Fillable Lady Bird Deed Document for Texas

In Texas, navigating the terrain of estate planning and asset transfer can feel like maneuvering through a thick forest without a guide. Enter the Texas Lady Bird Deed form, a tool designed to simplify the process, ensuring that property is transferred smoothly and efficiently to beneficiaries after the owner's death, without the need for probate court. This unique form of deed stands out because it allows the current property owner to retain control over the property, including the right to use, sell, or mortgage it, during their lifetime. It’s a forward-thinking strategy that not only provides peace of mind to property owners but also benefits the beneficiaries by streamlining the transfer of assets, potentially saving them time, money, and the complexities often associated with the transfer of property. As an estate planning instrument, the Lady Bird Deed is recognized for its efficiency and flexibility, making it a popular choice among Texas residents looking to protect their assets and ensure their legacy is passed on according to their wishes.

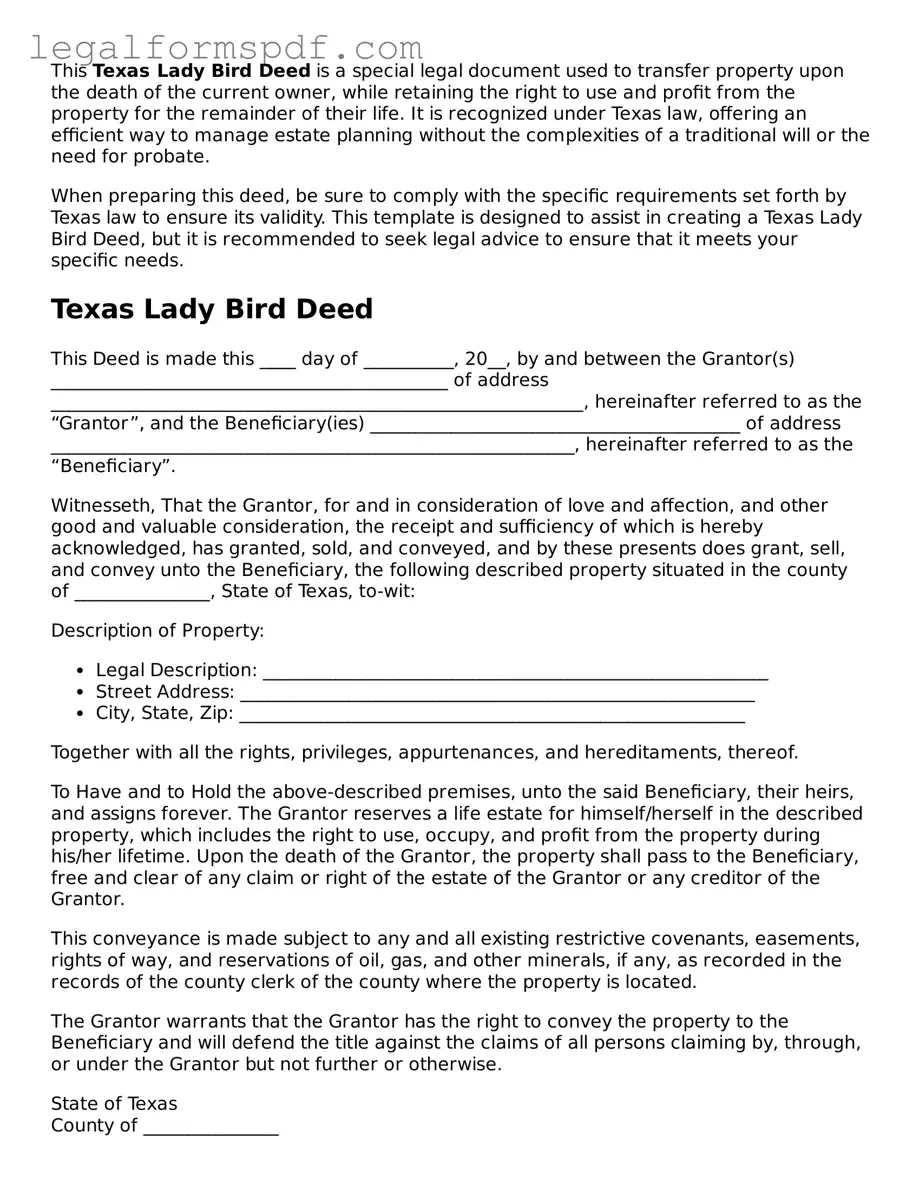

Document Example

This Texas Lady Bird Deed is a special legal document used to transfer property upon the death of the current owner, while retaining the right to use and profit from the property for the remainder of their life. It is recognized under Texas law, offering an efficient way to manage estate planning without the complexities of a traditional will or the need for probate.

When preparing this deed, be sure to comply with the specific requirements set forth by Texas law to ensure its validity. This template is designed to assist in creating a Texas Lady Bird Deed, but it is recommended to seek legal advice to ensure that it meets your specific needs.

Texas Lady Bird Deed

This Deed is made this ____ day of __________, 20__, by and between the Grantor(s) ____________________________________________ of address ___________________________________________________________, hereinafter referred to as the “Grantor”, and the Beneficiary(ies) _________________________________________ of address __________________________________________________________, hereinafter referred to as the “Beneficiary”.

Witnesseth, That the Grantor, for and in consideration of love and affection, and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, has granted, sold, and conveyed, and by these presents does grant, sell, and convey unto the Beneficiary, the following described property situated in the county of _______________, State of Texas, to-wit:

Description of Property:

- Legal Description: ________________________________________________________

- Street Address: _________________________________________________________

- City, State, Zip: ________________________________________________________

Together with all the rights, privileges, appurtenances, and hereditaments, thereof.

To Have and to Hold the above-described premises, unto the said Beneficiary, their heirs, and assigns forever. The Grantor reserves a life estate for himself/herself in the described property, which includes the right to use, occupy, and profit from the property during his/her lifetime. Upon the death of the Grantor, the property shall pass to the Beneficiary, free and clear of any claim or right of the estate of the Grantor or any creditor of the Grantor.

This conveyance is made subject to any and all existing restrictive covenants, easements, rights of way, and reservations of oil, gas, and other minerals, if any, as recorded in the records of the county clerk of the county where the property is located.

The Grantor warrants that the Grantor has the right to convey the property to the Beneficiary and will defend the title against the claims of all persons claiming by, through, or under the Grantor but not further or otherwise.

State of Texas

County of _______________

This document was acknowledged before me on __________ (date) by _______________________________ (name of Grantor).

____________________________________

(Signature of Notary Public)

Notary Public, State of Texas

My Commission Expires: __________________

Prepared by:

____________________________________

(Name)

____________________________________

(Address)

____________________________________

(Phone Number)

This template is provided as a general guide to create a Texas Lady Bird Deed. It's recommended to consult with a legal professional before finalizing the document to ensure it accurately reflects your intentions and complies with current Texas laws.

PDF Specifications

| Fact | Description |

|---|---|

| 1. Definition | A Texas Lady Bird Deed is a legal document that allows property owners to retain control over their property while alive, and upon their death, the property automatically transfers to a designated beneficiary without the need for probate. |

| 2. Official Name | The official legal term for a Lady Bird Deed in Texas is an "Enhanced Life Estate Deed." |

| 3. Governing Law | Enhanced Life Estate Deeds are governed by Texas Property Code, which provides the framework within which these deeds must operate. |

| 4. Probate Avoidance | One of the main benefits of a Lady Bird Deed is that it allows real property to pass to beneficiaries without going through the probate process. |

| 5. Retained Rights | Property owners retain the right to use, sell, or mortgage the property during their lifetime without consent from the beneficiary. |

| 6. Medicaid Benefits | Utilizing a Lady Bird Deed can potentially prevent the property from being counted as an asset for Medicaid eligibility purposes, under current Texas Medicaid eligibility criteria. |

| 7. Flexibility | The deed provides flexibility, as the grantor can change the beneficiary or revoke the deed without needing the beneficiary's permission. |

| 8. Tax Implications | The transfer of property through a Lady Bird Deed is generally not considered a taxable event, and beneficiaries may receive a step-up in basis upon the death of the grantor. |

| 9. Not Universally Recognized | The Lady Bird Deed is a legal instrument specific to certain states, including Texas, and may not be recognized or applicable in jurisdictions outside of those states. |

Instructions on Writing Texas Lady Bird Deed

Filling out a Texas Lady Bird Deed requires attention to detail and an understanding of the property you wish to transfer. This specific kind of deed allows the owner to retain control over the property during their lifetime and automatically transfer it upon their death without passing through probate. The process does not have to be daunting. By following the outlined steps, you can ensure the document is completed accurately and serves its intended purpose. It's important to approach this task with clear information about the property and the future beneficiary.

- Start by identifying the preparer of the deed. This is typically the individual completing the form or an attorney who is assisting with the property transfer.

- Include the full legal name and mailing address of the preparer at the top of the document to ensure proper future correspondence.

- Next, specify the current property owner's (grantor's) full legal name and their complete mailing address.

- Identify the county where the property is located, as the deed must be recorded in this specific county to be legally effective.

- Provide a comprehensive legal description of the property. This usually includes lot numbers, subdivision names, and any other details that define the property's legal boundaries. For accuracy, refer to previous property deeds or county records.

- List the full legal name(s) of the beneficiary or beneficiaries (grantee) who will receive the property upon the grantor's death. Also, include their complete mailing addresses.

- Clarify the type of ownership rights the beneficiaries will have. If there are multiple beneficiaries, decide whether they will own the property equally as joint tenants or in individual shares as tenants in common.

- The grantor must sign the deed in front of a notary public to affirm their intention to transfer the property after death, retaining life estate for themselves. The date of signing should be accurately recorded.

- Have the signed deed notarized to authenticate the identities of the parties involved and validate the document.

- Finally, file the completed and notarized deed with the county clerk's office in the county where the property is located. There may be a filing fee, which varies by county.

By carefully following these steps, you can effectively complete a Texas Lady Bird Deed, facilitating the future transfer of your property according to your wishes. While the process is straightforward, consider consulting with a legal professional if you encounter ambiguity or require advice specific to your situation. Correctly executed, this deed can be a powerful tool in estate planning, ultimately ensuring that your property is passed on smoothly and without unnecessary legal complication.

Understanding Texas Lady Bird Deed

What is a Texas Lady Bird Deed?

A Texas Lady Bird Deed is a legal document that allows property owners to retain control over their property during their lifetime and automatically transfer it to a designated beneficiary when they pass away without the need for the property to go through probate. This type of deed offers a simple way for property owners to ensure their property is passed on to their heirs directly.

How does a Lady Bird Deed differ from a traditional life estate deed?

A traditional life estate deed and a Lady Bird Deed both allow property owners to transfer property upon their death without probate. However, a Lady Bird Deed provides the original property owner more flexibility by permitting them to retain control over the property during their lifetime, including the ability to sell or mortgage the property without the beneficiary's consent. Traditional life estate deeds do not typically allow for such control.

Who can use a Lady Bird Deed in Texas?

Any property owner in Texas looking to transfer real estate upon their death without the hassle of probate can use a Lady Bird Deed. It is particularly beneficial for those seeking to ensure a straightforward transfer of their property to a beneficiary, while still retaining the right to use, sell, or mortgage the property in their lifetime. This makes it a valuable estate planning tool for homeowners of all ages and health statuses.

What are the benefits of using a Lady Bird Deed?

The benefits of using a Lady Bird Deed include avoiding the time-consuming and potentially costly probate process, minimizing estate taxes, and preserving the owner's eligibility for certain government benefits, such as Medicaid. Additionally, it offers the peace of mind of knowing that the property will directly pass to the intended beneficiary while allowing the property owner to maintain full control over the property during their lifetime.

Are there any limitations or risks associated with a Lady Bird Deed?

While a Lady Bird Deed offers numerous benefits, there are some limitations and risks. For instance, because the deed allows the property owner to change their mind and sell the property, the beneficiary has no guaranteed interest in the property until the owner's death. It is also essential to properly execute and record the deed according to Texas law to ensure its validity. Consulting with a knowledgeable attorney can help mitigate these risks.

How does one create a Lady Bird Deed in Texas?

Creating a Lady Bird Deed in Texas involves drafting a deed that includes specific language stating that the property is to be retained by the grantor for their lifetime with the remaining interest to pass to the named beneficiary upon the grantor's death. This document must be signed, notarized, and recorded in the county where the property is located. Given the legal nuances involved, it's strongly recommended to seek legal assistance to ensure the deed complies with Texas law and accurately reflects the property owner's wishes.

Common mistakes

One common mistake when people fill out the Texas Lady Bird Deed form is not properly identifying the property. The legal description of the property must be precise, as a general address is not enough. This description often includes lot numbers, subdivision names, and any other details that distinguish the property legally. If this information is not accurately included, it can lead to disputes over the property's identity in the future or could even render the deed invalid.

Another error involves not clearly naming the beneficiaries. It's crucial to specify who will receive the property upon the death of the current owner. Many people mistakenly believe a verbal agreement or a simple reference, such as "my children," is sufficient. Without clear, specific names, the deed may not effectively transfer the property, leading to potential legal battles among possible heirs.

Forgetting to sign and notarize the deed is a surprisingly common oversight. For a Lady Bird Deed to be legally binding in Texas, it must be signed by the property owner and notarized. This formalizes the document, making it a legitimate part of the public record. Failing to complete these steps can mean the deed has no legal effect, leaving the property to pass through probate instead.

Many individuals also mistake the effect of a Lady Bird Deed on their Medicaid eligibility. While it's true that this type of deed can help protect assets from being counted for Medicaid eligibility, it does not guarantee eligibility. The property could still be subject to estate recovery by the state of Texas to cover the cost of Medicaid benefits. People often miss consulting with a legal expert to understand these implications fully.

Another frequent mistake is not considering the impact of existing debts or liens on the property. A Lady Bird Deed transfers property upon death but does not necessarily clear the property of debts or liens. If there are outstanding obligations, they can complicate the beneficiary's ability to take clear ownership. It's essential to disclose and address these matters upfront.

Last but not least, many individuals fail to keep the deed updated. Life changes such as marriage, divorce, or the death of a named beneficiary can alter one's wishes for property distribution. If updates to the Lady Bird Deed are not made to reflect these life events, the property may not transfer as intended upon the owner's death. Regularly reviewing and amending the deed as necessary can prevent such issues.

Documents used along the form

In estate planning, the Texas Lady Bird Deed form is a vital tool for transferring property upon the death of the owner, without the necessity of going through probate. This unique instrument allows the property owner to retain control over the property during their lifetime, including the right to sell or mortgage. Yet, to ensure a comprehensive estate plan, several other forms and documents might be used in conjunction with a Lady Bird Deed. Each serves its specific purpose, contributing to a more complete and effective estate planning strategy.

- Warranty Deed - A Warranty Deed is used to guarantee that the grantor (the person transferring the property) holds clear title to a piece of real estate and has a right to sell it. This document is crucial for confirming the legal status of the property before it can be transferred using a Lady Bird Deed or any other transfer deed.

- Durable Power of Attorney - This legal document allows an individual (the principal) to appoint another person (the agent) to make decisions on their behalf, including financial and real estate transactions, should they become incapacitated. A Durable Power of Attorney is essential for managing the principal's affairs without court interference, complementing the objectives of a Lady Bird Deed.

- Medical Power of Attorney - Similar to a Durable Power of Attorney but specifically focused on healthcare decisions, a Medical Power of Attorney designates someone to make medical decisions for the principal if they are unable to do so themselves. Integrating healthcare decisions into estate planning ensures that all aspects of a person's well-being are considered.

- Living Will - Also known as an advance directive, a Living Will outlines the types of medical care a person wishes to receive or not receive if they become incapacitated and incapable of communicating their desires. While not directly related to property transfer, it is a crucial component of thorough estate planning, ensuring that an individual's health care preferences are honored.

Taken together, these documents can create a solid foundation for any estate plan, ensuring that both health care preferences and property matters are addressed. By employing a Lady Bird Deed alongside these documents, individuals can ensure a smoother transition of their assets while also maintaining control over their property during their lifetime. Each document plays a critical role in comprehensive estate planning, providing peace of mind for both the property owner and their heirs.

Similar forms

The Lady Bird Deed, a unique estate planning tool used in Texas and a few other states, shares similarities with several other legal documents, each designed to manage and transfer property or assets under specific conditions. One such document is the Revocable Living Trust. A Revocable Living Trust allows someone to place their assets within the trust during their lifetime, with the freedom to amend or revoke the trust as they see fit. Upon the death of the trust's creator, assets are transferred to designated beneficiaries without the need for probate, similar to the immediate transfer of property through a Lady Bird Deed.

Another document akin to the Lady Bird Deed is the Transfer on Death Deed (TODD). This non-probate mechanism allows property owners to name beneficiaries who will inherit their property upon the owner's death, bypassing the probate process. This feature mirrors the Lady Bird Deed's ability to designate a remainder beneficiary to inherit property directly, avoiding probate and ensuring a smoother transition of assets.

The Enhanced Life Estate Deed, often what the Lady Bird Deed is formally called, is nearly identical in nature but not always recognized under the same name across states. This deed permits the current property owner to retain control over the property until death, including the right to sell or mortgage, and then automatically transfers ownership to a predetermined beneficiary. This mirrors the key characteristic of the Lady Bird Deed, emphasizing control during the owner’s life and a straightforward transfer after death.

A Joint Tenancy Agreement shares the principle of avoiding probate with the Lady Bird Deed. In a Joint Tenancy, two or more individuals hold property with rights of survivorship, meaning that upon the death of one tenant, the property automatically passes to the surviving tenant(s), circumventing the probate process. This method similarly facilitates the seamless transition of property ownership, though it lacks the unilateral control provided by a Lady Bird Deed.

The Durable Power of Attorney for Property is a legal document that permits an individual to appoint another person to manage their property and financial affairs, potentially including the sale or transfer of property. While it operates differently from a Lady Bird Deed — which doesn't involve managing affairs before death — it similarly aims to ensure that property matters are handled according to the owner’s wishes, especially in scenarios where they are unable to make decisions themselves.

A Beneficiary Deed, used in some states, permits property owners to retain full control over their property while alive — including the right to sell or encumber the property — and designates beneficiaries to automatically receive the property upon the owner's death, much like the Lady Bird Deed. It's another probate-avoidance instrument, ensuring property is transferred swiftly and directly to the designated heirs or beneficiaries, without the need for probate court proceedings.

Finally, the Simple Will, a fundamental estate planning document, allows individuals to specify how their assets will be distributed upon their death, including the designation of heirs and the executor of the estate. While a Simple Will does not avoid probate and differs fundamentally from the Lady Bird Deed's operation and purpose, it serves the similar crucial role of indicating the property owner's intentions for the distribution of their assets, guiding the probate court in distributing assets according to the wishes of the deceased.

Dos and Don'ts

Completing a Lady Bird Deed in Texas involves certain best practices to ensure its legality and effectiveness. Below are recommended dos and don'ts to consider:

Do's:

Ensure all personal information is accurate and matches the details in your other estate planning documents. This includes full legal names, addresses, and descriptions of the property.

Have the deed reviewed by a legal professional familiar with Texas property and estate planning laws to confirm it meets all legal requirements and your estate planning goals.

Clearly define the retained life estate and the remainder interest. Specify the rights the life tenant retains over the property during their lifetime.

Sign the deed in the presence of a notary public to validate your identity and your intention in executing the document.

Record the deed with the county clerk's office in the county where the property is located to make it legally effective and to provide public notice of the intended future transfer of property.

Don'ts:

Don't neglect to consider how the Lady Bird Deed fits into your broader estate plan, especially concerning beneficiaries, taxes, and Medicaid planning.

Don't use generic or outdated templates. Texas law evolves, and using an incorrect form can invalidate your deed or create unintended legal consequences.

Don't forget to specify the conditions under which the transfer of the remainder interest becomes effective, typically upon the death of the life tenant.

Don't fail to consult with an estate planning attorney if you have a complex estate or if you're unsure about any part of the process.

Don't omit any legally required elements from the deed, such as the legal description of the property, or fail to follow state-specific signing and witnessing requirements.

Misconceptions

When planning for the future, many Texans consider using a Lady Bird Deed to handle property affairs. However, several misconceptions persist about this legal document. Understanding these can help individuals make informed decisions regarding their estate planning.

- It’s a one-size-fits-all solution: Not every property or estate situation benefits from a Lady Bird Deed. It's essential to assess individual needs and circumstances with a professional before proceeding.

- It avoids probate completely: While a Lady Bird Deed can help avoid probate for the specific property mentioned in the deed, it doesn’t eliminate the need for probate for other assets not covered by this or other similar mechanisms.

- It’s recognized in all states: The Lady Bird Deed is not recognized in every state. Its acceptance and use are specific to Texas and a few other states.

- It provides full protection from creditors: Although it offers some level of protection, a Lady Bird Deed does not completely shield the property from all creditors, especially those with claims that arose before the deed's execution.

- It's complicated and expensive to create: Contrary to this belief, creating a Lady Bird Deed is relatively straightforward and cost-effective, especially when compared to the potential legal fees and processes involved in probate or other estate planning tools.

- It replaces a will: A Lady Bird Deed is not a substitute for a will. While it can be part of a comprehensive estate plan, other assets and considerations should be addressed in a separate will.

- Only the elderly should consider it: Property owners of any age looking to streamline the process of transferring real estate upon their death might find a Lady Bird Deed beneficial, not just older adults.

- It can’t be revoked: One of the unique features of a Lady Bird Deed is that it can indeed be revoked by the property owner, offering flexibility not available in many other types of deed transfers.

Understanding these misconceptions and seeking professional advice can lead to more effective estate planning strategies. Whether considering a Lady Bird Deed or other estate planning tools, it's crucial to examine all options to determine the best fit for one's specific needs and goals.

Key takeaways

A Texas Lady Bird Deed can be a powerful tool in estate planning, helping to streamline the process of transferring property upon the death of the owner. This form of deed allows homeowners to retain control over their property during their lifetime, including the rights to sell or make changes, while automatically transferring the property to a designated beneficiary when they pass away. Below are key takeaways about the Texas Lady Bird Deed to consider:

- Retain ownership and control: One of the most significant benefits of a Lady Bird Deed is that it allows the current property owner to maintain full control over the property until their death. This means they can sell, lease, or mortgage the property without needing approval from the future beneficiary.

- Avoid probate process: Properties transferred via a Lady Bird Deed bypass the probate process, which can be lengthy and costly. This way, the property goes directly to the beneficiaries, allowing for a smoother and faster transition.

- Flexibility: The terms of a Lady Bird Deed can be changed at any time during the owner's lifetime. This allows the property owner to adjust the beneficiaries as their wishes or circumstances change without going through a complicated process.

- Potentially reduce estate taxes: By avoiding probate and expediting the transfer of property, the estate may also see reduced estate taxes. However, it’s important to consult with a legal or tax professional to understand the specific implications.

- Simple to execute: Compared to other estate planning tools, a Lady Bird Deed is relatively straightforward to execute. However, it must be drafted correctly to ensure that it meets all legal requirements and accurately reflects the owner's intentions.

It is crucial for property owners to consult with an experienced attorney when considering a Lady Bird Deed. This ensures that the deed is correctly executed and fits within the broader context of their estate plan. Making informed decisions in estate planning can provide peace of mind and safeguard a family's future.

More Lady Bird Deed State Forms

What States Allow Lady Bird Deeds - This deed choice highlights a proactive step towards securing a family's financial future and preserving the integrity of one's estate planning endeavors.

How to Get a Lady Bird Deed in Florida - A Lady Bird Deed is a legal document that allows property to be transferred upon the owner's death without going through probate.

Disadvantage of a Lady Bird Deed Michigan - With this deed, the original owner retains the flexibility to make changes, including revoking the deed or changing the beneficiary without their consent.