Fillable Deed Document for California

In California, transferring property is a significant process, necessitating careful documentation to ensure legality and prevent future disputes. The cornerstone of this process is the deed form, a crucial document that officially records the change of ownership from one party to another. This form comes in various types, each tailored to different transfer scenarios, such as a warranty deed for fully guaranteed transactions and a quitclaim deed for more informal transfers with no guarantees. A thorough understanding of each type helps in selecting the most appropriate for your needs. At its core, the deed form requires detailed information about the parties involved, the property in question, and any terms or conditions of the transfer. It's not merely a formality; executing this document properly involves adherence to legal requirements, including signature witnessing or notarization, to ensure its enforceability. The significance of this document extends beyond the moment of transfer, affecting tax implications, ownership disputes, and more, thereby highlighting its role as a foundational element in property transactions in California.

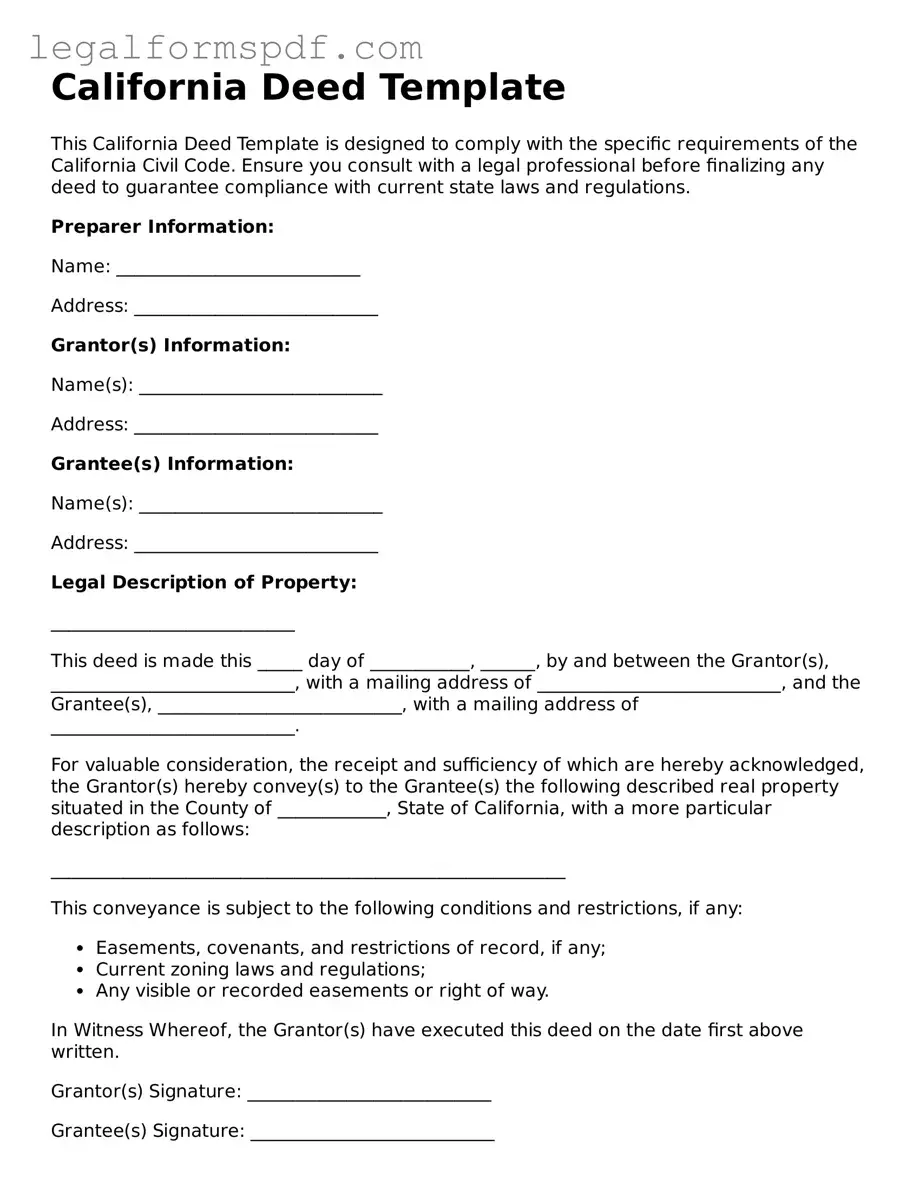

Document Example

California Deed Template

This California Deed Template is designed to comply with the specific requirements of the California Civil Code. Ensure you consult with a legal professional before finalizing any deed to guarantee compliance with current state laws and regulations.

Preparer Information:

Name: ___________________________

Address: ___________________________

Grantor(s) Information:

Name(s): ___________________________

Address: ___________________________

Grantee(s) Information:

Name(s): ___________________________

Address: ___________________________

Legal Description of Property:

___________________________

This deed is made this _____ day of ___________, ______, by and between the Grantor(s), ___________________________, with a mailing address of ___________________________, and the Grantee(s), ___________________________, with a mailing address of ___________________________.

For valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Grantor(s) hereby convey(s) to the Grantee(s) the following described real property situated in the County of ____________, State of California, with a more particular description as follows:

_________________________________________________________

This conveyance is subject to the following conditions and restrictions, if any:

- Easements, covenants, and restrictions of record, if any;

- Current zoning laws and regulations;

- Any visible or recorded easements or right of way.

In Witness Whereof, the Grantor(s) have executed this deed on the date first above written.

Grantor(s) Signature: ___________________________

Grantee(s) Signature: ___________________________

State of California

County of ____________

On this _____ day of ___________, ______, before me, ___________________________ (name and title of the officer), personally appeared ___________________________, who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

Witness my hand and official seal.

(Seal)

Signature of Notary Public: ___________________________

PDF Specifications

| Fact | Description |

|---|---|

| Governing Law(s) | California Civil Code sections 1091 to 1093 govern Deed forms in California. |

| Types of Deeds | California recognizes several types of deeds, including Grant Deeds, Quitclaim Deeds, and Warranty Deeds. |

| Document Recording | Deeds must be recorded with the county recorder in the county where the property is located. |

| Required Information | The form must include the legal description of the property, the grantor's and grantee's names, and must be signed by the grantor. |

Instructions on Writing California Deed

Filling out a California Deed form is a critical step in the process of transferring ownership of real estate from one party to another. Whether you're buying, selling, or transferring property to a family member, it's important to correctly complete this legal document to ensure the transfer is legally binding. The steps outlined below will guide you through the process of filling out the deed form, making sure all necessary details are accurately captured.

- Begin by downloading the correct California Deed form from a reliable source. Make sure it's the form that matches your specific needs, such as a Grant Deed or a Quitclaim Deed.

- Enter the name(s) of the grantor(s) (the current owner(s) of the property) in the designated area, ensuring spelling is correct and matches the name(s) on the current deed.

- Write the grantee(s) name(s) (the person(s) receiving the property) in the specified section, double-checking for accurate spelling.

- Include the mailing address of the grantee(s), as this information is necessary for tax purposes and future correspondence.

- Specify the legal description of the property. This information can be found on the current deed or by contacting the county assessor's office. It includes detailed information about the property's location and boundaries.

- For forms that require it, state the amount of money being exchanged for the property, if applicable. In cases of a gift or no monetary exchange, this may be stated differently according to the specific deed form instructions.

- The grantor(s) must sign the deed in the presence of a notary public. The notary will then fill out their section, confirming the identity of the signers and the date of signing.

- In some cases, you might need to attach an additional document called a Preliminary Change of Ownership Report (PCOR), which is required by many counties in California.

- Finally, submit the completed deed form and any required additional documents to the county recorder's office where the property is located. There will be a filing fee, which varies by county.

After the deed is submitted, the county recorder's office will process it. Once recorded, they will typically send a confirmation to the grantee or return the original deed. This documentation is crucial as it's the final step in legally transferring property ownership. Remember, if any part of the process seems confusing or you're unsure about the specific details required on the deed form, consulting with a legal professional is highly recommended to ensure the transfer is conducted correctly.

Understanding California Deed

What is a California Deed form?

A California Deed form is a legal document used to transfer ownership of real property from one person or entity to another. This form records the change of ownership and ensures that it is officially documented with the county where the property is located.

Who needs to sign the California Deed form?

The individual or entity transferring the property, known as the grantor, must sign the deed form. Additionally, the signature must be notarized, verifying the identity of the grantor and that they signed the document willingly.

Are there different types of Deed forms in California?

Yes, California recognizes several types of Deed forms, including but not limited to, the General Warranty Deed, which provides the highest level of buyer protection, the Grant Deed, offering a moderate level of protection by implying certain covenants, and the Quitclaim Deed, which offers no warranties regarding the title's quality.

How do I file a California Deed form?

Once properly completed and signed, the Deed form must be filed with the County Recorder's Office in the county where the property is located. Filing fees will apply, and vary by county. It is important to ensure the document meets all state and local requirements to be successfully recorded.

What happens if a California Deed form is not recorded?

If a Deed form is not recorded, the transfer of property might not be recognized by the county, potentially leading to legal disputes in the future. Recording the deed helps to protect the new owner's rights to the property.

Can I prepare a California Deed form myself?

Yes, it is possible to prepare a California Deed form yourself; however, it is crucial to ensure that the form complies with all applicable state and county regulations. Seeking advice from a legal professional can help avoid costly mistakes.

Is witness signatory required for a California Deed form?

While California's state law does not generally require a witness for the signing of a Deed form, the notarization process is mandatory. The notary public acts as an official witness to the signature of the grantor.

Common mistakes

Filling out a California Deed form seems straightforward, but it's easy to fall into common pitfalls that can lead to significant legal complications down the line. First and foremost, one of the most frequent mistakes is incorrect information. When people fill out names, addresses, or legal descriptions inaccurately, it can invalidate the entire deed or, at best, cause delays. This is particularly crucial for the legal description of the property, which must match public records exactly to ensure the deed is legally binding.

Another common error is not understanding the different types of deeds. California offers several, including the General Warranty Deed, the Quitclaim Deed, and the Grant Deed. Each serves a different purpose and carries varying levels of warranty. For example, choosing a Quitclaim Deed when a Grant Deed is more appropriate could unintentionally limit the buyer's legal protections against previous claims on the property. It’s essential to select the correct deed type that accurately reflects the transaction and the parties' intentions.

Many people also overlook the importance of signatures and notarization. The deed must be signed by the grantor (the person transferring the property) in the presence of a notary public. Failing to have the deed properly notarized is a relatively common mistake that renders the document not legally enforceable. This step is crucial for the deed to be recorded correctly with the county recorder’s office.

Failing to file the deed with the county recorder’s office is another error that can have significant repercussions. Once a deed is completed, signed, and notarized, it doesn't automatically mean the property has changed hands. The document must be officially recorded to establish the new ownership publicly. This process involves submitting the deed to the local county recorder's office, which can then make the change official. Failure to record the deed leaves the property transfer in a sort of legal limbo.

Last but certainly not least, attempting to complete the process without professional advice can lead to mistakes. Real estate transactions are complex, and the consequences of errors can be severe. Whether it’s misunderstanding state laws, misinterpreting the type of deed required, or simply filling out the form incorrectly, professional guidance can help avoid these pitfalls. Legal professionals or real estate experts can provide invaluable advice, ensuring that both parties' rights are protected and the deed is executed correctly.

Documents used along the form

When dealing with property transactions in California, the deed form is crucial for transferring ownership. However, this document does not stand alone. Several other forms and documents often accompany it, ensuring the transaction is complete, legal, and recorded properly. These supplementary documents can vary based on the transaction's complexity, the property type, and the parties involved. Below is a selection of commonly used forms and documents that accompany a California Deed form during property transactions.

- Preliminary Change of Ownership Report (PCOR): This document is required by the county assessor in California whenever real estate ownership is transferred. It provides the assessor with information about the sale and assists in determining if the sale qualifies for any exclusions from reassessment under Proposition 13.

- Transfer Tax Declarations: Many counties and cities in California impose a transfer tax on real estate transactions. This document declares the amount of sale and calculates the tax owed. The rate and specific requirements can vary significantly from one jurisdiction to another.

- Title Report: Prepared by a title company, this report outlines the property's ownership history, identifies any liens or encumbrances on the property, and verifies that the seller has the right to transfer ownership. It is essential for ensuring a clear title is conveyed to the buyer.

- Escrow Instructions: These written instructions, agreed upon by the buyer and seller, guide the escrow agent in the proper disbursement of funds and documents related to the property transaction. They ensure that all conditions of the sale are met before the property changes hands.

- Notice of Transfer and Release of Liability: While this document is more relevant to the sale of vehicles than real estate, it's worth noting for completeness. In real estate transactions, similar notices may be involved when transferring responsibility for utilities or homeowner association dues from the seller to the buyer.

In conclusion, transferring property in California involves more than just completing a deed form. The accompanying documents, such as the Preliminary Change of Ownership Report, Transfer Tax Declarations, Title Report, Escrow Instructions, and others, play vital roles in ensuring the transaction adheres to legal standards and records the transfer accurately. Understanding these documents is crucial for anyone involved in a real estate transaction, helping to navigate the process smoothly and efficiently.

Similar forms

The California Deed form is similar to the Warranty Deed, which also involves the transfer of property ownership. While the Deed form might not specify the guarantee that the title is clear from claims, the Warranty Deed explicitly assures the buyer that the seller has a valid title to the property and it's free from liens or claims.

Similar to the California Deed form is the Quitclaim Deed, which is used to transfer any ownership interest the seller (grantor) has in the property, without making any promises about the validity of the property title. This document is often used between family members or to clear up title issues.

The Grant Deed is another document that shares similarities with the California Deed form, offering a middle ground between the Warranty and Quitclaim Deeds. It provides the assurance that the property has not been sold to someone else and that there are no undisclosed encumbrances, although it does not provide the extensive guarantees of a Warranty Deed.

Like the California Deed form, the Trust Transfer Deed is used in specific circumstances, particularly in the transfer of property into or out of a trust. It's similar in function—transferring ownership—but is tailored for situations involving trusts, providing a mechanism for handling property within estate planning.

The Assignment of Deed of Trust is akin to the California Deed form in that it involves the transfer of interest in property. However, it specifically relates to transferring the beneficiary interest in a deed of trust from one party to another, often used in mortgage transactions.

Similar in purpose to the California Deed form, the Easement Deed is used for granting or releasing a right-of-way across a property rather than transferring full property ownership. This document specifies the terms under which one party can use another party's property for a specified purpose, like installing utilities or creating a driveway.

The Land Contract mirrors the California Deed form in its facilitation of property transfer but does so under a different structure. In a Land Contract, the seller finances the purchase and holds the title until the buyer completes the agreed-upon payments, at which point the deed is transferred.

Sharing a kinship with the California Deed form, the Correction Deed is utilized to make amendments or correct errors in a previously recorded deed. While serving a different function, it underscores the importance of accuracy and completeness in documenting property transfers.

Lastly, the Life Estate Deed, like the California Deed form, facilitates property transfer but with a unique twist. It allows the original owner (grantor) to retain rights to the property during their lifetime, with the property automatically passing to a named individual (remainderman) upon their death, bypassing the need for probate.

Dos and Don'ts

When it comes to filling out a California Deed form, it’s important to keep certain dos and don'ts in mind. This process is crucial in legally transferring property from one party to another. Here are some essential tips to help you complete the form correctly and avoid common pitfalls.

Do:

- Double-check all information: Ensure all names, addresses, and details are accurate and match the official documents.

- Use black ink: Fill out the form in black ink to make sure it is legible and adheres to official recording standards.

- Include a legal description of the property: Besides the address, include the legal description as found in previous deed or property records.

- Sign in the presence of a notary: Your signature must be notarized for the deed to be legally binding and recordable.

Don’t:

- Leave blanks: Complete every section of the form. If a section doesn’t apply, write “N/A” (not applicable) rather than leaving it empty.

- Use guesswork for legal descriptions: Don’t estimate or guess the legal description of the property. Always refer to a previous deed or public records for accuracy.

- Forget to check recording requirements: Different counties may have specific requirements for recording a deed. Confirm with your local recorder’s office before submission.

- Overlook the need for witness signatures: Some deeds require witness signatures in addition to notarization. Verify if this applies to your document.

Misconceptions

When managing property transactions in California, understanding the nuances of the deed form is crucial. Misconceptions can complicate the process, leading to unexpected delays or even legal challenges. Below, we address seven common misconceptions to provide clarity and guidance.

- All deed forms are the same in California. One common misconception is that a single type of deed form is used for all property transactions across California. In reality, several types of deeds exist, including grant deeds, warranty deeds, and quitclaim deeds, each serving different purposes and offering varying levels of protection to the buyer.

- A deed form only needs to be signed by the buyer. Actually, the critical signature on a deed form is that of the seller. The seller's signature formally transfers ownership of the property to the buyer. However, in certain cases, such as when the property is owned by a married couple, both spouses may need to sign, depending on the form of title ownership.

- You can fill out and file a deed form without legal help. While it’s possible to complete and file a deed form on one's own, expert guidance is often recommended to navigate the complexities of property law and ensure that the deed is legally valid and properly recorded. Even a minor mistake can result in significant legal and financial repercussions.

- Notarization is optional for a deed form in California. This is incorrect. For a deed to be legally binding in California, it must be notarized. Notarization confirms the authenticity of the signature(s) on the deed, preventing fraud and adding a layer of protection for all parties involved.

- Electronic deeds are not legally valid in California. Contrary to this belief, electronic recording of deeds is acceptable in California, as long as the county in question supports e-recording. This technological advancement streamlines the process, making it faster and more efficient to record a deed.

- Once signed, a deed form immediately transfers property ownership. While signing the deed is a critical step in transferring ownership, the process is not complete until the deed is officially recorded with the county recorder’s office. This step is vital for the transfer to be recognized legally.

- Property details do not need to be precise in the deed form. Accuracy is paramount when filling out a deed form. The property description must be exact, often requiring a legal description rather than just a street address. Inaccuracies can cause disputes over property boundaries and ownership, leading to potential legal challenges.

Addressing these misconceptions head-on helps ensure a smoother, more informed transaction process. Whether buying or selling property in California, it’s wise to seek professional advice to navigate the complexities of property deeds accurately and efficiently.

Key takeaways

When dealing with property transactions in California, the deed form plays a pivotal role in the transfer of property ownership. Understanding how to properly fill out and use this form is essential for a smooth transition. Here are nine key takeaways to guide you through the process:

- Identify the deed type: California offers different types of deeds, such as grant deeds and quitclaim deeds. Each serves a specific purpose, so determining the correct one for your transaction is crucial.

- Know the parties involved: The grantor is the person selling or transferring the property, while the grantee is the recipient. Accurately identifying these parties prevents future legal complications.

- Legal descriptions are critical: The deed must include a precise legal description of the property. This includes boundaries and parcel numbers, ensuring the exact property is transferred.

- Consider additional documentation: Sometimes, additional documents are required to accompany the deed. These could include declarations or forms related to property taxes.

- Signatures matter: California law mandates that the grantor must sign the deed. Depending on the deed type and local regulations, notarization may also be necessary for the document to be valid.

- Understand tax implications: Transferring property can have tax implications for both the grantor and the grantee. It’s important to know these details ahead of time to avoid unexpected liabilities.

- Recording is a final step: After the deed is signed and notarized, it must be recorded with the county recorder’s office where the property is located. This public recording legitimizes the change in ownership.

- Seek professional advice: Filling out a deed incorrectly can lead to significant legal issues. Consulting with a real estate attorney or a professional legal document preparer can provide clarity and assurance.

- Be aware of fraud: Unfortunately, real estate transactions can be targets for fraud. Verify all information and parties involved in the transaction to protect yourself and your assets.

Transferring property is a significant legal action that requires attention to detail and an understanding of the process. Whether you’re a first-time buyer or selling property you’ve owned for years, taking these key points into account will help ensure the deed accurately reflects the transaction, complies with California law, and secures your real estate interests.

More Deed State Forms

Quick Claim Deeds Georgia - Important for resolving disputes related to property ownership or boundaries.

What Does a House Deed Look Like in Pa - It is a trusted method for documenting the exchange of property, ensuring legal standards are met.