Fillable Deed in Lieu of Foreclosure Document for New York

In the complex landscape of financial agreements, homeowners facing the challenging prospect of foreclosure have various options at their disposal to navigate these turbulent times. Among these, the New York Deed in Lieu of Foreclosure form stands out as a compassionate alternative designed to mitigate the harsh realities of losing one’s home. This legal document serves as a mutual agreement between the homeowner and the lender, allowing the homeowner to transfer the property back to the lender, thereby avoiding the conventional foreclosure process. It's a pathway that not only helps in preserving the homeowner's credit score to some extent but also aids the lender by reducing the time and financial costs associated with foreclosure proceedings. Essential components of this agreement include the meticulous documentation of any financial obligations that remain post-transfer, such as potential deficiencies, and the meticulous outlining of any conditions or stipulations agreed upon by the involved parties. Understanding the breadth and implications of this form is crucial for individuals seeking to make informed decisions during such challenging times.

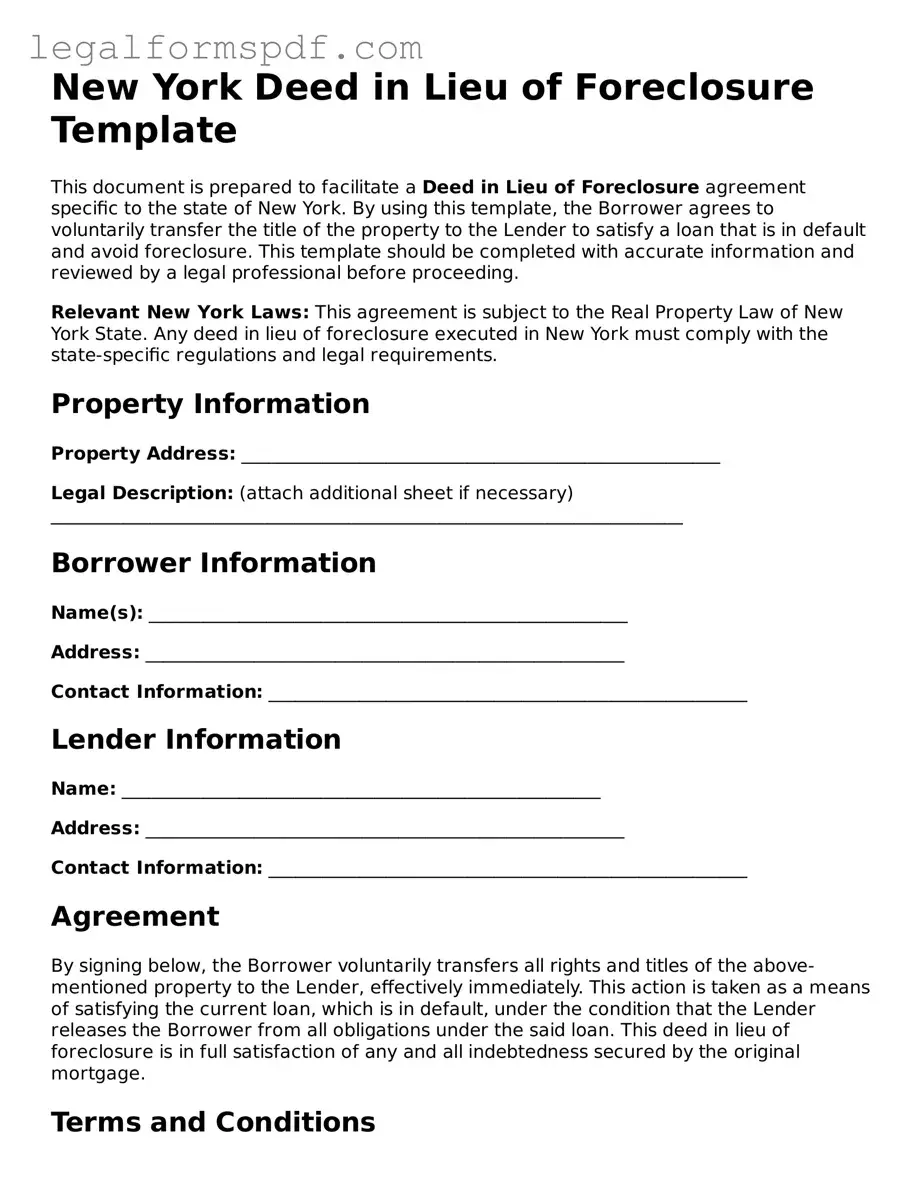

Document Example

New York Deed in Lieu of Foreclosure Template

This document is prepared to facilitate a Deed in Lieu of Foreclosure agreement specific to the state of New York. By using this template, the Borrower agrees to voluntarily transfer the title of the property to the Lender to satisfy a loan that is in default and avoid foreclosure. This template should be completed with accurate information and reviewed by a legal professional before proceeding.

Relevant New York Laws: This agreement is subject to the Real Property Law of New York State. Any deed in lieu of foreclosure executed in New York must comply with the state-specific regulations and legal requirements.

Property Information

Property Address: _____________________________________________________

Legal Description: (attach additional sheet if necessary) ______________________________________________________________________

Borrower Information

Name(s): _____________________________________________________

Address: _____________________________________________________

Contact Information: _____________________________________________________

Lender Information

Name: _____________________________________________________

Address: _____________________________________________________

Contact Information: _____________________________________________________

Agreement

By signing below, the Borrower voluntarily transfers all rights and titles of the above-mentioned property to the Lender, effectively immediately. This action is taken as a means of satisfying the current loan, which is in default, under the condition that the Lender releases the Borrower from all obligations under the said loan. This deed in lieu of foreclosure is in full satisfaction of any and all indebtedness secured by the original mortgage.

Terms and Conditions

Failure by the Borrower to disclose any liens, encumbrances, or other claims on the property not known to the Lender may render this agreement null and void.

The Lender agrees to release the Borrower from all obligations under the loan once the deed in lieu of foreclosure is executed and recorded.

Both parties agree that this agreement is made in good faith and without deceit with the intention to settle the debt.

Signature

Borrower's Signature: ___________________________________ Date: _________

Lender's Signature: _____________________________________ Date: _________

This document is executed on the understanding that it is subject to approval by legal counsels representing both parties and in compliance with applicable New York State laws and regulations.

PDF Specifications

| # | Fact |

|---|---|

| 1 | The New York Deed in Lieu of Foreclosure form is used when a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| 2 | This form is a legal document that must be executed in accordance with New York state laws. |

| 3 | It serves as an alternative to the foreclosure process, which can be lengthy and costly for both the lender and borrower. |

| 4 | Using this form can help protect the borrower's credit rating by avoiding the negative impact of a foreclosure. |

| 5 | Governing laws include New York Real Property Actions and Proceedings Law (RPAPL) and New York Real Property Law (RPL). |

| 6 | Before a Deed in Lieu of Foreclosure can be accepted, most lenders require the property to be on the market for a certain period. |

| 7 | The document must be properly recorded with the county recorder's office to be effective. |

| 8 | Both parties should conduct a thorough title search to ensure no other liens or encumbrances exist on the property. |

| 9 | The lender may not agree to a Deed in Lieu if there are significant second mortgages or other liens. |

| 10 | This form can provide a mutual benefit: it allows the borrower to avoid the stigma of foreclosure, and the lender can more quickly possess the property. |

Instructions on Writing New York Deed in Lieu of Foreclosure

Completing the New York Deed in Lieu of Foreclosure form is a crucial step for borrowers who have come to an agreement with their lender to transfer property ownership to avoid foreclosure. This procedure allows for a smoother transaction and helps both parties avoid the lengthy and costly process of foreclosure. To ensure accuracy and compliance, it is important to follow each step carefully and provide all necessary information.

- Gather all required documentation, including mortgage statements, property details, and personal identification.

- Read through the form thoroughly before filling it out to understand all the sections and requirements.

- Enter the borrower's full name and address in the designated fields. Make sure to spell all names correctly and to use the address associated with the property in question.

- Provide the lender's information, including the legal name of the institution, address, and contact details. This information must match the details on the mortgage agreement.

- Fill in the legal description of the property. This could include the block, lot number, and any other specifics that uniquely identify the property. Legal descriptions can usually be found on the original deed or mortgage documents.

- State the reason for the deed in lieu of foreclosure in the space provided. Be concise but thorough in explaining the circumstances that led to this decision.

- Include the date of the agreement. Ensure this matches any communication or agreements made with the lender regarding the decision.

- Both the borrower and the lender must sign the form in the presence of a notary public to validate the agreement. Ensure all parties have a government-issued ID for verification.

- After completing and signing the form, submit it to the appropriate county clerk's office or other designated government office for recording. There may be a filing fee associated with this submission.

- Keep a copy of the submitted form for personal records. It's important to have proof of the submission and all related documentation in case of future disputes or inquiries.

Once the form is filled out, submitted, and recorded, it effectively transfers ownership of the property from the borrower to the lender. This process relieves the borrower from the mortgage debt and allows both parties to move forward. Remember, it is beneficial to consult with a legal professional or advisor throughout this process to ensure all legal requirements are met and rights are protected.

Understanding New York Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure in New York?

A Deed in Lieu of Foreclosure is a document in which a homeowner voluntarily transfers ownership of their property to the lender to avoid the foreclosure process. In New York, this legal maneuver serves as an alternative for both parties when the homeowner is unable to meet mortgage payments. Essentially, it's an agreement that can sometimes provide a more agreeable resolution for both the lender and the borrower, potentially offering the borrower relief from the financial burden and the lender a smoother acquisition of the property.

How does the process of a Deed in Lieu of Foreclosure work in New York?

In New York, the process typically begins with the homeowner and the lender discussing the possibility of a deed in lieu of foreclosure as an alternative to the foreclosure process. If both parties agree, the homeowner will sign the deed to the property over to the lender. This transaction requires the preparation of several documents, including the deed itself, an estoppel affidavit, and possibly a non-merger agreement, to ensure that the debt is fully satisfied. Both parties may also negotiate terms regarding any remaining mortgage balance which might not be covered by the property's value. After the documentation is complete and submitted, the legal title of the property transfers to the lender, effectively releasing the homeowner from their mortgage debt.

Are there any specific benefits of choosing a Deed in Lieu of Foreclosure in New York?

Opting for a Deed in Lieu of Foreclosure can offer several benefits for homeowners facing financial difficulties in New York. It can prevent the negative impact of a foreclosure on the homeowner's credit report, although it will still reflect negatively, but less severely than a foreclosure. This option also potentially allows for more dignified exit from the property and can help avoid the public notoriety and personal stress of a foreclosure. For lenders, it provides a straightforward means of acquiring property without the time and expense of pursuing foreclosure through the courts.

What are the potential drawbacks of a Deed in Lieu of Foreclosure?

While a Deed in Lieu of Foreclosure offers certain advantages, it's not without its drawbacks. For homeowners, it means losing their property and possibly still being responsible for a deficiency balance if the property's value doesn't cover the mortgage owed. Additionally, there could be tax implications since the cancellation of debt may be considered taxable income. For lenders, the risk involves taking on the responsibility for the property, including any undisclosed liens or other issues that might not have been identified. Hence, both parties should thoroughly consider and negotiate the terms to mitigate potential downsides.

Common mistakes

When navigating the complexities of avoiding foreclosure through a Deed in Lieu of Foreclosure in New York, many individuals stumble over several common pitfalls. These missteps can lead to delays, increased legal fees, or even the denial of the deed in lieu agreement. Awareness and caution can prevent these issues, ensuring a smoother process for all parties involved.

One frequently encountered mistake is inaccurate information. This refers to incorrect personal details, property descriptions, or financial data. Such inaccuracies can invalidate the agreement or cause legal complications down the line. The gravity of ensuring every piece of information is accurate cannot be overstated.

A second error often made is failure to attach required documents. A deed in lieu of foreclosure transaction requires specific documentation, such as proof of financial hardship and the property's current market value. Overlooking or neglecting to attach these crucial documents slows down the process significantly.

The third mistake is not obtaining lender consent beforehand. Before proceeding with filling out any forms, it's imperative that the lender agrees to a deed in lieu of foreclosure. Without this agreement, the effort put into filling out the form is essentially wasted.

A common misstep is the omission of necessary legal descriptions of the property. A legal property description goes beyond the street address, including details that define the property's boundaries. This precise description is crucial for the legal transfer of the property.

Another frequent error is ignoring tax implications. Participants often misunderstand or are unaware of the potential tax consequences of a deed in lieu of foreclosure. It's important to consult with a tax professional to understand these implications fully.

Additionally, many people neglect to secure a release from the mortgage or deed of trust obligation. Completing a deed in lieu of foreclosure form does not automatically release the borrower from their mortgage obligations unless it's explicitly stated in the agreement.

Another common mistake is the failure to check for junior liens or encumbrances. Prior to executing a deed in lieu of foreclosure, a thorough search to identify if there are other claims on the property is necessary. These claims could complicate or invalidate the agreement.

Individuals often make the mistake of submitting the form without legal review. Consulting with a legal professional before submission can identify issues that a non-professional might miss and ensure the process complies with all legal requirements.

The final common error is misunderstanding the relinquishing of rights. When signing a deed in lieu of foreclosure, individuals may not fully comprehend the rights they're giving up, such as the right to the property and certain legal protections. Thorough understanding and consideration of these aspects are crucial before proceeding.

Steering clear of these common mistakes when filling out a New York Deed in Lieu of Foreclosure form can significantly streamline the process, ensuring a better outcome for the borrower facing foreclosure.

Documents used along the form

When navigating the complexities of foreclosure in New York, property owners sometimes consider a deed in lieu of foreclosure as a viable alternative to the traditional foreclosure process. This method allows a homeowner to transfer the title of their property to the lender voluntarily, effectively avoiding foreclosure. Alongside the New York Deed in Lieu of Foreclosure Form, there are several important forms and documents typically used to ensure the process is comprehensive and legally sound.

- Hardship Letter: A document prepared by the homeowner explaining the financial difficulties they are encountering that prevent them from paying their mortgage, thereby justifying the need for a deed in lieu of foreclosure.

- Financial Statement: This outlines the homeowner's incomes, expenses, assets, and liabilities, providing the lender with a clear picture of the homeowner’s financial situation.

- Agreement Not to Pursue a Deficiency Judgment: An agreement where the lender promises not to pursue any remaining balance owed after the property is sold.

- Warranty Deed or Quitclaim Deed: These documents are used to transfer the property's title from the homeowner to the lender.

- Estoppel Affidavit: An affidavit where both parties state the terms and conditions of the deed in lieu agreement, ensuring there are no other claims or encumbrances on the property that could affect the deal.

- IRS Form 982: This form is used to report the discharge of indebtedness, which can sometimes result in tax implications for the homeowner.

- Settlement Statement: A detailed accounting of all transactions between the borrower and lender during the settlement process of a deed in lieu of foreclosure, including any fees and charges.

These documents play crucial roles in the deed in lieu of foreclosure process, each serving to clarify, legalize, or financially settle aspects of the transaction. Homeowners considering this route should work closely with legal counsel to fully understand the implications and requirements of each document involved. Proper preparation and knowledge of these forms can significantly affect the process's smoothness and legality.

Similar forms

A Mortgage Agreement is similar to the New York Deed in Lieu of Foreclosure form. Both documents deal with the specifics of mortgage arrangements between a borrower and a lender. While a Mortgage Agreement sets the terms and conditions of the mortgage loan, a Deed in Lieu of Foreclosure comes into play when the borrower is unable to meet those terms, offering a way to transfer property ownership back to the lender as an alternative to foreclosure.

A Loan Modification Agreement has similarities with the New York Deed in Lieu of Foreclosure form as well. This document is used when the terms of an original loan agreement need to be altered, often to avoid the risk of foreclosure. It shares the goal of avoiding foreclosure by modifying the borrower’s loan obligations, whereas the Deed in Lieu directly transfers property to settle the loan.

Quitclaim Deeds bear resemblance to the New York Deed in Lieu of Foreclosure form since both involve the transfer of property ownership without selling the property. However, a Quitclaim Deed is usually used between family members or to clear a title, and does not necessarily relate to a mortgage or foreclosure situation. The Deed in Lieu specifically deals with mortgage failure and the lender retrieving the property as a result.

Short Sale Agreements also share common ground with a Deed in Lieu of Foreclosure. Both are alternatives to foreclosure that a lender might agree to when a borrower cannot meet mortgage payments. A Short Sale Agreement allows the sale of the property for less than the owed mortgage balance. Meanwhile, a Deed in Lieu involves transferring the property directly back to the lender.

The Assignment of Mortgage is another document with similarities to the Deed in Lieu of Foreclosure form, involving the transfer of mortgage obligations. While the Assignment of Mortgage is about transferring the lender's interest in the mortgage to another party, a Deed in Lieu transfers the borrower's property to the lender, both aiming to settle the mortgage debt in different ways.

The Forbearance Agreement is relevantly similar since it offers a borrower temporary relief from foreclosure. While it involves an agreement to delay foreclosure actions and modify repayment terms temporarily, it differs from a Deed in Lieu, where the solution to mortgage default is transferring the property ownership to the lender as a final settlement.

A Satisfaction of Mortgage document is also related to the process outlined by a Deed in Lieu of Foreclosure. It is used when a mortgage has been fully paid off, to release the borrower from further obligations. Unlike the Deed in Lieu, which is used when the borrower can’t pay off the mortgage, the Satisfaction of Mortgage signifies a successful end to mortgage terms.

A Release of Lien is another document with similarities, as it involves removing a lien from the property records, typically after a debt has been paid. However, the context differs: a Release of Lien is used after payment completion, while a Deed in Lieu of Foreclosure is employed as an alternative to full payment, to resolve debt without fulfilling the original mortgage terms.

Finally, the Grant Deed is somewhat similar to the New York Deed in Lieu of Foreclosure form. The Grant Deed is used to transfer property ownership while guaranteeing that the property has not been sold to someone else. The Deed in Lieu also transfers property but specifically as a means to settle an unpaid mortgage under the agreement that foreclosure will be avoided.

Dos and Don'ts

When you're handling the complexities of financial difficulties, a deed in lieu of foreclosure can offer a way out without going through the foreclosure process. In New York, properly completing the Deed in Lieu of Foreclosure form is critical. Here are several important dos and don'ts to help guide you smoothly through this process:

- Do thoroughly review the entire form before you start filling it out. Understanding every part is essential for accuracy and completeness.

- Do gather all the necessary documents related to your property and mortgage. These documents will provide you with the information needed to accurately complete the form.

- Do consult with a legal professional. Legal advice can be invaluable in ensuring that this step is in your best interest and that you're aware of its implications.

- Do check with your lender if they have specific requirements or forms that need to be attached to the Deed in Lieu of Foreclosure form. Each lender might have unique requirements.

- Do keep a copy of the completed form and any correspondence with your lender. This documentation will be important for your records.

Equally important are some critical don'ts:

- Don't rush through filling out the form. Errors or omissions can complicate the process or even render the deed invalid.

- Don't ignore potential tax consequences. A deed in lieu of foreclosure can have significant tax implications, so it's wise to consult with a tax advisor.

- Don't hesitate to ask questions. Whether it's a question for your lender, a tax advisor, or a legal consultant, obtaining clarity is crucial.

- Don't leave any sections blank. If a section doesn't apply, it's better to note that it's not applicable rather than leaving it empty. This demonstrates that you did not accidentally overlook the section.

Approaching the Deed in Lieu of Foreclosure with patience, diligence, and the right guidance can make a challenging situation more manageable. Remember, you're not alone in this process, and resources are available to help guide you through to resolution.

Misconceptions

When homeowners in New York face the daunting prospect of losing their homes, a Deed in Lieu of Foreclosure (DIL) often comes up as a possible solution. However, many misconceptions surround this legal process, complicating what can already be a stressful time. Let's clear up some common misunderstandings.

- It's an easy way out of any mortgage problem. Many believe that a DIL is a simple solution that can be used in any foreclosure scenario. The truth is, lenders often consider it as a last resort and not all homeowners will qualify. The decision to accept a DIL rests with the lender, who may require that the homeowner attempt to sell the home for its market value first.

- It doesn't impact your credit score as much as a foreclosure. While it's true that a DIL may have a slightly less severe impact on your credit score compared to a foreclosure, the difference is not as significant as some might think. Both are considered negative marks and will substantially affect your ability to borrow in the future.

- The process eliminates all mortgage debt. A common misconception is that once a DIL is executed, the homeowner is free from all mortgage obligations. However, if the home sells for less than the amount owed, the lender may still seek a deficiency judgment, depending on New York state laws and the terms of the DIL agreement.

- It can be completed without any legal or financial advice. Some homeowners assume that they can navigate the DIL process on their own. However, due to its complexity and the legal and financial consequences involved, seeking advice from professionals is crucial. Lawyers and financial advisers can provide invaluable assistance, ensuring that homeowners understand all implications and options.

- The homeowner can remain in the home until the process is complete. Many assume they can stay in their home throughout the DIL process. While you may not have to leave your home immediately, the exact timeline depends on the terms negotiated with the lender. It's essential to understand when you're required to vacate the property to avoid any surprises.

Understanding the nuances of a Deed in Lieu of Foreclosure in New York can be the first step toward making informed decisions during difficult times. By dispelling these common misconceptions, homeowners can better navigate their options and work towards a solution that best fits their situation.

Key takeaways

Filling out and using the New York Deed in Lieu of Foreclosure form involves several critical steps and considerations. Understanding these key takeaways ensures both lenders and borrowers navigate this process effectively, safeguarding their rights and interests.

A deed in lieu of foreclosure is a legal document where a borrower conveys all interest in their property to the lender to satisfy a loan that's in default and avoid foreclosure.

Before considering this option, both parties should exhaust all other foreclosure alternatives, such as loan modifications, refinancing, or selling the home.

The form must be completed accurately, detailing all relevant information about the property, the borrower, and the lender.

All parties must agree to the terms of the deed in lieu of foreclosure, highlighting the importance of clear communication and mutual agreement.

Legal counsel is strongly recommended for both parties to ensure the agreement is fair, legally binding, and does not include unfavorable terms.

It is essential to include a clear legal description of the property involved to avoid any future disputes regarding what property was transferred.

The document must be signed in the presence of a notary public to be legally valid. Ensure that all necessary signatures are obtained.

Filing the completed form with the appropriate county clerk’s office or land records office is crucial for the deed in lieu of foreclosure to be effective and enforceable.

Understand the tax implications for both the lender and borrower. In some cases, the borrower might face taxable income for the difference between the loan balance and the property’s fair market value.

Consider the impact on the borrower's credit score. While a deed in lieu of foreclosure can be less damaging than a foreclosure, it still negatively affects credit.

The borrower should negotiate the right to remain in the property for a specified period after the agreement, a practice known as "leaseback" or "rentback."

Navigating the deed in lieu of foreclosure process in New York requires careful consideration and thorough preparation. By adhering to these key takeaways, borrowers and lenders can manage the process more effectively, ensuring a smoother transition and resolution to what can be a difficult and emotionally charged situation.

More Deed in Lieu of Foreclosure State Forms

Deed in Lieu of Foreclosure Florida - A formal arrangement permitting a homeowner in financial distress to transfer property ownership to the lender instead of undergoing foreclosure.

Foreclosure Vs Deed in Lieu - A deeds instrument where the borrower hands over the property to the lending institution as an alternative to foreclosure.

Deed in Lieu of Mortgage - An expedited process for settling mortgage debt by transferring property ownership from the borrower to the lender, circumventing the foreclosure process.

Will I Owe Money After a Deed in Lieu of Foreclosure - This document represents an arrangement where a borrower can avoid foreclosure by giving the property to the lender voluntarily.