Fillable Gift Deed Document for California

In the scenic state of California, where the transfer of real estate or personal property is often a cause for celebration, the California Gift Deed form stands out as a crucial document. This form, vital for smoothly passing assets from one party to another without any expectation of payment, symbolizes generosity and thoughtfulness. It lays down a clear, legal pathway for individuals wishing to gift property to family members, friends, or charities, ensuring that the transfer is recognized and respected under state law. Not only does it help in avoiding potential misunderstandings or disputes among those involved, but it also adheres to the specific regulatory requirements of California. The form meticulously records the donor's intention to make a gift, the description of the gift itself, and the recipient's acceptance, all vital for the deed's legal standing. Furthermore, by detailing the process of how these properties can change hands, it guides donors in navigating the complexities of property gifting, making it a beacon for anyone looking to express their generosity in a manner that is both heartfelt and legally sound.

Document Example

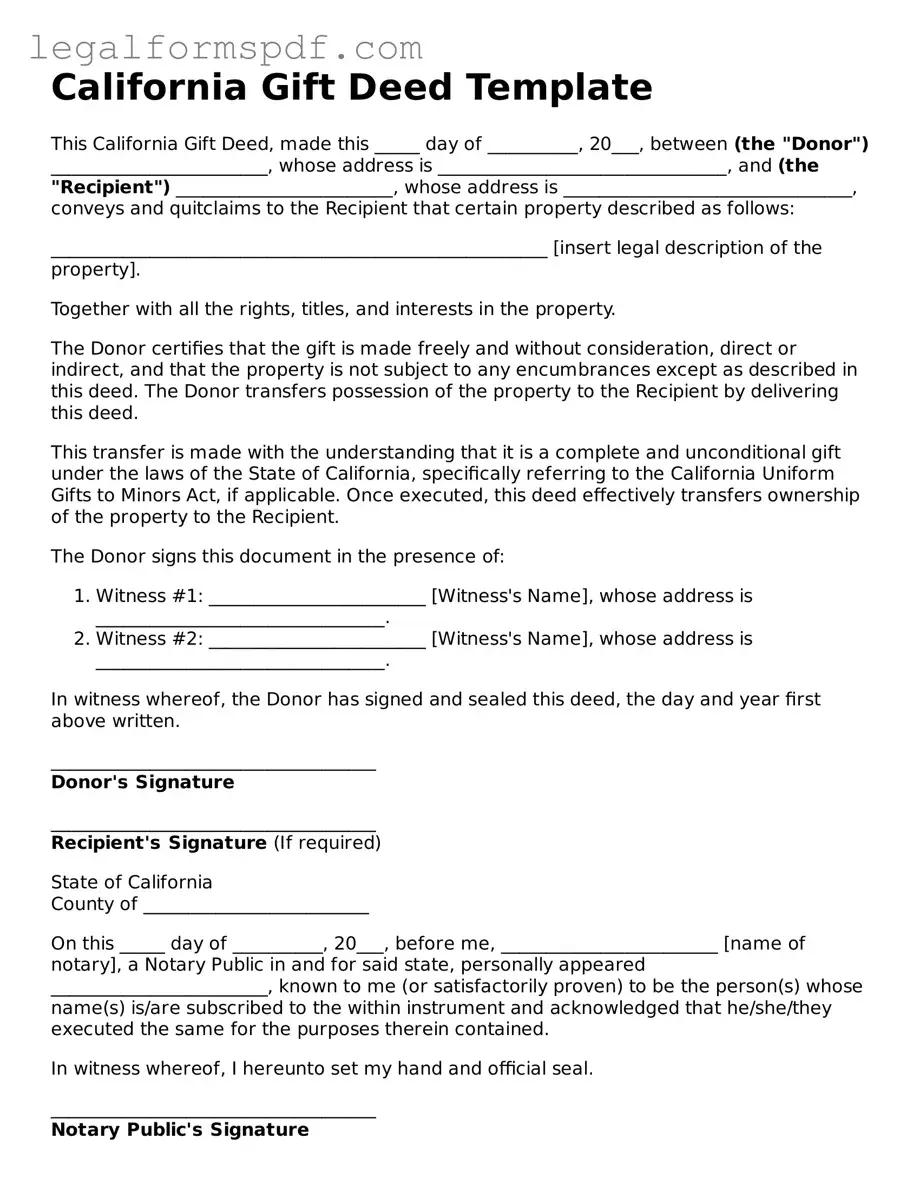

California Gift Deed Template

This California Gift Deed, made this _____ day of __________, 20___, between (the "Donor") ________________________, whose address is ________________________________, and (the "Recipient") ________________________, whose address is ________________________________, conveys and quitclaims to the Recipient that certain property described as follows:

_______________________________________________________ [insert legal description of the property].

Together with all the rights, titles, and interests in the property.

The Donor certifies that the gift is made freely and without consideration, direct or indirect, and that the property is not subject to any encumbrances except as described in this deed. The Donor transfers possession of the property to the Recipient by delivering this deed.

This transfer is made with the understanding that it is a complete and unconditional gift under the laws of the State of California, specifically referring to the California Uniform Gifts to Minors Act, if applicable. Once executed, this deed effectively transfers ownership of the property to the Recipient.

The Donor signs this document in the presence of:

- Witness #1: ________________________ [Witness's Name], whose address is ________________________________.

- Witness #2: ________________________ [Witness's Name], whose address is ________________________________.

In witness whereof, the Donor has signed and sealed this deed, the day and year first above written.

____________________________________

Donor's Signature

____________________________________

Recipient's Signature (If required)

State of California

County of _________________________

On this _____ day of __________, 20___, before me, ________________________ [name of notary], a Notary Public in and for said state, personally appeared ________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

____________________________________

Notary Public's Signature

My Commission Expires: _________________________

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose | The California Gift Deed is used to transfer ownership of property from one person to another without any consideration, payment, or exchange involved. |

| Governing Law | This form is governed by the California Probate Code, specifically sections related to the voluntary transfer of personal or real property. |

| Revocability | Once a Gift Deed is executed and delivered, it is generally irrevocable unless conditions are stated otherwise within the deed itself. |

| Recording Requirements | To be effective against third parties, the deed must be properly recorded with the county recorder in the county where the property is located. |

| Tax Implications | While transferring property via a Gift Deed may be exempt from general sales taxes, it can still have implications for federal and state gift taxes and potential future capital gains taxes for the recipient. |

Instructions on Writing California Gift Deed

Filling out a California Gift Deed form is a straightforward process, but it’s vital to ensure that every step is completed with accuracy and attention to detail. A Gift Deed is a legal document used to transfer ownership of real property from one person to another without any exchange of money. The giver of the gift is known as the donor, and the recipient is the donee. In the state of California, completing a Gift Deed requires following specific guidelines to ensure that the document is legal and valid. Here are the steps needed to fill out the form properly.

- Start by providing the full legal name and address of the donor in the designated sections of the form.

- Next, insert the full legal name and address of the donee to whom the property is being gifted.

- Describe the gifted property in detail, including its address and a legal description. The legal description can typically be found on the property's current deed or at the local county recorder's office.

- State the relationship between the donor and the donee, if any, to clarify the intent of the gift.

- Include the date the gift deed is to be executed. This date signifies when the transfer of property will officially take place.

- If necessary, specify any conditions or reservations about the gift. This section is optional and should only be completed if there are specific terms that need to be included in the gift transfer.

- Ensure the donor signs the form in the presence of a notary public. The notarization of the document is a critical step to validate the deed.

- Finally, record the completed Gift Deed at the local county recorder’s office where the property is located. This is an essential step to make the transfer of ownership public record and legally binding.

By following these steps carefully, individuals can successfully complete a California Gift Deed form, ensuring that the transfer of property is recognized and valid according to state laws. Remember that accuracy and thoroughness are key when dealing with legal documents, and seeking advice or assistance from a professional is wise if there are any uncertainties during the process.

Understanding California Gift Deed

What is a California Gift Deed?

A California Gift Deed is a legal document that facilitates the process of giving a gift of real property from one person to another in the state of California. It is used when an individual wants to transfer ownership of a piece of real estate to a family member, friend, or any other person without any consideration or payment in return. The deed must be properly executed and filed with the county recorder's office to ensure the transfer is legally recognized.

How does one properly execute a California Gift Deed?

To properly execute a California Gift Deed, the donor (the person giving the property) must fill out the deed form accurately, ensuring all necessary information is provided, including the legal description of the property and the names of the donor and the recipient (donee). The deed must then be signed by the donor in the presence of a notary public. Once notarized, the deed should be filed with the county recorder in the county where the property is located to complete the transfer.

Are there any tax implications when using a California Gift Deed?

Yes, there are potential tax implications when transferring property using a California Gift Deed. While the deed itself does not incur a purchase price or consideration, the Internal Revenue Service (IRS) may consider the value of the property as a gift for tax purposes. The donor may be responsible for filing a federal gift tax return if the value of the gift exceeds the annual exclusion limit set by the IRS. It is important for both the donor and the donee to consult with a tax professional to understand any tax liabilities that may arise.

Can a California Gift Deed be revoked?

Once a California Gift Deed has been properly executed and recorded, it is generally irrevocable, meaning it cannot be revoked or undone by the donor. The transfer of property rights is complete once the deed is filed with the county recorder's office. Therefore, individuals should consider the decision to transfer property via a gift deed carefully before proceeding.

Is consideration required for a California Gift Deed to be valid?

No, consideration, or payment, is not required for a California Gift Deed to be valid. The distinguishing feature of a gift deed is the transfer of property from the donor to the donee without any payment or exchange of value. The deed must expressly state that the property is being transferred as a gift, and it should comply with all other legal requirements for the transfer of real property in California.

Common mistakes

One common error is not including the full and legal names of both the giver (donor) and the receiver (donee). This might seem like a small detail, but improper or incomplete names can cause significant delays. The deed might even be considered invalid if the identities of the parties involved are not clearly stated. Legal documents need exact information to ensure they are enforceable and accurate.

Another mistake often seen is forgetting to describe the property in detail. A Gift Deed for real estate in California requires a detailed description of the property being given away. This isn't just the address; it involves legal descriptions which can be found on property tax statements or previous deeds. Skipping this step or providing insufficient information can lead to misunderstandings or disputes in the future.

Failing to have the deed notarized is a crucial error that is surprisingly common. In California, a Gift Deed must be notarized to be valid. Notarization confirms the identities of the signatories and the voluntary nature of the agreement, offering an extra layer of legal protection. Without this, the document might not be legally recognized, potentially nullifying the gift transaction.

Many also overlook the importance of filing the deed with the County Recorder’s Office. After the gift deed is properly filled out and notarized, it doesn’t automatically change the property records. If the deed is not recorded, future transactions can be complicated, and the donee’s ownership might be contested.

A common pitfall is not considering the tax implications of a gift deed. While the form itself might be correctly filled out, individuals often forget to evaluate how the transfer may affect their taxes. The IRS has specific rules about gifting property and the potential taxes that might be owed by either party. Neglecting to consult with a tax professional before completing a gift deed can lead to unexpected financial burdens.

Finally, some people try to use a Gift Deed to avoid creditors or legal judgements. This is not only a mistake but could be considered fraudulent. Transferring property through a gift deed to hinder, delay, or defraud creditors can have serious legal consequences. It's always best to be transparent and straightforward with financial transactions, especially when it involves transferring property rights.

Documents used along the form

In California, the Gift Deed form is a document used to give a gift of real property from one person to another without any exchange of money. While the Gift Deed plays a crucial role in transferring ownership rights, several other forms and documents are often used alongside it to ensure the process is comprehensive and legally sound. Below is a list of forms and documents typically associated with the completion of a Gift Deed transaction.

- California Preliminary Change of Ownership Report (PCOR): This form is required in most counties whenever real property or a mobile home is transferred. It provides the county assessor's office with information about the transfer, helping them determine if the property will be reassessed at a new value.

- Notary Acknowledgment: A notary acknowledgment is a formal declaration by a notary public that the signer of the documents has willingly signed the documents. For a Gift Deed to be legally binding, it must be notarized.

- Quitclaim Deed: In some cases, a Quitclaim Deed might be used in conjunction with a Gift Deed to clear any cloud on the title or to transfer any remaining interest the giver might have in the property. Unlike a Gift Deed, a Quitclaim Deed does not guarantee that the grantor holds a clear title to the property.

- Transfer Tax Declaration: Although a gift of property is typically exempt from transfer tax, many counties require a Transfer Tax Declaration to be filed, stating the exemption, to accompany the Gift Deed upon recording.

- Trust Transfer Deed: If the property being gifted is held in a trust, a Trust Transfer Deed may be used. This deed is similar to a Gift Deed but is specifically designed to transfer property from a trust to an individual.

Understanding and completing these associated documents correctly is vital to the success of transferring property through a Gift Deed in California. It ensures that the transfer complies with state laws and properly reflects the intentions of all parties involved. Individuals are encouraged to consult with legal professionals to navigate the complexities of real estate transactions and ensure that all necessary legal requirements are met.

Similar forms

The California Gift Deed form bears resemblance to a Quitclaim Deed, as both are used to transfer property without a sale. A Quitclaim Deed conveys a person's interest in a property to another, but without warranties, similar to a Gift Deed that transfers property ownership as a gift without financial consideration. However, the Quitclaim may not guarantee clear title, just like the Gift Deed.

Another similar document is the Warranty Deed, which also facilitates property transfer. Unlike a Gift Deed, a Warranty Deed includes a guarantee that the grantor holds clear title to the property and has the right to sell it, offering more protection to the buyer than a Gift Deed, which does not provide such assurances.

A Grant Deed, like a Gift Deed, is used to transfer property ownership. However, the Grant Deed implies certain warranties, such as the assurance that the property has not been sold to someone else. Unlike the Gift Deed, it also assures that there are no undisclosed liens or encumbrances on the property.

The Trust Transfer Deed is tailored for transferring property into, or out of, a trust, similar to a Gift Deed that transfers property without financial compensation. Although both can serve to move ownership to another party, the Trust Transfer Deed is specifically designed for handling property within trusts, making it more specialized.

A Bill of Sale is akin to a Gift Deed in that it documents the transfer of ownership. However, unlike a Gift Deed, a Bill of Sale is typically used for personal property, not real estate, and usually involves a purchase price, indicating a sale rather than a no-cost transfer.

The Transfer-on-Death (TOD) Deed, or beneficiary deed, also mirrors the Gift Deed in its aim to change property ownership. The TOD Deed allows property to bypass probate and automatically transfer to a named beneficiary upon the owner's death, contrasting with the Gift Deed's immediate effect during the giver's lifetime.

The Deed of Trust is another document related to property transactions, like the Gift Deed. It involves a third party, the trustee, holding the real property as security for a loan. While the Deed of Trust is part of financing arrangements, the Gift Deed serves as a method to gift property outright, without involving debts or obligations.

A Life Estate Deed permits an individual to use a property for their lifetime before it passes to a remainder beneficiary. This arrangement shares similarities with a Gift Deed, in that it can be used to transfer property interest without financial consideration. However, it differs because the giver retains rights to the property during their lifetime, unlike in a Gift Deed transfer.

The Real Estate Assignment Contract is used to transfer rights in a real estate contract from one party to another. It's somewhat similar to a Gift Deed since it involves transferring interest in real estate. However, it usually pertains to rights and interests under a contract, not the direct transfer of property ownership as with a Gift Deed.

Lastly, the Declaration of Homestead protects a homeowner's primary residence from certain creditors. While not a transfer document per se, it is related to the Gift Deed in the context of property rights. By declaring a homestead, owners secure an interest in their property that, in turn, might impact how they choose to gift property while considering asset protection.

Dos and Don'ts

Filling out the California Gift Deed form is an important process that requires attention to detail and an understanding of the procedure. When you're ready to transfer property as a gift, this document is essential. Keep these dos and don'ts in mind for a smooth experience:

- Do: Double-check the legal description of the property. This includes the exact address and any additional details that identify the property being gifted.

- Do: Verify the recipient's legal name and your own. Ensuring the correct spelling and legal names are used is crucial for the validity of the deed.

- Do: Sign the deed in the presence of a notary public. This step cannot be skipped, as it verifies the identity of the signatories and the voluntariness of the act.

- Do: Keep a copy of the signed and notarized deed for your records. It's always wise to have your own copy in case of disputes or for future reference.

- Do: File the deed with the county recorder's office. This publically records the gift and is necessary for the transfer to be legally recognized.

- Don't: Leave any fields on the form blank. If certain information does not apply to your situation, it's better to indicate this with a "N/A" (not applicable) rather than leaving it empty.

- Don't: Forget to consult with a legal professional if you're unsure about any part of the process. While the deed form may seem straightforward, the implications of transferring property can be complex and benefit from legal advice.

Misconceptions

When it comes to transferring property in California, the Gift Deed form is a common document used to give real estate as a gift without any exchange of money. However, there are several misconceptions about how this form is used and its implications. Understanding these misconceptions is crucial for anyone considering using a Gift Deed in California.

- Gift Deeds are only for family members: People often believe that Gift Deeds can only be used to transfer property between family members. However, property can be given to anyone, including friends or charitable organizations, using a Gift Deed.

- No tax implications: Another misconception is that giving property through a Gift Deed avoids taxes. While the giver may not receive any financial compensation, they might still be responsible for federal gift tax if the value of the gift exceeds the annual exclusion limit. Furthermore, the recipient might have to pay taxes when they sell the property.

- It's a simple form without legal complexities: The process of completing a Gift Deed may appear straightforward, but it must be executed correctly to be legally binding. It requires specific language, must be notarized, and filed with the county recorder's office. Overlooking any legal requirement can invalidate the deed.

- A Gift Deed is revocable: Many people think that a Gift Deed can be easily revoked if the giver changes their mind. However, once a Gift Deed is executed and delivered, the giver cannot revoke the deed without the recipient's consent.

- It transfers all types of property: While Gift Deeds are commonly used for real estate transactions, they cannot transfer all types of property. For example, vehicles and other types of personal property require different forms for transfer.

- No need for a lawyer: There's a belief that the process is so simple that legal assistance is unnecessary. Although it's possible to complete a Gift Deed without a lawyer, getting legal advice can ensure that the deed complies with state laws and addresses any potential tax implications.

- Immediate transfer of property: Some think that property transfer through a Gift Deed is immediate. However, the transfer is only complete once the deed is properly executed, delivered, accepted by the recipient, and filed with the appropriate county office.

- A Gift Deed protects the recipient from the donor's future debts: People might assume that once property is transferred via a Gift Deed, it's safe from the donor's future creditors. This isn't always the case, especially if the transfer is seen as an attempt to defraud creditors.

- The Gift Deed must state the value of the property: Contrary to what some believe, the Gift Deed does not need to include the property's value. The important aspects are the legal description of the property and the intention to gift it without consideration.

Understanding these misconceptions can help guide individuals in making informed decisions when considering the use of a Gift Deed in California. Always consider consulting with a professional to navigate the specific legal requirements and implications.

Key takeaways

The California Gift Deed form is a legal document used to transfer property from one person to another without any payment or consideration. This form is particularly useful for those who wish to gift real estate or other significant assets to family members or friends. It's important to understand the key aspects of filling out and using this form to ensure the process is completed correctly and legally.

- Legal Requirements: The California Gift Deed must comply with state laws, including signing requirements and notarization, to be considered valid.

- Complete Information: Ensure all necessary fields are accurately filled out, including the full names and addresses of the donor (person giving the gift) and the donee (person receiving the gift).

- Description of the Gift: The form requires a thorough description of the property being gifted. If real estate is involved, a legal description of the property must be included.

- Revocability: Once executed and delivered, a Gift Deed is irrevocable without the consent of the donee, meaning the donor cannot take back the gift.

- No Consideration Required: A key characteristic of a Gift Deed is that no money or compensation is exchanged between the donor and the donee.

- Witnesses and Notarization: California law may require the Gift Deed to be witnessed and notarized to be legally effective.

- Recording the Deed: After completion, the Gift Deed should be filed with the county recorder’s office where the property is located to make the transfer public record.

- Tax Implications: While a Gift Deed transfers property without consideration, there may be tax implications for both the donor and the donee, including potential federal gift tax obligations for the donor.

- Medi-Cal Implications: Transfers of property through a Gift Deed may affect the donor's eligibility for Medi-Cal benefits, due to look-back periods for asset transfers.

- Professional Advice Recommended: Due to the legal and financial implications involved with transferring property, consulting with a legal or financial professional before executing a Gift Deed is advisable.

Properly completing and filing a California Gift Deed ensures a smooth transition of property ownership from the donor to the donee. It is a valuable tool for estate planning and gifting that, when used correctly, can facilitate generous gestures without unintended complications.

More Gift Deed State Forms

How to Transfer Deed of House - By clearly documenting that a transfer is a gift, it helps to avoid misunderstandings that could lead to familial or personal conflict.

Texas Gift Deed Form - This document underscores the donor's intention to make a gift, providing legal clarity to what might otherwise be considered an informal transaction.