Fillable Gift Deed Document for Georgia

In the beautiful state of Georgia, the act of giving takes on a formal process through the Gift Deed form, a document that stands as a beacon of generosity, allowing individuals to transfer property to others with the warmth of a gift. This legal instrument is crafted with precision, ensuring that the giver's intentions are clearly stated and legally recognized, which provides peace of mind for all parties involved. As it navigates through the specific requirements set by Georgia law, the form encapsulates details such as the identification of the donor and recipient, along with a comprehensive description of the gift itself. Beyond its basic function, the form also dips into nuances like tax implications and the need for notarization, ensuring that the process is as smooth as it is heartfelt. Its meticulous nature is designed to fortify the bond between giver and receiver, making it an essential tool for anyone looking to transfer property without the exchange of money, thereby embodying the true essence of giving.

Document Example

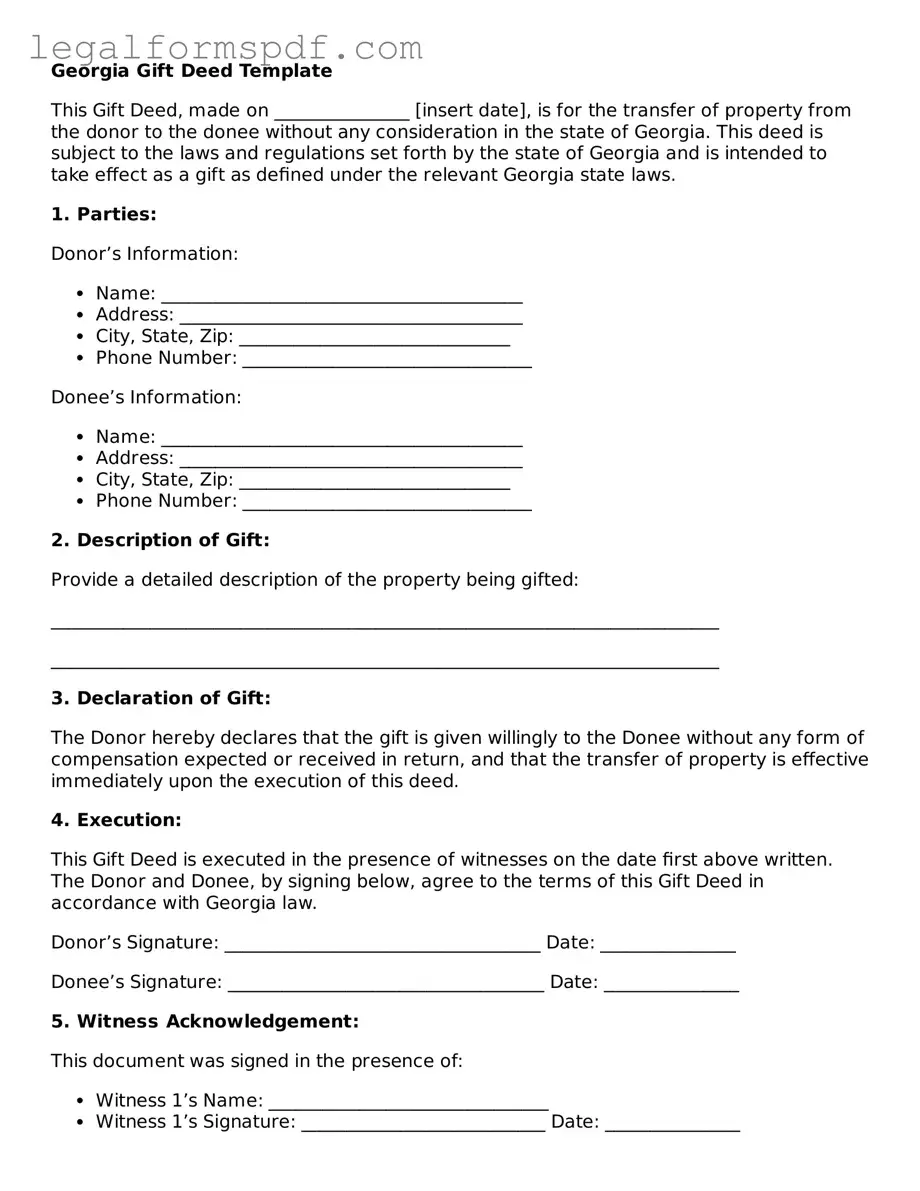

Georgia Gift Deed Template

This Gift Deed, made on _______________ [insert date], is for the transfer of property from the donor to the donee without any consideration in the state of Georgia. This deed is subject to the laws and regulations set forth by the state of Georgia and is intended to take effect as a gift as defined under the relevant Georgia state laws.

1. Parties:

Donor’s Information:

- Name: ________________________________________

- Address: ______________________________________

- City, State, Zip: ______________________________

- Phone Number: ________________________________

Donee’s Information:

- Name: ________________________________________

- Address: ______________________________________

- City, State, Zip: ______________________________

- Phone Number: ________________________________

2. Description of Gift:

Provide a detailed description of the property being gifted:

__________________________________________________________________________

__________________________________________________________________________

3. Declaration of Gift:

The Donor hereby declares that the gift is given willingly to the Donee without any form of compensation expected or received in return, and that the transfer of property is effective immediately upon the execution of this deed.

4. Execution:

This Gift Deed is executed in the presence of witnesses on the date first above written. The Donor and Donee, by signing below, agree to the terms of this Gift Deed in accordance with Georgia law.

Donor’s Signature: ___________________________________ Date: _______________

Donee’s Signature: ___________________________________ Date: _______________

5. Witness Acknowledgement:

This document was signed in the presence of:

- Witness 1’s Name: _______________________________

- Witness 1’s Signature: ___________________________ Date: _______________

- Witness 2’s Name: _______________________________

- Witness 2’s Signature: ___________________________ Date: _______________

This Gift Deed is acknowledged by the Donor and Donee and signed in the presence of the witnesses, making it effective and binding in the state of Georgia.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Georgia Gift Deed is a legal document used to transfer property from one person to another without any payment or consideration in Georgia. |

| Governing Law | The Georgia Code Title 44 property law governs the use and execution of Gift Deeds in the state of Georgia. |

| Revocability | A Gift Deed, once delivered and accepted, is irrevocable without the consent of the beneficiary. |

| Delivery and Acceptance | The Gift Deed must be delivered to the grantee and accepted by the grantee to be effective. |

| Recording | For the deed to be effective against third parties, it must be recorded with the local county's Clerk of Superior Court. |

| Witness Requirement | In Georgia, a Gift Deed must be signed in the presence of at least two witnesses who are not parties to the deed. |

| Notarization | The Gift Deed must be notarized to be considered valid for recording in the state of Georgia. |

| No Consideration | A Gift Deed transfers property without monetary compensation or consideration, distinguishing it from sale transactions. |

| Tax Implications | While a Gift Deed can transfer property without consideration, there may still be tax implications for the giver or recipient under federal and state law. |

Instructions on Writing Georgia Gift Deed

Filling out a Georgia Gift Deed form is a process that individuals go through to voluntarily transfer ownership of their property to someone else without any exchange of money. The procedure ensures that the gift is legally recognized and that the rights to the property are properly transferred. It's paramount to approach this task with attention to detail to ascertain that every section of the form is accurately completed, ensuring the gift's legality and preventing any potential complications in the future. Below are step-by-step instructions to guide you through filling out the form.

- Start by identifying the current property owner (the donor) and write down their full legal name along with their complete address, including city, state, and zip code.

- Next, provide the full legal name and complete address of the recipient (the donee) of the gift. Ensure all details mirror their legal documents for consistency.

- Describe the gifted property in detail. This includes the physical address and any identifying details such as parcel numbers or legal descriptions found in property records. Accuracy here is crucial to properly identify the property in question.

- For the signature section, the donor must sign the form in front of a notary public. This step is essential as it verifies the identity of the donor and affirms that the signature was made willingly and not under duress.

- The notary public will then complete their section, which includes noting the date of signing, attaching their seal, and signing the form themselves. This official seal and signature lend legal credibility to the entire document.

- Finally, record the completed gift deed with the local county recorder's office where the property is located. This step is necessary for the deed to be recognized publicly as a legal document and for the transfer of ownership to be officially noted in the county's records.

Note: While filling out the form, it is advisable to consult with a legal professional to ensure that all aspects of the gift deed comply with Georgia law and that you understand the potential tax implications of gifting property. Each step must be approached with care to ensure the validity of the document and the successful transfer of property.

Understanding Georgia Gift Deed

What is a Georgia Gift Deed form?

A Georgia Gift Deed form is a legal document used to transfer property from one person to another as a gift. This means no payment is exchanged between the giver (donor) and the receiver (donee). It's a way to give a gift that has significant value, like a piece of real estate or a vehicle, with a formal record of the transfer. In Georgia, this deed must be properly executed, signed, and notarized to be considered valid.

Do I need to file a Gift Deed form in Georgia with any government office?

Yes, after the Gift Deed is properly filled out, signed, and notarized, it needs to be filed with the appropriate county's Recorder's Office (or Clerk of the Courts in some counties) where the property is located. Filing this document makes the transfer public record, which is important for the clarity of property ownership and for the protection of the donee's rights.

How can I avoid paying gift tax when using a Gift Deed in Georgia?

While the Georgia Gift Deed form itself facilitates the transfer of property as a gift, the issue of gift tax is governed by federal law, not state law. As of the last known update, individuals can give up to $16,000 per year to another person without having to pay gift tax, thanks to the annual exclusion. Married couples can double this amount to $32,000 per donee per year. For gifts that exceed these amounts, you may need to file a gift tax return, although payment of the tax might not necessarily be required due to the lifetime estate and gift tax exemption. It’s always wise to consult with a tax advisor for the most current regulations and personal advice.

Can a Georgia Gift Deed be revoked?

Generally, once a Gift Deed is executed, delivered, accepted by the donee, and filed with the proper county office, it cannot be revoked. This transfer is considered irrevocable as the donor has voluntarily relinquished ownership and control over the property without expecting something in return. If conditions or circumstances necessitate revoking the deed, it's recommended to seek legal counsel as this can be complex and might require specific legal actions or the agreement of both parties.

Is a witness required for the signing of a Georgia Gift Deed?

In addition to requiring a notary public to notarize the signatures on the Gift Deed, Georgia law also requires the presence of two disinterested witnesses at the time of signing. Disinterested means that the witnesses cannot be parties to the deed (i.e., they cannot be the donor or donee) and must not stand to benefit from the transfer of the property. Having these witnesses adds to the legal strength of the deed and helps ensure that the document's execution is above suspicion.

Common mistakes

When preparing a Georgia Gift Deed form, individuals often overlook essential details that could significantly impact the legality and effectiveness of the document. One common error is neglect to properly describe the property being gifted. This description should be detailed and precise, ensuring that there is no ambiguity about what property is being transferred. A vague or incomplete description can lead to disputes or challenges down the line which might complicate the transfer process or invalidate the deed altogether.

Another mistake is failing to obtain the necessary witnesses or notary public to validate the deed. In Georgia, as in many states, a gift deed must be witnessed and notarized to be considered legally valid. Some people either forget this step or assume it’s a mere formality. However, the absence of a notary's seal or witness signatures can render the document legally ineffective, potentially nullifying the property transfer.

Additionally, individuals sometimes do not consider the tax implications of gifting real property. While gifting property can seem like a straightforward process, there might be federal or state tax consequences that could affect both the giver and the receiver. Seeking advice from a tax professional before completing a gift deed can prevent unexpected liabilities and ensure that all parties are fully informed of their obligations.

People often mistakenly believe that once a gift deed is filled out and signed, the document alone completes the property transfer. However, for the transfer to be officially recognized, the deed must be recorded with the relevant county office in Georgia. This crucial step finalizes the process, legally transferring ownership and ensuring the deed is part of the public record. Neglecting to record the document may leave the transfer incomplete and the property's title unclear.

Another significant oversight is not clearly stating the intent to gift. The language used in the gift deed must unequivocally indicate that the property is being given as a gift without any expectation of payment or compensation. Any ambiguity in the wording can lead to legal challenges, potentially invalidating the deed.

Using an outdated or incorrect form is a pitfall that catches many off guard. Real estate and property laws can change, and using a form that is not current can result in a gift deed that does not comply with the latest legal requirements. It’s imperative to use the most recent form available that accurately reflects Georgia law to ensure the gift deed is valid.

Lastly, a common mistake is not consulting with a legal professional before finalizing the gift deed. While it may seem straightforward, the process can have legal nuances best navigated with professional guidance. An attorney can provide advice tailored to the specific situation, ensuring that the deed is correctly filled out, the transfer adheres to all legal standards, and the parties' interests are fully protected.

Documents used along the form

When completing a Gift Deed in Georgia, various other forms and documents often accompany the central document to ensure a smooth and legally compliant transfer of property. The Gift Deed itself is a legal instrument used to gift property from one person to another without any exchange of value. It's crucial in such transfers to have all necessary paperwork in order to fulfill legal requirements and secure the rights of both parties involved. The documents listed below are commonly utilized alongside the Georgia Gift Deed to provide clarity, legal protection, and compliance with state regulations.

- Real Estate Transfer Tax Form: This document is necessary for property transfers, as it declares the tax due on the transaction. In the case of a gift deed, this may often show a nominal amount or be exempt, subject to specific conditions.

- Property Tax Forms: Used to update the county property records for tax assessment purposes. The transfer of ownership through a gift deed needs to be reflected in these records.

- Georgia Warranty Deed: In instances where the giver assures the recipient about the clear title of the property, this form might be used alongside the Gift Deed for extra protection.

- Title Search Report: Before the transfer, a title search is advisable to ensure there are no liens, debts, or other encumbrances on the property. This report provides peace of mind to the recipient.

- Affidavit of Legal Value: While not always mandatory, this affidavit may be requested to assert the transaction's value or the lack thereof in the case of a gift, helping to determine tax implications.

- Homestead Exemption Application: If the gifted property will be the recipient's primary residence, this form is essential to apply for a homestead exemption on property taxes.

- Declaration of Residence: This could be necessary if the recipient plans to make the property their primary residence, particularly if moving from out of state.

- Quit Claim Deed: In some cases, this document may be used in addition to or instead of a gift deed for a simpler transfer process, though it offers less protection for the recipient.

Collecting and completing these supporting documents can streamline the process of transferring property via a Gift Deed in Georgia. It’s important for both parties involved—the one giving and the one receiving—to understand the role each document plays in the transaction. Proper preparation and submission of these forms not only comply with legal standards but also secure the ownership rights of the property for the recipient. Consultation with a legal professional may be beneficial to navigate this process effectively.

Similar forms

The Grant Deed is similar to the Georgia Gift Deed in that both involve the transfer of property ownership. A Grant Deed not only transfers ownership from the grantor to the grantee but also promises that the property has not been sold to someone else. Unlike a Gift Deed, which is often used to transfer property as a gift without payment, a Grant Deed is typically used in sales transactions where the property is bought and sold.

Like the Georgia Gift Deed, the Quitclaim Deed is used to transfer property rights. However, the Quitclaim Deed does not guarantee that the property title is clear. It simply transfers whatever interest the grantor has in the property, which may be none at all. This contrasts with the Gift Deed, where the donor often implicitly assures that they own the property free and clear, though this assurance is not as strong as the one provided in a Grant Deed.

A Warranty Deed shares similarities with the Gift Deed because it is another form of transferring property titles. The key difference lies in the level of protection offered to the buyer. The Warranty Deed provides the strongest guarantee of a clear title, asserting that the grantor holds the full right to transfer the property and ensuring protection against future claims on the property. In comparison, the Gift Deed offers no such guarantees beyond the basic transfer of ownership.

The Deed of Trust is often brought up alongside the Georgia Gift Deed, as both are involved in property transactions. A Deed of Trust is used to secure a loan on a property, where the property is held as collateral by a trustee until the loan is paid off. Unlike the Gift Deed, which is a straightforward transfer of property without financial encumbrances, the Deed of Trust plays a pivotal role in financing arrangements.

The Transfer-on-Death (TOD) Deed, also similar to the Georgia Gift Deed, facilitates the transfer of property but does so upon the death of the property owner. It allows property to bypass the probate process, immediately transferring to a named beneficiary. While the Gift Deed transfers property ownership immediately and without strings attached, the TOD Deed waits until a specific event—the owner's death—before activating the transfer.

Lastly, the Life Estate Deed shares characteristics with the Georgia Gift Deed because it involves the transfer of property rights. In a Life Estate Deed, the grantor transfers property to the grantee but retains the right to use the property until their death. This contrasts with a Gift Deed where the transfer is unconditional, and the giver relinquishes all rights to the property upon transfer.

Dos and Don'ts

Filling out the Georgia Gift Deed form correctly is pivotal in ensuring the smooth transfer of property. This form, used to gift property from one person to another without any exchange of money, must be filled out with precision to ensure its legality and effectiveness. Below are nine critical dos and don'ts to guide you through this process.

Do:Ensure all the parties' full legal names are accurately entered. This includes the giver (donor) and the receiver (donee) of the gift.

Describe the property in detailed terms. Include an accurate and complete legal description of the property being gifted.

Sign the form in the presence of a notary public. Georgia law requires notarization for the Gift Deed to be legally valid.

Provide any additional documentation that may be required for the transfer. This can include a title search to prove ownership.

File the completed deed with the local county recorder’s office where the property is located.

Omit any personal information for both the donor and donee, such as addresses or identification, which might be required to confirm their identities.

Forget to check if the county recorder's office has additional filing requirements or fees.

Assume that a Gift Deed eliminates the need for a will or other estate planning documents. Gift Deeds work within a broader estate plan.

Rely on generic forms without confirming they comply with Georgia's specific legal requirements. State laws vary, and using a form not tailored to Georgia can invalidate the deed.

Misconceptions

When it comes to transferring property in Georgia, many people opt for a gift deed—a legal document that facilitates the giving of property to another person without any exchange of money. However, several misconceptions exist about the Georgia Gift Deed form. Let's clarify some of the most common misunderstandings:

- A Georgia Gift Deed is not formal. Contrary to what some believe, a gift deed must be formally executed. It requires specific language to ensure it is legally valid and enforceable. This includes accurately identifying the donor, the recipient, and a clear statement of intent.

- It doesn’t need to be recorded to be valid. While a Georgia Gift Deed becomes legally effective between the parties once it is properly executed, recording it with the local county recorder’s office protects the recipient's interest and ensures the transfer is recognized publicly.

- Any property can be transferred with no restrictions. Not all property can be transferred using a gift deed. Certain types of property, such as those with existing liens or restrictions, may not be eligible, or they might require additional documentation or steps for a successful transfer.

- No tax implications exist. This is a common misunderstanding. While the act of gifting property does remove it from one's estate, potentially minimizing estate taxes upon death, the donor might still face federal gift tax implications. Always consult with a tax advisor to understand the full scope.

- Witnesses are not necessary for the deed to be legal. Georgia law requires a gift deed to be signed in the presence of a notary and one additional witness for it to be considered valid and enforceable.

- Once given, property can be taken back at any time. A gift, once completed and legal, conveys full ownership to the recipient. The original owner relinquishes all rights and cannot reclaim the property unless the recipient agrees to transfer it back voluntarily.

- A verbal agreement is sufficient for small properties. Despite the size or value of the property, a legal, written gift deed is required to transfer ownership of any real property in Georgia. Verbal agreements are not recognized for this purpose.

- The recipient is responsible for all costs associated with the deed. Typically, the donor handles all costs related to the preparation and recording of the gift deed unless an agreement between the parties states otherwise. This may include notary fees, recording fees, and any other expenses.

- It's simple and doesn't require legal advice. While it's true that the process of gifting property can be straightforward, consulting with a legal professional is wise. They can ensure the deed complies with all state laws and regulations and that your interests are fully protected.

Understanding these common misconceptions about the Georgia Gift Deed form can help ensure a smooth and legally sound property transfer. Always seek professional advice to navigate the specifics of your situation accurately.

Key takeaways

When it comes to transferring property in Georgia, a gift deed can be a straightforward solution. Understanding the key components and legal requirements for properly completing and using a Georgia Gift Deed form is essential. The following takeaways aim to guide individuals through the process, ensuring that the deed is legally effective and reflects the donor's intentions.

- Eligibility of the Gift Deed: Only property located in Georgia can be transferred using a Georgia Gift Deed form. This ensures that the document adheres to state-specific laws and regulations.

- Required Information: The form needs to be thoroughly completed, including the full names and addresses of the donor (the person giving the property) and the recipient (the person receiving the property). Clear identification helps prevent any future disputes or confusion.

- No Consideration: A fundamental aspect of the gift deed is that the transfer is made without expecting anything in return. Documentation should clearly state that no consideration is involved, differentiating it from a sale.

- Legal Description of the Property: A detailed legal description of the property being gifted is necessary. This description goes beyond the physical address, including the property's dimensions and any applicable legal identifiers, ensuring precise identification.

- Signatures and Notarization: The gift deed must be signed by the donor in the presence of a notary public. This process formalizes the document, providing a layer of legal authenticity and validation.

- Witness Requirements: Depending on local law, witness(es) may also need to sign the deed. Their signatures further corroborate the donor's intention and the document's legitimacy.

- Filing with the County: After completion, the signed and notarized gift deed should be filed with the local county recorder's office. Filing is a critical step to make the property transfer public record, ensuring legal recognition and enforcement.

Properly filling out and using a Georgia Gift Deed form is crucial for a smooth property transfer process. By following these key takeaways, individuals can help protect everyone's interests, ensuring that the gift is legally effective and meets all necessary requirements.

More Gift Deed State Forms

Texas Gift Deed Form - In some states, the donee may also need to sign the document, acknowledging receipt of the gift.