Fillable Deed in Lieu of Foreclosure Document for Florida

When homeowners in Florida find themselves unable to meet their mortgage obligations, they're faced with several paths to avoid foreclosure—one of which is the Deed in Lieu of Foreclosure. This legal document represents an agreement between a homeowner and the lender, where the homeowner voluntarily transfers ownership of the property back to the lender. Far from being a simple transaction, the process serves as a less damaging alternative to foreclosure, allowing both parties to avoid the lengthy and costly court processes associated with foreclosing a home. For homeowners, it provides a dignified exit from a difficult situation, potentially sparing their credit scores from the full impact of a foreclosure. Lenders, on the other hand, receive the property without the need for legal battles. However, understanding the nuances, legal requirements, and implications of this form is crucial for anyone considering this route. It's not only about signing a document; it’s about making an informed decision that affects financial futures and personal well-being.

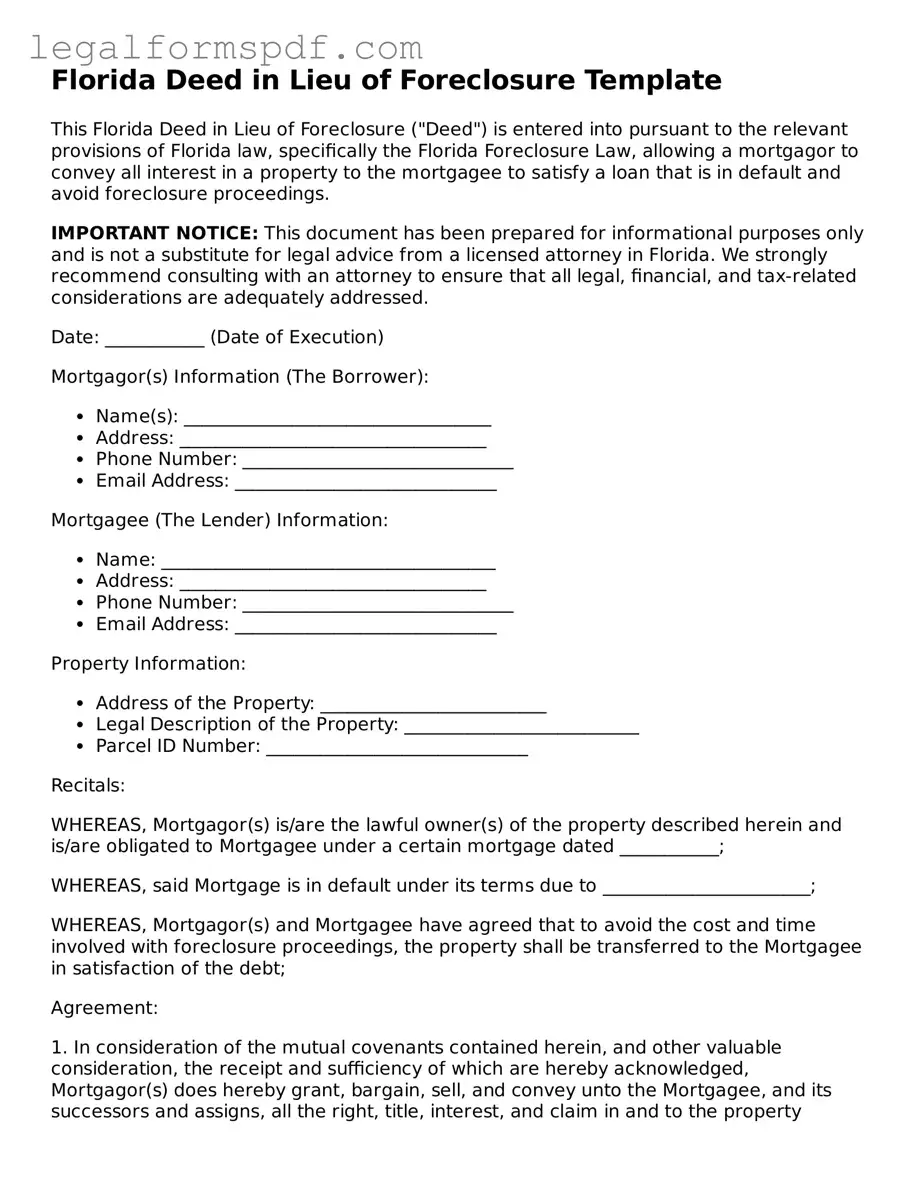

Document Example

Florida Deed in Lieu of Foreclosure Template

This Florida Deed in Lieu of Foreclosure ("Deed") is entered into pursuant to the relevant provisions of Florida law, specifically the Florida Foreclosure Law, allowing a mortgagor to convey all interest in a property to the mortgagee to satisfy a loan that is in default and avoid foreclosure proceedings.

IMPORTANT NOTICE: This document has been prepared for informational purposes only and is not a substitute for legal advice from a licensed attorney in Florida. We strongly recommend consulting with an attorney to ensure that all legal, financial, and tax-related considerations are adequately addressed.

Date: ___________ (Date of Execution)

Mortgagor(s) Information (The Borrower):

- Name(s): __________________________________

- Address: __________________________________

- Phone Number: ______________________________

- Email Address: _____________________________

Mortgagee (The Lender) Information:

- Name: _____________________________________

- Address: __________________________________

- Phone Number: ______________________________

- Email Address: _____________________________

Property Information:

- Address of the Property: _________________________

- Legal Description of the Property: __________________________

- Parcel ID Number: _____________________________

Recitals:

WHEREAS, Mortgagor(s) is/are the lawful owner(s) of the property described herein and is/are obligated to Mortgagee under a certain mortgage dated ___________;

WHEREAS, said Mortgage is in default under its terms due to _______________________;

WHEREAS, Mortgagor(s) and Mortgagee have agreed that to avoid the cost and time involved with foreclosure proceedings, the property shall be transferred to the Mortgagee in satisfaction of the debt;

Agreement:

1. In consideration of the mutual covenants contained herein, and other valuable consideration, the receipt and sufficiency of which are hereby acknowledged, Mortgagor(s) does hereby grant, bargain, sell, and convey unto the Mortgagee, and its successors and assigns, all the right, title, interest, and claim in and to the property described above, free and clear of all liens and encumbrances, except for the following: _____________.

2. Mortgagor(s) represents and warrants that the Mortgagor(s) has the full power and authority to transfer the property and that the property is free of all liens and encumbrances except as noted herein.

3. This Deed is executed as a deed in lieu of foreclosure and upon recording shall extinguish all rights, title, interest, and claims of the Mortgagor(s) in the property.

GOVERNING LAW: This Deed shall be governed, construed, and enforced in accordance with the laws of the State of Florida, without regard to its conflict of laws rules.

IN WITNESS WHEREOF, the parties hereto have executed this Deed as of the date first above written.

Mortgagor(s) Signature: _____________________________

Mortgagee Signature: ______________________________

State of Florida

County of ___________

On this ___ day of ___________, 20__, before me, the undersigned notary public, personally appeared ___________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

IN WITNESS WHEREOF, I hereunto set my hand and official seal.

Notary Public: ______________________________

My Commission Expires: ________________________

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure form in Florida is a legal document where a homeowner voluntarily transfers ownership of their property to the lender to avoid the foreclosure process. |

| Governing Law | Florida Statutes Section 702, et seq., governs the process and execution of a Deed in Lieu of Foreclosure in the state of Florida. |

| Benefits for Borrower | This process helps the borrower avoid the negative impacts of foreclosure on their credit history and may release them from the mortgage obligation. |

| Benefits for Lender | Lenders can avoid the lengthy and costly proceedings associated with foreclosure by agreeing to a Deed in Lieu of Foreclosure. |

| Execution Requirements | To be valid, the document must be signed by both the borrower and lender, notarized, and recorded in the county where the property is located. |

Instructions on Writing Florida Deed in Lieu of Foreclosure

When homeowners face the possibility of losing their home due to financial difficulties, the deed in lieu of foreclosure offers an alternative that can mitigate some of the damage to their credit and relieve the burden of an unmanageable mortgage. By transferring the title of their property back to the lender, homeowners can avoid the lengthy and stressful foreclosure process. To successfully complete a Deed in Lieu of Foreclosure form in Florida, it’s essential to follow each step with attention to detail and accuracy.

- Gather all necessary documents related to your mortgage and financial situation. This includes your mortgage statement, any correspondence from your lender regarding foreclosure, and proof of income or financial hardship.

- Review the form to familiarize yourself with the required information. If the form is not provided to you by your lender, it can be obtained from the Florida Department of Financial Services website or a legal forms provider.

- Fill out the property information section, providing the full address of the property, including county, and the legal description as it appears on your mortgage or property deed.

- Enter the names of all property owners as they appear on the property deed. Ensure that anyone whose name appears on the deed is also a signatory to the Deed in Lieu of Foreclosure form.

- Accurately complete the lender information section with the name, address, and contact details of your mortgage lender.

- Discuss and decide the terms of any agreement regarding the forgiveness of any deficiency remaining on the mortgage after the property is sold. If your lender agrees to forgive any remaining debt, this should be clearly stated in the document.

- Sign and date the form in the presence of a notary public. Your lender will also need to sign the form. Make sure to bring a valid form of identification for the notarization process.

- Submit the completed form and any additional required documents to your lender, following their instructions for submission. Keep copies of all documents for your records.

- Wait for confirmation from your lender that the deed in lieu of foreclosure has been accepted and recorded. This process can take several weeks, so maintaining communication with your lender during this time is crucial.

Completing a Deed in Lieu of Foreclosure form is a significant step towards resolving financial distress related to homeownership. While it can provide relief, it’s important to consider the long-term impacts on your credit and homeownership prospects. Seeking advice from a legal or financial advisor can help you make an informed decision and navigate the process with greater assurance.

Understanding Florida Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure in Florida?

A Deed in Lieu of Foreclosure is a legal document in which a homeowner voluntarily transfers the ownership of their property back to the lender as an alternative to going through a foreclosure process. This agreement can be beneficial to both parties, as it allows the homeowner to avoid the negative impact of a foreclosure on their credit report, and the lender to regain possession of the property without the time and expense of legal proceedings.

How can a homeowner qualify for a Deed in Lieu of Foreclosure in Florida?

To qualify for a Deed in Lieu of Foreclosure, typically, the homeowner must be experiencing a financial hardship that makes it impossible for them to continue making their mortgage payments. The property should not have any other liens or encumbrances against it unless the lender agrees to settle those as well. Homeowners must provide their lender with proof of their financial hardship, along with any other documents the lender requires, to prove that they are unable to meet their mortgage obligations.

What are the potential consequences of a Deed in Lieu of Foreclosure for a homeowner?

While a Deed in Lieu of Foreclosure can relieve the immediate pressure of a mortgage that cannot be paid, it is not without its consequences. The action may still negatively impact the homeowner's credit score, though typically less severely than a foreclosure would. Additionally, if the property’s value is less than the amount owed on the mortgage, the lender may pursue a deficiency judgment against the homeowner for the difference, unless specifically waived in the agreement.

Is a Deed in Lieu of Foreclosure always accepted by lenders in Florida?

Not necessarily. The decision to accept a Deed in Lieu of Foreclosure rests with the lender, who may choose to reject the arrangement if they believe that a foreclosure would be more financially beneficial to them. Factors such as the current real estate market, the amount remaining on the mortgage, and the condition of the property can all influence the lender’s decision. Homeowners should engage in discussions with their lenders to understand their position and negotiate the best possible outcome.

Common mistakes

Filling out a Florida Deed in Lieu of Foreclosure form can be a complex process, fraught with potential pitfalls. It's essential for individuals navigating this challenging time to approach the documentation with precision and understanding. One common mistake is failing to ensure the form is the current version, as laws and requirements can change. When outdated forms are used, the submission might be rejected, or worse, it could lead to legal discrepancies down the line.

Another frequently encountered error involves neglecting to properly identify all parties on the document. A deed in lieu of foreclosure involves the transfer of property ownership from the borrower to the lender to satisfy a loan in default. If all legal owners of the property or the correct legal name of the lender are not accurately listed, it could invalidate the agreement or delay the process.

Omitting vital details about the property can also derail the process. The legal description of the property, which is more detailed than the address and includes boundaries and measurements, must be meticulously transcribed onto the form. This is distinct from a simple street address and often requires reference to original deed documents to ensure accuracy. Errors or omissions here can lead to disputes over what was intended to be conveyed.

The misunderstanding of the impact of the deed in lieu on remaining debt obligations can further complicate matters. Some individuals incorrectly believe that transferring the deed to the lender clears all their debt. However, unless explicitly stated in the agreement that the lender forgives any remaining debt beyond the property value, the borrower could still be liable for the difference.

Similarly, overlooking the necessity for a clear title can be a significant oversight. The transfer cannot proceed if there are existing liens or encumbrances on the property not addressed in the agreement. This might require settling any secondary mortgages, homeowner association dues, or other liens before proceeding.

Failure to negotiate or understand the terms regarding the deficiency can also be problematic. In the absence of a negotiated settlement, lenders might retain the right to pursue a deficiency judgment for the difference between the mortgage amount owed and the property's value. Knowing and negotiating these terms can be crucial.

Not seeking legal advice is perhaps the most critical oversight. Legal representation or consultation can help avoid these pitfalls, ensuring that rights are protected, and the document meets all legal requirements. Additionally, legal counsel can help navigate negotiations with lenders, possibly improving the outcome for the borrower.

Inaccurately assuming the tax implications of a deed in lieu can lead to unexpected financial burdens. The forgiveness of debt can sometimes be considered taxable income, and understanding these implications in advance will prepare individuals for potential tax liabilities.

Ignoring the need for lender's consent can also lead to frustration and wasted effort. A deed in lieu of foreclosure must be agreed upon by the lender, as it is not an inherent right of the borrower. Starting this process without initial lender agreement can result in refusal to accept the deed, rendering the process null.

Lastly, not obtaining a release from the lender stating they will not pursue a deficiency judgment can leave individuals vulnerable. Without this document, there might be lingering financial liabilities tied to the defaulted loan, separate from the loss of property. It's critical to secure a written agreement from the lender, outlining the terms of any debt forgiveness.

Navigating the complexities of a deed in lieu of foreclosure requires attention to detail and a clear understanding of the legal and financial implications. Avoiding these common mistakes can help ensure a smoother process and protect against unforeseen consequences.

Documents used along the form

When a homeowner can no longer meet their mortgage obligations, a deed in lieu of foreclosure offers a way to transfer the ownership of the property back to the lender voluntarily. This approach can be less damaging to the borrower's credit than a traditional foreclosure. However, executing a deed in lieu of foreclosure involves several other forms and documents, both to ensure the process is legally sound and to protect the interests of both the borrower and the lender. Here's a look at some of these essential forms and documents typically used in conjunction with the Florida Deed in Lieu of Foreclosure form.

- Hardship Letter: This document explains the borrower's financial difficulties and why they are unable to continue making mortgage payments. It provides the lender with context for the request for a deed in lieu of foreclosure.

- Financial Statement: A detailed account of the borrower's monthly income, expenses, assets, and liabilities is outlined in this form, allowing the lender to assess the borrower's financial situation.

- Authorization to Release Information: This form gives the lender permission to verify the borrower's employment and income, speak with the borrower's creditors, and obtain the borrower's credit report.

- Property Appraisal or Valuation Report: An appraisal or a broker’s price opinion (BPO) is often required by the lender to determine the property's current market value.

- Title Search Report: This report verifies the property's legal ownership, ensuring there are no liens, disputes, or encumbrances that could complicate the transfer of the property.

- Estoppel Affidavit: The borrower declares that they are transferring the property voluntarily and not under duress, confirming there are no other agreements between the borrower and lender outside of those documented.

- Non-Merger Agreement: This agreement ensures that the acceptance of the deed in lieu of foreclosure does not merge the borrower's title with any rights the lender has under the existing mortgage, allowing the lender to pursue other claims related to the mortgage.

- W-9 Form: The lender may require the borrower to fill out a W-9 form to report the forgiveness of debt to the IRS, as it may be considered taxable income.

- Settlement Statement: This detailed accounting statement lists all costs related to the transaction, ensuring that both parties are aware of any fees, adjustments, and the final settlement figures.

- Release of Claims: The borrower may be asked to sign this document relinquishing any future claims against the lender related to the mortgage or property.

In the process of completing a deed in lieu of foreclosure, each document plays an integral role. These documents collectively ensure that the process is conducted transparently, protecting the rights of both the borrower and the lender. The borrower is advised to carefully review each form and seek legal advice if needed, ensuring they fully understand the implications and legal obligations of transferring their property through a deed in lieu of foreclosure.

Similar forms

A Mortgage Release or Satisfaction of Mortgage form shares similarities with a Florida Deed in Lieu of Foreclosure because both signal the end of a homeowner's mortgage obligations. While the Deed in Lieu of Foreclosure effectively transfers property ownership back to the lender to satisfy a loan that a borrower cannot repay, the Mortgage Release form is filled out by the lender after a mortgage has been fully paid off. Both documents result in the borrower being released from their mortgage debt, but the paths to reach this outcome differ significantly.

Loan Modification Agreements are another type of document that bears resemblance to a Florida Deed in Lieu of Foreclosure. These agreements modify the terms of an existing mortgage to provide more favorable repayment conditions for the borrower. While both documents are used to prevent foreclosure, a Deed in Lieu of Foreclosure is a final step when modification or other measures have failed, essentially surrendering the property to avoid foreclosure, whereas a Loan Modification Agreement seeks to make the mortgage more manageable to maintain ownership.

Short Sale Agreements are similar to Deeds in Lieu of Foreclosure in that they are both alternatives to foreclosure. A Short Sale Agreement allows the homeowner to sell their property for less than the outstanding mortgage balance with the lender's approval. Both options are considered when the homeowner is financially distressed and unable to meet mortgage payments, but they wish to avoid foreclosure. The key difference lies in the transfer of property to a third party in a short sale, as opposed to directly back to the lender in a deed in lieu.

Quitclaim Deeds, while generally used in different circumstances, have a resemblance to Deeds in Lieu of Foreclosure because of the transfer of property rights. In a Quitclaim Deed, a property owner transfers their ownership stakes to someone else without making guarantees about the property's clear title. Similarly, in a Deed in Lieu of Foreclosure, the borrower transfers their property back to the lender. Both result in a change of ownership, but the motivations and implications for each are vastly different.

Foreclosure Notices are part of the foreclosure process and serve as a warning to the borrower that foreclosure is imminent unless action is taken to remedy the default on the mortgage. While this document itself does not transfer property, it is a critical step in the process that could lead to a Deed in Lieu of Foreclosure if both parties agree it's the best course of action. Essentially, Foreclosure Notices signal the potential for an outcome that a Deed in Lieu of Foreclosure tries to preemptively resolve by offering a mutual agreement to transfer property ownership back to the lender.

Dos and Don'ts

Dealing with a situation where you're considering a Deed in Lieu of Foreclosure in Florida can be stressful. To ensure the process is as smooth as possible, it’s important to know what to do and what to avoid. Here are key pointers when filling out the Florida Deed in Lieu of Foreclosure form:

Do:

- Verify all details: Double-check the accuracy of all personal information, property details, and loan numbers to avoid any discrepancies.

- Understand the terms: Be sure you fully comprehend the terms and conditions outlined in the agreement, including any deficiency judgments or rights you may be waiving.

- Seek legal advice: Engaging with a legal professional can provide valuable insights and ensure that your rights are protected throughout this process.

- Consider the tax implications: Understand that forgiveness of debt can sometimes be considered taxable income. Consult with a tax advisor to understand your potential liabilities.

- Keep all records: Maintain copies of all communications and documents related to your Deed in Lieu of Foreclosure for future reference.

Don’t:

- Sign under pressure: Avoid rushing into signing the agreement without fully understanding the consequences. Take your time to review all information.

- Skip document review: Do not neglect the review of all document sections thinking some parts may not apply to you. Every clause is important.

- Ignore potential repercussions: Failing to consider how this action might affect your credit score and borrowing capacity in the future is unwise.

- Forget to verify the lender’s acceptance: Make sure you receive official confirmation from the lender that they accept your Deed in Lieu of Foreclosure to prevent any misunderstandings.

- Overlook negotiation opportunities: Before submitting the form, explore if there are options to negotiate terms that might be more favorable to your situation.

Misconceptions

Many people have misunderstandings about the Florida Deed in Lieu of Foreclosure form. This document serves as an alternative to the traditional foreclosure process, but misinformation can cloud its true benefits and limitations. Here, we address ten common misconceptions.

It clears all financial obligations: A widespread misconception is that once a deed in lieu of foreclosure is executed, the borrower is free from all financial obligations related to the mortgage. However, this is not always the case. Depending on the agreement with the lender, a borrower might still be responsible for any deficiency, which is the difference between the sale proceeds and the amount owed on the mortgage.

It's available to all borrowers facing foreclosure: Not every borrower facing foreclosure will qualify for a deed in lieu of foreclosure. Lenders have specific criteria and might not agree to a deed in lieu if they believe foreclosure could be more financially beneficial or if there are other liens on the property.

It significantly damages your credit score the same as a foreclosure: While a deed in lieu of foreclosure does negatively impact your credit score, its effect can be slightly less severe than a foreclosure. Credit reporting agencies may view it as a slightly more responsible way of handling debt obligation.

It's a quick process: The process for a deed in lieu of foreclosure can be complex and time-consuming. Both parties must agree on the terms, and the lender must conduct a thorough review of the borrower's financial situation and the property. This process can take several months.

It allows the borrower to stay in the home: Some people mistakenly believe that a deed in lieu of foreclosure agreement allows the borrower to remain in the home, either as a tenant or through some form of leaseback arrangement. While these situations can sometimes be negotiated, they are not a standard feature of such agreements.

It's free: There can be costs associated with a deed in lieu of foreclosure, including notary fees, recording fees, and possibly other administrative fees. While these costs are typically lower than those associated with a foreclosure, saying the process is free is misleading.

Lenders prefer foreclosure over a deed in lieu: This is not necessarily true. Many lenders prefer a deed in lieu of foreclosure because it can be less expensive and quicker than the traditional foreclosure process. However, each situation is unique, and lender preferences can vary based on the specific circumstances surrounding the property and borrower.

There are no tax implications: Completing a deed in lieu of foreclosure can have tax implications for the borrower. The forgiveness of debt may be considered taxable income by the IRS. Borrowers should consult a tax advisor to understand the potential tax consequences.

Tenants can be immediately evicted: If the property is occupied by tenants, state and federal laws may provide them with certain protections, allowing them to remain in the property for a designated period. The Protecting Tenants at Foreclosure Act offers some protections for tenants in foreclosed properties, which could apply in cases of a deed in lieu of foreclosure.

It will release the borrower from all property claims: While a deed in lieu of foreclosure transfers ownership of the property to the lender and typically releases the borrower from the mortgage debt, it may not release the borrower from all claims related to the property. For example, if there are second mortgages or other liens, those may not be discharged by this process.

Key takeaways

Filling out and using the Florida Deed in Lieu of Foreclosure form involves several key considerations that homeowners and lenders should be aware of. This legal document is used as an alternative to foreclosure, where a homeowner voluntarily transfers ownership of their property to the lender to satisfy a loan that is in default. Below are important takeaways to ensure the process is clear and effective.

- Understand the document: Before proceeding, both parties should fully understand what a Deed in Lieu of Foreclosure entails, its implications, and how it differs from other foreclosure options.

- Eligibility requirements: Not all borrowers or mortgages qualify for a Deed in Lieu of Foreclosure. Factors such as mortgage type, the lender’s policies, and the presence of other liens on the property can affect eligibility.

- Impact on credit score: Both parties should be mindful that a Deed in Lieu of Foreclosure typically has a significant negative impact on the borrower’s credit score, though it may be less severe than a foreclosure.

- Legal advice is crucial: Both the lender and borrower should seek legal advice before entering into a Deed in Lieu of Foreclosure agreement. This ensures that the interests of both parties are protected and that they understand the legal consequences.

- Accurate information: It is essential to fill out the Deed in Lieu of Foreclosure form accurately, ensuring all details about the property, the loan, and the parties involved are correct and current.

- Documentation: The process requires thorough documentation, including the reason for the default and proof that selling the property through traditional means is not feasible.

- Agreement terms: The terms of the agreement should be clearly defined in the document, including any financial obligations that remain after the transfer of the property.

- Approval process: The completion and submission of the form is just the beginning. The lender must review and approve the Deed in Lieu of Foreclosure, which can take time.

- Taxes: Both parties should be aware of potential tax implications, as the borrower could be liable for taxes on the forgiven debt.

- Record the deed: After approval, the deed must be officially recorded with the local county court to finalize the transfer of property ownership and release the borrower from their mortgage obligations.

In summary, while a Deed in Lieu of Foreclosure can be a mutually beneficial solution for avoiding the lengthy and costly process of foreclosure, it requires careful consideration, accurate documentation, legal counsel, and an understanding of the potential consequences. With the right approach, it can provide a dignified exit for borrowers struggling to meet their mortgage obligations while allowing lenders to mitigate their losses.

More Deed in Lieu of Foreclosure State Forms

Will I Owe Money After a Deed in Lieu of Foreclosure - A document that outlines the transfer of property from a defaulting borrower to a lender as an alternative to foreclosure.

Deed in Lieu of Mortgage - An alternative resolution for mortgage default, allowing borrowers to transfer property ownership to lenders instead of facing foreclosure.

Foreclosure Process in Georgia - Handling this document requires precision, as inaccuracies can lead to disputes or legal challenges down the line.