Official Deed of Trust Document

When diving into the world of real estate transactions, the Deed of Trust form emerges as a pivotal document, marking a significant milestone in the journey of property ownership. This unique legal instrument, serving as a linchpin in many states, elegantly orchestrates the relationship between the borrower, lender, and a neutral third party, known as the trustee. At its core, the Deed of Trust secures a loan on real property, distinguishing itself by involving this third-party trustee who holds the actual title as collateral until the loan balance is paid in full. Beyond just outlining the loan amount, interest rate, repayment schedule, and legal descriptions of the property, this document carries the weight of ensuring that all parties are protected under the law. It sets forth the conditions under which the property can be foreclosed if the borrower fails to meet the terms of the loan, providing a clear path for the lender to recover their investment while also detailing the borrower's rights to reclaim the title once obligations are fulfilled. Understanding the intricate details and implications of this form is crucial for anyone navigating the complexities of buying or refinancing a property, making it an indispensable tool in the vast expanse of real estate documentation.

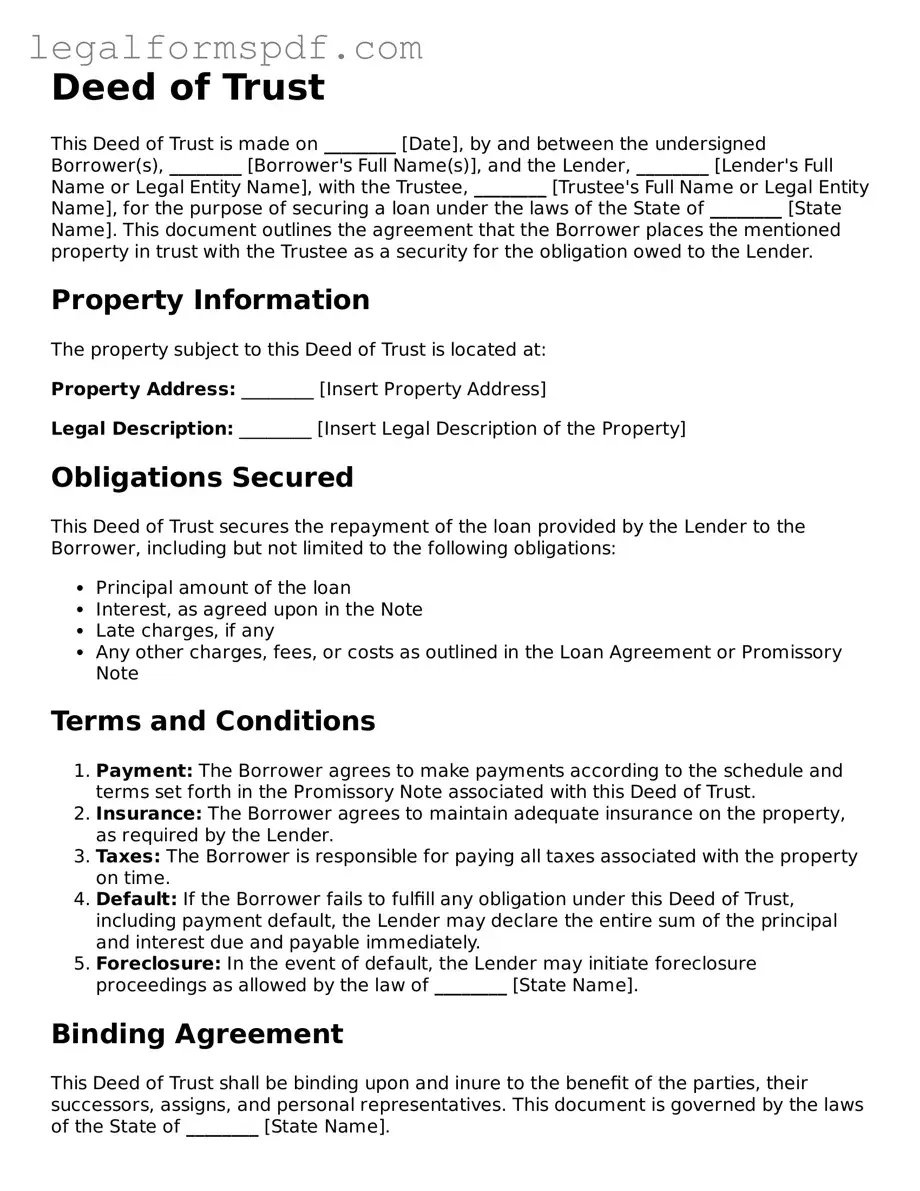

Document Example

Deed of Trust

This Deed of Trust is made on ________ [Date], by and between the undersigned Borrower(s), ________ [Borrower's Full Name(s)], and the Lender, ________ [Lender's Full Name or Legal Entity Name], with the Trustee, ________ [Trustee's Full Name or Legal Entity Name], for the purpose of securing a loan under the laws of the State of ________ [State Name]. This document outlines the agreement that the Borrower places the mentioned property in trust with the Trustee as a security for the obligation owed to the Lender.

Property Information

The property subject to this Deed of Trust is located at:

Property Address: ________ [Insert Property Address]

Legal Description: ________ [Insert Legal Description of the Property]

Obligations Secured

This Deed of Trust secures the repayment of the loan provided by the Lender to the Borrower, including but not limited to the following obligations:

- Principal amount of the loan

- Interest, as agreed upon in the Note

- Late charges, if any

- Any other charges, fees, or costs as outlined in the Loan Agreement or Promissory Note

Terms and Conditions

- Payment: The Borrower agrees to make payments according to the schedule and terms set forth in the Promissory Note associated with this Deed of Trust.

- Insurance: The Borrower agrees to maintain adequate insurance on the property, as required by the Lender.

- Taxes: The Borrower is responsible for paying all taxes associated with the property on time.

- Default: If the Borrower fails to fulfill any obligation under this Deed of Trust, including payment default, the Lender may declare the entire sum of the principal and interest due and payable immediately.

- Foreclosure: In the event of default, the Lender may initiate foreclosure proceedings as allowed by the law of ________ [State Name].

Binding Agreement

This Deed of Trust shall be binding upon and inure to the benefit of the parties, their successors, assigns, and personal representatives. This document is governed by the laws of the State of ________ [State Name].

Signatures

IN WITNESS WHEREOF, the parties have executed this Deed of Trust on the date first above written.

Borrower's Signature: ________ [Signature]

Borrower's Name (Printed): ________ [Name]

Lender's Signature: ________ [Signature]

Lender's Name (Printed): ________ [Name]

Trustee's Signature: ________ [Signature]

Trustee's Name (Printed): ________ [Name]

State of ________ [State Name]

County of ________ [County Name]

This document was acknowledged before me on ________ [Date] by ________ [Names of the individuals acknowledged].

Notary's Signature: ________ [Signature]

Notary's Name (Printed): ________ [Name]

My Commission Expires: ________ [Date]

PDF Specifications

| Fact | Description |

|---|---|

| Definition | A Deed of Trust is a document that secures a loan on real property. It involves three parties: the borrower, the lender, and a trustee. |

| Parties Involved | The borrower (trustor), the lender (beneficiary), and a neutral third party (trustee). |

| Function | It grants the trustee the authority to sell the property if the borrower defaults on the loan, to repay the lender. |

| State Specificity | Its use and the regulations governing it can vary significantly from one state to another. Some states use Mortgages instead of Deeds of Trust. |

| Recording Requirement | A Deed of Trust must be recorded with the county recorder’s office to be enforceable. |

| Foreclosure Process | In states that use Deeds of Trust, the foreclosure process can be faster and simpler, as it does not always require court action. |

Instructions on Writing Deed of Trust

When it's time to secure a loan against a real estate property, filling out a Deed of Trust form is a necessary step. This document plays a crucial role in laying out the agreement between the borrower, lender, and a neutral third party (trustee), ensuring that the property can be transferred to the trustee as a form of security for the loan. The process may seem daunting at first, but with the right guidance, it can be straightforward. Below, you'll find step-by-step instructions to help you complete the form accurately. Following these steps carefully is essential for protecting all parties involved and ensuring the process goes smoothly.

- Identify the parties: Clearly write the full legal names of the borrower (also known as the trustor), the lender (beneficiary), and the trustee. The trustee is typically a title company or a legal firm that will hold the actual title to the property until the loan is fully paid.

- Describe the property: Provide a complete legal description of the property that is being used as security for the loan. This information can usually be found on the title documents or obtained from a local assessor’s office. It's crucial that this description is accurate to prevent any legal issues down the line.

- State the loan amount: Specify the total amount of money being borrowed. This should match the amount stated in the loan agreement to avoid any discrepancies.

- Include the loan terms: Detail the terms of the loan, including the interest rate, payment schedule, maturity date, and any other conditions agreed upon by the lender and borrower. This section should match the loan agreement to ensure consistency.

- Sign and notarize the form: All parties involved—the borrower, lender, and trustee—must sign the Deed of Trust in front of a notary public. Notarization is a critical step, as it validates the identities of the signers and the document’s authenticity.

- Record the document: After notarization, the Deed of Trust must be filed with the local county recorder’s office or land registry agency. This step is vital for making the document a matter of public record, providing legal protection to all parties involved.

Completing the Deed of Trust form is a key step in the loan process, securing the agreement and ensuring that everyone's interests are properly safeguarded. Although the form itself is crucial, the actions taken after it's filled out—especially notarization and recording—are what truly finalize the arrangement. Taking time to ensure that every detail is correctly filled out and properly processed will lay a solid foundation for the financial and legal relationship between the borrower, lender, and trustee.

Understanding Deed of Trust

What is a Deed of Trust?

A Deed of Trust is a document that secures a real estate transaction, involving a borrower, a lender, and a trustee. Essentially, it's a legal tool used in some states instead of a mortgage. The property is transferred to a trustee, who holds it as security for the loan between the borrower and the lender. If the borrower defaults on the loan, the trustee has the authority to sell the property to repay the debt.

How does a Deed of Trust differ from a mortgage?

While both are used to secure a loan on a property, the fundamental difference lies in the number of parties involved and the foreclosure process. A mortgage involves two parties - the borrower and the lender. In contrast, a Deed of Trust involves an additional party, the trustee, who holds the legal title to the property until the loan is paid off. In terms of foreclosure, Deed of Trust allows for a non-judicial foreclosure process, meaning the trustee can sell the property without court involvement, making the process faster than the judicial foreclosure process often seen with mortgages.

Who can serve as a trustee in a Deed of Trust?

A trustee must be a neutral third party, typically an individual or a corporation like a title company, that is not involved in the borrowing or lending process. The role requires managing and enforcing the Deed of Trust's terms, including initiating the foreclosure process if necessary. The trustee's independent status helps to ensure that the process is fair and legal.

Is a Deed of Trust required in all states?

No, the use of a Deed of Trust depends on state laws. Some states use Deed of Trust, others use mortgages, and some allow both. For example, California, Texas, and Virginia use Deeds of Trust, while states like New York and Florida typically use mortgages. It's important to consult local laws to determine the appropriate legal instrument for real estate transactions in your area.

How is a Deed of Trust terminated?

A Deed of Trust is terminated when the loan secured by the deed is fully paid off. At that point, the trustee is required to execute a Deed of Reconveyance, which transfers the property title from the trustee back to the borrower, releasing the lien on the property and clearing the title.

Can modifications be made to a Deed of Trust after it's signed?

Yes, modifications to a Deed of Trust can be made after it's signed, but all parties involved - the borrower, the lender, and the trustee - must agree to the changes. The modifications must be documented in a formal amendment to the original deed and recorded with the county recorder's office to be legally effective.

What happens if a borrower defaults on a loan secured by a Deed of Trust?

If a borrower defaults on their loan, the trustee has the authority to initiate the foreclosure process without court involvement. This process, known as non-judicial foreclosure, allows the trustee to sell the property to repay the debt. The steps involved in this process, including notification requirements and the timeline, are dictated by state law and the terms of the Deed of Trust.

Common mistakes

When completing a Deed of Trust form, individuals often overlook important details, leading to common errors that can compromise the integrity of the legal document. An understanding of these mistakes is essential for ensuring the process is carried out correctly, ensuring all parties are protected under the law.

One of the first mistakes made is not verifying all names for accuracy. Names of the trustor, beneficiary, and trustee must be spelled correctly and match any other legal documents. A misspelled name can lead to disputes or confusion about the parties involved.

Another error involves failing to provide complete legal descriptions of the property. The Deed of Trust requires a detailed legal description that goes beyond just the address. This description, often found in a previous deed, includes boundaries and measurements that uniquely identify the property. Leaving this information incomplete or inaccurate could lead to complications in establishing clear property boundaries.

People also commonly neglect to state the loan amount clearly. The document must specify the exact amount being secured by the Deed of Trust. Any ambiguity here can affect the enforceability of the deed or lead to legal disputes down the line.

Skipping over the interest rate is another frequent error. It’s vital that the document clearly outlines the interest rate of the loan secured by the Deed of Trust. Omitting this information can invalidate agreements or cause misunderstandings between parties about financial obligations.

Some individuals forget to sign or date the document. For the Deed of Trust to be legally binding, all parties involved must sign it, and the signing date must be accurately recorded. An unsigned or undated document can significantly delay legal proceedings or even nullify the agreement.

Additionally, not acknowledging the trustee's powers and duties can lead to future disputes. The trustee holds the title to the property for the benefit of the lender and their specific roles and responsibilities should be detailed in the document to avoid any confusion about their authority.

Moreover, failing to have the document notarized is a crucial oversight. Notarization authenticates the signatures on the Deed of Trust, and without this verification, the document may not be recognized in legal proceedings. This step is essential for the document's legality and enforceability.

Last but not least, the mistake of not recording the document with the county recorder’s office can jeopardize legal claims. For a Deed of Trust to be effective against third parties, it must be recorded in the county where the property is located. Failure to do so can lead to issues with establishing a clear title, affecting future sales or transfers.

Addressing these common pitfalls when filling out a Deed of Trust form can significantly streamline the legal process, ensuring all parties are adequately protected. Attention to detail and an understanding of the form’s requirements are key to avoiding these errors.

Documents used along the form

When handling real estate transactions, a Deed of Trust is a common document used to secure a loan by using the property as collateral. However, this document does not stand alone in the process of buying or refinancing a property. Various other forms and documents play critical roles, each serving a unique purpose to ensure the transaction is legal, transparent, and beneficial to all parties involved. From establishing the terms of the loan to ensuring the property is free of liens, the documents listed below are often used in conjunction with a Deed of Trust.

- Promissory Note: This legal document outlines the borrower's promise to pay back the loan under the specified terms and conditions, such as interest rate and repayment schedule.

- Title Insurance Policy: Offers protection against losses due to title defects, ensuring the lender and homeowner have clear ownership rights.

- Homeowners Insurance Policy: Required by lenders to protect the property from damage or loss due to disasters, theft, or accidents.

- Appraisal Report: Provides an expert's assessment of the property's market value to ensure the loan amount does not exceed the property's worth.

- Home Inspection Report: Details the condition of the property, highlighting any issues that might need repair or cause concerns.

- Loan Estimate: Offers a detailed breakdown of the loan terms, including interest rates, monthly payments, and closing costs, allowing borrowers to compare offers.

- Closing Disclosure: Gives the final details of the loan terms and closing costs, providing a clear picture of the borrower's financial obligations at closing.

- Warranty Deed: Transfers title from the seller to the buyer, guaranteeing the property is free from liens and encumbrances.

- Loan Application: Used to apply for the mortgage, detailing the borrower's financial status, employment history, and credit information.

- Flood Certification: Determines whether the property is in a flood zone, which would require flood insurance as a condition of the loan.

Together, these documents ensure a secure, legal, and fair property transaction. Each one addresses a specific concern, from the financial arrangement between the buyer and lender to the physical and legal condition of the property. Understanding these documents and their significance can help all parties involved make informed decisions and facilitate a smooth real estate transaction.

Similar forms

A Deed of Trust is closely related to a Mortgage. Both documents serve as legal instruments used in securing a loan for real estate, where the borrower agrees to pay back the lender over time. The main difference lies in the parties involved and the foreclosure process. A Mortgage involves two parties, the borrower and the lender, while a Deed of Trust adds a third party, the trustee, who holds the legal title until the loan is repaid. In case of default, the foreclosure process can be faster with a Deed of Trust, as it may not require court action, unlike with a Mortgage that typically goes through the judicial system.

Another similar document is the Promissory Note. This is a financial document in which one party promises in writing to pay a debt to another party under specified terms. While the Promissory Note outlines the payment details of the loan, such as the interest rate, repayment schedule, and maturity date, the Deed of Trust provides the lender with a security interest in the property until the Promissory Note is paid in full. Thus, the Deed of Trust complements the Promissory Note by securing the loan with the property as collateral.

A Land Contract shares similarities with a Deed of Trust in the aspect of purchasing property. However, the approach differs significantly. In a Land Contract, the buyer makes payments to the seller for the property over time, and the title remains with the seller until the final payment is made. Conversely, in a Deed of Trust, the borrower obtains legal title immediately, but the trustee holds the power to sell the property if the borrower defaults on making loan payments, making it a security device rather than a sales agreement.

The Grant Deed is another document related to property transactions. It is used to transfer ownership of real property from one party (the grantor) to another (the grantee). While both the Grant Deed and the Deed of Trust involve the transfer of property rights, their purposes are different. The Grant Deed is used to convey the actual ownership, stating guarantees about the property's title, whereas the Deed of Trust is a security agreement that temporarily transfers the property's title to a trustee as collateral for a loan.

Dos and Don'ts

Filling out a Deed of Trust is a critical step in securing a mortgage for a property. This legal document creates a security interest in real estate, making it paramount to approach with accuracy and caution. Here are some do's and don'ts to guide you through the process.

- Do ensure all names are spelled correctly. The names on the Deed of Trust should match the names on the title of the property exactly. Any discrepancy can lead to legal issues or delays.

- Do include all necessary details about the property. This includes the legal description, which is more specific than just the address and may require consulting a property survey or title report.

- Do review the loan terms carefully. The Deed of Trust contains critical details about the loan, such as the interest rate, loan amount, and repayment terms. Ensure these are correct and understood.

- Do have the document notarized. A Deed of Trust is legally binding only if it's notarized. This means signing it in the presence of a notary public, who verifies the identity of the signers.

- Don't leave any blanks. If a section doesn't apply, it's better to write "N/A" than to leave it empty. Blank spaces can raise questions or lead to the document being considered incomplete.

- Don't use a generic form without verifying it complies with state laws. Deed of Trust requirements can vary significantly by state, so it's essential to use a form that meets your state's specific legal standards.

- Don't forget to determine whether additional state-specific disclosures are required. Some states have additional disclosures or notices that must be attached to the Deed of Trust.

- Don't sign without independent legal advice if you're unsure about anything. The legal and financial implications of a Deed of Trust are significant, making it wise to consult a professional if there's any uncertainty.

Misconceptions

Understanding the Deed of Trust is crucial for anyone involved in buying or selling property. However, several misconceptions cloud its concept and function. Here, we aim to clear up some of the most common misunderstandings.

Only related to trust funds or estate planning: Many believe that a Deed of Trust is solely associated with trusts or estate planning. However, it is primarily used in real estate transactions as a document that secures a loan on a property.

It’s the same as a mortgage: A common misconception is that a Deed of Trust and a mortgage are the same. While both serve to secure a loan on a property, a Deed of Trust involves three parties (borrower, lender, and trustee) instead of the two-party agreement seen in a traditional mortgage.

It transfers property ownership to the bank: Some think that signing a Deed of Trust means transferring the property's ownership to the bank or lender. In reality, it gives the lender a lien on the property as security for the loan, while the borrower retains ownership.

It gives the trustee full control over the property: There is a notion that the trustee holds complete control over the property. However, the trustee's role is primarily to hold the property's legal title for security purposes and to handle the foreclosure process if necessary, acting on behalf of the lender.

You can’t negotiate its terms: Just like any contract, the terms of a Deed of Trust can be negotiated. However, this process usually requires legal advice to ensure that the rights and interests of the borrower are safeguarded.

A Deed of Trust is only used in commercial transactions: It's a myth that Deed of Trust forms are exclusive to commercial real estate transactions. They are widely used in both commercial and residential property transactions across many states.

Foreclosures under Deeds of Trust take years: Another misconception is that foreclosures under a Deed of Trust are lengthy processes, similar to those under typical mortgages. However, because of the non-judicial foreclosure process allowed under a Deed of Trust, these can be faster, depending on state laws.

Once signed, it cannot be changed: People often mistakenly believe that once a Deed of Trust is signed, its terms are set in stone. In reality, amendments can be made if all parties agree and the changes are legally documented and recorded.

Clearing up these misconceptions allows all parties involved in a real estate transaction to better understand their rights, obligations, and the protections afforded to them under a Deed of Trust. It’s critical to approach these documents with a clear mind and accurate information.

Key takeaways

Filling out and using a Deed of Trust form is a crucial step in the process of securing a real estate transaction. This document, essentially a promise by the borrower to pay back a loan under specific terms, involves several key parties: the borrower, the lender, and the trustee. The journey through understanding and completing this form isn't as daunting as it first appears, especially when armed with some essential insights.

- Identify the Parties Accurately: The Deed of Trust involves three main roles: the borrower (also known as the trustor), the lender (the beneficiary), and the trustee. The trustee holds the property's title until the loan is paid off. Ensuring each party's information is correctly listed is fundamental.

- Understand the Terms: Know the loan amount, interest rate, payment schedule, and other significant terms. These details directly influence the obligations of the borrower and the enforcement actions the lender can take if the terms are not met.

- Check the Legal Descriptions: The property being secured must be described accurately in the deed, typically through a legal description that may include lot numbers, subdivisions, and more. This ensures that there is no ambiguity regarding what property is being discussed.

- Record the Document: A Deed of Trust isn’t effective until it is recorded with the county recorder's office. This process provides public notice that the property is encumbered by a loan.

- Know the Power of Sale Clause: Many Deeds of Trust include a power of sale clause, which allows the trustee to sell the property without a court order if the borrower defaults on the loan. Understanding how and when this clause can be activated is critical.

- Consider State Laws: Real estate and trust deed laws vary by state. It is essential to ensure that the Deed of Trust complies with the local legal requirements where the property is located.

- Right to Reinstate: Most states provide a right to reinstate the loan for a period after default, before the trustee sells the property. Familiarity with this right and its specific terms can be crucial for borrowers facing difficulties.

- Insurance and Taxes: The borrower usually is required to keep the property insured and to pay all property taxes. Failing to do so can result in default under the terms of the Deed of Trust.

- Seek Professional Advice: Lastly, the importance of consulting with a real estate attorney or a professional experienced in Deed of Trust transactions cannot be overstated. Their guidance can help navigate the complexities of this legal document and avoid potential pitfalls.

This overview provides a foundational understanding of Deed of Trust forms but remember, the unique details of your situation could require additional considerations. Tread carefully, prioritize accuracy, and when in doubt, seek expert advice to guide you through the process.

Consider More Types of Deed of Trust Forms

California Transfer on Death Deed - This form can be a safeguard, ensuring that one's real estate investment is passed on according to their wishes.

Simple Deed of Gift Template - Addresses the legal nuances of property transfer, allowing individuals to navigate the gift-giving process with confidence and security.

Corrective Deed California - It provides a legal pathway to rectify discrepancies found in property records, enhancing the deed's validity.