Fillable Tractor Bill of Sale Document for California

In California, the transaction of buying or selling a tractor involves several critical steps, among which the completion of a Tractor Bill of Sale form stands out as a cornerstone. This document not only signifies the transfer of ownership from the seller to the buyer but also serves as a vital record for taxation, registration, and legal purposes. It outlines the detailed specifications of the tractor, including make, model, year, serial number, and any additional equipment or attachments included in the sale. Moreover, the form captures essential information about the parties involved - the buyer and the seller - including their names, addresses, and signatures, thereby ensuring a legal and transparent transaction. Crucially, the California Tractor Bill of Sale form offers peace of mind by providing proof of purchase and establishing a clear chain of ownership, which can be particularly important in resolving any future disputes or claims. Therefore, this form is not just a simple document but a fundamental component that facilitates a fair and legally binding agreement between two parties.

Document Example

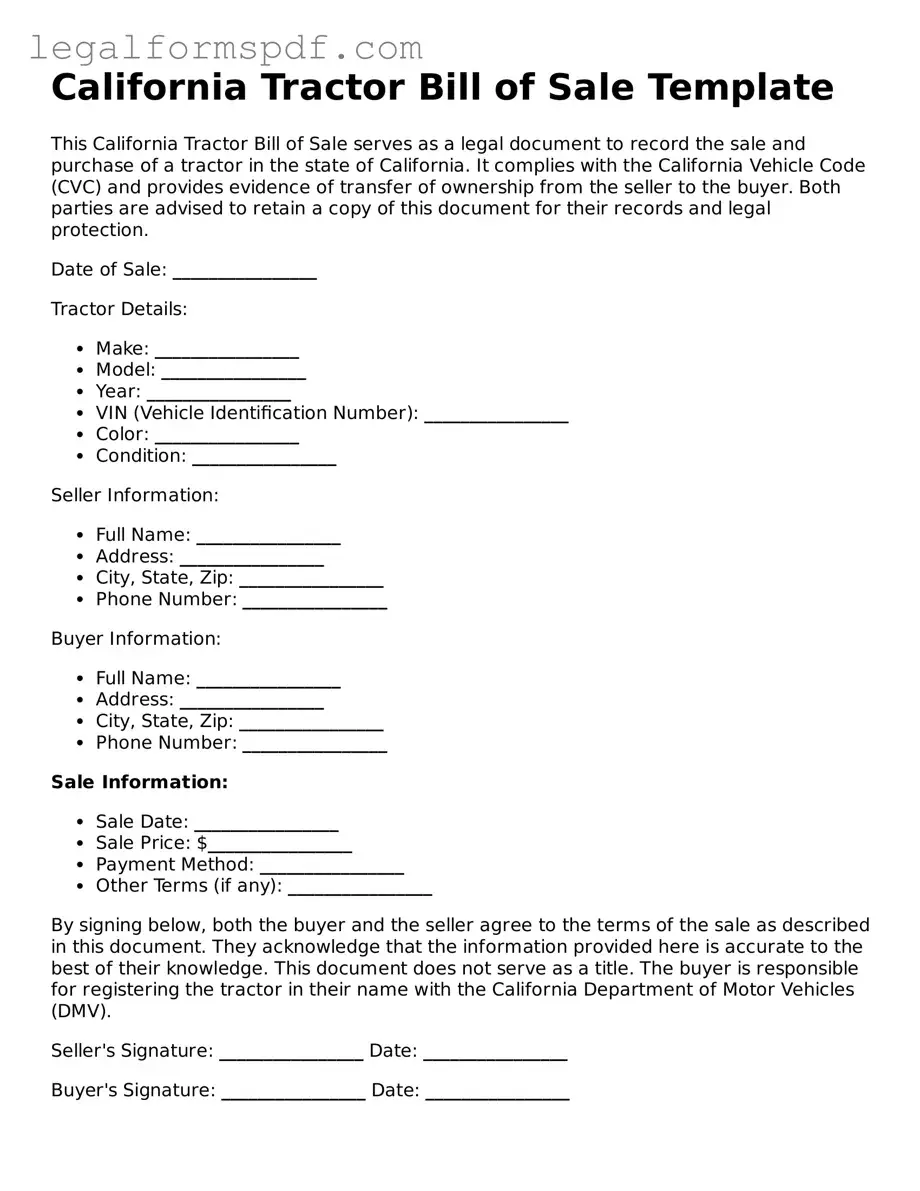

California Tractor Bill of Sale Template

This California Tractor Bill of Sale serves as a legal document to record the sale and purchase of a tractor in the state of California. It complies with the California Vehicle Code (CVC) and provides evidence of transfer of ownership from the seller to the buyer. Both parties are advised to retain a copy of this document for their records and legal protection.

Date of Sale: ________________

Tractor Details:

- Make: ________________

- Model: ________________

- Year: ________________

- VIN (Vehicle Identification Number): ________________

- Color: ________________

- Condition: ________________

Seller Information:

- Full Name: ________________

- Address: ________________

- City, State, Zip: ________________

- Phone Number: ________________

Buyer Information:

- Full Name: ________________

- Address: ________________

- City, State, Zip: ________________

- Phone Number: ________________

Sale Information:

- Sale Date: ________________

- Sale Price: $________________

- Payment Method: ________________

- Other Terms (if any): ________________

By signing below, both the buyer and the seller agree to the terms of the sale as described in this document. They acknowledge that the information provided here is accurate to the best of their knowledge. This document does not serve as a title. The buyer is responsible for registering the tractor in their name with the California Department of Motor Vehicles (DMV).

Seller's Signature: ________________ Date: ________________

Buyer's Signature: ________________ Date: ________________

Notice: This template is provided without any warranty, express or implied, regarding its legal effect and completeness. Use of this template should not be construed as legal advice or a replacement for consultation with a licensed professional. It is recommended that both parties consult with legal counsel to ensure compliance with all relevant California laws and regulations.

PDF Specifications

| Fact | Detail |

|---|---|

| 1. Purpose | The California Tractor Bill of Sale form is used to document the sale and transfer of ownership of a tractor from one party to another. |

| 2. Requirement | In California, a bill of sale is recommended for private sales of tractors to provide proof of the transaction and protect both the buyer and seller. |

| 3. Key Components | The form typically includes details such as the seller's and buyer's information, tractor description, sale price, and date of sale. |

| 4. Signatures | Both the buyer and seller are required to sign the document, making it a legally binding agreement. |

| 5. Notarization | While not mandatory, getting the document notarized can add an extra layer of legal protection. |

| 6. Governing Law | The form is governed by California state law, particularly those regulations relating to private vehicle sales and transfers. |

| 7. DMV Notification | After the sale, the buyer must notify the California Department of Motor Vehicles (DMV) to update the vehicle registration records. |

| 8. Use for Registration | The bill of sale can be used by the buyer as part of the documentation required to register the tractor in their name. |

| 9. Fraud Prevention | Providing a detailed and accurate bill of sale helps prevent potential fraud and misunderstandings between the parties. |

| 10. Retention of Copies | It is advisable for both the buyer and seller to retain copies of the bill of sale for their records and any future disputes or verifications. |

Instructions on Writing California Tractor Bill of Sale

For those looking to sell or buy a tractor in California, a Bill of Sale is an essential document that facilitates the process by officially transferring ownership of the tractor from the seller to the buyer. This document serves as a legal record of the transaction, providing proof of purchase that is necessary for both the registration of the tractor under the new owner's name and for tax purposes. To ensure the document is filled out correctly, follow the steps outlined below.

- Start by entering the date of the sale at the top of the form.

- Write the full legal name of the seller and the buyer along with their complete addresses, including city, state, and ZIP code.

- Describe the tractor being sold. This description should include the make, model, year, condition, VIN (Vehicle Identification Number), and any other details that uniquely identify the tractor.

- Enter the sale price of the tractor in dollars and specify the terms of the sale. If there are any additional conditions or warranties associated with the sale, be sure to include them here.

- Both the seller and the buyer must sign and print their names at the bottom of the form to validate the bill of sale. Include the date of signing next to the signatures.

- If the form includes a section for a witness or notary public, ensure that this section is properly filled out to affirm the authenticity of the bill of sale.

Once the form is completed, both parties should retain a copy for their records. This serves as a tangible proof of the terms agreed upon at the time of sale and can protect both the seller and buyer in case of disputes or when proof of ownership is required during the registration process. The buyer will likely need to present this document when registering the tractor with the California Department of Motor Vehicles (DMV) or similar local authority.

Understanding California Tractor Bill of Sale

What is a California Tractor Bill of Sale form?

A California Tractor Bill of Sale form is a legal document that records the sale and transfer of ownership of a tractor from a seller to a buyer in the state of California. This form typically includes details about the tractor (such as make, model, year, and serial number), information about the seller and buyer, and the sale price. It serves as proof of purchase and can be used for registration and tax purposes.

Is a California Tractor Bill of Sale form required for transferring tractor ownership?

In California, while the Department of Motor Vehicles (DMV) does not specifically require a Tractor Bill of Sale form for the transfer of most farm equipment, having one can provide legal protection and serve as a crucial record of the transaction for both the buyer and the seller. For the registration of the tractor, if required, or for tax purposes, this document may be necessary.

What information should be included in a California Tractor Bill of Sale form?

A comprehensive California Tractor Bill of Sale form should include the full names and addresses of both the buyer and the seller, a detailed description of the tractor (including make, model, year, and serial number), the sale date, the sale price, and any other conditions or warranties agreed upon. Both parties should also sign and date the document, possibly in the presence of a notary public for added legal verification.

Do both the buyer and the seller need to sign the California Tractor Bill of Sale form?

Yes, for the document to be considered legally binding, both the buyer and the seller must sign the California Tractor Bill of Sale form. It is also recommended to have the signatures notarized to authenticate the identities of the parties involved and provide an additional layer of legal protection.

Can a California Tractor Bill of Sale form be used for other types of equipment?

While a Tractor Bill of Sale form is specifically designed for the transaction of a tractor, similar types of bills of sale can be used for other types of equipment by modifying the description of the item being sold. However, when dealing with different types of equipment, it's essential to ensure that the form meets the legal requirements for that particular type of property in California.

Where can I find a California Tractor Bill of Sale form?

A California Tractor Bill of Sale form can be found online through legal document providers or can be created with the help of a legal professional. It is important to ensure that the form contains all the necessary information and meets the specific needs of the transaction. Customizable templates may also be available, allowing for a more tailored document.

Common mistakes

One common mistake made when filling out the California Tractor Bill of Sale form is not providing accurate details about the tractor. It's important that the description includes the make, model, year, and, most significantly, the vehicle identification number (VIN). This information is crucial for identifying the tractor accurately and ensuring the sale is legally binding. An incomplete or incorrect description can lead to problems in the legal documentation and ownership transfer process.

Another error involves neglecting to include the sale date and price on the form. These details are essential for both tax purposes and for any future disputes regarding the sale. The sale date establishes when the ownership officially changed hands, while the price can affect taxes and fees. It’s important for both the seller and the buyer to accurately record this information to avoid potential legal and financial issues down the line.

Frequently, individuals mistakenly think they don’t need to disclose the tractor's condition or any existing liens against it. However, revealing the tractor's current state, including any known faults or liens, is critical. This transparency ensures that the buyer is fully informed before the purchase, helping to prevent disputes and possible legal action after the sale. A clear statement regarding the condition and any liens or encumbrances provides protection for both parties involved.

Ignoring the need for witness signatures is yet another oversight. While not always legally required, having witnesses sign the Bill of Sale can provide additional legal safeguards for the transaction. Witnesses can verify the authenticity of the sale and the agreement between the parties, adding a layer of protection against claims of fraud or disputes over the sale’s validity.

Forgetting to obtain a release of liability from the California Department of Motor Vehicles (DMV) is a serious mistake. Once the sale is completed, the seller should promptly report the transaction to the DMV. This step is crucial to release them from liability for what the new owner might do with the tractor. Without completing this procedure, the seller could inadvertently be responsible for future tickets, toll violations, or even criminal activities.

Lastly, many parties neglect the significance of making copies of the completed form for their records. Having a copy of the Bill of Sale is essential for both the buyer and the seller as it serves as a receipt and a legal document proving the transfer of ownership. Should any disputes arise, or if needed for registration and tax purposes, having an accessible copy will simplify resolving these issues.

Documents used along the form

When buying or selling a tractor in California, using a Tractor Bill of Sale form is a crucial step in the transaction. This form is not the only document needed to ensure a smooth and legally compliant process. A handful of other forms and documents often accompany the Tractor Bill of Sale to protect both buyer and seller, ensuring all legal requirements are met and providing additional layers of security and peace of mind. Here’s an overview of some of these essential documents.

- Certificate of Title: This document proves ownership of the tractor. It must be transferred from the seller to the buyer to complete the sale legally. If the tractor is under a lien, the relevant details should also be mentioned.

- Release of Liability Form: A Release of Liability Form, or Notice of Transfer and Release of Liability, is required to absolve the seller from any future liabilities arising from the tractor's use once it has been sold. This form is submitted to the California Department of Motor Vehicles (DMV).

- Odometer Disclosure Statement: For tractors with an odometer, federal and state laws require the seller to provide an accurate odometer reading at the time of sale. This ensures the buyer is aware of the tractor's exact mileage.

- Loan Satisfaction Letter: If there was a lien on the tractor that has been paid off, a Loan Satisfaction Letter from the lender is necessary. It serves as proof that the tractor is free from liens and is crucial for transferring the title to the buyer.

- As-Is Sales Agreement: This document indicates that the tractor is being sold in its current condition, and the seller will not be responsible for future repairs or problems. This agreement protects the seller, but the buyer must agree to purchase the tractor "as is."

Together with the Tractor Bill of Sale, these documents form a comprehensive package that addresses legal requirements, protects all parties involved, and underlines the terms and conditions of the sale. Each document plays a vital role in the transaction’s success, ensuring clarity, legality, and peace of mind for both the buyer and the seller.

Similar forms

The California Tractor Bill of Sale form is closely related to the Vehicle Bill of Sale form. Both serve as legal documents that record the sale and transfer of ownership of a vehicle—whether it is a tractor or an automobile—from a seller to a buyer. They detail the transaction date, price, and the parties involved, ensuring that the transaction is legally binding and recognized for registration and taxation purposes.

Similarly, the Boat Bill of Sale document mirrors the functionality of the tractor bill of sale, but for watercraft transactions. It captures critical information about the sale, including the make, model, year, and hull identification number (HIN) of the boat, alongside the sale price and the names of the seller and buyer. This document is essential for the proper transfer of ownership and for registration with maritime authorities.

The Motorcycle Bill of Sale form is another analogous document that underscores the sale of a motorcycle from one party to another. It includes specific details about the motorcycle, such as its VIN, make, model, and year, alongside transactional information. This form helps in proving ownership and is often required for insurance and registration purposes.

Equine Bill of Sale documents bear a resemblance to the tractor bill of sale as well, despite dealing with living animals. They record the sale of a horse, detailing the animal’s description, any registration information, and the sale conditions. This document safeguards both parties against future disputes regarding the horse’s condition or ownership.

The General Bill of Sale form shares similarities with the tractor bill of sale by acting as a catch-all document for various types of personal property transactions, not limited to vehicles. It serves to document the sale of items such as electronics, furniture, or other non-titled property, listing the item details, sale price, and party information to validate the transfer of ownership.

The Firearms Bill of Sale form, while specific to the transfer of ownership of guns, parallels the tractor bill of sale. It documents critical information about the firearm being sold (including make, model, caliber, and serial number), the sale price, and the identities of the buyer and seller, ensuring a legal transfer of ownership in accordance with state and federal law.

An Equipment Bill of Sale is akin to the tractor bill of sale, tailored for the sale of machinery and heavy equipment other than tractors. This document records important details of the equipment, such as serial numbers, make, model, and condition, along with the transaction’s specifics, facilitating a transparent transfer of ownership.

The Aircraft Bill of Sale form, though more specialized, serves a similar purpose for aviation vehicles. It meticulously records details of the aircraft, such as its registration number, make, model, and serial number, in addition to the sale information. This form is crucial for the legal transfer of ownership and is often a requirement for registration with aviation authorities.

The Business Bill of Sale is related but focuses on transactions involving the sale of a business rather than a physical asset like a tractor. It outlines the details of the transaction, including the business assets being transferred, the sale price, and information on the buyer and seller. This document is essential for transferring ownership and operational rights of the business.

Lastly, the Mobile Home Bill of Sale form, similar to the tractor bill of sale, documents the transfer of ownership of a mobile home. It includes specific information about the mobile home, such as its make, model, year, and VIN, along with transaction details. This form is vital for securing financing, insurance, and for registration purposes.

Dos and Don'ts

When filling out the California Tractor Bill of Sale form, it is essential to proceed with care. This document serves as a legal record of the sale and transfer of ownership of a tractor. Follow these guidelines to ensure the process is smooth and legally sound.

- Do ensure all information is legible and accurate. The details provided will serve as official records, so clarity is crucial.

- Do verify the tractor’s identification number (VIN) and make sure it matches the tractor being sold.

- Do include a complete description of the tractor, including make, model, year, and any identifying marks or features.

- Do record the sale price clearly. This is essential for both the seller and buyer for tax reporting purposes.

- Do get the signatures of both the buyer and seller on the form. The document isn't legally binding without these.

- Don’t leave any fields blank. If a section does not apply, indicate this clearly by writing ‘N/A’ (not applicable).

- Don’t rely on verbal agreements. Ensure all terms and conditions of the sale are outlined in the bill of sale.

- Don’t forget to give a copy to both the buyer and the seller. Each party should have a copy for their records.

- Don’t hesitate to verify the legal requirements specific to California or consult with a legal representative if there are any uncertainties.

Misconceptions

When dealing with the sale of a tractor in California, the process requires careful attention to detail, especially regarding the Tractor Bill of Sale form. There are several misconceptions that can create confusion. It's important to clarify these to ensure both parties involved in the sale understand the requirements and implications.

It's only necessary for new tractors: A common misconception is that a Bill of Sale is only required for the sale of new tractors. In reality, this document is necessary for the transfer of ownership of both new and used tractors, providing a legal record of the transaction.

Only the buyer needs to keep a copy: Some might think that only the buyer needs to retain a copy of the Bill of Sale. However, it's crucial for both the buyer and the seller to keep a copy of this document. It serves as proof of purchase for the buyer and as evidence of the sale for the seller.

Any template will work: Another misunderstanding is that any Bill of Sale template found online will suffice. While there are many templates available, the document should meet California's specific legal requirements to ensure its validity.

Notarization is mandatory: People often believe that the Bill of Sale must be notarized to be valid. While notarization can add an extra layer of authenticity, it is not a mandatory requirement in California for the Bill of Sale to be considered legal.

It serves as a title: There is a false notion that the Bill of Sale serves as the title for the tractor. The Bill of Sale is a record of the transaction, whereas the title is a separate document that officially signifies ownership. The title needs to be transferred separately.

It only needs basic information: Underestimating the information required on the Bill of Sale is a common error. This document should not only include basic details like the sale price and the names of the buyer and seller, but also specific information regarding the tractor, such as make, model, serial number, and any relevant warranties or disclosures.

Understanding these misconceptions can help sellers and buyers navigate the process of transferring tractor ownership more smoothly, ensuring all legal requirements are met and protecting the interests of both parties involved.

Key takeaways

When it comes to the sale of a tractor in California, using a Tractor Bill of Sale form is crucial for both the buyer and the seller. This document serves as a vital record of the transaction, ensuring clarity and protection for all parties involved. Here are key takeaways to keep in mind:

- The Tractor Bill of Sale form should include detailed information about the tractor, such as make, model, year, serial number, and any other identifying characteristics. This ensures the tractor is clearly identified and differentiated from others.

- Both parties should provide their full legal names, contact information, and signatures. This confirms the agreement between the involved individuals and makes the document legally binding.

- The sale price should be clearly listed in the document. It's important for tax and warranty purposes, and provides clear evidence of the financial terms of the deal.

- Dates matter: Ensure the sale date is accurately recorded on the Bill of Sale. This date is crucial for any possible future disputes or for registration purposes.

- If there are specific terms and conditions associated with the sale (e.g., the tractor is being sold "as is"), these should be explicitly stated on the form to avoid future misunderstandings or legal disputes.

- After completing the form, both the buyer and the seller should keep a copy of the Bill of Sale. It's a critical proof of purchase and ownership transfer, which might be required for registration or insurance.

- While a notary’s seal is not mandatory for the validity of a Tractor Bill of Sale in California, having the document notarized can add an additional layer of authenticity and may prevent potential legal issues.

Properly filling out and using the California Tractor Bill of Sale form is not just about following legal protocol—it's about establishing a clear, enforceable agreement that protects both the buyer and the seller. Ensuring all the key elements are correctly captured in the form can save a lot of headaches in the future. For this reason, it's always recommended to approach this document thoughtfully and with attention to detail.

More Tractor Bill of Sale State Forms

Tractor Bill of Sale Form - Helps in creating a transparent and legally-binding agreement, reducing potential legal complications from the sale.

Farm Equipment Bill of Sale - It serves as a crucial piece of evidence in case of disputes or legal issues regarding the tractor's ownership.

Do Tractors Have Titles in Texas - The Tractor Bill of Sale form is a proactive step in asset protection, ensuring the buyer's investment is certified, and the seller’s liability is minimized.

Tractor Bill of Sale Form - A properly executed Tractor Bill of Sale helps to prevent fraud by documenting the transaction’s specifics.