Fillable Deed in Lieu of Foreclosure Document for Texas

For many homeowners in Texas facing the stressful possibility of foreclosure, understanding all available options is crucial. One such option is the Deed in Lieu of Foreclosure, a form that can serve as a mutually beneficial solution for both the homeowner and the lender. This alternative allows homeowners to transfer their property voluntarily to the lender, thereby avoiding the foreclosure process. While it may seem straightforward, navigating the specifics of this form and the consequences it entails requires careful consideration. The form itself encompasses several important aspects, including the release of the homeowner from most, if not all, of their mortgage debt, potential impacts on credit scores, and the need for agreement from the lender. Additionally, it's vital for homeowners to be aware of any tax implications that could arise from this course of action. Understanding these major components can provide a clearer path for those considering a Deed in Lieu of Foreclosure as a way to address their financial hardships.

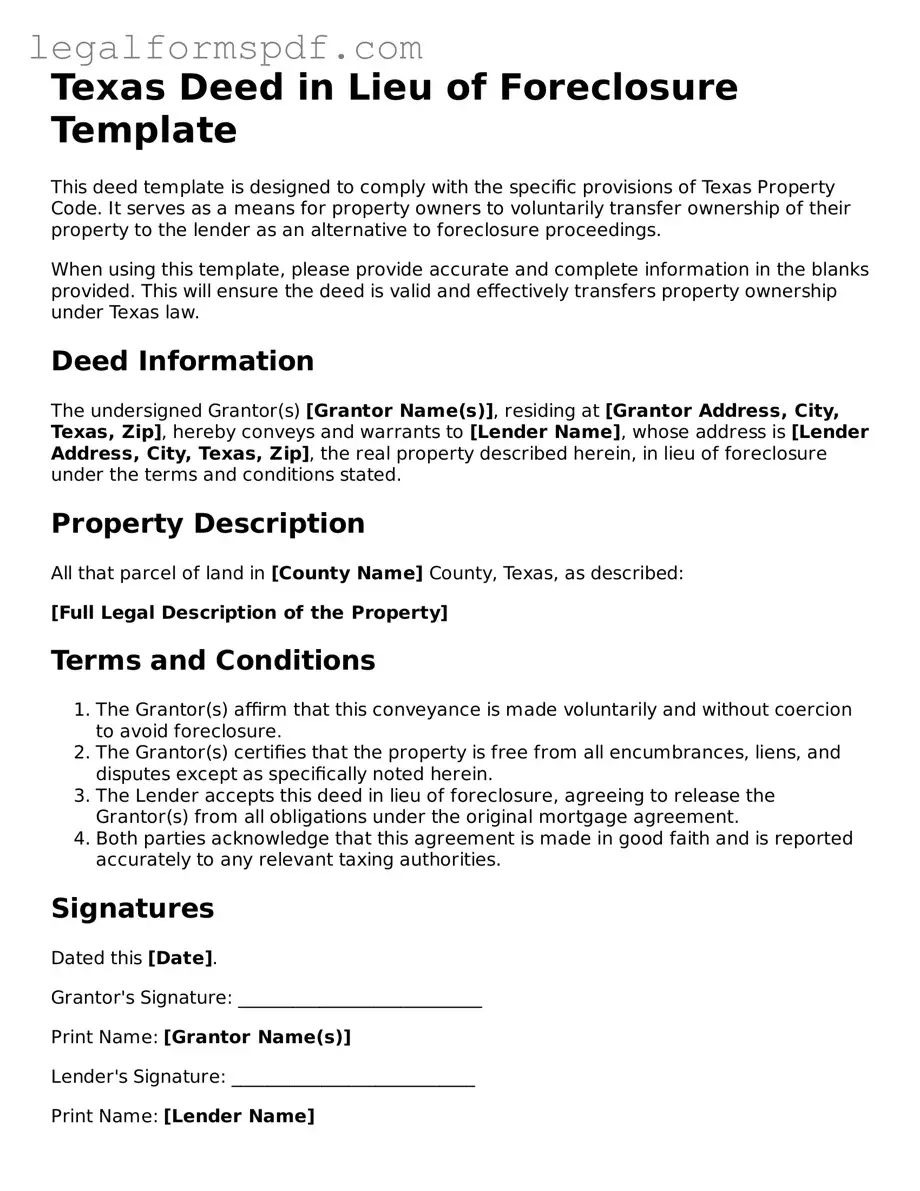

Document Example

Texas Deed in Lieu of Foreclosure Template

This deed template is designed to comply with the specific provisions of Texas Property Code. It serves as a means for property owners to voluntarily transfer ownership of their property to the lender as an alternative to foreclosure proceedings.

When using this template, please provide accurate and complete information in the blanks provided. This will ensure the deed is valid and effectively transfers property ownership under Texas law.

Deed Information

The undersigned Grantor(s) [Grantor Name(s)], residing at [Grantor Address, City, Texas, Zip], hereby conveys and warrants to [Lender Name], whose address is [Lender Address, City, Texas, Zip], the real property described herein, in lieu of foreclosure under the terms and conditions stated.

Property Description

All that parcel of land in [County Name] County, Texas, as described:

[Full Legal Description of the Property]

Terms and Conditions

- The Grantor(s) affirm that this conveyance is made voluntarily and without coercion to avoid foreclosure.

- The Grantor(s) certifies that the property is free from all encumbrances, liens, and disputes except as specifically noted herein.

- The Lender accepts this deed in lieu of foreclosure, agreeing to release the Grantor(s) from all obligations under the original mortgage agreement.

- Both parties acknowledge that this agreement is made in good faith and is reported accurately to any relevant taxing authorities.

Signatures

Dated this [Date].

Grantor's Signature: ___________________________

Print Name: [Grantor Name(s)]

Lender's Signature: ___________________________

Print Name: [Lender Name]

State of Texas

County of [County Name]

On [Date], before me, [Notary Name], a notary public in and for said state, personally appeared [Grantor Name(s)], personally known to me (or proved to me on the basis of satisfactory evidence) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument, the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

WITNESS my hand and official seal.

Signature of Notary: ___________________________

Notary Public for the State of Texas

My Commission Expires: [Expiration Date]

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document that allows a borrower to transfer the ownership of their property to the lender to avoid foreclosure proceedings. |

| Governing Law | In Texas, Deeds in Lieu of Foreclosure are governed by the state's Property Code, as well as other relevant state and federal laws. |

| Voluntary Agreement | Both parties, the borrower and lender, must agree to the Deed in Lieu voluntarily, without coercion. |

| Financial Consideration | The agreement often involves the borrower being released from their mortgage debt obligations. |

| Impact on Credit | Although less damaging than a foreclosure, having a Deed in Lieu on a credit report can still negatively impact the borrower's credit score. |

| Documentation Required | Completing the process requires several documents, including financial statements, a hardship letter, and the deed itself. |

| Potential Tax Implications | The borrower may face tax implications, as the debt relief can be considered taxable income under certain circumstances. |

| Not Always an Option | Lenders are not required to agree to a Deed in Lieu of Foreclosure and may pursue foreclosure if they believe it to be in their best interest. |

| Recording the Deed | Once agreed upon, the deed must be recorded with the local county recorder's office to be effective and clear the property title. |

Instructions on Writing Texas Deed in Lieu of Foreclosure

Once you're faced with the prospect of foreclosure, it may feel like you're at a crossroads without clear direction. Thankfully, for those in Texas, the Deed in Lieu of Foreclosure offers a viable path forward, allowing homeowners to transfer their property to the lender, thus avoiding the foreclosure process. It's a significant step that not only requires agreement from both parties but also diligent completion of the necessary form to ensure everything is legally binding and properly documented. Here are the steps to fill out the Texas Deed in Lieu of Foreclosure form, designed to guide you through this process and help ensure that all your bases are covered.

- Gather necessary documents: Before you start, ensure you have all related mortgage documents, the original deed of your property, and any other pertinent financial documents. These will provide important details needed for the form.

- Identify the parties: Write the full legal names of the borrower (you) and the lender on the designated lines. If there's more than one borrower, include each person's information.

- Describe the property: Clearly describe the property being transferred. This includes the physical address, legal description, and any identifying numbers such as the lot or block number from the county records. The more detailed, the better.

- State the consideration: This part refers to the agreement terms between you and the lender regarding the deed in lieu transaction. Often, it's the forgiveness of debt in return for the property. Be precise in outlining any agreements made.

- Sign and date the form: Both the borrower and lender must sign and date the form in the presence of a notary public. Ensure this is done correctly, as it's critical for the form's validity.

- Notarize the form: The notary public will fill out their section, certifying that all parties correctly signed the form in their presence.

- Record the deed: Take the completed, signed, and notarized form to the county recorder's office where the property is located. Filing this document officially transfers ownership and completes the process. There may be a recording fee, so be prepared to pay this at the office.

By methodically following these steps, you can navigate through the completion of the Texas Deed in Lieu of Foreclosure form. This document symbolizes a mutual agreement and understanding between the borrower and lender, aiming to bring about a resolution that avoids the long and often stressful process of foreclosure. While it marks an end to one's ownership of the property, it also opens new avenues to rebuild financially without the looming shadow of foreclosure.

Understanding Texas Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender. This action is taken to avoid the foreclosure process, which can be lengthy, stressful, and damaging to the borrower's credit score. Essentially, it's an agreement between the lender and borrower, offering a more graceful exit from the mortgage obligation.

How does a Deed in Lieu of Foreclosure work in Texas?

In Texas, the process involves the borrower and lender agreeing that the transfer of the home's title will serve as payment in full for the mortgage owed. This agreement must be in writing and include specific terms that both parties have agreed upon. Once the deed is transferred, the borrower is typically relieved from all or most of the remaining debt associated with the mortgage. However, it's essential to review the terms carefully, as some agreements may require the borrower to pay any shortfall if the property's sale doesn't cover the outstanding mortgage balance.

What are the benefits of choosing a Deed in Lieu of Foreclosure for both parties involved?

For borrowers, the primary benefit is avoiding the foreclosure process, which can significantly impact credit scores and create public records of financial distress. It can also be a faster resolution to unmanageable debt. For lenders, it reduces the time and cost associated with foreclosure proceedings and property maintenance until sale. Furthermore, it offers a smoother transition of property ownership, potentially preserving the property's condition and value.

Are there any potential downsides to a Deed in Lieu of Foreclosure?

Despite its benefits, there are downsides to consider. For the borrower, certain agreements may not absolve all the debt, especially if the property is sold for less than the mortgage's remaining balance. There may also be tax implications, as forgiven debt can sometimes be considered taxable income. For lenders, if there are any secondary liens on the property, those do not automatically disappear with a deed in lieu of foreclosure. Therefore, they may end up with a property that has multiple claims against it, complicating its sale or transfer.

Common mistakes

When homeowners find themselves in a financial bind, the Deed in Lieu of Foreclosure offers a viable exit, at least in the state of Texas. However, navigating this process can be tricky, and mistakes are common. One misstep involves inaccurately filling out personal information. It sounds straightforward, but you'd be surprised how often individuals accidentally enter incorrect names, addresses, or identification numbers. This isn't just about getting details wrong; it's about the potential legal ramifications that incorrect information can invite, muddling the path to a clean resolution.

Another common error is not properly describing the property in question. This deed requires a detailed account of the property being surrendered. Every parcel of land comes with its unique identifiers and descriptions, and overlooking these specifics can lead to significant delays. Imagine the frustration of having your deed rejected simply because a legal description was incomplete or inaccurate. It's like setting up a domino chain with great care, only to bump the table at the last moment.

A critical mistake many make is not consulting with a legal professional before submitting the form. A Deed in Lieu of Foreclosure is a complex legal document, and while it may be tempting to go it alone, the guidance of someone versed in real estate law is invaluable. They can spot issues you might overlook, provide advice on negotiation points, and ensure the document fully protects your interests. Consider this legal consultation not as an expense but as an investment in your financial recovery.

Last but not least, homeowners often miss out on reviewing the tax implications of their decision. When a property is transferred via a Deed in Lieu of Foreclosure, the difference between the outstanding mortgage balance and the property's market value can have tax consequences. Without understanding these nuances, homeowners might find themselves unexpectedly facing a hefty tax bill. This oversight underscores the importance of not only consulting a legal professional but also perhaps a tax adviser to navigate these murky waters.

Documents used along the form

When navigating the complexities of a Deed in Lieu of Foreclosure in Texas, various forms and documents often accompany the primary agreement. These supplemental documents are essential for both the borrower and the lender, ensuring a comprehensive and legally sound process. Understanding these documents aids in streamlining the process, minimizing the risk of potential legal hurdles down the line.

- Hardship Letter: This document is a personal letter written by the borrower to the lender. It explains the circumstances that led to the borrower's financial difficulties, justifying why the deed in lieu of foreclosure is being considered. This letter aims to provide the lender with a clear understanding of the borrower's situation, possibly influencing their decision-making process.

- Financial Statement: Accompanying the hardship letter, this detailed statement outlines the borrower's financial status, including income, expenses, assets, and liabilities. The financial statement is crucial for the lender to assess the borrower's financial health and determine whether a deed in lieu of foreclosure is the most viable option.

- Agreement Not to Pursue Deficiency Judgment: Often negotiated between the borrower and the lender, this document states that the lender agrees not to pursue any deficiency judgment against the borrower after the deed in lieu transaction. This provides peace of mind to the borrower, knowing they won't be pursued for any remaining debt after the property is transferred.

- IRS Form 1099-A or 1099-C: Following the completion of a deed in lieu of foreclosure, the lender may be required to report the transaction to the Internal Revenue Service. IRS Form 1099-A (Acquisition or Abandonment of Secured Property) or 1099-C (Cancellation of Debt) would be used, depending on the specifics of the transaction. These forms are essential for tax purposes, indicating potential tax liability for the borrower as a result of debt forgiveness.

The inclusion and accurate completion of these forms alongside the Texas Deed in Lieu of Foreclosure form can significantly impact the outcome of the process. Borrowers and lenders are advised to meticulously prepare and review these documents to ensure a smooth transition and prevent future legal complications. By understanding the purpose and necessity of each document, parties can approach the transaction with clarity and confidence.

Similar forms

The Texas Deed in Lieu of Foreclosure form bears resemblance to a Mortgage Agreement in how it pertains to the handling of property to secure a debt. Both documents involve a borrower and a lender, with the property acting as collateral to guarantee repayment of the loan. The Mortgage Agreement spells out the conditions under which the borrower agrees to mortgage their property, similar to how the Deed in Lieu of Foreclosure transfers the property's title to the lender if the borrower is unable to fulfill their debt obligations.

Similarly, a Quitclaim Deed is another document that echoes aspects of the Texas Deed in Lieu of Foreclosure form. This type of deed transfers ownership of property without making any warranties or guarantees about the property’s title. When a property owner signs a Quitclaim Deed, they essentially "quit" any claim they have to the property, allowing ownership to pass to someone else. This action is akin to the function of a Deed in Lieu of Foreclosure, where the borrower surrenders their rights to the property to the lender.

A Loan Modification Agreement shares commonalities with the Texas Deed in Lieu of Foreclosure form by aiming to alter an existing loan's terms to prevent foreclosure. Through negotiation, the lender and borrower may agree to modify the loan terms to make repayments more manageable for the borrower. While a Deed in Lieu of Foreclosure is one outcome of unsuccessful loan modification attempts, it represents a mutually agreed upon conclusion to avoid the foreclosure process.

The concept of a Short Sale Approval Letter also aligns with the principles behind a Deed in Lieu of Foreclosure. In situations where a borrower cannot meet their mortgage obligations, a short sale allows for the property to be sold for less than the amount owed on the mortgage. Similar to a Deed in Lieu of Foreclosure, it presents an alternative solution to foreclosure, albeit through the sale of the property rather than its transfer back to the lender.

An Assignment of Rent also intersects with the intentions behind a Deed in Lieu of Foreclosure, especially in the realm of rental properties. This document allows a lender to collect rents from tenants in the event the landlord defaults on their loan. Although its direct effect is different, the underlying purpose of mitigating financial losses for the lender in cases of borrower default is a shared objective with the Deed in Lieu of Foreclosure.

Lastly, the Release of Lien document parallels the finality of a Deed in Lieu of Foreclosure by legally freeing the borrower from the lien placed on their property due to a mortgage or other debt once that debt is settled. The Deed in Lieu of Foreclosure similarly concludes the financial and legal obligations between borrower and lender by transferring property ownership, effectively releasing the lien associated with the mortgage loan.

Dos and Don'ts

When facing the possibility of foreclosure, a Deed in Lieu of Foreclosure can be a viable option for homeowners in Texas. This legal document transfers ownership of the property from the homeowner to the lender, effectively preventing foreclosure. This process is complicated, and every step should be taken with caution. Below are essential guidelines on what you should and shouldn't do when filling out the Texas Deed in Lieu of Foreclosure form.

Things You Should Do

- Review all terms and conditions of your mortgage and the Deed in Lieu of Foreclosure agreement. It’s crucial to understand your rights and any potential consequences.

- Consult with a legal advisor. Professional advice can help you navigate the complexities of foreclosure laws in Texas.

- Gather all necessary documents, including your mortgage agreement and any correspondence with your lender regarding your financial situation.

- Fill out the form accurately. Double-check all entries for correctness, including personal information and property details.

- Keep copies of all documents related to the Deed in Lieu of Foreclosure, including the completed form, for your records.

Things You Shouldn't Do

- Ignore letters or calls from your lender. Communication is key to finding a solution, and avoiding discussions can lead to less favorable outcomes.

- Sign the Deed in Lieu of Foreclosure form without fully understanding the implications. This step will significantly affect your financial situation and legal rights.

- Omit important financial information or misrepresent your situation. Transparency is critical for a fair resolution.

- Fill out the form in haste. Take your time to accurately complete every section to avoid errors that could delay the process.

- Attempt to handle the entire process alone if you are feeling overwhelmed. Seeking the help of a legal advisor or a housing counselor is advisable.

Remember, opting for a Deed in Lieu of Foreclosure is a significant legal decision that should be considered carefully. The guidance of a legal advisor cannot be underestimated in evaluating the best course of action for your particular situation.

Misconceptions

When dealing with the process of handling distressed properties in Texas, a Deed in Lieu of Foreclosure is an option that comes up often. However, there are several misconceptions about this form and process that can lead to confusion. Below are five common misconceptions explained for better understanding.

It's the same as a foreclosure. Many think that a Deed in Lieu of Foreclosure is the same as going through a foreclosure. However, in practice, a Deed in Lieu of Foreclosure is where the borrower voluntarily hands over the property title to the lender to satisfy a loan that's in default and avoid foreclosure proceedings. It's a different process from foreclosure, intended to be less damaging to the borrower's credit.

It will completely erase any debt tied to the property. Another common misconception is that once a Deed in Lieu of Foreclosure is executed, the borrower is free from all the debt associated with the property. This isn't always the case. Depending on the agreement with the lender, the borrower might still be responsible for any deficiency, which is the difference between the value of the property and the amount owed.

Any homeowner can pursue it as an option. Not every homeowner facing foreclosure will qualify for a Deed in Lieu of Foreclosure. Lenders often have specific criteria and conditions that must be met, including a clear title free from other liens or encumbrances. Homeowners must go through an application process, and not all are approved.

It's a quick fix for foreclosure. Many believe that a Deed in Lieu of Foreclosure can quickly resolve their foreclosure issues. While it can be faster than going through a foreclosure, it's not an immediate process. There are negotiations, document preparations, and potentially waiting periods required by the lender or mandated by state law.

It has no impact on the borrower's credit report. Finally, some may think that a Deed in Lieu of Foreclosure will not affect their credit report. While it may have a less severe impact than a foreclosure, it is still a negative mark on a borrower's credit report. It indicates that the loan was not paid as originally agreed, which can influence future creditworthiness.

Key takeaways

When homeowners in Texas find themselves unable to meet their mortgage obligations, a Deed in Lieu of Foreclosure offers a potential alternative to the foreclosure process. This approach involves the voluntary transfer of property ownership from the borrower to the lender. It's crucial to understand the key aspects of filling out and using the Texas Deed in Lieu of Foreclosure form effectively. Below are ten important takeaways to guide you through this process.

- The Deed in Lieu of Foreclosure form requires thorough accuracy in the details provided. This includes the full legal names of both the borrower and the lender, and a precise description of the property being transferred.

- Both parties must agree to the terms of the Deed in Lieu of Foreclosure voluntarily. Coercion or pressuring a party into signing can render the agreement invalid.

- It's essential to review the form to ensure that it meets all Texas legal requirements. These requirements may include specific language or clauses that protect both parties' interests.

- Securing a title search on the property ahead of finalizing the agreement is advisable. This step verifies that there are no undisclosed liens or encumbrances that could complicate the transfer.

- The form must be signed in the presence of a notary public to be legally binding. The notary acknowledges that all parties signed the document willingly and under their own power.

- After signing, the Deed in Lieu of Foreclosure must be filed with the county recorder's office where the property is located. This action makes the agreement public record and legally transfers ownership.

- Consider the tax implications for both the borrower and the lender. Sometimes, a Deed in Lieu of Foreclosure can result in tax liabilities due to forgiven debt being considered taxable income.

- Understand that accepting a Deed in Lieu of Foreclosure might not discharge all the borrower's obligations. If the property's value is less than the mortgage owed, the lender may seek a deficiency judgment.

- Engage with an attorney specializing in real estate or foreclosure law in Texas. Professional guidance can help navigate the complex legal landscape and protect your rights and interests.

- Finally, explore all other foreclosure alternatives. While a Deed in Lieu of Foreclosure can be beneficial, ensuring it's the best option for your circumstances is vital. Other possibilities might include loan modification, refinancing, or selling the property to avoid foreclosure.

Approaching the Deed in Lieu of Foreclosure process with a detailed understanding and careful planning can provide a dignified exit from a challenging situation, potentially benefiting both the borrower and the lender. However, it's critical to handle each step of the process thoughtfully and to seek professional advice when necessary.

More Deed in Lieu of Foreclosure State Forms

Foreclosure Process in Georgia - It facilitates a smoother transition of property ownership, minimizing the impact on the borrower’s credit compared to a foreclosure.

Deed in Lieu of Foreclosure Template - It includes information on any compensation the homeowner will receive, which could range from debt forgiveness to cash incentives for relocation.

Foreclosure Vs Deed in Lieu - This document formally agrees to transfer property from the homeowner to the lending institution as an alternative to facing foreclosure.

Deed in Lieu of Mortgage - An arrangement that avoids the lengthy foreclosure process by allowing homeowners to transfer their property title directly to the lender.