Fillable Deed Document for Michigan

In the picturesque state of Michigan, nestled among the Great Lakes, transferring property ownership is a process that requires attention to detail and a thorough understanding of legal procedures. At the heart of this process is the Michigan Deed form, a critical document that signifies the transfer of property from one party to another. This document not only encapsulates the agreement between buyer and seller but also ensures that the transfer is recognized by law, providing a clear, legal title to the new owner. The significance of this form cannot be overstated; it contains essential information such as the identities of the buyer and seller, the legal description of the property, and the terms of the property transfer. Furthermore, the form must be duly signed and notarized to validate the transaction. With various types of deeds available, each serving different purposes and providing different levels of warranty, understanding the nuances of the Michigan Deed form is paramount for anyone involved in real estate transactions within this vibrant state. This introduction aims to shed light on the major aspects of the form, guiding those who are navigating the complexities of property transfer in Michigan.

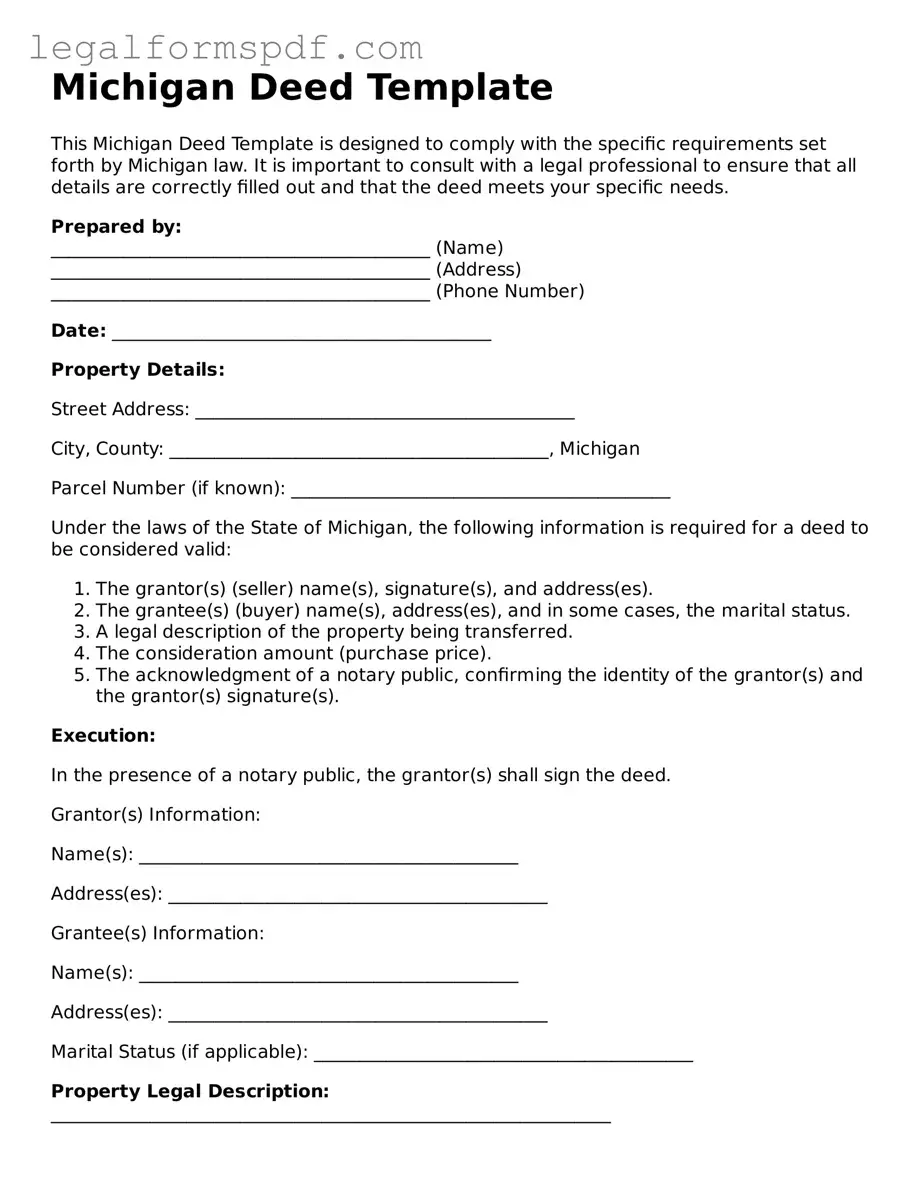

Document Example

Michigan Deed Template

This Michigan Deed Template is designed to comply with the specific requirements set forth by Michigan law. It is important to consult with a legal professional to ensure that all details are correctly filled out and that the deed meets your specific needs.

Prepared by:

__________________________________________ (Name)

__________________________________________ (Address)

__________________________________________ (Phone Number)

Date: __________________________________________

Property Details:

Street Address: __________________________________________

City, County: __________________________________________, Michigan

Parcel Number (if known): __________________________________________

Under the laws of the State of Michigan, the following information is required for a deed to be considered valid:

- The grantor(s) (seller) name(s), signature(s), and address(es).

- The grantee(s) (buyer) name(s), address(es), and in some cases, the marital status.

- A legal description of the property being transferred.

- The consideration amount (purchase price).

- The acknowledgment of a notary public, confirming the identity of the grantor(s) and the grantor(s) signature(s).

Execution:

In the presence of a notary public, the grantor(s) shall sign the deed.

Grantor(s) Information:

Name(s): __________________________________________

Address(es): __________________________________________

Grantee(s) Information:

Name(s): __________________________________________

Address(es): __________________________________________

Marital Status (if applicable): __________________________________________

Property Legal Description:

______________________________________________________________

Consideration Amount: $ __________________________________________

State of Michigan, County of _______________________: This document was acknowledged before me on (date) _______________ by (name(s) of grantor(s)) ________________________________.

Notary Public Signature: __________________________________________

Print Name: __________________________________________

My Commission Expires: __________________________________________

PDF Specifications

| Fact | Detail |

|---|---|

| Purpose | Used to legally transfer real estate property ownership in Michigan. |

| Governing Laws | Primarily governed by Michigan Compiled Laws, specifically sections within Chapters 565 and 211. |

| Types of Deeds | Includes Warranty Deeds, Quitclaim Deeds, and Lady Bird Deeds, each serving different purposes and providing varying levels of protection. |

| Recording Requirement | Must be filed with the Register of Deeds in the county where the property is located to be considered valid. |

| Signatory Requirements | Requires the signature of the grantor(s). Michigan law also mandates that the signature be acknowledged before a notary public. |

| Witness Requirement | While Michigan law does not require witnesses for the deed to be valid, some counties may have specific requirements. |

| Transfer Tax | Subject to state and possibly local transfer taxes, the amount of which depends on the property sale price and/or its fair market value. |

Instructions on Writing Michigan Deed

Once you've decided to transfer property in Michigan, filling out a deed form is the next critical step. This document is essential for legally transferring ownership from the current owner (grantor) to the new owner (grantee). It's important to proceed with precision to ensure that the process is completed accurately and effectively. The steps outlined below will guide you through filling out the Michigan Deed form, making sure all necessary details are correctly documented.

- Gather necessary information, including the full legal names of the grantor and grantee, the property description, and the parcel number.

- Identify the type of deed being used for the transfer (e.g., Warranty Deed, Quitclaim Deed) and ensure you have the correct form.

- Enter the grantor's full legal name and address at the top of the deed form.

- Fill in the grantee's full legal name and address in the designated sections.

- Write down the legal description of the property. This description can be found on the current deed, within the property's tax documents, or by contacting a local assessor's office.

- Include the parcel identification number, which can also be found on property tax statements or by contacting the local assessor's office.

- State the amount of consideration (the value being exchanged for the property, often denoted in dollars).

- Have the grantor(s) sign the deed in the presence of a notary public.

- Ensure the deed is notarized, with the notary public signing and affixing their official seal on the document.

- Check if your county requires any additional forms or disclosures to be submitted along with the deed. If so, fill these out accordingly.

- Submit the completed deed form to the appropriate county clerk's office for recording. There may be a recording fee, which varies by county.

After submitting the deed form to the county clerk's office, it will be reviewed, processed, and officially recorded. This formal recording in public records completes the transfer of property ownership. It's advisable to keep a copy of the recorded deed for personal records, as it signifies proof of ownership. If any questions or uncertainties arise during this process, seeking the advice of a legal professional can provide clarity and ensure that the property transfer adheres to Michigan law.

Understanding Michigan Deed

What is a Michigan Deed form?

A Michigan Deed form is a legal document that is used to transfer property ownership from one person (the seller) to another (the buyer) in the state of Michigan. This form contains important information such as the legal description of the property, the names of the seller and buyer, and the terms of the property transfer.

Are there different types of Deed forms in Michigan?

Yes, Michigan recognizes several types of Deed forms, each serving a different purpose. The most common types include Warranty Deeds, which guarantee that the seller holds clear title to the property; Quit Claim Deeds, which transfer any ownership interest the seller may have without any guarantees; and Covenant Deeds, which offer limited guarantees about the property's title.

Where can I find a Michigan Deed form?

Michigan Deed forms can be obtained from several sources, including online legal document services, county clerk's offices, or through a real estate attorney. It is important to ensure that the form you use complies with Michigan law and is specific to the type of Deed you need.

What information is required to complete a Michigan Deed form?

To complete a Michigan Deed form, you will need the legal description of the property being transferred, the names and addresses of the seller and buyer, the amount of consideration (if applicable), and the signature of the seller, which must also be notarized. Some forms might require additional information, so it's important to review the specific requirements for the type of Deed you are using.

Do I need an attorney to prepare a Michigan Deed form?

While it's not a legal requirement to have an attorney prepare a Michigan Deed form, it’s often recommended. A real estate attorney can provide valuable advice, ensure the Deed complies with all legal requirements, and help protect your interests during the property transfer process.

How do I record a Michigan Deed form?

After completing the Michigan Deed form, it must be recorded with the Register of Deeds in the county where the property is located. Recording the Deed makes it part of the public record and provides official notice that the property ownership has changed. There may be a fee for recording, and the Deed must meet specific formatting requirements to be accepted for recording.

Common mistakes

When filling out the Michigan Deed form, many people overlook the importance of double-checking the legal description of the property. This description is more than just the address; it includes specific details that define the property's boundaries. If this information is incorrect or incomplete, it could lead to issues with property lines and ownership down the road. Ensuring the legal description accurately matches the one on your current deed or property documents is crucial.

Another common mistake is not specifying the type of deed being transferred. In Michigan, there are several types of deeds—warranty, quitclaim, and covenant deeds, to name a few. Each type has its own implications for the seller's liability and the guarantees provided to the buyer. Failing to clearly indicate the deed type can lead to misunderstandings or legal complications concerning what rights and protections the buyer is receiving.

Not properly identifying the grantor (the person selling or giving the property) and the grantee (the person receiving the property) is also a frequent issue. Full legal names must be used, and care should be taken to ensure they are spelled correctly. Additionally, if the property is being transferred from or to more than one person, the relationships and ownership shares need to be clearly stated to prevent future ownership disputes.

Many fail to obtain the necessary signatures. A Michigan Deed form requires not only the signatures of all parties involved but also a notarization to legally validate the document. Missing signatures or a notary seal can render the deed transfer invalid, potentially nullifying the transaction.

Incorrectly handling the transfer tax declaration can be another pitfall. Depending on the property's value and other exemptions, transfer taxes may need to be paid. Misunderstanding these requirements or incorrectly filling out the transfer tax section can lead to financial penalties or delays in the deed recording process.

Forgetting to file the deed with the appropriate county office is a surprisingly common mistake. After all parties have signed the deed and it's been notarized, it must be recorded with the county where the property is located. This step is vital; until the deed is recorded, the transfer of ownership is not considered complete. The failure to record can lead to legal complications and affect the grantee's rights to the property.

Lastly, overlooking the need for legal advice is a misstep some take. While the Michigan Deed form may seem straightforward, property transfers can be complex, and legal issues can arise. Consulting with a legal professional can help ensure that the form is filled out correctly and that all legal requirements for a property transfer in Michigan are met, safeguarding the interests of all parties involved.

Documents used along the form

In real estate transactions, particularly those involving the transfer of property in Michigan, the deed form plays a critical role in legally conveying property from one party to another. However, to complete this process effectively and ensure compliance with Michigan's legal and regulatory requirements, several other forms and documents often accompany the deed form. These documents are essential for various reasons, including verifying the property's legal status, ensuring the accuracy of public records, and protecting the interests of both the seller and the buyer.

- Property Transfer Affidavit: This document must be filed with the local municipality whenever real estate is transferred. It notifies the municipality of the change in ownership and is crucial for the assessment of property taxes.

- Title Insurance Policy: This document provides insurance against financial loss from defects in title to real property and from the invalidity or unenforceability of mortgage liens. It's a way to protect both buyer and lender interests.

- Real Estate Transfer Tax Declarations: These forms are used to calculate and report the state and county transfer taxes due upon the sale of real estate. It's essential for compliance with Michigan's tax regulations.

- Mortgage Documents: If the property purchase is being financed, the buyer and lender will execute a mortgage document that outlines the terms of the loan and the property's use as security for the mortgage.

- Closing Statement: This itemized list of all the costs associated with the real estate transaction shows what each party is paying and receiving. It's critical for ensuring transparency and understanding of all expenses involved.

- Warranty Disclosures: Sellers are often required to provide certain disclosures about the property's condition and any known defects. This can include a Seller's Disclosure Statement, which provides buyers with important information about the property's condition.

- Environmental Risk Reports: In some transactions, especially commercial property deals, an environmental risk report might be necessary to identify potential environmental liabilities associated with the property.

Together, these documents serve to streamline the real estate transaction process, ensuring that all parties have a clear understanding of their rights and obligations and that the transfer of property adheres to Michigan law. Utilizing these documents alongside the Michigan deed form helps to create a transparent, efficient, and legally compliant property transfer process.

Similar forms

When understanding the intricacies of property transactions, it's essential to recognize documents that share similarities with the Michigan Deed form. One such document is the Warranty Deed. Like the Michigan Deed, a Warranty Deed is a legal instrument that transfers property ownership from one party to another. Moreover, it guarantees that the seller holds clear title to the property and has the right to sell it, mirroring the assurances provided by the Michigan Deed. This document is vital in giving the buyer peace of mind regarding the property's legal status and history.

Another document closely related to the Michigan Deed form is the Quitclaim Deed. While both serve the primary function of transferring title, the Quitclaim Deed does so without making any warranties about the property's title. This key difference distinguishes it from the Michigan Deed and the Warranty Deed. However, its similarity lies in its ability to convey ownership rights, making it a common tool in more informal transactions between family members or to clear up title issues.

The Trustee's Deed is also akin to the Michigan Deed form, used when a property held in a trust is being transferred. This document bears the trustee's signature, acting on behalf of the trust to move the property to another party. Similar to the Michigan Deed, the Trustee's Deed is an effective vehicle for transferring ownership, ensuring the property is passed along according to the trust's terms or upon the grantor's wishes, encapsulating the transaction's legality and intent.

A Land Contract is another document that shares similarities with the Michigan Deed, though it represents a unique blend of property sale and financing agreement. Under a Land Contract, the buyer makes payments to the seller over a period until the agreed-upon price is paid in full, at which point the deed is transferred. While it's a more protracted process than a direct deed transfer, the end goal of transferring ownership rights aligns closely with that of the Michigan Deed form, underscoring the broader goal of property transactions.

Finally, the Grant Deed is another document related to the Michigan Deed. Like the Michigan Deed, the Grant Deed is used to transfer title to real property from one party to another. It contains guarantees from the seller to the buyer that the property has not been sold to someone else and is free from encumbrances, except those noted within the deed itself. This alignment in purpose -- securing the transfer of ownership rights with certain protections -- links the Grant Deed closely to the operation and intent behind the Michigan Deed form.

Dos and Don'ts

When it comes to filling out a Michigan Deed form, it's crucial to approach the task with precision and care. This document has significant legal implications, affecting property rights and ownership. Below are key practices to adopt, as well as what to avoid, to ensure the process is handled correctly:

Things You Should Do:

- Review the entire form before starting to fill it out, ensuring you understand each section and what's required.

- Use black ink or type the information to ensure the document is legible and can be photocopied or scanned without issues.

- Double-check the legal description of the property to confirm it matches the description on the title. This step is crucial as it precisely identifies the property being transferred.

- Include all necessary parties in the deed. If the property is owned jointly, ensure each owner’s name is accurately listed.

- Sign the deed in the presence of a notary public. Michigan law requires deeds to be notarized to be valid.

- Keep a copy of the filled-out deed for your records before submitting it to the county clerk’s office. This will help in case there are any questions or issues.

- Confirm the recording fees and payment methods accepted by the county clerk's office to avoid delays. Each county may have different fees and acceptable payment methods.

- Consult with a real estate attorney or a title company if you have any doubts or questions about the form or the process. Professional advice can prevent costly mistakes.

Things You Shouldn't Do:

- Avoid leaving blank spaces on the form. If a section doesn’t apply, write “N/A” (not applicable) to indicate that it has been considered but is not relevant.

- Do not use guesswork for legal descriptions or names. Verify all information against official documents to ensure accuracy.

- Refrain from signing the deed without a notary public present. An unnotarized deed can create legal issues down the line.

- Avoid neglecting to specify how new owners will hold the property (e.g., joint tenancy, tenancy in common). This decision has significant legal and tax implications.

- Do not delay in submitting the completed form to the county clerk’s office. Timely recording of the deed establishes the new ownership publicly and helps prevent potential legal disputes.

- Avoid ignoring local and state tax implications tied to the property transfer. Familiarize yourself with any tax responsibilities to ensure compliance.

- Do not overlook the need for additional documentation that might be required by the state or the county for a property transfer.

- Avoid attempting to use the deed to transfer property encumbered by financial liens or disputes without addressing those issues first.

Misconceptions

In discussing the Michigan Deed form, numerous misconceptions circulate, leading to confusion and sometimes incorrect handling of real estate transactions. Correcting these misunderstandings is crucial for anyone involved in buying, selling, or transferring property in Michigan. Here are ten common misconceptions, clarified for better understanding:

Any form will work for a property deed. Michigan law requires specific language and formatting for deeds to be legally valid. Using an incorrect or generic form can invalidate the transfer.

Deeds don’t need to be recorded to be effective. While a deed may be legally binding when signed and notarized, recording it with the county register of deeds is crucial to protect against claims from third parties.

Electronic signatures are not acceptable. Michigan law allows for electronic signatures on deeds as long as they comply with state and federal electronic signature statutes.

All deeds offer the same level of protection. There are several types of deeds, including warranty, quitclaim, and covenant deeds, each offering different levels of buyer protection and guarantees about the property’s title.

Witnesses are always needed for a deed to be valid. Michigan requires deeds to be notarized, but not all deeds require witnesses. The notary may serve as a witness, but additional witnesses are not always mandated.

The person transferring the property (grantor) must deliver the deed in person for it to be valid. The physical transfer of the deed from grantor to grantee is not required; what matters legally is the intent to transfer the property and the acceptance of the deed by the grantee.

The grantee’s Social Security Number must be on the deed. Including personal identifying information, like a Social Security Number, on a publicly recorded document is unnecessary and raises identity theft risks.

A deed must detail the sale price of the property. While the consideration (value exchanged for the property) should be mentioned, the exact sale price does not always need to be specified on the deed itself.

All liens and encumbrances are removed when a new deed is recorded. Recording a new deed does not automatically eliminate existing claims or liens on the property. These must be resolved separately.

Fill-in-the-blank deeds from the internet are always accurate and legal. While available online, not all templates account for Michigan-specific requirements. Reliance on such forms without legal advice can lead to errors and invalid transfers.

Understanding these misconceptions about the Michigan Deed form can help individuals navigate property transactions more effectively, ensuring the legal transfer of ownership is executed correctly. When in doubt, consulting with a legal professional experienced in Michigan property law is the best course of action.

Key takeaways

When approaching the process of filling out and using the Michigan Deed form, individuals should keep several key points in mind to ensure the transaction is completed efficiently and accurately. These takeaways provide clarity on the steps to be followed and the importance of each detail in the deed preparation and execution process.

- Ensure all parties' names are spelled correctly and match the identification documents. Accuracy in personal details is crucial for the legal validity of the deed.

- Clearly specify the property's legal description as outlined in prior deeds or official property records. This description is essential for identifying the exact boundaries and size of the property being transferred.

- Verify which type of deed is appropriate for your situation. Michigan allows for several types of deeds, including warranty, quitclaim, and lady bird deeds, each serving different purposes and offering varying levels of protection.

- Signatures must be notarized. Michigan law requires notarization for the deed to be considered valid. This step confirms the identity of the parties and their agreement to the deed terms.

- Check for any additional forms required by local municipalities. Some areas may require extra paperwork or disclosures to be completed alongside the deed.

- Understand the tax implications. Transferring property can have tax consequences for both the giver and receiver, affecting property taxes and potential federal taxes.

- The deed must be recorded with the county recorder's office in the county where the property is located. Recording formalizes the change of ownership and is a critical step for the protection of the new owner’s rights.

- Consider consulting with a professional. Real estate transactions can be complex, and professional advice from a lawyer or real estate expert can help navigate the specifics of Michigan law and ensure all legal requirements are met.

- Ensure all involved parties have a clear understanding of the deed's contents and the transfer's implications. Communication and transparency throughout the process can prevent misunderstandings and disputes.

By adhering to these guidelines, individuals can effectively navigate the complexities of real estate transactions in Michigan, safeguarding their legal rights and ensuring a smooth property transfer process.

More Deed State Forms

What Does House Title Look Like - It often requires witness signatures, in addition to those of the buyer and seller, for added validity.

What Does a House Deed Look Like in Pa - Deed forms vary by type, such as warranty deeds, grant deeds, and quitclaim deeds, each serving different purposes.

Warranty Deed Form - Legal paperwork that is fundamental in the validation of property transfers.

Nc Deed Transfer Form - Inheritance of property often involves the execution of a new Deed form to legally document the change in ownership.