Fillable Deed in Lieu of Foreclosure Document for Ohio

When homeowners in Ohio find themselves facing financial difficulties, unable to continue making mortgage payments, one option they might consider is a Deed in Lieu of Foreclosure. This legal document allows a borrower to transfer ownership of their property back to the lender, effectively avoiding the foreclosure process. While this may seem like a straightforward solution, numerous intricacies are involved, requiring careful consideration. The form itself is a critical component of this process, encompassing various aspects such as the need for detailed information about the borrower, the lender, and the property, conditions that must be met, and the implications for both parties. Understanding these elements is essential for anyone considering this path as a means to address their mortgage challenges. It not only signifies a borrower’s intent to transfer property rights but also sets in motion a series of legal and financial considerations that both the lender and the borrower must navigate. This introductory exploration aims to shed light on major aspects of the Ohio Deed in Lieu of Foreclosure form, providing an overview of its purpose, the process it initiates, and its consequences for all involved.

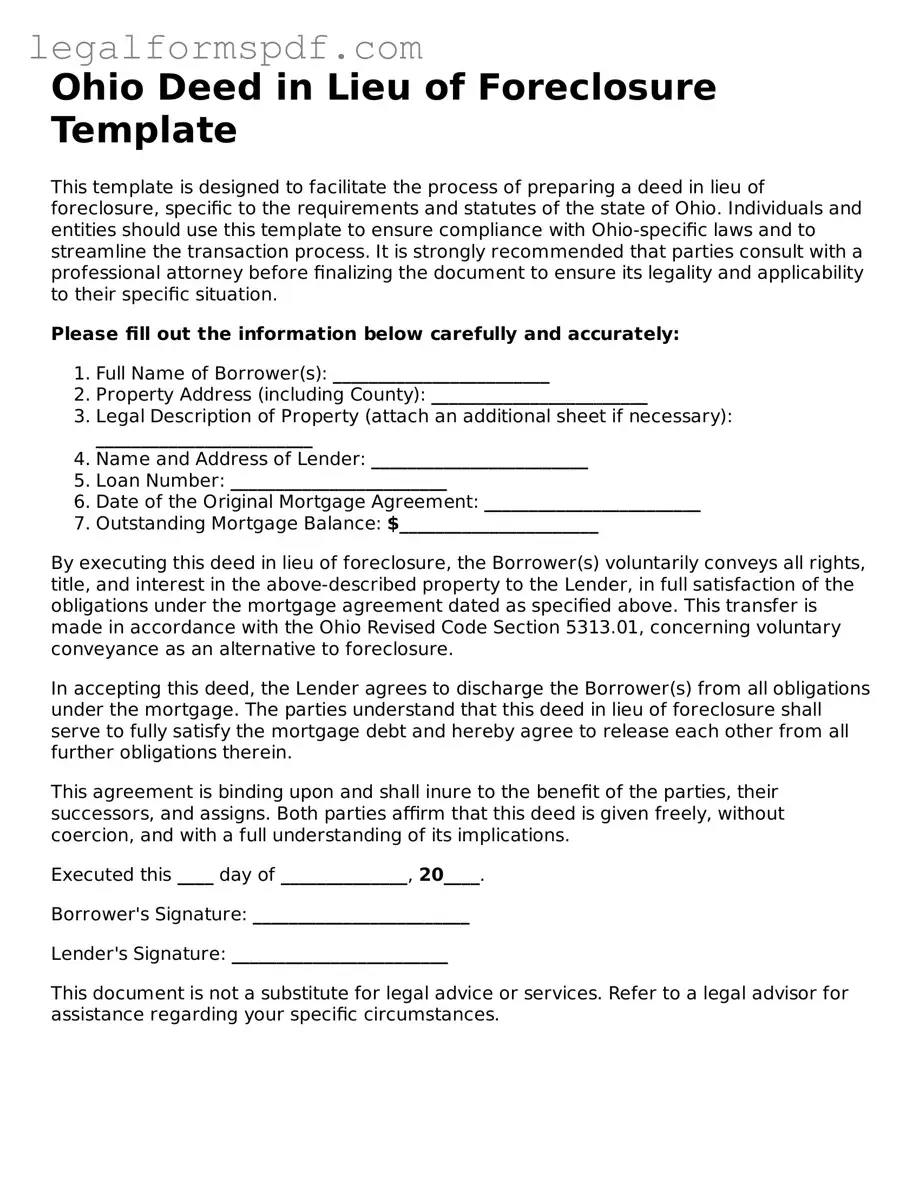

Document Example

Ohio Deed in Lieu of Foreclosure Template

This template is designed to facilitate the process of preparing a deed in lieu of foreclosure, specific to the requirements and statutes of the state of Ohio. Individuals and entities should use this template to ensure compliance with Ohio-specific laws and to streamline the transaction process. It is strongly recommended that parties consult with a professional attorney before finalizing the document to ensure its legality and applicability to their specific situation.

Please fill out the information below carefully and accurately:

- Full Name of Borrower(s): ________________________

- Property Address (including County): ________________________

- Legal Description of Property (attach an additional sheet if necessary): ________________________

- Name and Address of Lender: ________________________

- Loan Number: ________________________

- Date of the Original Mortgage Agreement: ________________________

- Outstanding Mortgage Balance: $______________________

By executing this deed in lieu of foreclosure, the Borrower(s) voluntarily conveys all rights, title, and interest in the above-described property to the Lender, in full satisfaction of the obligations under the mortgage agreement dated as specified above. This transfer is made in accordance with the Ohio Revised Code Section 5313.01, concerning voluntary conveyance as an alternative to foreclosure.

In accepting this deed, the Lender agrees to discharge the Borrower(s) from all obligations under the mortgage. The parties understand that this deed in lieu of foreclosure shall serve to fully satisfy the mortgage debt and hereby agree to release each other from all further obligations therein.

This agreement is binding upon and shall inure to the benefit of the parties, their successors, and assigns. Both parties affirm that this deed is given freely, without coercion, and with a full understanding of its implications.

Executed this ____ day of ______________, 20____.

Borrower's Signature: ________________________

Lender's Signature: ________________________

This document is not a substitute for legal advice or services. Refer to a legal advisor for assistance regarding your specific circumstances.

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a document through which a homeowner can transfer ownership of their property to the lender to avoid the foreclosure process. |

| Governing Law | In Ohio, Deeds in Lieu of Foreclosure are governed by state law, primarily under the Ohio Revised Code and case law. |

| Voluntary Agreement | Both the lender and the borrower must agree to the Deed in Lieu of Foreclosure voluntarily. It cannot be forced upon either party. |

| Impact on the Borrower | Completion of a Deed in Lieu of Foreclosure may relieve the borrower from the mortgage debt, but it could still impact the borrower's credit score. |

| Recording Requirement | After execution, the Deed in Lieu of Foreclosure must be recorded in the county where the property is located to be effective and to provide public notice. |

Instructions on Writing Ohio Deed in Lieu of Foreclosure

Following the decision to pursue a deed in lieu of foreclosure, individuals facing challenges with their mortgage in Ohio will find relatively straightforward steps to complete the necessary documentation. This non-foreclosure path allows borrowers and lenders to agree on transferring the property's title back to the lender as a way to avoid the foreclosure process. Below, one will find a detailed breakdown of how to properly fill out the Ohio Deed in Lieu of Foreclosure form, ensuring that all parties are properly informed and the legal standards are adhered to.

- Begin by accurately filling in the date at the top of the form. Ensure that the current date is used, as this marks the official start of the agreement process.

- Next, enter the full legal name(s) of the borrower(s), also referred to as the Grantor(s), in the designated area. This should match the name(s) as recorded on the property deed and any loan documents.

- Identify the legal name of the lender, or the Grantee, in the provided space. This refers to the financial institution or entity that is taking back ownership of the property.

- Fill in the property address, including the county in which the property is located, in the indicated section. This should be the complete address as it should accurately describe the property being transferred.

- Include the legal description of the property. This could be a detailed description that often includes lot numbers, subdivision names, and other identifiers that are unique to the property. It is crucial to ensure accuracy in this step to prevent any disputes about the property in question.

- In the provided space, write the amount for which the transfer is being made, often stated as $0 or $10, which is a nominal consideration to make the deed legally valid.

- Both the Borrower(s)/Grantor(s) and the Lender/Grantee must sign the form in the presence of a Notary Public. This step is essential for legal verification and ensures that all parties have willingly entered into the agreement.

- Complete the document by having a Notary Public officially notarize the deed. This includes the Notary Public filling out their section, which will include their stamp and signature.

Upon completion of these steps, the document should be filed with the appropriate county recorder's office to become part of the public record, officially transferring the property title from the borrower to the lender. This filing is crucial as it finalizes the transfer and ensures the property transfer is legally recognized. Moving forward, it is beneficial for both the borrower and lender to keep copies of the finalized form for their records, marking a clear end to their mortgage agreement through this mutually agreed-upon arrangement.

Understanding Ohio Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document in which a homeowner voluntarily transfers the ownership of their property to the lender. This is done to avoid the foreclosure process when the homeowner can no longer make mortgage payments. It's a mutual agreement between the borrower and the lender that can benefit both parties by simplifying the process and minimizing additional costs and negative impacts on credit scores.

How does a Deed in Lieu of Foreclosure work in Ohio?

In Ohio, the process begins when both the borrower and the lender agree that a Deed in Lieu of Foreclosure is the best course of action. The homeowner then signs legal documents transferring the property's title to the lender. This action satisfies the mortgage debt, avoiding the need for a foreclosure. The lender may choose to forgive any remaining debt, although this is not guaranteed and could have tax implications for the borrower.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

Choosing a Deed in Lieu of Foreclosure offers several benefits including avoiding the lengthy and stressful process of foreclosure, potentially reducing or eliminating remaining debt on the mortgage, and having a lesser negative impact on the homeowner's credit score compared to a foreclosure. It can also benefit the lender by saving time and reducing the costs associated with the foreclosure process.

Are there any downsides to a Deed in Lieu of Foreclosure?

While a Deed in Lieu of Foreclosure can provide relief in difficult circumstances, there are potential downsides. These include possible tax implications from forgiven debt, which could be considered taxable income. Additionally, it may not fully absolve the borrower of all financial obligations if there are any junior liens on the property, and it still negatively impacts the borrower's credit, though generally less severely than a foreclosure.

Who is eligible for a Deed in Lieu of Foreclosure in Ohio?

Eligibility for a Deed in Lieu of Foreclosure in Ohio typically requires that the homeowner is experiencing financial hardship that prevents them from making mortgage payments, has unsuccessfully tried to sell the property at fair market value, and has no other liens against the property. Each lender may have additional requirements, making it important for homeowners to discuss their individual situation with their lender.

What is the process to apply for a Deed in Lieu of Foreclosure in Ohio?

The first step is contacting the lender to discuss potential hardship options. If a Deed in Lieu of Foreclosure is considered a viable solution, the homeowner will need to provide documentation to the lender showing their financial situation and inability to continue making payments. This includes a hardship letter, proof of income, and other financial statements. The lender will assess the situation and, if they agree, will provide the necessary paperwork to transfer the property ownership.

Can a Deed in Lieu of Foreclosure be reversed in Ohio?

Once a Deed in Lieu of Foreclosure has been completed and the property ownership has been transferred to the lender, the process cannot typically be reversed. Due to the finality of this action, it is essential for homeowners to thoroughly understand the implications and ensure it is the best decision for their circumstances before proceeding.

How does a Deed in Lieu of Foreclosure affect my credit score?

A Deed in Lieu of Foreclosure does negatively affect your credit score, but generally not as severely as a foreclosure. It will remain on your credit report for up to seven years. The impact on your credit score can vary depending on your overall credit history and the scoring model being used, but it's important to plan for a significant impact in the short term.

Is it possible to owe money after a Deed in Lieu of Foreclosure?

Yes, it's possible to owe money after a Deed in Lieu of Foreclosure if the amount forgiven by the lender is less than the total debt owed on the mortgage. This is known as a deficiency balance. Ohio law determines whether lenders can seek a deficiency judgment, which would require the borrower to pay the remaining debt. Borrowers should carefully review their agreement with the lender to understand their financial obligations fully.

Where can I get help with a Deed in Lieu of Foreclosure in Ohio?

It's advisable to seek guidance from a legal professional experienced in Ohio real estate law to navigate the process of a Deed in Lieu of Foreclosure successfully. Additionally, housing counseling agencies approved by the U.S. Department of Housing and Urban Development (HUD) can offer valuable advice and support to homeowners exploring their options to avoid foreclosure.

Common mistakes

When filling out the Ohio Deed in Lieu of Foreclosure form, individuals often bypass a crucial step: not consulting with a legal expert. This oversight can lead to misinterpretations of legal requirements or missing critical legal advice tailored to one's unique situation. Engaging with a lawyer ensures that all aspects of the deed in lieu agreement are clear, protecting the rights and interests of the property owner throughout the process. This professional guidance is invaluable in navigating the complex terrain of real estate transactions and foreclosure laws.

Another common mistake is failing to accurately describe the property. The form requires a detailed description of the property being transferred, including the legal description used in official documents. Some people mistakenly provide only a street address or an incomplete description, which can lead to confusion and potential legal complications down the line. Ensuring the property is described accurately and completely is essential for the deed in lieu of foreclosure to be legally effective and for the property transfer to proceed without issues.

Individuals also frequently overlook the importance of securing the agreement of all parties with an interest in the property. This includes not only all the owners but also any lenders or lienholders who have a stake in the property's title. Without the consent and signature of every party involved, the deed in lieu of foreclosure cannot legally transfer the property's title. This mistake can result in a void agreement, prolonging the foreclosure process and complicating the borrower's financial situation further.

A further mistake is not thoroughly understanding the tax implications of a deed in lieu of foreclosure. While it can provide a way out of a challenging financial situation, a deed in lieu of foreclosure may have significant tax consequences for the borrower. For instance, the cancellation of the remaining mortgage debt could be treated as taxable income under certain circumstances. Individuals often complete the form without considering these ramifications, which can lead to unexpected tax liabilities. Consulting with a tax professional before proceeding can help mitigate these potential financial surprises.

Documents used along the form

When handling the complexities of navigating a Deed in Lieu of Foreclosure in Ohio, several documents are commonly used in the process. These forms and documents play crucial roles in ensuring the procedure is conducted efficiently and accurately, providing all parties involved with the necessary legal protections and clarity.

- Hardship Letter: This document is a personal letter written by the borrower, explaining the circumstances that led to their financial difficulties. The letter makes a case for why the lender should accept a deed in lieu of foreclosure.

- Financial Statement: A detailed report of the borrower's income, expenses, assets, and liabilities. It serves to provide the lender with a clear picture of the borrower's financial situation.

- Authorization to Release Information: Signed by the borrower, this document allows the lender to obtain private financial information from various institutions. It is essential for verifying the information provided in the borrower’s financial statement.

- Property Appraisal Report: A professional assessment that determines the current market value of the property. Lenders require this to ensure the value of the property is in line with the debt owed.

- Title Search Report: Conducted to reveal any liens or claims on the property that could affect the transfer of title. This ensures the lender receives the title free of any encumbrances.

- Agreement in Lieu of Foreclosure: This formal agreement outlines the terms and conditions under which the deed in lieu is accepted by the lender. It includes details such as any debt forgiveness, if applicable.

- Quit Claim or Warranty Deed: The legal document used to transfer the title of the property from the borrower to the lender. It specifies the type of deed being transferred.

- IRS Form 982: This tax form may be necessary if the lender forgives any part of the mortgage debt. It helps the borrower determine if they qualify for exclusion of that forgiven debt from their income for tax purposes.

Together, these documents ensure a comprehensive approach to executing a Deed in Lieu of Foreclosure. It's crucial for those going through this process to understand the importance of each document and to ensure they are accurately completed and submitted. This not only facilitates a smoother transaction but also protects the rights and interests of all parties involved.

Similar forms

The Ohio Deed in Lieu of Foreclosure form shares similarities with the Mortgage Release (Satisfaction of Mortgage) document. Both serve as legal instruments to remove financial encumbrances on a property. Where the Deed in Lieu forgives the outstanding mortgage in exchange for property ownership, the Mortgage Release officially announces the fulfillment of debt, thereby clearing the title. Each document signals an end to the borrower's mortgage obligations, but through different mechanisms of resolution.

Comparable to the Ohio Deed in Lieu of Foreclosure form is the Quitclaim Deed. This document is used to transfer property ownership without a sale, typically between family members or to clear title issues. Like the Deed in Lieu, it involves a property transfer but without warranties about the property’s debt status. Both documents facilitate ownership transfer without standard sale proceedings, although the Quitclaim does not inherently relate to the settlement of debts.

Another document similar to the Ohio Deed in Lieu of Foreclosure is the Short Sale Agreement. In both cases, homeowners seek alternatives to foreclosure when they cannot meet mortgage obligations. The Short Sale Agreement allows selling the property for less than the outstanding mortgage balance with the lender's approval. While both methods aim to avoid foreclosure, the Deed in Lieu transfers property ownership directly to the lender, whereas a short sale involves a third-party buyer.

The Loan Modification Agreement also shares common ground with the Ohio Deed in Lieu of Foreclosure form, as both are foreclosure avoidance strategies. A Loan Modification Agreement adjusts the original terms of the mortgage, making payments more manageable for the borrower to avoid default. In contrast, the Deed in Lieu represents a final settlement, where the borrower surrenders the property, terminating the mortgage under mutually agreed-upon terms.

Similarly, the Forbearance Agreement is related in purpose to the Deed in Lieu of Foreclosure form. It provides temporary relief to borrowers facing financial hardship, allowing them to pause or reduce payments for a set period. Although both documents aim to prevent foreclosure, the Forbearance Agreement is a temporary solution that anticipates the borrower will resume full payments, whereas a Deed in Lieu concludes the mortgage obligation through property transfer.

The Foreclosure Notice is another document with relevant similarities. It officially starts the foreclosure process when a borrower fails to meet mortgage payments. While the Foreclosure Notice is a precursor to legal action culminating in the lender seizing the property, the Deed in Lieu of Foreclosure form can preempt the foreclosure process, offering a more cooperative solution between the borrower and lender to settle the debt.

Dos and Don'ts

Filling out the Ohio Deed in Lieu of Foreclosure form is a significant decision that can have profound implications. When approaching this task, individuals should proceed with careful consideration, ensuring accuracy and completeness in every detail. The following list provides guidance on what should and should not be done during this process.

Things You Should Do

- Thoroughly review the entire form before filling it out, to ensure understanding of all requirements and sections.

- Gather all necessary documents and information beforehand, including mortgage account numbers and property descriptions, to ensure the information entered is accurate and complete.

- Seek advice from a qualified professional, such as a lawyer specializing in real estate, to understand the legal implications and ensure that this decision aligns with your financial well-being.

- Use clear and legible handwriting if filling out the form by hand, or ensure typed text is readable, to avoid any misinterpretations of your information.

- Double-check all entries for accuracy before submitting the form, especially the legal description of the property and personal details.

- Keep a copy of the completed form for your records, as it is crucial to have proof of submission and the details provided.

- Contact the lender or servicer directly if you have any questions or require clarification on specific areas of the form or the process itself.

Things You Shouldn't Do

- Avoid rushing through the form without understanding its contents and the consequences of a deed in lieu of foreclosure.

- Do not leave any sections blank; if a section does not apply, write "N/A" (not applicable) to indicate this.

- Refrain from guessing on details or making approximate entries, especially concerning the legal description of the property or financial information.

- Avoid signing the form without having a qualified professional review it, as missing crucial legal advice can result in significant personal detriment.

- Do not ignore the potential tax implications or impacts on your credit score without consulting a tax advisor or financial counselor.

- Refrain from submitting the form without ensuring all necessary documents are attached, as incomplete submissions may result in delays or denial.

- Avoid proceeding without understanding the servicer’s policies on the deed in lieu of foreclosure process, as policies may vary and affect the outcome.

Misconceptions

Many people have misunderstandings about the Ohio Deed in Lieu of Foreclosure form, which can lead to confusion and incorrect assumptions about its use and consequences. Below are seven common misconceptions clarified to provide a better understanding of the form and its implications.

- It immediately clears all debt: A common misconception is that once a Deed in Lieu of Foreclosure is executed, the borrower is freed from all their mortgage debt. In reality, if the property's sale does not cover the full amount owed, the lender may still seek a deficiency judgment unless specifically waived in the agreement.

- It has no impact on credit score: Another misunderstanding is that this deed does not affect a borrower's credit score. While it may have a less severe impact compared to a foreclosure, it still negatively affects the borrower's credit score.

- Approval is guaranteed: Many believe that lenders are always open to accepting a Deed in Lieu of Foreclosure. However, lenders have the discretion to refuse this arrangement if they believe it is not in their best interest, especially if other options might result in greater financial recovery.

- It releases the borrower from all property obligations: While a Deed in Lieu of Foreclosure does transfer the property's title to the lender, the borrower may still be responsible for certain obligations, such as property taxes or homeowners association fees incurred up until the transfer is completed.

- It is only available when the property value is less than the mortgage balance: There's a common belief that this deed is only an option if the property value has fallen below the mortgage balance. However, lenders may consider it under various circumstances as a means to avoid the lengthy and costly foreclosure process.

- It can be executed without lender agreement: Some believe that a borrower can initiate a Deed in Lieu of Foreclosure without the lender's consent. In reality, this process requires mutual agreement between the borrower and the lender; it cannot be unilaterally initiated by the borrower.

- The process is quick and simple: Lastly, there is a misconception that the process is straightforward and can be completed rapidly. The truth is that it involves negotiation, the drafting of documents that protect both parties' interests, and possibly dealing with other liens on the property, making the process potentially lengthy and complex.

Key takeaways

When facing financial difficulties, homeowners in Ohio have various options to prevent foreclosure. One such option is a Deed in Lieu of Foreclosure. This legal document transfers the ownership of a property from the homeowner back to the lender as an alternative to going through a formal foreclosure process. Understanding the key aspects of filling out and using the Ohio Deed in Lieu of Foreclosure form can help ensure that the process is handled correctly and efficiently.

- Accuracy is Critical: When completing the Ohio Deed in Lieu of Foreclosure form, it’s essential to provide accurate and complete information. Incorrect data can lead to delays or the rejection of the document. Double-check facts such as property descriptions, names, and account numbers for accuracy.

- Notarization is Required: For the document to be legally valid, it must be notarized. This means that after filling out the form, the homeowner and any other parties need to sign it in front of a Notary Public. The notary confirms the identities of the signers and ensures that they are signing under their own free will.

- Legal Advice Can Be Invaluable: Navigating the process of a Deed in Lieu of Foreclosure can be complex. Consulting with a legal expert who understands Ohio’s real estate laws can provide guidance and help avoid potential pitfalls. This step is especially important to ensure that the rights of the homeowner are protected throughout the process.

- Understand the Consequences: Opting for a Deed in Lieu of Foreclosure can have significant implications for the homeowner's credit score and tax obligations. It’s important to thoroughly understand these impacts. Discuss these aspects with a financial advisor to fully grasp the short-term and long-term consequences of this decision.

- Keep a Record: After the Deed in Lieu of Foreclosure form is completed, notarized, and submitted, it’s important to keep a copy for personal records. This documentation can be crucial for future financial planning and for resolving any disputes that may arise regarding the property transfer.

Ultimately, a Deed in Lieu of Foreclosure represents a legal agreement that impacts all parties involved. By approaching this option with care and due diligence, homeowners in Ohio can navigate their financial challenges with a bit more ease. Properly filling out and using the Ohio Deed in Lieu of Foreclosure form is a critical step in this process, laying the groundwork for a clearer path forward.

More Deed in Lieu of Foreclosure State Forms

Foreclosure Process in Georgia - By using this form, borrowers may negotiate terms that could potentially allow them to remain in the home as a tenant.

Will I Owe Money After a Deed in Lieu of Foreclosure - The process of transferring real estate property from the homeowner to the lender to evade foreclosure under a mutual agreement.

Deed in Lieu of Foreclosure Florida - An alternative foreclosure solution involving a legal document where the borrower agrees to transfer the property back to the lender.

Foreclosure Vs Deed in Lieu - A preventive measure against foreclosure, this form allows homeowners to legally transfer their property to the lender.