Official Gift Deed Document

Transferring property or assets from one individual to another without any expectation of receiving something in return is a practice as old as property ownership itself. However, when it comes to formalizing this transfer legally to avoid any future disputes or complications, a Gift Deed form becomes indispensable. This legal document not only delineates the intent of the donor to give and the acceptance of the donee to receive but also provides a clear record of the gift to ensure it's recognized by law. Essential aspects covered by this form include the identification of the parties involved, a detailed description of the gift, and any conditions attached to the transfer. Ensuring the deed is properly executed involves witnessing and notarization, which varies by jurisdiction but is a critical step in cementing the gift's legality. It's a tool to not only make the giver's intentions clear but also to protect the recipient's newly acquired rights to the property or asset in question. Beyond its legal functionality, the Gift Deed carries emotional weight, often used to pass down heirlooms or significant assets within families, making its correct implementation even more crucial.

State-specific Information for Gift Deed Forms

Document Example

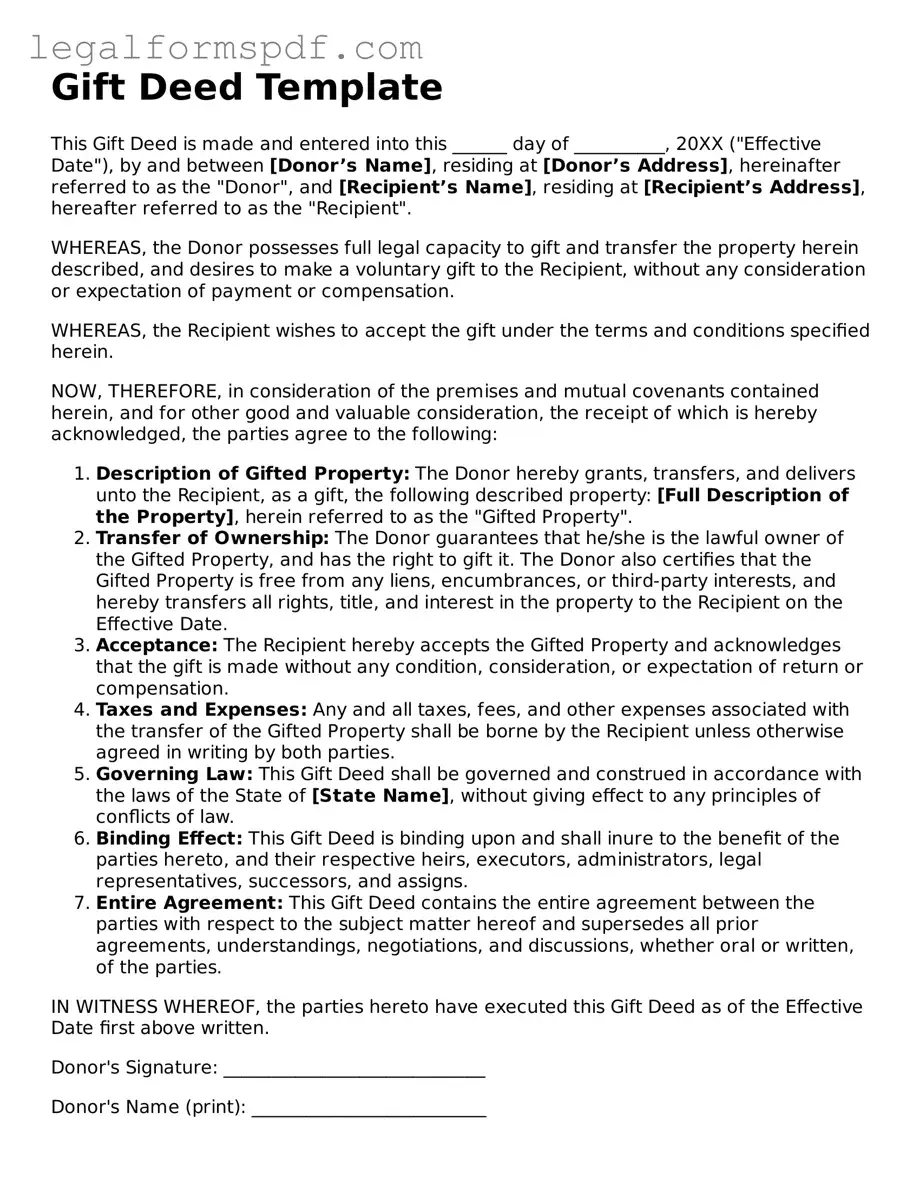

Gift Deed Template

This Gift Deed is made and entered into this ______ day of __________, 20XX ("Effective Date"), by and between [Donor’s Name], residing at [Donor’s Address], hereinafter referred to as the "Donor", and [Recipient’s Name], residing at [Recipient’s Address], hereafter referred to as the "Recipient".

WHEREAS, the Donor possesses full legal capacity to gift and transfer the property herein described, and desires to make a voluntary gift to the Recipient, without any consideration or expectation of payment or compensation.

WHEREAS, the Recipient wishes to accept the gift under the terms and conditions specified herein.

NOW, THEREFORE, in consideration of the premises and mutual covenants contained herein, and for other good and valuable consideration, the receipt of which is hereby acknowledged, the parties agree to the following:

- Description of Gifted Property: The Donor hereby grants, transfers, and delivers unto the Recipient, as a gift, the following described property: [Full Description of the Property], herein referred to as the "Gifted Property".

- Transfer of Ownership: The Donor guarantees that he/she is the lawful owner of the Gifted Property, and has the right to gift it. The Donor also certifies that the Gifted Property is free from any liens, encumbrances, or third-party interests, and hereby transfers all rights, title, and interest in the property to the Recipient on the Effective Date.

- Acceptance: The Recipient hereby accepts the Gifted Property and acknowledges that the gift is made without any condition, consideration, or expectation of return or compensation.

- Taxes and Expenses: Any and all taxes, fees, and other expenses associated with the transfer of the Gifted Property shall be borne by the Recipient unless otherwise agreed in writing by both parties.

- Governing Law: This Gift Deed shall be governed and construed in accordance with the laws of the State of [State Name], without giving effect to any principles of conflicts of law.

- Binding Effect: This Gift Deed is binding upon and shall inure to the benefit of the parties hereto, and their respective heirs, executors, administrators, legal representatives, successors, and assigns.

- Entire Agreement: This Gift Deed contains the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior agreements, understandings, negotiations, and discussions, whether oral or written, of the parties.

IN WITNESS WHEREOF, the parties hereto have executed this Gift Deed as of the Effective Date first above written.

Donor's Signature: _____________________________

Donor's Name (print): __________________________

Date: ________________

Recipient's Signature: _____________________________

Recipient's Name (print): __________________________

Date: ________________

State of [State Name]

County of [County Name]

On this, the ______ day of __________, 20XX, before me, a Notary Public in and for said state, personally appeared [Donor’s Name] and [Recipient’s Name], known to me to be the persons described in and who executed the foregoing instrument, and acknowledged that they executed the same as their free act and deed.

Notary's Signature: _____________________________

Notary's Printed Name: _________________________

Commission Expires: _________________________

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Gift Deed is a legal document that allows an individual, the donor, to transfer ownership of property to another person, the recipient, without any payment or consideration. |

| Voluntary Action | The transfer of the property through a Gift Deed must be made voluntarily and not under any duress or compulsion. |

| Governing Law | The Gift Deed is governed by the state law where the property is located, as real estate laws vary significantly from state to state. |

| No Consideration | Unlike a sale, a gift of property involves no exchange of money or other forms of consideration from the recipient to the donor. |

| Irrevocability | Once a Gift Deed has been executed and delivered, it is typically irrevocable, meaning the donor cannot take back the gift without the recipient's consent. |

| Delivery and Acceptance | The Gift Deed must be delivered to, and accepted by, the recipient to be considered valid. Acceptance can be assumed if the gift benefits the recipient. |

| Recording | In most states, for a Gift Deed to be valid against third parties, it must be recorded with the local county recorder’s office or land registry. |

| Tax Implications | The transfer of property via a Gift Deed may have tax implications for both the donor and the recipient, including potential liability for federal gift tax. |

Instructions on Writing Gift Deed

Filling out a Gift Deed form is an important step in transferring ownership of property from one person to another as a gift. This document legally records the gift and ensures that the transfer is recognized. The process requires careful attention to detail to make sure that the document accurately reflects the intentions of the giver (donor) and is legally binding.

To complete the Gift Deed form, follow these steps:

- Gather all necessary information, including the full legal names and addresses of both the donor and the recipient (donee), as well as a detailed description of the property being gifted.

- Enter the date on which the Gift Deed is being prepared at the top of the form.

- Fill in the donor's full legal name and address in the designated section.

- Provide the donee's full legal name and address in the corresponding section.

- Describe the gifted property in detail, including its exact location and any identifying numbers or legal descriptions.

- State the relationship between the donor and the donee, if any, to clarify the context of the gift.

- If applicable, list any conditions attached to the gift. This might include stipulations that the donee must meet to retain ownership of the property.

- The donor must sign and date the form in the presence of a notary public. Some states may require additional witnesses.

- The notary public should then fill out their section, which includes their official seal, confirming that the donor's signature was made voluntarily and with the donor's full understanding of the document's purpose.

Once these steps are completed and the form is notarized, the Gift Deed becomes a legal document. It's important to keep a copy for personal records and, depending on state requirements, to file the deed with the local county office to finalize the transfer of property.

Understanding Gift Deed

What is a Gift Deed form?

A Gift Deed form is a legal document used when one person wishes to gift their property or assets to another. It is a formal declaration that transfers ownership without any exchange of money. The form outlines the details of the gift, including the donor's (the person giving the gift) and the recipient's (the person receiving the gift) information, a description of the gift, and any conditions attached to the transfer. Signing this document in the presence of a notary public is often required to ensure its validity.

Why do I need a Gift Deed form?

Having a Gift Deed is important because it legally records the transfer and helps avoid any future disputes about the ownership of the property. It clear-cut verifies the donor’s intention to give the gift and protects the recipient's right to the property. This form is particularly necessary when the gift has significant value, such as real estate, to ensure that the transfer is recognized by the law and taxation authorities.

Can a Gift Deed be revoked?

Generally, once a Gift Deed is executed and delivered to the recipient, it cannot be revoked unless the deed itself specifies conditions under which revocation is possible. For example, some Gift Deeds include a clause that allows the donor to revoke the gift if certain conditions are met. However, without such a clause, revoking a gift is difficult and may require legal action if the recipient does not agree to return the gift voluntarily.

Are there any tax implications for gifting property?

Yes, there can be tax implications for both the donor and the recipient of a gift. In the United States, if the value of the gift exceeds the annual gift tax exclusion amount ($15,000 per recipient for 2023), the donor may need to file a gift tax return and might owe gift tax. However, there is also a lifetime exemption amount that may cover the gift before any tax is due. The recipient may also face tax implications, particularly when selling gifted property that has appreciated in value, as capital gains tax could apply.

What steps should I follow to complete a Gift Deed form?

To complete a Gift Deed form, you should first gather all necessary information, including the legal names and addresses of the donor and recipient, a thorough description of the gift, and any conditions of the gift. Next, consult with a legal professional to ensure the form meets all legal requirements of your state. After drafting the deed, both the donor and recipient should sign the deed in the presence of a notary public to ensure its legality. Finally, depending on the type of gift, you may need to file the deed with a local or state government office to record the transfer officially.

Common mistakes

When it comes to transferring property without expecting anything in return, many people opt for a Gift Deed. This legal document is preferred for its clarity and formality in establishing the giver's and recipient's intentions. However, completing this form is a meticulous process, and overlooking certain aspects can lead to complications down the line. Here are five common mistakes individuals make when filling out the Gift Deed form.

Firstly, a significant number of people fail to clearly identify the parties involved—in particular, the donor (the person giving the gift) and the donee (the person receiving the gift). Precision in names, including middle initials or names, and accurately distinguishing between individuals with similar or identical names, is critical. The identities need to be unmistakable to prevent any ambiguity concerning the parties' roles. Ambiguities can render the deed open to legal challenges or administrative headaches when it's time for the document to be officially recorded or recognized.

Secondly, the description of the gifted property often lacks the detail necessary for clear identification. Whether it’s real estate, a vehicle, or a piece of valuable personal property, every relevant detail—such as legal descriptions for real estate, VIN numbers for vehicles, or serial numbers and unique identifying features for personal property—should be meticulously documented. Insufficient detail can lead to disputes over what was precisely meant to be gifted, especially if similar properties or items are owned by the donor.

Another common oversight is neglecting to specify any conditions attached to the gift. While most gifts are unconditional, some donors wish to attach specific conditions that the donee must meet for the gift to remain effective. Without these conditions clearly outlined in the document, it becomes much more challenging to enforce them, potentially leading to legal disputes if the donor believes the donee has not fulfilled their obligations.

People often forget to have the document properly witnessed and notarized as well. Many jurisdictions require a Gift Deed to be witnessed and/or notarized to be legally valid. The purpose of this requirement is to confirm the authenticity of the document and the identity of the signatories. Failing to comply with these formalities can invalidate the deed, making it as though the transfer never occurred in the eyes of the law.

Last but not least, failing to file the Gift Deed with the appropriate government office can be a critical misstep. For certain types of property, especially real estate, simply executing a Gift Deed does not complete the transfer process. The deed must be filed, typically with the county recorder’s office, to effectuate the legal transfer of property and make the transaction public record. This step is crucial, as it finalizes the gift legally and ensures the transferred property is recognized under the new ownership in official records.

Documents used along the form

When dealing with the transfer of property or assets through a Gift Deed form, several other forms and documents may also be utilized to ensure the process is complete and legally binding. These documents help in verifying the details of the agreement, the parties involved, and the assets being transferred, while also complying with regulatory and tax obligations.

- Affidavit of Delivery: This confirms that the gift deed was delivered to and accepted by the recipient. It serves as proof that the transfer was indeed intended as a gift.

- Revocation of Gift Deed: If the gift needs to be revoked for any reason, this document outlines the terms under which it can be done, provided revocation is allowed under the original terms of the gift deed.

- Property Title: Shows the legal ownership of the property being gifted and must be updated to reflect the change in ownership after the gift deed is executed.

- Settlement Statement: Used primarily in real estate transactions, this outlines the costs associated with the transfer and is important for recording the financial aspects of the gift transaction.

- Quitclaim Deed: Often used in conjunction with a gift deed when transferring real estate, to release any interest the giver may have in the property without stating that the property is free of liens.

- Real Estate Transfer Declaration: A document required in many jurisdictions that provides details about the property being transferred, for the purposes of valuation and taxation.

- IRS Form 709: United States Gift (and Generation-Skipping Transfer) Tax Return, which must be filed by individuals who give gifts in excess of the annual exclusion amount.

- Trust Agreement: If the gift is being transferred to a trust instead of directly to an individual or entity, this document outlines the terms under which the trust will manage the gifted property or asset.

Each of these documents plays a critical role in facilitating smooth and legally sound gift transactions. Depending on the value of the gift, the relationship between the donor and recipient, and the state laws applicable, additional documents might be required. It is advised to consult with a legal professional to ensure all necessary paperwork is properly completed and filed.

Similar forms

A Gift Deed form is closely related to a Will in that both documents specify how assets are to be distributed by an individual. A Will, however, typically takes effect after the death of the individual, directing how their property and responsibilities are to be handled among heirs. In contrast, a Gift Deed transfers ownership of property from one person to another while the giver is still alive, without any exchange of money. Both legal instruments are used to manage the transfer of assets, but they operate under different conditions and at different times.

Similar to a Gift Deed, a Trust Declaration document outlines the transfer of assets but does so by placing property into a trust for the benefit of one or more beneficiaries. The Trust Declaration serves as a mechanism to manage, protect, or distribute assets according to specific terms laid out by the creator of the trust. Both documents facilitate the transfer of assets without financial consideration, but a Trust Declaration involves an ongoing management structure, often providing benefits over a longer term or after the grantor's death.

The Transfer-on-Death Deed (TODD) also shares similarities with a Gift Deed, as both involve the process of transferring property. A TODD allows property owners to name beneficiaries who will receive the property upon the owner’s death, bypassing the probate process. Like a Gift Deed, it is a non-probate instrument, but it distinctly waits until the death of the owner to transfer the property, avoiding the immediate change of ownership inherent in a Gift Deed.

A General Warranty Deed is another document paralleling the Gift Deed, with both ensuring the transfer of property titles. The General Warranty Deed is used in real estate transactions to provide the highest level of protection to the buyer, guaranteeing the seller owns the property free and clear of any liens or claims. Although both deeds facilitate property transfers, the General Warranty Deed is involved in sales transactions with financial consideration, contrasting with the Gift Deed's purpose of transferring property as a gift.

Similarly, a Quitclaim Deed facilitates the transfer of a property owner’s interest to another person. This document is often used among family members or to clear up title issues. It differs from a Gift Deed because it does not guarantee that the property title is free and clear of claims; it merely transfers whatever interest the grantor has in the property. Both are instrumental in real estate transfers without commercial transactions, but the Quitclaim Deed carries more risk for the recipient.

The Power of Attorney (POA) document, while not directly transferring property, authorizes another individual to act on one’s behalf, possibly including the power to transfer assets. It is similar to a Gift Deed in that it can enable the management or gifting of assets, but a POA encompasses a broader range of authorities, not limited to asset transfer. The key difference is that a Gift Deed executes an immediate transfer of property, whereas a POA grants the authority to perform various actions, including transfers, on behalf of the grantor.

Likewise, a Beneficiary Deed is used to transfer property, but it does so upon the death of the property owner. It allows the owner to retain control over the property during their lifetime, including the right to sell or mortgage. The Beneficiary Deed and the Gift Deed are similar as they both avoid the probate process. However, the former operates in the realm of estate planning, taking effect after death, contrasting with the Gift Deed's immediate transfer of property during the grantor's lifetime.

Dos and Don'ts

When preparing a Gift Deed, a document that facilitates the process of voluntarily transferring ownership of property from one person to another without payment, it's crucial to pay attention to the specifics. To ensure clarity and legality in the document, here are key dos and don'ts to keep in mind:

Do:- Provide Complete Information: Make sure all required fields are filled in accurately. This includes the full names of both the donor (the person giving the gift) and the recipient, a detailed description of the property being gifted, and any terms or conditions associated with the gift.

- Ensure the Deed is Signed in the Presence of Witnesses: Most jurisdictions require the signing of the Gift Deed to be witnessed by two or more independent individuals. Their signatures also need to be included in the document to attest to its authenticity.

- Notarization: While not always mandatory, getting the Gift Deed notarized can add an additional layer of legal protection and authenticity. Check the requirements in your jurisdiction.

- Keep Records Safe: Once all parties have signed the Gift Deed and it has been notarized, ensure that both the giver and the receiver retain copies of the document for their records.

- Rush the Process: Take your time to review all sections of the Gift Deed form thoroughly to ensure accuracy and completeness. Overlooking details can lead to unnecessary complications or legal challenges later on.

- Use Ambiguous Language: Be as clear and specific as possible when describing the gift and any conditions related to it. Ambiguity can lead to misinterpretations and disputes.

- Forget to Check State Laws: Gift Deeds are subject to state laws, which can vary significantly. Ensure that your Gift Deed complies with the requirements specific to your state or jurisdiction.

- Ignore Tax Implications: Depending on the value of the gift and your jurisdiction, there may be tax implications for either the giver or the receiver. Consult a tax professional to understand any potential obligations.

Misconceptions

When it comes to transferring property or assets to a loved one, many choose to use a Gift Deed form. However, there are several misconceptions surrounding Gift Deeds that can cause confusion. Understanding these points is crucial for anyone considering this method of property transfer.

Gift Deeds are only for real estate. While it's true that Gift Deeds are often used to transfer real estate between family members or friends, they can also be used for other types of property, such as vehicles, shares, or personal items. The key is that the item must be tangible and have value.

A Gift Deed immediately transfers ownership. While signing a Gift Deed is an important step in transferring ownership, the deed must usually be delivered to, and accepted by, the recipient to be legally effective. Some states might also require the deed to be recorded or registered, so the process can involve several steps.

Gift Deeds are irrevocable. This is mostly true, but there are exceptions. For example, if a deed was made under duress, fraud, or undue influence, it might be challenged and potentially revoked. However, under normal circumstances, once a Gift Deed is executed and delivered, it cannot be undone by the giver.

Creating a Gift Deed is expensive. The cost to create a Gift Deed can vary widely depending on whether you draft it yourself, use an online template, or hire an attorney. While attorney-drafted deeds are more costly, self-drafted or template-based deeds may also incur some expenses, such as notary fees or recording fees, but they are significantly less expensive than people often fear.

Gift Deeds eliminate tax liability. Gifting property does not necessarily mean you are free from tax. In the United States, the giver may need to file a gift tax return if the value of the gift exceeds the annual exclusion limit set by the IRS. There are also potential implications for estate tax and capital gains tax for the receiver, depending on the value and nature of the gift.

You can gift property to anyone with a Gift Deed. Legally, yes, but practically, it’s important to consider the implications, especially for minors or those unable to manage property. Gifting property to someone who cannot legally manage it may require the appointment of a guardian or trustee, which can complicate the situation and necessitate additional legal steps.

Properly executed, a Gift Deed is a valuable tool for transferring property to another person. However, dispelling the common misconceptions surrounding them ensures that the process is understood and undertaken with the appropriate legal foresight.

Key takeaways

A gift deed form is a vital legal document that transfers ownership of property from one person to another without any exchange of money. The use of this form carries significant legal weight and should be approached with care and a thorough understanding of its implications. Here are key takeaways to consider when filling out and using a gift deed form:

- Accuracy is crucial: Ensure all information on the gift deed form is accurate and complete. Mistakes or omissions can lead to disputes over the property's ownership or could invalidate the deed altogether.

- Identification of parties: Clearly identify the donor (the person giving the property) and the donee (the person receiving the property). Including full legal names and additional identifying information can help prevent any confusion about the parties involved.

- Describe the property: Offer a detailed description of the property being gifted. This can include the address, parcel number, or any other unique identifier that ensures the property is accurately recognized and transferred.

- Witnesses and notarization: Many jurisdictions require the gift deed to be signed in the presence of witnesses and/or notarized to be considered legally binding. This process adds a layer of verification, confirming that the parties involved willingly participated in the transfer.

Understanding these key takeaways can help guide individuals through the process of successfully transferring property through a gift deed, ensuring that this generous act is properly recorded and legally recognized.

Consider More Types of Gift Deed Forms

California Transfer on Death Deed - It's an important consideration for anyone with significant real estate assets looking for a streamlined estate planning process.

Corrective Deed California - It ensures any oversights in the original deed are corrected for a clear and undisputed title.

Sample Deed in Lieu of Foreclosure - A crucial tool for homeowners facing financial difficulty, allowing them to avoid the implications of a foreclosure on their credit report.