Official Deed in Lieu of Foreclosure Document

When homeowners find themselves unable to meet their mortgage obligations, they are faced with some daunting choices, one of which could involve the decision to opt for a Deed in Lieu of Foreclosure. This option serves as a mutual agreement between the borrower and the lender, allowing the homeowner to transfer ownership of the property back to the lender, effectively avoiding the foreclosure process. The significance of this form lies in its ability to provide a less damaging exit for both parties involved. For the borrower, it means potentially avoiding the more severe credit implications of a foreclosure, and for the lender, it often represents a faster, less costly resolution to a problematic loan. Understanding the intricacies of this agreement, including eligibility requirements, potential tax implications, and impacts on future homeownership, is crucial for those considering this route. The process, while appearing straightforward, involves meticulous documentation and often the guidance of legal or financial professionals to ensure the interests of all parties are preserved. The Deed in Lieu of Foreclosure form is the legal embodiment of this agreement and must be handled with careful attention to detail to ensure a smooth and agreeable resolution.

State-specific Information for Deed in Lieu of Foreclosure Forms

Document Example

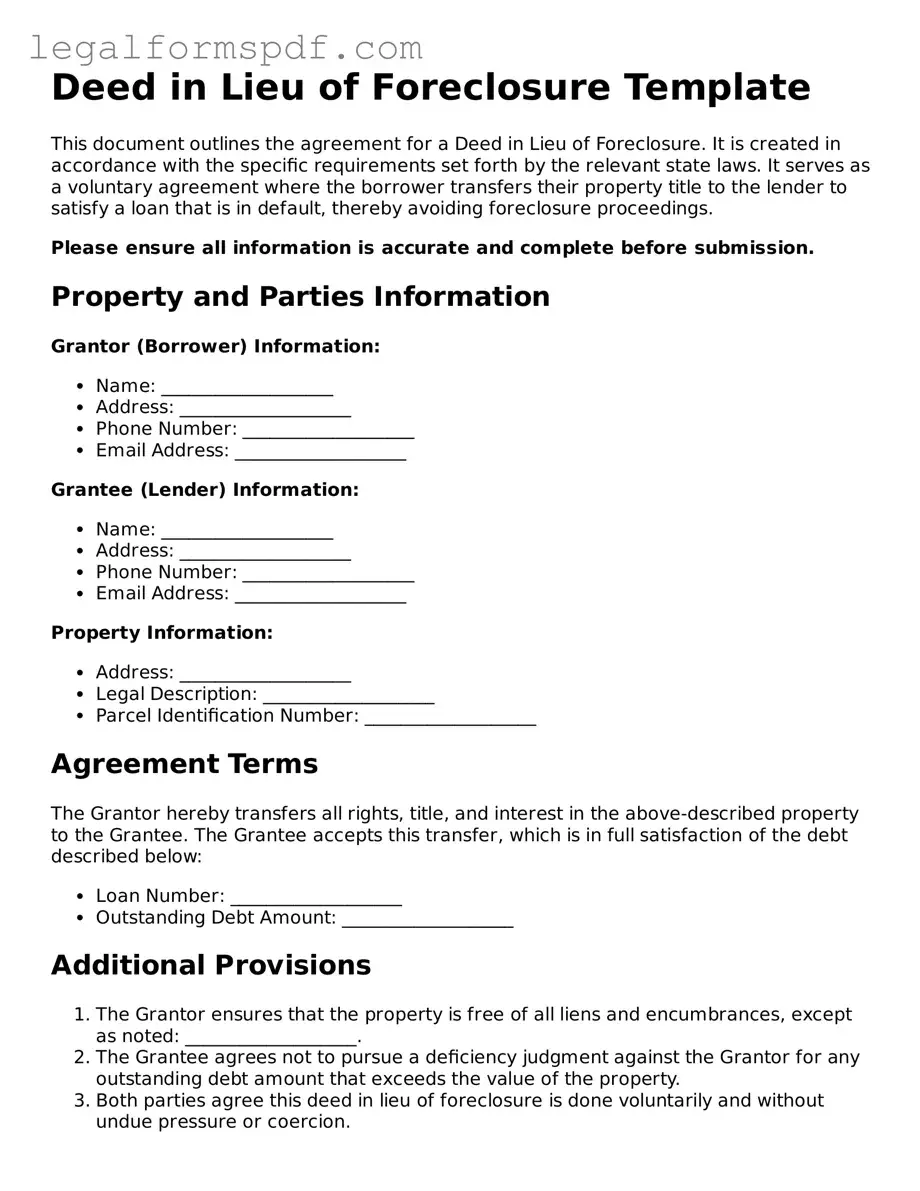

Deed in Lieu of Foreclosure Template

This document outlines the agreement for a Deed in Lieu of Foreclosure. It is created in accordance with the specific requirements set forth by the relevant state laws. It serves as a voluntary agreement where the borrower transfers their property title to the lender to satisfy a loan that is in default, thereby avoiding foreclosure proceedings.

Please ensure all information is accurate and complete before submission.

Property and Parties Information

Grantor (Borrower) Information:

- Name: ___________________

- Address: ___________________

- Phone Number: ___________________

- Email Address: ___________________

Grantee (Lender) Information:

- Name: ___________________

- Address: ___________________

- Phone Number: ___________________

- Email Address: ___________________

Property Information:

- Address: ___________________

- Legal Description: ___________________

- Parcel Identification Number: ___________________

Agreement Terms

The Grantor hereby transfers all rights, title, and interest in the above-described property to the Grantee. The Grantee accepts this transfer, which is in full satisfaction of the debt described below:

- Loan Number: ___________________

- Outstanding Debt Amount: ___________________

Additional Provisions

- The Grantor ensures that the property is free of all liens and encumbrances, except as noted: ___________________.

- The Grantee agrees not to pursue a deficiency judgment against the Grantor for any outstanding debt amount that exceeds the value of the property.

- Both parties agree this deed in lieu of foreclosure is done voluntarily and without undue pressure or coercion.

- Any disputes arising from this agreement shall be resolved through mediation or arbitration within the state in which the property is located.

State-Specific Provisions

This agreement is subject to the laws of the State of ___________________. Each party agrees to comply with any additional requirements imposed by state law.

Signatures

By signing below, both the Grantor and the Grantee acknowledge they have read, understood, and agreed to the terms of this Deed in Lieu of Foreclosure Agreement.

Grantor's Signature: ___________________Date: ___________________

Grantee's Signature: ___________________

Date: ___________________

PDF Specifications

| Fact Name | Detail |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal instrument where a borrower conveys all interest in a property to the lender to satisfy a loan that is in default and avoid foreclosure proceedings. |

| Benefits for Borrowers | It helps borrowers avoid the stigma and credit damage of a foreclosure. It also offers a quicker resolution than the lengthy foreclosure process. |

| Benefits for Lenders | Lenders receive the property more rapidly and at a lower cost compared to foreclosure. It also mitigates the risk of borrower vandalism and legal challenges. |

| Governing Law(s) | Varies by state, but generally governed by state foreclosure laws and real estate transfer statutes. Some states require specific disclosure forms or agreements. |

Instructions on Writing Deed in Lieu of Foreclosure

Filling out a Deed in Lieu of Foreclosure form is a crucial step for homeowners looking to avoid the foreclosure process by voluntarily transferring their property back to the lender. This option can offer a sense of resolution during what is often a challenging time, allowing both parties to avoid the lengthy and costly procedures associated with foreclosure. To ensure the form is completed accurately and all necessary information is clearly communicated, follow these step-by-step instructions. Each step is designed to guide you through the process, making it simpler and more manageable.

- Gather Necessary Documents: Before filling out the form, have all relevant mortgage documents, your loan account information, and any correspondence with your lender about your intention to pursue a deed in lieu of foreclosure at hand.

- Personal Information: Start by entering your full name, the co-borrower's name (if applicable), and complete contact information, including your current address, phone number, and email address.

- Property Information: Clearly list the address of the property being transferred, its legal description as it appears on the deed, and the tax parcel identification number. If you have trouble finding the legal description, it can usually be located on your original loan documents or by contacting your county recorder's office.

- Lender Information: Insert the name, address, and contact details of the lender who is accepting the deed in lieu of foreclosure. If unsure, refer to your mortgage statement or the last correspondence from your lender.

- Loan Information: Provide detailed information about the loan being resolved through this deed in lieu, including the loan number, the original amount, the date the loan was secured, and the current outstanding balance.

- Default and Hardship Information: Briefly describe the reason(s) for the loan default and the economic or personal hardship that prevents you from maintaining your mortgage payments.

- Signatures: The form must be signed by all property owners as listed on the title. Ensure that each signature is witnessed by a notary public to validate the authenticity of the document.

- Submit the Form: Review the completed form for accuracy, then submit it to your lender either via mail, in person, if local, or as directed by your lender. Keep a copy of the submitted form for your records.

- Contact Your Lender: After submitting the form, follow up with your lender to confirm receipt and to inquire about the next steps in the process. Communication is key to ensure that both parties are aligned and the process moves forward smoothly.

Completing the Deed in Lieu of Foreclosure form is a significant step towards resolving your mortgage challenges. It's highly recommended to consult with a legal advisor who specializes in real estate or foreclosure matters to ensure that you understand the implications of this action and that it's the best course for your situation. Additionally, a professional can offer guidance in negotiating terms that may prevent the foreclosure from appearing on your credit report or securing a waiver for the deficiency balance that could arise from the sale of the property.

Understanding Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer ownership of their property directly to the lender. This is done to avoid the foreclosure process. It's an agreement that benefits both the lender and the borrower, helping the borrower to avoid the negative impacts of foreclosure on their credit report.

How does a Deed in Lieu of Foreclosure work?

In a Deed in Lieu of Foreclosure, the homeowner voluntarily hands over the deed to their property to the lender. The lender, in return, agrees not to proceed with foreclosure actions. This agreement must be voluntary and entered into by both parties to avoid any potential legal issues.

Are there any eligibility criteria for a Deed in Lieu of Foreclosure?

Yes, there are certain criteria that both the lender and borrower must meet. Typically, the property should not have any other liens or encumbrances, and the borrower might need to demonstrate financial hardship. It's essential to check with the lender, as criteria can vary.

What documents are required to process a Deed in Lieu of Foreclosure?

The required documents can vary by lender but generally include a hardship letter, financial statements, the property deed, and possibly a settlement agreement. All documents must be carefully reviewed and completed accurately to ensure the process goes smoothly.

How does a Deed in Lieu of Foreclosure affect my credit score?

While a Deed in Lieu of Foreclosure can negatively impact your credit score, it is generally less damaging than a foreclosure. It will still appear on your credit report but may be viewed more favorably by future creditors than a foreclosure record.

Can I negotiate the terms of a Deed in Lieu of Foreclosure?

Yes, it's possible to negotiate terms, such as asking the lender to not pursue a deficiency judgment (the difference between the sale price and what is owed) or requesting that the deed in lieu be reported in a specific way on your credit report. However, outcomes can vary based on lender policies and negotiation skills.

Is receiving relocation assistance after a Deed in Lieu of Foreclosure possible?

Some lenders offer relocation assistance programs to homeowners completing a Deed in Lieu of Foreclosure. These programs can provide financial help with moving and housing expenses. Availability and terms depend on the lender and specific circumstances.

Are there tax implications for a Deed in Lieu of Foreclosure?

There can be tax implications, as the cancellation of debt may be considered taxable income. However, there might be exemptions or exclusions available under federal law, particularly if the property is your primary residence. It's advisable to consult with a tax professional for detailed advice.

How long does the process of a Deed in Lieu of Foreclosure take?

The time frame can vary greatly depending on the lender, the complexity of the situation, and how quickly all necessary documents are submitted and processed. Generally, it can take several weeks to several months from the initial application to completion.

Can I stay in my home after completing a Deed in Lieu of Foreclosure?

Typically, the property is transferred to the lender, and the former homeowner must vacate the property. However, some lenders may offer a leaseback or rental agreement that allows the former homeowner to stay in the home for a designated period. These agreements are less common and would need to be negotiated separately.

Common mistakes

One common mistake when filling out a Deed in Lieu of Foreclosure form is not checking the accuracy of all personal information. It might seem minor, but even small errors in your name, address, or loan number can lead to significant delays. The foreclosure process is stressful enough without adding unnecessary complications. It's crucial to double-check every detail, ensuring everything matches the information your lender has on file.

Another area where people often slip up is in failing to document all communication with the lender. When pursuing a Deed in Lieu of Foreclosure, keeping a detailed record of every conversation, email, or letter exchanged with your lender plays a critical role. This documentation can protect your interests if there are any questions or disputes about what was agreed upon. It's not just about having the forms filled out; it's about making sure there's a comprehensive paper trail to back up your case.

Not understanding the implications for the deficiency balance is also a prevalent error. In some cases, even after the deed in lieu of foreclosure is completed, there might still be a remaining balance owed to the lender. Many people overlook this detail and are surprised when they receive a bill for the deficiency. It's important to discuss this aspect with your lender beforehand and, if possible, negotiate the forgiveness of the deficiency balance as part of the agreement.

Finally, a lack of legal guidance can lead to missteps in the process. While it might be tempting to handle everything on your own to save money, navigating the complexities of a deed in lieu without legal advice can be risky. Mistakes in the paperwork or failing to negotiate the terms effectively can result in unfavorable conditions. Consulting with a legal professional who understands your rights and can advocate on your behalf is often a wise investment.

Documents used along the form

When managing the process of transferring property ownership to avoid foreclosure, a Deed in Lieu of Foreclosure is a critical document. It signifies an agreement between the lender and borrower, allowing the borrower to transfer their property to the lender to satisfy a loan that is in default, thus avoiding foreclosure. To complete this process efficiently and protect all parties involved, several other forms and documents are commonly used alongside this agreement. These documents ensure the transaction complies with legal standards, and that all aspects of the property transfer are clearly understood and agreed upon by both parties.

- Hardship Letter: This document is a personal letter from the borrower to their lender, explaining the financial difficulties they are experiencing that prevent them from making mortgage payments. It provides context for requesting a Deed in Lieu of Foreclosure and is often required by lenders to understand the borrower's situation fully.

- Financial Statement: Accompanying the Hardship Letter, this detailed statement offers a comprehensive overview of the borrower's financial status. It includes income, debts, expenses, and any assets. Lenders use this information to verify the borrower's financial hardship and determine the feasibility of the Deed in Lieu of Foreclosure.

- Agreement Not to Pursue Deficiency Judgment: This legal document, when applicable, prevents the lender from seeking a deficiency judgment against the borrower if the sale of the property doesn't cover the remaining mortgage balance. It offers an additional layer of security for the borrower, ensuring they are not held liable for any remaining debt after the property transfer.

- Title Report: Before accepting the property, the lender will require a title report to ensure that the title is free of any issues, such as liens or encumbrances, that could affect its value. This report provides a detailed history of the property's ownership and is crucial for the lender's due diligence process.

Together, these documents play vital roles in the Deed in Lieu of Foreclosure process. They provide the necessary information and legal assurances needed by both parties to facilitate a smooth transfer of property. By understanding and properly using these forms and documents, both lenders and borrowers can navigate the complexities of avoiding foreclosure with more clarity and security.

Similar forms

The Deed in Lieu of Foreclosure form shares similarities with a Mortgage Agreement, as both documents are rooted in real estate transactions. However, while the Mortgage Agreement outlines the terms under which a borrower agrees to repay a loan secured by property, the Deed in Lieu of Foreclosure serve as an alternative resolution to an impending foreclosure, effectively allowing the borrower to transfer the title back to the lender to satisfy the loan and avoid foreclosure proceedings.

Akin to the Quitclaim Deed, the Deed in Lieu of Foreclosure involves the transfer of property title. While the Quitclaim Deed is used to transfer property without making any warranties about the property's title, the Deed in Lieu of Foreclosure specifically resolves a default on a mortgage by transferring the property's title from the borrower to the lender, making it a targeted solution for averting foreclosure.

The Loan Modification Agreement also parallels the Deed in Lieu of Foreclosure, as both are methods to avoid foreclosure. The key difference lies in their approaches; the Loan Modification Agreement alters the original terms of the mortgage to make it more manageable for the borrower to keep making payments, whereas the Deed in Lieu of Foreclosure concludes the mortgage agreement through the transfer of the property's title to the lender.

Another document closely related is the Short Sale Agreement, which also serves as an alternative to foreclosure. The Short Sale Agreement allows the borrower to sell the property for less than the balance owing on the mortgage with the lender's approval. In contrast, the Deed in Lieu of Foreclosure bypasses the sale process, directly transferring the property to the lender to settle the debt.

Similar to the Foreclosure Notice, the Deed in Lieu of Foreclosure is embedded in the foreclosure process. However, while the Foreclosure Notice is a lender's initial legal step towards repossessing a property due to unpaid mortgage payments, the Deed in Lieu of Foreclosure is a voluntary agreement to hand over the property to the lender, often seen as a last resort to avoid the completion of foreclosure.

The Forbearance Agreement, much like the Deed in Lieu of Foreclosure, is used when a borrower faces difficulty in keeping up with mortgage payments. The Forbearance Agreement provides temporary relief from payments or a reduction in payment amount, aiming to prevent foreclosure. On the other hand, a Deed in Lieu of Foreclosure is a measure taken when the borrower is unable, even with temporary measures, to continue with mortgage payments.

The Warranty Deed, while primarily a document facilitating the transfer of property with assurances regarding the title's clarity from the seller to the buyer, shares the aspect of property transfer with the Deed in Lieu of Foreclosure. However, the latter involves transferring title back to the lender as a specific remedy for mortgage default, without the warranties provided in a typical sales transaction.

Similar to an Assignment of Rent, which permits a lender to collect rents from a property owned by a borrower in default, the Deed in Lieu of Foreclosure involves actions taken in response to mortgage default. Nonetheless, rather than assigning rights to income generated by the property, it transfers the property's title itself to the lender.

Lastly, the Eviction Notice, although it originates from a different area of law—landlord and tenant law—shares its fundamental purpose with the Deed in Lieu of Foreclosure: a legal means to regain possession of property. While an Eviction Notice is used to remove tenants who are in violation of their lease terms, the Deed in Lieu of Foreclosure enables lenders to reclaim property from borrowers who can no longer adhere to the terms of their mortgage.

Dos and Don'ts

Filling out a Deed in Lieu of Foreclosure form can be a practical step towards addressing financial challenges, but it requires careful attention to detail and a thorough understanding of the process. Here's a compact list of do's and don'ts that can guide you through filling the form with clarity and precision.

- Do review the form thoroughly before filling it out to ensure you understand all requirements and implications.

- Don't rush through the process. Taking your time to fill out the form accurately can prevent potential issues down the line.

- Do consult with a legal or financial advisor if you're unsure about any part of the form. Professional guidance can clarify complex aspects and help you make informed decisions.

- Don't omit any requested information. Incomplete forms can lead to delays or a rejection of the deed in lieu agreement.

- Do double-check all the details you enter, especially personal information and numbers, to ensure they are correct and match your documents.

- Don't sign the form without understanding every term and condition. Knowing exactly what you're agreeing to is crucial for your financial well-being.

- Do keep copies of the completed form and any related correspondence or documents for your records.

- Don't hesitate to ask questions. If there's anything you're uncertain about, reaching out for clarification is key.

- Do consider the long-term impacts on your credit score and financial situation. While a deed in lieu can offer relief, it's important to plan for the future.

Misconceptions

Many people have heard of a deed in lieu of foreclosure but are often misinformed about what it entails. Let's address some of these misconceptions to clarify how this process actually works.

-

It completely clears all debts associated with the property: One common misconception is that once a deed in lieu of foreclosure is executed, the borrower is free from all financial obligations related to the property. This is not always the case. In some instances, if the value of the property does not cover the balance owed on the mortgage, the lender may pursue a deficiency judgment, seeking to recover the remaining amount from the borrower.

-

It is an easy process: Another misunderstanding is that the deed in lieu of foreclosure is a simple and quick solution. The truth is it involves a complex negotiation process with the lender. Homeowners must provide extensive financial documentation to prove their inability to continue making payments. The lender must then agree that accepting the deed is in their best interest, which often involves significant time and effort from both parties.

-

It does not affect credit scores: Some people mistakenly believe that a deed in lieu of foreclosure will not impact their credit history. While it may have a slightly lesser impact than a foreclosure, it still significantly lowers one's credit score and remains on the credit report for up to seven years. The effect on the individual’s credit can hinder their ability to secure loans in the future.

-

It’s available to all homeowners facing foreclosure: Many homeowners assume that a deed in lieu of foreclosure is available to anyone facing foreclosure. However, not all lenders offer this option. It is typically only considered after other loss mitigation options, such as loan modifications or short sales, have been exhausted. Additionally, the lender must believe that the market value of the property is worth the exchange and that the homeowner’s financial distress is genuine and longstanding.

-

It relieves the borrower of all property-related liabilities: Some individuals think that once they have transferred the deed, they are no longer responsible for any liabilities associated with the property. This perception is inaccurate. Certain obligations, particularly those tied to homeowner association fees or taxes that were not settled prior to the execution of the deed in lieu of foreclosure, may still be the responsibility of the borrower.

Key takeaways

When homeowners face the possibility of foreclosure due to inability to pay their mortgage, a Deed in Lieu of Foreclosure can be a viable alternative. This method allows the homeowner to transfer the ownership of their property back to the lender voluntarily. Here are some key takeaways to keep in mind when filling out and using this form:

- Clarity and Accuracy: It is crucial to provide clear and accurate information on the form. Each detail, from the homeowner's personal information to the description of the property, must be double-checked for accuracy. This ensures the process moves smoothly and reduces the risk of delays or complications.

- Financial Consideration: Generally, a Deed in Lieu of Foreclosure is used when the property's market value is less than the total mortgage amount owed. This should be discussed and clarified with the lender before proceeding. Sometimes, the lender might forgive the difference, but in other situations, the homeowner might still be responsible for paying the shortfall.

- Legal Advice: Before submitting a Deed in Lieu of Foreclosure, seeking legal advice is strongly recommended. A legal professional can provide critical insights into the process, ensuring that the homeowner's rights are protected and they are fully aware of the potential consequences of such an action. This step cannot be overstated for its importance in making an informed decision.

- Taxes: A Deed in Lieu of Foreclosure can have significant tax implications. In some cases, the forgiveness of the remaining mortgage balance could be considered taxable income by the Internal Revenue Service (IRS). Homeowners should consult with a tax advisor to understand the potential tax impact and plan accordingly.

This process, while challenging, can provide a sense of closure and a pathway to financial recovery. Understanding these key aspects helps individuals navigate the complexities of a Deed in Lieu of Foreclosure with greater confidence and preparedness.

Consider More Types of Deed in Lieu of Foreclosure Forms

Deed of Trust Sample - This document lays the groundwork for what happens in the event of the borrower’s death, ensuring the property’s treatment aligns with the legal agreement.

Simple Deed of Gift Template - Ensures that sentimental or high-value gifts are recognized under the law as intended, preventing any unintended legal consequences.