Official Deed Document

In the world of real estate transactions, few documents hold as much weight as the Deed form. This pivotal piece of paper is the linchpin in the transfer of property ownership, acting as the formal record that the seller (grantor) has transferred their right, title, and interest in a piece of real estate to the buyer (grantee). Varying types of Deed forms, each serving different purposes and offering different levels of protection to the buyer, can be found across jurisdictions. From the widely known Warranty Deed, offering the highest level of buyer protection by guaranteeing the grantor holds clear title to the property, to the simpler Quitclaim Deed, where the grantor transfers whatever interest they have in the property without warranties, understanding the intricacies of each is paramount. Such documentation not only delineates the terms of transfer but also can include specific conditions under which the property is being transferred, adding layers of complexity or reassurance, depending on one's perspective. As vital as they are, navigating Deed forms can be a daunting task, riddled with legal formalities that ensure the legitimacy and legality of the property transfer. Embarking on this journey with a foundational understanding of what these forms entail, and what protections they offer, can significantly demystify the process, making it a smoother endeavor for everyone involved.

State-specific Information for Deed Forms

Document Example

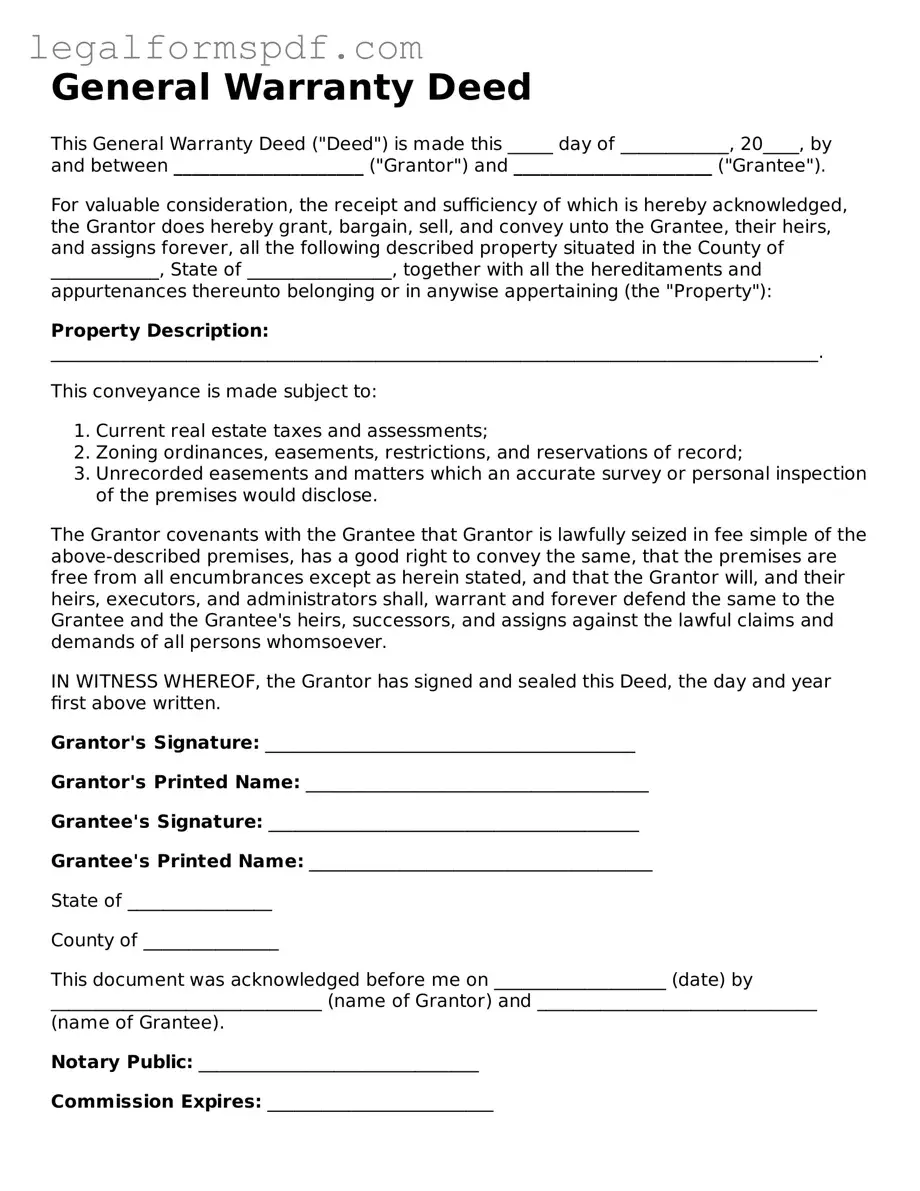

General Warranty Deed

This General Warranty Deed ("Deed") is made this _____ day of ____________, 20____, by and between _____________________ ("Grantor") and ______________________ ("Grantee").

For valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Grantor does hereby grant, bargain, sell, and convey unto the Grantee, their heirs, and assigns forever, all the following described property situated in the County of ____________, State of ________________, together with all the hereditaments and appurtenances thereunto belonging or in anywise appertaining (the "Property"):

Property Description: _____________________________________________________________________________________.

This conveyance is made subject to:

- Current real estate taxes and assessments;

- Zoning ordinances, easements, restrictions, and reservations of record;

- Unrecorded easements and matters which an accurate survey or personal inspection of the premises would disclose.

The Grantor covenants with the Grantee that Grantor is lawfully seized in fee simple of the above-described premises, has a good right to convey the same, that the premises are free from all encumbrances except as herein stated, and that the Grantor will, and their heirs, executors, and administrators shall, warrant and forever defend the same to the Grantee and the Grantee's heirs, successors, and assigns against the lawful claims and demands of all persons whomsoever.

IN WITNESS WHEREOF, the Grantor has signed and sealed this Deed, the day and year first above written.

Grantor's Signature: _________________________________________

Grantor's Printed Name: ______________________________________

Grantee's Signature: _________________________________________

Grantee's Printed Name: ______________________________________

State of ________________

County of _______________

This document was acknowledged before me on ___________________ (date) by ______________________________ (name of Grantor) and _______________________________ (name of Grantee).

Notary Public: _______________________________

Commission Expires: _________________________

PDF Specifications

| Fact Name | Description |

|---|---|

| Purpose of a Deed | A deed is a legal document that transfers ownership of real estate from one party to another. |

| Types of Deeds | Common types include warranty deeds, which guarantee the seller has the right to sell the property, and quitclaim deeds, which transfer any ownership the seller has without guarantees. |

| Key Components | Deeds must include the names of the buyer and seller, a legal description of the property, the signature of the party transferring the property, and, in many cases, a notary’s acknowledgment. |

| Governing Law | Deed forms and requirements can vary significantly by state, as real estate law is governed at the state level. |

Instructions on Writing Deed

When it comes time to transfer property ownership, a deed form comes into play. This legal document is essential for the process, ensuring that the transfer is recognized officially and legally. To make sure everything goes smoothly, it's crucial to fill out this form accurately and completely. Here are the steps you’ll need to take to fill out a deed form correctly, ensuring a seamless transition and avoiding any potential legal hiccups.

- Identify the type of deed required: Before you start, it's important to understand the type of deed necessary for your situation, such as a warranty, quitclaim, or special warranty deed.

- Gather necessary information: Collect all relevant information, including the legal description of the property, the current owner's name(s), and the new owner's name(s).

- Complete the title of the document: The title should accurately reflect the content of the document, such as “Warranty Deed” or “Quitclaim Deed”.

- Enter the date: Include the date when the deed is being executed.

- Detail the grantor information: Fill in the name(s) and address(es) of the current owner(s) transferring the property.

- Include grantee information: Enter the name(s) and address(es) of the new owner(s) receiving the property.

- Provide the legal description of the property: This may include the lot number, subdivision name, and any other information that uniquely identifies the property.

- State the consideration: Mention the amount of money being exchanged for the property, if applicable.

- Signature(s) of the grantor(s): The current owner(s) must sign the deed in the presence of a notary public.

- Notarization: The deed must be officially notarized to authenticate the signatures.

- File the deed with the local county office: After notarization, the deed needs to be filed with the appropriate county office to make the transfer public record.

After the deed form is fully completed and filed, the property ownership is officially transferred. This process may seem daunting, but with careful attention to detail and a clear understanding of the requirements, it can be managed smoothly. Remember, each step is integral to ensuring the legal and official transfer of property ownership.

Understanding Deed

What is a deed form?

A deed form is a legal document that signifies the transfer of ownership of real property from one party, known as the grantor, to another, known as the grantee. It contains details about the property being transferred, the identities of both the grantor and the grantee, and must be signed by the grantor to be effective.

Are there different types of deed forms?

Yes, there are several types of deed forms, each serving a different purpose. The most common ones include the warranty deed, which provides the grantee with the highest level of protection; the quitclaim deed, which transfers only the grantor's interest in the property without any warranties of clear title; and the special warranty deed, which limits the warranty provided by the grantor to the period during which they owned the property.

Why is a deed form important?

A deed form is crucial because it legally formalizes the transfer of property rights. Without a properly executed deed, the transfer of real estate ownership might not be recognized by law, endangering the grantee's title and rights to the property. This document is also important for recording purposes, as it provides a public record of property ownership changes.

What details are included in a deed form?

A typical deed form includes the legal description of the property, the names and signatures of the grantor(s) and grantee(s), the date of the transfer, and a statement of consideration, which is the value exchanged for the property. Some deeds might also include warranty clauses or, in the case of a quitclaim deed, a statement that the transfer is made without warranties.

Is a deed form required to be notarized?

Most jurisdictions require that a deed form be notarized to verify the identity of the signing parties and to acknowledge that the signatures were made willingly and under no duress. Notarization helps in preventing fraud and adds a layer of security to the transfer process. Upon notarization, the deed form is usually ready to be filed with the local county recorder's office.

How does one obtain a deed form?

Deed forms can be obtained from several sources, including online legal document services, local real estate agents, or an attorney's office. It's important to ensure that the form complies with the legal requirements of the jurisdiction where the property is located. For this reason, consulting with a real estate attorney can be a reliable way to obtain an appropriate deed form.

What happens after a deed form is signed and notarized?

After a deed form is signed and notarized, it should be filed with the county recorder's or land registry office in the county where the property is located. This step, known as recording, makes the document part of the public record. Recording the deed is essential for protecting the grantee's interests, as it provides notice to the public of the grantee's rightful ownership of the property.

Can a deed form be changed or revoked once it's executed?

After a deed form is fully executed – meaning it has been signed, notarized, and recorded – it cannot be changed or revoked unilaterally. Any modification to the terms or to the property's ownership would require a new deed to be executed and recorded, reflecting the current intentions of the parties involved. In cases where one party wishes to change the deed without the other's agreement, legal action may be required.

Are there any specific considerations for filling out a deed form?

When filling out a deed form, accuracy is paramount. A mistake in the legal description of the property or in the names of the parties can lead to disputes or could invalidate the deed. It's also important to use the correct deed type for the transaction's needs and to understand the implications of the warranties being made or disclaimed. Because of these complexities, consulting with a professional, such as a real estate attorney, is often recommended to ensure that the deed is properly executed and meets legal requirements.

Common mistakes

Filling out a Deed form is a crucial step in transferring property ownership, yet many make mistakes due to lack of understanding or attention to detail. One common mistake is not checking the type of Deed required for the property transfer. Different types of deeds, such as warranty deeds or quitclaim deeds, provide various levels of protection and guarantees about the property's title. Choosing the wrong type can have significant legal implications.

Another error occurs when people inaccurately describe the property on the Deed form. This description must match the legal description used in public records, including boundaries and any easements. Incorrect or incomplete descriptions can lead to disputes about the property's extent and features that are being transferred.

Often, individuals forget to verify or include all the necessary parties in the transaction. If the property is owned jointly, all owners must sign the Deed for the transfer to be valid. Failure to include all legal owners can render the transfer null and void.

Not securing a new title insurance policy is also a frequent oversight. When a property changes hands, a new title insurance policy should be issued to protect the new owner against past defects in title. This step is skipped by many, leaving them vulnerable to unforeseen claims or legal issues.

The importance of signing the Deed in the presence of a notary is sometimes underestimated. The law requires that the signatures on the document be notarized to verify the identity of the signatories and confirm their willingness to sign. Neglecting this formal requirement can lead to questions about the Deed’s authenticity.

Improper filing of the completed Deed with the local county office is another common error. This document needs to be filed correctly to be legally effective. Late or incorrect filing can delay the transfer process or even invalidate the Deed.

Many also mistakenly believe that once the Deed form is filled out and signed, no further action is required. However, some jurisdictions require additional forms, such as a property transfer affidavit, to be filed along with the Deed. Failing to submit these can complicate or delay the transfer process.

Overlooking the requirement to declare the sale for tax purposes can lead to issues with tax authorities. Certain transfers might be taxable, and not declaring them may result in fines or penalties.

Introducing errors in personal information, such as misspelling names or entering incorrect addresses, is a minor but significant mistake. Such inaccuracies can question the parties' identities, leading to potential challenges in validating the transfer.

Last but not least, some individuals fail to consult with a professional when completing a Deed form. Real estate transactions can be complex, and professional guidance ensures that all legal requirements are met and common mistakes avoided.

Documents used along the form

When it comes to buying or selling property, a deed is a crucial document that officially transfers ownership from one party to another. However, this process involves more than just a deed. Several other forms and documents play vital roles in ensuring the transaction is legal, binding, and in accordance with local and state regulations. Below is a list of ten such documents often used alongside the deed form to facilitate a smooth property transaction.

- Title Search Report: This report outlines the historical records of the property, including previous owners, and reveals any liens, easements, or other encumbrances on the property. It's essential for confirming the seller's right to transfer ownership.

- Purchase Agreement: This contract between the buyer and seller details the terms of the sale, including price, property boundaries, and any conditions or contingencies that must be met before the sale is finalized.

- Mortgage Documents: For buyers who are financing the purchase, mortgage documents outline the terms of the loan, including interest rate, repayment schedule, and the rights of the lender.

- Closing Disclosure: Required for most real estate transactions, this document provides a detailed breakdown of all the costs associated with the transaction, including taxes, fees, and any other charges.

- Home Inspection Report: Before finalizing a purchase, a professional inspector assesses the property for any structural problems or necessary repairs. This report informs the buyer about the condition of the property.

- Property Survey: This document provides detailed information about the property's boundaries, improvements (like buildings or fences), and any encroachments from neighboring properties. It's essential for resolving any disputes about property lines.

- Home Warranty Policy: A home warranty can provide buyers with peace of mind by offering coverage for the cost of repairs or replacement of the home's major systems and appliances.

- Flood Zone Statement: This document informs about whether the property is in a flood zone, which affects insurance requirements and costs.

- Lead-Based Paint Disclosure: For homes built before 1978, this disclosure is required by federal law; it informs buyers about the presence of lead-based paint, which can pose health risks.

- Appraisal Report: An appraisal determines the property's fair market value. Lenders often require this to ensure the property is worth the loan amount.

These documents complement the deed by providing a comprehensive view of the property's legal, financial, and physical condition, helping all parties involved make informed decisions. While the process might seem overwhelming, each document serves to protect the interests of both buyers and sellers, ensuring a transparent and fair transaction.

Similar forms

A deed form is closely related to a warranty deed, which also serves as a legal instrument to transfer property. A warranty deed guarantees that the grantor holds clear title to a piece of real estate and has the right to sell it, providing the buyer with greater protection against future claims to the property. Both documents are essential in real estate transactions to ensure the proper transfer of ownership rights.

Similarly, a quitclaim deed is another cousin of the deed form. While it transfers an owner's interest in property, it does not offer the same level of guarantee about the title as a warranty deed does. Quitclaim deeds are commonly used between family members or to clear up title issues, emphasizing the varying levels of protection provided by different types of deed forms.

The grant deed is another document similar to the deed form, utilized mainly to convey and guarantee that a property has not been sold to someone else. Like a warranty deed, it contains promises about the property's title but generally offers fewer guarantees than the warranty deed. This similarity highlights the nuanced differences in the type of rights and protections transferred by each deed form.

Mortgage documents also share similarities with deed forms, as they signify a borrower's agreement to put a property as security for a loan. While a deed transfers property ownership, a mortgage documents the terms under which the ownership can be reclaimed by the lender should the borrower default on the loan, illustrating different facets of property rights and transactions.

A promissory note, often used in conjunction with mortgage documents, embodies a written promise to pay a specified sum of money. While not transferring property rights directly, it is integral to transactions involving deeds by detailing the financial obligations that accompany the property's conveyance, thereby influencing the terms under which property is held or transferred.

The transfer-on-death (TOD) deed, also known as a beneficiary deed, allows property owners to name a beneficiary who will receive the property upon the owner's death, bypassing probate. This document shares the deed form's goal of transferring property rights, albeit with the specific timing and conditions that distinguish it within estate planning and property transfer contexts.

A trustee's deed is used when property is held in a trust and the trustee is authorized to sell the property. This type of deed confirms the trustee's authority to transfer the property, similar to how other deeds confirm the grantor's right to sell. The comparison underscores the role of legal documents in validating and facilitating property transfers under varied circumstances.

The easement agreement provides a right of use over the real property of another, typically for a specific purpose, such as utilities or access. Although it does not transfer ownership of the property, it creates significant rights to use the property, which can affect the property's enjoyment and value, paralleling the impact of a deed form in determining property use and ownership parameters.

A land contract outlines the terms under which property will be purchased, including payment schedule, interest rate, and when legal title will transfer. This agreement shares the deed form's focus on transferring property rights but does so over time and under conditions specified by the contract, blending elements of a deed and a financing agreement.

Last but not least, a power of attorney (POA) for property management can resemble a deed in the sense that it grants someone the authority to handle property transactions on behalf of the property owner. Although the POA does not transfer property ownership, it delegates the power to manage or transact with the property within specified or general terms, reflecting the important theme of control and stewardship over property rights in various legal contexts.

Dos and Don'ts

When filling out a Deed form, it's crucial to handle the process with care and attention to detail. Below, find a list of dos and don’ts that should be taken into consideration.

Do:

Review the entire form before starting to ensure you understand all requirements.

Use black ink or type the information electronically for clarity and permanence.

Double-check legal descriptions of the property to ensure accuracy; mistakes here can lead to significant legal issues.

Have all necessary parties available to sign the deed, as required by law.

Notarize the document if required by your state or jurisdiction to validate its authenticity.

Keep a copy of the completed deed for your records before submitting it to the county recorder's office.

Don’t:

Rush through filling out the form without verifying all information.

Use non-permanent ink that may fade or blur over time, making the document hard to read.

Overlook the requirement for witness signatures if your state demands them.

Forget to check for any restrictions or clauses that might affect the transfer of the property.

Assume the form does not need to be notarized; always confirm with local laws.

Delay in recording the deed after completion, as this could impact legal ownership.

Misconceptions

When it comes to transferring property ownership, deeds play a crucial role. However, several misconceptions about the deed process often lead to confusion. Understanding the facts can help individuals navigate these processes more effectively. Here are five common misconceptions:

All deeds are the same. This is not true. There are various types of deeds, such as warranty deeds, quitclaim deeds, and special warranty deeds, each serving different purposes and offering varying levels of protection to the buyer.

A deed guarantees a clear title. Not all deeds provide a guarantee of a clear title. For example, a quitclaim deed transfers only the interest the grantor has in the property, if any, without any representation that the title is clear.

Filing a deed is complicated and time-consuming. While the process of filing a deed with the appropriate county office involves several steps, including ensuring the document meets specific state and local requirements, it is generally straightforward. Professionals can assist in simplifying this process.

Once a deed is signed, the transaction is complete. Signing the deed is a critical step, but the transaction isn't complete until the deed is delivered to the grantee (the person receiving the property) and filed (recorded) with the county recorder's office or appropriate government entity.

A deed and a title are the same thing. This is a common misunderstanding. A deed is a physical legal document that transfers ownership of the property, while a title is a conceptual term that represents the legal right to own, use, and dispose of that property.

Key takeaways

Completing a Deed form correctly is crucial for the legal transfer of property ownership. Here are key takeaways to ensure this process is handled efficiently and accurately:

- Before starting, ensure you have the correct Deed form for your transaction. Different types of Deeds serve different purposes.

- Verify the legal description of the property. This includes the property's boundaries, land measurements, and any reference made to mapped plots. Accuracy in this detail is critical for the Deed's validity.

- Include the full legal names of both the grantor (seller) and grantee (buyer). It is essential these names are spelled correctly and match any related legal documents.

- State clearly the consideration, which is the value being exchanged for the property. Though often monetary, consideration can also be other forms of compensation.

- Ensure that notarization is part of the process. A notary public must witness the signing of the Deed for it to be legally valid.

- The grantor's signature is required on the Deed form. Depending on the state law, the grantee might also need to sign.

- Check if there are any state-specific requirements. Some states require additional witnesses beyond a notary public, and others may have specific forms or disclosures that must be attached.

- It is advisable to review the Deed with a real estate attorney. Legal advice can prevent future disputes and assure that the Deed complies with all local laws.

- Once the Deed is complete, it must be filed with the local County Recorder's Office or a similar government entity. This public recordation formally completes the property transfer.

- Keep copies of the recorded Deed for personal records. Having access to this document is important for future transactions or verifying property ownership.

By attentively following these steps, the individuals involved can ensure a seamless and legally sound transfer of property ownership. This not only secures the rights of the buyer and seller but also establishes a clear and indisputable record of the transaction for future reference.

Other Templates

Bill of Sale California Template - It signals the conclusion of the sales process, allowing both parties to have closure and a clear record of the transaction.

Basic Short Rental Agreement - It helps landlords manage their properties efficiently with clear week-to-week bookings.

What Is an Employment Verification Letter - Includes employer's contact information, employee's job details, and sometimes reason for termination.