Fillable Deed Document for Florida

In the state of Florida, transferring property ownership is a process that hinges on the completion and execution of a precise legal document known as the deed form. This crucial document, required by law, serves as the official record of the transfer of real estate from one party to another. There are several types of deeds used in Florida, each tailored to different real estate transactions and levels of protection for the buyer and seller. The deed typically includes vital information such as the legal description of the property, the names of the former and current owners, and the signatures of all parties involved, notarized to affirm the authenticity of the document. The crafting and execution of this document are pivotal, as any inaccuracies or omissions can lead to complications in the property's title, potentially affecting future sales or transfers. Florida's specific regulations and requirements for deed forms underscore the importance of understanding and accurately completing this document, ensuring a lawful and transparent transition of property ownership.

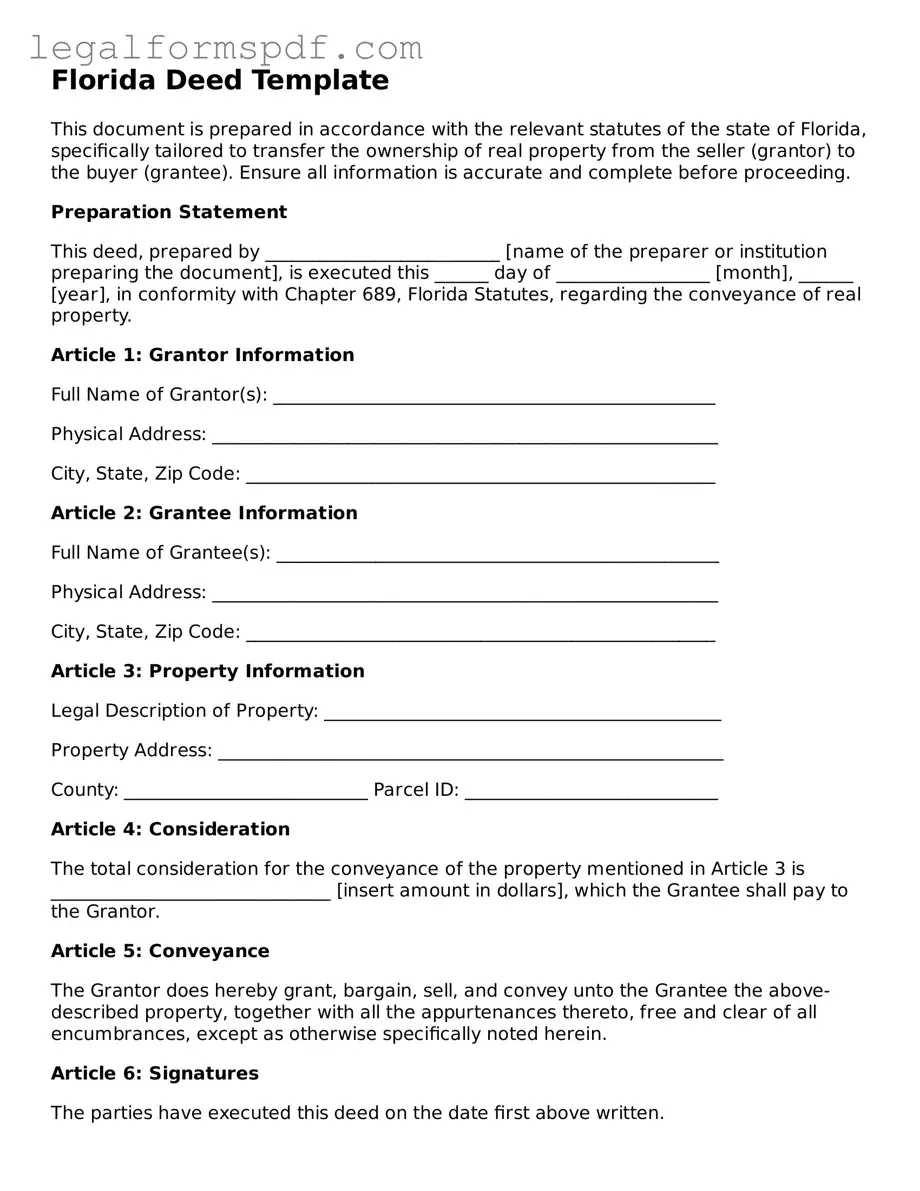

Document Example

Florida Deed Template

This document is prepared in accordance with the relevant statutes of the state of Florida, specifically tailored to transfer the ownership of real property from the seller (grantor) to the buyer (grantee). Ensure all information is accurate and complete before proceeding.

Preparation Statement

This deed, prepared by __________________________ [name of the preparer or institution preparing the document], is executed this ______ day of _________________ [month], ______ [year], in conformity with Chapter 689, Florida Statutes, regarding the conveyance of real property.

Article 1: Grantor Information

Full Name of Grantor(s): _________________________________________________

Physical Address: ________________________________________________________

City, State, Zip Code: ____________________________________________________

Article 2: Grantee Information

Full Name of Grantee(s): _________________________________________________

Physical Address: ________________________________________________________

City, State, Zip Code: ____________________________________________________

Article 3: Property Information

Legal Description of Property: ____________________________________________

Property Address: ________________________________________________________

County: ___________________________ Parcel ID: ____________________________

Article 4: Consideration

The total consideration for the conveyance of the property mentioned in Article 3 is _______________________________ [insert amount in dollars], which the Grantee shall pay to the Grantor.

Article 5: Conveyance

The Grantor does hereby grant, bargain, sell, and convey unto the Grantee the above-described property, together with all the appurtenances thereto, free and clear of all encumbrances, except as otherwise specifically noted herein.

Article 6: Signatures

The parties have executed this deed on the date first above written.

______________________________ ______________________________

Grantor's Signature Grantee's Signature

______________________________ ______________________________

Print Name Print Name

Article 7: Witness Acknowledgment

In the presence of the undersigned witnesses, the Grantor has signed and delivered this deed on the date first above written.

Witness #1 Signature: ________________________ Witness #2 Signature: ________________________

Print Name: ________________________ Print Name: ________________________

Article 8: Notary Acknowledgment

This section is to be completed by a Notary Public, affirming the identity of the Grantor and Grantee, and witnessing their signing of this deed.

State of Florida

County of ___________________

On this ______ day of _________________ [month], ______ [year], before me, the undersigned notary public, personally appeared _______________________ [names of individuals acknowledged], known to me (or satisfactorily proven) to be the person(s) whose names are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

______________________________

Notary Public

My commission expires: ___________________

PDF Specifications

| Fact | Detail |

|---|---|

| Type of Document | Florida Deed Form |

| Governing Law | Florida Statutes, specifically Chapter 689 |

| Primary Purpose | To legally transfer property ownership from the grantor (seller) to the grantee (buyer) |

| Witness Requirement | Two disinterested witnesses must witness the signing of the deed form |

| Notarization Requirement | The document must be notarized to be valid and recordable |

| Recording | The deed must be recorded with the County Clerk’s Office in the county where the property is located |

Instructions on Writing Florida Deed

Completing a Florida Deed form is a crucial step in the process of transferring property ownership. This document legally transfers the title from the current owner (grantor) to the new owner (grantee). It is important to fill out this form accurately to ensure a smooth transition and avoid potential legal complications in the future. The steps below will guide you through the process of filling out the Florida Deed form meticulously.

- Begin by identifying the type of deed you are executing. Florida law recognizes several types of deeds, including warranty deeds, special warranty deeds, and quitclaim deeds. Choose the one that best suits your situation.

- Enter the name(s) of the grantor(s) (current owner(s)) as they appear on the current deed or public record. Include their full legal names and any suffixes or titles.

- List the legal address and mailing address of the grantor(s), ensuring accuracy for future correspondence.

- Specify the name(s) of the grantee(s) (new owner(s)), using full legal names. If there are multiple grantees, define how they will hold the title (e.g., as joint tenants, tenants in common).

- Provide the legal description of the property being transferred. This description can be found on the current deed, a previous survey of the property, or within the public records. The legal description may include lot numbers, subdivision names, and measurements.

- State the consideration being exchanged for the property. This can be a dollar amount or another form of value agreed upon by both parties.

- The grantor(s) must sign the deed in the presence of a notary public and two witnesses. Florida law requires these witnesses for the deed to be valid.

- After completing the form, submit the deed to the local county recorder's office where the property is located. There may be a filing fee, which varies by county.

Once the deed is recorded, the property ownership transfer is officially documented in public records, completing the legal transfer process. Recording this document as soon as possible is crucial to protecting the rights of the new owner.

Understanding Florida Deed

What is a Florida Deed form?

A Florida Deed form is a legal document used to transfer property ownership from one person to another in the state of Florida. It must include certain information to be valid, such as the legal description of the property, the names of the buyer and seller, and it needs to be signed by the seller in front of a notary public.

How do I fill out a Florida Deed form?

To properly fill out a Florida Deed form, you need to gather accurate information including the full legal names of the buyer and seller, a complete legal description of the property, and any specific terms of the property transfer. After filling out the form, the seller must sign it in the presence of a notary public. It's highly recommended to consult with a real estate attorney to ensure the form is filled out correctly.

Where do I file a completed Florida Deed form?

Once signed and notarized, the completed Florida Deed form must be filed with the clerk of the court in the county where the property is located. Filing the deed makes the transfer of ownership public record, which is an important step in protecting the rights of the new property owner.

What are the different types of Deed forms available in Florida?

In Florida, there are several types of deed forms, each serving different purposes. The most common are the General Warranty Deed, which provides the buyer the highest level of protection against title defects; the Special Warranty Deed, which only guarantees against defects that occurred while the seller owned the property; and the Quitclaim Deed, which offers no warranties and is typically used to transfer property between family members or to clear up title issues.

Common mistakes

Filling out a deed form in Florida is a crucial step in transferring property, but it's easy to make mistakes if you're not careful. One common error is not checking the type of deed required. Florida recognizes several types, including warranty and quitclaim deeds, each serving different purposes. Opting for the wrong type can lead to unintended legal and financial consequences.

Another frequent oversight is neglecting to use the legal description of the property. This is much more detailed than the physical address, involving lot numbers, block numbers, and subdivision names. Without this precise description, the deed could be considered invalid, putting the property transfer at risk.

People often forget to include all necessary parties in the transaction. In the case of married individuals, both spouses may need to sign, even if only one is listed on the original deed. This oversight can result in the deed being challenged or even undone later on.

Forgetting to have the deed notarized is yet another common mistake. Florida law requires deeds to be notarized to be legally binding. Without this verification, the document won't be accepted by the county clerk for recording, which is essential for the deed to be considered valid and enforce the transfer of property rights.

Many also overlook the importance of checking for liens or encumbrances on the property. If these issues are not resolved before the transfer, the new owner could become responsible for them. A thorough title search is recommended to identify any potential problems before completing the deed form.

Incorrectly recording the deed is a significant error. Once the deed is completed and notarized, it must be recorded with the county clerk's office in the county where the property is located. Failure to record the document in a timely manner can lead to disputes over property ownership and may complicate future sales.

Some individuals mistakenly believe that filling out and recording a deed by themselves is enough to complete the transfer. However, in Florida, both parties involved in the transaction should receive legal advice to ensure that the transfer complies with state laws and that all paperwork is properly completed.

A subtle but crucial detail often missed is ensuring the grantee's correct name and address are included on the deed. Any errors here can cause significant problems when trying to locate property records in the future or when attempting to sell or transfer the property again.

Not specifying the form of ownership for the new owner is a common mistake when there are multiple grantees. Florida law allows for different types of co-ownership, and the deed should specify whether the property is held as joint tenants, tenants in common, or tenants by the entirety. Each has different rights of survivorship and implications for heirs, which should be carefully considered.

Lastly, a mistake often made is not attaching necessary additional documents. Depending on the circumstances of the property transfer, additional documents such as a seller's disclosure, lead paint disclosure, or other affidavits may be required. Failing to attach these documents can delay or invalidate the transfer.

By avoiding these common errors, individuals can ensure a smoother property transfer process in Florida. Paying close attention to detail and seeking appropriate legal guidance are key steps in this important transaction.

Documents used along the form

In the process of transferring property in Florida, the deed form plays a critical role as the official document that conveys ownership from one party to another. However, it's important to understand that this form is often just one piece of a larger puzzle. Several other documents are typically used in conjunction to ensure the legality, accuracy, and completeness of the property transfer process. From declarations that affect how property is held, to forms required by state or local laws for reporting and tax purposes, each plays a vital role in the real estate transaction.

- Promissory Note: This document outlines the terms of a loan that may be associated with the property purchase, including the repayment schedule, interest rate, and what happens in the event of a default.

- Mortgage Agreement: If the property purchase is being financed, this agreement secures the loan by making the property itself collateral, detailing the rights and responsibilities of both the lender and borrower.

- Closing Disclosure: Required by federal law, this form provides final details about the mortgage loan, including the loan terms, projected monthly payments, and how much the buyer will pay in fees and other costs.

- Title Search Document: Not a form in itself, but a report that outlines the history of the property, including past ownership, to confirm that the title is clear of any liens or claims that could affect the purchase.

- Title Insurance Policy: Protects the buyer and lender from potential losses caused by defects in the title that were not discovered during the title search.

- Homestead Declaration Form: For properties that will serve as the primary residence, this document is filed with the local government to claim homestead exemption, which can provide certain protections and tax benefits.

- Survey: A detailed drawing of the property showing its boundaries, any structures, easements, or encroachments that may impact the property's use or value.

- Flood Zone Statement: Indicates whether the property is in a flood zone, affecting insurance requirements and potentially the property's value and usability.

- Seller's Disclosure: A form where the seller provides information about the property's condition, including any known problems or defects, to the buyer.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about the presence of lead-based paint, which can pose health risks.

Understanding these documents and their purpose can significantly ease the process of buying or selling property in Florida. Each document, while serving its unique function, reinforces the importance of transparency and legality in real estate transactions. Engaging with these forms thoughtfully and thoroughly helps protect the interests of all parties involved and ensures that the transfer of property adheres to all state and federal regulations.

Similar forms

One document that bears similarity to the Florida Deed form is the Warranty Deed. This legal document serves as a guarantee that the seller holds clear title to a piece of real estate and has the right to sell it. It is akin to the Florida Deed form in that it transfers ownership of property from one party to another but goes further by providing assurances regarding the status of the property's title.

The Quit Claim Deed is another document related to the Florida Deed form. While it also involves the transfer of interest in real property from one individual to another, the Quit Claim Deed does not guarantee that the grantor’s title is valid. It simply transfers whatever interest the grantor has in the property, which could be nothing. This resemblance underscores the diversity in deed types, each serving different purposes in property transactions.

A Grant Deed is similarly employed in real estate transactions to convey title from the grantor to the grantee. Similar to the Florida Deed form, it signifies the transfer of ownership. However, a Grant Deed typically assures the recipient that the property has not been sold to someone else and that there are no undisclosed encumbrances, offering a middle ground between the warranty and quit claim deeds.

Mortgage agreements also share similarities with the Florida Deed form, primarily in their connection to real estate transactions. While a mortgage agreement outlines the terms under which a lender provides money to a borrower for purchasing property, essentially placing a lien on the property as collateral, the deed form signifies the transfer of property ownership. Both documents are crucial in the process of buying and selling homes and involve detailed legal descriptions of the property.

The Promissory Note is related to the Florida Deed form in the context of property transactions, particularly when financing is involved. It is a written promise to pay a specified sum of money to another party under agreed-upon terms. In real estate, this often ties in with mortgages, where the deed is the document transferring ownership and the promissory note is the borrower's promise to repay the loan used to purchase the property.

Title Insurance Policies also intersect with the purpose and function of the Florida Deed form. Title insurance protects against losses due to defects in the title not uncovered by a title search. Given that a deed is a physical manifestation of the transfer of a clean title from seller to buyer, obtaining title insurance is a critical step after receiving a deed to ensure the protection of one’s ownership rights.

A Bill of Sale is somewhat akin to the Florida Deed form but for personal property rather than real estate. It documents the transfer of ownership of personal assets, such as vehicles or furniture, from a seller to a buyer. Both documents serve to formalize the change of ownership, although they apply to different types of property.

Real Estate Sales Contracts closely relate to the Florida Deed form by setting forth the conditions under which a property will be sold, including price and terms of sale, before the official transfer takes place through a deed. Essentially, the sales contract is the agreement on which the deed acts, translating the agreement’s terms into the formal transfer of property ownership.

For Lease Agreements, the connectivity to the Florida Deed form lies in their mutual involvement in the use and possession of real estate. While a deed transfers ownership of property, a lease agreement transfers the right to use and occupy property for a specified period under certain conditions. Both are pivotal in defining rights and responsibilities in real estate transactions, albeit in different contexts.

Lastly, the Homeowners Association (HOA) Documents are related to the Florida Deed form since they often affect the ownership and use of property within a community governed by an HOA. The deed conveys the property, and the HOA documents outline the rules, restrictions, and obligations of property ownership within the community, impacting how the new property owner can use their property.

Dos and Don'ts

Handling the Florida Deed form with care is crucial to ensure a smooth transfer of property. Errors can delay the process, incur additional costs, or invalidate the deed. Here's a guide to what you should and shouldn't do when completing this form.

Do's

- Review the entire form carefully before filling it out to understand all the requirements and ensure no sections are overlooked.

- Use black ink or type the information to ensure legibility. This reduces the risk of errors or misinterpretation of the details provided.

- Double-check all entered information for accuracy, including the legal description of the property, to prevent any discrepancies that could affect the deed's validity.

- Consult with a legal professional or a real estate attorney to ensure that the form is filled out correctly and in compliance with Florida laws and regulations.

Don'ts

- Do not leave any required fields blank. Incomplete forms may be rejected or cause significant delays in the property transfer process.

- Avoid using erasable ink or making corrections and alterations on the form, as this can raise questions about the document's authenticity and integrity.

- Refrain from guessing or estimating information, especially when it comes to the legal description of the property. Accuracy is paramount.

- Do not sign the deed without the presence of a notary public. In Florida, deeds must be notarized to be legally valid.

Misconceptions

In discussing the Florida Deed form, it’s essential to clear up some common misconceptions. These misunderstandings can cause confusion and potentially lead to mistakes in the transaction or conveyance of property. Let’s explore some of these misconceptions to provide a clearer understanding of how deed forms function in Florida.

- All Florida Deed forms are the same. This misconception can lead to significant issues. In reality, Florida has several types of deed forms, such as the General Warranty Deed, Special Warranty Deed, and Quitclaim Deed, each serving different purposes and providing varying levels of protection for the grantor and grantee.

- A Florida Deed form automatically guarantees a clear title. Many believe that simply executing a deed ensures the property title is clear of liens or encumbrances. However, the deed itself only conveys the interest the grantor has in the property, if any. A title search and title insurance are typically needed to confirm a clear title.

- Notarization is optional for a Florida Deed to be valid. In Florida, notarization is a mandatory step for recording a deed. This formalizes the document, confirming it was willingly signed by the grantor in the presence of a notary public.

- No witnesses are needed to sign a Florida Deed. Contrary to this belief, Florida law requires that two disinterested witnesses watch the grantor sign the deed. This requirement helps to validate the authenticity of the deed.

- Electronic signatures aren't acceptable on Florida Deeds. With technological advancements and legal updates, electronic signatures are now widely accepted and legally binding on Florida Deed forms, provided they comply with state laws and regulations concerning electronic transactions.

- Filing a Florida Deed is an instantaneous process. Once a deed is signed, notarized, and witnessed, it must be filed with the appropriate county recorder's office. This process can take time, and the deed does not officially transfer ownership until it is recorded.

- A deed must be drafted by a lawyer to be valid in Florida. Although it’s wise to consult with a legal professional to ensure accuracy and compliance with state laws, a deed does not have to be drafted by a lawyer to be considered valid in Florida.

- Only the grantee needs to agree to the terms in a Florida Deed. This is a common misunderstanding. In reality, while the grantee's acceptance is crucial, it is the grantor who must convey the property willingly. Their agreement and intent to transfer the property are fundamental to the deed’s execution and validity.

- The property's purchase price must be stated on the Florida Deed form. Including the purchase price on the deed is not a legal requirement in Florida. The consideration can be nominal or valued at "$10 and other valuable considerations," if the parties agree, as the deed is primarily a vehicle for transferring property rights rather than detailing financial transactions.

Understanding these misconceptions can lead to a smoother property transaction process in Florida. Always consider consulting with a legal advisor to navigate the nuances of property law in your state effectively.

Key takeaways

Filling out and using the Florida Deed form is a crucial step in transferring property ownership within the state. It's a process that requires attention to detail and adherence to state-specific guidelines. Below are seven key takeaways to keep in mind when dealing with the Florida Deed form:

- Identification of the Parties: It's mandatory to clearly identify both the grantor (seller) and the grantee (buyer) by their full legal names to ensure the transfer is legally binding.

- Accurate Description of the Property: The deed must contain a precise and complete description of the property being transferred. This includes the legal description used in public records, not just the property's address.

- Signing Requirements: The Florida Deed form must be signed by the grantor in the presence of two witnesses and a notary public. The signatures validate the deed.

- Consideration: The form should clearly state the consideration, or the value exchanged for the property. This could be a monetary amount or other forms of value.

- Type of Deed: Florida recognizes several types of deeds (such as warranty deeds, quit claim deeds, and special warranty deeds), each providing different levels of protection and guarantees regarding the property's title. Choose the one that best suits your needs.

- Recording the Deed: After the deed is properly completed and signed, it must be recorded with the local county recorder’s office. Recording the deed is a critical step, as it shows the change in ownership and protects the new owner's rights.

- Mandatory Disclosures: Florida law requires certain disclosures at the time of property transfer, such as the presence of lead-based paint (for properties built before 1978) or sinkhole disclosures. Ensure these are completed and attached to the deed as needed.

Understanding and following these points closely can simplify the property transfer process, ensuring it is conducted legally and effectively. When in doubt, consulting with a legal professional specialized in Florida real estate law can provide valuable guidance and peace of mind.

More Deed State Forms

Nc Deed Transfer Form - Understanding the different types of Deed forms is important for choosing the right one for your specific transaction and legal needs.

What Does a House Deed Look Like in Pa - Recording a deed form with local authorities provides a public record of the property transaction and protects against fraud.