Fillable Deed in Lieu of Foreclosure Document for California

In California, homeowners facing financial difficulties that lead to the inability to meet mortgage obligations have various options to consider, one of which is the Deed in Lieu of Foreclosure. This legal document offers a method for borrowers to avoid the often lengthy and costly foreclosure process by voluntarily transferring the ownership of their property back to the lender. The arrangement benefits the borrower by lessening the impact on their credit score compared to a foreclosure and potentially releasing them from most, if not all, of the debt associated with the mortgage. For lenders, it provides a more straightforward way to regain property without engaging in the legal battles foreclosure might entail. While this option can seem like a clear path out of a financial bind, it is essential for homeowners to understand the terms, such as whether the lender will pursue a deficiency judgment for the difference between the mortgage balance and the home’s value, and tax implications, since forgiven debt can sometimes be considered taxable income. Comprehensive analysis and qualified legal advice are crucial steps before embarking on this process, to ensure that this legal instrument aligns with the homeowner's financial recovery plan.

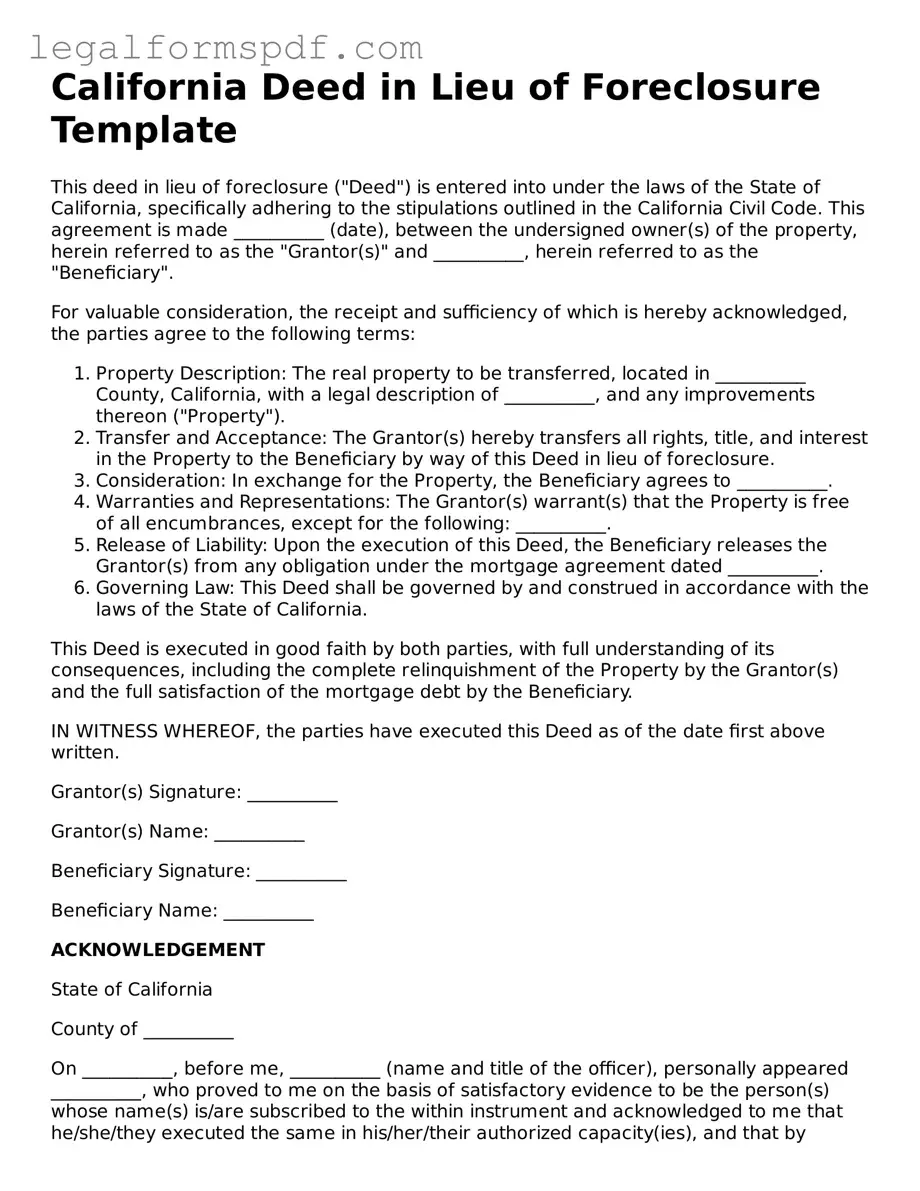

Document Example

California Deed in Lieu of Foreclosure Template

This deed in lieu of foreclosure ("Deed") is entered into under the laws of the State of California, specifically adhering to the stipulations outlined in the California Civil Code. This agreement is made __________ (date), between the undersigned owner(s) of the property, herein referred to as the "Grantor(s)" and __________, herein referred to as the "Beneficiary".

For valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties agree to the following terms:

- Property Description: The real property to be transferred, located in __________ County, California, with a legal description of __________, and any improvements thereon ("Property").

- Transfer and Acceptance: The Grantor(s) hereby transfers all rights, title, and interest in the Property to the Beneficiary by way of this Deed in lieu of foreclosure.

- Consideration: In exchange for the Property, the Beneficiary agrees to __________.

- Warranties and Representations: The Grantor(s) warrant(s) that the Property is free of all encumbrances, except for the following: __________.

- Release of Liability: Upon the execution of this Deed, the Beneficiary releases the Grantor(s) from any obligation under the mortgage agreement dated __________.

- Governing Law: This Deed shall be governed by and construed in accordance with the laws of the State of California.

This Deed is executed in good faith by both parties, with full understanding of its consequences, including the complete relinquishment of the Property by the Grantor(s) and the full satisfaction of the mortgage debt by the Beneficiary.

IN WITNESS WHEREOF, the parties have executed this Deed as of the date first above written.

Grantor(s) Signature: __________

Grantor(s) Name: __________

Beneficiary Signature: __________

Beneficiary Name: __________

ACKNOWLEDGEMENT

State of California

County of __________

On __________, before me, __________ (name and title of the officer), personally appeared __________, who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument, the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

WITNESS my hand and official seal.

Signature of Notary: __________

Seal:

PDF Specifications

| Fact Name | Description |

|---|---|

| Definition | A California Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers ownership of a property back to the lender to avoid the foreclosure process. |

| Governing Law | California Civil Code and real estate law, primarily under sections related to foreclosure procedures and borrower/lender agreements. |

| Benefits for Borrower | This process helps the borrower avoid the stigma and credit damage associated with going through a foreclosure. |

| Benefits for Lender | The lender can save on the time, cost, and legal complication of conducting a foreclosure sale. |

| Considerations | Both parties must agree to the terms, and it’s typically used as a last resort when the borrower cannot refinance or sell the property to cover the mortgage. |

Instructions on Writing California Deed in Lieu of Foreclosure

Preparing a Deed in Lieu of Foreclosure entails a mutual agreement where a homeowner voluntarily transfers their property deed to the lender to avoid the foreclosure process. It's a critical step that can have a significant impact on one’s financial and legal standing. The process involves several detailed steps to ensure the document is filled out correctly, clearly, and completely. Following these steps carefully is paramount in executing this agreement effectively, thus providing a smoother transition during a challenging financial period.

- Gather the necessary documents, including the current property deed, loan information, and any agreements or correspondence regarding the foreclosure process with your lender.

- Identify the form designated for a Deed in Lieu of Foreclosure specific to California. This can usually be obtained from the lender or a legal forms provider.

- Start by entering the date at the top of the form, ensuring it reflects the date you are completing the document.

- Fill in the property owner's full legal name(s) as the "Grantor(s)" in the designated spaces. Ensure the name matches the one on the current property deed.

- Enter the legal name of the lender or financial institution acting as the "Grantee" in the space provided.

- Provide a complete legal description of the property involved. This information can be copied directly from the current property deed to avoid any discrepancies.

- Outline any specific agreements made between the homeowner and the lender regarding the transfer, including but not limited to, debt forgiveness, financial settlements, or property condition requirements.

- Review the document carefully, ensuring all information is accurate and all necessary sections are completed. Mistakes or omissions can lead to delays or complications in the process.

- Sign and date the form in the presence of a notary public. The lender will also need to sign the form, acknowledging their acceptance of the property in lieu of foreclosure.

- File the completed and notarized Deed in Lieu of Foreclosure form with the county recorder’s office where the property is located to officially record the transfer of ownership.

Completing a Deed in Lieu of Foreclosure form is a structured yet manageable process that requires attention to detail and a clear understanding of the agreement made with the lender. Each step taken with care helps to navigate this challenging process, with the goal of providing relief and a clear path forward for the homeowner facing foreclosure.

Understanding California Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure in California?

A Deed in Lieu of Foreclosure is a legal document in California that enables a homeowner to transfer the ownership of their property to the lender. This is done to avoid the foreclosure process when the homeowner is unable to make mortgage payments. It is a mutual agreement where the lender often agrees not to pursue any deficiency judgment against the borrower, depending on the terms of the agreement.

How does the process of a Deed in Lieu of Foreclosure work?

To initiate a Deed in Lieu of Foreclosure, the borrower must first communicate their inability to meet mortgage obligations and their desire to proceed with a deed in lieu of foreclosure to their lender. The lender then evaluates the proposal, considering the property's value, the outstanding loan balance, and any other encumbrances on the property. If the lender agrees, both parties will sign a legal agreement detailing the terms, and the homeowner will transfer the property’s deed to the lender. This process absolves the borrower from their mortgage debt under the conditions stipulated in the agreement.

Are there any potential tax implications for completing a Deed in Lieu of Foreclosure in California?

When a homeowner completes a Deed in Lieu of Foreclosure, there may be tax implications. The difference between the mortgage amount and the property’s fair market value can sometimes be considered as forgiven debt by the IRS, which could be taxable as income. However, there have been laws, such as the Mortgage Forgiveness Debt Relief Act, that may exempt homeowners from such taxes under specific conditions. Homeowners are advised to consult with a tax professional to understand their personal tax obligations.

Can a lender refuse to accept a Deed in Lieu of Foreclosure?

Yes, a lender can refuse to accept a Deed in Lieu of Foreclosure. The decision primarily depends on the lender’s assessment of the situation. If the lender believes that proceeding with a foreclosure could potentially recover more of the outstanding loan balance or if there are complications, such as other liens on the property, the lender might opt to proceed with the foreclosure process instead. Each case is unique, and lenders must weigh the benefits and drawbacks before making a decision.

Common mistakes

One common mistake individuals make when filling out the California Deed in Lieu of Foreclosure form is failing to accurately describe the property. This form requires a detailed description of the property being transferred, including its address and legal description. Failing to provide a clear and accurate description can lead to misunderstandings and potential legal issues down the road. It is critical that this information is double-checked for accuracy to ensure the deed in lieu is properly recorded and accepted.

Another error is not properly executing the form according to California law. The deed in lieu of foreclosure must be signed in the presence of a notary public to be considered valid. Often, individuals overlook this requirement or improperly complete the notarization process. This oversight can invalidate the entire agreement, causing significant delays and potentially impacting one's ability to avoid foreclosure.

Many people also neglect to negotiate or fully understand the terms regarding the deficiency balance. In some cases, the mortgage lender can pursue a deficiency judgment for the difference between the mortgage balance and the property’s sale price. Before submitting the deed in lieu form, it's important to reach an agreement with the lender about the handling of any potential deficiency. Without this agreement in writing, homeowners may unknowingly expose themselves to future financial liability.

Lastly, individuals often forget to confirm the form's filing with the county recorder's office. After the deed in lieu of foreclosure is completed and notarized, it must be filed with the appropriate county office to be effective. Failure to do so means the property transfer is not officially recorded, which can create legal complications in the future. Ensuring the document is filed correctly and promptly is crucial for the process to be completed successfully.

Documents used along the form

When navigating the resolution of financial difficulties involving a mortgage in California, a Deed in Lieu of Foreclosure stands as a notable option. This course of action allows a homeowner to transfer the property ownership back to the lender, effectively sidestepping the traditional foreclosure process. However, to successfully navigate this path, additional documents and forms are typically required to ensure thoroughness, compliance with legal standards, and protection for all parties involved.

- Promissory Note: Establishes the borrower's obligation to repay the borrowed amount. While not a new document in the process, the original note is crucial for confirming the existing debt that the deed in lieu seeks to settle.

- Mortgage or Trust Deed: This document secures the loan with the property as collateral and outlines the terms under which foreclosure can occur. It is essential for demonstrating the lien that the deed in lieu will extinguish.

- Hardship Letter: Provides a personal account of the borrower's financial difficulties. This letter explains why the borrower cannot continue making payments and requests the lender to accept a deed in lieu of foreclosure as an alternative.

- Financial Statement: Details the borrower's income, expenses, assets, and liabilities. Lenders use this document to assess the borrower's financial situation and the feasibility of a deed in lieu.

- Settlement Agreement: Outlines the terms under which the lender agrees to accept the deed in lieu. This may include provisions for the borrower to vacate the property and may specify any financial agreements, such as a deficiency waiver.

- Estoppel Affidavit: Certifies the voluntary nature of the deed in lieu transaction. It may confirm the absence of coercion, and the borrower’s understanding of the transaction’s terms.

- Warranty Deed or Quitclaim Deed: Transfers the property title from the borrower to the lender. The use of either deed depends on the guarantees the borrower is willing and able to make regarding the property's title.

- Title Report: Shows the history of ownership and any encumbrances on the property, such as liens or easements. This report is crucial for ensuring the lender receives a clear title.

- IRS Form 1099-A: This form is issued by the lender after a deed in lieu of foreclosure to report the acquisition or abandonment of secured property. It is important for the borrower's tax filings, as it details the forgiven debt that may be considered taxable income.

Together, these documents form a comprehensive framework that supports the execution of a Deed in Lieu of Foreclosure process. Each plays a distinct role in ensuring the transaction is conducted legally, ethically, and with a clear understanding by all parties of their responsibilities and rights. For individuals facing the challenging prospect of foreclosure, understanding and preparing these documents can provide a streamlined path toward a resolution while mitigating financial loss and legal complications.

Similar forms

The California Deed in Lieu of Foreclosure form shares similarities with the Quitclaim Deed, primarily in their function of transferring property interests. While the Deed in Lieu conveys a borrower's property to the lender to satisfy a loan that's in default and avoid foreclosure, a Quitclaim Deed transfers the grantor's property rights to the grantee without making any promises or guarantees about the property's title. Both documents are used to convey real estate interests quickly without the usual extensive paperwork involved in traditional property sales.

Similar to the Mortgage Agreement, the Deed in Lieu of Foreclosure form is integral in the management of properties under financial strain. The Mortgage Agreement outlines the borrower's obligations to the lender under the loan secured by real estate, detailing the loan's terms, repayment schedule, and the consequences of default. In contrast, a Deed in Lieu offers a resolution to default under a Mortgage Agreement by transferring the property to the lender, thereby bypassing the lengthy and costly foreclosure process.

The Forbearance Agreement is another document that, like the Deed in Lieu of Foreclosure, deals with situations where the borrower is unable to meet mortgage obligations. This agreement temporarily postpones foreclosure, giving the borrower time to improve their financial situation. Although both aim to prevent foreclosure, the Deed in Lieu acts as a final settlement by transferring the property to the lender, whereas a Forbearance Agreement offers a temporary reprieve, allowing the borrower to catch up on payments.

Loan Modification Agreements also share a goal with the Deed in Lieu of Foreclosure form: to avoid the foreclosure process. This type of agreement modifies the original terms of the mortgage loan, such as the interest rate, payment schedule, or other terms, to make it easier for the borrower to make payments and avoid default. While a Loan Modification Agreement seeks to prevent foreclosure by adjusting loan terms, a Deed in Lieu resolves the situation through property transfer once the loan default appears unavoidable.

The Grant Deed is another real estate document that, like the Deed in Lieu, involves the transfer of property. However, the purposes behind each document differ significantly. A Grant Deed transfers property from the seller to the buyer and guarantees that the property has not been sold to anyone else. In contrast, the Deed in Lieu transfers property from a financially distressed borrower to the lender to satisfy a default on the loan, not as a sale but as a means to fulfill debt obligations. Both documents signify the transfer of property rights, albeit under very different circumstances.

Dos and Don'ts

Filling out the California Deed in Lieu of Foreclosure form is a crucial step for homeowners who are considering this option as an alternative to foreclosure. Approaching this process with care is essential to ensure that it goes smoothly and without issue. Here are some important dos and don'ts to keep in mind:

Dos:- Seek legal advice: Before filling out the form, it’s vital to consult with a legal professional who specializes in real estate transactions. They can offer guidance tailored to your specific situation.

- Review your mortgage agreement: Ensure you fully understand the terms of your mortgage and any clauses related to foreclosure or alternatives to it.

- Gather required documents: This may include financial statements, your mortgage agreement, and any communication with your lender regarding foreclosure.

- Communicate with your lender: Engage in open and honest dialogue with your lender about your desire to pursue a deed in lieu of foreclosure. In many cases, lenders prefer this to the foreclosure process.

- Consider the tax implications: Understand that there may be tax consequences to this decision and consult a tax advisor for a full understanding.

- Fill out the form accurately: Ensure all information provided on the form is correct and complete to avoid delays or issues in the process.

- Ignore lender communication: Avoiding dialogue with your lender can lead to missed opportunities for alternative solutions and can aggravate the situation.

- Leave blanks on the form: Incomplete forms can cause delays or outright rejections of your deed in lieu of foreclosure request.

- Submit without double-checking: Always review the filled form for any errors or omissions to ensure accuracy.

- Forget to keep a copy for your records: Having a personal copy of all submitted documents is crucial for future reference and for maintaining a record of your actions.

- Overlook potential impacts on your credit: Be aware that a deed in lieu of foreclosure can still affect your credit score. Understand and prepare for this outcome.

- Rush the process: Taking the time to carefully prepare and consider all aspects of the deed in lieu of foreclosure is essential. Hasty decisions can lead to unfavorable outcomes.

Misconceptions

When it comes to navigating the complexities of financial distress and the potential loss of a home, homeowners may come across various options, including the deed in lieu of foreclosure. This option allows a homeowner to transfer the ownership of their property to the lender to satisfy a loan that is in default and avoid the foreclosure process. However, there are many misconceptions surrounding the California Deed in Lieu of Foreclosure form. Let's debunk some of these common myths.

- It's the same as a foreclosure. Many believe a deed in lieu of foreclosure is identical to a foreclosure in its impact on one's financial and credit future. However, while both lead to losing your home, a deed in lieu often has a less severe impact on your credit score and may be processed more quickly than a foreclosure.

- Anyone can get it. Not every homeowner in distress is eligible for a deed in lieu of foreclosure. Lenders typically require that you've attempted to sell the property at its fair market value for at least 90 days and that there are no other liens against the property.

- It wipes out all debt. This might not always be the case. If your property is sold by the lender for less than the amount owed on the mortgage, you might still be responsible for the deficiency unless the lender agrees in writing to forgive that debt.

- It doesn't affect credit scores. A deed in lieu of foreclosure does impact your credit score, although typically not as severely as a foreclosure. The specifics can vary, but it can remain on your credit report for up to seven years.

- It's quick and easy. While it might be faster than a foreclosure, the process still involves paperwork, negotiation with the lender, and possibly legal advice, which can take time and effort.

- All lenders accept it. Not all lenders will agree to a deed in lieu of foreclosure. It is at the lender's discretion whether to accept the deed in lieu of foreclosure as a resolution to the default.

- Taxes aren't an issue. There may be tax implications for the homeowner. If the debt forgiven by the lender exceeds $600, the IRS may treat the forgiven debt as income, and you may have to pay taxes on that amount.

- It releases you from all property obligations. While the deed in lieu of foreclosure transfers the property to the lender, you may still be responsible for certain obligations, such as homeowners association fees, until the transfer is officially recorded.

- It is a public embarrassment. Unlike foreclosure, which involves public notices, a deed in lieu of foreclosure is a private agreement between the lender and the borrower. While it is a matter of public record once completed, the process itself is more discreet.

- Once you apply, it's guaranteed to be approved. Applying for a deed in lieu of foreclosure does not guarantee approval. The lender will review the homeowner's financial situation, the property's value, and other factors before making a decision.

Understanding the facts about a deed in lieu of foreclosure in California can arm homeowners with the knowledge to make informed decisions about their financial futures. When facing the possibility of foreclosure, it's beneficial to explore all options, possibly with the guidance of a legal or financial professional, to find the best pathway forward.

Key takeaways

When dealing with the complexities of avoiding foreclosure, a Deed in Lieu of Foreclosure presents a dignified exit for homeowners in California. It's a formal agreement where a homeowner voluntarily transfers the ownership of their property back to the lender to settle their mortgage debt in full. This method is considered an alternative to the often more damaging foreclosure process. Below are key takeaways regarding the completion and application of the California Deed in Lieu of Foreclosure form that should be considered carefully.

- Understanding the form's requirements is crucial before beginning the process. The form serves as a legal document that needs to be completed accurately to ensure it is valid and legally binding.

- Ensure all parties involved are clearly identified. This includes the full legal names of both the borrower and the lender, along with any co-borrowers or guarantors associated with the mortgage.

- Accuracy in detailing the property is fundamental. The form must include a complete and precise description of the property being transferred. This typically involves the address, legal description, and parcel number.

- Consideration for the deed transfer must be explicitly stated in the document. Even though the property is being transferred in lieu of foreclosure, the form should clearly outline any agreement terms, including if the debt is fully satisfied or if there remain any financial obligations on the part of the borrower.

- Executing the form requires notarization. To be legally binding, signatures from all parties involved must be witnessed by a notary public, legitimizing the document.

- Recording the deed is a necessary step following execution. Once signed and notarized, the deed must be filed with the county recorder's office where the property is located, officially transferring ownership.

- The tax implications of a Deed in Lieu of Foreclosure should not be overlooked. This transaction might affect the borrower's tax obligations, potentially leading to a taxable event based on forgiveness of debt.

- Seeking professional advice is highly advised. Given the legal and financial intricacies involved, consulting with a real estate attorney or a financial advisor can provide clarity and guidance through the process.

- Finally, understanding the impact on one's credit score is important. While a Deed in Lieu of Foreclosure may have a less detrimental effect than an actual foreclosure, it still negatively affects the borrower's credit report and score.

Ultimately, a Deed in Lieu of Foreclosure can offer a way out for homeowners facing financial difficulties without enduring the long-lasting repercussions of foreclosure. However, it's essential to approach this option with a thorough understanding of its potential impacts and the procedural steps involved.

More Deed in Lieu of Foreclosure State Forms

Deed in Lieu of Foreclosure Template - It includes specific details about the property being surrendered and any agreements on remaining mortgage balances or other financial considerations.

Foreclosure Process in Georgia - A properly executed Deed in Lieu of Foreclosure can offer tax benefits for the borrower, under certain circumstances.

Will I Owe Money After a Deed in Lieu of Foreclosure - A financial tool that permits a distressed homeowner to transfer their property to the lender, negating the need for foreclosure.

Deed in Lieu of Mortgage - It outlines the process for a debtor to transfer their property voluntarily to a creditor as a way to settle a defaulted loan and avoid foreclosure.