Fillable Deed in Lieu of Foreclosure Document for Pennsylvania

In the intricate landscape of real estate transactions, homeowners facing financial hurdles have various avenues to consider, one of which involves the Pennsylvania Deed in Lieu of Foreclosure form. This option serves as a mutual agreement between a lender and a borrower, where the borrower can transfer the ownership of their property to the lender to satisfy a loan that is in default, effectively avoiding the foreclosure process. The appeal of this form lies in its ability to provide a relatively swift resolution, minimizing the financial and emotional toll associated with foreclosures. Additionally, it spares both parties involved from the lengthy and public foreclosure proceedings, thereby offering a more discreet resolution to a pressing financial crisis. Equally important, this form addresses specific details regarding the property's condition, any junior liens, and the agreement's impact on the borrower's credit rating. By understanding the critical elements and implications of the Pennsylvania Deed in Lieu of Foreclosure form, homeowners and lenders can navigate the challenging waters of financial distress with a clearer perspective, potentially turning a dire situation into a manageable resolution.

Document Example

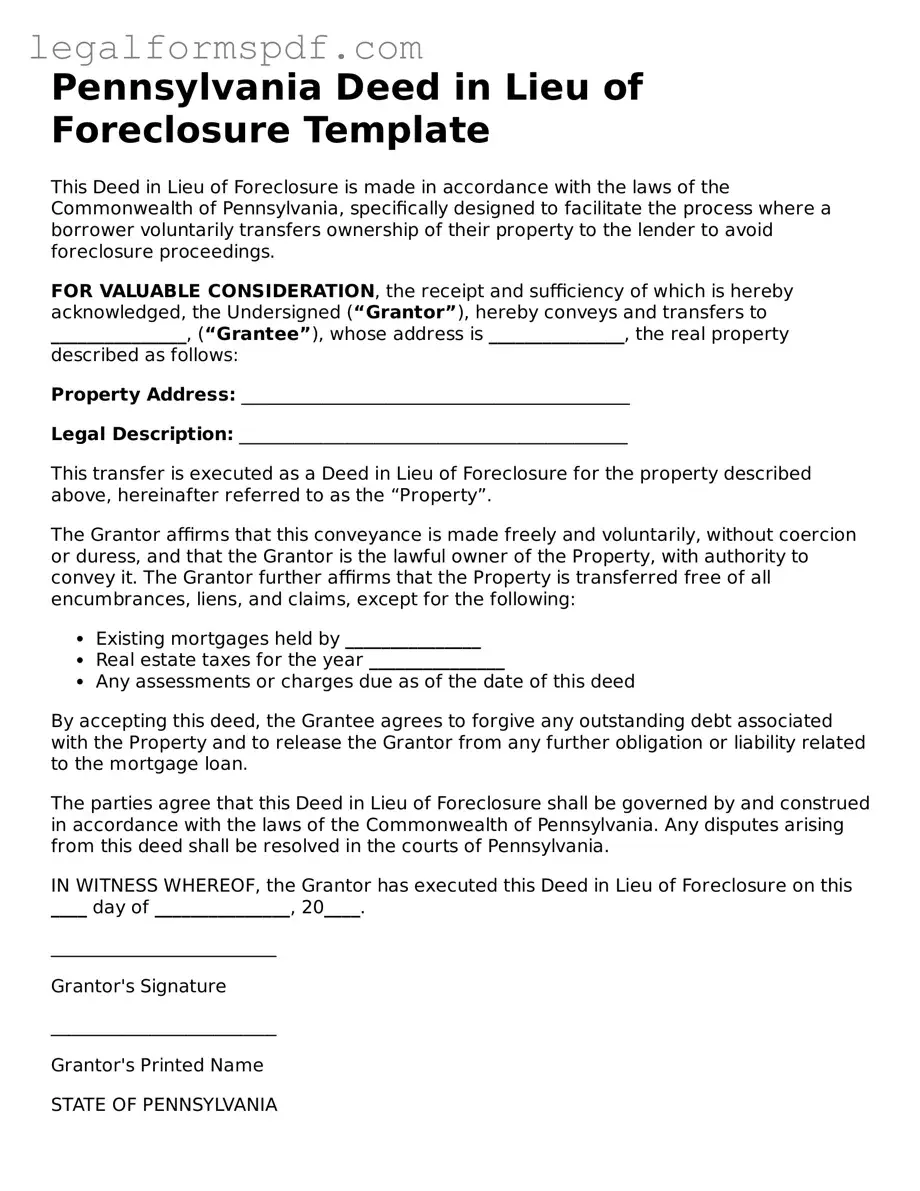

Pennsylvania Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made in accordance with the laws of the Commonwealth of Pennsylvania, specifically designed to facilitate the process where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure proceedings.

FOR VALUABLE CONSIDERATION, the receipt and sufficiency of which is hereby acknowledged, the Undersigned (“Grantor”), hereby conveys and transfers to _______________, (“Grantee”), whose address is _______________, the real property described as follows:

Property Address: ___________________________________________

Legal Description: ___________________________________________

This transfer is executed as a Deed in Lieu of Foreclosure for the property described above, hereinafter referred to as the “Property”.

The Grantor affirms that this conveyance is made freely and voluntarily, without coercion or duress, and that the Grantor is the lawful owner of the Property, with authority to convey it. The Grantor further affirms that the Property is transferred free of all encumbrances, liens, and claims, except for the following:

- Existing mortgages held by _______________

- Real estate taxes for the year _______________

- Any assessments or charges due as of the date of this deed

By accepting this deed, the Grantee agrees to forgive any outstanding debt associated with the Property and to release the Grantor from any further obligation or liability related to the mortgage loan.

The parties agree that this Deed in Lieu of Foreclosure shall be governed by and construed in accordance with the laws of the Commonwealth of Pennsylvania. Any disputes arising from this deed shall be resolved in the courts of Pennsylvania.

IN WITNESS WHEREOF, the Grantor has executed this Deed in Lieu of Foreclosure on this ____ day of _______________, 20____.

_________________________

Grantor's Signature

_________________________

Grantor's Printed Name

STATE OF PENNSYLVANIA

COUNTY OF _______________

On this ____ day of _______________, 20____, before me, the undersigned officer, personally appeared _________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

_________________________

Notary Public

My Commission Expires: ____/____/____

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Pennsylvania Deed in Lieu of Foreclosure is a legal document where a homeowner voluntarily transfers the property title to the lender to avoid the foreclosure process. |

| Governing Laws | It is governed by Pennsylvania state law, particularly the laws that regulate real estate transactions and foreclosures. |

| Benefit to Borrower | The borrower can avoid the negative impact of a foreclosure on their credit report. |

| Benefit to Lender | The lender can save time and money by bypassing the lengthy and costly foreclosure process. |

| Document Components | It typically includes the property description, agreement terms, borrower and lender information, and the date of transfer. |

| Recording Requirements | Once executed, the deed must be recorded with the county recorder’s office in the county where the property is located. |

| Potential Tax Implications | Transferring property through a deed in lieu of foreclosure may have tax implications for the borrower, such as being taxed on the forgiven debt as income. |

Instructions on Writing Pennsylvania Deed in Lieu of Foreclosure

When a homeowner can no longer meet their mortgage payments, offering the property back to the lender through a Deed in Lieu of Foreclosure can be a viable alternative to foreclosure. It allows the borrower to transfer the ownership of their property to the lender voluntarily. This process is not only complex but involves careful documentation. The Pennsylvania Deed in Lieu of Foreclosure form is an essential document for this process, ensuring that the transfer of property is legally binding and accurately recorded. It's crucial to fill out this form correctly to avoid any potential legal issues in the future. Here are the steps you need to follow to complete the form accurately.

- Gather Necessary Information: Before you start filling out the form, collect all the required information, including the legal description of the property, the homeowner's details, and the lender's details.

- Identify the Parties: Clearly state the name of the borrower (grantor) and the lender (grantee) as outlined in your mortgage documents.

- Describe the Property: Include a complete legal description of the property being transferred. This description can be found in your original mortgage or deed documents.

- Include Outstanding Loan Amount: Specify the current outstanding loan amount that is being satisfied by the Deed in Lieu of Foreclosure.

- Terms and Conditions: Carefully outline any terms and conditions agreed upon by both parties regarding the property transfer, including any financial considerations, release of liabilities, or specific conditions the lender requires.

- Signatures: Both the borrower and the lender must sign the form in the presence of a notary public to validate the agreement. Ensure that all signatures are affixed correctly.

- Notarization: The form must be notarized to confirm the identities of all parties involved and to acknowledge that they entered into the agreement willingly and without coercion.

- File the Form: Once completed and notarized, submit the Deed in Lieu of Foreclosure form to the appropriate county office in Pennsylvania where the property is located to make the agreement official. Recording fees may apply.

Filling out the Pennsylvania Deed in Lieu of Foreclosure form is a critical step in transferring property ownership from the borrower to the lender without going through the foreclosure process. By following these steps diligently, you ensure that the process is performed legally and accurately, providing a smoother transition for all parties involved. Remember, it's beneficial to consult with a professional to assist you throughout this process, ensuring that all legal requirements are met and your rights are protected.

Understanding Pennsylvania Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure form in Pennsylvania?

A Deed in Lieu of Foreclosure form in Pennsylvania is a legal document that allows a homeowner to transfer the ownership of their property back to the lender. This is used as a means to avoid the foreclosure process. When homeowners find they can no longer afford their mortgage payments, this form provides a way to hand over the property voluntarily, thus dodging the often lengthy and costly foreclosure process.

How does a Deed in Lieu of Foreclosure affect my credit score?

While opting for a Deed in Lieu of Foreclosure may seem like a favorable alternative to foreclosure, it still impacts your credit score negatively. However, the impact is generally less severe than a foreclosure. It's important to understand that though the reduction in credit score can be significant, the ability to recover and rebuild credit might be quicker than if the property had gone through foreclosure.

Can I offer a Deed in Lieu if my house in Pennsylvania is worth less than what I owe?

Yes, it is possible to offer a Deed in Lieu of Foreclosure even if your house is "underwater," meaning you owe more on your mortgage than the current market value of the property. However, whether or not the lender accepts the Deed in Lieu under these circumstances can vary. Lenders might agree if they determine that accepting the deed is more beneficial financially than proceeding with a foreclosure.

What are the tax implications of a Deed in Lieu of Foreclosure in Pennsylvania?

Proceeding with a Deed in Lieu of Foreclosure can have tax implications. For instance, if the lender forgives any part of your mortgage debt, the forgiven amount could be considered taxable income. It's important to consult with a tax professional to understand the specific implications for your situation and possibly identify any exclusions or exemptions that could apply.

Do I need a lawyer to complete a Deed in Lieu of Foreclosure in Pennsylvania?

While it's not a strict requirement, consulting with a lawyer who specializes in real estate or foreclosure law can be extremely beneficial. They can help navigate the process, negotiate terms with the lender, and ensure that your rights are protected throughout. A lawyer can also help clarify any legal jargon and make sure that you fully understand the agreement and its implications.

What steps should I take to begin the Deed in Lieu of Foreclosure process in Pennsylvania?

To start the process, you should first contact your lender to discuss the possibility of a Deed in Lieu of Foreclosure. It's crucial to have an open and honest discussion about your financial situation. The lender may require you to fill out a loss mitigation application or provide financial information to prove that you're unable to continue making mortgage payments. Gathering and preparing your financial documents in advance can help streamline this process. Also, consult a real estate or foreclosure attorney to guide you through the legal aspects and paperwork involved.

Common mistakes

Filling out the Pennsylvania Deed in Lieu of Foreclosure form can be a complex process. Many individuals falter by not thoroughly understanding the legal consequences it entails. A significant mistake is neglecting to seek legal advice. The expertise of a lawyer can guide one through the nuances and potential ramifications, ensuring that all parties' rights are protected.

Another common error is not accurately describing the property. The form requires an exact description of the property being transferred. Failing to include all relevant details or providing incorrect information can lead to disputes and potentially invalidate the deed. The property description must match public records to ensure clarity and legality.

Incorrectly executing the document is another pitfall. The deed must be signed in the presence of a notary public to be legally binding. Without proper notarization, the deed in lieu of foreclosure is not valid, which can complicate matters further for the homeowner facing foreclosure.

Many also overlook the importance of addressing all liens and encumbrances on the property. It's crucial to disclose any and all financial obligations tied to the property. Failure to do so can lead to unresolved debts and legal challenges from creditors, which the new owner would certainly want to avoid.

Failing to obtain lender agreement is a critical mistake. The lender must agree to accept the deed in lieu of foreclosure as a full settlement of the mortgage debt. Without this agreement, documented in writing, the transfer might not fully release the borrower from the obligation, leaving them financially liable.

Ignoring tax implications can lead to unexpected financial burdens. Transferring property via a deed in lieu can create tax liabilities for both parties. Individuals should consult with a tax professional to understand the potential impacts and plan accordingly.

Not disclosing the property's condition honestly is another error. Any known issues or defects should be communicated to the lender prior to the transfer. This transparency can mitigate legal risks and foster trust in the transaction.

People sometimes assume that a deed in lieu will automatically stop the foreclosure process. This assumption can lead to a false sense of security. The lender must formally agree to halt foreclosure actions, and this cessation should be explicitly stated in the agreement.

Last but not least, neglecting to secure a release of liability from the lender post-transfer is a risky oversight. Without this release, the former homeowner could remain liable for any shortfall between the property's value and the mortgage balance. Securing a written release ensures a clean break from the property's financial obligations.

Documents used along the form

In Pennsylvania, navigating the process surrounding a Deed in Lieu of Foreclosure requires dealing not only with the deed itself but also with multiple other documents. These documents ensure clarity, legality, and full understanding of the process for all parties involved. Each serves a specific purpose in the transaction, providing additional details, agreements, or disclosures necessary for a smooth transition of property ownership without the traditional foreclosure process.

- Hardship Letter: This is a personal letter written by the borrower to the lender explaining the reasons they are unable to continue making payments on their mortgage. It often includes financial statements and other evidence of financial hardship.

- Financial Statement: Accompanying the Hardship Letter, this detailed form outlines the borrower's income, expenses, assets, and liabilities, giving the lender a clear picture of the borrower's financial situation.

- Authorization to Release Information: Allows the lender to obtain information directly from third parties, such as employers, banks, and the IRS, which is necessary to verify the borrower's financial condition and hardship claims.

- Estoppel Affidavit: This affirms that there are no additional claims against the property beyond the mortgage being settled by the deed in lieu transaction. It may address matters such as judgments, liens, and other encumbrances.

- Non-Merger Agreement: Prevents the merger of the deed's interest with the mortgage interest, allowing the lender to pursue other claims related to the mortgage that were not settled by the deed in lieu of foreclosure.

- 1099-A Form or 1099-C Form: These IRS forms are used for tax purposes. The 1099-A form is issued if the property is abandoned, stating the acquisition or abandonment of secured property. The 1099-C form is issued if the debt is canceled, reporting the canceled amount of debt that may be considered as income for the borrower.

Understanding and preparing each of these documents is critical to properly executing a deed in lieu of foreclosure in Pennsylvania. They each contribute to a legal and transparent process, safeguarding the interests of all parties. Securing the necessary information and ensuring the accurate completion of these documents optimizes the outcome for both the lender and the borrower during this challenging time.

Similar forms

The Pennsylvania Deed in Lieu of Foreclosure form shares similarities with the Mortgage Agreement document, as both outline the obligations of borrowers towards lenders concerning real estate. The Mortgage Agreement establishes the terms under which the lender provides a loan for the borrower to purchase property, while the Deed in Lieu of Foreclosure comes into play when the borrower is unable to fulfill those obligations, offering the property back to the lender to satisfy the debt.

Similar to a Quitclaim Deed, the Deed in Lieu of Foreclosure involves the transfer of property ownership without making any warranties about the title. The Quitclaim Deed is often used between family members or to clear up a title issue, transferring ownership interest from the grantor to the grantee with no guarantees. The Deed in Lieu, while also transferring ownership, specifically aims to resolve an outstanding mortgage under the threat of foreclosure.

The Deed in Lieu of Foreclosure form and the Warranty Deed both facilitate the transfer of property. However, a Warranty Deed includes guarantees from the seller (grantor) to the buyer (grantee) that the property is free of liens and encumbrances, apart from those explicitly stated. The Deed in Lieu, conversely, may not disclose the complete financial or legal status of the property but also transfers ownership, typically under distressed circumstances.

A Loan Modification Agreement, like the Deed in Lieu of Foreclosure form, is used when a borrower is facing financial difficulties. Instead of transferring property ownership to resolve debt as seen in a Deed in Lieu, a Loan Modification Agreement changes the original terms of the mortgage loan, such as interest rate or payment schedule, to make it more manageable for the borrower to continue making payments and retain ownership of the property.

Similar to the Settlement Statement in a closing process, the Deed in Lieu of Foreclosure form includes crucial financial details regarding the mortgage and property. The Settlement Statement breaks down fees, payments, and credits in a real estate transaction, providing a transparent accounting to both buyer and seller. In contrast, the Deed in Lieu of Foreclosure highlights the resolution of an outstanding mortgage balance through the transfer of property but similarly focuses on clarifying financial aspects.

The Foreclosure Notice and the Deed in Lieu of Foreclosure form are closely linked in the foreclosure process. The Foreclosure Notice is a legal document that informs the borrower of the lender's intent to foreclose on the property due to default. It is the preliminary step that may lead to a Deed in Lieu of Foreclosure if both parties agree to avoid the foreclosure process through the transfer of the property back to the lender.

Similarly, the Notice of Default is an essential document that precedes the need for a Deed in Lieu of Foreclosure. It serves as a formal notification from the lender to the borrower that they have not met their payment obligations under the mortgage agreement. Like the Foreclosure Notice, it highlights financial distress but precedes the actual foreclosure process, offering a potential point at which a Deed in Lieu of Foreclosure could be considered as an alternative solution.

The Assignment of Mortgage is another document related to the Deed in Lieu of Foreclosure form. It involves the transfer of a mortgage from one party to another, often used by lenders to sell mortgages to other investors. Unlike the Deed in Lieu, which transfers property ownership to satisfy debt, the Assignment of Mortgage transfers the interest in the mortgage itself, reflecting a shift in who has the right to collect the debt rather than resolving the underlying obligation through property transfer.

Lastly, the Release of Mortgage document, like the Deed in Lieu of Foreclosure form, signals the end of a mortgage obligation. The Release of Mortgage is issued by the lender once the borrower has fulfilled all mortgage terms, clearing the borrower of any further claims against the property. Conversely, the Deed in Lieu of Foreclosure also concludes a mortgage obligation but does so because the borrower is unable to meet the terms, offering property transfer as an alternative resolution.

Dos and Don'ts

When dealing with the Pennsylvania Deed in Lieu of Foreclosure form, individuals must tread carefully to ensure that the process is handled correctly and efficiently. Here is a helpful guide that outlines what should and shouldn’t be done:

Do's:

- Review the Agreement Thoroughly: Prior to completing the form, make sure to carefully read through the entire agreement to fully understand the terms and conditions stipulated.

- Provide Accurate Information: It is crucial to enter all requested details accurately to avoid any potential legal complications. Double-check to ensure that there are no errors.

- Seek Legal Advice: Given the complexity of real estate transactions, consulting with a legal professional is advisable to navigate the process effectively and to comprehend the implications of the agreement.

- Use Black Ink: For clarity and formality, always fill out the form in black ink, unless otherwise specified.

- Sign in the Presence of a Notary: Ensure that all signatures are done in the presence of a notary to validate the authenticity of the document.

- Keep Copies for Personal Records: After submission, it’s important to keep copies of the form and any related documents for personal records and future reference.

- Follow Up: After submitting the form, follow up with the relevant party to confirm receipt and inquire about any further steps or additional information required.

Don'ts:

- Postpone the Submission: Avoid delays in submitting the form. Timely submission is key to preventing additional complications or the risk of foreclosure.

- Leave Fields Blank: Do not leave any fields blank. If a section does not apply, indicate this by writing “N/A” (not applicable) to demonstrate it was not overlooked.

- Alter the Form without Authorization: Making unauthorized changes to the form can lead to legal issues. Only provide the information requested in the specified fields.

- Ignore Specific Instructions: Adhere to all specified instructions on the form to ensure that it is filled out correctly. Ignoring these may result in the rejection of the form.

- Overlook the Need for Witnesses: Failure to have the document witnessed (if required) can invalidate the agreement. Always check whether witness signatures are necessary.

- Use Pencil or Coloured Ink: Do not use pencil, as it can easily be erased or altered, and avoid coloured inks that may not be acceptable for official documents.

- Submit Without Reviewing: Finally, don’t submit the document without reviewing it for mistakes or omissions. A final check can prevent unnecessary issues.

Misconceptions

When navigating the complexities of avoiding foreclosure in Pennsylvania, many individuals might consider a Deed in Lieu of Foreclosure. This process can be quite misunderstood, leading to a number of misconceptions.

- It completely clears all your debt tied to the property: One common misunderstanding is that opting for a Deed in Lieu of Foreclosure will eliminate all the debt associated with the home. However, this is not always the case. In some instances, if the property’s sale doesn’t cover the full amount owed, the borrower may still be responsible for the remaining balance, known as a deficiency.

- It's an easy and quick solution: Another misconception is that this process is straightforward and fast. In reality, getting approval for a Deed in Lieu of Foreclosure can be a lengthy process that involves negotiation with the lender. The bank or mortgage servicer must agree that accepting the deed is in their best interest, which is not always the case.

- It will not affect your credit score as much as a foreclosure: While it's true that a Deed in Lieu of Foreclosure may have a slightly less negative impact on your credit score compared to a traditional foreclosure, it is still a negative mark and can significantly affect your ability to borrow in the future. The difference in impact between the two can vary, but both are detrimental to credit health.

- Any homeowner can choose this option regardless of their mortgage status: This is not correct. Typically, homeowners who have exhausted other loss mitigation options without success might be eligible for a Deed in Lieu of Foreclosure. It often requires the borrower to be in default under their mortgage terms. Lenders are not obligated to accept a deed in lieu and may not do so if there are better recovery options available.

- It frees the borrower from all financial obligations related to the property immediately: While a Deed in Lieu of Foreclosure can relieve the homeowner from the mortgage debt, there may still be other financial obligations tied to the property. For instance, any outstanding homeowners association (HOA) fees, second mortgages, or equity lines of credit secured by the property might not be discharged through this process.

Understanding these misconceptions is crucial for homeowners considering a Deed in Lieu of Foreclosure. This knowledge can help them make informed decisions and explore all possible options when facing foreclosure.

Key takeaways

Filling out and using the Pennsylvania Deed in Lieu of Foreclosure form is an important process for homeowners facing the prospect of foreclosure. This legal document allows a homeowner to transfer the ownership of their property back to the lender voluntarily, to avoid the foreclosure process. Here are the key takeaways to understand when dealing with this form:

- A Deed in Lieu of Foreclosure must be in writing and should accurately identify the property being transferred.

- The homeowner must have clear title to the property, free of any liens, judgments, or other encumbrances that could complicate the transfer.

- The lender must agree to accept the deed in lieu of proceeding with foreclosure. This agreement should be documented in writing.

- Both parties should conduct a thorough title search to ensure there are no unseen issues with the property's title.

- The homeowner may be required to provide a financial package and hardship letter, detailing their financial situation and reasons for seeking a deed in lieu of foreclosure.

- It’s important to negotiate whether the transaction will fully satisfy the debt or if the homeowner will be liable for any deficiency balance.

- The document must be signed by all necessary parties, typically including the homeowner(s) and a representative of the lender.

- Notarization of the deed is a crucial step for the document to be legally binding.

- After the deed is executed, it must be recorded with the county recorder's office where the property is located.

- Homeowners should be aware that a deed in lieu of foreclosure may have tax implications, particularly related to the forgiveness of debt.

Understanding these key points can help ensure the process is completed correctly and both the homeowner and lender are protected. It is often beneficial to seek legal counsel to navigate the complexities of this transaction.

More Deed in Lieu of Foreclosure State Forms

Will I Owe Money After a Deed in Lieu of Foreclosure - A legal mechanism for homeowners to avoid the foreclosure process by transferring the title of their home back to the lender.

California Property Surrender Deed - By executing a deed in lieu of foreclosure, homeowners may also reduce or eliminate the amount of debt pursued by other creditors.

Deed in Lieu of Mortgage - This is a voluntary transfer of property from a borrower to a lender to fulfill loan obligations and avoid the foreclosure process.