Fillable Lady Bird Deed Document for Florida

In the realm of estate planning, the Florida Lady Bird Deed stands out as a unique tool for property owners. This form of deed allows an individual to retain control over their property during their lifetime, including the ability to sell or refinance, while ensuring that upon their passing, the property smoothly transitions to a predetermined beneficiary without the need for probate. This mechanism not only simplifies the process of transferring property but also offers a layer of flexibility and security not found in traditional deed formats. It strikes a balance between control and ease of transfer, making it an attractive option for many property owners in Florida looking to manage their estate efficiently and effectively. Whether the goal is to bypass the time-consuming and expensive probate process or to ensure a seamless transition of property to loved ones, the Lady Bird Deed form is a powerful instrument in the toolkit of estate planning strategies.

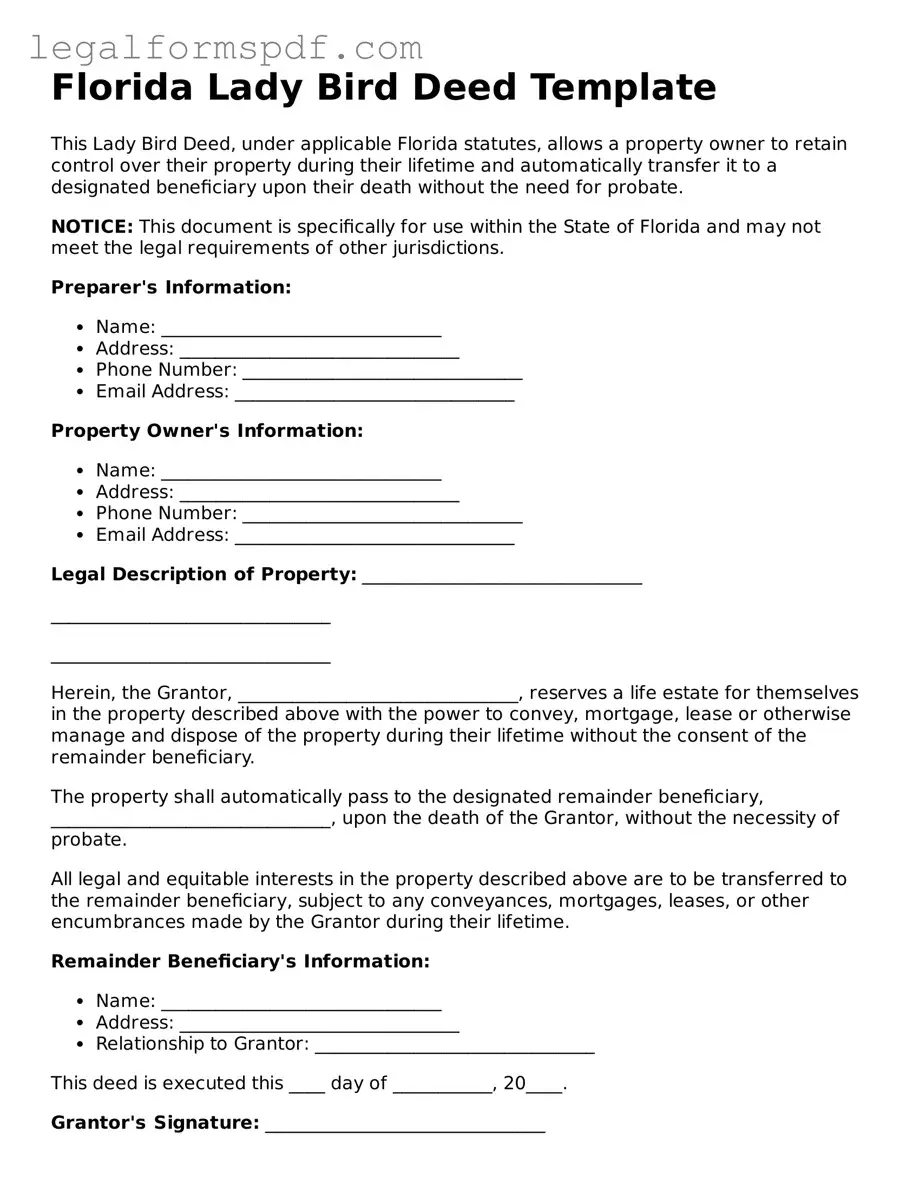

Document Example

Florida Lady Bird Deed Template

This Lady Bird Deed, under applicable Florida statutes, allows a property owner to retain control over their property during their lifetime and automatically transfer it to a designated beneficiary upon their death without the need for probate.

NOTICE: This document is specifically for use within the State of Florida and may not meet the legal requirements of other jurisdictions.

Preparer's Information:

- Name: _______________________________

- Address: _______________________________

- Phone Number: _______________________________

- Email Address: _______________________________

Property Owner's Information:

- Name: _______________________________

- Address: _______________________________

- Phone Number: _______________________________

- Email Address: _______________________________

Legal Description of Property: _______________________________

_______________________________

_______________________________

Herein, the Grantor, _______________________________, reserves a life estate for themselves in the property described above with the power to convey, mortgage, lease or otherwise manage and dispose of the property during their lifetime without the consent of the remainder beneficiary.

The property shall automatically pass to the designated remainder beneficiary, _______________________________, upon the death of the Grantor, without the necessity of probate.

All legal and equitable interests in the property described above are to be transferred to the remainder beneficiary, subject to any conveyances, mortgages, leases, or other encumbrances made by the Grantor during their lifetime.

Remainder Beneficiary's Information:

- Name: _______________________________

- Address: _______________________________

- Relationship to Grantor: _______________________________

This deed is executed this ____ day of ___________, 20____.

Grantor's Signature: _______________________________

State of Florida

County of ______________________

On this ____ day of ___________, 20____, before me, the undersigned notary public, personally appeared _______________________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the foregoing instrument and acknowledged that they executed the same for the purposes therein contained. In witness whereof, I hereunto set my hand and official seal.

Notary Public's Signature: _______________________________

My commission expires: ______________________

PDF Specifications

| Fact | Description |

|---|---|

| Definition | A Florida Lady Bird Deed is a legal document that allows property owners to transfer their real estate to beneficiaries upon their death without the need for probate court. |

| Governing Law | This deed is governed by Florida state law, specifically under the Florida Statutes that relate to the transfer of property. |

| Rights Retained | The original property owner retains full control over the property until their death, meaning they can sell or encumber the property without needing consent from the beneficiary. |

| Cost-Effectiveness | Using a Lady Bird Deed can be a cost-effective estate planning tool, as it helps avoid the time and expenses associated with probate proceedings. |

| Flexibility | The deed offers flexibility as it can be revoked or amended by the property owner at any time before their death. |

Instructions on Writing Florida Lady Bird Deed

Filling out a Florida Lady Bird Deed form is a straightforward process that allows property owners to transfer real estate upon their death without the need for probate. This special type of deed grants the owner continued control over the property during their lifetime, including the right to sell or modify the property. Here's how to accurately complete the form to ensure a smooth transition of your property.

- Begin by inserting the date of the deed's execution at the top of the form. This should reflect the current date on which you are filling out the document.

- Next, enter the full legal name(s) of the grantor(s) (the current owner(s) of the property) as well as their mailing address, including the city, state, and zip code.

- Specify the consideration, or the value exchanged for the property transfer. In the case of a Lady Bird Deed, this is typically a nominal amount, such as "Ten Dollars and other valuable considerations."

- Identify the grantee(s), or the recipient(s) of the property after the grantor's death. Include their full legal names and mailing addresses.

- Clearly describe the property being transferred. This includes the physical address, any legal descriptions, parcel ID numbers, and other pertinent details that accurately identify the property. Detailed legal descriptions can be found on your property’s current deed or tax documents.

- Include any reservations or exceptions related to the deed. This might involve specifying that the grantor retains lifetime rights to the property, including the right to sell or make changes to the property without the grantee's consent.

- Have the grantor(s) sign the deed in the presence of two witnesses and a notary public. The witnesses must be of legal age and not have any interest in the property. Their role is to verify the grantor's signature.

- The notary public will then complete the acknowledgement section, affirming that the grantor(s) appeared before them and signed the deed.

- Finally, record the completed deed with the local county clerk's office to make it official. There may be a recording fee, which varies by county.

Completing the Florida Lady Bird Deed requires careful attention to detail to ensure that your intentions for the property are clearly communicated and legally binding. By following these steps, property owners can navigate the process efficiently, providing peace of mind and securing the future transfer of their property.

Understanding Florida Lady Bird Deed

What is a Lady Bird Deed in Florida?

A Lady Bird Deed, also known as an Enhanced Life Estate Deed, is a special type of property deed used in Florida. It allows the property owner to retain control over their property during their lifetime, including the ability to sell or mortgage the property, and upon their death, the property automatically passes to the designated beneficiaries without the need for probate.

How does a Lady Bird Deed differ from a traditional life estate deed?

Unlike a traditional life estate deed, a Lady Bird Deed gives the life tenant (the original property owner) more control over the property. The life tenant can sell or mortgage the property without needing permission from the remainder beneficiaries. Upon the life tenant's death, the property passes directly to the remainder beneficiaries, bypassing probate, which is not the case with a traditional life estate deed.

Who should consider using a Lady Bird Deed?

Individuals who own property in Florida and wish to avoid probate upon their death may consider using a Lady Bird Deed. It is particularly beneficial for those desiring to keep control of their property during their lifetime while ensuring a smooth transition to their heirs or designated beneficiaries.

Can a Lady Bird Deed be revoked?

Yes, one of the unique features of a Lady Bird Deed is that it can be revoked by the property owner at any time during their lifetime. This allows for flexibility if the property owner's intentions or circumstances change.

Are there any tax implications with a Lady Bird Deed?

Since the property does not go through probate, it may help in avoiding certain probate-associated fees. However, the property may still be subject to federal estate tax if it exceeds the federal estate tax exemption limit at the time of the owner's death. It's advisable to consult with a tax professional for specific advice regarding individual situations.

Does a Lady Bird Deed provide asset protection?

While a Lady Bird Deed allows the property to pass outside of probate, it does not necessarily protect the property from creditors of the life tenant or the remainder beneficiaries. It’s important to consult with a legal professional to discuss asset protection strategies.

How is a Lady Bird Deed created?

To create a Lady Bird Deed, specific language must be used to establish the enhanced life estate and name the remainder beneficiaries. It is crucial to have the deed prepared by a legal professional to ensure it meets all legal requirements and accurately reflects the property owner's wishes.

Can a Lady Bird Deed be used for any type of property?

In Florida, a Lady Bird Deed can be used for almost any type of real property, including single-family homes, condominiums, and certain types of agricultural land. However, it may not be suitable for all property types, so consulting with a legal professional is recommended.

What happens if the remainder beneficiaries predecease the life tenant?

If the remainder beneficiaries predecease the life tenant, the Lady Bird Deed would not automatically transfer the property upon the life tenant's death. The property owner should update the deed to reflect new beneficiaries. If not updated, the property may become part of the life tenant’s estate and subject to probate.

Where can I get help with creating a Lady Bird Deed?

Considering the specific language and legal nuances involved in creating a valid Lady Bird Deed, it's wise to seek assistance from a legal professional experienced in Florida real estate and estate planning laws. They can provide personalized advice and ensure the deed is correctly drafted and executed.

Common mistakes

One common mistake when completing a Florida Lady Bird Deed form is failing to properly identify the property by omitting or inaccurately recording the legal description. The legal description is more precise than a street address and is crucial for correctly transferring the property. This detail ensures the deed is valid and binds to the correct property, avoiding potential legal disputes over property identification.

Another error is neglecting to include the correct and full names of all parties involved, including the grantor(s) (current owner(s)) and the grantee(s) (future owner(s)). This step is essential for the clear transfer of property rights. Ambiguities over parties' identities can lead to challenges in the deed's enforcement and may require legal actions to resolve, complicating what should be a straightforward process.

Individuals often overlook the necessity of having the deed signed in the presence of two witnesses and a notary public, as mandated by Florida law. This oversight can render the deed invalid. Witnessing and notarization are critical processes that provide a layer of legal protection, verifying the identities of the parties involved and the voluntariness of the transaction.

There is also a tendency to mistake the Lady Bird Deed for a tool that can substitute for a comprehensive estate plan. While beneficial for bypassing probate for the specific property it covers, it should not be seen as a replacement for a well-rounded estate plan. It does not address other aspects of one’s estate, such as personal property, investments, or other real estate holdings, which could still be subject to probate.

Many incorrectly assume that executing a Lady Bird Deed will automatically protect the property from creditors. However, this type of deed does not provide absolute protection against claims or liens that might be placed on the property for debts owed by the grantor. It’s important to understand the legal implications and limitations associated with its use.

Another frequent mistake is misunderstanding the tax implications of transferring property using a Lady Bird Deed. While it offers some tax advantages, such as the avoidance of reassessment under certain conditions, it’s important for property owners to consult with tax professionals to understand the potential tax consequences for both the grantor and the grantee.

Some individuals fail to record the deed with the county clerk’s office after it's been executed. This is a critical final step in the process. Until the deed is officially recorded, it may not be recognized as legally effective, leaving the property transfer at risk.

There’s often confusion about the rights retained by the grantor after the deed is in place. A Lady Bird Deed allows the grantor to retain control over the property during their lifetime, including the right to sell or mortgage the property. Failing to understand these retained rights can lead to misunderstandings about what actions the grantor can legally take once the deed is executed.

A number of people exclude or incorrectly specify the contingency plan in the event that the designated grantee predeceases the grantor. This oversight can create complications and potentially defeat the purpose of avoiding probate, as the property may not pass as intended without clear direction.

Lastly, there is a misconception that a Lady Bird Deed can be used for any type of property in any state. This deed is specific to certain jurisdictions, including Florida, and its applicability and effect can vary significantly based on local laws and the type of property being transferred. Understanding the geographic and property-type limitations is essential for ensuring the deed achieves its intended purpose.

Documents used along the form

In the process of estate planning and real estate transactions in Florida, the Lady Bird Deed form is often accompanied by several other forms and documents. These documents are essential for ensuring that all aspects of a property's transfer or management are legally accounted for and clearly documented. Among them, some facilitate the transfer of assets, while others protect the rights of the property owner and their beneficiaries.

- Warranty Deed – This document is used to transfer property ownership, guaranteeing that the seller holds clear title to the property and has the right to sell it. It provides the highest level of protection for the buyer.

- Quitclaim Deed – Similar to the warranty deed in its function to transfer property, this document offers no guarantees about the title’s status, making it a common choice for transferring property between family members.

- Power of Attorney – This legal document allows an individual to appoint another person to make decisions on their behalf, including those related to property and financial matters, in case they become unable to do so themselves.

- Revocable Living Trust – A form of agreement that allows the property owner to control their assets during their life and specify how they should be distributed upon their death. It helps avoid probate.

- Last Will and Testament – This vital document outlines how an individual’s assets will be distributed upon their death, including any property not included in a Lady Bird Deed.

- Declaration of Homestead – Used to protect a portion of the home's value from creditors, this document is important for homeowners as it can also have implications for estate planning.

- Life Estate Deed – Separate from a Lady Bird Deed, this document allows the property owner to use the property for their lifetime, after which it passes to the named remainderman.

- Notice of Confidential Information Within Court Filing – This form is used to ensure that sensitive information is adequately protected in documents filed with the court, important in case of disputes related to property or estate matters.

Each of these documents plays an integral role in comprehensive estate planning and property management, ensuring that individuals' wishes are respected and legal standards are met. When used correctly and in conjunction with a Lady Bird Deed, these documents can provide a robust framework for managing and transferring property in Florida, thus giving property owners and their heirs peace of mind.

Similar forms

The Florida Lady Bird Deed form shares similarities with a Life Estate Deed. In both, the property owner transfers a future interest in their property but retains control over the property during their lifetime. The main difference lies in the retained control; with a Lady Bird Deed, the original owner can sell or mortgage the property without the consent of the remainder beneficiaries, unlike with a traditional Life Estate Deed.

Another document resembling the Florida Lady Bird Deed is the Transfer on Death Deed (TOD). Both allow property to bypass probate and go directly to the intended beneficiaries upon the owner’s death. However, the Lady Bird Deed is specific to certain states, including Florida, whereas TOD deeds are recognized in different states, highlighting a geographical limitation in their application.

A Revocable Living Trust also bears similarity to the Lady Bird Deed. Owners can place their assets in the trust to be passed to their beneficiaries upon death, avoiding probate. Just like with the Lady Bird Deed, the original property owner retains full control over the assets during their lifetime. The distinction here is in the complexity and setup costs; trusts are generally more complicated and costly to establish.

Joint Tenancy with Right of Survivorship documents are somewhat analogous to the Lady Bird Deed because they allow property to pass directly to the surviving owner(s) upon one’s death, circumventing the probate process. However, this arrangement does not allow the original owner the same level of control over the property as a Lady Bird Deed does, particularly in terms of unilateral decisions regarding the property without the consent of the other owner(s).

The Durable Power of Attorney for Property is a legal document that grants someone else the authority to manage your property on your behalf. While it focuses on allowing another individual to make decisions about the property while the owner is still alive, it contrasts with the Lady Bird Deed, which primarily deals with the transfer of property upon the owner’s death but also highlights the theme of control over property decisions.

A Will is a traditional means by which people specify how their assets should be distributed after their death. Similar to a Lady Bird Deed, a Will can dictate who receives the property. The key difference is that the property transferred via a Will must go through probate, a sometimes lengthy and costly process, unlike the transfer through a Lady Bird Deed which avoids probate.

Finally, the Enhanced Life Estate Deed, often synonymous with the Lady Bird Deed itself, functions similarly by allowing property owners to retain control over their property until death, after which the property is automatically transferred to the designated remainder beneficiaries. Both ensure the property does not go through probate. However, the term "Enhanced Life Estate Deed" helps to differentiate it in discussions and legal documents from traditional life estate deeds which do not afford the same level of control to the grantor.

Dos and Don'ts

When it comes to filling out a Florida Lady Bird Deed form, it's essential to handle the process with care to ensure the deed is valid and accomplishes your estate planning goals. Here are key dos and don'ts to keep in mind:

Things You Should Do- Review your current deed and property information to ensure accuracy in the Lady Bird Deed.

- Clearly identify the grantor(s) and grantee(s), including full legal names and addresses, to avoid any confusion.

- Specify the life estate retained by the grantor with precise language, indicating the grantor’s right to use and profit from the property for their lifetime.

- Ensure the property description is detailed and matches the description on your current deed to prevent disputes over property boundaries or parcels.

- Sign and notarize the deed in the presence of two witnesses, as required by Florida law, to make the document legally binding.

- Record the completed deed with the county recorder’s office where the property is located to make it a public record and protect against future claims.

- Consult with an estate planning attorney or legal expert specializing in Florida property law to ensure the deed meets all legal requirements and accurately reflects your wishes.

- Do not overlook the need for precise and correct legal descriptions of the property, as vague or incorrect descriptions can invalidate the deed.

- Do not fail to include any language specifying the retention of a life estate, as this oversight could lead to the deed not functioning as intended.

- Do not neglect to record the deed, as an unrecorded deed may not effectively transfer the property upon the grantor's death.

- Do not utilize a standard warranty or quitclaim deed form without modifications, as the Lady Bird Deed has unique requirements that differ from these forms.

- Do not omit the names of future beneficiaries, because without them, the deed cannot direct to whom the property should pass upon the grantor's demise.

- Do not attempt to use a Lady Bird Deed to bypass legal debts or obligations, as creditors may still have claims against the property.

- Do not assume a Lady Bird Deed is the best tool for every estate plan; in some cases, other estate planning instruments may be more appropriate.

Misconceptions

When it comes to planning for the future of one's property in Florida, Lady Bird deeds are often brought up as an efficient tool for estate planning. However, there are several misconceptions surrounding this legal instrument. Understanding these common misunderstandings can help individuals make more informed decisions.

It's only for the wealthy: A common misconception is that Lady Bird deeds are exclusively for individuals with high net worth. In reality, this type of deed can be beneficial for anyone looking to ensure their property is transferred smoothly to their heirs without the need for probate, regardless of the estate's size.

It replaces a will: While a Lady Bird deed can help bypass probate for specific assets, it does not replace a will entirely. A comprehensive estate plan often includes both a will and one or more Lady Bird deeds, as they serve different purposes and cover different aspects of one's estate.

It provides full protection against creditors: Some people mistakenly believe that a Lady Bird deed offers full protection against creditors' claims on their property. Although it can offer some level of protection by avoiding probate, creditors may still have claims against the estate or the beneficiaries directly.

It's complicated to set up: The process of creating a Lady Bird deed might seem daunting, but with the right legal advice, it's quite straightforward. This deed is relatively simple compared to other estate planning tools and offers a flexible option for property owners to retain control over their property until death.

It's the same as a traditional life estate deed: A significant difference between a Lady Bird deed and a traditional life estate deed is the level of control retained by the original property owner. With a Lady Bird deed, the owner retains the right to sell, use, and even mortgage the property without the beneficiary's consent — a flexibility not offered by a traditional life estate deed.

By clarifying these misconceptions, property owners can make better choices regarding their estate planning and ensure their property is passed on according to their wishes with minimized legal complications.

Key takeaways

When managing or planning estate affairs in Florida, a Lady Bird Deed can be an invaluable tool. This special type of deed allows property owners to retain control over their property until death, at which point the property transfers to a designated beneficiary without the need for probate. Here are nine key takeaways to understand when filling out and using this form:

- The Lady Bird Deed, formally known as an Enhanced Life Estate Deed, allows the current property owner (grantor) to maintain control over the property for the duration of their life, including the right to sell or mortgage the property.

- It is essential to clearly identify the property in question by including its legal description, usually found on the current deed or property tax documents, to avoid any ambiguity.

- This deed must list the beneficiary (or beneficiaries) who will receive the property upon the grantor’s death. These beneficiaries are often referred to as remaindermen.

- To ensure the document is legally binding, it must be signed by the grantor in the presence of two witnesses and a notary public. All Florida deeds require this to be recorded officially.

- One of the primary benefits of a Lady Bird Deed is its ability to bypass the probate process, facilitating a smoother and more direct transfer of property to the beneficiary upon the grantor's death.

- The deed offers significant flexibility, allowing the grantor to change the beneficiary or revoke the deed entirely, without needing the consent of the beneficiary.

- It's crucial to consult with an attorney specializing in estate planning or real estate law in Florida to ensure the Lady Bird Deed aligns with your overall estate planning strategy and complies with current Florida law.

- Upon the grantor's death, the beneficiaries must file a death certificate and possibly a form affirming no estate tax is due, depending on the estate's value, to formalize the transfer of property ownership.

- When properly executed, a Lady Bird Deed can also have favorable tax implications, preserving the property’s eligibility for homestead exemption and potentially minimizing capital gains taxes for beneficiaries.

The strategic use of a Lady Bird Deed in Florida can offer peace of mind and financial benefits, ensuring that your property bypasses probate and directly transfers to your designated beneficiaries according to your wishes. However, detailed attention to the deed's requirements and consultation with legal professionals is crucial to fully leverage its advantages.

More Lady Bird Deed State Forms

Disadvantage of a Lady Bird Deed Michigan - By offering an elegant solution to common estate planning dilemmas, the Lady Bird Deed remains a popular choice for proactive property owners.

Texas Deed Transfer Form - Protects the property from being a part of the public probate process, keeping the matter private and straightforward.