Fillable Bill of Sale Document for Texas

When engaging in the sale of personal property in Texas, a critical document to have is the Texas Bill of Sale form. This form serves as a legal record of the transaction, detailing the transfer of ownership from the seller to the buyer. It's essential for various types of sales, ranging from vehicles to smaller personal items. The document not only provides proof of purchase but also plays a pivotal role in the registration and titling process, especially in the case of vehicles. Moreover, for both parties, it acts as a safeguard against potential disputes by clearly defining the item sold, the sale amount, and the date of the transaction. Although not all sales in Texas mandate a Bill of Sale, having one ensures a layer of security and peace of mind for both the buyer and the seller. It's a straightforward form that both parties should complete and keep for their records, as it can be an important piece of evidence in case any legal issues arise post-sale.

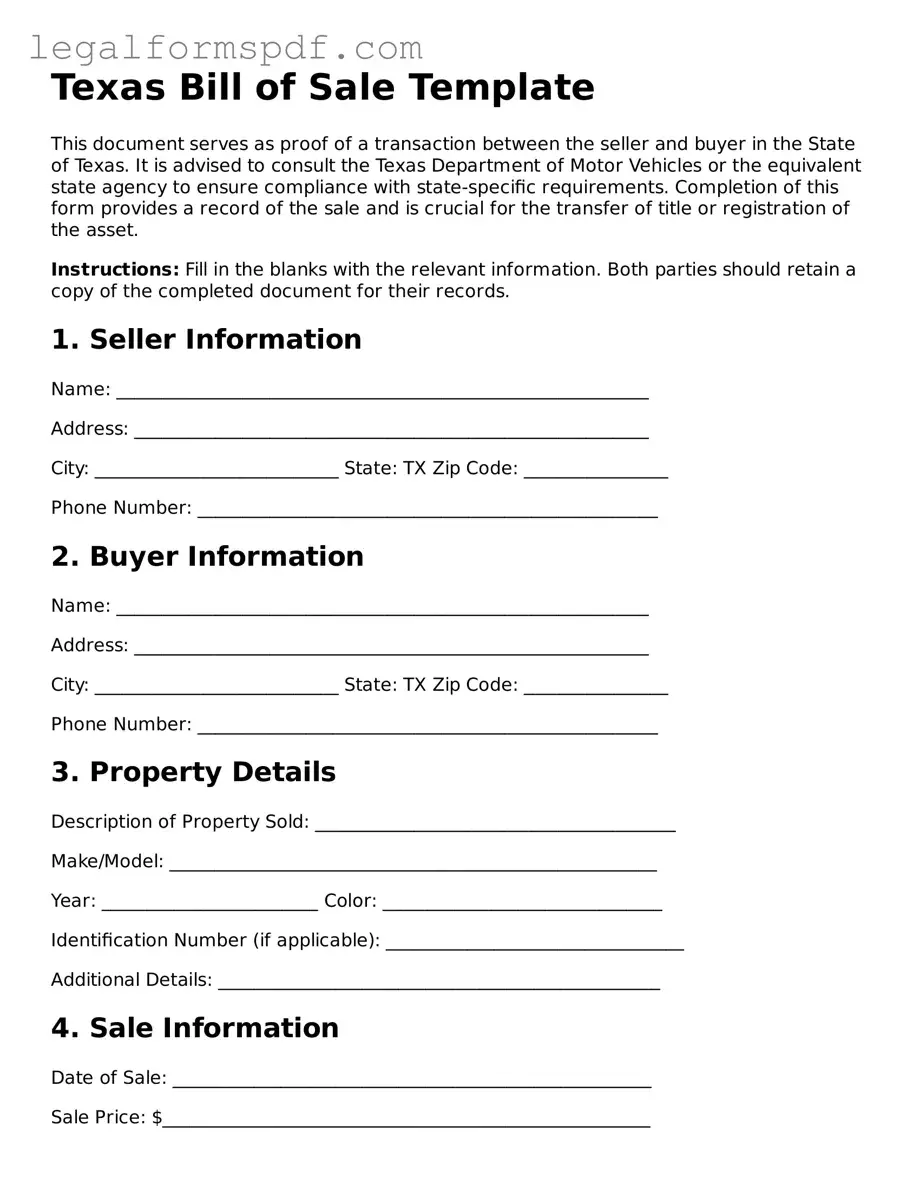

Document Example

Texas Bill of Sale Template

This document serves as proof of a transaction between the seller and buyer in the State of Texas. It is advised to consult the Texas Department of Motor Vehicles or the equivalent state agency to ensure compliance with state-specific requirements. Completion of this form provides a record of the sale and is crucial for the transfer of title or registration of the asset.

Instructions: Fill in the blanks with the relevant information. Both parties should retain a copy of the completed document for their records.

1. Seller Information

Name: ___________________________________________________________

Address: _________________________________________________________

City: ___________________________ State: TX Zip Code: ________________

Phone Number: ___________________________________________________

2. Buyer Information

Name: ___________________________________________________________

Address: _________________________________________________________

City: ___________________________ State: TX Zip Code: ________________

Phone Number: ___________________________________________________

3. Property Details

Description of Property Sold: ________________________________________

Make/Model: ______________________________________________________

Year: ________________________ Color: _______________________________

Identification Number (if applicable): _________________________________

Additional Details: _________________________________________________

4. Sale Information

Date of Sale: _____________________________________________________

Sale Price: $______________________________________________________

Method of Payment: ________________________________________________

5. Seller's Disclosure

The seller states that the above information is true and correct to the best of their knowledge at the time of the sale and that they have the legal right to sell this property. The property is sold "as is," without any warranties, either expressed or implied, regarding its condition.

6. Buyers Acknowledgment

The buyer acknowledges receipt of this Bill of Sale and understands that the above property is sold "as is," with no warranties or guarantees, either expressed or implied.

7. Signatures

Seller's Signature: _______________________ Date: _________________

Buyer's Signature: ________________________ Date: _________________

This document is subject to and governed by Texas law. Any disputes or legal proceedings related to this Bill of Sale will be resolved in the judicial system of Texas.

PDF Specifications

| Fact | Detail |

|---|---|

| Definition | A Texas Bill of Sale form is a legal document used to transfer ownership of personal property from a seller to a buyer in the state of Texas. |

| Types | Common types include vehicle, boat, firearm, and general bill of sale forms. |

| Governing Law | The Texas Bill of Sale is governed by the Texas Business and Commerce Code. |

| Notarization | Notarization is not mandatory for most types, but it is recommended for legal protection. |

| Information Required | Typically includes the names and addresses of the buyer and seller, description of the item, sale date, and purchase price. |

| Usage | Used as proof of purchase and to help document the transfer of ownership. |

| Additional Forms | For vehicles, a signed title and an Application for Texas Title (Form 130-U) may also be required. |

| Benefits | Provides a written record of the sale, reduces potential legal disputes, and may be required for registration purposes. |

Instructions on Writing Texas Bill of Sale

Completing a Bill of Sale in Texas is an essential step in the process of buying or selling property, such as vehicles or other valuable assets. This document serves as a legal record that a transaction took place, detailing the terms of the sale and providing proof of ownership transfer. It's important for both parties - the seller and the buyer - to accurately fill out this form to ensure a smooth and legally binding transaction. The instructions provided below aim to guide you through each necessary step, making sure you don't miss any crucial information that might protect you in the event of disputes or legal inquiries.

- Begin by entering the date of the sale. This is crucial as it establishes when the ownership officially changed hands.

- Include the full names and addresses of both the buyer and the seller. This information is necessary for identifying the parties involved in the transaction.

- Describe the item being sold. If it's a vehicle, provide specifics such as make, model, year, color, VIN (Vehicle Identification Number), and mileage. Accurate description is key to identifying the exact item involved in the sale.

- State the sale price. This should be the agreed amount between the buyer and the seller.

- Outline any additional conditions or terms of the sale. This could include warranty information or the inclusion of extra items (e.g., vehicle accessories).

- Both the buyer and the seller must sign and date the form. These signatures are essential, as they certify that both parties agree to the terms of the sale and that the information provided is accurate.

Once the form is completed, ensure that both the buyer and the seller retain a copy for their records. This document may be required for various legal, tax, or insurance purposes in the future. It's the tangible evidence of the transaction and serves to protect the interests of both parties. Filling out the Texas Bill of Sale form meticulously and keeping it in a safe place is a critical step in any buying or selling process.

Understanding Texas Bill of Sale

What is a Texas Bill of Sale form?

A Texas Bill of Sale form is a legal document that details the transfer of ownership of an item from one party to another. It is commonly used for the private sale of vehicles, boats, firearms, and other valuable items. This document serves as proof of purchase and can be used for registration, tax collection, and legal protection.

Is a Bill of Sale legally required in Texas?

While Texas law does not require a bill of sale for all transactions, it is strongly recommended to have one for the private sale of vehicles, boats, and firearms. For vehicles and boats, it provides essential information required for registration. For firearms, it acts as a record of the sale which can be important for legal protection.

What information should be included in a Texas Bill of Sale form?

A comprehensive Texas Bill of Sale form should include the following information: the date of sale, full names and addresses of the seller and buyer, detailed description of the item being sold (including make, model, year, and VIN or serial number if applicable), sale price, and signatures of both the seller and buyer. Additionally, it may include terms of the sale and any warranties or as-is statements.

Do both parties need to sign the Texas Bill of Sale form?

Yes, for the document to be considered valid and to offer legal protection, both the seller and the buyer must sign the Texas Bill of Sale form. Additionally, including the print names of both parties can provide clarity.

Does a Texas Bill of Sale form need to be notarized?

Notarization is not a legal requirement for a Bill of Sale in Texas. However, having the document notarized can add an extra layer of security and authentication, ensuring that the signatures on the document are genuine.

Can I create a Texas Bill of Sale form myself?

Yes, you can create a Texas Bill of Sale form yourself. The form does not have to follow a standard format, but it must contain all necessary information such as the parties' information, detailed description of the item, sale price, and signatures. It is advisable to use a template or seek legal guidance to ensure the document meets all requirements.

How do I register a vehicle with a Bill of Sale in Texas?

To register a vehicle in Texas with a Bill of Sale, you must provide the Texas Department of Motor Vehicles (DMV) with the completed Bill of Sale form, along with the vehicle's title, a completed application for Texas title, proof of insurance, and payment for all applicable fees. The Bill of Sale alone is not enough to prove ownership; the title transfer must be completed.

Can a Texas Bill of Sale form be used as proof of ownership?

A Texas Bill of Sale form can be used as proof of purchase but cannot serve as the sole proof of ownership, especially for vehicles and boats. For these items, the title document is the official proof of ownership. However, the Bill of Sale is an important supporting document in ownership and registration processes.

What should I do if I lose my Texas Bill of Sale?

If you lose your Texas Bill of Sale, it is advisable to contact the other party involved in the transaction to see if they have a copy. If both parties have lost the document, drafting and signing a new Bill of Sale, containing the same information as the original, is recommended. For added security, both parties might consider having the document notarized.

Common mistakes

One common error individuals make when filling out the Texas Bill of Sale form is neglecting to verify the accuracy of the vehicle identification number (VIN). The VIN is a unique code used to identify motor vehicles. Mistakes in transcribing or recording this number can lead to significant legal complications, as the VIN is critical for vehicle registration and history checks. Ensuring the VIN is accurately copied onto the Bill of Sale is paramount for a smooth transaction.

Another mistake often made involves the omission of necessary details regarding the sale price. It's crucial that both the seller and the buyer agree on and clearly record the sale price on the form. This figure should reflect the total amount paid for the vehicle. Leaving this blank or vague can lead to disputes or issues with tax assessments.

Many individuals fail to properly describe the condition of the vehicle being sold. A detailed account of the vehicle's current state, including any defects or damages, should be included in the Bill of Sale. This description helps protect the seller from future claims by the buyer regarding the condition of the vehicle at the time of sale.

Forgetting to include the date of the sale is another frequent oversight. This date is essential as it indicates when the ownership officially transfers from the seller to the buyer. Without it, establishing the effective date of the sale can be problematic, impacting warranty periods and the start date of the buyer's responsibility for the vehicle.

Many fail to sign and date the Bill of Sale. Without the signatures of both parties and the date of signing, the document may not be considered legally binding. It's imperative that both the seller and the buyer sign the form to acknowledge the terms and conditions of the sale.

A lack of buyer and seller information is a common mistake. Full names, addresses, and contact information of both parties must be accurately recorded on the Bill of Sale. This information is necessary for legal identification and could be vital in case of disputes or for notification purposes.

Some omit the make, model, and year of the vehicle from the Bill of Sale. These details provide specific identification of the vehicle being sold and are necessary for registration and insurance purposes. Failure to include this information can lead to unnecessary complications during these processes.

Incorrect or unclear payment terms are often a source of confusion. The Bill of Sale should clearly state if the payment is complete or if arrangements for payment installments have been made. Ambiguity in this area can lead to misunderstandings and legal disputes over payment.

Not identifying any liens or encumbrances on the vehicle is a critical oversight. If the vehicle is subject to any liens, these should be disclosed in the Bill of Sale. Failure to do so can result in the new owner unknowingly inheriting the responsibility to settle these debts.

Lastly, individuals frequently forget to make or distribute copies of the Bill of Sale to all relevant parties. It's essential that both the buyer and the seller retain a copy for their records. Additionally, a copy may need to be submitted to the state or local authority for registration and tax purposes. Overlooking this step can lead to administrative headaches and proof of ownership issues.

Documents used along the form

When people in Texas buy or sell items, especially significant assets such as vehicles or boats, they usually complete a Bill of Sale to document the transfer of ownership. This legal form is crucial for both the buyer and the seller, serving as proof of the transaction. However, to further ensure the legality and smoothness of the transaction, several other documents often accompany the Bill of Sale. These complementary forms add layers of verification, ownership clarity, and legal compliance to the transaction process.

- Title Transfer Form: This form is critical when selling or buying a vehicle or boat in Texas. It officially records the change of ownership and is required to update the records with the Texas Department of Motor Vehicles (DMV). The Title Transfer form must be filled out with accurate details and submitted in accordance with DMV guidelines.

- Odometer Disclosure Statement: For the sale of vehicles, federal law requires the seller to provide the buyer with an odometer disclosure statement. This document records the vehicle's correct mileage at the time of sale, helping to ensure that the buyer is aware of the vehicle’s condition and history.

- Release of Liability Form: When selling a vehicle or boat, the seller should complete a Release of Liability form to inform the state DMV that the vehicle has been sold and to release themselves from liability for any accidents or violations involving the vehicle after the sale.

- Registration Forms: The buyer of a vehicle or boat will need to submit registration forms to the Texas DMV or the relevant state agency to legally operate the vehicle or boat. These forms require the buyer’s personal information and details about the vehicle or boat, including the Bill of Sale as proof of purchase.

- Promissory Note (if applicable): In transactions where the buyer agrees to pay the seller over time, a promissory note outlines the repayment terms, including the loan amount, interest rate, payment schedule, and the consequences of non-payment. This document protects both parties by clearly defining the terms of the payment agreement.

Each of these documents plays a vital role in the sale and purchase of significant assets in Texas, providing legal protections and assurances for both parties involved. While the Bill of Sale is the cornerstone document recording the agreement to transfer ownership, these additional forms are equally important to ensure that all aspects of the transaction comply with legal requirements and are thoroughly documented. Understanding and preparing these documents ensures a more secure and smooth transition of ownership.

Similar forms

The Texas Bill of Sale form shares similarities with a Vehicle Title Transfer form, commonly used across states to officially change ownership of a vehicle. Both documents serve as essential proofs of sale and transfer of ownership; however, the Vehicle Title Transfer specifically caters to vehicles and requires additional details such as the odometer reading. They both must be submitted to respective state departments to finalize the ownership transfer process, ensuring the new owner can legally register and operate the vehicle.

Comparable to the Texas Bill of Sale is the General Sales Agreement, which outlines the terms and conditions of a sale between two parties. While the Bill of Sale verifies the transaction and transfer of ownership for items ranging from vehicles to personal property, the General Sales Agreement delves deeper, detailing payment plans, warranties, and dispute resolution mechanisms. This makes the General Sales Agreement more comprehensive, covering not just the proof of purchase but also the specifics of the agreement.

The Warranty Deed, like the Texas Bill of Sale, is a document used to transfer property; however, it is specifically utilized in real estate transactions. The Warranty Deed guarantees that the seller holds a clear title to the property and has the right to sell it, offering more protection to the buyer compared to the Bill of Sale. While both documents are crucial for the legal transfer of ownership, the Warranty Deed contains more guarantees regarding the history and claims on the property.

Similarly, the Quitclaim Deed is used in real estate but differs from the Texas Bill of Sale in its provision of rights and claims over a property. A Quitclaim Deed transfers any ownership interest the grantor may have without making any promises about the validity of the property title. Unlike the Bill of Sale, which confirms a complete transfer of ownership for various types of property, the Quitclaim Deed is more about relinquishing rights or claims without confirming the seller's ownership status.

Another document related to the Texas Bill of Sale is the Promissory Note. This note is an agreement to pay back a loan under specified conditions. While the Bill of Sale acknowledges that an item has been sold and ownership has been transferred, a Promissory Note details the buyer's promise to pay the seller a certain amount, sometimes including interest, over a period. Both documents are pivotal in transactions, though they serve distinct purposes—transfer of ownership vs. terms of repayment.

The Receipt is a simple document that, like the Texas Bill of Sale, provides proof of a transaction between two parties. Both confirm a transfer—of ownership in the case of the Bill of Sale and of payment in the case of a Receipt. However, a Receipt is typically less formal and detailed than a Bill of Sale. It may not be legally binding on its own in terms of transferring ownership rights but serves as evidence that a transaction took place.

Dos and Don'ts

When filling out a Texas Bill of Sale form, there are several key steps you should follow to ensure the process is completed correctly and legally. Below, find a list outlining essential do's and don'ts that can help guide you through this important documentation process.

DO:

- Include all necessary details such as the full names and addresses of both the buyer and seller, a detailed description of the item being sold (including make, model, year, and VIN or serial number for vehicles), and the sale price.

- Ensure both the buyer and seller sign and date the form. In some cases, witnesses or a notary public may also need to sign the document to confirm its authenticity.

- Keep a copy of the Bill of Sale for your own records. It's important for both the buyer and seller to have a copy of this document, as it serves as proof of the transaction and ownership.

- Verify the accuracy of all information entered on the form. This includes double-checking the spelling of names, addresses, and the description of the item being sold.

DON'T:

- Leave any fields blank. If a particular section does not apply to your sale, it's better to enter “N/A” rather than leaving it empty to avoid any potential misunderstandings or issues down the road.

- Forget to specify the condition of the item being sold. Clearly stating whether the item is being sold “as is” or under certain conditions is crucial for legal clarity.

- Ignore local or state-specific requirements. Some areas may have additional stipulations or forms that need to be completed in conjunction with the Bill of Sale.

- Rush through the process without reviewing the document. It's essential to carefully read through the entire Bill of Sale before signing to ensure all information is accurate and complete.

Misconceptions

When it comes to completing a Bill of Sale in Texas, there are some misunderstandings that can complicate the process. It's important to have clear information to ensure transactions are conducted smoothly and legally. Here are four common misconceptions about the Texas Bill of Sale form:

It's Not Necessary for Private Sales: Many people assume that a Bill of Sale form isn't required for private sales, especially between two individuals. However, having a Bill of Sale is crucial as it serves as evidence of the transaction and transfers ownership from the seller to the buyer. It's not just about legality; it's also about protection for both parties involved.

Any Form Will Do: Another common misunderstanding is that any Bill of Sale form will suffice. However, for it to be legally binding in Texas, the document must include specific information such as the buyer and seller's names, a detailed description of the item being sold, the sale price, and the date of sale. It's not a one-size-fits-all document; it needs to meet Texas state requirements to be valid.

Witnesses or Notarization Aren't Required: While Texas does not mandate a Bill of Sale to be witnessed or notarized, having it notarized or at least witnessed can add an extra layer of authenticity and may help resolve any future disputes. This step is often overlooked but can significantly protect everyone involved.

A Bill of Sale Transfers Ownership Completely: Completing a Bill of Sale is an important step in the ownership transfer process, but it's not the only one. In the case of vehicles, for example, ownership is not fully transferred until the title is legally changed over to the new owner's name. Therefore, a Bill of Sale should be seen as part of the process, not the entirety of it.

Understanding these common misconceptions can help ensure that when you're involved in a property transaction in Texas, everything is completed correctly and legally. Being informed makes the process smoother for everyone involved.

Key takeaways

When preparing and utilizing a Texas Bill of Sale form, it's important to keep several key considerations in mind. This document serves not only as evidence of a transaction but also plays an essential role in the legal transfer of property. Here are six crucial takeaways:

- Complete Information is Critical: Ensure all fields of the form are filled out with accurate and complete information. This includes the full names and addresses of both the buyer and seller, a thorough description of the item(s) being sold, and the sale price. Precise details prevent misunderstandings and provide clear evidence of the agreement.

- Verify Item Description: When selling vehicles, firearms, or any high-value items, the description should include serial numbers, make, model, year, and any other identifying details. This specificity helps in verifying the ownership and authenticity of the items.

- Don't Forget the Date: The date of the sale is crucial for record-keeping and, in some cases, for legal reasons. It can determine when the ownership officially transfers and can be used to establish timelines for any warranties or returns as per the agreement.

- Signatures are Vital: Both the buyer's and seller's signatures are required to validate the Bill of Sale. These signatures are a formal acknowledgment of the terms and conditions of the sale, making the document legally binding.

- Notarization May Be Required: Depending on the type of transaction or local regulations, notarization of the Bill of Sale may be necessary. This added step certifies the authenticity of the signatures, adding an extra layer of legal protection.

- Keep Copies for Record-Keeping: Both parties should keep copies of the Bill of Sale for their records. Having this document readily available can resolve disputes, assist in tax preparation, and is often required for registration purposes by state agencies.

Taking the time to accurately complete a Texas Bill of Sale form can save both parties significant time and trouble in the future. It's a straightforward document that, when properly executed, offers substantial legal and financial protection.

More Bill of Sale State Forms

Can You Do a Title Transfer Online - For sellers, it's a way to document the release of liability, showing that the item is no longer in their possession.

North Carolina Vehicle Bill of Sale - It's a foundational document in the accurate recording and reporting of large personal or business assets.