Fillable Lady Bird Deed Document for North Carolina

In the realm of estate planning, the North Carolina Lady Bird Deed stands out as a unique and powerful tool for homeowners. This form allows property owners to retain control over their real estate during their lifetime while ensuring that upon their passing, the property seamlessly transfers to a designated beneficiary without the need for probate. Given its ability to bypass the often lengthy and costly probate process, it's gaining popularity among property owners looking for a straightforward method to manage their estate. The deed is named after Lady Bird Johnson, though she wasn't directly associated with its creation; it's a moniker that adds a touch of history and curiosity to its function. While it offers several advantages, including the preservation of eligibility for certain government benefits for the grantor, it's important for individuals to consult with legal professionals to understand its implications fully and to ensure it aligns with their overall estate planning goals. Understanding the major aspects and potential impacts of the North Carolina Lady Bird Deed is crucial for anyone considering this estate planning strategy.

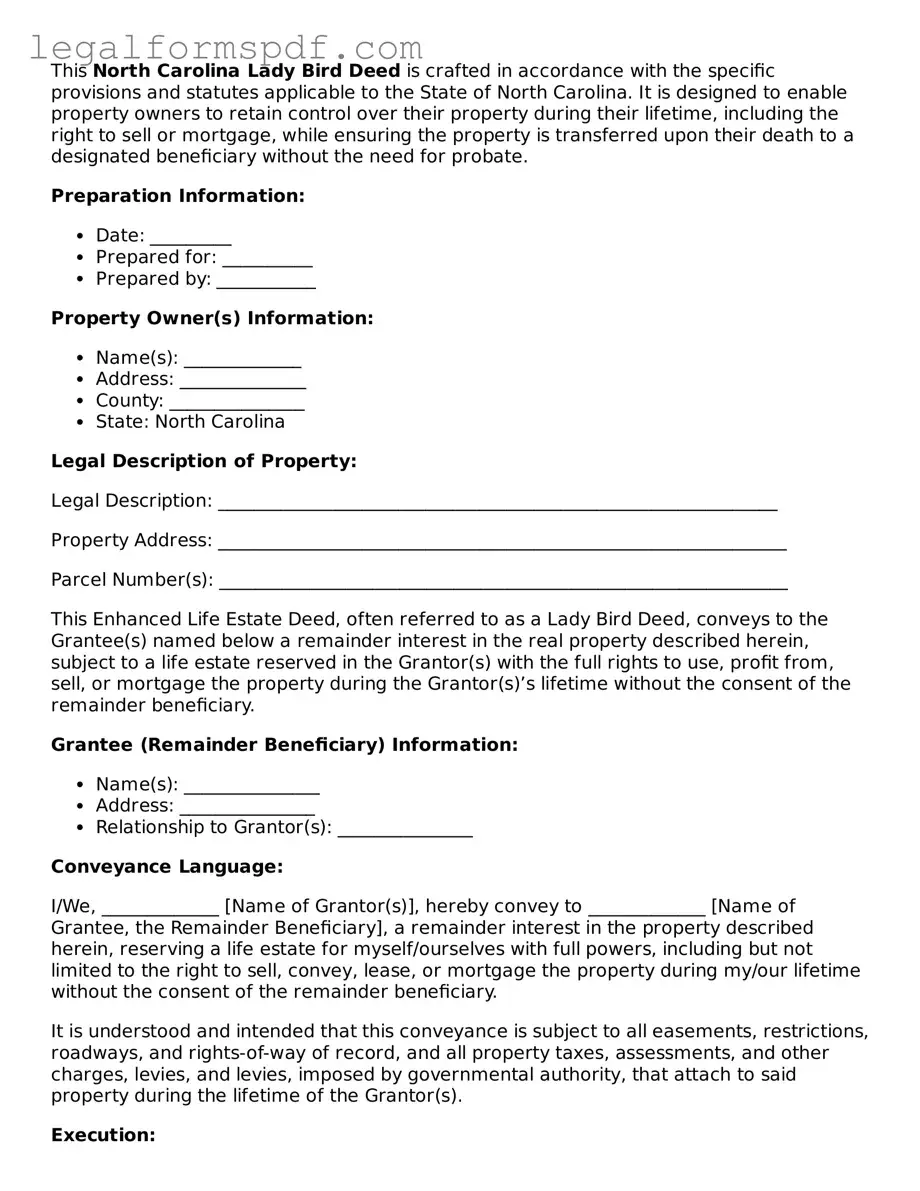

Document Example

This North Carolina Lady Bird Deed is crafted in accordance with the specific provisions and statutes applicable to the State of North Carolina. It is designed to enable property owners to retain control over their property during their lifetime, including the right to sell or mortgage, while ensuring the property is transferred upon their death to a designated beneficiary without the need for probate.

Preparation Information:

- Date: _________

- Prepared for: __________

- Prepared by: ___________

Property Owner(s) Information:

- Name(s): _____________

- Address: ______________

- County: _______________

- State: North Carolina

Legal Description of Property:

Legal Description: ______________________________________________________________

Property Address: _______________________________________________________________

Parcel Number(s): _______________________________________________________________

This Enhanced Life Estate Deed, often referred to as a Lady Bird Deed, conveys to the Grantee(s) named below a remainder interest in the real property described herein, subject to a life estate reserved in the Grantor(s) with the full rights to use, profit from, sell, or mortgage the property during the Grantor(s)’s lifetime without the consent of the remainder beneficiary.

Grantee (Remainder Beneficiary) Information:

- Name(s): _______________

- Address: _______________

- Relationship to Grantor(s): _______________

Conveyance Language:

I/We, _____________ [Name of Grantor(s)], hereby convey to _____________ [Name of Grantee, the Remainder Beneficiary], a remainder interest in the property described herein, reserving a life estate for myself/ourselves with full powers, including but not limited to the right to sell, convey, lease, or mortgage the property during my/our lifetime without the consent of the remainder beneficiary.

It is understood and intended that this conveyance is subject to all easements, restrictions, roadways, and rights-of-way of record, and all property taxes, assessments, and other charges, levies, and levies, imposed by governmental authority, that attach to said property during the lifetime of the Grantor(s).

Execution:

This deed is executed this ______ day of _______________, 20___.

_________________ [Signature of Grantor(s)]

_________________ [Printed Name of Grantor(s)]

State of North Carolina

County of ________________

This document was acknowledged before me on ___[date]___ by ___________ [name(s) of Grantor(s)].

_________________ [Signature of Notary Public]

_________________ [Printed Name of Notary Public]

My Commission Expires: ___________

Instructions for Recording:

This document must be filed with the Register of Deeds in the county where the property is located. A North Carolina excise tax may not apply to this transfer if no consideration is given other than the retention of a life estate. However, consult with a legal advisor to ensure compliance with all local and state filing requirements and tax implications.

PDF Specifications

| Fact | Description |

|---|---|

| Definition | A Lady Bird Deed, also known as an enhanced life estate deed, allows property owners in North Carolina to retain control over their property during their lifetime, including the ability to sell or mortgage, and automatically transfer it to a designated beneficiary upon their death without going through probate. |

| Governing Law | North Carolina has not codified Lady Bird Deeds into state law explicitly. However, the state recognizes the validity of these deeds under its broader property and probate laws. |

| Probate Avoidance | One of the primary benefits of a Lady Bird Deed is that it allows real property to bypass the probate process, streamlining the transfer to beneficiaries upon the death of the property owner. |

| Control During Lifetime | The property owner maintains complete control over the property during their lifetime. This includes the ability to sell or refinance the property without needing approval from the future beneficiaries. |

| Medicaid Eligibility | Under certain conditions, property transferred via a Lady Bird Deed in North Carolina may not be counted as an asset for Medicaid eligibility purposes, potentially preserving more of the estate for inheritance. |

| Flexibility | Lady Bird Deeds offer flexibility that traditional life estate deeds do not, as the grantor can change the beneficiary or revoke the deed without the beneficiary's consent. |

| Protection Against Beneficiary's Creditors | Since the beneficiary does not have a legal interest in the property until the original owner's death, the property is generally protected from the beneficiary’s creditors during the owner's lifetime. |

| Cost-Effectiveness | Creating and recording a Lady Bird Deed in North Carolina is typically less expensive than establishing a revocable living trust for the purpose of avoiding probate. |

| Ease of Implementation | Lady Bird Deeds can be simpler and quicker to implement than other estate planning tools, requiring only that the deed be properly drafted, signed, and recorded in the county where the property is located. |

| Not Universally Available | While recognized in North Carolina, Lady Bird Deeds are not available or recognized in all states, limiting their use to property within states that recognize this type of deed. |

Instructions on Writing North Carolina Lady Bird Deed

In the state of North Carolina, a Lady Bird deed provides a unique way to manage property transfer upon the death of the property owner, without the need for probate. This legal instrument allows the owner to retain control over the property during their lifetime, including the right to use, sell, or mortgage the property, and automatically transfers ownership to a predetermined beneficiary when the owner passes away. Following the correct steps to fill out this form is crucial to ensure the deed is legally binding and effective. Here's a detailed guide to help you through the process:

- Identify the current property owner(s) as the grantor(s). Write their full legal names and addresses at the beginning of the deed.

- Specify the grantee beneficiary(ies). These are the individuals or entities that will receive the property upon the death of the current owner. Include their full legal names and addresses.

- Provide a detailed legal description of the property. This should match the description used in the current deed of the property. It often includes property boundaries, lot numbers, and any other identifiers used in public records.

- Include a statement that reserves a life estate for the grantor. This is what allows the current owner to retain control over the property during their lifetime. The language should clearly state that the grantor keeps the right to use, sell, or mortgage the property while alive.

- State clearly that upon the death of the grantor, the property shall pass automatically to the named grantee(s). Ensure the language used reflects that the transfer is intended to occur without the need for probate proceedings.

- Have the grantor(s) sign the deed in the presence of a notary public. The notary must acknowledge the signing with their own signature and seal to make the deed legally valid.

- Record the deed at the local county recorder’s office. The requirements and fees for recording can vary, so it's important to check with the specific office where the property is located. Recording the deed ensures that it becomes a part of the public record and effectively transfers the property rights as intended.

Once the deed is correctly filled out and recorded, the property transfer mechanism you've set in place with a Lady Bird deed becomes operative upon the death of the current owner, without the need for a probate process. This not only simplifies the transfer of property but also ensures that your wishes are carried out smoothly and efficiently. It is important to consult with a legal professional to ensure that all aspects of the deed comply with North Carolina law and accurately reflect your intentions.

Understanding North Carolina Lady Bird Deed

What is a Lady Bird Deed in North Carolina?

A Lady Bird Deed, also known as an enhanced life estate deed, is a legal document used in North Carolina to transfer property upon the death of the original owner without the need for probate. It allows the owner to retain full control over the property during their lifetime, including the ability to sell or modify the property, but automatically transfers ownership to a named beneficiary when the owner passes away.

How does a Lady Bird Deed differ from a traditional life estate deed?

Unlike traditional life estate deeds, where the life tenant's rights to sell or mortgage the property are limited, a Lady Bird Deed gives the original owner more flexibility. The owner retains the right to sell, lease, or mortgage the property without the consent of the remainder beneficiaries. This type of deed effectively bypasses the probate process for the property specified in the deed, thereby facilitating a smoother transition of ownership.

What are the benefits of using a Lady Bird Deed?

The primary benefits of a Lady Bird Deed include avoiding probate, maintaining control over the property during the owner’s lifetime, and potentially protecting the property from certain creditor claims against the estate. It also allows for a straightforward transfer of property, can help in Medicaid planning, and may provide some tax advantages in terms of capital gains for the beneficiaries.

Are there any downsides to executing a Lady Bird Deed?

While Lady Bird Deeds offer several advantages, there are considerations to keep in mind. These include the potential of inadvertently affecting eligibility for Medicaid if not properly planned, the need to ensure the deed is correctly drafted to avoid unwanted legal challenges, and the fact that not all states recognize Lady Bird Deeds, which could complicate interstate property matters.

Who should consider using a Lady Bird Deed?

Individuals who own property in North Carolina and wish to ensure a smooth and efficient transfer of their real estate upon their death should consider using a Lady Bird Deed. It is particularly beneficial for those looking to avoid probate, minimize estate taxes, and protect their property from possible creditors’ claims against their estate.

How is a Lady Bird Deed created?

A Lady Bird Deed is created by preparing and signing a legal document that specifies the current owner retains possession and control of the property until their death, at which point the property automatically transfers to the designated beneficiary. It’s crucial that this document is drafted accurately to include all necessary legal requirements and then recorded with the appropriate county registrar in North Carolina where the property is located.

Can a Lady Bird Deed be revoked or changed?

Yes, a significant advantage of a Lady Bird Deed is the owner’s ability to revoke or change the deed without needing consent from the beneficiary. This can be done by executing and recording a new deed that either revokes the prior one or conveys the property to a different beneficiary, providing immense flexibility to the property owner.

Does a Lady Bird Deed protect against creditors?

While a Lady Bird Deed can offer some level of protection against claims by the estate's creditors, it does not completely shield the property. Since the original owner retains control over the property during their lifetime, it may be subject to claims by the owner’s creditors. However, once the property passes to the beneficiary upon the owner’s death, it generally is not part of the probate estate and thus is less accessible to estate creditors.

What happens if the beneficiary predeceases the property owner?

If the beneficiary designated in a Lady Bird Deed dies before the property owner, the property would revert to the owner's estate unless a contingent beneficiary is named in the deed. In such cases, owners may want to consider updating their Lady Bird Deed to designate a new beneficiary to ensure their property is distributed according to their wishes without undergoing probate.

Common mistakes

In North Carolina, a common error people make when filling out a Lady Bird Deed form is not accurately describing the property. This deed requires a precise legal description of the property, including the boundary lines and any pertinent identifiers that are usually found in the property’s original deed or a current property survey. Without this precise description, the deed could be considered invalid, which may lead to complications in transferring the property upon the death of the owner.

Another frequent mistake is failing to correctly identify the remainder beneficiaries. These are the individuals or entities designated to receive the property after the death of the current owner. Oftentimes, people might list the beneficiaries but not provide adequate identifying information, such as their full legal names or their relationship to the owner. This lack of detail can lead to confusion and potential legal disputes among those who might inherit the property.

Additionally, many individuals forget to have the deed notarized. In North Carolina, for a Lady Bird Deed to be valid, it must be signed by the owner in the presence of a notary public. The notary must then certify the deed with their seal for it to be legally binding. If this step is overlooked, the deed might not be recognized as valid, which could prevent the property from bypassing probate, negating one of the primary benefits of a Lady Bird Deed.

Lastly, a common oversight is not recording the deed with the county register of deeds. After the deed has been properly completed and notarized, it must be filed with the register of deeds in the county where the property is located. Failure to do so can result in the deed not being recognized as legal, as North Carolina property law prioritizes recorded documents. This step ensures that the transfer of property rights is publicly documented and recognized, safeguarding the future transfer to the remainder beneficiaries as intended.

Documents used along the form

When preparing a North Carolina Lady Bird Deed, an effective estate plan often requires additional documents to fully protect and manage your assets. Each form serves a unique purpose, ensuring your wishes are honored and your estate is handled efficiently. Below is a list of documents often used in conjunction with a Lady Bird Deed:

- Will: A legal document that outlines how you want your assets to be distributed after your death. It names an executor who will manage the distribution of your assets.

- Durable Power of Attorney: This grants someone you trust the authority to handle your financial affairs if you become incapacitated. It's essential for managing your estate while you're alive but unable to act on your own behalf.

- Health Care Power of Attorney: Similar to a Durable Power of Attorney, this document designates someone to make health care decisions for you if you're unable to make them yourself, ensuring your health care wishes are followed.

- Living Will: Also known as an advance directive, it outlines your wishes for medical treatment if you become terminally ill or permanently unconscious and cannot communicate your healthcare preferences.

- Declaration of Desire for a Natural Death: Commonly used alongside a Living Will, this document allows you to declare your wish to withhold or withdraw life-prolonging measures in certain situations.

- Revocable Living Trust: This helps manage and protect your assets while you're alive and distribute them after your death, without the need for probate. You can change or revoke this type of trust any time before your death.

- Beneficiary Designation Forms: These forms allow you to name beneficiaries for specific assets, such as retirement accounts and life insurance policies, bypassing the probate process.

- Real Estate Deeds: In addition to a Lady Bird Deed, other types of real estate deeds, such as warranty deeds or quitclaim deeds, may be needed to handle different property transactions or to clear titles.

- Personal Property Memorandum: Often attached to a will, this document allows you to specify who will receive certain personal property items that may not be covered in the main body of your will.

Combining a North Carolina Lady Bird Deed with these documents can provide a comprehensive estate plan tailored to your specific needs. It ensures not only the smooth transition of your real estate but also the efficient management of your entire estate, giving you peace of mind about the future of your assets and your loved ones' well-being.

Similar forms

A Lady Bird Deed, a unique estate planning tool used in some states, shares certain similarities with other property transfer documents, yet distinguishes itself by allowing property owners to retain control over their property during their lifetime. Let's delve into six documents that share some commonalities with the Lady Bird Deed, understanding their nuances and comparisons.

1. Standard Warranty Deed: Much like a Lady Bird Deed, a Standard Warranty Deed is used to transfer property ownership. However, the Standard Warranty Deed offers a guarantee that the property is free from any liens or encumbrances, a promise not inherent in Lady Bird Deeds. Both serve the fundamental purpose of transferring property rights, but a Lady Bird Deed uniquely allows the original owner to maintain control over the property until their passing.

2. Quitclaim Deed: Quitclaim Deeds, similar to Lady Bird Deeds, are often used to transfer property between family members or into a trust. Although both documents facilitate property transfer without the need for a traditional sale, Quitclaim Deeds do not guarantee clear title to the property. This is a key difference; while the Lady Bird Deed allows the grantor to retain life interest and ensure direct transfer upon death, Quitclaim Deeds typically do not involve any guarantees on the title or ownership rights after transfer.

3. Life Estate Deed: Life Estate Deeds are very similar to Lady Bird Deeds in that they allow the property owner (grantor) to reserve the right to use and live on the property until death. The crucial difference lies in the control over the property; unlike a Lady Bird Deed that permits the grantor to sell, finance, or change the beneficiary designation at any time without consent from the remainderman, a traditional Life Estate Deed restricts the grantor’s ability to make such changes without the agreement of the future owner.

4. Revocable Living Trust: Revocable Living Trusts and Lady Bird Deeds share the common objective of avoiding probate upon the death of the property owner. Both instruments allow for the direct transfer of assets to the designated beneficiaries. However, a Revocable Living Trust is more comprehensive, covering the management of an individual's entire estate, not just a single piece of property. While Lady Bird Deeds focus solely on real estate, Revocable Living Trusts can include various assets, offering a broader estate planning solution.

5. Transfer on Death Deed (TODD): Similar to a Lady Bird Deed, a Transfer on Death Deed allows property owners to name beneficiaries who will receive the property upon their death, bypassing the probate process. Both deeds ensure a swift transfer of ownership after death. The main difference lies in the control retained over the property; with a TODD, the owner cannot revoke the deed or change the beneficiary without executing a new deed, whereas a Lady Bird Deed provides more flexibility to the owner to make changes without such formalities.

6. Joint Tenancy with Right of Survivorship: This method of co-owning property allows the property to pass directly to the surviving owner(s) upon the death of one owner, akin to the immediate transfer feature of the Lady Bird Deed. However, Joint Tenancy with Right of Survivorship necessitates that all owners hold an equal share of the property and that they acquire their interest at the same time. While it offers a way to avoid probate, it doesn't provide the singular owner the same level of control and flexibility over decisions regarding the property as a Lady Bird Deed does.

Dos and Don'ts

When filling out the North Carolina Lady Bird Deed form, it is essential to approach the task with care and attention to detail. Below are key dos and don'ts to guide you through the process:

Do:Ensure all parties involved are clearly identified with their full legal names to prevent any ambiguity about the property's future ownership.

Accurately describe the property in detail, including its legal description as found on the deed or tax records, to avoid any potential disputes over what property is being transferred.

Consult with a legal professional who has experience with real estate transactions in North Carolina to ensure that the deed complies with state laws and meets all required legal standards.

Have the deed notarized by a certified notary public after all parties have signed it to validate the document's authenticity.

Rely solely on generic forms or online templates without verifying their compliance with North Carolina's specific legal requirements.

Forget to file the completed and notarized deed with the local county recorder's office, as failure to do so could invalidate the transfer or create complications in the property's title.

Overlook the need to discuss the potential tax implications of transferring property using a Lady Bird Deed with a tax professional.

Ignore the importance of clearly specifying the conditions under which the property will transfer to the remainder beneficiaries to prevent any future misunderstandings or legal challenges.

Misconceptions

In North Carolina, the Lady Bird Deed is a legal document that has been the subject of many misunderstandings. This document is designed to pass property to beneficiaries without going through probate. Despite its benefits, misconceptions have arisen. Below is a list of seven commonly held misunderstandings about the North Carolina Lady Bird Deed form:

- All property types can be transferred with a Lady Bird Deed. It's a common belief, but incorrect. In reality, the Lady Bird Deed in North Carolina is primarily used for real estate. Personal property, such as vehicles and furnishings, cannot be transferred using this document.

- The Lady Bird Deed provides asset protection from creditors. This is not entirely accurate. While it is true that the deed allows the property owner to retain control and ownership until death, creditors could potentially make claims against the estate for debts owed by the deceased.

- Creating a Lady Bird Deed is a simple DIY project. While templates exist, drafting a Lady Bird Deed that accurately reflects one's intentions and complies with North Carolina law can be complex. Professional legal advice is often necessary to ensure the deed's effectiveness and legality.

- Lady Bird Deeds are recognized in all states. This is incorrect. Lady Bird Deeds are not recognized in every state, and their acceptance varies. Within the United States, only a few states acknowledge the use of Lady Bird Deeds, and their rules can differ significantly.

- Using a Lady Bird Deed will automatically disqualify you from Medicaid. This statement is misleading. While transfer of ownership rights can impact Medicaid eligibility, a Lady Bird Deed is designed in such a manner that it should not automatically disqualify the grantor from receiving Medicaid benefits. However, specific circumstances may vary, so consulting with a professional is advisable.

- Taxes are avoided entirely with a Lady Bird Deed. While it's true that a Lady Bird Deed can help avoid some forms of taxation, it does not provide a blanket exemption from all taxes. For instance, property transferred through a Lady Bird Deed may still be subject to federal estate taxes if the estate exceeds the federal estate tax exemption limit.

- Once signed, a Lady Bird Deed cannot be revoked. Many people think that a Lady Bird Deed is irrevocable. However, one of its key features is that the original property owner retains the right to sell, use, or mortgage the property and may revoke the deed at any time before death.

Understanding the realities of the Lady Bird Deed in North Carolina is crucial for anyone considering it as part of their estate planning. Misconceptions can lead to unintended consequences, so obtaining accurate and professional advice is always recommended.

Key takeaways

Navigating the paperwork for transferring property in North Carolina can be daunting, especially with the specific requirements of a Lady Bird Deed. Understanding the form's nuances not only streamlines the estate planning process but also safeguards the grantor's intent and the beneficiary's future rights. Below are several key takeaways everyone should be aware of:

- Retention of Control: One of the hallmark benefits of the Lady Bird Deed is that it allows the property owner (grantor) to retain control over the property during their lifetime. This means they can alter, sell, or mortgage the property without needing permission from the beneficiary.

- Avoidance of Probate: Upon the death of the grantor, the property automatically transfers to the designated beneficiary, bypassing the often long and costly probate process. This seamless transfer is a major advantage for beneficiaries looking to avoid legal hurdles.

- Tax Benefits: The use of a Lady Bird Deed can offer potential tax advantages. Since the property is not considered part of the grantor's probate estate at their death, it may lead to reductions in estate taxes. Additionally, the beneficiary often receives a step-up in basis, minimizing capital gains taxes if the property is sold.

- Medicaid Considerations: Importantly, the transfer of property via a Lady Bird Deed does not typically affect the grantor's eligibility for Medicaid. Since the deed allows for the revocation or change by the grantor, it is not deemed a transfer for Medicaid eligibility purposes. However, it's crucial to consult with a professional for advice tailored to individual circumstances.

- Form Requirements and Execution: Proper execution of a Lady Bird Deed requires adherence to North Carolina's legal standards, including notarization and witness signatures. It's essential to complete the form with accurate and clear information to ensure the deed's validity. Seeking legal assistance can help prevent common mistakes that could render the deed ineffective.

Considering these key points, utilizing a Lady Bird Deed in North Carolina presents a viable estate planning tool for property owners looking to smoothly transition their property to beneficiaries while retaining control during their lifetime. As with any legal document, consulting with a professional is advisable to navigate the specific requirements and implications for your situation.

More Lady Bird Deed State Forms

Texas Deed Transfer Form - This document is a favorite among estate planners for its simplicity and effectiveness in transferring property rights.

How to Get a Lady Bird Deed in Florida - It is recognized in a few states and is considered a valuable tool for estate planning and Medicaid planning.