Fillable Deed Document for Illinois

When it comes to transferring property ownership in the state of Illinois, navigating through the process can seem daunting at first. However, understanding the Illinois Deed form is a crucial step in making the transaction smooth and secure. This essential document plays a key role in the legal transfer of real estate from one party to another. Whether it's a sale, a gift, or an inheritance, the deed form captures all the necessary details to ensure that the property's ownership change is officially recognized by law. It outlines the identities of both the grantor and the grantee, the precise description of the property, and any terms or limitations related to the transfer. Additionally, the document must be signed in the presence of a notary to be valid. Each type of deed, whether it be warranty, quitclaim, or special warranty, serves a different purpose and offers varying levels of protection for the parties involved. Thus, selecting the correct form and understanding its implications are fundamental steps for anyone involved in real estate transactions within Illinois.

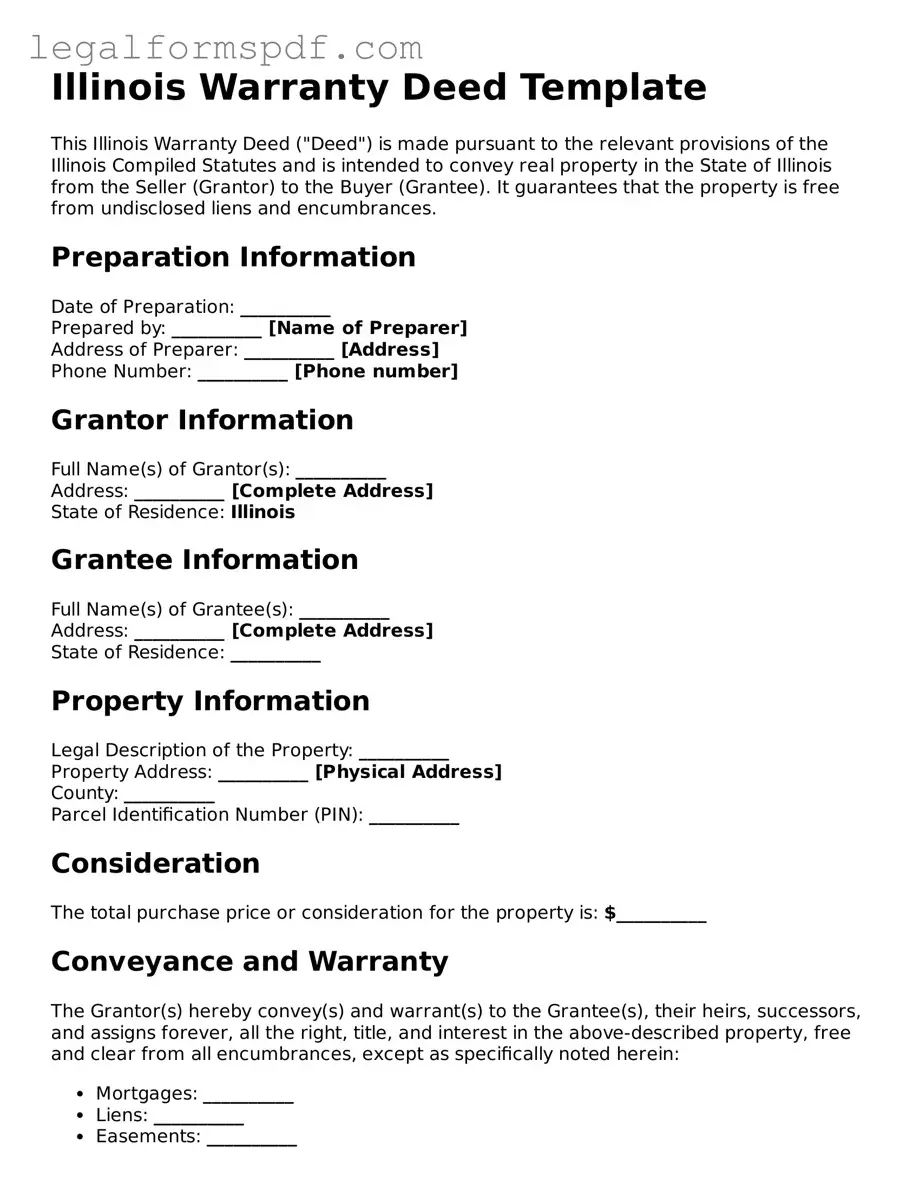

Document Example

Illinois Warranty Deed Template

This Illinois Warranty Deed ("Deed") is made pursuant to the relevant provisions of the Illinois Compiled Statutes and is intended to convey real property in the State of Illinois from the Seller (Grantor) to the Buyer (Grantee). It guarantees that the property is free from undisclosed liens and encumbrances.

Preparation Information

Date of Preparation: __________

Prepared by: __________ [Name of Preparer]

Address of Preparer: __________ [Address]

Phone Number: __________ [Phone number]

Grantor Information

Full Name(s) of Grantor(s): __________

Address: __________ [Complete Address]

State of Residence: Illinois

Grantee Information

Full Name(s) of Grantee(s): __________

Address: __________ [Complete Address]

State of Residence: __________

Property Information

Legal Description of the Property: __________

Property Address: __________ [Physical Address]

County: __________

Parcel Identification Number (PIN): __________

Consideration

The total purchase price or consideration for the property is: $__________

Conveyance and Warranty

The Grantor(s) hereby convey(s) and warrant(s) to the Grantee(s), their heirs, successors, and assigns forever, all the right, title, and interest in the above-described property, free and clear from all encumbrances, except as specifically noted herein:

- Mortgages: __________

- Liens: __________

- Easements: __________

- Restrictions: __________

Acknowledgment

This document was prepared by __________ [Name of Preparer] who is neither an attorney nor a party to this conveyance. Using this template does not substitute for legal advice.

Signatures

In witness whereof, the parties have executed this Deed on the date written below.

Grantor Signature: __________

Date: __________

Grantee Signature: __________

Date: __________

Notary Acknowledgment

State of Illinois, County of __________: On __________ [Date], before me, __________ [Notary's Full Name], a notary public, personally appeared __________ [Name(s) of Signatory(ies)], known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument, and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public Signature: __________

My Commission Expires: __________

PDF Specifications

| Fact | Description |

|---|---|

| 1. Governing Law | The Illinois deed form is governed by the laws of the State of Illinois, specifically the Illinois Compiled Statutes. |

| 2. Types of Deeds | In Illinois, common types of deeds include warranty deeds, quitclaim deeds, and special warranty deeds, each offering different levels of protection for the grantee. |

| 3. Required Information | The form must include details such as the legal description of the property, the names of the grantor and grantee, and the consideration (the value exchanged for the property). |

| 4. Notarization | All deeds must be notarized in the presence of a notary public to be legally binding in Illinois. |

| 5. Recording | After notarization, the deed must be recorded with the County Recorder’s Office where the property is located. This is a vital step in making the transaction public record. |

| 6. Transfer Tax Declaration | When transferring real estate, a transfer tax declaration might be required. This form is used to calculate any taxes due on the transfer. |

| 7. Consideration Statement | A statement of consideration is often required to be included on the deed or submitted with it, detailing the financial terms of the property transfer. |

Instructions on Writing Illinois Deed

When you're ready to transfer property ownership in Illinois, completing a deed form is a necessary step. This document is pivotal in legally documenting the change in ownership from the seller (grantor) to the buyer (grantee). The process might seem daunting, but with careful attention, you can complete the form correctly. Follow these steps to ensure your Illinois Deed form is filled out accurately, making sure every detail is covered for a successful property transfer.

- Start by identifying the type of deed you are completing – Warranty, Quitclaim, or Special Warranty. Your choice will depend on the level of protection you and the buyer have agreed upon.

- Enter the full name and address of the grantor or grantors. If there are multiple grantors, make sure to include each person’s information.

- List the full name and address of the grantee or grantees. As with grantors, include all details if there are multiple grantees.

- Write in the legal description of the property. This includes the property’s physical address and its legal boundaries. If unsure, you can find this information on a previous deed or by contacting your local county recorder’s office.

- Include the date of the transfer. This is the date on which the property ownership officially changes hands.

- State the consideration. This term refers to the amount of money being exchanged for the property. If the property is a gift, you should state that here.

- Have the grantor or grantors sign the deed in the presence of a notary public. The signature process formalizes the deed, making it a binding document.

- The notary public will then fill their section, confirming the identity of the signer(s) and the date of signing. This step is crucial as it authenticates the document.

- Finally, file the completed deed with the county recorder’s office in the county where the property is located. There might be a filing fee, so it’s a good idea to contact the office beforehand to confirm.

Completing the Illinois Deed form meticulously is critical in ensuring a legal and smooth transition of property ownership. As you follow these steps, remember to double-check each detail for accuracy. Once filed with the county recorder's office, the transfer of property will officially be recorded, marking the completion of your transaction.

Understanding Illinois Deed

What is an Illinois Deed form and why is it needed?

An Illinois Deed form is a legal document used to transfer ownership of real property from the seller (grantor) to the buyer (grantee) in Illinois. It ensures that the transfer is legally recognized and documented, providing clear evidence of the grantee's title to the property.

What are the different types of Deeds available in Illinois?

In Illinois, the most common types of Deeds include Warranty Deeds, which provide the highest level of buyer protection with guarantees from the seller; Quitclaim Deeds, which transfer any ownership the seller has without any guarantees; and Special Warranty Deeds, which only guarantee against claims that occurred while the seller owned the property.

How can one obtain an Illinois Deed form?

The form can be obtained from a local county recorder's office, a trusted legal document provider, or an attorney specializing in real estate transactions. Ensure that the form complies with Illinois state laws and is specific to the county where the property is located.

What information is required to complete an Illinois Deed form?

Completing an Illinois Deed form requires details such as the legal description of the property, the names and addresses of the grantor and grantee, the consideration (purchase price), and the signatures of all parties involved. It must also be notarized and, in some cases, witnessed.

Are there any particular filing requirements for an Illinois Deed?

Yes, after completion, the Deed must be recorded with the county recorder's office where the property is located. Recording fees must be paid, and specific recording requirements, such as margin size and paper quality, may vary by county. Proper recording ensures that the Deed is publicly documented and legally effective.

What happens if an Illinois Deed form is not filed properly?

If a Deed is not filed properly, it may not legally transfer title to the property, leaving the grantee without legal ownership and protections. Improper filing can lead to disputes over property ownership and may complicate future sales or transfers. Ensuring the form is accurately completed, signed, notarized, and recorded according to Illinois and county requirements is essential for a valid transfer.

Common mistakes

Filling out a deed form in Illinois can be a tricky process, fraught with potential errors if one is not careful. One common mistake many people make is improperly listing the parties involved. This includes inaccurately naming the grantor (the person selling or transferring the property) and the grantee (the person receiving the property). Precise legal names are required, and not getting this right can lead to significant issues in establishing clear title to the property.

Another significant error is failing to provide a complete legal description of the property. Unlike a simple street address, a legal description includes specific details that accurately describe the property's boundaries and physical characteristics as recorded in public records. An incomplete or inaccurate legal description can void the deed, leading to disputes over property boundaries or ownership.

Many individuals also overlook the requirement to have the deed signed in the presence of a notary public. This step is crucial, as the notary public verifies the identity of the signatories, ensuring that the deed is legally binding. Skipping this step means the deed might not be recognized as legitimate by the state of Illinois or by parties involved in the property transaction.

Submitting a deed without the required witness signatures is another prevalent mistake. While not all states require witnesses in addition to notarization, failing to adhere to Illinois' specific requirements around witnessing can render the deed unrecordable or invalid.

Incorrectly handling the transfer tax declaration portion of the process is yet another common error. This involves submitting the necessary paperwork to report the transaction to the state and possibly the municipal government, and accurately calculating and paying the required taxes. Missteps here can lead to legal complications and financial penalties.

Not checking for any encumbrances or liens on the property before completing the deed is a critical oversight. Encumbrances might include mortgages, easements, or liens for unpaid taxes. If these are not properly addressed and cleared before the transfer, the grantee may inherit these financial burdens and legal complications.

Lastly, a frequent error is not filing the completed deed with the county recorder's office. For a deed to be considered valid and for the transfer of ownership to be officially recognized, the deed must be recorded in the office of the county where the property is located. Failure to do so can lead to issues with proving ownership, obtaining future financing, or selling the property.

It's essential for individuals involved in property transfers to be diligent and thorough when filling out a deed form in Illinois. Avoiding these common mistakes can help ensure the process goes smoothly and legally secures the property transfer.

Documents used along the form

When dealing with property transactions in Illinois, the Deed form is just one piece of the puzzle. There are several other forms and documents that are often used in tandem with it to ensure a smooth and legally compliant transfer of ownership. Each of these documents has its own role in the process, from confirming the legal description of the property to ensuring that all taxes related to the transfer have been paid. Here's a look at some of these essential documents:

- Title Search Report: This document verifies the legal ownership of the property and checks for any liens, easements, or other encumbrances that might affect the transfer.

- Plat of Survey: A detailed map showing the property's boundaries, dimensions, and the location of any structures on the land. It confirms the property's legal description.

- Mortgage Payoff Statement: If there's an existing mortgage on the property, this statement provides the amount required to pay off the balance at closing.

- Property Tax Bill: This shows the current status of property taxes on the property, ensuring that all taxes are up to date.

- Closing Statement: A summary of the financial transactions related to the property transfer, including the sale price, closing costs, and adjustments.

- Home Warranty: Sometimes included in the sale, this warranty can cover certain home repairs or problems that occur after the sale is finalized.

- Flood Zone Statement: This document confirms whether the property is in a flood hazard area, which affects insurance requirements and costs.

- Zoning Compliance: Verifies that the property's use and structures comply with local zoning regulations.

- Disclosure Statements: These may include disclosures about the condition of the property, such as lead-based paint disclosures or other material facts that could affect the property's value or desirability.

- Home Inspection Report: A comprehensive report detailing the condition of the property, including the electrical system, plumbing, roofing, and more. This report identifies any potential issues that may need to be addressed.

Each of these documents plays a critical role in the real estate transaction process, providing assurances to both the buyer and the seller. By understanding these documents and how they work together with the Deed form, parties involved in a property transfer in Illinois can ensure a seamless and successful transaction.

Similar forms

The Illinois Deed form is similar to a Quitclaim Deed in that both are legal instruments used to transfer interests in real property. A Quitclaim Deed, specifically, transfers any ownership the grantor might have without guaranteeing that the title is clear. This makes it alike the Illinois Deed in function, especially when used between parties who trust each other, like family members.

Comparable to a Warranty Deed, the Illinois Deed form also facilitates the transfer of property rights from one person to another. However, a Warranty Deed goes further by providing the grantee (buyer) warranties that the property is free from any encumbrances and that the grantor holds a clear title to the property. This type of deed provides more protection to the buyer compared to the basic Illinois Deed form.

A Trust Deed shares similarities with the Illinois Deed as both can pertain to the transfer of property. The key difference is that a Trust Deed involves three parties - the borrower, lender, and trustee - and is often used in securing a debt with the property acting as collateral. While the Illinois Deed can also transfer property rights, it is not specifically designed for transactions involving debt.

The Illinois Deed form and a Grant Deed both serve the purpose of transferring title to real property from one party to another. Grant Deeds guarantee that the property has not been sold to anyone else and that there are no undisclosed liens or encumbrances. This shared goal of title transfer aligns them closely, though the Grant Deed offers additional assurances to the buyer.

Likewise, a Special Warranty Deed and the Illinois Deed form facilitate the conveyance of property rights. What distinguishes a Special Warranty Deed is its limitation to guaranteeing the title only against defects that arose during the ownership tenure of the grantor, not prior. This makes the Special Warranty Deed slightly more secure for the buyer than a standard Illinois Deed form, which may not specify the extent of the warranties provided.

Joint Tenancy Agreement is related to the Illinois Deed form in their capacity to outline the ownership of property. Specifically, a Joint Tenancy Agreement allows two or more parties to own property together with rights of survivorship, meaning if one owner dies, their share directly passes to the remaining owner(s). The Illinois Deed can also transfer property to joint tenants, making these documents complementary in creating co-ownership arrangements.

Similarly, a Tenancy in Common Agreement encompasses aspects of the Illinois Deed by establishing ownership shares of a property among two or more people without rights of survivorship. This agreement allows each party to own a specified fraction of the property, which can be passed to their heirs. While the Illinois Deed can transfer ownership to tenants in common, the specific rights and arrangements are delineated in a separate Tenancy in Common Agreement.

A Transfer-on-Death (TOD) Deed, like the Illinois Deed, is used for the purpose of transferring property. However, a TOD Deed uniquely allows the property owner to designate a beneficiary who will receive the property upon the owner's death, bypassing probate. While both documents concern property transfer, the TOD Deed's distinctive feature is its post-mortem effectivity without needing the proceedings of a court.

Finally, a Life Estate Deed is akin to the Illinois Deed because it involves the transfer of property rights. A Life Estate Deed, in particular, grants someone the right to use and live on the property during their lifetime, after which the property passes to a remainderman. This parallels the Illinois Deed's role in property transfer, but is specific in creating a present and future interest in the property.

Dos and Don'ts

Filling out an Illinois Deed form requires attention to detail and understanding of the legal requirements. To ensure the process is completed accurately and effectively, consider the following list of dos and don'ts.

Do:- Review the entire form before filling it out to understand all the required sections and information.

- Use black ink or type the information to ensure legibility and prevent any issues during the recording process.

- Ensure all parties involved in the deed are clearly identified with their full legal names and correct contact information.

- Have the deed signed in the presence of a notary public to validate the signatures.

- Include a complete legal description of the property, which can be found in previous deeds or at the county recorder's office.

- Check for any specific county requirements in Illinois where the property is located, as they can vary.

- Keep a copy of the fully executed deed for your records once it has been recorded.

- Leave blank spaces on the form; if a section does not apply, mark it as N/A.

- Use correction fluid or make unauthorized alterations on the form after it has been signed.

- Forget to verify the accuracy of all information before signing, especially the legal description of the property and personal details.

- Miss out on securing a preliminary title search to identify any potential issues with the property’s title.

- Assume all deeds are the same; understand the difference between a warranty deed, quitclaim deed, and other types pertinent to Illinois.

- Omit the preparer's information at the end of the deed, which is a requirement in many counties.

- Fail to record the deed with the county recorder’s office after it has been executed and notarized.

Misconceptions

When it comes to transferring property, the process can be filled with complexities and misunderstandings, especially in states like Illinois with specific requirements. Here, we're debunking some common misconceptions about the Illinois Deed form to help clarify the process.

Only One Type of Deed Is Available in Illinois: Many people incorrectly assume there's only one type of deed form in Illinois. In truth, there are several, including warranty deeds, quit claim deeds, and special warranty deeds, each serving different purposes and offering varying levels of protection for the buyer and seller.

Deed Forms Are One-Size-Fits-All: The assumption that a single deed form is suitable for all circumstances is misleading. Depending on your specific situation such as the nature of the property, the relationship between the buyer and seller, and the guarantees (if any) being made about the property, a particular deed form is needed to match these conditions.

A Lawyer Isn't Necessary: While it's possible to fill out and file a deed form without legal assistance, it's generally not advisable. Deeds can affect property rights in significant and sometimes unexpected ways. Consulting with a lawyer ensures that the deed is properly executed, reflects the parties' intentions, and complies with Illinois law.

Filling Out A Deed Form Is Simple: While the form itself might not look complicated, understanding the legalese and ensuring all necessary information is accurately included can be tricky. Small mistakes can lead to big problems down the road, such as challenges to the property’s title.

Any Mistakes Can Be Easily Fixed Later: Correcting errors on a recorded deed can be complex, time-consuming, and sometimes impossible without legal action. It’s much more efficient to ensure the deed is correctly filled out and filed the first time around.

Recording A Deed Guarantees Clear Title: Simply recording a deed with the local county does not automatically clear all claims or liens against the property. A thorough title search and sometimes title insurance are necessary to ensure that the title is clear.

Deed Forms Don't Need To Be Notarized in Illinois: This is incorrect. Illinois law requires deed forms to be notarized as a crucial step in validating the identity of the signing parties and ensuring the deed’s legitimacy.

Understanding these misconceptions can help streamline the process of transferring property and ensure that all legal requirements are met. When in doubt, seeking professional advice can provide clarity and peace of mind.

Key takeaways

When dealing with the Illinois Deed form, it's crucial to grasp both the requirements and implications of this legal document. The deed itself is a powerful tool in property transactions, effectively transferring ownership from one party to another. Below are key takeaways to consider:

- Ensure all parties involved are correctly identified, with their full legal names accurately listed to prevent any future disputes or legal complications.

- Detail of the property must be exhaustive, including its legal description (not just the address) which is often found on the title documents or a recent property tax statement.

- It's important to choose the right type of deed for the transaction. In Illinois, common types include warranty deeds, which guarantee the seller has the right to sell the property and that it's free of debt or other liens, and quitclaim deeds, which make no guarantees about the property title and are often used between family members.

- Illinois law requires the deed to be signed in the presence of a notary public to ensure the document is legally binding.

- The deed must be filed with the county recorder’s office where the property is located. This is a critical step to make the transfer of ownership public record, providing legal protection to the new owner.

- There are fees associated with recording the deed, which vary by county. It's advisable to contact the local recorder's office beforehand to know the exact amount.

- Consider the tax implications of transferring property. Illinois may impose a transfer tax, and the amount can differ depending on whether the property is in a city, village, or unincorporated area of the county.

- If the property is mortgaged, the mortgage must be addressed in the deed transfer. This might involve obtaining permission from the lender or potentially paying off the mortgage in full.

- Professional assistance is highly recommended to navigate the complexities of real estate transactions and legal documentation in Illinois. A lawyer or real estate professional can provide invaluable advice tailored to the specifics of your situation.

Handling a deed involves not just filling out a form but understanding the legal responsibilities and implications of the transfer. By paying close attention to these key points, parties can ensure a smoother transaction process and protect their rights and interests.

More Deed State Forms

Life Estate Deed New York Form - Recording a deed incorrectly can nullify the transfer or make it invalid, emphasizing the need for accuracy and legal advice.

Release of Dower Rights Ohio Form - Can specify whether the property is being transferred with warranties or as is.