Official Corrective Deed Document

In the intricate world of property transactions, precision is paramount. Yet, errors, ranging from minor misspellings to significant legal description inaccuracies, can and do occur. When such discrepancies surface, rectifying them becomes an urgent priority to ensure the smooth transfer of ownership and to uphold the integrity of the legal record. This is where the Corrective Deed form plays a crucial role. Serving as a remedial tool, it allows parties involved in property transactions to amend previously recorded deeds that contain mistakes. The form, while straightforward in its purpose, demands careful attention to detail, ensuring that the corrections it embodies are accurate and legally sound. It acts as a safeguard, preserving the rights of all parties involved and maintaining the veracity of real estate records. Beyond its functional importance, the Corrective Deed form underscores the value of diligence and precision in legal documentation, reflecting a broader commitment to fairness and clarity in property law.

Document Example

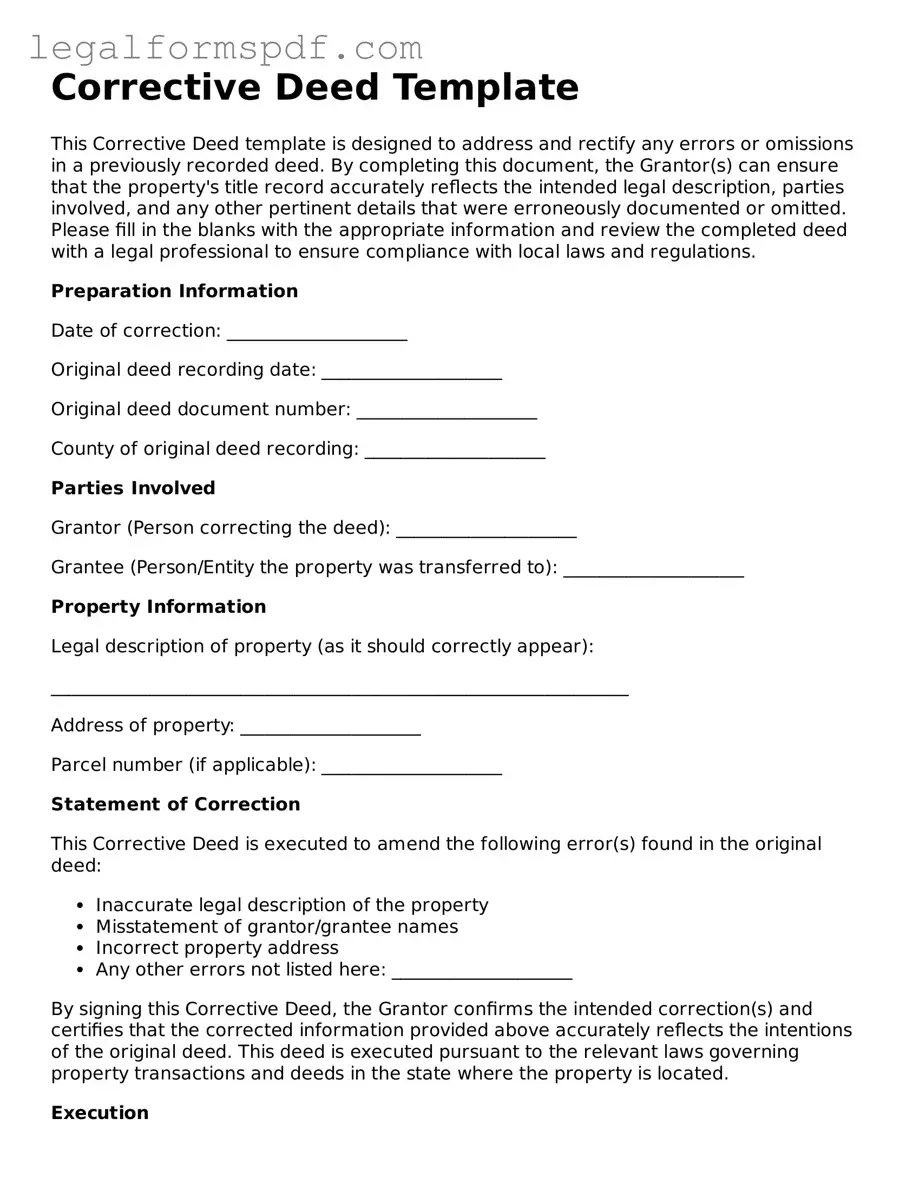

Corrective Deed Template

This Corrective Deed template is designed to address and rectify any errors or omissions in a previously recorded deed. By completing this document, the Grantor(s) can ensure that the property's title record accurately reflects the intended legal description, parties involved, and any other pertinent details that were erroneously documented or omitted. Please fill in the blanks with the appropriate information and review the completed deed with a legal professional to ensure compliance with local laws and regulations.

Preparation Information

Date of correction: ____________________

Original deed recording date: ____________________

Original deed document number: ____________________

County of original deed recording: ____________________

Parties Involved

Grantor (Person correcting the deed): ____________________

Grantee (Person/Entity the property was transferred to): ____________________

Property Information

Legal description of property (as it should correctly appear):

________________________________________________________________

Address of property: ____________________

Parcel number (if applicable): ____________________

Statement of Correction

This Corrective Deed is executed to amend the following error(s) found in the original deed:

- Inaccurate legal description of the property

- Misstatement of grantor/grantee names

- Incorrect property address

- Any other errors not listed here: ____________________

By signing this Corrective Deed, the Grantor confirms the intended correction(s) and certifies that the corrected information provided above accurately reflects the intentions of the original deed. This deed is executed pursuant to the relevant laws governing property transactions and deeds in the state where the property is located.

Execution

IN WITNESS WHEREOF, the Grantor has executed this Corrective Deed on the date first above written.

Grantor Signature: ____________________

Printed Name: ____________________

State of ____________________

County of ____________________

On this day, ____________________, before me, ____________________ (name of notary), personally appeared ____________________ (name of Grantor), known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument and acknowledged that he/she executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

Notary Signature: ____________________

Printed Name: ____________________

My commission expires: ____________________

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose of a Corrective Deed | Corrective deeds are used to fix minor errors in previously recorded deeds, ensuring the accuracy of legal property descriptions and ownership details. |

| Types of Errors Corrected | Common errors include misspellings of names, incorrect property descriptions, or missing signatures. |

| Legal Effectiveness | A corrective deed does not replace the original deed but rather amends the previously recorded document to correct the inaccuracies. |

| Execution Requirements | The corrective deed must be signed by the grantor from the original deed and, in some cases, the grantee, then notarized to be legally effective. |

| Recording a Corrective Deed | After execution, the corrective deed must be recorded with the county recorder's office where the property is located to make the correction part of the public record. |

| Governing Law | Each state has specific laws and requirements for executing and recording corrective deeds, making it vital to consult state-specific statutes and regulations. |

Instructions on Writing Corrective Deed

Completing a Corrective Deed form is an essential step in rectifying any inaccuracies or omissions that occurred during the original property transfer process. It ensures that the property title is clean, which is crucial for future transactions. This document must be handled with precision and attention to detail to avoid any potential legal complications. Following the steps below will guide you through filling out the form correctly.

- Gather the original deed and any other pertinent documents related to the property transaction. Review these documents thoroughly to understand the errors that need correction.

- Identify the specific parts of the original deed that contain inaccuracies. Note the correct information for each part that requires amendment.

- Locate the section at the top of the Corrective Deed form where you must enter the preparer's information. Fill in your name, address, and any other requested contact details.

- Fill in the "Return to" section with the name and address of the individual or entity where the recorded deed should be sent after processing.

- Enter the date of the original deed in the designated space.

- Provide the grantor's (the person who is transferring the property) complete legal name as it appears on the original deed.

- Supply the grantee's (the person who is receiving the property) complete legal name, making sure it matches the name on the original deed.

- Input the corrected property description in the designated area. This description should include all necessary legal terminology and boundary information to accurately describe the property.

- Ensure both the grantor and grantee sign the Corrective Deed form in the presence of a notary public. The form must then be notarized to verify the authenticity of the signatures.

- Check all the information for accuracy. Once completed, submit the Corrective Deed form to the local county recorder’s office, along with any required filing fees.

After submission, the Corrective Deed will undergo a review process by the county recorder's office. They will verify that the corrected information adheres to local laws and regulations. Once approved, the Corrective Deed will be officially recorded, thus amending the original deed. It is important to retain a copy of the recorded Corrective Deed for personal records. This ensures there is evidence of the correction should any questions arise in the future regarding the property's title.

Understanding Corrective Deed

What is a Corrective Deed form?

A Corrective Deed form is a legal document used to correct errors or omissions in a previously recorded deed. This might involve misspellings, incorrect property descriptions, or any other inaccuracies that were made when the original deed was created and filed. By recording a Corrective Deed, these errors can be officially amended, ensuring the public record accurately reflects the details of the property transaction.

When is it necessary to use a Corrective Deed?

A Corrective Deed is needed when discrepancies or mistakes in a previously filed deed are discovered. These can range from minor typographical errors to significant issues that might affect the legal description of the property. It's crucial to address these mistakes promptly to avoid complications in future transactions or legal disputes over property ownership and boundaries.

What are the steps to file a Corrective Deed?

Filing a Corrective Deed involves several key steps. First, the error in the original deed must be identified clearly. Next, a new deed, the Corrective Deed, is drafted, specifying the corrections being made. This deed must then be signed by the parties involved in the original transaction, often requiring notarization. Finally, the Corrective Deed must be filed with the county recorder's office where the property is located, along with any required filing fees.

Do all parties involved in the original deed need to sign the Corrective Deed?

Typically, yes, all parties who were part of the original deed are required to sign the Corrective Deed to validate the correction. This includes not only the property seller (grantor) but also the buyer (grantee). In some cases, if the correction is minor and does not affect the transfer of ownership, signatures from all parties might not be necessary. However, the requirements can vary by jurisdiction, and it's advisable to consult with a legal professional to understand the specific requirements in your area.

Common mistakes

Filling out a Corrective Deed form can be a complex process, and mistakes are not uncommon. One of the first errors individuals make lies in not clearly identifying the error from the original deed that needs correction. This lack of specificity can lead to confusion and may fail to rectify the intended issue, thereby defeating the purpose of the corrective action.

Another frequent mistake is the misuse of legal descriptions of the property. Precise legal terminology is crucial when amending any part of a property deed. Failing to use the correct legal language can result in the correction not being legally binding, or worse, it could introduce new errors into the property record.

Often, people neglect to obtain the necessary signatures, which is a critical step in the process. Every party involved in the original deed must also sign the Corrective Deed for it to be valid. This oversight can significantly delay the correction process or nullify the deed's correction attempt altogether.

Underestimating the importance of notarization is another common pitfall. Like the original deed, a Corrective Deed must be notarized to ensure its authenticity and legality. Failure to have the document properly notarized can render the corrective effort invalid.

A considerable number of individuals mistakenly assume that filing the Corrective Deed with the local county office is an immediate process. In reality, these filings can take time, and delays in processing can impact related transactions, such as property sales or refinancing efforts.

Incorrectly assuming that a Corrective Deed resolves all issues with the property is a misstep that can lead to future complications. While it can amend errors in the deed itself, it does not address other potential issues such as liens or encumbrances on the property.

Some people overlook the requirement to notify all involved parties once the Corrective Deed is filed. This notification is a crucial step in ensuring that all stakeholders are aware of the changes and can adjust their records accordingly.

Lastly, failing to consult with a legal professional when dealing with complex property issues is a common mistake. A legal expert can provide guidance, ensure the accuracy of the Corrective Deed, and prevent potential legal hurdles down the line. The assumption that one can navigate these waters without professional help often leads to errors and omissions that could have been avoided.

Documents used along the form

When dealing with property transactions, particularly when rectifying errors in previously filed deeds, a Corrective Deed form is a crucial document. However, this form usually does not stand alone in the process of modifying property records to ensure they accurately reflect the current status of ownership and any encumbrances. Other forms and documents often accompany the Corrective Deed to complete this process, each serving its unique purpose in the realm of property documentation and transaction rectification.

- Title Report: Provides a detailed analysis of the property's title history, revealing any previous issues or discrepancies that might affect the current state of ownership. It is essential to understand the property's background and ensure that the Corrective Deed addresses all pertinent issues.

- Affidavit of Property Value: This document is required in some jurisdictions to accompany any deed filed with the county recorder’s office. It outlines the transaction's financial aspects, including the sale price, which can be relevant when corrections involve the financial terms of the original deed.

- Quitclaim Deed: Often used in conjunction with a Corrective Deed, especially if the correction involves clarifying or changing the ownership interest conveyed in the original deed without warranty to title.

- Warranty Deed: While a Corrective Deed fixes errors, a Warranty Deed might accompany it to provide assurances to the new owner about the validity of the property title post-correction, guaranteeing against future claims.

- Escrow Instructions: These are detailed directions to an escrow agent, specifying the conditions under which the correction and any other related transactions are to be completed. They ensure that all parties have a clear understanding of the process and conditions involved in the correction.

Each of these documents plays a vital role in the broader context of property transactions and legal documentation. They ensure that all aspects of the property's history, value, ownership, and title status are accurately recorded and acknowledged. This comprehensive approach protects all parties involved, facilitating smoother and more transparent property transactions.

Similar forms

A Quitclaim Deed shares similarities with a Corrective Deed in that both are used to transfer property rights without making any warranties about the property title. While a Corrective Deed is specifically used to amend a previously recorded deed that has errors, a Quitclaim Deed can transfer ownership interest, often between family members or to clear title discrepancies, without addressing the state of the title or guaranteeing its validity.

Warranty Deeds are another type of document related to Corrective Deeds. They are used to guarantee that the seller holds clear title to a piece of real estate and has the right to sell it, thus offering more protection to the buyer than a Corrective Deed. When errors are found in a Warranty Deed, a Corrective Deed may be employed to rectify those errors and ensure the accuracy of the property description or ownership rights detailed in the Warranty Deed.

The Grant Deed, much like the Corrective Deed, is employed in the transfer of property rights. The distinct feature of a Grant Deed is its assurance that the property has not been sold to anyone else and that it is free from any undisclosed encumbrances. However, it does not provide the extensive warranties found in a Warranty Deed. When mistakes are identified in a previously recorded Grant Deed, a Corrective Deed may be necessary to amend the inaccuracies.

A Deed of Trust is a document that involves three parties - the borrower, lender, and trustee, and is used in some states instead of a mortgage. It places the property into a trust as security for the loan. Although its purpose differs from that of a Corrective Deed, they intersect when there are errors in the documentation of the trust that need correction to ensure the property is accurately described and the parties' interests are correctly represented.

Special Warranty Deeds offer a middle ground between a full Warranty Deed and a Quitclaim Deed by assuring the buyer that the seller has not caused any title problems during their period of ownership. Similar to when using a Corrective Deed, the purpose is to ensure the accuracy of the property transfer. However, if prior errors are discovered in the original deed, a Corrective Deed might be required to fix these discrepancies.

A Fiduciary Deed is used when a property is transferred through a trust, estate, or guardianship, and the fiduciary (trustee, executor, or guardian) has the authority to transfer property on behalf of the entity or person. Similar to a Corrective Deed, it is highly specific and comes into play when property is being transferred under special circumstances. If there are mistakes within the original deed related to the transfer, a Corrective Deed would be necessary to amend the document accurately.

Finally, a Transfer-on-Death Deed allows property owners to name a beneficiary who will receive the property upon the owner’s death, bypassing the probate process. While fundamentally different in purpose, its similarity to a Corrective Deed lies in its need for accuracy concerning property and ownership descriptions. Should there be errors or updates needed to reflect the current status accurately, a Corrective Deed could be used for correction before the owner’s demise.

Dos and Don'ts

Filling out a Corrective Deed form is an important process when needing to correct errors in previously recorded deeds, ensuring the accurate reflection of property ownership details in public records. To avoid common mistakes and ensure the process is completed correctly, consider the following dos and don'ts.

Do:

- Review the original deed carefully to identify all the errors needing correction.

- Clearly state the corrections being made, making sure to reference the original deed information, including the recording date and number if available.

- Include all relevant parties in the Corrective Deed process, ensuring that anyone who signed the original deed also signs the Corrective Deed.

- Get the Corrective Deed notarized, as this will validate the signatures and authenticate the document.

- Record the Corrective Deed with the appropriate county recorder’s office to update the public record.

- Consult with a real estate attorney or professional if you have questions or concerns about how to properly fill out the form.

- Keep copies of both the original deed and the Corrective Deed for your records.

Don't:

- Attempt to use the Corrective Deed for purposes other than correcting minor errors, such as changing ownership.

- Overlook small errors, as even minor mistakes can create significant issues in the future.

- Forget to verify the legal description of the property; it should match exactly as it is in the original deed unless that is the error being corrected.

- Assume the form is filled out correctly without double-checking all information and signatures.

- Delay filing the Corrective Deed, as this could complicate future transactions involving the property.

- Ignore state or county-specific requirements, which may have unique stipulations for filing a Corrective Deed.

- Discard the original deed after the corrective one is filed; maintaining a comprehensive record is crucial.

Misconceptions

Many people have misconceptions about the Corrective Deed form and its usage in rectifying errors in previously recorded deeds. Understanding these can help in applying these deeds properly and ensuring that property records are accurate. Below are eight common misconceptions.

- All mistakes can be fixed with a Corrective Deed: It's important to note that not all errors can be rectified using a Corrective Deed. This form is typically utilized for minor corrections, such as typographical errors, misspellings, or incorrect legal descriptions. More significant errors may require more complex legal actions.

- Corrective Deeds do not require the original grantor's signature: Contrary to this belief, the Original grantor must sign the Corrective Deed to validate the correction of the initial document. This ensures that any changes are agreed upon by the original parties involved.

- Filing a Corrective Deed is the same as filing a new deed: While it might seem that filing a Corrective Deed is equivalent to creating a new deed, in reality, a Corrective Deed serves to amend the original document, not replace it. The original deed remains in effect, with the Corrective Deed clarifying or correcting the specific error.

- A Corrective Deed changes the original transfer of property: A common misunderstanding is that a Corrective Deed alters the initial transfer of property. However, the objective of a Corrective Deed is to correct errors, not to change ownership or the terms under which the property was transferred.

- Corrective Deeds are only for errors made by the county: While it's true that errors in recording by the county can be corrected by a Corrective Deed, this form can also rectify mistakes made by the parties to the transaction or their representatives.

- Corrective Deeds are complicated and expensive: Many assume that correcting an error on a deed through a Corrective Deed is a complex and costly process. Although some cases might require legal consultation, many corrective actions are straightforward and involve minimal fees.

- Using a Corrective Deed can cloud the title: In fact, the purpose of a Corrective Deed is to clarify and ensure the accuracy of the property record, thereby reducing the chances of issues or disputes regarding the title. Using this deed appropriately helps clear up potential title problems.

- There is no time limit for recording a Corrective Deed: While it might seem you can file a Corrective Deed at any time after discovering an error, promptly addressing mistakes is always advised to avoid complications. Delays in recording a Corrective Deed can lead to disputes or confusion in the property’s legal standing.

Key takeaways

Corrective deeds are essential tools in the realm of real estate transactions, aimed at rectifying errors in previously recorded deeds. Their correct use ensures the legal and accurate conveyance of property rights. Here are key takeaways to understand when dealing with a Corrective Deed form:

- Identification of the Error: The first step is to clearly identify the error in the original deed that requires correction. This could be a misspelled name, incorrect property description, or any other mistake affecting the deed's accuracy.

- Use of the Correct Form: Ensure you're using the correct form specific to your jurisdiction, as requirements can vary widely across different locations.

- Original Deed Reference: The Corrective Deed must reference the original deed by date, recording information, and the parties involved to clarify what is being corrected.

- Detailing the Correction: The form should specify the exact nature of the error and the corrected information, making it clear what changes are being made.

- Signatures: All parties involved in the original deed typically need to sign the Corrective Deed to validate the correction. This may include witnesses or a notary public, depending on state laws.

- Recording the Corrective Deed: Once completed, the Corrective Deed must be recorded with the appropriate county office where the property is located, just like the original deed.

- Fees: Be prepared to pay a filing fee, which varies by location. This fee is required to officially record the corrective action and is separate from any fees paid for the original deed.

- Legal Advice: Given the legal implications of amending a recorded deed, consulting with a real estate attorney can provide guidance and ensure the correction is made properly.

- No Changes in Ownership: It's important to note that a Corrective Deed is used to correct errors, not to change ownership or alter rights conveyed in the original deed.

- Impact on Title: Correctly executed and recorded, a Corrective Deed clears up any ambiguities or mistakes that could affect the property's title, ensuring clear ownership.

Understanding these key aspects ensures that any necessary corrections to property deeds are made accurately and legally, maintaining the integrity of real estate records and ownership.

Consider More Types of Corrective Deed Forms

Simple Deed of Gift Template - Avoids potential misinterpretations about the transfer’s purpose, emphasizing that no services or payments are expected in return.