Fillable Tractor Bill of Sale Document for Michigan

When individuals or businesses in Michigan decide to engage in the sale or purchase of a tractor, a critical document comes into play: the Michigan Tractor Bill of Sale form. This essential piece of paperwork serves multiple purposes, acting as a receipt for the transaction, a legal document that proves ownership, and a valuable tool for registration and tax purposes. Its importance cannot be overstated, as it not only provides peace of mind for both the seller and the buyer by clearly outlining the terms of the sale, including the make, model, and serial number of the tractor, but also ensures compliance with Michigan's legal requirements. Moreover, the form facilitates a smooth transition of ownership and assists in the avoidance of future disputes by meticulously recording the details of the sale, such as the date of the transaction, the sale price, and the signatures of the involved parties. As a result, the Michigan Tractor Bill of Sale form is a fundamental component of the sale process, safeguarding the interests of all parties and ensuring that the transfer of property is executed in a legal and orderly fashion.

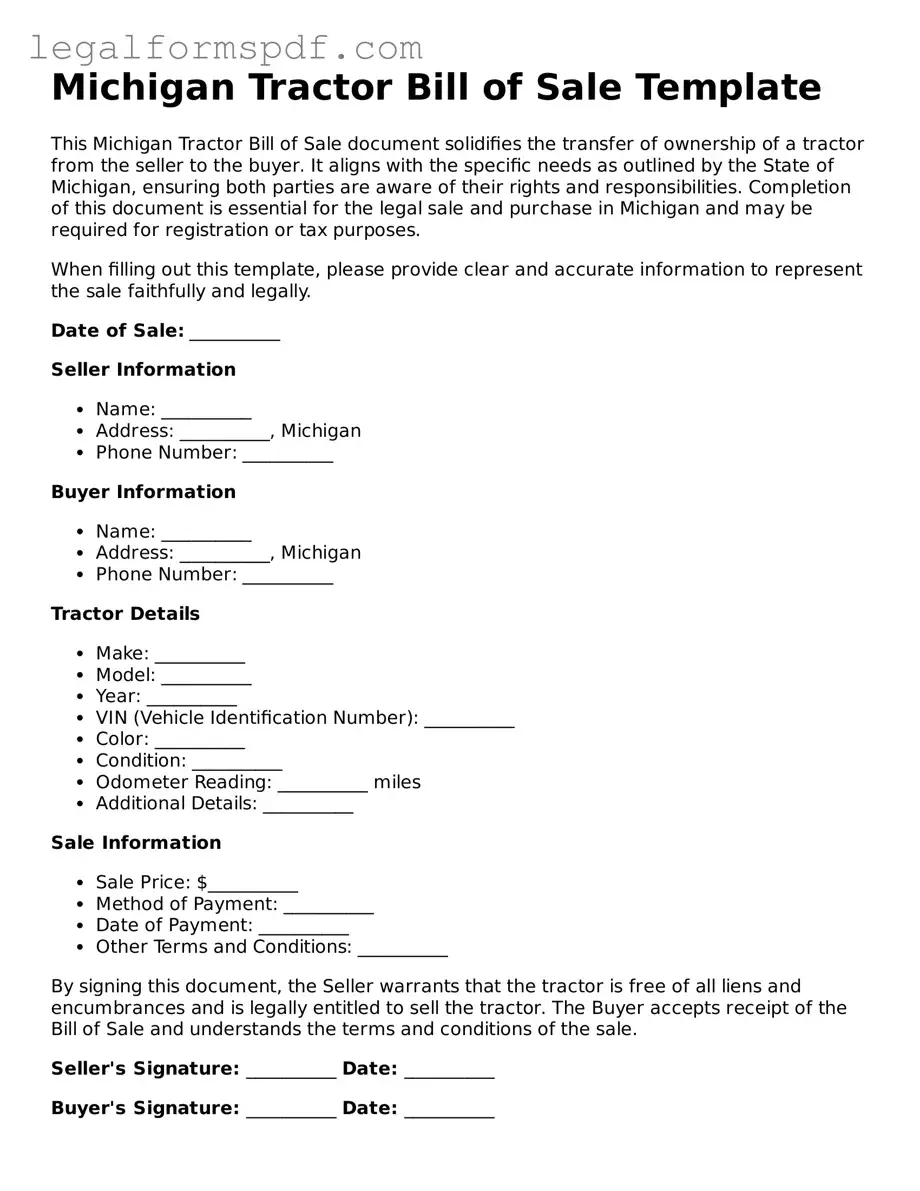

Document Example

Michigan Tractor Bill of Sale Template

This Michigan Tractor Bill of Sale document solidifies the transfer of ownership of a tractor from the seller to the buyer. It aligns with the specific needs as outlined by the State of Michigan, ensuring both parties are aware of their rights and responsibilities. Completion of this document is essential for the legal sale and purchase in Michigan and may be required for registration or tax purposes.

When filling out this template, please provide clear and accurate information to represent the sale faithfully and legally.

Date of Sale: __________

Seller Information

- Name: __________

- Address: __________, Michigan

- Phone Number: __________

Buyer Information

- Name: __________

- Address: __________, Michigan

- Phone Number: __________

Tractor Details

- Make: __________

- Model: __________

- Year: __________

- VIN (Vehicle Identification Number): __________

- Color: __________

- Condition: __________

- Odometer Reading: __________ miles

- Additional Details: __________

Sale Information

- Sale Price: $__________

- Method of Payment: __________

- Date of Payment: __________

- Other Terms and Conditions: __________

By signing this document, the Seller warrants that the tractor is free of all liens and encumbrances and is legally entitled to sell the tractor. The Buyer accepts receipt of the Bill of Sale and understands the terms and conditions of the sale.

Seller's Signature: __________ Date: __________

Buyer's Signature: __________ Date: __________

This document is subject to the laws of the State of Michigan, and any disputes arising out of this sale shall be resolved in accordance with those laws.

PDF Specifications

| Fact | Description |

|---|---|

| Definition | The Michigan Tractor Bill of Sale form is a legal document proving the sale and transfer of ownership of a tractor from a seller to a buyer in the state of Michigan. |

| Primary Use | It is primarily used to document the transaction and provide a record for both parties involved. |

| Key Components | Important components of the form include the sale date, sale amount, and information about the tractor (make, model, year, serial number) and the parties involved. |

| Governing Law | This form is governed by Michigan's state laws pertaining to personal property sales and transfers. |

| Registration Requirement | Following the sale, the buyer may need to register the tractor with the state, depending on its use and Michigan's current laws and regulations regarding such vehicles. |

| Signatures | Both the seller's and buyer's signatures are required on the form for it to be considered valid and legally binding. |

| Notarization | While not always mandatory, having the form notarized can add a level of legal verification to the transaction. |

Instructions on Writing Michigan Tractor Bill of Sale

When completing a transaction involving the sale of a tractor in Michigan, both the seller and the buyer are expected to fill out a Tractor Bill of Sale form. This document serves as a record of the sale, providing proof of transfer of ownership from the seller to the buyer. It encompasses vital information about the tractor being sold, the sale price, and the parties involved in the transaction. Ensuring that this form is filled out correctly and comprehensively is crucial for both legal and registration purposes. Below, the steps required to accurately fill out the Michigan Tractor Bill of Sale are detailed.

- Begin by entering the date of the sale at the top of the form. This should reflect the actual date when the transaction is taking place.

- Write the full legal name of the seller(s) in the space provided. If there is more than one seller, include each person's name.

- Enter the complete address of the seller, including the city, state, and zip code.

- In the corresponding section, fill in the full legal name of the buyer(s). For multiple buyers, include all names.

- Provide the full address of the buyer, including the city, state, and zip code, ensuring it matches what is on their identification for registration purposes.

- Describe the tractor being sold. This description should include the make, model, year, and any identifying numbers (such as the VIN or serial number).

- Specify the sale price of the tractor in dollars and be as precise as possible. If applicable, also note any other conditions of the sale next to this amount.

- Both the seller and the buyer must sign the document. Place the seller's signature in the designated area, followed by the date of signing.

- Have the buyer sign the form as well, ensuring they also date their signature to confirm the date of purchase.

After the Michigan Tractor Bill of Sale form is fully completed and signed by both parties, it's essential to make copies for everyone involved. The buyer will need this document for registration purposes, while the seller should keep a copy for their records. This form not only substantiates the transaction but also offers protection and clarity should any disputes or questions about the sale arise in the future.

Understanding Michigan Tractor Bill of Sale

What is a Michigan Tractor Bill of Sale form?

A Michigan Tractor Bill of Sale form is a legal document that records the sale and transfer of ownership of a tractor from the seller to the buyer within the state of Michigan. It serves as a receipt for the transaction and provides proof of purchase.

Why do I need a Michigan Tractor Bill of Sale?

Having a Michigan Tractor Bill of Sale is crucial because it legally documents the sale and ensures both parties have a record of the transaction. This document can be essential for registration, tax purposes, and to protect both the seller and buyer in case of future disputes.

What information is required on a Michigan Tractor Bill of Sale?

The form typically requires the full names and addresses of both the seller and the buyer, a detailed description of the tractor (including make, model, year, and serial number), the sale date, the purchase price, and signatures of both parties involved in the transaction.

Is notarization required for a Michigan Tractor Bill of Sale?

Notarization is not mandatory for a Michigan Tractor Bill of Sale to be considered valid. However, having the document notarized can add an extra layer of authenticity and may be beneficial for record-keeping and legal purposes.

Can I create my own Michigan Tractor Bill of Sale?

Yes, it is possible to create your own Michigan Tractor Bill of Sale. However, it must contain all the necessary information to be considered valid. Utilizing an official form or template is recommended to ensure all required fields are covered.

Is a Michigan Tractor Bill of Sale legally binding?

Yes, once signed by both parties, the Michigan Tractor Bill of Sale becomes a legally binding document that confirms the transfer of ownership and the specifics of the transaction.

How many copies of the Michigan Tractor Bill of Sale are needed?

It is advisable to prepare at least two copies of the Michigan Tractor Bill of Sale – one for the seller and one for the buyer. Each party should retain a copy for their records and any future needs that may arise.

What happens if I lose my Michigan Tractor Bill of Sale?

If you lose your Michigan Tractor Bill of Sale, it's recommended to contact the other party involved in the transaction for a copy. If that's not an option, creating a new document detailing the same information and requesting it to be signed again can serve as an alternative.

Can the Michigan Tractor Bill of Sale be used for other types of vehicles?

No, the Michigan Tractor Bill of Sale is specifically designed for transactions involving tractors. Using it for other types of vehicles is not appropriate. Each type of vehicle may have unique requirements and forms designated for their sale.

Where can I find a Michigan Tractor Bill of Sale form?

A Michigan Tractor Bill of Sale form can be found online through legal websites, Michigan government resources, or by contacting a local DMV office. Ensure that any template used complies with Michigan law and includes all necessary information.

Common mistakes

One common error individuals make when filling out the Michigan Tractor Bill of Sale form is neglecting to ensure that all parties' names are correctly spelled. This oversight can lead to confusion and potential disputes about the tractor’s legal ownership. It is crucial that names on the form match those on official identification documents to affirm the sale's legitimacy.

Another mistake often encountered is the omission of pertinent details about the tractor itself. Vital information, such as the make, model, year, and serial number, must be accurately recorded. These details are essential for the identification of the tractor and can greatly impact the validity of the bill of sale should any issues arise.

Many individuals also fail to specify the sale conditions on the bill of sale. Whether the tractor is sold as-is or with certain warranties should be clearly stated. Absence of this information can lead to misunderstandings between the buyer and seller regarding the condition of the tractor at the time of sale.

Incorrectly handling the financial details is another prevalent error. The sale price must be precisely documented on the form. Equally important is the mention of any payment plans or agreements related to the transaction. Failing to accurately list these details can result in legal and financial complications down the line.

Forgetting to secure signatures from all parties is a significant oversight. The buyer’s and seller’s signatures, along with the date of the signing, are necessary to authenticate the document. Sometimes, witnesses or a notary's endorsement is required to further validate the sale, depending on local regulations.

The date of the sale is often recorded incorrectly or omitted entirely. This error can affect the enforcement of any warranties and the determination of ownership, especially if the transaction is contested in the future. The sale date ensures a clear timeline of when the ownership was transferred.

A failure to provide a comprehensive description of the tractor’s current condition is another mistake. This includes any existing damages or mechanical issues. A detailed account helps protect the seller from future claims by the buyer about the tractor’s condition that were not disclosed at the time of sale.

Some individuals mistakenly believe a single copy of the bill of sale is sufficient. However, it is advisable for both the buyer and seller to have their own copies of the completed document. This ensures that both parties have the necessary proof of transaction and ownership details readily available.

Frequently, the importance of verifying the buyer’s and seller’s information is overlooked. Ensuring that contact details like addresses and phone numbers are correct can prevent problems in contacting the other party if any questions or issues about the sale emerge.

Last but not least, neglecting to check applicable state and local laws can be a critical mistake. The Michigan Tractor Bill of Sale form must comply with state-specific requirements. Failure to do so can invalidate the document and potentially derail the entire sale process.

Documents used along the form

When it comes to selling or buying a tractor in Michigan, the Bill of Sale form is not the only important document involved in the transaction. Aside from this crucial form, which officially records the details of the sale and transfer of ownership, several other documents are often required to ensure the legality of the transaction and to fulfill state requirements. These documents complement the Michigan Tractor Bill of Sale, each serving its unique purpose in the transaction process, from proving ownership to ensuring the vehicle is legally operable on public roads.

- Title Transfer Forms: This is essential for legally transferring ownership of the tractor from the seller to the buyer. It officially updates the tractor’s registered owner in state records.

- Sales Tax Forms: Depending on the specific laws in Michigan, a sales tax form may be necessary to document and process any sales tax due on the purchase of the tractor.

- Proof of Insurance: Often required for tractors that will be used on public roads, proof of insurance must be obtained by the buyer to comply with Michigan state laws.

- Odometer Disclosure Statement: For tractors that have odometers (particularly those considered to be road-worthy vehicles), an odometer disclosure statement might be required to document the mileage of the vehicle at the time of sale.

- Registration Forms: To legally operate the tractor on public roads, the buyer must register the vehicle with the state of Michigan. Registration forms are crucial for this process.

Collectively, these documents secure a transparent, legal, and official transfer of ownership. They also help protect both the buyer and seller from future legal issues that may arise regarding the tractor's condition, ownership, and use. Ensuring all relevant forms and documents are appropriately completed and filed is essential for the smooth execution of a tractor sale in Michigan.

Similar forms

The Michigan Tractor Bill of Sale form shares similarities with a Vehicle Bill of Sale. Both documents are used to record the transaction of a movable item from a seller to a buyer, detailing the item's make, model, year, and identification numbers. The primary function is to provide proof of purchase and transfer of ownership. Like a tractor bill of sale, a vehicle bill of sale includes information about both parties involved in the transaction and serves as a significant document during the title transfer process at the Department of Motor Vehicles (DMV).

Another similar document is the Equipment Bill of Sale, which is used for the sale and purchase of equipment goods, much like tractors. This document typically captures specifics about the equipment, including its condition, serial number, and any warranties. It serves the same legal purpose of recording a transaction and transferring ownership rights from the seller to the buyer. The Equipment Bill of Sale is crucial for buyers and sellers in the agricultural or construction sectors, providing a legal record of the sale.

A Warranty Deed is also akin to the Michigan Tractor Bill of Sale in that it is used to transfer ownership, but specifically of real estate, rather than personal property like tractors. It guarantees that the seller holds a clear title to the property and has the right to sell it, offering protection to the buyer against future claims to the property. While the content focuses on real estate, the underlying principle of transferring ownership and ensuring the seller’s right to sell the property is shared with the tractor bill of sale.

Similarly, a General Bill of Sale is used for transactions involving personal property items other than vehicles or equipment, such as furniture or electronics. This document includes details about the items being sold, the sale price, and the parties involved. Like the Michigan Tractor Bill of Sale, it serves as a written agreement that confirms the transaction between the seller and the buyer, providing a record that the ownership of the items has been transferred to the buyer.

Lastly, the Livestock Bill of Sale resembles the Michigan Tractor Bill of Sale as it documents the sale and transfer of ownership of animals such as cows, pigs, horses, and other livestock. Essential details such as the animal's breed, age, health condition, and any identifying marks are typically included. Both documents play crucial roles in the respective transactions they cover by providing legal evidence of the sale and transfer of ownership, protecting the interests of both the buyer and the seller.

Dos and Don'ts

When filling out the Michigan Tractor Bill of Sale form, ensuring accuracy and completeness is essential for a valid transaction. Here are some dos and don'ts to consider:

Do:

- Include all relevant information about the tractor, such as make, model, year, and serial number.

- Specify the sale price and the date of sale clearly to avoid any confusion.

- Provide accurate and detailed personal information for both the seller and the buyer, including full names and addresses.

- Make sure both parties sign and date the form to legally validate the sale.

- Keep a copy of the completed bill of sale for your records to protect against any future disputes or discrepancies.

Don't:

- Leave any sections of the form blank. If a section does not apply, write 'N/A' (not applicable).

- Forget to verify the buyer's and seller's information for accuracy. Any mistakes could cause legal issues down the line.

- Overlook the importance of including any warranties or "as is" condition statements. This clarifies the terms of sale regarding the tractor's condition.

- Rush through filling out the form. Taking your time ensures all information is correct and legible.

- Use pencil or erasable ink. All entries should be made in permanent blue or black ink to ensure permanence and legibility.

Misconceptions

There are several misunderstandings about the Michigan Tractor Bill of Sale form. Highlighting these misconceptions can help clarify its purpose and requirements.

It's Not Necessary for Private Sales: Many people believe that if they are buying or selling a tractor through a private sale, they don't need a Bill of Sale. However, the state of Michigan recommends the use of a Bill of Sale for all private vehicle transactions, including tractors, to create a legal record of the sale.

One Standard Form Fits All: Some individuals might think there's a single, standard Bill of Sale form for every type of vehicle, including tractors, in Michigan. The reality is that while there's a general format, details may vary depending on the specific requirements for tractors versus other types of vehicles.

Only the Buyer Needs a Copy: Another common misconception is that only the buyer should keep a copy of the Bill of Sale. In truth, both the buyer and the seller should retain copies of the signed Bill of Sale for their records, protection, and future reference.

No Need to Notarize: Though notarization is not mandatory in Michigan for a tractor Bill of Sale, it's a misconception that it's unnecessary. Having the document notarized can provide an additional layer of legal security and authenticity to the transaction.

All Tractors are the Same: A Bill of Sale should detail the specific make, model, year, and serial number of the tractor being sold. It's incorrect to think all tractors are the same; detailed identification helps avoid disputes about which tractor was actually sold.

It's Only About the Sale Price: While the sale price is a critical component of the Bill of Sale, it's a misconception that this is its sole purpose. The Bill of Sale should also include details about the condition of the tractor, any warranties, and specifics of the agreement between the buyer and seller.

Key takeaways

Filling out and using a Tractor Bill of Sale form in Michigan is a crucial step in the sale and purchase of a tractor. This document not only provides proof of the transaction but also offers protection to both the seller and the buyer. Here are key takeaways to ensure the process is handled correctly and efficiently:

- The Michigan Tractor Bill of Sale form must include detailed information about the tractor being sold, such as make, model, year, and serial number. This ensures the tractor is correctly identified.

- Both the seller and the buyer's full names and addresses should be clearly stated to establish the identities of the parties involved in the transaction.

- The sale price of the tractor must be accurately documented in the Bill of Sale. This is important for tax and record-keeping purposes.

- It's essential to specify the date of the sale to establish when the ownership officially transfers from the seller to the buyer.

- Signatures from both the seller and the buyer are required to validate the Bill of Sale. Without these signatures, the document might not be legally binding.

- The Bill of Sale should explicitly state whether the tractor is being sold as-is or if there are any warranties or guarantees included. This clarifies the condition of the tractor at the time of sale.

- For added protection, it is advisable to have the Bill of Sale notarized, though it's not a mandatory requirement in Michigan. Notarization can lend an extra layer of authenticity to the document.

- Keep a copy of the Bill of Sale for your records. Both the seller and the buyer should retain a copy for future reference in case any disputes or questions arise.

- If applicable, include information about any additional equipment or accessories being sold with the tractor. This ensures all components of the sale are documented.

- Before completing the sale, both parties should verify the information on the Bill of Sale for accuracy. Any errors could potentially lead to legal complications down the line.

Adhering to these guidelines when filling out and using the Michigan Tractor Bill of Sale form can help make the transaction smooth and legally sound for all parties involved.

More Tractor Bill of Sale State Forms

Do Tractors Have Titles in Texas - Its preparation encourages due diligence, prompting the seller to gather and verify the tractor’s legal and operational details before sale.

Tractor Bill of Sale Form - A critical document for anyone buying or selling a tractor in a private sale or through a dealership.

Do Tractors Need to Be Registered - It includes important information such as the make, model, and serial number of the tractor, as well as the sale price and date of sale.

Tractor Bill of Sale Form - Including a detailed description of the tractor in the Bill of Sale helps to ensure that both parties are clear about what is being sold.