Fillable Deed in Lieu of Foreclosure Document for Georgia

In the states like Georgia, where the real estate market is as fluctuating as the seasons, homeowners find themselves in the precarious position of being unable to meet their mortgage obligations. This reality, coupled with the desire to avoid the strenuous process of foreclosure, introduces the Georgia Deed in Lieu of Foreclosure form as a viable alternative. By opting for this method, property owners voluntarily transfer the ownership of their property to the lender, effectively releasing them from their mortgage debts under mutually agreed terms. The form, which plays a pivotal role in this procedure, stands as a documented agreement that ensures both parties' interests are safeguarded. It outlines the specifics of the property transfer, including any conditions or contingencies that must be met. Additionally, it serves to protect homeowners from the potential future legal and financial ramifications associated with foreclosure, offering a path that is both less damaging to credit scores and more dignified. Understanding the major aspects of this form is not just beneficial for those directly involved; it provides valuable insights into alternative foreclosure prevention methods available within the state of Georgia. The document carries significant implications for the process, making it imperative for homeowners and lenders alike to navigate its intricacies with due diligence and care.

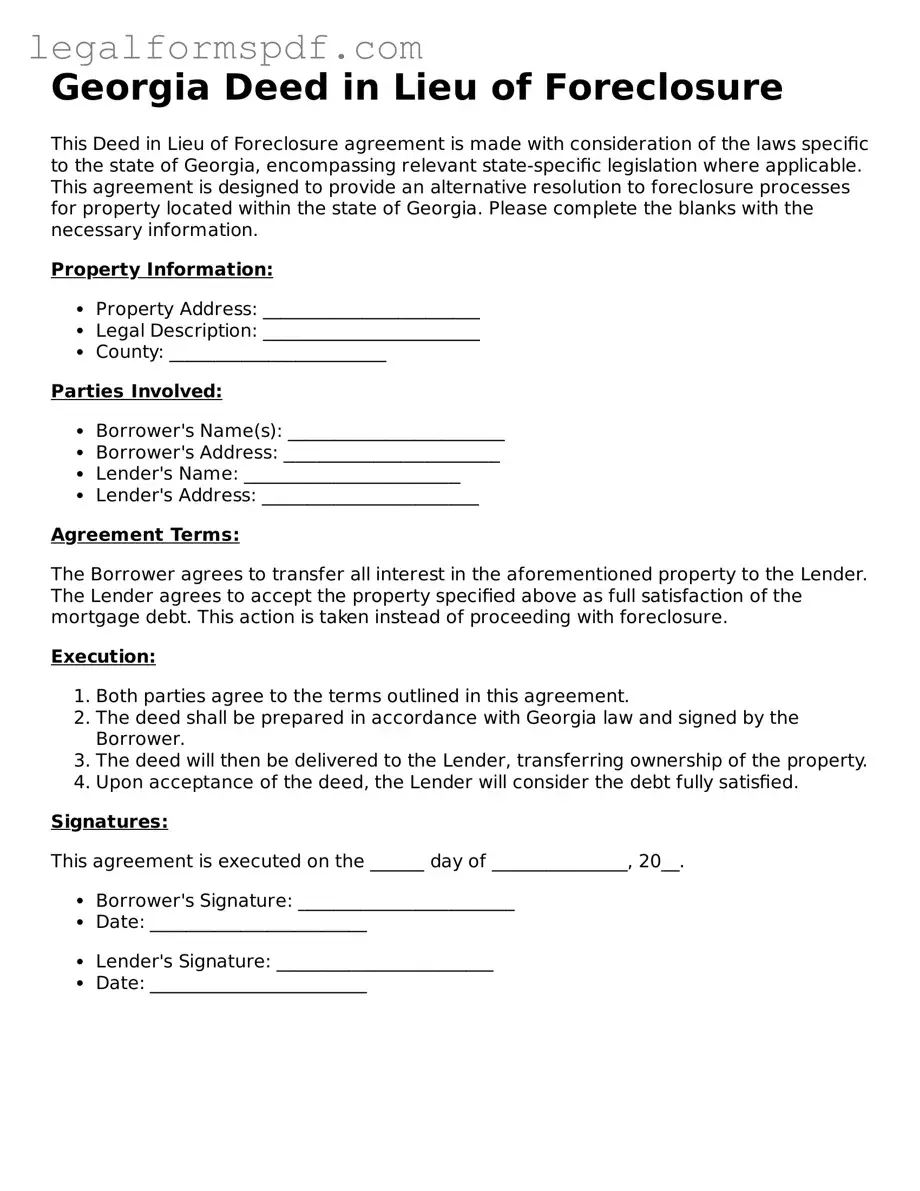

Document Example

Georgia Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure agreement is made with consideration of the laws specific to the state of Georgia, encompassing relevant state-specific legislation where applicable. This agreement is designed to provide an alternative resolution to foreclosure processes for property located within the state of Georgia. Please complete the blanks with the necessary information.

Property Information:

- Property Address: ________________________

- Legal Description: ________________________

- County: ________________________

Parties Involved:

- Borrower's Name(s): ________________________

- Borrower's Address: ________________________

- Lender's Name: ________________________

- Lender's Address: ________________________

Agreement Terms:

The Borrower agrees to transfer all interest in the aforementioned property to the Lender. The Lender agrees to accept the property specified above as full satisfaction of the mortgage debt. This action is taken instead of proceeding with foreclosure.

Execution:

- Both parties agree to the terms outlined in this agreement.

- The deed shall be prepared in accordance with Georgia law and signed by the Borrower.

- The deed will then be delivered to the Lender, transferring ownership of the property.

- Upon acceptance of the deed, the Lender will consider the debt fully satisfied.

Signatures:

This agreement is executed on the ______ day of _______________, 20__.

- Borrower's Signature: ________________________

- Date: ________________________

- Lender's Signature: ________________________

- Date: ________________________

PDF Specifications

| Fact Number | Fact Description |

|---|---|

| 1 | Georgia's Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers the ownership of their property to the lender to avoid foreclosure. |

| 2 | It serves as a resolution for borrowers in default under Georgia law, helping both lender and borrower avoid the lengthy and costly foreclosure process. |

| 3 | The governing law for the Deed in Lieu of Foreclosure in Georgia primarily falls under the Georgia Code, Title 44, "Property," emphasizing the importance of compliance with state-specific legal procedures. |

| 4 | Before execution, it often requires a written agreement detailing the terms of the deed transfer, including any forgiveness of debt or financial obligations post-transfer, ensuring transparency and consensus between parties. |

Instructions on Writing Georgia Deed in Lieu of Foreclosure

Filling out the Georgia Deed in Lieu of Foreclosure form is a critical process for homeowners seeking an alternative to foreclosure. This legal step allows you to transfer the ownership of your property back to the lender voluntarily. It is important to approach this task with attention to detail to ensure all the necessary information is accurately provided. The following guidelines are designed to assist you in completing the form correctly. By adhering to these steps, you can navigate this legal process more smoothly and with confidence.

- Begin by gathering all required personal information, including your full legal name, address, and the loan number associated with the property in question.

- Identify the lender's information. This includes the legal name of the lending institution, along with their address and contact details.

- Locate the section of the form that specifies the property description. Accurately enter the full address of the property, including the county in Georgia where it is located. Ensure you also include any legal descriptions or parcel numbers associated with the property.

- In the part of the form dedicated to the terms of agreement, review the conditions under which you are transferring the property. Make sure you understand these terms completely before proceeding.

- Pay close attention to the signature section. Both you (the borrower) and a representative from the lending institution must sign the form. The signatures must be witnessed by a notary public, affirming that both parties agreed to the terms voluntarily.

- Before submitting the completed form, double-check all entered information for accuracy. Errors or omissions can lead to delays or complications in the process.

- Finally, submit the deed in lieu of foreclosure form to the appropriate county office in Georgia for recording. There may be a filing fee associated with this submission, so be prepared to cover this cost.

Upon the successful submission and acceptance of the Georgia Deed in Lieu of Foreclosure form, you have taken a significant step towards resolving your mortgage difficulties. It is advisable to maintain a copy of the submitted form for your records and to monitor the process until you receive confirmation that the deed transfer is complete. Remember, navigating through legal processes can be challenging, but taking it step by step can make the journey more manageable.

Understanding Georgia Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document in which a borrower voluntarily transfers the ownership of their property to the lender. This is done to avoid the foreclosure process when the borrower is unable to meet mortgage obligations.

How does a Deed in Lieu of Foreclosure work in Georgia?

In Georgia, the process involves the borrower and lender agreeing that the transfer of property ownership will serve as full satisfaction of the mortgage debt. This agreement must be in writing and both parties must consent to the terms. It effectively ends the borrower’s responsibility under the mortgage.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

Choosing a Deed in Lieu of Foreclosure can benefit both the borrower and lender by avoiding the lengthy and costly foreclosure process. For the borrower, it can also result in a less severe impact on their credit score compared to foreclosure and potentially releases them from any deficiency judgments related to the mortgage debt.

Are there any drawbacks to a Deed in Lieu of Foreclosure?

Yes, there are several potential drawbacks. For the borrower, it may still negatively affect their credit score and could have tax implications based on debt forgiveness. Lenders might also refuse the deed in lieu if there are junior liens on the property, as accepting the deed does not necessarily eliminate these secondary claims.

What is required to qualify for a Deed in Lieu of Foreclosure in Georgia?

Qualification criteria can vary by lender, but generally, borrowers must demonstrate a genuine financial hardship preventing them from making mortgage payments, have a property that hasn't significantly depreciated, and ensure there are no other liens against the property unless the lienholders agree to the deed in lieu.

What steps should be taken to start the Deed in Lieu of Foreclosure process in Georgia?

Borrowers interested in this option should first contact their lender to discuss the possibility and to understand any specific requirements or processes the lender follows. It’s advised to consult with a legal or financial advisor to understand the implications and to help negotiate the terms.

How does a Deed in Lieu of Foreclosure affect a borrower's taxes?

Owing to debt forgiveness laws, borrowers may face tax liabilities for the difference between the amount owed on the mortgage and the property’s value when the deed in lieu is executed. It's important to consult with a tax advisor to understand any potential tax implications.

Can a lender refuse a Deed in Lieu of Foreclosure?

Yes, a lender can refuse to accept a deed in lieu of foreclosure for various reasons, such as when there are multiple liens on the property, the market value of the property has significantly decreased, or if they believe they might recover more through the foreclosure process.

Is it possible to rescind a Deed in Lieu of Foreclosure once it has been agreed upon?

In general, once a deed in lieu of foreclosure is executed and accepted by the lender, it cannot be rescinded. It is a final agreement that transfers the property's title to the lender, relieving the borrower of their mortgage debt. This underscores the importance of fully understanding the terms and implications before proceeding.

Common mistakes

One common mistake made during the completion of the Georgia Deed in Lieu of Foreclosure form involves neglecting to accurately describe the property in question. The legal description of the property, which includes specific details and boundaries, must be precisely outlined. Failing to provide this detailed description can lead to significant legal complications, potentially rendering the agreement unenforceable. Individuals often mistakenly insert a brief or insufficient description, not realizing the importance of this component in the overall legality of the document.

Another frequent error is the failure to correctly identify all parties involved. The deed in lieu of foreclosure requires the clear identification of both the borrower and the lender, including their legal names and statuses. Mistakes in the spelling of names or omitting the legal status of entities (such as Inc., LLC, etc.) can invalidate the document or, at the very least, necessitate tedious corrections. It's crucial to double-check this information to ensure its accuracy, thereby solidifying the legal standing of the agreement.

Not securing the agreement of all lienholders before proceeding is a critical oversight that individuals often encounter. In situations where there are secondary mortgages or other liens against the property, obtaining their consent is mandatory for the deed in lieu of foreclosure to be valid. Overlooking this step can lead to the agreement being challenged or nullified, leaving the primary parties in a potentially worse position than before the process began.

Overlooking the requirement to obtain a written agreement that the deed in lieu satisfies the outstanding mortgage debt is another pitfall. Without this documentation, borrowers may unknowingly leave the door open for lenders to claim a deficiency judgment against them, seeking to recover the difference between the mortgage amount and the property's value. Ensuring that the agreement explicitly states the debt is considered settled upon the transfer of the deed is paramount for protecting the interests of the borrower.

Individuals often misunderstand the importance of including specific legal clauses that protect against future claims. For instance, a clause stating that the transfer of the deed is in full satisfaction of the debt can provide essential legal protection for the borrower. Without such clauses, the borrower may face unforeseen legal challenges down the line. It is essential to include and carefully word these protective clauses to ensure that both parties’ intentions are clearly documented and legally binding.

Lastly, failing to properly record the deed in lieu of foreclosure with the appropriate county office is a significant yet common mistake. This step is critical for the legal transfer of the property to be recognized and effective. Without proper recording, the transfer may not be acknowledged by law, leaving the borrower’s name on the title and potentially responsible for taxes and other liabilities associated with the property. Ensuring the deed is recorded as soon as possible after the agreement solidifies the transfer and relieves the borrower from further obligations related to the property.

Documents used along the form

When dealing with a Deed in Lieu of Foreclosure in Georgia, there are several important forms and documents that often accompany the primary form to ensure the transaction is handled efficiently and legally. These documents play a critical role in the process by providing detailed information, stipulating conditions, and protecting both the lender and borrower's interests. Understanding each document's purpose can help ensure a smoother transition of property ownership while mitigating potential future disputes.

- Hardship Letter: This document is prepared by the borrower, explaining the circumstances that led to their financial hardship. It provides context for why the borrower cannot continue to make mortgage payments and why a deed in lieu of foreclosure is being considered.

- Loan Modification Agreement: Before proceeding with a deed in lieu of foreclosure, a loan modification agreement may be attempted. This document outlines the terms under which the lender agrees to modify the original loan conditions, potentially allowing the borrower to retain ownership of the property under new terms.

- Estoppel Affidavit: An Estoppel Affidavit is often required, which is a legally binding document where the borrower confirms that they are voluntarily transferring the property and that there are no other liens or encumbrances against the property other than the mortgage being settled.

- Settlement Statement: This detailed document itemizes all costs and fees associated with the transaction. It provides both parties with a clear understanding of the financial aspects of the agreement, ensuring transparency and clarity in the closing of the deal.

Together, these documents form a comprehensive package, guiding the deed in lieu of foreclosure process. Each serves to safeguard the interests of both lender and borrower, ensuring that the transfer of property is conducted fairly. It is crucial for both parties to review these documents carefully, possibly with the assistance of legal counsel, to fully comprehend their implications and to ensure compliance with Georgia state laws.

Similar forms

A Deed in Lieu of Foreclosure form, particularly in Georgia, bears a resemblance to a Quitclaim Deed in several respects. Both documents are instrumental in transferring property rights from one party to another without the sale of the property. Unlike the typical warranty deeds, these do not guarantee the title's clearness; instead, they transfer the owner's interests as is, possibly with encumbrances. The main difference lies in their use, where a Quitclaim Deed is often used to clear up title issues or transfer property between family members, while a Deed in Lieu transfers property back to the lender to avoid foreclosure.

Similar to a Warranty Deed, the Georgia Deed in Lieu of Foreclosure facilitates the transfer of property. However, a Warranty Deed is distinguished by providing the grantee (usually the buyer) with certain guarantees about the property's title and its freedom from liens, which is not the case in a Deed in Lieu. In providing these guarantees, the Warranty Deed ensures a cleaner and more secure transfer of property compared to the as-is nature of a Deed in Lieu.

The Mortgage Agreement also shares similarities with a Deed in Lieu of Foreclosure because both involve a relationship between a borrower and a lender concerning property ownership. While a Mortgage Agreement outlines the terms under which a lender provides funds to a borrower with the property acting as collateral, a Deed in Lieu represents one outcome when the borrower cannot meet these terms, opting to transfer the property to the lender voluntarily.

Loan Modification Agreement forms and Deeds in Lieu of Foreclosure are connected through their roles in addressing financial distress related to mortgages. A Loan Modification Agreement adjusts the terms of an existing loan to prevent default, often modifying interest rates, loan terms, or principal amounts. If these adjustments fail to prevent default, a Deed in Lieu may be considered as a last resort to avoid foreclosure, allowing the borrower to relinquish the property to the lender.

The Short Sale Agreement presents another method for homeowners to avoid foreclosure, akin to the Deed in Lieu of Foreclosure. In a Short Sale, the property is sold for less than the amount owed on the mortgage with the lender's permission. This approach, like a Deed in Lieu, offers an escape from mortgage distress, although it involves finding a buyer for the property, unlike the immediate transfer involved in a Deed in Lieu.

Foreclosure Notices, while not agreements themselves, are precursors to the same financial distress situation that a Deed in Lieu of Foreclosure seeks to resolve. These notices legally inform a borrower that the foreclosure process is about to begin due to default in payment. Opting for a Deed in Lieu can be a direct response to such a notice, aiming to preclude the formal and public foreclosure process.

The Satisfaction of Mortgage document marks the end of a mortgage through the payment or fulfillment of its terms, paralleling the Deed in Lieu where the mortgage ends, not through fulfillment, but through the transfer of the property title. Both signify an end to the obligations under the original mortgage agreement, though through very different means – one through satisfaction, the other through surrender.

Assignment of Rents forms, commonly used in real estate financing, resemble the Deed in Lieu in scenarios involving rental properties. These documents allow the lender to collect rent from a property used as collateral on a loan, which becomes relevant when a borrower defaults. Similarly, a Deed in Lieu transfers ownership of the property, including any rights to collect rents, back to the lender but through a different mechanism.

Lastly, the Trust Deed is akin to the Deed in Lieu of Foreclosure as both involve three parties: the borrower (trustor), the lender (beneficiary), and a neutral third party who holds the title until the loan is repaid or, in the case of default, facilitates the transfer of property. However, a Trust Deed is employed at the inception of a loan to secure it, while a Deed in Lieu is a means to resolve the loan's default without resorting to foreclosure proceedings.

Power of Attorney documents, which authorize an individual to act on another's behalf, share an indirect similarity with a Deed in Lieu of Foreclosure. They are alike in that they both involve the transfer of rights: a Power of Attorney may include the transfer of authority to manage or dispose of the grantor's property, whereas a Deed in Lieu involves the transfer of the property itself. However, the situations in which each is used are markedly different, with one focusing on representation and the other on resolving mortgage default.

Dos and Don'ts

Filling out the Georgia Deed in Lieu of Foreclosure form is a serious legal matter that can significantly impact your financial and housing situation. Here are seven dos and don'ts to keep in mind when completing this form:

- Do ensure all the information you provide is accurate. Mistakes can delay the process or impact the agreement's legality.

- Do consult with a legal advisor before signing the document. Understanding the full implications of a deed in lieu of foreclosure is crucial.

- Do keep a copy of the completed and signed form for your records. This document is important evidence of your arrangement.

- Do discuss the tax implications with a tax advisor. There could be taxable consequences from a deed in lieu of foreclosure.

- Do contact the lender directly if you have any questions or concerns while filling out the form. Clear communication can often resolve minor issues before they become major problems.

- Don't leave any sections blank. If a section does not apply, ensure to write "N/A" (not applicable) to demonstrate that it was reviewed, but not needed.

- Don't sign the form without understanding every element of the agreement. If there's something you do not comprehend, seek clarification.

Misconceptions

When discussing the Georgia Deed in Lieu of Foreclosure form, several misconceptions often arise from misunderstandings or a lack of detailed knowledge. Shedding light on these errors is vital for anyone navigating the complexities of avoiding foreclosure. Below are six common misconceptions:

- It’s an Easy Escape from Mortgage Debt: Many believe that opting for a Deed in Lieu of Foreclosure is an easy way to avoid mortgage debt altogether. The truth is more nuanced; while it can release a borrower from their mortgage obligations, there might still be financial consequences, such as owing taxes on the forgiven debt, depending on the specific circumstances and agreements with the lender.

- Approval Is Guaranteed: Homeowners often assume that their lenders will automatically agree to a Deed in Lieu of Foreclosure once requested. In reality, lenders have the discretion to accept or deny such requests based on their policies, the borrower's financial situation, and the current real estate market conditions.

- No Negative Impact on Credit Score: There is a misconception that this agreement will not affect the borrower's credit score. While a Deed in Lieu of Foreclosure may have a lesser impact compared to a foreclosure, it still negatively affects the borrower’s credit score, signaling to future lenders that the borrower defaulted on their loan.

- It Releases All Liens on the Property: Some homeowners mistakenly believe that getting a Deed in Lieu of Foreclosure will remove all liens or claims against their property. However, this process typically only extinguishes the primary mortgage. Second mortgages, home equity lines of credit, and other liens may not be covered and would still need resolution.

- It Prevents Deficiency Judgments: A common misconception is that once a Deed in Lieu of Foreclosure is agreed upon, the borrower is safe from any further claims by the lender for the difference between the sale price and the amount owed (deficiency). This is not always the case; the specifics depend on the terms negotiated with the lender and the applicable state laws.

- One Form Fits All Situations: Homeowners might think that there is a standard Deed in Lieu of Foreclosure form that applies to every situation in Georgia. In contrast, the terms and requirements can vary greatly based on the lender, the loan, and other factors. Professional legal advice is often necessary to ensure the form accurately reflects the agreement's details and protects the homeowner’s interests.

Understanding these misconceptions can clarify the Deed in Lieu of Foreclosure process for Georgia homeowners. It’s crucial to approach this option with a full understanding of its potential impacts and complexities.

Key takeaways

Understand that a Deed in Lieu of Foreclosure is an alternative method for managing the inability to make mortgage payments in Georgia by transferring property ownership from the homeowner to the lender voluntarily to avoid foreclosure proceedings.

Prior to completing the form, conduct a thorough review of any and all outstanding debts or encumbrances on the property, as these may affect the process and the lender's willingness to accept the property.

Ensure accuracy in filling out the form by providing all required details, such as the complete legal description of the property, the name(s) of the homeowner(s), and the lender's information, to prevent any potential delays or complications.

Seek advice from a legal professional or housing counselor to understand the implications a deed in lieu can have on your financial situation and credit score, ensuring you're making an informed decision.

Gather and prepare any documentation that supports your situation (e.g., financial hardship evidence) to submit along with your deed in lieu form, which can bolster your case with the lender.

Engage in open communication with your lender about the possibility of a deed in lieu of foreclosure, as they may have specific requirements or conditions that need to be met for the process to be accepted.

Before submitting the form, understand that this action may not exempt you from all financial obligations. For instance, if the sale of the property doesn’t cover the mortgage balance, you might still owe a deficiency unless explicitly waived by the lender.

Ensure that the lender provides a written agreement that specifies the terms of the deed in lieu transaction, including any waivers of deficiency, to protect your interests and provide clarity on the agreement.

After completing the process, verify that the lender records the deed in lieu with the appropriate county office in Georgia to officially transfer ownership and remove your name from the property title.

More Deed in Lieu of Foreclosure State Forms

Deed in Lieu of Foreclosure Florida - A solution for struggling homeowners to avoid foreclosure by directly transferring their property to the lender.

Deed in Lieu of Foreclosure Template - It represents a formal acknowledgment by the lender that the homeowner is unable to fulfill their mortgage commitments due to financial hardship.