Fillable Deed in Lieu of Foreclosure Document for Illinois

When homeowners in Illinois find themselves in the challenging situation of not being able to meet their mortgage obligations, one viable option to avoid the stressful and often lengthy foreclosure process is considering a Deed in Lieu of Foreclosure. This legal document offers a mutually beneficial solution for both the lender and the borrower. Essentially, it allows homeowners to transfer the ownership of their property back to the lender, effectively releasing them from their mortgage debt. While this option can relieve the financial strain and emotional stress associated with potential foreclosure, it is important for individuals to understand the major aspects and implications of the Illinois Deed in Lieu of Foreclosure form. Detailed consideration should be given to the specific conditions, rights, and potential consequences involved in this agreement, including its impact on one’s credit history and the possibility of a deficiency judgment depending on the state’s specific laws. Navigating this option requires careful consideration and, often, guidance from professionals who can help assess whether this step makes sense for the homeowner's unique financial situation.

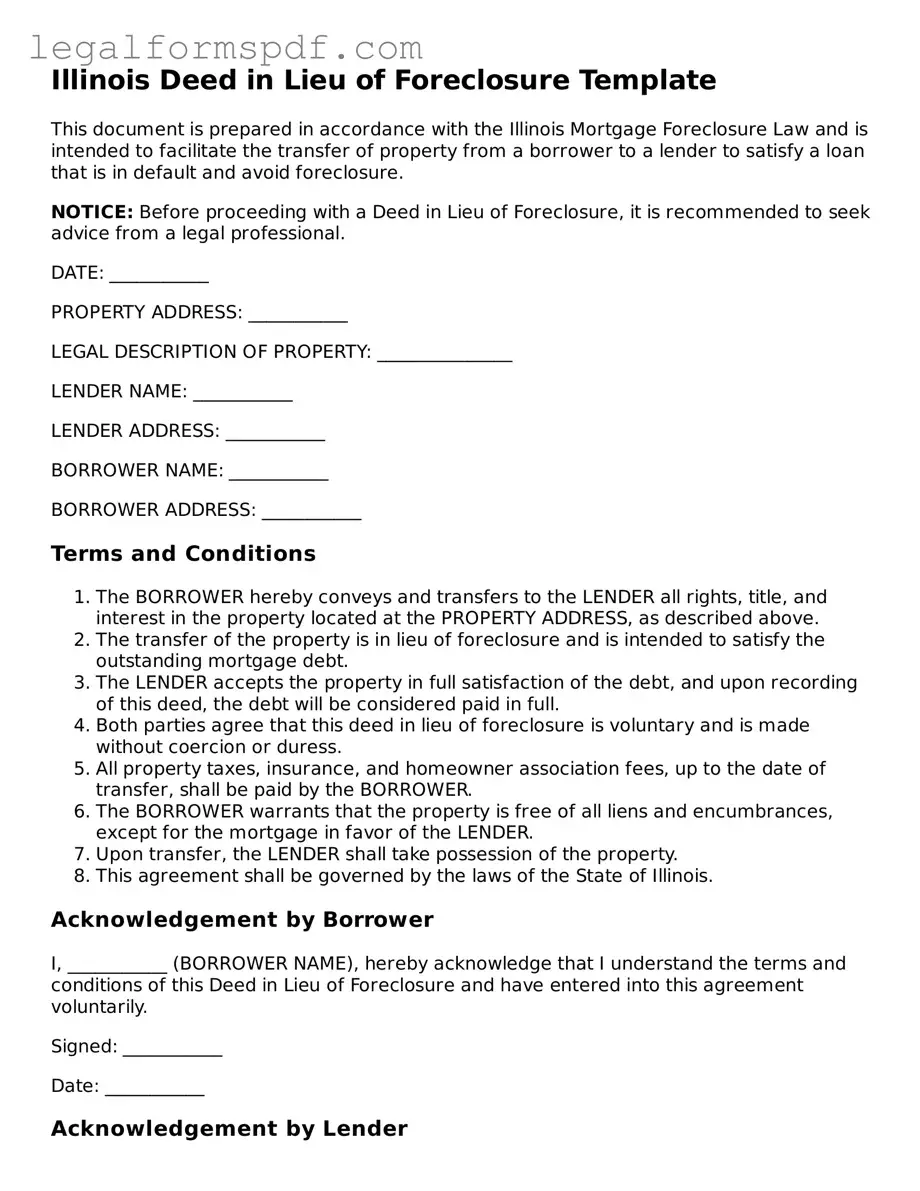

Document Example

Illinois Deed in Lieu of Foreclosure Template

This document is prepared in accordance with the Illinois Mortgage Foreclosure Law and is intended to facilitate the transfer of property from a borrower to a lender to satisfy a loan that is in default and avoid foreclosure.

NOTICE: Before proceeding with a Deed in Lieu of Foreclosure, it is recommended to seek advice from a legal professional.

DATE: ___________

PROPERTY ADDRESS: ___________

LEGAL DESCRIPTION OF PROPERTY: _______________

LENDER NAME: ___________

LENDER ADDRESS: ___________

BORROWER NAME: ___________

BORROWER ADDRESS: ___________

Terms and Conditions

- The BORROWER hereby conveys and transfers to the LENDER all rights, title, and interest in the property located at the PROPERTY ADDRESS, as described above.

- The transfer of the property is in lieu of foreclosure and is intended to satisfy the outstanding mortgage debt.

- The LENDER accepts the property in full satisfaction of the debt, and upon recording of this deed, the debt will be considered paid in full.

- Both parties agree that this deed in lieu of foreclosure is voluntary and is made without coercion or duress.

- All property taxes, insurance, and homeowner association fees, up to the date of transfer, shall be paid by the BORROWER.

- The BORROWER warrants that the property is free of all liens and encumbrances, except for the mortgage in favor of the LENDER.

- Upon transfer, the LENDER shall take possession of the property.

- This agreement shall be governed by the laws of the State of Illinois.

Acknowledgement by Borrower

I, ___________ (BORROWER NAME), hereby acknowledge that I understand the terms and conditions of this Deed in Lieu of Foreclosure and have entered into this agreement voluntarily.

Signed: ___________

Date: ___________

Acknowledgement by Lender

I, ___________ (LENDER NAME), hereby acknowledge that I understand the terms and conditions of this Deed in Lieu of Foreclosure and accept the transfer of property as full satisfaction of the debt.

Signed: ___________

Date: ___________

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure in Illinois is a legal document transferring the title of a property from a borrower to a lender as an alternative to going through the foreclosure process. |

| Governing Law | In Illinois, Deeds in Lieu are governed by the Illinois Mortgage Foreclosure Law, 735 ILCS 5/15-1401 et seq. |

| Voluntary Agreement | Both parties, the borrower, and the lender must agree voluntarily to the deed in lieu of foreclosure. It cannot be forced upon either party. |

| Benefits for Borrower | It allows a borrower to avoid the negative consequences of a foreclosure on their credit report. |

| Benefits for Lender | It saves the lender the time and expense of pursuing a foreclosure lawsuit. |

| Deficiency Judgments | Illinois law permits lenders to seek a deficiency judgment against the borrower if the property’s sale does not cover the mortgage balance. However, this can be waived in the deed in lieu agreement. |

| Eligibility Requirements | The borrower must typically demonstrate a hardship and prove that they have explored all other foreclosure alternatives. |

| Consideration for Other Liens | The lender will usually require a title search to ensure there are no other liens against the property, as accepting a deed in lieu could transfer the responsibility of these liens to the lender. |

| Tax Implications | Forgiven debt through a deed in lieu of foreclosure may be considered taxable income by the IRS, though there are exceptions based on insolvency or other factors. |

Instructions on Writing Illinois Deed in Lieu of Foreclosure

When you're dealing with a difficult situation like the possibility of foreclosure, an Illinois Deed in Lieu of Foreclosure can sometimes offer a more graceful exit from the home. This form represents an agreement where you voluntarily transfer your property back to the lender. It can be a complex process, but one that might help avoid the turmoil of a foreclosure. Taking the time to accurately complete this form is crucial, ensuring all parties understand the arrangement. Here's a step-by-step guide to help you fill it out.

- Party Information: Start by entering the full names and addresses of the borrower (you) and the lender. Include any co-borrowers or co-lenders as well.

- Property Details: Provide the complete address of the property being transferred, including the legal description found in your original loan documents. This description is crucial for the deed's validity.

- Loan Information: Input the loan number and any other identifying information for the mortgage that this agreement will affect.

- Signatures: All parties involved must sign the form. The borrower(s), lender, and possibly a witness or notary, depending on state requirements. Check if your state requires notarization.

- Date the Document: Ensure you date the document with the day you and the other parties sign it. This date is necessary for the record.

- Attach Required Documents: If the form asks for it, attach any required documents. This might include hardship letters, financial statements, or other proofs of your inability to continue with the mortgage.

- Submit the Form: Finally, submit the deed in lieu of foreclosure form to the appropriate county recorder's office. You might need to pay a filing fee. Ensure you keep copies of the form and any other documents submitted for your records.

Completing an Illinois Deed in Lieu of Foreclosure form is a delicate process that demands attention to detail. Carefully filling out each section can help ensure the agreement is understood and legally binding. By following the steps above, you can navigate this process more confidently, knowing that you're taking a significant step towards resolving a challenging situation.

Understanding Illinois Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure in Illinois?

A Deed in Lieu of Foreclosure is a legal document used in Illinois where a homeowner voluntarily transfers the ownership of their property to the lender. This is done to avoid the foreclosure process when the homeowner can no longer make payments on their mortgage. It's an agreement that can provide a more graceful exit for homeowners facing financial difficulties, potentially allowing them to avoid some of the negative impacts a foreclosure could have on their credit history.

How does the Deed in Lieu of Foreclosure process work in Illinois?

In Illinois, the process begins with the homeowner approaching their lender to propose a Deed in Lieu of Foreclosure. If the lender agrees, both parties will then negotiate the terms, which could include forgiving any deficiency between the sale price and the mortgage owed. The homeowner will prepare and sign the deed and other necessary paperwork, transferring the property's title to the lender. Finally, the lender must record the deed with the county recorder's office to complete the transfer.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

Choosing a Deed in Lieu of Foreclosure offers several benefits, including avoiding the public and often lengthy process of foreclosure, potentially less damaging effects on the homeowner's credit score, and the possibility of negotiating terms with the lender, such as debt forgiveness or a different resolution. It can also provide a sense of relief and closure for homeowners, allowing them to move forward more quickly.

Are there any drawbacks to a Deed in Lieu of Foreclosure?

Yes, there can be drawbacks. A Deed in Lieu of Foreclosure may still negatively impact a homeowner's credit score, though typically less than a foreclosure. There might also be tax implications, as forgiven debt can be considered taxable income. Additionally, not all lenders will agree to a Deed in Lieu of Foreclosure, especially if there are second mortgages or other liens on the property, as these can complicate the process.

Can any homeowner in Illinois choose a Deed in Lieu of Foreclosure?

Not all homeowners may qualify for a Deed in Lieu of Foreclosure. Lenders typically require that the homeowner has explored all other options, such as loan modifications or refinancing. The property must also usually be on the market for a certain period without selling. Furthermore, the lender must agree that accepting the deed is in their best interest, often requiring that there be no other liens on the property as these can complicate the process.

How does a Deed in Lieu of Foreclosure affect a homeowner's taxes?

The impact of a Deed in Lieu of Foreclosure on a homeowner's taxes can vary. If the lender forgives any part of the mortgage debt, the forgiven amount might be considered as income for tax purposes. However, the Mortgage Forgiveness Debt Relief Act could allow some homeowners to exclude this forgiven debt from their income, under certain conditions. It's advisable for homeowners to consult with a tax professional to understand the specific tax implications related to their situation.

Common mistakes

Many individuals facing financial difficulties make the critical decision to opt for a Deed in Lieu of Foreclosure as a means to avoid the foreclosure process in Illinois. However, during this stressful time, it's easy to overlook key aspects of the form, leading to mistakes that can complicate the situation further. One common error is neglecting to thoroughly review all the financial implications. This option, while beneficial in avoiding foreclosure, may still have significant tax consequences and could impact one’s credit score profoundly. It is always advisable to seek expert advice to understand the full scope of this decision.

Another frequent oversight is failing to include all necessary legal descriptions of the property. The legal description is more detailed than just the address; it includes the exact boundaries and dimensions of the property as recorded in the county’s official records. This detail is crucial for the deed to be accurately recorded, ensuring the proper transfer of ownership. Without it, the process may face unnecessary delays or even legal challenges.

Incorrectly assuming that submitting a Deed in Lieu of Foreclosure immediately releases the borrower from all financial obligations related to the property is another mistake. In some cases, if the property’s sale does not cover the total debt owed, the lender may still seek a deficiency judgment, requiring the borrower to pay the remaining amount. It is essential to clarify and possibly negotiate the terms of the deficiency rights with the lender before finalizing the deed.

Failure to secure a written agreement from the lender that they will not pursue further action to recover any remaining debt is a pivotal oversight. Obtaining a signed document from the lender, stating they accept the deed in lieu as full satisfaction of the mortgage, is vital. Without such an agreement, the lender could potentially pursue a deficiency judgment, leaving the borrower at risk of additional financial liability. Ensuring all agreements are fully documented and agreed upon by all parties provides a level of security and peace of mind in this transaction.

Lastly, overlooking the importance of filing the completed form with the appropriate county office is a critical mistake. The transfer of property is not complete until the deed in lieu of foreclosure is officially recorded in the county where the property is located. This step is essential for the deed to be legally recognized, providing the borrower with documentation that they are no longer responsible for the property. A delay or failure to record this document can lead to significant legal and financial complications down the line.

Documents used along the form

When facing the situation of a Deed in Lieu of Foreclosure in Illinois, it’s crucial to understand that it involves not just a single document but a series of important papers. A Deed in Lieu of Foreclosure is a complex legal process allowing a homeowner to transfer the ownership of their property back to the lender to avoid foreclosure. While it appears straightforward, it requires thorough documentation to protect the interests of both the homeowner and the lender. Besides the primary Deed in Lieu of Foreclosure form, several other essential documents often come into play to ensure the process is conducted accurately and legally.

- Hardship Letter: This document is a personal letter from the homeowner to the lender, explaining the financial difficulties they are facing and why they are unable to continue making mortgage payments. It’s a critical piece that outlines the justification for seeking a Deed in Lieu of Foreclosure.

- Financial Statement: To supplement the Hardship Letter, the homeowner must provide a detailed financial statement. This includes income, expenses, assets, and liabilities. It paints a complete picture of the homeowner’s financial situation.

- Proof of Income: This can be in the form of recent pay stubs, tax returns, or any other documents that verify the income level of the homeowner. The lender uses this to assess the homeowner's financial capacity.

- Property Appraisal: An essential part of the process is determining the current market value of the property. A professional appraisal report is required to establish this value, helping the lender decide if a Deed in Lieu of Foreclosure is a viable option.

- Agreement Not to Pursue a Deficiency Judgment: This legal document may be used if the lender agrees not to pursue the difference between the sale price of the property and the amount still owed on the mortgage.

- Title Search Report: Before accepting a Deed in Lieu of Foreclosure, the lender will require a title search to ensure no other liens or encumbrances on the property. This report details the findings of such a search.

To navigate the Deed in Lieu of Foreclosure process effectively, it's beneficial to have a clear understanding of each document’s role and requirements. Homeowners considering this path should gather all necessary documentation and may wish to consult with a legal advisor to ensure their rights are protected throughout the process. The above documents are instrumental in facilitating a smooth and legally sound transition, helping both parties reach a mutually agreeable resolution.

Similar forms

A Deed in Lieu of Foreclosure form, commonly used in Illinois, bears resemblance to a variety of legal documents due to its nature and purpose. One such document is a Mortgage Release (Satisfaction of Mortgage) form. Both documents are used as part of the process to release a borrower from the obligations of a mortgage. While a Deed in Lieu of Foreclosure transfers the title of the property from the borrower back to the lender to satisfy the loan and prevent foreclosure, a Mortgage Release form is used when the mortgage is paid off or fulfilled under the terms agreed, officially releasing the borrower from the mortgage lien on the property.

Another similar document is the Quitclaim Deed, which is used to transfer ownership, interest, or rights in a property from one party to another without any warranty regarding the title's quality. Like the Deed in Lieu of Foreclosure, a Quitclaim Deed can swiftly change the property's title, but it is often used in less adversarial circumstances, such as between family members or to clear up title issues. The Deed in Lieu specifically aims to resolve a defaulting mortgage situation by transferring the property back to the lender.

A Loan Modification Agreement also shares similarities with the Deed in Lieu of Foreclosure, as both are methods to avoid foreclosure. However, a Loan Modification Agreement is an arrangement that adjusts the terms of the existing mortgage—such as the interest rate, monthly payments, or loan duration—to make it more manageable for the borrower to continue making payments. This agreement aims to keep the borrower in the home, contrasting with the Deed in Lieu, which ultimately transfers the property's title away from the borrower.

The Short Sale Agreement is another document with resemblances. In a short sale, the lender agrees to let the borrower sell the property for less than the outstanding mortgage balance. Like a Deed in Lieu, it provides an alternative to foreclosure, allowing both the lender and borrower to avoid the long, costly foreclosure process. However, the key difference lies in the outcome; a short sale involves selling the property to a third party, whereas a Deed in Lieu transfers it directly back to the lender.

Finally, a Foreclosure Notice is crucially related yet distinctly different from a Deed in Lieu of Foreclosure. This notice is typically a formal declaration from the lender to the borrower that foreclosure proceedings will begin due to default on the mortgage. While it precedes an adversarial and often lengthy process leading to the lender forcibly reclaiming the property, a Deed in Lieu serves as a voluntary alternative for the borrower to preemptively surrender the property, thereby sidestepping the formal foreclosure process.

Dos and Don'ts

When dealing with the Illinois Deed in Lieu of Foreclosure form, it's paramount to navigate the process with attention to detail and a clear understanding of the legal ramifications. This document, marking the transfer of property ownership from a borrower to a lender to avoid foreclosure, necessitates careful handling. Here are essential dos and don'ts to consider:

Do:- Review all loan documents before proceeding, ensuring that a deed in lieu of foreclosure is permitted under the terms of your mortgage or deed of trust.

- Gather all relevant financial information and documentation, reflecting your current financial state to present to the lender, emphasizing the necessity of a deed in lieu.

- Consult with a legal advisor to understand fully the implications of a deed in lieu of foreclosure, including but not limited to tax consequences and the possibility of a deficiency judgment.

- Communicate openly and directly with your lender, expressing your desire to avoid foreclosure through a deed in lieu, and begin negotiations for terms that could include the full satisfaction of the mortgage.

- Proceed without a written agreement from the lender, specifying the terms of the deed in lieu, including the release of any remaining mortgage obligation.

- Ignore potential tax implications, as the forgiveness of debt may have significant tax liabilities. It's crucial to understand the potential financial impact beyond the immediate transfer of property.

- Overlook other potential relief options, such as loan modification, refinance, or short sale, which might provide a more favorable outcome depending on your situation.

- Fail to record the deed in lieu properly in county records once executed, as this step is crucial to ensure the legal transfer of ownership and to avoid future disputes.

Misconceptions

When discussing the Illinois Deed in Lieu of Foreclosure form, several misconceptions commonly arise. This form is a legal document used as an alternative to foreclosure, where a homeowner voluntarily transfers ownership of their property to the lender. Understanding the facts can clear up any confusion and help both lenders and borrowers make informed decisions.

Misconception 1: It's a quick and simple process. Many believe that a deed in lieu of foreclosure is a fast way to resolve financial distress with minimal paperwork. In reality, this process involves a detailed agreement and may require negotiations between the borrower and the lender, along with the fulfillment of various conditions before it is finalized.

Misconception 2: It absolves all borrower's debt. Another common misunderstanding is that once a deed in lieu of foreclosure is completed, the borrower is free from all mortgage-related debts. However, if the property's sale doesn't cover the full mortgage amount, the lender may still pursue a deficiency judgment, unless specifically waived in the agreement.

Misconception 3: It doesn't impact credit scores. Some think that a deed in lieu of foreclosure won't affect their credit history as severely as a foreclosure would. While it might be slightly less damaging, it still significantly impacts the borrower's credit score and remains on the credit report for several years.

Misconception 4: It's always an available option. Not all lenders accept a deed in lieu of foreclosure. Its acceptance depends on various factors, including the lender's policies, the potential for recovering the loan amount through foreclosure, and the presence of any secondary loans or liens on the property.

Misconception 5: It leads to immediate eviction. Many believe that once a deed in lieu of foreclosure is executed, they must vacate the property immediately. In some cases, lenders may allow the former homeowner to rent the property for a period or provide a timeframe for vacating, offering a more manageable transition.

Misconception 6: It's advantageous for the borrower only. Often, it's thought that only borrowers benefit from a deed in lieu of foreclosure by avoiding foreclosure's stigma and cost. However, lenders also benefit by avoiding the lengthy and costly process of foreclosure, property maintenance, and resale.

By dispelling these misconceptions, individuals facing financial hardship can better understand their options and the implications of a deed in lieu of foreclosure in Illinois. It's crucial to consult with legal and financial professionals to explore all available avenues and make informed decisions based on accurate information.

Key takeaways

- A Deed in Lieu of Foreclosure form is a legal document where a homeowner voluntarily transfers ownership of their property to the lender. This is done to avoid the foreclosure process when the homeowner can no longer make mortgage payments.

- Before filling out the form in Illinois, it’s critical to ensure that all mortgage payments and property taxes are reported accurately. This helps in determining the outstanding debt and may affect the agreement terms.

- The form requires precise identification of all parties involved, including the legal names of the homeowner(s) and the lender. This accuracy ensures that the deed transfer is legally valid.

- Detailing the property’s legal description is a must. Unlike a simple address, this legal description outlines the property’s exact boundaries and is usually found in the property’s current deed or title documents.

- Homeowners should consider any implications of a Deed in Lieu agreement on future housing. Although it may seem like a solution to immediate financial woes, the impact on one’s credit score and ability to purchase future homes should be evaluated.

- Seeking legal advice before proceeding is advisable. A qualified attorney can provide valuable insights on the ramifications and guide through the nuances of the agreement to ensure the homeowner’s rights are protected.

- After the form is filled out, it must be signed by all parties involved in the presence of a notary public to be legally binding. This step is crucial to authenticate the document and prevent any future disputes.

- Finally, once the deed in lieu form is completed and signed, it must be filed with the appropriate county recorders office in Illinois. This public record filing is essential for the legal transfer of property ownership and to officially release the homeowner from their mortgage obligations.

More Deed in Lieu of Foreclosure State Forms

Deed in Lieu of Foreclosure Florida - A legal agreement where a borrower conveys their property to the lender to cancel the mortgage debt and avoid foreclosure.

Deed in Lieu of Mortgage - Serves as an agreement where a property owner willingly transfers the deed to the lender, avoiding the foreclosure process and satisfying mortgage debt.

Deed in Lieu of Foreclosure Template - The form is a crucial step in formalizing the agreement between the lender and the homeowner, ensuring all parties understand their rights and obligations.