Official Business Purchase and Sale Agreement Document

When navigating the complexities of buying or selling a business, one of the most crucial steps involves documenting the transaction through a Business Purchase and Sale Agreement. This formal document outlines the terms and conditions under which the business will change hands, capturing details such as the purchase price, assets and liabilities being transferred, and any contingencies that must be satisfied before the deal is finalized. It serves as a binding contract between the buyer and seller, providing a roadmap for the transaction and helping to prevent misunderstandings or disputes that could arise during the process. Additionally, it addresses representations and warranties made by both parties, establishing confidence and accountability. Designed to protect the interests of both buyer and seller, this agreement not only facilitates a smoother transition but also ensures that each party is clear on their rights and obligations, making it an indispensable part of the business sale process.

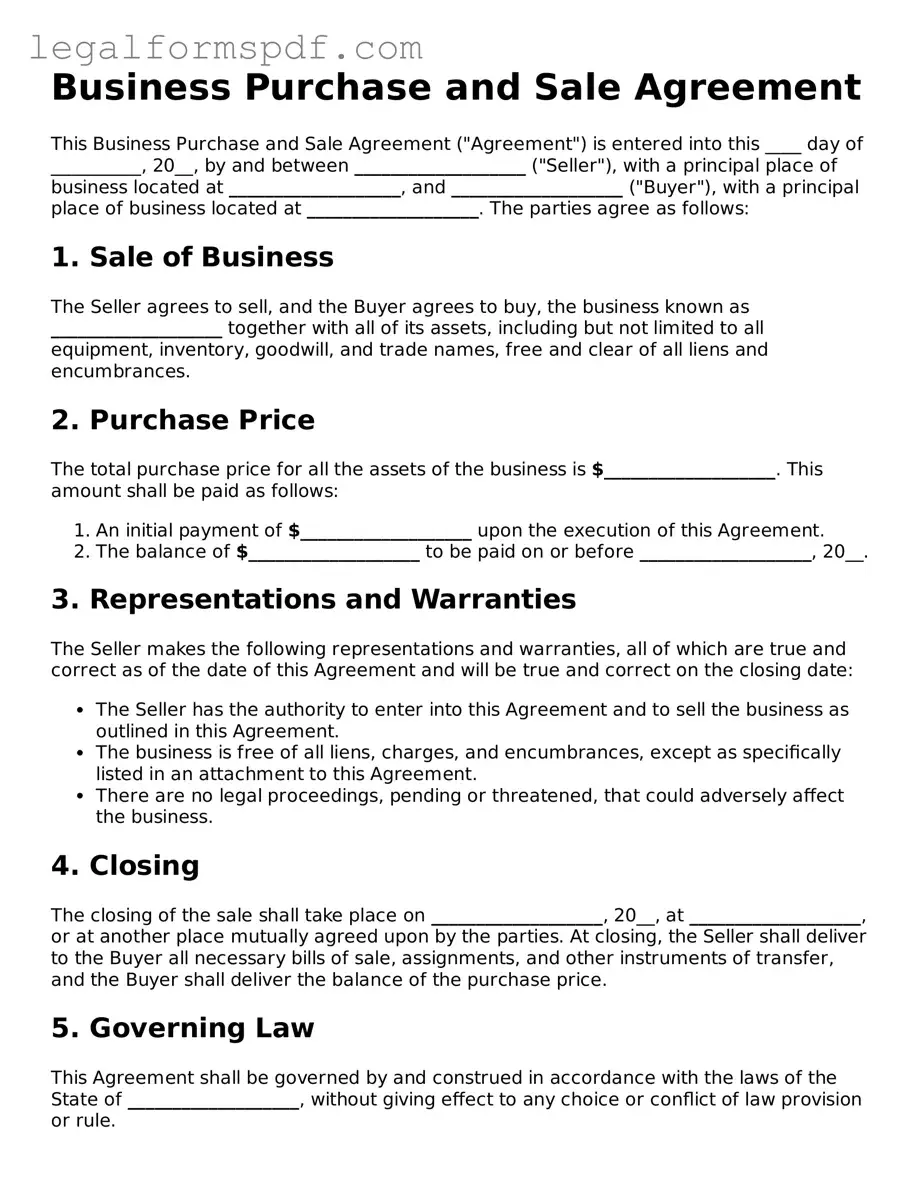

Document Example

Business Purchase and Sale Agreement

This Business Purchase and Sale Agreement ("Agreement") is entered into this ____ day of __________, 20__, by and between ___________________ ("Seller"), with a principal place of business located at ___________________, and ___________________ ("Buyer"), with a principal place of business located at ___________________. The parties agree as follows:

1. Sale of Business

The Seller agrees to sell, and the Buyer agrees to buy, the business known as ___________________ together with all of its assets, including but not limited to all equipment, inventory, goodwill, and trade names, free and clear of all liens and encumbrances.

2. Purchase Price

The total purchase price for all the assets of the business is $___________________. This amount shall be paid as follows:

- An initial payment of $___________________ upon the execution of this Agreement.

- The balance of $___________________ to be paid on or before ___________________, 20__.

3. Representations and Warranties

The Seller makes the following representations and warranties, all of which are true and correct as of the date of this Agreement and will be true and correct on the closing date:

- The Seller has the authority to enter into this Agreement and to sell the business as outlined in this Agreement.

- The business is free of all liens, charges, and encumbrances, except as specifically listed in an attachment to this Agreement.

- There are no legal proceedings, pending or threatened, that could adversely affect the business.

4. Closing

The closing of the sale shall take place on ___________________, 20__, at ___________________, or at another place mutually agreed upon by the parties. At closing, the Seller shall deliver to the Buyer all necessary bills of sale, assignments, and other instruments of transfer, and the Buyer shall deliver the balance of the purchase price.

5. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of ___________________, without giving effect to any choice or conflict of law provision or rule.

6. Amendments

This Agreement may only be amended or modified by a written document executed by both parties.

7. Entire Agreement

This Agreement constitutes the entire agreement between the parties and supersedes all prior understandings, agreements, or representations by or between the parties, written or oral, to the extent they relate in any way to the subject matter hereof.

8. Signatures

In witness whereof, the parties have executed this Agreement as of the date first above written.

Seller: ___________________________________

Date: ___________________________________

Buyer: ___________________________________

Date: ___________________________________

PDF Specifications

| Fact Number | Detail |

|---|---|

| 1 | The Business Purchase and Sale Agreement outlines the terms of the sale of a business from one party to another. |

| 2 | This agreement includes specifics such as payment amount, payment method, and any conditions precedent to the sale. |

| 3 | It ensures a clear understanding between buyer and seller of what is expected from each party. |

| 4 | Confidentiality clauses may be included to protect sensitive information shared during the sale process. |

| 5 | Legal descriptions of the business being sold, including assets and liabilities, are detailed in the agreement. |

| 6 | It may specify any non-compete agreements to prevent the seller from starting a competing business. |

| 7 | Governing laws are specified based on the state where the transaction is taking place. |

| 8 | Due diligence periods, allowing the buyer to verify the business's financials and operations, are often included. |

Instructions on Writing Business Purchase and Sale Agreement

When it comes to buying or selling a business, the Business Purchase and Sale Agreement form plays a crucial role. This document outlines the specific terms and conditions of the sale, ensuring both parties have a clear understanding of their rights and responsibilities. This form can appear daunting at first glance, but breaking down the process into simple steps makes it more manageable. The correctly filled-out form is a cornerstone for a successful transaction, providing a legal foundation that protects everyone involved. Here’s how you can fill it out.

- Start by gathering all necessary information about the business that's being sold. This includes the legal name of the business, its structure (such as LLC, corporation, etc.), and the physical address.

- Identify the buyer and the seller. Include full legal names, contact information, and any agents or representatives acting on their behalf in the transaction.

- List the assets or shares being sold. Detail all physical and intangible assets, including inventory, equipment, trademarks, and customer lists, if applicable.

- Specify the purchase price and the terms of payment. Clearly state the total amount to be paid for the business and outline the payment schedule, whether it's a lump sum or installments.

- Include any representations and warranties provided by the seller. This could encompass assurances regarding the legal status of the business, its financial health, or the condition of its assets.

- Outline any contingencies that must be met before the sale is finalized. Common contingencies include the buyer securing financing or the completion of a due diligence investigation.

- Detail the closing terms. Specify the date, location, and any conditions that must be met by both parties prior to this event.

- Include provisions for handling disputes. Agree on a mechanism for resolving any disagreements that may arise regarding the agreement’s terms.

- State the governing law. Specify which state’s law will govern the interpretation and enforcement of the agreement.

- Leave space at the end of the document for both parties to sign and date, legally binding them to the agreement. Ensure that each party has a witness present during the signing to validate the authenticity of the signatures.

Filling out the Business Purchase and Sale Agreement requires careful attention to detail and a clear understanding of the terms involved. Once completed and signed, this document serves as a binding contract that governs the transaction. It's advisable for both parties to review the agreement thoroughly and consult with legal counsel if there are any questions or concerns. By following these steps, sellers and buyers can navigate the legal intricacies of transferring ownership and set the stage for a successful transition.

Understanding Business Purchase and Sale Agreement

What is a Business Purchase and Sale Agreement?

A Business Purchase and Sale Agreement is a legally binding document that outlines the terms and conditions under which one party agrees to purchase a business from another party. This comprehensive agreement covers all aspects of the sale, including the purchase price, payment method, assets and liabilities to be transferred, and other critical terms and conditions necessary for a smooth transition of ownership.

Why is it important to have a Business Purchase and Sale Agreement?

Having a Business Purchase and Sale Agreement is crucial because it ensures that both the buyer and the seller have a clear understanding of their rights and obligations regarding the transaction. This document is designed to prevent misunderstandings by detailing the entire agreement in writing, protecting the interests of both parties and providing a legal framework to resolve disputes should they arise.

What should be included in a Business Purchase and Sale Agreement?

The agreement should include detailed information such as the names and contact information of the buyer and seller, a description of the business being sold, the purchase price and payment terms, a list of assets and liabilities included in the sale, any conditions precedent to the closing, and warranties and representations made by the seller. It may also cover any adjustments to be made, terms of non-compete agreements, and provisions for breach of contract.

How is the purchase price determined in a Business Purchase and Sale Agreement?

The purchase price is typically one of the primary negotiation points in a business sale. It can be determined through various methods, such as a valuation of the business’s assets, earnings, market position, and potential for future growth. Both parties may agree upon a price after conducting their own independent appraisals or negotiations, taking into consideration any liabilities that will be assumed by the buyer.

Can the terms of a Business Purchase and Sale Agreement be negotiated after it’s been signed?

Once a Business Purchase and Sale Agreement has been signed, its terms are legally binding. However, if both the buyer and seller agree to amend certain aspects of the agreement, they can do so by signing a written amendment. It's important to note that any changes should be documented in writing and signed by both parties to ensure the modifications are legally enforceable.

What happens if one party breaches the Business Purchase and Sale Agreement?

If one party breaches the Business Purchase and Sale Agreement, the non-breaching party has the right to seek legal remedies. These can include enforcing the agreement through specific performance, seeking damages for financial losses incurred due to the breach, or terminating the agreement under certain conditions. The exact remedies available will depend on the terms of the agreement and the nature of the breach.

Common mistakes

One common mistake made during the filling out of a Business Purchase and Sale Agreement is neglecting to accurately detail the assets included in the sale. It's critical that both tangible and intangible assets are thoroughly listed. This oversight can lead to disputes and confusion, undermining the integrity of the agreement. Ensuring that every asset, from physical equipment to intellectual property, is accounted for, creates clarity for both the buyer and seller.

Another area where errors frequently occur is in the allocation of liabilities. Sometimes, individuals fail to specify which party will bear the burden of existing debts or obligations. This ambiguity can lead to significant legal and financial complications down the line. Clearly defining how liabilities are handled protects both parties and ensures a smoother transaction process.

A third mistake involves inaccuracies in representing the financial state of the business. A comprehensive and truthful disclosure of the business's financial health is essential. When parties do not accurately represent these financials, it can lead to breaches of trust and potential legal action. Ensuring that all financial documents and statements are accurate and up-to-date is crucial for a transparent and fair deal.

Failure to outline dispute resolution mechanisms within the agreement is another common oversight. Without a clear plan for managing disputes, parties may find themselves embroiled in costly and time-consuming litigation. Including terms for mediation, arbitration, or other forms of dispute resolution can save both parties time and money in the event of a disagreement.

Lastly, a significant number of individuals mistakenly neglect to seek legal advice when drafting or signing a Business Purchase and Sale Agreement. This decision can lead to oversight of vital legal protections and clauses. Consulting with a legal professional can help ensure that the agreement is comprehensive, legally sound, and tailored to the specific needs of both the buyer and the seller. This step, often perceived as an unnecessary expense, can actually prevent costly mistakes and oversights.

Documents used along the form

When individuals embark on the journey of buying or selling a business, they encounter a variety of documents beyond the Business Purchase and Sale Agreement. These documents are crucial as they provide additional details, set the terms and conditions, and ensure a smooth and transparent transaction. Below is a list of six important forms and documents commonly used alongside the Business Purchase and Sale Agreement. Each serves a specific purpose, facilitating various aspects of the transaction process.

- Bill of Sale: This document provides proof of the transfer of business ownership. It lists the assets and liabilities being transferred as part of the sale, including equipment, inventory, and intellectual property.

- Non-Disclosure Agreement (NDA): Often used in the preliminary stages of a purchase, this agreement ensures that all confidential information disclosed during the negotiation process remains private.

- Due Diligence Checklist: A critical document that outlines all the information a buyer needs to verify before proceeding with the purchase. This includes financial statements, contracts, leases, and employee information.

- Employment Agreement(s): If the acquisition includes retaining current employees, new employment agreements may be drafted to outline the terms of their continued employment under the new ownership.

- Promissory Note: Should the purchase be financed by the seller, this document outlines the terms of repayment. It specifies the loan amount, interest rate, repayment schedule, and any collateral securing the loan.

- Closing Statement: This document summarizes the transaction's details, including the final sale price, adjustments, closing costs, and the distribution of funds. It provides a comprehensive closure on the financial aspects of the deal.

Together with the Business Purchase and Sale Agreement, these documents play a pivotal role in ensuring that both buyer and seller are well-informed and protected throughout the transaction process. By understanding the purpose and importance of each document, parties can navigate the complexities of buying or selling a business with greater ease and confidence.

Similar forms

The Asset Purchase Agreement (APA) is remarkably similar to the Business Purchase and Sale Agreement, primarily because both deal with the buying and selling of business assets. However, the APA specifically focuses on the transfer of all or part of a company's assets, rather than the entire business entity. This crucial distinction means that while both documents outline the terms, conditions, and covenants of the transaction, the APA is tailored to situations where the buyer may not wish to take on the seller's legal liabilities.

The Bill of Sale document shares a common purpose with the Business Purchase and Sale Agreement in that it evidences the transfer of ownership of assets from the seller to the buyer. However, the Bill of Sale is generally used for more straightforward transactions involving tangible assets only, such as equipment or vehicles, and lacks the comprehensive nature of business purchase agreements which cover assets, liabilities, and more detailed terms of sale.

Partnership Agreements closely resemble the Business Purchase and Sale Agreement when a business transaction involves the buyout or sale of a partner's interest in a company. While both documents facilitate the transfer of business ownership, a Partnership Agreement places more emphasis on the ongoing operations and management of the business post-transaction, detailing the roles, responsibilities, and profit-sharing arrangements between the remaining and/or new partners.

The Stock Purchase Agreement (SPA) is akin to the Business Purchase and Sale Agreement as it's used in transactions involving the sale of a company. However, the SPA specifically involves the transfer of ownership through the sale of shares in the company rather than its physical or intangible assets. This distinction makes the SPA particularly relevant for corporation transactions, where the buyer takes over the seller's shareholding position, thus gaining control of the company.

Franchise Agreements bear a resemblance to Business Purchase and Sale Agreements in the context of buying and selling business operations. Both documents govern the transfer and operation of a business. However, Franchise Agreements are unique in that they grant the buyer (franchisee) the rights to operate a business under the franchisor's name, following specific guidelines and operations set by the franchisor, which is not typically the case in a standard business sale.

The Commercial Lease Assignment Agreement parallels the Business Purchase and Sale Agreement when a business being sold operates out of leased premises. This document is critical for transferring the seller's interest in a commercial lease to the buyer, ensuring the continuity of the business's physical location under the terms agreed upon by the original lessee and the landlord. It is a necessary step in transactions where the business' physical location is integral to its operation and value.

The Non-Disclosure Agreement (NDA) complements the Business Purchase and Sale Agreement by safeguarding the confidentiality of the information exchanged during the negotiation and due diligence phases of a business sale. While the NDA itself does not facilitate the sale, it is often executed in conjunction with business purchase transactions to protect the proprietary and sensitive information of the business being sold, ensuring that such information is not improperly disclosed or used.

Dos and Don'ts

When entering into a Business Purchase and Sale Agreement, both sellers and buyers should undertake this process with great attention and care. This document legally binds both parties to the sale terms of a business, making it crucial to avoid errors that could lead to disputes or legal complications. Here are some key do's and don'ts to consider:

Do's:

- Review all sections carefully before filling them out to ensure you understand the requirements and implications.

- Use clear and concise language to prevent any misunderstandings or ambiguity.

- Be accurate with financial figures and dates, as any inaccuracies can lead to significant issues down the line.

- Consult with a legal professional if there are any clauses or terms you do not understand.

- Ensure all parties’ names are spelled correctly and match their legal documentation.

- Discuss and agree on the allocation of costs such as taxes, fees, and other expenses related to the sale.

- Specify the conditions under which the agreement can be terminated to avoid future disputes.

- Include a confidentiality clause if sensitive information is being exchanged.

- Clearly define the assets and liabilities being transferred to avoid confusion.

- Have all parties sign and date the document to validate the agreement.

Don'ts:

- Avoid making verbal agreements outside of the documented contract, as they are difficult to enforce.

- Do not rush through the process without giving each section the attention it requires.

- Refrain from using vague or ambiguous terms that could lead to different interpretations.

- Do not skip having the agreement reviewed by a professional, even if it seems straightforward.

- Avoid altering the agreement after it has been signed without the consent of all parties involved.

- Do not neglect to disclose any known issues or liabilities of the business that could affect the sale.

- Refrain from omitting any relevant attachments or appendices that are referenced in the agreement.

- Avoid signing the agreement if you have any unresolved concerns or questions.

- Do not underestimate the importance of the closing date, as it has legal and financial implications.

- Refrain from overlooking the need for written consent from any party whose consent is necessary for the sale.

Misconceptions

When it comes to buying or selling a business, the Business Purchase and Sale Agreement form is a crucial document. However, there are several misconceptions about this agreement that can lead to confusion or missteps. Here's a clear-up of some common misunderstandings:

It's just a standard form. Many believe that this agreement is a one-size-fits-all document. In reality, it should be meticulously customized to fit the specifics of each transaction, protecting all parties involved.

Legal help isn't necessary. Given the complexity and the significant implications of these agreements, securing advice from a legal professional is critical. They ensure the agreement is comprehensive and legally enforceable.

It only covers the sale price. The agreement addresses far more than just the purchase price. It includes terms about the transition period, employee contracts, asset listings, and potential liabilities, among other critical elements.

Verbal agreements are enough. While verbal agreements might sound simple, they aren’t legally binding in the context of business sales. Documentation is key to enforce the terms of the deal.

It's only necessary for large businesses. Regardless of size, when a business changes hands, a formal agreement is essential. Small businesses also have complexities that require clear documentation.

Once signed, it's set in stone. Negotiations can lead to amendments before the final sale, provided both parties agree. However, after closing, changes are significantly more challenging to implement.

There's no need to disclose certain information. Full disclosure is a fundamental aspect of these agreements. Hiding liabilities or overstating assets can lead to legal repercussions.

It doesn't affect ongoing contracts. The agreement can significantly impact existing contracts with clients, suppliers, and employees. It’s crucial to understand how these relationships transition post-sale.

It guarantees future business performance. These agreements do not guarantee the future success of the business. Buyers should due diligence in assessing the business's viability.

All terms are financially oriented. While financial clauses are significant, other critical terms include confidentiality, non-compete clauses, and dispute resolution mechanisms, emphasizing the multi-faceted nature of these agreements.

Understanding these misconceptions and approaching the Business Purchase and Sale Agreement form with a well-informed perspective can significantly impact the outcome of a business sale or purchase. Engaging knowledgeable legal counsel is advised to navigate this critical document effectively.

Key takeaways

When entering the process of buying or selling a business, the Business Purchase and Sale Agreement form is a crucial document. This agreement outlines the terms and conditions of the sale, ensuring both parties are clear on their obligations, rights, and expectations. Below are key takeaways to keep in mind when filling out and using this form:

- Detail is Key: Clearly outline all aspects of the sale, including the purchase price, payment structure, and any conditions precedent to the sale. Specificity can prevent misunderstandings and disputes.

- Legal Descriptions are Essential: Include precise descriptions of what is being sold. This not only covers the physical assets and inventory but also intangible assets like intellectual property and goodwill.

- Warranties and Representations Must Be Accurate: Both parties should thoroughly disclose the business' operational, financial, and legal status. Accurate representations can protect against potential liability after the sale.

- Understand the Impact of Non-Compete Clauses: Such clauses can restrict the seller's ability to start a new, competing business. Both parties must understand and agree to these terms.

- Consider Contingencies: Contingencies, such as securing financing or passing regulatory approvals, should be clearly defined. These conditions protect both the buyer and seller by outlining conditions that must be met for the sale to proceed.

- Seek Professional Help: Given the legal and financial complexities of selling or buying a business, consulting with professionals such as lawyers and accountants can provide valuable insights and help avoid costly errors.

Taking these points into account can facilitate a smoother transaction and help protect the interests of all parties involved in the sale of a business.

Other Templates

How to Address a Letter to a Judge - The goal of a Character Letter for Court is not to dispute legal facts but to provide a supplementary perspective on the individual’s moral standing and personal development.

Draft Letter of Recommendation - Typically detailed and thoughtfully composed, it outlines specific examples of the applicant's achievements and their impact on previous roles or projects, providing a tangible measure of their capabilities.

California Vehicle Title - This form protects a seller from liability after a vehicle is sold, transferring responsibility to the new owner.