Fillable Deed Document for Georgia

In the realm of property transactions within Georgia, the deed form plays a pivotal role, serving as the official document that facilitates the conveyance of property rights from one party to another. This crucial piece of documentation bears the responsibility of ensuring that the transfer of ownership is legally binding, meticulously detailing the specifics such as the identity of the buyer and seller, a comprehensive description of the property, and any pertinent terms of the sale. Its importance cannot be overstated, as it not only signifies the completion of a sale but also safeguards the interests of both parties involved in the transaction. Understanding the nuances of the Georgia Deed Form requires a thorough appreciation of its legal implications, the various types of deeds available—each catering to different circumstances and levels of warranty—and the procedural norms governing its execution and recording. This introduction aims to traverse these major aspects, presenting a guide that elucidates the significance of the deed within Georgia's legal framework concerning real estate transactions.

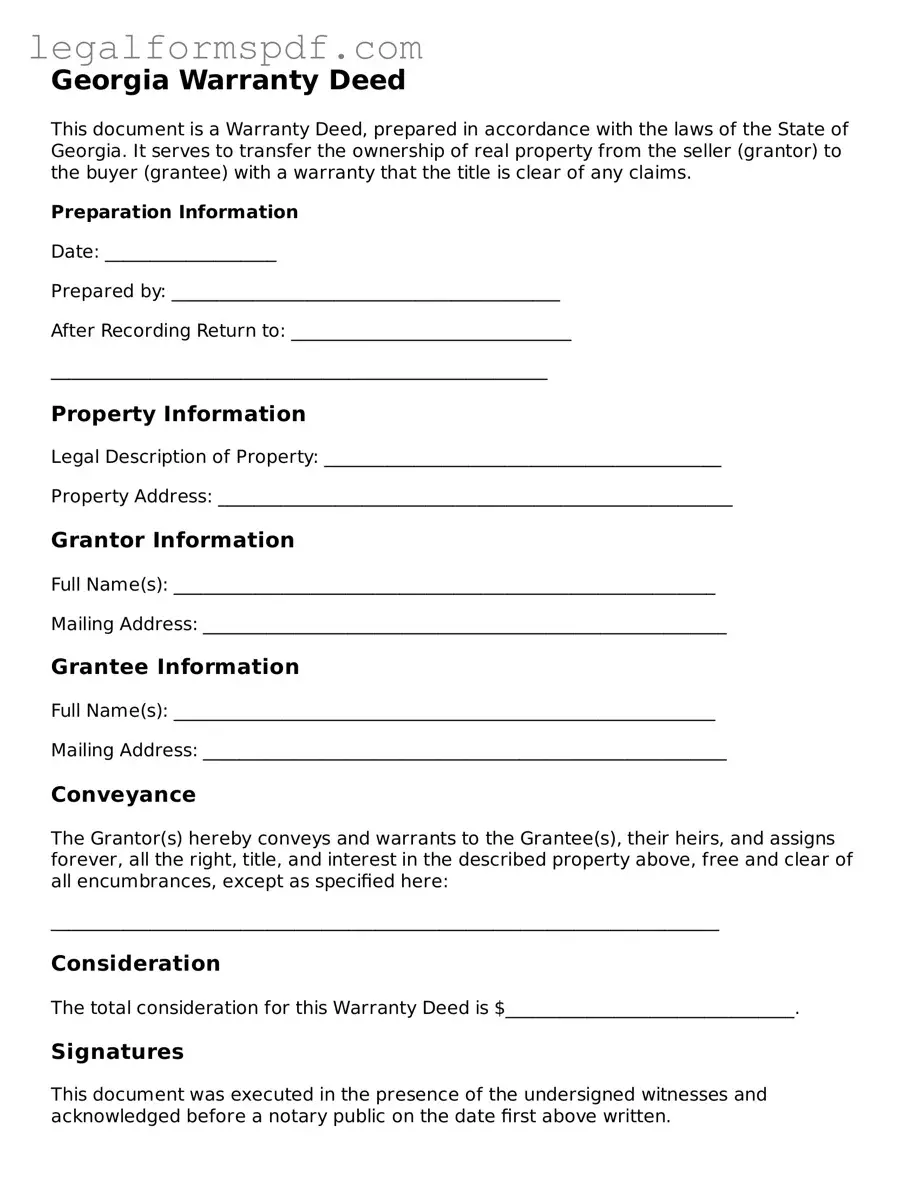

Document Example

Georgia Warranty Deed

This document is a Warranty Deed, prepared in accordance with the laws of the State of Georgia. It serves to transfer the ownership of real property from the seller (grantor) to the buyer (grantee) with a warranty that the title is clear of any claims.

Preparation Information

Date: ___________________

Prepared by: ___________________________________________

After Recording Return to: _______________________________

_______________________________________________________

Property Information

Legal Description of Property: ____________________________________________

Property Address: _________________________________________________________

Grantor Information

Full Name(s): ____________________________________________________________

Mailing Address: __________________________________________________________

Grantee Information

Full Name(s): ____________________________________________________________

Mailing Address: __________________________________________________________

Conveyance

The Grantor(s) hereby conveys and warrants to the Grantee(s), their heirs, and assigns forever, all the right, title, and interest in the described property above, free and clear of all encumbrances, except as specified here:

__________________________________________________________________________

Consideration

The total consideration for this Warranty Deed is $________________________________.

Signatures

This document was executed in the presence of the undersigned witnesses and acknowledged before a notary public on the date first above written.

Witness #1 Signature: _______________________________ Date: ________________

Witness #2 Signature: _______________________________ Date: ________________

Notary Public Signature: _____________________________ Date: ________________

My Commission Expires: ______________________________

This document follows specific state statutes applicable to Georgia, hence it is advised to consult with a legal professional before finalization to ensure compliance with current laws and regulations.

PDF Specifications

| Fact Name | Description |

|---|---|

| Type of Document | Georgia Deed Form |

| Purpose | To legally transfer property ownership in the state of Georgia. |

| Governing Law | O.C.G.A. Title 44 (Property), primarily |

| Key Elements | Must include the legal description of the property, grantor and grantee information, and signatures. |

| Signature Requirement | Must be signed in the presence of a notary public and one additional witness. |

| Recording Requirement | Deeds must be filed with the County Recorder's Office where the property is located. |

| Common Types | General Warranty Deed, Limited Warranty Deed, Quitclaim Deed. |

| Consideration Statement | A statement of consideration is required, detailing the value exchanged for the property. |

| Revocation | A deed can only be revoked by recording a new deed that legally transfers the property back or to another party. |

Instructions on Writing Georgia Deed

Filling out the Georgia Deed form is an important step in transferring property legally and securely. Understanding and completing this document requires attention to detail to ensure that all information is accurate and clear. This process involves several key steps, starting from identifying the parties involved to properly describing the property. By following these instructions carefully, individuals can navigate this process with confidence, knowing their rights and duties are well-documented.

- Begin by entering the date the deed will be executed at the top of the form.

- Identify the grantor(s) (the person or entity transferring the property) by writing their full legal name(s), followed by their current mailing address.

- Identify the grantee(s) (the person or entity receiving the property) by listing their full legal name(s) and current mailing address.

- Specify the consideration, or the amount of money being exchanged for the property. Insert this figure in the space provided.

- Provide a complete legal description of the property being transferred. This should include the lot number, subdivision, land district, and any other details that accurately describe the property's location and boundaries. If necessary, attach a separate sheet for a detailed description.

- If the property is located in Georgia, indicate the county where the property is situated.

- Ensure that the grantor(s) sign(s) the deed in the presence of a notary public. The notary public must then fill out their section, confirming that the grantor(s) appeared before them and signed the deed.

- The form should also be signed by two witnesses. One witness can be the notary public, but there needs to be an additional witness besides the notary.

- After the form is fully completed and signed, submit it to the appropriate county office for recording. The specific office might vary, but it is typically the Clerk of the Superior Court in the county where the property is located.

Once the deed is properly filled out, signed, and submitted for recording, the property transfer process is officially documented. This provides a legal basis for the transfer, safeguarding the rights and interests of both parties. For any questions or concerns about filling out the form or the transfer process, consulting with a legal professional specializing in property law in Georgia is advisable.

Understanding Georgia Deed

What is a Georgia Deed Form?

A Georgia Deed Form is a legal document that transfers property ownership from one party (the grantor) to another (the grantee) in the state of Georgia. It includes key details such as the identities of the buyer and seller, a legal description of the property, and the signature of the party transferring the property, often notarized to confirm its authenticity.

Are there different types of Deed Forms in Georgia?

Yes, in Georgia, there are primarily three types of deed forms used for different purposes: the General Warranty Deed, which provides the highest level of buyer protection by guaranteeing clear title; the Limited Warranty Deed, offering limited assurances against title defects; and the Quitclaim Deed, transferring only the interest the grantor has in the property, if any, without any warranties.

Is a lawyer required to complete a Deed Form in Georgia?

While Georgia law does not mandate the involvement of a lawyer to complete a deed form, consulting with one is highly recommended. A lawyer can ensure that the deed complies with all relevant laws, that the legal description of the property is accurate, and that the transfer effectively protects the buyer’s interests.

What is the process for filing a Georgia Deed Form?

After completing and signing the deed form, it must be filed with the Clerk of the Superior Court in the county where the property is located. The document must be submitted along with the appropriate filing fee. Recording the deed is crucial as it serves as public notice of the property transfer and protects the grantee’s interests.

How does one ensure the accuracy of a property description in a Georgia Deed Form?

Accuracy in the property description within a Georgia Deed Form is vital. This typically involves using the legal description from the current deed or seeking assistance from a professional, such as a surveyor, to verify or draft the property description. Ensuring this accuracy avoids future disputes or challenges related to property boundaries or ownership.

Can a Georgia Deed Form be revoked once it's filed?

Once a Georgia Deed Form is filed with the county clerk, it cannot be unilaterally revoked by the grantor. If both parties agree, the original transfer can be reversed with a new deed. However, without mutual consent, the grantor would need to prove fraud, duress, or another legal basis in court to invalidate the deed.

Common mistakes

Many people dive into filling out the Georgia Deed form with enthusiasm, eager to complete the process. However, this eagerness often results in common mistakes that can lead to delays, disputes, or even the invalidation of the deed. Understanding these pitfalls can save a lot of time and stress.

One frequent error is not specifying the type of deed being executed. Georgia law recognizes several types of deeds, including warranty deeds, limited warranty deeds, and quitclaim deeds, each serving different purposes and providing different levels of protection to the buyer. Leaving this crucial detail vague or incorrect can disrupt the legal transfer of the property or the rights associated with it.

Another common mistake is incorrect or incomplete information about the parties involved. The deed should accurately name the grantor (the person or entity transferring the property) and the grantee (the person or entity receiving the property). Any errors in spelling, omission of middle names, or failure to mention a relevant party, such as a spouse, can create significant legal complications down the line.

Also, people often overlook the requirement for precise legal description of the property. The deed must include a detailed description that is not merely the street address. This description typically references lot numbers, block numbers, subdivision names, book and page numbers of previous deeds, or metes and bounds. An inaccurate or incomplete description can lead to disputes over what property was actually transferred.

Not getting the deed properly witnessed and notarized is another pitfall. Georgia law requires that a deed be signed by the grantor in the presence of two witnesses, one of whom may also be the notary. Failing to meet this requirement can render the deed void, preventing the intended transfer of property ownership.

Last but not least, many forget about the importance of filing the deed with the county. After it is properly executed, the deed needs to be recorded at the county recorder's office where the property is located. This public recording of the deed is what officially completes the transfer of ownership. Failure to record can lead to legal challenges and may jeopardize the grantee's claim to the property.

By paying close attention to these details, individuals can ensure the property transfer process is smooth and legally sound. Avoiding these common mistakes on the Georgia Deed form can protect the interests of all parties involved and pave the way for a successful real estate transaction.

Documents used along the form

When processing real estate transactions in Georgia, the deed form is pivotal for the legal transfer of property ownership. However, this document does not stand alone. A suite of supporting documents often accompanies the deed form, each serving a unique role in ensuring the transaction is thorough and legally compliant. Highlighted below are key documents commonly used alongside the Georgia Deed form, offering a comprehensive approach to property transactions.

- Title Search Report: This document reviews the history of the property title to identify any liens, encumbrances, or claims that could affect ownership.

- Purchase Agreement: Outlining the terms of the sale, this agreement specifies the purchase price, contingencies, deadlines, and other essential details agreed upon by the buyer and seller.

- Closing Disclosure: Required for most real estate transactions, this form provides a detailed breakdown of all the financial costs involved in the transaction, including loans, fees, and other charges.

- Loan Documents: If the property purchase involves financing, various loan documents will be part of the package, including the mortgage agreement and the promissory note, detailing the loan terms and repayment schedule.

- Home Inspection Report: This report, generated by a professional home inspector, details the condition of the property, including any defects or necessary repairs, providing a comprehensive overview for the buyer.

- Property Insurance Documents: Proof of property insurance is often required to finalize real estate transactions, ensuring the property is covered against certain risks from the moment ownership is transferred.

- Government Identification: Official identification for both the buyer and seller, typically a driver's license or passport, is necessary to verify identities during the signing of the deed and other related documents.

Together, these documents form an ecosystem that supports the transfer of property, safeguarding the interests of all parties involved. They ensure that the property's history is understood, terms of sale are clear, financing is in order, and the property itself is in the expected condition, making the transition of ownership as smooth as possible. By familiarizing oneself with these documents, participants can navigate the complexities of real estate transactions with greater confidence and effectiveness.

Similar forms

The Georgia Deed form shares similarities with a Warranty Deed, one of the most common documents for transferring property ownership. Both ensure the legal transfer of real estate from the seller (grantor) to the buyer (grantee). The key similarity lies in the warranty aspect, where the seller guarantees they hold a clear title to the property, free from any liens, disputes, or encumbrances. This promise provides a significant level of protection to the buyer, making the process secure and trustworthy.

Similar to the Quitclaim Deed, the Georgia Deed form facilitates the conveyance of real estate interests from one party to another. However, unlike the broader protection offered by a Warranty Deed, a Quitclaim Deed does not guarantee the quality of the property title. It merely transfers whatever interest the grantor has in the property, if any, which might not include any ownership at all. This type of deed is often used among family members or to clear title disputes.

Comparable to the Grant Deed, the Georgia Deed form provides a medium for transferring property with certain assurances. Specifically, Grant Deeds guarantee that the property has not been sold to someone else and is free from undisclosed encumbrances. These guarantees are also inherent in many Georgia Deed forms, ensuring the buyer receives a clear title while the seller is legally bound to their warranties.

The Special Warranty Deed, much like the Georgia Deed, is used in property transactions, offering a level of assurance to the buyer. It guarantees that the seller holds the title to the property and that there are no issues with the title during their ownership period. Unlike a full Warranty Deed, the protection here is limited to the period of the seller’s ownership, making it somewhat less comprehensive but still giving buyers a significant degree of security.

Trust Deed documents share a functional similarity with the Georgia Deed form in terms of involving property transactions. However, a Trust Deed involves a trustee, who holds the property's title for the benefit of another, acting as a security measure for a loan. When the loan is repaid, the property title is transferred from the trustee to the borrower, reflecting a mechanism of transferring interests in property through a third party, much like a direct transfer between seller and buyer in a deed.

The Security Deed, often used in Georgia, is akin to the Georgia Deed form as it pertains to real estate transactions. This document acts as a collateral for loans, granting the lender a security interest in the property. While it functions differently, the act of transferring interests—albeit temporarily until a loan is repaid—is a core similarity. The critical distinction lies in the Security Deed serving more as a loan security instrument rather than a straightforward sale or ownership transfer document.

Lastly, the Conservation Easement is a document that, while different in purpose, shares a procedural similarity with the Georgia Deed form. It is used to restrict the development rights of a property to preserve its natural, cultural, or historical values. Like the Deed, it involves the transfer of certain rights in a property—here, the right to develop the land—to secure specific outcomes, focusing on conservation rather than residential or commercial development.

Dos and Don'ts

When filling out a Georgia Deed form, it is crucial to ensure accuracy and completeness in every detail. Here are some dos and don'ts that can guide you through the process:

- Do thoroughly review the deed form to ensure it matches the type of deed you require, such as a warranty deed or a quitclaim deed.

- Do verify the legal description of the property is accurate. This description typically includes the lot number, subdivision, and any pertinent dimensions or boundaries.

- Do include all necessary parties in the deed, ensuring both the grantor(s) (seller) and grantee(s) (buyer) are correctly identified with full legal names and addresses.

- Don't leave any blanks unfilled on the form. If a section does not apply, it is appropriate to indicate with "N/A" for "not applicable."

- Don't forget to have the deed signed in the presence of a notary public to validate its authenticity. The notary will also need to sign and affix their seal to the deed.

- Don't neglect the step of filing the completed deed with the appropriate county office. This process, known as recording, is essential for the deed to be legally binding and to ensure the transfer of property is documented.

Misconceptions

When it comes to transferring property, the paperwork can seem daunting. In Georgia, as in other states, a deed form is a crucial document in this process. However, there are several misconceptions about the Georgia Deed form that can lead to confusion or even legal complications. Let's clear up some of these misunderstandings.

- Any type of deed form will work for any property transfer. This is a common misconception. In reality, Georgia has specific requirements for deed forms based on the type of transfer. For instance, Warranty Deeds and Quitclaim Deeds serve different purposes and provide different levels of protection to the buyer. Choosing the wrong form can affect your rights to the property.

- A deed form can be filled out and signed without a notary. This is incorrect. In Georgia, a deed must be notarized to be valid. The presence of a notary public during the signing ensures that the signatures on the document are legitimate. Skipping this step can invalidate the entire transaction.

- Once signed and notarized, the deed form doesn't need to be filed anywhere. Actually, for the transfer to be legally recognized, the completed deed form must be filed with the county's Superior Court Clerk's Office where the property is located. Failure to file the deed means the transfer isn't officially recorded, potentially leading to legal disputes down the line.

- Creating and executing a deed form will automatically take care of all legal and financial obligations. This is a dangerous misconception. While drafting and signing a deed form is a significant step in property transfer, it doesn't absolve the parties of all other responsibilities. For example, the grantor might still have financial obligations, such as paying off any mortgages or liens on the property, and the grantee might need to comply with local property laws and regulations.

Understanding these misconceptions is vital for anyone involved in a property transaction in Georgia. Proper knowledge and adherence to the state's requirements can help ensure that the process goes smoothly and legally. Always seek legal advice if you have questions about the correct procedure for transferring property.

Key takeaways

When preparing to fill out and use the Georgia Deed form, it’s crucial to understand several key points to ensure the process is completed accurately and effectively. These takeaways are essential for anyone looking to transfer property in Georgia, whether you’re a first-time homebuyer or an experienced real estate investor.

- Before filling out the Georgia Deed form, it’s important to confirm the type of deed required for your transaction. Georgia law recognizes several types of deeds, including Warranty Deeds and Quitclaim Deeds, each serving different purposes and providing various levels of protection to the buyer.

- Accuracy is critical when completing the form. Mistakes can lead to legal complications or even invalidate the deed. Double-check all information, including the correct spelling of names and the precise description of the property.

- When describing the property in the deed form, use the legal description found on the current deed or property records, not just the street address. This description often includes lot numbers, subdivision names, and other details vital for accurately identifying the property.

- The person or entity transferring the property, known as the grantor, must sign the deed in the presence of a notary public. Some counties in Georgia may also require additional witnesses for the deed to be legally valid.

- After the deed is signed and notarized, it needs to be filed with the county registrar's office or court in the county where the property is located. This step is crucial as it updates the public record, showing the new ownership of the property.

- Filing fees must be paid when the deed is recorded. These fees vary by county, so it’s wise to contact the local registrar's office ahead of time to confirm the exact amount.

- Consider consulting with a real estate attorney or a legal consultant. They can offer valuable guidance throughout the process, ensuring that the deed complies with Georgia law and that your interests are protected.

Following these guidelines will help streamline the process of filling out and using the Georgia Deed form, making your property transaction as smooth and trouble-free as possible.

More Deed State Forms

Property Owners Search - Grant deeds provide assurance that the property has not been sold to anyone else and is free of liens or encumbrances.

What Does a House Deed Look Like in Michigan - Digital or electronic Deeds are becoming more common but must meet specific legal standards to be valid.

Broward County Property Search by Owner Name - It provides a historical record of ownership, essential for resolving any future legal questions about the property.

Release of Dower Rights Ohio Form - Should be carefully reviewed by both parties before signing to avoid future disputes.