the deed in the presence of a notary public. The notary will then fill out their section, confirming the identity of the grantor(s) and witnessing the signing of the deed.

- Lastly, the completed deed must be filed with the appropriate county clerk’s office, typically in the county where the property is located. A filing fee may be required.

Filling out the New York deed form is a significant step in the property transfer process. By following these instructions carefully, you help ensure that the legal transfer of the property adheres to state laws and regulations. Remember, this document is not just a formality but a legally binding contract that affirms the new owner's rights to the property. Therefore, taking the time to complete it accurately is essential for a smooth and lawful transition of ownership.

Understanding New York Deed

What is a New York Deed Form?

A New York Deed Form is a legal document used to transfer ownership of real estate from one party to another in the state of New York. This form records the details of the transaction, including information about the buyer, seller, and the property itself.

Are there different types of Deed Forms available in New York?

Yes, there are several types of deed forms used in New York, including Warranty Deeds, which provide the highest level of protection to the buyer, Grant Deeds, and Quitclaim Deeds, which offer varying levels of protection and guarantees regarding the property's title.

Who needs to sign the New York Deed Form?

The seller of the property, also known as the grantor, must sign the deed form. Depending on the type of deed and local laws, the buyer might also need to sign the document. Signatures often need to be notarized to validate the document.

Does the New York Deed Form need to be notarized?

Yes, after the parties involved in the transaction sign the deed, it must be notarized. A notary public witnesses the signing and affixes their seal to the document, confirming the identities of the signatories.

What information is required on a New York Deed Form?

The form typically requires the legal description of the property, the names of the seller and buyer, the signature of the seller, and the amount of money exchanged for the property, if applicable. It should also include any conditions or warranties related to the property transfer.

Where can I find a New York Deed Form?

Deed forms can be obtained from legal form providers online, county clerk's offices, or through a real estate attorney who can also provide advice on which type of deed is most appropriate for your situation.

What should I do after completing a New York Deed Form?

Once the deed is completed and notarized, it should be filed with the county clerk's office where the property is located. This process, known as recording, is crucial for making the document part of the public record and legally transferring ownership.

Is there a fee to record a deed in New York?

Yes, recording fees vary by county. It is important to contact the local county clerk’s office to find out the exact fee. Additional taxes or fees may also apply depending on the specifics of the property transfer.

Can I fill out a New York Deed Form by myself?

While it is possible to fill out a deed form on your own, it's often advisable to consult with a real estate attorney. An attorney can help ensure that the deed is properly filled out and matches your individual needs and legal requirements, reducing the risk of future disputes or complications.

Common mistakes

When it comes to transferring property ownership in New York, correctly filling out the deed form is crucial. However, people often make a few common mistakes during this process, inadvertently leading to delays or legal complications. Understanding and avoiding these errors can streamline the property transfer process.

One frequent mistake is not properly identifying the parties involved in the transaction. Every participant, whether giving or receiving the property, must be named accurately, including their full legal names. Mismatched or misspelled names can create significant confusion, potentially invalidating the deed or necessitating legal actions to correct it.

Another common error is neglecting to provide a complete legal description of the property. This description goes beyond the street address, encompassing the boundaries, lot number, and any other details that uniquely identify the parcel in question. Incomplete or inaccurate descriptions can lead to disputes about what property was actually conveyed.

Many also overlook the need for the grantor's (the person transferring the property) signature to be notarized. In New York, this is not just a formality; it's a legal requirement for the deed to be valid. Failing to have the signature properly notarized can render the entire deed void, undoing the transaction.

Additionally, people sometimes choose the wrong type of deed for their situation. New York law recognizes several types of deeds, each with its own level of warranty against title defects. Selecting the inappropriate type can either leave the grantee (the person receiving the property) unprotected against future claims or unnecessarily obligate the grantor.

Failure to properly address tax implications is another pitfall. Transferring property can have significant tax consequences for both parties, including the necessity of paying transfer taxes or affecting future property taxes. Ignoring these implications can result in unexpected liabilities.

Another mistake is not filing the deed with the correct county clerk's office. Once the deed is correctly filled out and executed, it must be filed in the county where the property is located. Failure to do so does not complete the transfer process, leaving the property title unclear.

Lastly, individuals sometimes attempt to complete and file the deed without professional guidance. Given the complex legal and tax implications associated with transferring property, seeking advice from a real estate attorney or a professional experienced in New York property law is advisable. This can help avoid not only the mistakes mentioned above but also other potential complications.

In conclusion, while the process of filling out and filing a New York deed form might seem straightforward, it is fraught with potential pitfalls. By being aware of and avoiding these common mistakes, parties involved in a property transfer can ensure the process proceeds smoothly and legally.

Documents used along the form

In the process of transferring property in New York, using a deed form is just one step in a series of necessary legal procedures. This document is paramount as it officially transfers ownership of real estate from one party to another. However, along with a deed, various other forms and documents are often used to ensure the transaction complies with state laws and regulations, protects all parties involved, and accurately records the details of the transfer. Below is a list of documents commonly utilized alongside the New York Deed form.

- Title Insurance Policy: This document offers protection to both real estate owners and lenders against any loss or damage they might face due to liens, encumbrances, or defects in the title to the property.

- Property Tax Forms: These are required to ensure that all property taxes have been paid up to the date of transfer. They might include statements or certification from the local tax assessor.

- Mortgage Documents: If the property being transferred has an existing mortgage, documents related to the mortgage need to be handled. This could include a mortgage assumption agreement if the buyer is assuming the mortgage.

- Closing Statement: A comprehensive document that outlines all of the financial transactions taking place between the buyer and seller, including the sales price, closing costs, adjustments, and other relevant financial information.

- Real Estate Transfer Tax Forms: These forms are needed to calculate and pay any transfer taxes due to the state or municipal government as a result of the property changing hands.

- Homeowners' Association (HOA) Documents: If the property is part of a community with an HOA, documents regarding the association’s rules, regulations, and financial status will need to be reviewed and provided to the new owner.

- Property Disclosure Statement: This document requires the seller to disclose any known issues or defects with the property. It serves to inform the buyer and protect the seller from future legal action related to the condition of the home.

Each of these documents plays a crucial role in the real estate transaction process. They work in tandem with the New York Deed form to ensure a smooth, legally compliant transfer of property. Ensuring each document is accurately completed and filed not only provides peace of mind to all parties involved but also solidifies the legality and permanence of the real estate transaction.

Similar forms

The New York Deed form shares similarities with a Bill of Sale. Both documents serve as legal evidence that an item or property has been transferred from one party to another. While a Deed specifically deals with the transfer of ownership rights in real estate, a Bill of Sale covers personal property such as vehicles, equipment, or other tangible goods. Each document provides the necessary details about the transaction, including the identity of the parties involved, descriptions of the property, and the terms of transfer. However, the primary difference lies in the type of property they address.

Another document similar to the New York Deed form is the Warranty Deed. The Warranty Deed not only transfers ownership of real estate from one party to another but also explicitly guarantees that the seller holds clear title to the property. This means the seller is promising that there are no legal claims or liens against the property that could complicate the transfer. Both documents facilitate the transfer of real estate but offering different levels of protection and assurance regarding the status of the property's title.

The Quitclaim Deed also closely relates to the New York Deed form. While both are used to transfer ownership rights in property, the Quitclaim Deed does so without any guarantees about the property's title. It effectively passes whatever interest the seller has in the property to the buyer, but if the seller doesn't actually own the property or there are title issues, the buyer receives no compensation or remedy. This contrasts with other types of deeds, like Warranty Deeds, that offer more protection to the buyer against title defects.

Lastly, the Grant Deed resembles the New York Deed form in its function of transferring property ownership. A Grant Deed, like a Warranty Deed, includes certain guarantees - namely, that the property has not been sold to anyone else and that it is free from undisclosed encumbrances. This middle ground between a Warranty Deed and a Quitclaim Deed makes it a common choice for property transactions. Essentially, it conveys property with assurances against past actions by the seller but without the broader guarantees of a Warranty Deed.

Dos and Don'ts

Filling out a New York Deed form is an important process that requires attention to detail and clarity. Here are some of the dos and don'ts that can guide you through this critical task:

Dos:

Double-check all the information for accuracy before you submit the form.

Use black ink or type the information electronically for clarity and legibility.

Include all required attachments or supplements that are part of the deed form.

Ensure the legal description of the property is precise and matches the description on record.

Have the deed signed in the presence of a notary public to validate the signatures.

Keep a copy of the deed for your records after it is filed.

Verify that all parties required to sign the deed have done so before submitting.

Use the exact legal names of all parties involved in the transaction.

Review the form for any special instructions specific to New York that must be followed.

File the deed with the appropriate county clerk's office to ensure it is legally recorded.

Don'ts:

Do not leave any required fields on the deed blank. If a section does not apply, mark it as "N/A".

Avoid using erasable ink or pencils to fill out the form, as these can render the document non-legible or alterable.

Do not forget to check for any county-specific requirements or additional forms that may need to accompany the deed.

Do not guess the legal description of the property; always refer to a previous deed or property records for accuracy.

Refrain from signing the deed without a notary, as the absence of notarization can invalidate the document.

Do not overlook the need for witnesses in addition to the notary, depending on New York's current requirements.

Avoid submitting the deed without first copying all documents for your personal file.

Do not use nicknames or incomplete names for any parties to the deed; always use the full legal names.

Resist the temptation to rush through filling out the form without reviewing it for errors or omissions.

Do not delay in filing the deed with the county clerk, as procrastination can lead to complications or disputes later on.

Misconceptions

When discussing the intricacies of property transactions in New York, various misconceptions about the Deed form often circulate among the public. It is important to dispel these misunderstandings to ensure that individuals are properly informed about this crucial aspect of property transfer. Here are seven common misconceptions:

- All Deed forms in New York are the same. In reality, New York offers several types of Deed forms, each serving different purposes. For instance, Warranty Deeds offer the greatest level of buyer protection, whereas Quitclaim Deeds provide no such guarantees. Choosing the correct form depends on the specific circumstances of the transaction.

- The Deed form is the only document needed to transfer property. While the Deed is a vital document in the property transfer process, it is not the only requirement. Other necessary documents may include a Real Property Transfer Report, a Transfer Tax Return, and possibly a mortgage satisfaction if the property is being sold free and clear of any loans.

- Electronic signatures are not allowed on New York Deed forms. Contrary to this belief, New York does allow electronic signatures on Deed forms and many other real estate transaction documents. This development is in line with modernizing legal processes and making transactions more convenient.

- Only a lawyer can prepare a Deed form. While it is highly advisable to consult with a legal professional when preparing a Deed, the form can legally be completed by anyone. However, due to the complex nature and significant implications of this document, seeking legal advice is strongly recommended.

- A Deed must be notarized in New York to be valid. This statement is accurate; however, the misconception lies in the belief that notarization alone guarantees the Deed's legality and enforceability. The Deed must also be delivered to and accepted by the grantee (the person receiving the property) and subsequently recorded with the appropriate county clerk’s office.

- Recording the Deed immediately after signing is not necessary. Delaying the recording of a Deed can lead to significant legal and financial risks. The priority of claims on the property is determined by the order in which Deeds are recorded. Failure to promptly record a Deed could result in another party asserting a claim on the property.

- Any mistakes on a Deed can easily be corrected after filing. While minor corrections to a Deed are possible, they often require filing an entirely new Deed or a correction Deed, both of which can be time-consuming and potentially costly processes. Ensuring accuracy before filing the original Deed is crucial to avoid these complications.

Understanding these misconceptions is vital for anyone involved in a property transaction in New York. Accurate knowledge can prevent unnecessary delays, legal issues, and additional expenses. Always consider consulting with a legal professional to navigate the complexities of property transfer effectively.

Key takeaways

Filling out and using the New York Deed form is a crucial step in the process of transferring property. It's important to approach this task with care and attention to detail to ensure the transfer is legally sound. Here are some key takeaways to keep in mind when dealing with this form:

- Ensure all parties are correctly identified: The Deed must accurately reflect the names of the seller (grantor) and the buyer (grantee). It's vital to use full legal names and double-check spelling to avoid any potential issues with the property transfer.

- Complete all required sections: New York Deed forms have specific sections that must be filled out thoroughly, including a legal description of the property being transferred. This description is crucial and must match public records to avoid discrepancies.

- Signatures are crucial: The Deed must be signed by the grantor in the presence of a notary public. This step is non-negotiable and legally verifies the grantor's intention to transfer the property to the grantee.

- Recording the Deed: After the Deed is executed, it must be filed with the appropriate county clerk’s office in New York. This step is necessary for the transfer to be officially recognized by the state. Recording fees vary by county, so it’s important to check the exact amount in advance.

By keeping these key points in mind, the process of filling out and using the New York Deed form can be navigated more smoothly, ensuring a legal and effective transfer of property.

More Deed State Forms

Quick Claim Deeds Georgia - It may include specific covenants or clauses to cover various legal aspects.

Broward County Property Search by Owner Name - Property transfers that do not involve a traditional sale, such as inheritance or gifts, also require a suitable deed form.

What Does a House Deed Look Like in Pa - Historically, deed forms have been instrumental in shaping land ownership and use patterns across the United States.