Fillable Gift Deed Document for Texas

In the realm of transferring property rights with generosity at its core, the Texas Gift Deed form emerges as a pivotal document, facilitating the conveyance of real estate from one individual to another without the exchange of monetary compensation. This legal instrument, grounded in the statutes and regulations peculiar to the state of Texas, serves not only as a declaration of the giver’s intent but also as a permanent record of the transfer, ensuring clarity and preventing future disputes over ownership. For those considering the use of such a form, comprehending its prerequisites—including the requirement for the deed to be voluntarily executed, delivered, and accepted, as well as properly recorded in the county where the property resides—proves essential. It stands as a testament to the generosity of the donor, while simultaneously providing a streamlined, cost-effective method for property transfer, distinguishing itself from more complex and costly processes typically involved in real estate transactions. The precise formulation and execution of this document, including acknowledgment before a notary public to imbue it with legal standing, embodies the meticulous nature of property gift transfers in Texas, ensuring that the benevolent act of gifting property is preserved in the legal annals with due solemnity and respect.

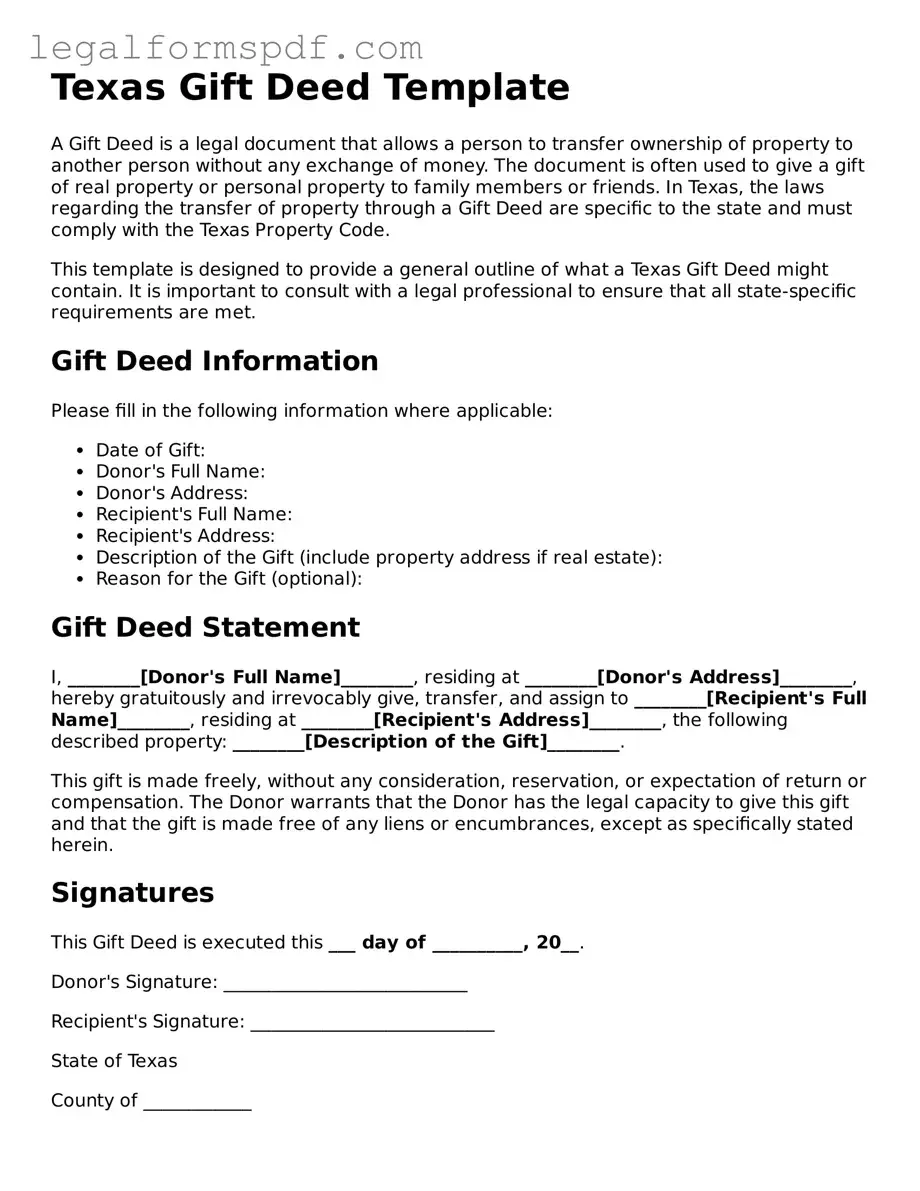

Document Example

Texas Gift Deed Template

A Gift Deed is a legal document that allows a person to transfer ownership of property to another person without any exchange of money. The document is often used to give a gift of real property or personal property to family members or friends. In Texas, the laws regarding the transfer of property through a Gift Deed are specific to the state and must comply with the Texas Property Code.

This template is designed to provide a general outline of what a Texas Gift Deed might contain. It is important to consult with a legal professional to ensure that all state-specific requirements are met.

Gift Deed Information

Please fill in the following information where applicable:

- Date of Gift:

- Donor's Full Name:

- Donor's Address:

- Recipient's Full Name:

- Recipient's Address:

- Description of the Gift (include property address if real estate):

- Reason for the Gift (optional):

Gift Deed Statement

I, ________[Donor's Full Name]________, residing at ________[Donor's Address]________, hereby gratuitously and irrevocably give, transfer, and assign to ________[Recipient's Full Name]________, residing at ________[Recipient's Address]________, the following described property: ________[Description of the Gift]________.

This gift is made freely, without any consideration, reservation, or expectation of return or compensation. The Donor warrants that the Donor has the legal capacity to give this gift and that the gift is made free of any liens or encumbrances, except as specifically stated herein.

Signatures

This Gift Deed is executed this ___ day of __________, 20__.

Donor's Signature: ___________________________

Recipient's Signature: ___________________________

State of Texas

County of ____________

On this ___ day of __________, 20__, before me, the undersigned, a Notary Public in and for said state, personally appeared ________[Donor's Full Name]________ and ________[Recipient's Full Name]________, known to me (or satisfactorily proven) to be the persons whose names are subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Public Signature: ___________________________

My Commission Expires: ___________________________

PDF Specifications

| Fact | Description |

|---|---|

| Purpose | A Texas Gift Deed is used to give property or assets to someone else without any expectation of payment or compensation. |

| Governing Law | It is governed by the Texas Property Code, specifically sections relevant to the transfer of real property. |

| Recording Requirement | For real estate, the deed must be filed with the county clerk in the county where the property is located to be effective against third parties. |

| Consideration Statement | Although no payment is exchanged, the deed often states "for love and affection" as the consideration to satisfy legal requirements. |

| Signature Requirements | The deed must be signed by the giver (donor) and, in Texas, should also be notarized to ensure its validity. |

| Witnesses | While Texas does not require witnesses for the signing of a Gift Deed, having witnesses or a notarial acknowledgement can provide additional proof of the transaction. |

Instructions on Writing Texas Gift Deed

In Texas, a Gift Deed is a legal document used to transfer ownership of real property from one person (the donor) to another (the donee) without any payment or consideration. This transfer is often made during the donor's lifetime as a form of gift. A properly executed Gift Deed not only facilitates the transfer of property rights but also provides a record of the gift for both legal and tax purposes. Before filling out a Texas Gift Deed, it’s important to understand the steps involved in preparing the document to ensure it meets all legal requirements in Texas. The process includes accurately describing the property, identifying the parties involved, and complying with state laws regarding the signing and recording of the deed.

- Begin by entering the Preparer's Information: Include the name and address of the person completing the form. This ensures any correspondence related to the deed can be directed appropriately.

- Next, input the Return Address: Specify where the recorded deed should be sent after processing. This is usually the address of the donee.

- List the Donor's Information: Write the full legal name and mailing address of the current property owner who is gifting the property.

- Fill in the Donee's Information: Provide the full legal name and mailing address of the individual who is receiving the gift of property.

- Provide a Legal Description of the Property: This detailed description is crucial for accurately identifying the property being transferred. It can often be found on the current deed or the county’s official records.

- State the County in which the property is located: This determines where the Gift Deed will be filed and recorded.

- Include any Additional Provisions if necessary: While not always required, this section can specify any conditions or rights being transferred with the property, such as access rights.

- Sign and Notarize the Deed: The donor must sign the deed in front of a notary public. The notary will then fill out their section, confirming the identity of the signer and that the signer executed the deed willingly.

- File the Deed with the County Clerk's Office: After the Gift Deed is properly executed, it needs to be filed with the county clerk in the county where the property is located. Filing fees will apply.

Following these steps carefully will help ensure the Gift Deed is legally valid and the property transfer is properly recorded. It’s recommended to consult with a legal professional or real estate expert when preparing and filing a Gift Deed to avoid any potential issues in the process.

Understanding Texas Gift Deed

What is a Texas Gift Deed?

A Texas Gift Deed is a legal document used to transfer ownership of property from one person (the donor) to another (the donee) without any payment or consideration. This form of property transfer is often used between family members or close friends and is recognized under Texas law when properly executed and recorded.

How can I properly execute a Texas Gift Deed?

To properly execute a Texas Gift Deed, the document must be in writing, contain the legal description of the property being gifted, and the names of the donor and donee. The deed must be signed by the donor in the presence of a notary public. Afterward, it should be filed with the county clerk's office in the county where the property is located to be effective.

Is a Texas Gift Deed subject to any taxes?

While the transfer of property via a Gift Deed may not be subject to the typical sales taxes, it can have implications for federal gift taxes. Donors should consult with a tax professional to understand any tax liabilities, as they may need to file a gift tax return if the value of the property exceeds the annual federal gift tax exclusion amount.

Can I revoke a Texas Gift Deed after it's been executed?

In general, once a Gift Deed has been properly executed and delivered to the donee, the donor cannot revoke it. It creates an immediate transfer of property rights. Thus, individuals considering a gift of property should be sure of their decision before proceeding.

What happens if the donee does not outlive the donor?

If the donee does not outlive the donor, the property may revert to the donor or the donor's estate, depending on the specific terms outlined in the Gift Deed and the applicable state law. It is essential to clearly state the conditions in the deed to cover such possibilities.

Does a Texas Gift Deed guarantee that the property is free from all encumbrances?

A Texas Gift Deed does not inherently guarantee that the property is free from all liens, mortgages, or other encumbrances. A thorough title search is recommended to identify any potential issues. The donor should disclose any known encumbrances in the deed.

Where should a Texas Gift Deed be filed?

After being notarized, a Texas Gift Deed should be filed with the County Clerk’s office in the county where the property is located. This step is crucial for the deed to be considered valid and to put the public on notice of the new ownership.

Common mistakes

When filling out a Texas Gift Deed form, people often overlook the significance of ensuring every detail is accurate and complete. This form is a legal document used to give property or assets from one person to another without any exchange of money. Although it might seem straightforward, there are several common mistakes to be diligent about avoiding.

One frequent error is failing to provide the full legal description of the property being gifted. While a street address might seem sufficient, the Gift Deed requires a detailed legal description to unequivocally identify the property. This might include lot numbers, subdivision names, and other specific information that ties the property to the public record.

Another mistake is neglecting to have the Gift Deed notarized. In Texas, for the deed to be valid and legally binding, it must be notarized. This process involves having a notary public witness the signing of the document, verifying the identity of the parties involved, and then signing and stamping it themselves. Without notarization, the transfer of property might not be recognized legally, which could lead to significant complications down the line.

People often incorrectly assume that a Gift Deed does not require witness signatures. Although Texas law does not mandate witnesses for the signing of a Gift Deed, having disinterested third parties witness the document can add an extra layer of legality and may help in validating the deed if it's ever disputed.

Not clearly stating the intention to gift is another common oversight. The language used in the deed must unequivocally convey the grantor's desire to make a gift of the property to the grantee, with no expectation of payment or compensation. Ambiguities in the wording can lead to interpretation issues and potentially invalidate the deed.

Forgetting to file the Gift Deed with the county clerk's office is a critical mistake. Once the Gift Deed is completed and notarized, it must be recorded with the clerk in the county where the property is located. This public recording formally completes the process of transferring ownership and ensures the gift is recognized under state law.

A somewhat less known error is neglecting to consider the gift tax implications of transferring property. While the act of gifting itself might seem straightforward, there may be federal tax responsibilities that come with a large-scale transfer of ownership. Individuals should consult with a tax professional to understand any potential financial obligations.

Lastly, an all-too-common mistake is attempting to use a Gift Deed to transfer property as a way to avoid creditors or legal responsibilities. Such actions can be deemed fraudulent. Transferring property via a Gift Deed does not relieve the grantor of liabilities associated with the property before the transfer, and attempting to do so can have legal repercussions.

Documents used along the form

When you're transferring property as a gift in Texas, a Gift Deed form is a crucial document. However, this form doesn't stand alone in the process. Several other forms and documents might be needed to ensure that the property transfer goes smoothly and complies with Texas law. These documents range from those confirming the property's legal status to those that might dictate specific conditions of the transfer. Understanding each of these documents will help streamline the gifting process.

- Warranty Deed - Used to officially transfer property from the seller to the buyer, guaranteeing that the title is free and clear of any claims.

- Special Warranty Deed - Similar to the Warranty Deed but with limited guarantees, only covering the period of the seller's ownership.

- Quitclaim Deed - Transfers any interest the grantor might have in the property without any warranties of clear title.

- Transfer on Death Deed (TODD) - Allows property owners to name a beneficiary who will obtain the property upon the owner's death, bypassing probate.

- General Warranty Deed - A more inclusive version of a Warranty Deed that provides a full guarantee of clear title against all claims and is not limited to the period of the seller's ownership.

- Mineral Rights Deed - Used specifically to transfer mineral rights of a property, either in part or whole, from the grantor to the grantee.

- Property Tax Forms - Necessary for updating the ownership records for taxation purposes and ensuring all property taxes are current.

- Affidavit of Heirship - Utilized when property needs to be transferred to an heir after the original owner's death, specifically when no will is present.

- Title Search Documents - Perform to verify the legal owner of the property and to discover any claims or liens against the property.

Together, this suite of forms and documents supports the legal transfer of property in Texas, whether it's through a gift deed or other means. Each document serves its own purpose, from establishing heirs in the absence of a will to ensuring clear ownership through a title search. Using the appropriate documents in conjunction with a Texas Gift Deed ensures that your generous act is legally sound, protecting both the giver's and receiver’s interests.

Similar forms

The Texas Gift Deed form shares similarities with a Last Will and Testament, primarily in its function to transfer personal property from one individual to another. While the Gift Deed becomes effective immediately without the need for the giver’s passing, both documents dictate the transfer of an asset from one party to another. The Last Will and Testament takes effect upon the individual's death, detailing the distribution of their assets to designated beneficiaries, just as the Gift Deed specifies the recipient of a gift during the giver's lifetime.

Comparable to the Warranty Deed, the Texas Gift Deed form also involves the transfer of property rights. However, whereas the Gift Deed involves the transfer of property as a gift without any exchange of money, the Warranty Deed is typically used in sales transactions and includes guarantees from the seller to the buyer that the property is free from any undisclosed encumbrances. Both serve the primary goal of changing property ownership, but under different conditions and assurances.

Similar to a Quitclaim Deed, the Texas Gift Deed form involves the transfer of property interest from one individual to another. Quitclaim Deeds are often used to transfer property without a traditional sale or exchange, akin to the Gift Deed, but without the guarantee that the grantor holds clear title to the property. Both documents are instrumental in non-commercial property transfers, emphasizing the intent and rights transferred rather than financial transactions.

The Texas Gift Deed form is akin to a Transfer-on-Death Deed (TODD) in that both allow for the transfer of property to a beneficiary upon the death of the property owner. While the Gift Deed facilitates an immediate transfer without the necessity of the giver's death, TODD offers a mechanism for individuals to name beneficiaries for their property, effective upon their passing. Both deeds bypass the probate process, albeit under different circumstances.

Reflective of a Trust Instrument, the Texas Gift Deed enables an individual to transfer property to another. Trust Instruments appoint a trustee to manage property on behalf of a beneficiary, which can include transferring property to that beneficiary. Though the context differs—with trust instruments often used for managing assets until certain conditions are met—the essence of transferring property rights from one party to another remains central to both documents.

Similarities can be drawn between the Texas Gift Deed form and a Power of Attorney (POA) in terms of allowing individuals to manage property and affairs on another's behalf. A POA may include provisions for gifting assets, which could mimic the action of executing a Gift Deed. While POA encompasses a broader scope of actions beyond property transfer, including making medical or financial decisions, both it and the Gift Deed involve designated individuals managing assets in some capacity.

Like a Bill of Sale, the Texas Gift Deed form is used to document the transfer of property from one party to another. The Bill of Sale is commonly associated with the sale and purchase of personal property, providing proof of change of ownership. Although the Gift Deed is specifically for gifts without any consideration exchanged, both documents serve as important records of property transfer between individuals.

The Texas Gift Deed form and the Beneficiary Deed share a common purpose in designating individuals to receive property. While Beneficiary Deeds are commonly used to transfer real estate upon the death of the property owner without going through probate, the Gift Deed allows for immediate transfer during the giver’s lifetime. Both mechanisms provide a way to bypass lengthy and potentially costly court processes, facilitating smoother transitions of ownership.

An Affidavit of Heirship is another document related to the Texas Gift Deed form, as both relate to the transfer of property interests. An Affidavit of Heirship is used when someone dies without a will, identifying legal heirs and facilitating the transfer of property. Although one document is used posthumously and the other during a person's lifetime, both are integral in identifying rightful recipients of property when traditional conveyance methods are not employed.

Lastly, the Texas Gift Deed form is analogous to a Living Trust in that both afford a method to transfer property. A Living Trust allows an individual to transfer property into a trust for the benefit of others while still alive, with the property passing to the beneficiaries upon the individual's death. Both the Living Trust and the Gift Deed enable the distribution of assets without the need for probate, yet they do so in markedly different legal contexts and structures.

Dos and Don'ts

Filling out a Texas Gift Deed form is an important step in transferring property ownership without payment. It's a generous act, but it requires careful attention to detail to ensure the process goes smoothly. Below are key dos and don'ts to consider:

- Do ensure that all the information provided is accurate. Mistakes could make the deed void or create legal disputes down the line.

- Do verify that both the giver (donor) and the receiver (donee) meet the legal requirements for participating in the transaction. For instance, they must be of legal age and sound mind.

- Do clearly describe the property being gifted to avoid any confusion. Include detailed information like the property address and any identifiers that are part of public record.

- Do check if you need to pay the Federal Gift Tax, or if any exemptions apply. The laws may change, so it's important to be up-to-date.

- Don't leave any fields incomplete on the form. Each section is important for the deed's validity and legal standing.

- Don't sign the deed without the presence of a notary public. Their official seal and signature are required to authenticate the document.

- Don't forget to file the completed deed with the county clerk's office where the property is located. This step is crucial for making the deed public record and finalizing the transfer.

- Don't use the deed to transfer property that you do not own outright or is currently mortgaged without consulting with a legal professional. This can lead to complicated legal situations.

Completing a Texas Gift Deed form is a significant gesture that can have a lasting impact on both parties involved. Paying attention to detail and following these guidelines can help ensure that the process is completed as smoothly and effectively as possible. If you're unsure about any part of the process or if your situation involves complex legal issues, it may be wise to seek professional advice.

Misconceptions

When it comes to transferring property, many people in Texas consider using a Texas Gift Deed form. However, there are several common misconceptions surrounding this legal document. It's important to clear up these misunderstandings to ensure that property is transferred smoothly and legally.

Gift Deeds are complicated: Many believe that creating a Gift Deed in Texas is a complex process. In reality, it's quite straightforward. The form needs to be completed accurately and should meet all legal requirements, but it's generally less complicated than other property transfer documents.

Notarization isn't important: This is a significant misconception. In Texas, for a Gift Deed to be valid, it must be notarized. Notarization confirms the identity of the parties involved and ensures that the document is legally binding.

Gift Deeds are only for real estate: Some people think Gift Deeds can only be used for transferring real estate. In truth, they can be used to gift various types of personal and real property, though it's most commonly used for real estate transactions.

No tax implications: It's incorrectly assumed there are no tax implications when using a Gift Deed. However, there may be federal gift tax consequences depending on the value of the gift. It's always recommended to consult with a tax professional.

All property can be transferred with a Gift Deed: This isn't always the case. Certain types of property or situations may not be suitable for a Gift Deed. It's essential to understand the legal restrictions and guidelines surrounding property gifts.

Once signed, it can't be changed: People often think that once a Gift Deed is signed, it cannot be altered. While it's true that making changes after execution can be challenging, modifications can be made before all parties sign and the document is notarized.

Gift Deeds protect the giver from future liability: Unfortunately, this isn't guaranteed. Depending on the circumstances and how the deed is drafted, the giver might still face some risks or liabilities. Consulting with a legal professional can help minimize such risks.

Understanding the facts about the Texas Gift Deed form can alleviate many worries and misconceptions. When considering the transfer of property through a Gift Deed, seeking the advice of a legal professional is always best. This ensures that the process is completed accurately and aligns with all legal requirements.

Key takeaways

In Texas, utilizing a Gift Deed form is a formal way to transfer property freely from one person to another. It's a generous act, often between family members, that sidesteps the usual buying and selling process. However, navigating the intricacies of this form and ensuring its proper use is essential. Here are key takeaways to consider:

- A Gift Deed must be in writing: Oral promises to gift property do not hold up in Texas courts. A written document is necessary to legally transfer ownership without consideration (payment).

- The donor's intention to give and the acceptance by the donee are critical elements: The document must clearly indicate the donor's intention to make a gift of the property to the donee, who must accept the gift for the deed to be valid.

- Legal descriptions and exact details are crucial: The Gift Deed form should include a precise legal description of the property being gifted. This ensures the property is accurately identified and transferred.

- Notarization is required: For a Gift Deed to be legally valid in Texas, it must be signed by the donor in the presence of a notary public. This formalizes the deed and helps protect against fraud.

- Recording the deed is essential for protecting the donee's interest: Once signed and notarized, the deed should be filed with the county clerk's office in the county where the property is located. This public record solidifies the donee's legal claim to the property.

- No revocation: Once a Gift Deed has been executed and delivered, the donor cannot revoke or take back the gift without the donee's consent. This irreversible transfer emphasizes the importance of certainty in the donor's intentions.

Understanding these key points ensures that both the donor and donee can approach the gift transfer with confidence and clarity. Whether it's a piece of treasured real estate or a cherished family home, handling the transfer through a Gift Deed in Texas respects the legal process while celebrating the spirit of giving.

More Gift Deed State Forms

Gift Deed California - Provides a clear record of the transfer of a gift from one person to another, ensuring transparency.