Official Lady Bird Deed Document

Navigating the complex world of estate planning and property transfer can often feel like a daunting task. Among the myriad of tools available to achieve a seamless transition of real estate from one generation to the next, the Lady Bird Deed form stands out for its unique benefits and simplicity. This particular deed allows property owners to retain control over their property until their death, at which point it passes directly to the designated beneficiaries without the need for probate court proceedings. A Lady Bird Deed can potentially save families time and money, all while avoiding the complications often associated with traditional methods. Furthermore, this form of deed helps in maintaining eligibility for certain benefits, such as Medicaid, by not counting the property as part of an estate. However, it's important to note that not all states recognize this form of deed, which underscores the importance of understanding its applicability and implications in your specific context. Thus, when considering the best avenues for estate planning and property transfer, understanding the major aspects of the Lady Bird Deed form becomes a crucial step in making informed decisions that align with one's financial and familial goals.

State-specific Information for Lady Bird Deed Forms

Document Example

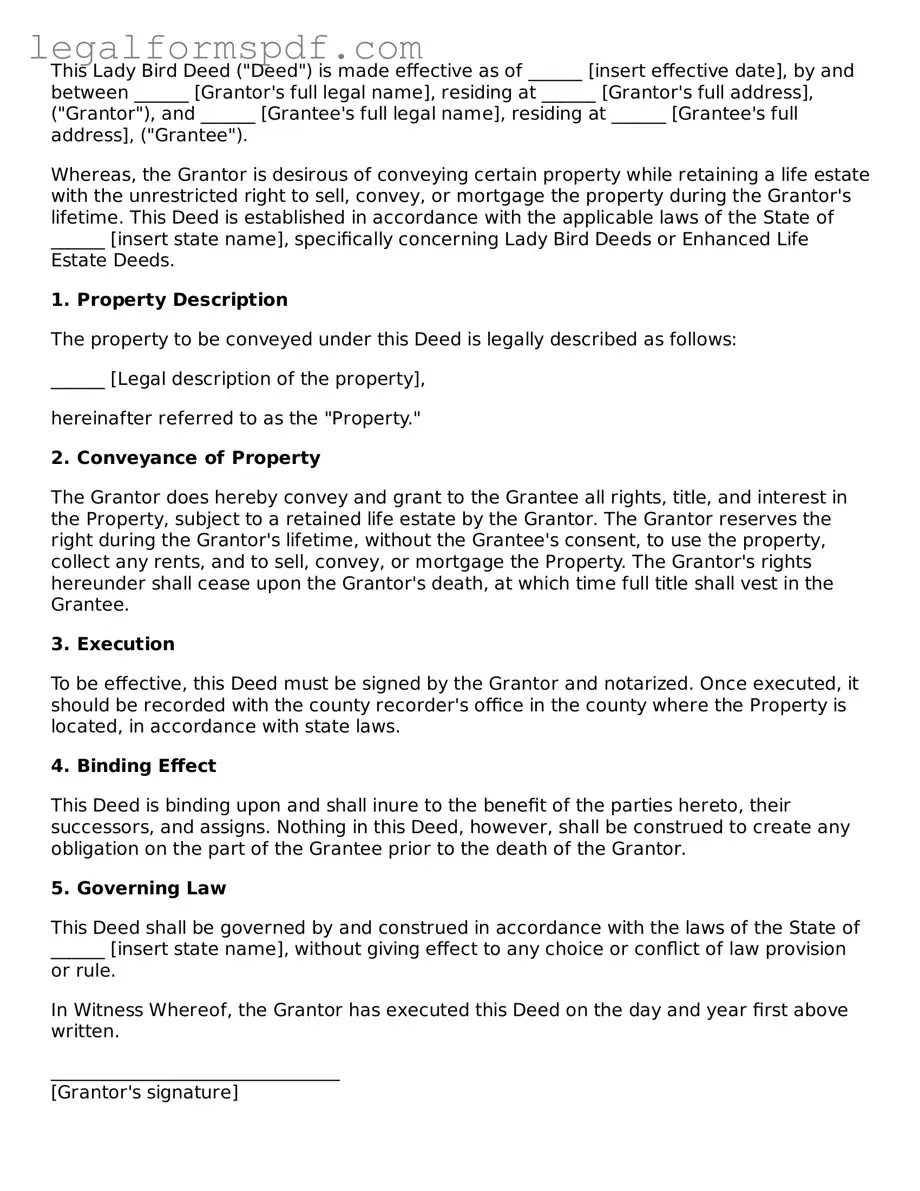

This Lady Bird Deed ("Deed") is made effective as of ______ [insert effective date], by and between ______ [Grantor's full legal name], residing at ______ [Grantor's full address], ("Grantor"), and ______ [Grantee's full legal name], residing at ______ [Grantee's full address], ("Grantee").

Whereas, the Grantor is desirous of conveying certain property while retaining a life estate with the unrestricted right to sell, convey, or mortgage the property during the Grantor's lifetime. This Deed is established in accordance with the applicable laws of the State of ______ [insert state name], specifically concerning Lady Bird Deeds or Enhanced Life Estate Deeds.

1. Property Description

The property to be conveyed under this Deed is legally described as follows:

______ [Legal description of the property],

hereinafter referred to as the "Property."

2. Conveyance of Property

The Grantor does hereby convey and grant to the Grantee all rights, title, and interest in the Property, subject to a retained life estate by the Grantor. The Grantor reserves the right during the Grantor's lifetime, without the Grantee's consent, to use the property, collect any rents, and to sell, convey, or mortgage the Property. The Grantor's rights hereunder shall cease upon the Grantor's death, at which time full title shall vest in the Grantee.

3. Execution

To be effective, this Deed must be signed by the Grantor and notarized. Once executed, it should be recorded with the county recorder's office in the county where the Property is located, in accordance with state laws.

4. Binding Effect

This Deed is binding upon and shall inure to the benefit of the parties hereto, their successors, and assigns. Nothing in this Deed, however, shall be construed to create any obligation on the part of the Grantee prior to the death of the Grantor.

5. Governing Law

This Deed shall be governed by and construed in accordance with the laws of the State of ______ [insert state name], without giving effect to any choice or conflict of law provision or rule.

In Witness Whereof, the Grantor has executed this Deed on the day and year first above written.

________________________________

[Grantor's signature]

________________________________

[Grantor's printed name]

State of ______: [insert state]

County of ______: [insert county]

On this day, personally appeared before me ______ [Grantor's full legal name], to me known to be the person(s) described in and who executed the foregoing instrument and acknowledged that he/she/they executed the same as his/her/their free act and deed.

Notary Public: __________________________________

[Printed Name of Notary]

My commission expires: ________________________

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird deed is a form of property deed that allows the property owner to transfer their real estate upon death without the need for probate court. |

| States Recognition | The deed is recognized in a few states, including Florida, Texas, and Michigan, among others, each governed by their state-specific laws. |

| Benefits | It provides benefits such as bypassing probate court, retaining the right to use and profit from the property during life, and the ability to revoke the deed. |

| Limitations | Not all states recognize Lady Bird deeds, and its effectiveness can be influenced by changes in state law or federal tax law. |

Instructions on Writing Lady Bird Deed

Completing the Lady Bird Deed form is a significant step for property owners who wish to transfer real estate upon their death without the need for probate court involvement. This deed allows the property to automatically pass to the designated beneficiaries, ensuring a smoother transition of ownership. While the deed offers considerable advantages, correctly filling out the form is crucial to its validity. The following steps are designed to guide individuals through this process, ensuring clarity and accuracy in every section of the Lady Bird Deed form.

- Begin by gathering all necessary information about the property, including its legal description and parcel identification number. This information can usually be found on your current deed or property tax statement.

- Identify the current owner(s) of the property. These are the individuals who will be executing the deed, transferring their interest in the property upon death. Write down their full legal names and addresses.

- Determine who will receive the property after the current owner’s death. These individuals are known as the remainder beneficiaries. List their full names and addresses accurately.

- Complete the legal description of the property section. It's important to copy this information exactly as it appears on the current deed to avoid discrepancies and potential legal challenges.

- Fill in the date the deed will be executed. This must be the current date when the deed is signed.

- Have the current owner(s) sign the deed in the presence of a notary public. This step is crucial for the deed's legality and ensures that the document is legally binding.

- The notary public will then complete their section, often found at the bottom of the deed. This includes witnessing the signatures, adding their seal, and signing the deed themselves.

- Finally, file the completed and notarized deed with the appropriate county office where the property is located. Each county might have specific requirements for filing, including fee payments, so it's recommended to contact the county office beforehand to confirm their process.

Following these steps diligently is essential for ensuring the Lady Bird Deed is executed correctly and is effective in transferring property ownership smoothly and efficiently. While the form might seem straightforward, paying attention to detail and ensuring all information is accurate cannot be overstressed. If there's any uncertainty, consulting with a legal professional can provide guidance and peace of mind throughout this process.

Understanding Lady Bird Deed

What is a Lady Bird Deed?

A Lady Bird Deed is a legal document that allows property owners to transfer their real estate to someone else upon their death without the need for probate. It's a unique estate planning tool that gives the current owner, often referred to as the grantor, the ability to retain control over the property during their lifetime, including the right to sell or mortgage the property. Upon the grantor's death, the property automatically passes to the designated beneficiary, known as the remainderman, outside of the probate process.

How does a Lady Bird Deed work?

In practice, a Lady Bird Deed involves the property owner signing a deed that names a beneficiary who will receive the property upon the owner's death. Until the owner passes away, they retain full ownership rights, meaning they can use, sell, or otherwise dispose of the property during their lifetime without needing permission from the beneficiary. If the property has not been sold or given away by the time of the owner's death, the property then automatically transfers to the beneficiary.

What are the benefits of using a Lady Bird Deed?

The main benefits include avoiding probate, which can be a time-consuming and expensive process; maintaining control over the property during the owner's lifetime; and the potential to protect the property from certain types of creditor claims against the estate. Additionally, Lady Bird Deeds can help in planning for Medicaid eligibility, as the transfer of property upon death may not be considered in the Medicaid eligibility process.

Are Lady Bird Deeds recognized in all states?

No, Lady Bird Deeds are not recognized in all states. They are a specific estate planning tool available only in some states, such as Florida, Michigan, and Texas. It's important to consult with a legal professional in your state to understand if Lady Bird Deeds are an option and how they are treated under local laws.

Can a Lady Bird Deed be revoked?

Yes, one of the key features of a Lady Bird Deed is that it can be revoked by the property owner at any time during their lifetime. This means the owner can change the named beneficiary or decide against transferring the property through a Lady Bird Deed entirely, as long as this change is made while the owner is still alive and competent.

What happens if the property is sold before the owner's death?

If the property that's subject to a Lady Bird Deed is sold before the owner's death, the deed becomes null and void. The beneficiary named in the Lady Bird Deed has no right to the proceeds of the sale unless otherwise specified by the owner in a separate legal document.

Does a Lady Bird Deed avoid estate taxes?

While a Lady Bird Deed can help avoid probate and, in some cases, protect assets from Medicaid estate recovery, it does not necessarily avoid estate taxes. The impact of a Lady Bird Deed on estate taxes can vary depending on the overall estate plan and the specific laws of the state. Consulting with an estate planning attorney can provide clarity on how a Lady Bird Deed fits into broader tax planning strategies.

How is a Lady Bird Deed created?

To create a Lady Bird Deed, the property owner must execute a deed that complies with the legal requirements of their state. This typically involves drafting the deed with specific language that reserves a life estate for the owner and specifies the remainderman who will receive the property upon the owner's death. The deed must then be signed, notarized, and recorded in the local public records to be effective.

Can a Lady Bird Deed be challenged?

Like any legal document, a Lady Bird Deed can be challenged, particularly if there are questions about the owner's mental capacity at the time the deed was executed, or if there are allegations of undue influence or fraud. Challenges can also arise if the deed was not properly executed, signed, or recorded according to state law. To minimize the risk of challenges, it's important to ensure that the deed is clearly drafted, properly executed, and in compliance with all relevant legal requirements.

Common mistakes

One common mistake people make when filling out the Lady Bird Deed form is neglecting to provide all the necessary information. This form requires precise details, including full legal descriptions of the property and correct identification of all parties involved. Failing to include complete details can lead to the deed being invalid, causing complications down the line.

Another frequent error is misunderstanding the nature of the property being transferred. The Lady Bird Deed is specific to real estate and does not cover other types of property or assets. Individuals sometimes erroneously include personal property, vehicles, or bank accounts in the deed, which are not applicable and can nullify the intended effect of the document.

A critical mistake is not having the deed signed in the presence of a notary and the required witnesses. The legal requirements for executing a Lady Bird Deed vary by state, but typically, a notary public must acknowledge the signature of the grantor (the person creating the deed), and certain states require witness signatures as well. Overlooking this step can render the deed invalid.

People often fail to properly define the remainder beneficiaries in the Lady Bird Deed. The deed allows the property owner to retain control over the property during their lifetime, including the right to sell or mortgage the property, with the property automatically transferring to the named remainder beneficiaries upon the owner’s death. Incorrectly identifying these beneficiaries, or not naming them clearly, can lead to disputes and legal challenges.

Another misstep is not considering the potential impact on eligibility for Medicaid and other benefits. While one of the advantages of a Lady Bird Deed is that it can help the property avoid probate and potentially not be counted as an asset for Medicaid eligibility, improper use or understanding of this tool can adversely affect eligibility. It’s crucial to consult with a legal or financial advisor to understand these implications fully.

Last but not least, individuals sometimes forget to file the completed deed with the county recorder’s office. A Lady Bird Deed must be filed and recorded in the public record of the county where the property is located to be effective. Failure to record the deed can result in the property not transferring as intended upon the death of the property owner, undermining the entire purpose of creating the deed in the first place.

Documents used along the form

In addition to the Lady Bird Deed form, there are several other forms and documents commonly utilized in estate planning and property management. These tools are essential for individuals aiming to ensure a smooth and legally sound transfer of their assets. Below is a list of forms and documents often used alongside the Lady Bird Deed to complement and enhance estate planning strategies.

- Will: A legal document that outlines how a person's assets will be distributed upon their death. It can also appoint a guardian for minor children.

- Revocable Living Trust: A document that allows individuals to manage their assets during their lifetime and specify how these assets should be distributed after their death, often avoiding probate.

- Financial Power of Attorney: This form grants a designated person or entity the authority to make financial decisions on behalf of the individual, should they become unable to do so themselves.

- Medical Power of Attorney: Also known as a healthcare proxy, this document designates someone to make healthcare decisions for an individual if they are incapacitated.

- Advance Healthcare Directive: A written statement of an individual’s preferences for medical treatment in scenarios where they are unable to communicate their decisions. It often includes living wills and medical powers of attorney.

- Beneficiary Designations: Forms that specify who will receive assets from accounts such as IRAs, life insurance policies, and retirement plans upon the account holder's death, bypassing the will and sometimes trust documents.

- Property Deeds: Legal documents that transfer property ownership. Types vary based on the specifics of the transfer but can include warranty deeds, quitclaim deeds, and deed to transfer to a trust, among others.

- Certificate of Trust: This document provides proof of a trust’s existence, outlines the powers given to the trustee, and might be required by financial institutions when transferring assets into or out of a trust.

Using these documents in conjunction with the Lady Bird Deed can provide a comprehensive estate planning strategy that addresses various facets of asset transfer. Properly executed, they can ensure an individual's wishes are honored, potentially reduce taxes, and simplify the legal process for heirs. As each individual’s situation is unique, it is advisable to consult with legal professionals to ensure the correct utilization of these documents in line with one’s estate planning objectives.

Similar forms

A Lady Bird Deed, also known as an enhanced life estate deed, is a legal document that allows property owners to transfer their real estate to beneficiaries while retaining certain rights during their lifetime. There are several documents similar to the Lady Bird Deed, each with its unique features and purposes. One such document is a Standard Life Estate Deed. Like the Lady Bird Deed, a Standard Life Estate Deed enables the property owner to retain possession and use of the property for their lifetime. However, unlike the Lady Bird Deed, it does not allow the grantor the flexibility to sell or mortgage the property without the beneficiary's consent.

Another similar document is the Revocable Living Trust. This estate planning tool allows individuals to maintain control over their assets while they're alive and enables the smooth transfer of these assets after their death. Similar to the Lady Bird Deed, assets can be passed to beneficiaries without going through probate. The key difference lies in the scope; Revocable Living Trusts can include a variety of assets, not just real estate, and provide more comprehensive management options.

A Transfer on Death Deed (TODD) shares common objectives with the Lady Bird Deed, facilitating the transfer of property to a beneficiary upon the owner's death without going through probate. However, the primary difference is that, with a TODD, the owner does not retain the right to mortgage or sell the property without involving the beneficiary, which limits the owner’s control over the property during their lifetime.

A Durable Power of Attorney (DPOA) for property is a legal document that grants someone else the authority to make decisions related to the grantor's property and finances. While it doesn’t directly facilitate the transfer of real estate upon death, it allows for comprehensive management of the owner's property during their lifetime. This similarity in managing property assets links it with the intentions behind the Lady Bird Deed.

The Will, or Last Will and Testament, is a document specifying how a person’s assets will be distributed upon their death. It is similar to a Lady Bird Deed in that it addresses the transfer of property to beneficiaries. However, unlike a Lady Bird Deed which avoids probate for real estate, a Will typically requires probate, a legal process that can be time-consuming and costly.

Lastly, a Joint Tenancy with Right of Survivorship is a form of co-ownership where the property automatically passes to the surviving owner(s) upon one’s death. This bypasses the probate process, akin to the Lady Bird Deed’s transfer mechanism. The key difference is that in a Lady Bird Deed, the transfer is unilateral and controlled solely by the original owner, whereas in a joint tenancy, all owners hold equal rights and interests in the property during their lifetimes.

Dos and Don'ts

The Lady Bird Deed, a special type of deed used in some states, allows property owners to transfer real estate to beneficiaries upon death without the need for probate. Here are some essential dos and don'ts when filling out this form:

Do:

- Ensure you are in a state that recognizes Lady Bird Deeds. Not every state allows their use, so confirm your state’s stance on these deeds.

- Clearly identify the property by including the full legal description. This description is often more detailed than your address and may be found on your existing deed or property tax documents.

- Clearly name the beneficiary or beneficiaries. Specify their full legal names to avoid any confusion about who should inherit the property.

- Sign the deed in front of a notary public. For the deed to be legally binding, it must be notarized.

- Record the deed at the local county recorder’s office. Filing the deed with your county ensures it is recognized as official and provides public notice of the transfer upon death.

- Consult a legal professional. To ensure the deed is properly executed and meets all legal requirements, seeking advice from a legal advisor familiar with real estate law in your state is wise.

Don't:

- Attempt to use a Lady Bird Deed in states where it is not recognized. This could lead to legal complications and invalidation of the deed.

- Omit any beneficiaries you wish to inherit the property. Only those named in the deed will have legal rights to the property upon your death.

- Forget to specify a clear contingency plan. In case the primary beneficiary predeceases you, it's wise to name an alternate beneficiary.

- Fail to update the deed if circumstances change. If you wish to change beneficiaries or if a beneficiary’s circumstances change, the deed should be revised accordingly.

- Overlook the impact on eligibility for Medicaid or other benefits. In some cases, how the deed is structured could affect your or your beneficiary's eligibility for government benefits.

- Rely solely on generic forms found online without ensuring they comply with current state laws. Real estate laws vary significantly by state, and using an outdated or non-compliant form could invalidate the deed.

Misconceptions

A Lady Bird Deed, also known as an enhanced life estate deed, is a legal document that allows property owners to transfer real estate upon their death without the need for probate. Despite its benefits, there are several common misconceptions about the Lady Bird Deed form.

- It Allows the Grantor Unrestricted Control: While a Lady Bird Deed does permit the original owner (grantor) to maintain control over the property during their lifetime, including the ability to sell or mortgage the property, this control is not entirely unrestricted. The grantor cannot make changes that would significantly impair the future interest of the beneficiary without their consent.

- It’s Valid in All States: This is not the case. The Lady Bird Deed is an estate planning tool recognized only in a few states. Therefore, its validity is geographically limited, and one should consult with legal professionals to understand if it’s an option in their state.

- It Guarantees Avoidance of Estate Taxes: While a Lady Bird Deed can help avoid the probate process, it does not automatically exempt the property from estate taxes. The impact on taxes can vary based on the specific circumstances and the overall estate plan of the individual.

- It Protects the Property from Medicaid Estate Recovery: Some people believe that a Lady Bird Deed can protect a property from being claimed by the state for Medicaid repayments after the grantor's death. While it may provide some level of protection, it does not offer a full guarantee. Each state has its own rules regarding Medicaid estate recovery, and in some cases, the property could still be subject to claims.

- It Replaces a Will: A Lady Bird Deed does not replace a will. It is a tool for estate planning that works alongside a will. It specifically deals with the transfer of real property and does not address other assets, guardianship, or various other legal matters typically covered in a will.

- It Is a Complicated and Costly Process: The process of creating and recording a Lady Bird Deed can be straightforward, especially with the guidance of a knowledgeable real estate or estate planning attorney. The cost is generally not prohibitive and is often significantly less than the costs associated with probate or the management of a traditional life estate deed.

Key takeaways

A Lady Bird Deed, often known in legal circles as an enhanced life estate deed, is a popular tool for estate planning, particularly for passing on real estate to heirs smoothly and without the need for probate. Here are ten key takeaways you should understand when considering the use of a Lady Bird Deed:

Retain Control: One of the most significant advantages of the Lady Bird Deed is that it allows the current property owner to maintain control over the property until death. The grantor can sell, convey, or mortgage the property without needing consent from the beneficiaries.

Avoid Probate: Properties transferred using a Lady Bird Deed bypass the probate process, going directly to the designated beneficiaries upon the death of the grantor. This saves time, money, and privacy.

Flexibility: Since the grantor retains control over the property, they have the flexibility to change beneficiaries or reverse the deed without requiring permission or informing the future beneficiaries.

Medicaid Considerations: In many cases, property transferred with a Lady Bird Deed is not considered part of the estate for Medicaid eligibility purposes, helping preserve assets while adhering to Medicaid's look-back provisions.

Simple to Execute: Compared to other estate planning tools, a Lady Bird Deed is relatively straightforward and does not require the complex trust management involved in other methods.

Limitations on Use: Not all states recognize Lady Bird Deeds. It's essential to consult with a local legal advisor to understand if this instrument is available and effective in your state.

Cost-Effective: Using a Lady Bird Deed is generally less expensive than creating a revocable living trust. It's a cost-effective method for estate planning, particularly for those with a primary interest in transferring real estate.

Protection from Creditors: In some jurisdictions, the Lady Bird Deed can offer protection from certain creditors of the beneficiaries, since the property does not become part of the beneficiary’s estate until the grantor's death.

No Immediate Tax Implications: There are no immediate tax consequences for the grantor or the beneficiary upon filing a Lady Bird Deed. Property taxes remain the responsibility of the grantor until their death.

Beneficiary Responsibilities: Beneficiaries should be aware that upon inheriting the property, they become responsible for any liens or encumbrances on the property and must also consider the potential for estate taxes, depending on the value of the inherited property.

When considering a Lady Bird Deed, it's crucial to tailor the deed to your specific circumstances and estate planning goals. Professional advice from a competent legal advisor with experience in estate planning in your state is invaluable to ensure that this tool is correctly implemented and harmonizes with your overall estate plan.

Consider More Types of Lady Bird Deed Forms

Simple Deed of Gift Template - Offers peace of mind by formalizing the generosity between two parties, safeguarding the gift's integrity and the parties' intentions.