Fillable Tractor Bill of Sale Document for Texas

When purchasing or selling a tractor in Texas, a comprehensive document, known as the Texas Tractor Bill of Sale form, plays a pivotal role in the transaction. This crucial form not only facilitates a smoother transition of ownership but also serves as a legal record that documents the details of the exchange between the buyer and the seller. It encompasses vital information such as the make, model, and year of the tractor, the agreed-upon sale price, and the personal details of the involved parties, ensuring that all aspects of the sale are transparent and traceable. The importance of the Texas Tractor Bill of Sale form extends beyond the mere acknowledgment of the sale, providing both parties with protection in the case of future disputes or inquiries regarding the tractor’s ownership or condition at the time of sale. Given its legal significance, the form must be completed with accuracy and diligence, underpinning the legality of the tractor's transfer and offering a foundation for a secure and trustworthy transaction.

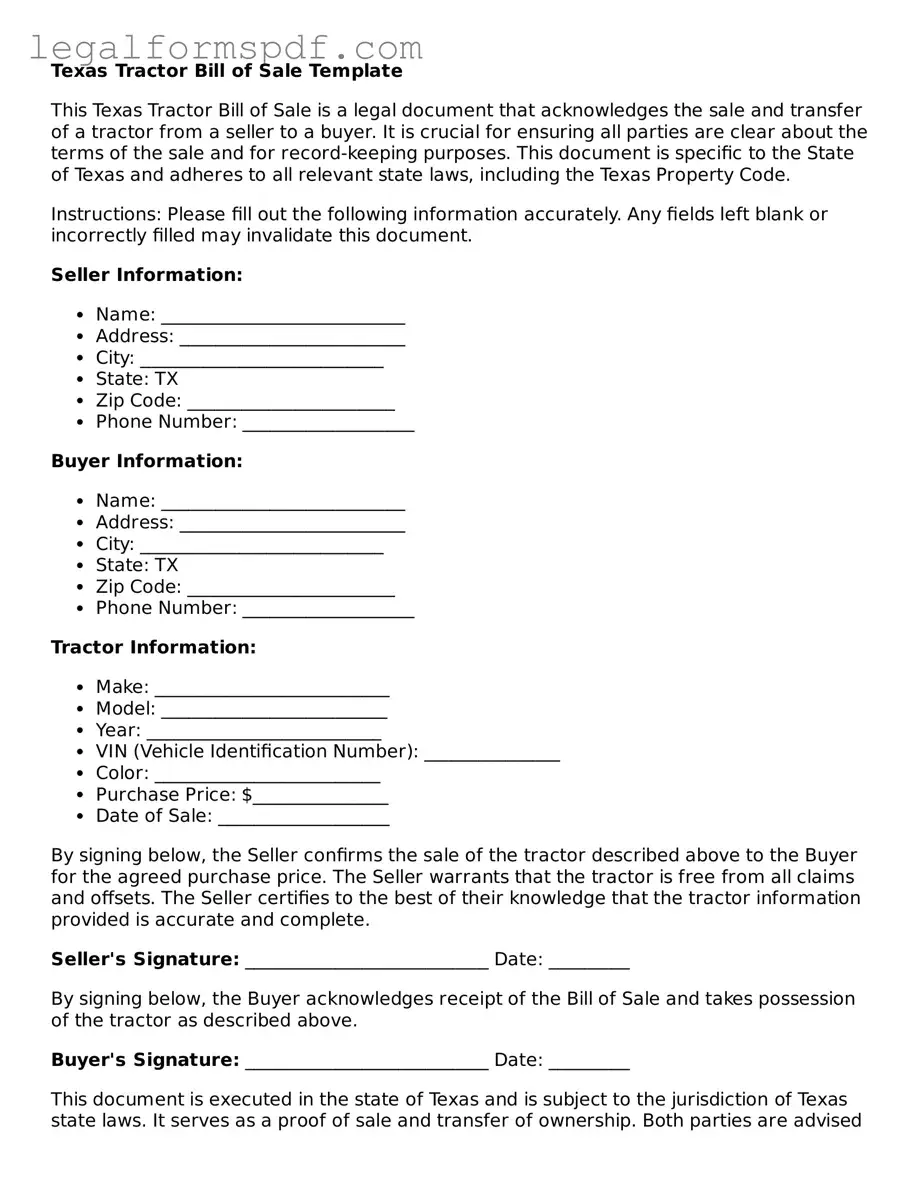

Document Example

Texas Tractor Bill of Sale Template

This Texas Tractor Bill of Sale is a legal document that acknowledges the sale and transfer of a tractor from a seller to a buyer. It is crucial for ensuring all parties are clear about the terms of the sale and for record-keeping purposes. This document is specific to the State of Texas and adheres to all relevant state laws, including the Texas Property Code.

Instructions: Please fill out the following information accurately. Any fields left blank or incorrectly filled may invalidate this document.

Seller Information:

- Name: ___________________________

- Address: _________________________

- City: ___________________________

- State: TX

- Zip Code: _______________________

- Phone Number: ___________________

Buyer Information:

- Name: ___________________________

- Address: _________________________

- City: ___________________________

- State: TX

- Zip Code: _______________________

- Phone Number: ___________________

Tractor Information:

- Make: __________________________

- Model: _________________________

- Year: __________________________

- VIN (Vehicle Identification Number): _______________

- Color: _________________________

- Purchase Price: $_______________

- Date of Sale: ___________________

By signing below, the Seller confirms the sale of the tractor described above to the Buyer for the agreed purchase price. The Seller warrants that the tractor is free from all claims and offsets. The Seller certifies to the best of their knowledge that the tractor information provided is accurate and complete.

Seller's Signature: ___________________________ Date: _________

By signing below, the Buyer acknowledges receipt of the Bill of Sale and takes possession of the tractor as described above.

Buyer's Signature: ___________________________ Date: _________

This document is executed in the state of Texas and is subject to the jurisdiction of Texas state laws. It serves as a proof of sale and transfer of ownership. Both parties are advised to retain a copy for their records.

PDF Specifications

| Fact | Description |

|---|---|

| Necessity | In Texas, a Tractor Bill of Sale form serves as a legal document to prove the transfer of ownership of a tractor from one party to another. |

| Components | It typically includes details such as the make, model, year, serial number of the tractor, the sale price, and the names and signatures of both the buyer and seller. |

| Governing Law | This form is governed by Texas law and must comply with state requirements, including any specific local mandates related to the sale of personal property. |

| Functionality | Aside from validating the transaction, this document is crucial for the buyer’s registration and titling process of the tractor in Texas. |

Instructions on Writing Texas Tractor Bill of Sale

Once you've agreed to sell or purchase a tractor in Texas, effectively and legally transferring ownership requires a Tractor Bill of Sale form. This document is pivotal; it not only serves as a record of the transaction but also provides necessary information to register the tractor under the new owner's name. Here are the steps to ensure this document is filled out accurately and comprehensively.

- Start by writing the date of the sale at the top of the form.

- Next, fill in the seller's full name and address, including the city, state, and zip code.

- Do the same for the buyer: their full name and address with the city, state, and zip code.

- Then, detail the tractor: make, model, year, and the Vehicle Identification Number (VIN).

- Enter the sale price of the tractor and the date when this amount was or will be paid in full.

- If there are any additional terms and conditions of the sale (e.g., sold "as is", with certain guarantees, etc.), specify them in the designated section.

- Both the seller and buyer should sign and date the bottom of the form, indicating their agreement to the terms of the sale and the accuracy of the information provided.

- Lastly, if applicable, have the form notarized to validate its authenticity further. This step is optional but recommended for added legal protection.

After completing the Tractor Bill of Sale, it's crucial for both parties to keep a copy. This document will be needed for registration purposes and may serve as proof of the transaction's date and terms. Furthermore, it offers both the seller and buyer legal protection in case of disputes. Ensuring the form is filled out correctly and retained signifies a successful transfer of ownership and a clear record of the sale.

Understanding Texas Tractor Bill of Sale

What is a Texas Tractor Bill of Sale form?

A Texas Tractor Bill of Sale form is a legal document that records the sale and transfer of a tractor from one party, the seller, to another, the buyer. This document includes important information such as the tractor's description, the sale price, and the names and signatures of both parties. It serves as proof of purchase and can be used for registration and tax purposes.

Why do I need a Texas Tractor Bill of Sale?

Having a Texas Tractor Bill of Sale is crucial for several reasons. It legally documents the transaction and ownership transfer of the tractor, which is essential for the buyer’s protection. This form is also helpful for tax assessment, and it may be required for the buyer to register the tractor with local Texas authorities. For the seller, it provides legal evidence that they have transferred the ownership and are no longer responsible for the tractor.

What information should be included in a Texas Tractor Bill of Sale?

A comprehensive Texas Tractor Bill of Sale should include the full names and addresses of both the buyer and seller, a detailed description of the tractor (including make, model, year, and serial number), the sale price, the sale date, and any additional terms and conditions agreed upon by both parties. It should also contain the signatures of both the buyer and seller and, ideally, a witness or notary public to validate its authenticity.

Do I need to notarize my Texas Tractor Bill of Sale?

While Texas law does not require a Tractor Bill of Sale to be notarized, having it notarized adds a layer of security and authenticity to the document. A notarized Bill of Sale can help prevent legal disputes by verifying the identity of the parties and the authenticity of their signatures.

Can I create a Texas Tractor Bill of Sale by myself?

Yes, you can create a Texas Tractor Bill of Sale by yourself. Ensure you include all necessary information and follow the guidelines for what should be included in the document. Templates are available online, but be sure to customize it to fit the specifics of your transaction and check for any recent changes in Texas law that might affect the Bill of Sale’s requirements.

What should I do after completing a Texas Tractor Bill of Sale?

Once the Texas Tractor Bill of Sale is completed, both the buyer and seller should keep a copy for their records. The buyer may need to present this document for registration and tax purposes. It's also a good practice to contact your local county tax office to ensure all necessary steps have been taken for a legal transfer of ownership and to inquire about any additional paperwork that may be required.

Common mistakes

When filling out the Texas Tractor Bill of Sale form, a common mistake made by individuals is not including all necessary details. The form requires specific information about both the buyer and the seller, such as full names, addresses, and contact numbers. Omitting any of these details can render the document incomplete or invalid. It's crucial to verify that all sections that require personal information are thoroughly completed to ensure the document's legal efficacy.

Another area where errors frequently occur is in the description of the tractor itself. A complete and accurate description of the tractor, including the make, model, year, and any identifying numbers or marks, is essential. Sometimes, individuals neglect to provide all these details or enter them inaccurately. This oversight can lead to confusion or disputes in the future regarding the tractor's identity. It is advisable to double-check this section for accuracy and completeness.

Incorrect or unclear financial information is also a frequent error on the Texas Tractor Bill of Sale form. The sale price of the tractor must be clearly stated, along with the terms of payment (e.g., whether it is to be paid in installments or in full at the time of purchase). Sometimes, people forget to specify the payment method or misstate the sale amount, which can lead to legal complications or misunderstandings between the parties involved.

Failure to document the date of sale accurately is another common mistake. The transaction's date plays a crucial role for both legal and record-keeping purposes. An incorrect date can lead to issues with warranties, returns, or even legal disputes. Ensuring that the date of sale is correctly recorded helps in establishing an official timeline for the transaction.

Lastly, individuals often overlook the necessity of obtaining signatures from both parties involved in the transaction. The Texas Tractor Bill of Sale form is not legally binding without the signatures of both the buyer and the seller. In some cases, people either forget to sign the document or fail to get it signed by the other party, thereby making the document legally ineffective. It's crucial to ensure that everyone involved signs the form to validate the sale and protect the interests of both parties.

Documents used along the form

When purchasing or selling a tractor in Texas, the Tractor Bill of Sale form is a vital document that formalizes the transaction between the buyer and the seller, ensuring it is legally binding. However, this form is often accompanied by additional documents that serve to further validate the transaction, protect both parties, and fulfill legal requirements. Understanding these documents can provide both buyers and sellers with a clearer, more secure transaction process.

- Certificate of Title: This document is crucial as it officially records the ownership of the tractor. If the tractor is titled, the seller must provide the buyer with a properly endorsed title at the time of sale to transfer ownership legally.

- Odometer Disclosure Statement: Required for tractors equipped with an odometer, this document is a declaration of the vehicle's mileage at the time of sale. It helps to verify the tractor's condition and ensure the accuracy of the information provided by the seller.

- Sales Tax Exemption Certificate: In certain transactions, the buyer might be eligible for a sales tax exemption. This certificate must be completed and submitted where applicable to qualify for an exemption from sales tax on the purchase.

- Proof of Insurance: Although not always a requirement for the purchase transaction itself, proof of insurance is necessary for the new owner to operate the tractor legally on public roads. It ensures that the tractor is covered in case of an accident.

Being familiar with these documents, in addition to the Tractor Bill of Sale, can significantly streamline the purchasing or selling process. Each document carries its importance, ensuring a smooth transfer of ownership, adherence to legal requirements, and protection for both the buyer and the seller. For a hassle-free transaction, it's advisable to prepare and review these documents carefully.

Similar forms

The Texas Tractor Bill of Sale form shares similarities with a Vehicle Bill of Sale, as both serve as legal documentation to transfer ownership from the seller to the buyer. They typically contain details about the item being sold, the sale price, and the parties involved. Both documents also offer protection to the seller and buyer, demonstrating that the transaction was consensual and recording the terms of the sale.

Similar to a Boat Bill of Sale, the Tractor Bill of Sale is essential for transactions involving specific types of property - in this case, tractors and boats, respectively. Each form is tailored to capture the unique details relevant to the item being sold, such as the make, model, and identification numbers, and both are necessary for the proper registration of the item in the buyer’s name.

A Firearm Bill of Sale resembles the Tractor Bill of Sale in that it documents the transfer of ownership of a highly regulated item. This form includes specific information regarding the item's condition, serial number, and any pertinent legal notices. It’s an important document for ensuring compliance with local and federal regulations surrounding private sales of regulated items.

Another document similar to the Texas Tractor Bill of Sale is the General Bill of Sale. This more generic document is used for transactions involving personal property, such as electronics, furniture, or other non-titled property. While less specialized, it serves the same fundamental purpose of documenting the details of a transaction and the change of ownership.

The Livestock Bill of Sale is akin to the Tractor Bill of Sale as both are used in agricultural transactions, facilitating the sale of assets within the farming industry. The Livestock Bill of Sale would detail the sale of animals, including their breed, health status, and quantity, ensuring a clear record of the transaction for both regulatory and tax purposes.

Comparable to the Tractor Bill of Sale, an Aircraft Bill of Sale documents the sale of a very specific type of property—aircraft. It records intricate details about the aircraft, such as its model, make, and serial number, similar to how the tractor bill records details pertinent to agricultural machinery. Besides, both documents are vital for the registration process in the respective authority's registry.

The Mobile Home Bill of Sale, just like the Texas Tractor Bill of Sale, is used to document the sale and transfer of ownership of personal property, in this case, a mobile home. Both documents delineate the condition of the item, the sale price, and identify buyer and seller details, which are necessary for updating records and proving ownership.

Last but not least, the Business Bill of Sale shares characteristics with the Tractor Bill of Sale because it formalizes the transfer of ownership of a business. Although one deals with a piece of machinery and the other with an entire business, both documents serve as a formal agreement detailing the transaction specifics, including any assets, such as equipment, inventory, and intellectual property, to ensure a smooth transition of ownership.

Dos and Don'ts

Filling out a Texas Tractor Bill of Sale form requires attention to detail and a clear understanding of what information is necessary. This document is not only a record of the sale but it also serves as a protection for both the buyer and the seller in the transaction. Here are some guidelines to follow to ensure the process goes smoothly.

- Do ensure all the information provided on the form is accurate. Details such as the make, model, and year of the tractor, as well as the VIN (Vehicle Identification Number), should be double-checked for accuracy.

- Do include both the buyer’s and seller’s full names and addresses. Clear identification of the parties involved is crucial for the validity of the document.

- Do specify the sale price of the tractor. This should be the agreed amount between the buyer and seller.

- Do include the date of the sale. This information is important for record-keeping and potentially for tax purposes.

- Don't leave any fields blank. If a section does not apply, it is better to note it as "N/A" (not applicable) rather than leaving it empty. This prevents misunderstandings or the impression that the form was filled out carelessly.

- Don't sign the bill of sale without ensuring that both parties understand and agree to its contents. The signatures are a declaration that the information is correct and that both parties agree to the terms of the sale.

- Don't forget to make copies of the completed form. Both the buyer and seller should keep a copy of the bill of sale for their records.

- Don't ignore the need for notarization, if required. Some states or circumstances may require the bill of sale to be notarized. It’s important to verify whether this is necessary in Texas or for the particular situation of the sale.

By following these guidelines, the process of filling out a Texas Tractor Bill of Sale form can be straightforward and effective, ensuring that all legal and personal requirements are satisfactorily met.

Misconceptions

When dealing with the Texas Tractor Bill of Sale form, several misconceptions commonly arise. These misconceptions can create confusion and misunderstandings about the documentation requirements and legal considerations involved in the sale and purchase of a tractor in Texas. It's important to address these misconceptions to ensure that the transaction process is conducted smoothly and in compliance with state laws.

- The Bill of Sale is the only document needed to complete the sale. Many people mistakenly believe that the tractor bill of sale form is the sole document required to finalize the sale of a tractor in Texas. However, this is a misconception. In addition to the bill of sale, the seller may also need to provide clear title documentation to transfer ownership officially, and the buyer might need to register the tractor with the appropriate local authorities, depending on the tractor's use and the county regulations.

- Notarization is a requirement for the Bill of Sale to be valid. While notarization provides an added level of legal verification, the State of Texas does not mandate that a tractor bill of sale must be notarized for it to be deemed valid. Ensuring that the bill of sale is filled out completely and signed by both parties is typically sufficient to confirm its validity for most private sales.

- There is a standard, state-issued Bill of Sale form for all tractors. This is a common misconception, as the State of Texas does not provide a specific, standardized bill of sale form for tractors. Sellers and buyers are often left to their discretion when drafting a bill of sale, although it must contain certain essential information, such as the make, model, year, purchase price, and the names and signatures of both parties involved.

- A Bill of Sale is not necessary for older tractors or those of lesser value. Regardless of the tractor's age or value, a bill of sale acts as a critical record of the transaction, providing proof of transfer of ownership from the seller to the buyer. This document can be crucial for registration, insurance, and tax purposes.

- Only the buyer needs to keep a copy of the Bill of Sale. It is a common misunderstanding that only the buyer should retain a copy of the Bill of Sale. However, it's important for both the seller and the buyer to keep a copy. This document serves as a receipt for the seller, offering protection in case of future disputes regarding the tractor’s condition or claims of ownership.

Key takeaways

When handling the sale of a tractor in Texas, using a proper Bill of Sale form is crucial for both the buyer and the seller. This document serves as a legal record of the transaction, offering proof of purchase and detailing the change of ownership. To ensure the process is smooth and legally compliant, consider the following key takeaways about filling out and using the Texas Tractor Bill of Sale form:

- Fully complete the form with accurate details, including the tractor's make, model, year, VIN (Vehicle Identification Number), and the sale price. This information is vital for both legal protection and for record-keeping purposes.

- Both the buyer and seller must provide their personal information, such as names, addresses, and signatures. This not only formalizes the agreement but also helps in any future disputes or inquiries about the tractor’s ownership.

- It's recommended to notarize the Bill of Sale, although it's not a mandatory requirement in Texas. Notarization adds an extra layer of legal validation, confirming the identities of the parties involved and the authenticity of their signatures.

- Keep a copy of the Bill of Sale for your records. Both the seller and the buyer should retain a copy. This document can be important for tax purposes, for use as proof of ownership, or when registering the tractor with the Texas Department of Motor Vehicles (DMV).

By following these guidelines, both parties can ensure a transparent and legally sound transaction, minimizing potential disputes and providing a clear record of the sale for future reference.

More Tractor Bill of Sale State Forms

Tractor Bill of Sale Form - Simplifies the process for tax reporting, providing evidence of the asset's sale price and date of sale.

Do Tractors Have Titles in Texas - This form can help in resolving disputes or misunderstandings about the sale details, as it provides a written record of the agreed-upon terms.