Fillable Bill of Sale Document for Ohio

In the bustling state of Ohio, the sale of personal and private property between individuals is facilitated through an essential document known as the Ohio Bill of Sale form. Serving as a binding contract, it meticulously records the details of transactions, offering clarity and legal protection to both buyers and sellers involved. This form, crucial in its function, captures information such as the description of the item sold, the sale price, and the personal details of the involved parties, ensuring that the transfer of ownership is both transparent and legitimate. Moreover, the Ohio Bill of Sale form stands as an irreplaceable piece of evidence should disputes or claims regarding the ownership or condition of the item arise post-sale. With considerations ranging from legality to peace of mind, understanding the major aspects of this form is imperative for anyone engaging in private sales within the state, underscoring the importance of procedural correctness and attention to detail in private sales transactions.

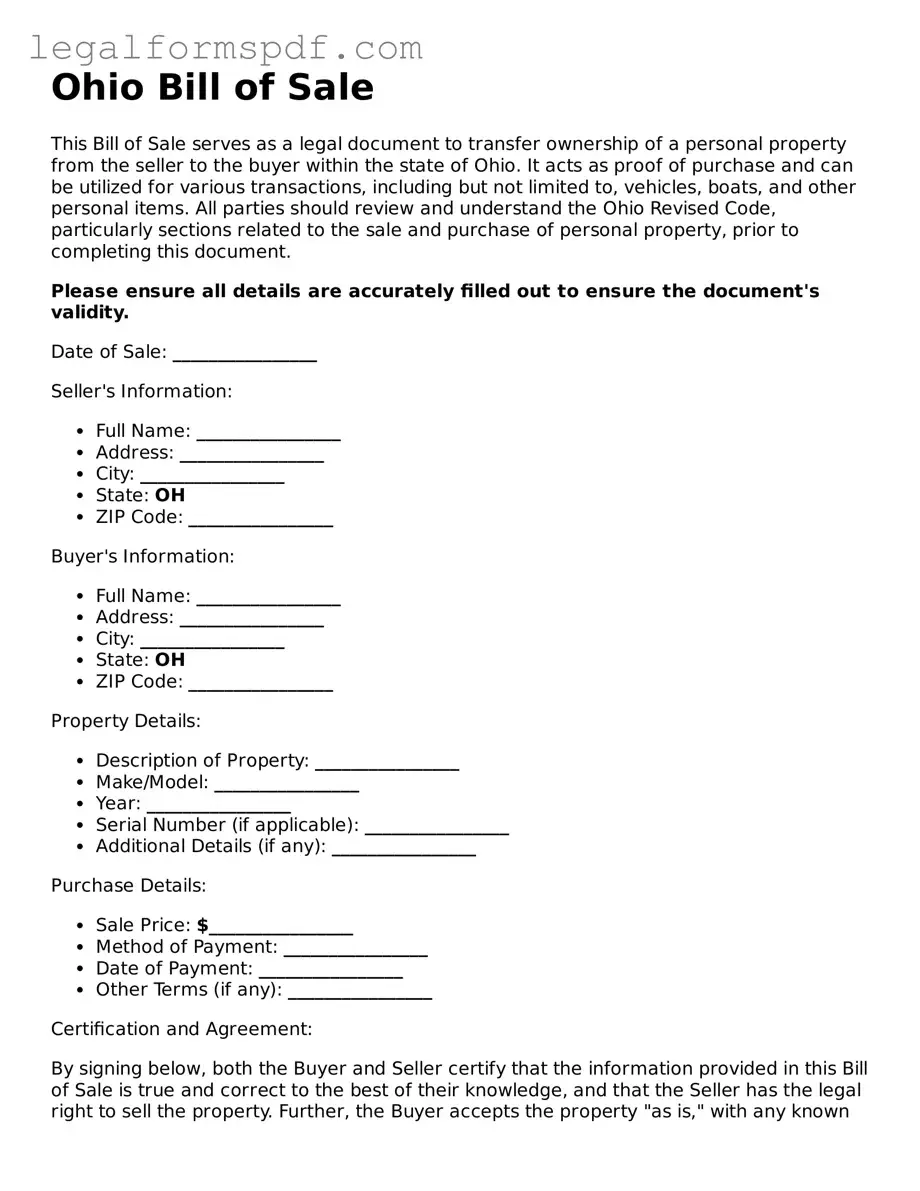

Document Example

Ohio Bill of Sale

This Bill of Sale serves as a legal document to transfer ownership of a personal property from the seller to the buyer within the state of Ohio. It acts as proof of purchase and can be utilized for various transactions, including but not limited to, vehicles, boats, and other personal items. All parties should review and understand the Ohio Revised Code, particularly sections related to the sale and purchase of personal property, prior to completing this document.

Please ensure all details are accurately filled out to ensure the document's validity.

Date of Sale: ________________

Seller's Information:

- Full Name: ________________

- Address: ________________

- City: ________________

- State: OH

- ZIP Code: ________________

Buyer's Information:

- Full Name: ________________

- Address: ________________

- City: ________________

- State: OH

- ZIP Code: ________________

Property Details:

- Description of Property: ________________

- Make/Model: ________________

- Year: ________________

- Serial Number (if applicable): ________________

- Additional Details (if any): ________________

Purchase Details:

- Sale Price: $________________

- Method of Payment: ________________

- Date of Payment: ________________

- Other Terms (if any): ________________

Certification and Agreement:

By signing below, both the Buyer and Seller certify that the information provided in this Bill of Sale is true and correct to the best of their knowledge, and that the Seller has the legal right to sell the property. Further, the Buyer accepts the property "as is," with any known or unknown faults at the time of sale. Both parties acknowledge this sale does not violate any laws of the state of Ohio.

Seller's Signature: ________________ Date: ________________

Buyer's Signature: ________________ Date: ________________

This document is executed in the state of Ohio and is subject to the state's jurisdiction. It is advised to keep a copy of this Bill of Sale for personal records.

PDF Specifications

| Fact Name | Detail |

|---|---|

| Purpose | It serves as proof of transfer of ownership from the seller to the buyer. |

| Necessary Information | It includes details like the names and addresses of the buyer and seller, description of the item sold, sale date, and purchase price. |

| Notarization | In Ohio, notarization of a Bill of Sale is not mandatory but recommended for added legal protection. |

| Vehicle Sales | For vehicle sales, the Bill of Sale complements the title transfer but does not replace the need for a title. |

| Governing Law | While Ohio does not have a specific statute requiring a Bill of Sale, the Uniform Commercial Code (UCC) adopted by Ohio governs such transactions. |

| Additional Requirements | For vehicles, an odometer disclosure statement is often required in addition to the Bill of Sale. |

| Record Keeping | Both the buyer and seller should keep copies of the Bill of Sale for their records and any future disputes or as required by law. |

Instructions on Writing Ohio Bill of Sale

Once you have decided to buy or sell a personal item, like a car or a piece of equipment, in Ohio, completing a Bill of Sale form is a crucial step in the process. This document serves as proof of the transaction, detailing the transfer of ownership from the seller to the buyer. It is essential for both parties to ensure all information is accurately recorded on the form. Following the steps correctly can protect the rights of both the buyer and seller, avoid potential legal issues, and simplify the transfer process.

- Gather all necessary information about the item being sold, including make, model, year, and serial number, if applicable.

- Collect contact information for both the seller and the buyer, such as full names, addresses, and phone numbers.

- Agree on the sale price of the item and ensure it is clearly specified in the document.

- Specify any additional details regarding the sale conditions, such as "as is" or if there are any warranties or guarantees included.

- Both the buyer and the seller must provide signatures and the date of the transaction. Ensure all fields are signed to make the document legally binding.

- Retain copies of the completed Bill of Sale for both parties. Keeping a record is essential for tax purposes and can serve as evidence of ownership transfer.

Completing the Ohio Bill of Sale is straightforward but requires attention to detail. By following these steps, you can ensure a smooth and legally sound transaction. Remember, this form not only provides legal protection but also peace of mind for both the buyer and seller. It's worth taking the time to do it right.

Understanding Ohio Bill of Sale

What is an Ohio Bill of Sale form?

An Ohio Bill of Sale form is a legal document used during the sale of property in Ohio, indicating that an item was sold by one party to another. This document is crucial as it records the transaction in detail, including what was sold, the sale price, and the date of sale. It acts as a receipt for the transaction and can serve as evidence of ownership transfer.

Is an Ohio Bill of Sale form required for all sales transactions in Ohio?

No, an Ohio Bill of Sale form is not required for all sales transactions; however, it is highly recommended for both the buyer's and seller's protection. It is particularly important for private sales of vehicles, boats, firearms, and other major assets. Having this document can resolve disputes about the sale or prove ownership if the item's legality comes into question.

What information needs to be included in an Ohio Bill of Sale form?

The Ohio Bill of Sale form should include specific details to ensure it is comprehensive. These details typically consist of the date of the transaction, the names and addresses of the buyer and seller, a thorough description of the item being sold (including make, model, year, and serial number, if applicable), the sale amount, and the signatures of both the buyer and seller. It might also include terms of the sale and warranty information, if any.

Do I need to notarize my Ohio Bill of Sale form?

While notarization of an Ohio Bill of Sale form is not a legal requirement, it is a wise step to authenticate the document. Notarization provides an additional layer of verification, confirming that the signatures on the form are genuine and that the document can be trusted. This can be especially helpful if the sale is questioned or if a legal issue arises.

How can I use an Ohio Bill of Sale form once it's completed?

Once completed, the Ohio Bill of Sale form serves multiple purposes. It can be used by the buyer to prove ownership of the item, which is helpful for registration and insurance purposes. For the seller, it provides proof that the item was legally transferred to the new owner, releasing them from liability for what the buyer does with the item. It's advisable to keep copies of the bill of sale for both parties' records.

Can the Ohio Bill of Sale form be used as a legal document in court?

Yes, the Ohio Bill of Sale form can be used as a legal document in court. It acts as a binding agreement between the buyer and seller regarding the transaction and can provide critical evidence in disputes, fraud cases, or when proving ownership. Ensuring the form is accurately filled out and, if possible, notarized, can enhance its credibility as a legal document.

Common mistakes

One common mistake people make when filling out the Ohio Bill of Sale form is not providing complete information on the buyer and seller. This form requires detailed information, including full names, addresses, and contact numbers. When any of this information is incomplete or missing, it can raise issues in establishing the legality of the transaction or in future disputes. It's crucial for both parties to verify that their details are accurate and fully provided on the form.

Another frequent error occurs with the description of the item being sold. Individuals often provide vague or insufficient descriptions of the item, such as just "car" or "boat." For legal and record-keeping purposes, it is necessary to include a detailed description, including make, model, year, color, condition, and any identifying numbers (such as a VIN for vehicles). This level of detail helps to clearly identify the item in the bill of sale and prevent misunderstandings.

Not including the sale date or providing an incorrect sale date is also a mistake people commonly make. The date of the sale is essential for a variety of reasons, including tax assessment and as a record for potential future disputes. Forgetting to include the sale date or writing an incorrect date can lead to complications in proving when the transaction took place.

A significant oversight is failing to specify the terms of the sale, such as whether the item is being sold "as is" or with a warranty. When this information is not explicitly stated, it leaves room for legal ambiguity. If a dispute arises regarding the condition of the item after the sale, having the terms clearly outlined in the bill of sale can provide important legal protection and clarity for both parties.

Last but not least, not obtaining a notary’s acknowledgment on the bill of sale when required is a critical mistake. While not all states require a notarized bill of sale, ensuring that this document is officially acknowledged can add an extra layer of authenticity and may be required for certain items or by certain state regulations. Skipping this step can invalidate the document or complicate its use in legal or registration processes.

Documents used along the form

In addition to the Ohio Bill of Sale form, a variety of other documents are often required or beneficial to complement the process, especially in transactions involving vehicles, business sales, and property transfers. These documents serve to protect the rights of the parties involved, ensure the accuracy of information, and comply with legal requirements. They range from those confirming identity and ownership to those securing rights and detailing the terms of agreements.

- Title Transfer Form: This document is crucial in the sale of vehicles, as it officially transfers ownership from the seller to the buyer. It's required by the Department of Motor Vehicles (DMV) to update their records and issue a new title.

- Odometer Disclosure Statement: For vehicle sales, this statement is necessary to comply with federal law, recording the mileage of the vehicle at the time of sale. It helps to prevent odometer fraud and assures the buyer of the vehicle's condition.

- Warranty Deed: Often used in real estate transactions, this document guarantees the buyer that the property is free from any liens or claims and that the seller holds clear title to the property. It provides the highest level of protection to the buyer.

- Promissory Note: If the purchase involves a payment plan or financing, a promissory note outlines the terms of repayment. It specifies the loan amount, interest rate, payment schedule, and consequences of non-payment.

- Vehicle Registration Forms: After acquiring a vehicle, the new owner must register it with the Ohio DMV. These forms are necessary to obtain license plates and a registration certificate, proving that the vehicle complies with state regulations.

- Sales and Use Tax Forms: For transactions that require the payment of sales tax, such as vehicle sales, these forms are used to calculate and remit the correct amount of tax to the state treasury.

- Personal Property Inventory List: Especially relevant in business sales, this comprehensive list details all items included in the sale, ensuring clear agreement and transfer of all assets from the seller to the buyer.

Each of these documents plays a vital role in their respective contexts, helping to ensure that both parties have a clear understanding of their rights and obligations, securing the transfer of ownership, and conforming to statutory requirements. Collecting and preparing these documents can be as crucial as the Bill of Sale itself, paving the way for a smooth and legally sound transaction.

Similar forms

The Ohio Bill of Sale form is closely related to the Warranty Deed in that they both serve as proof of a transaction. A Warranty Deed, however, is used specifically for real estate transactions and guarantees that the title to the property is free from any claims, ensuring the buyer acquires ownership without legal encumbrances. This is analogous to the Bill of Sale offering assurance that a personal property item has been sold, but the Warranty Deed includes more detailed protections and applies only to real estate.

Similar to the Ohio Bill of Sale is the Promissory Note. This document outlines the details of a loan between two parties, specifying the amount borrowed, interest rate, repayment schedule, and consequences of non-repayment. While the Bill of Sale confirms the sale and transfer of ownership of an item, the Promissory Note secures the promise of payment from the borrower to the lender, serving as an essential document in financial transactions.

Another document akin to the Ohio Bill of Sale is the Quitclaim Deed. This form is used in property transfers, often between family members or close associates. It differs as it does not guarantee a clear title, merely transferring the seller's interest in the property to the buyer. The Bill of Sale and Quitclaim Deed alike finalize transfers of ownership, though the latter has a more specific use in real estate and less protection for the buyer.

The General Contract for Services shares similarities with the Ohio Bill of Sale, focusing on agreements for service rather than the transfer of tangible goods. It details the scope of work, payment terms, and obligations of both parties in a service agreement. While one documents the sale of physical items, both reflect a mutually agreed-upon transaction, underscoring the significance of clear, documented terms in any agreement.

Closely related to the Ohio Bill of Sale is the Vehicle Title Transfer form. This document is specific to the sale and purchase of vehicles, indicating the change of ownership on the official vehicle title. Both serve as legal evidence of the sale and transfer of property, but the Vehicle Title Transfer also involves the government's motor vehicle department to update records accordingly, making it more specific to vehicles.

The Certificate of Title is another document bearing similarities to the Ohio Bill of Sale. It serves as official proof of ownership for various types of property, including vehicles, boats, or even real estate in some cases. Although the Certificate of Title doesn't facilitate the transaction like a Bill of Sale, it embodies the outcome by officially recognizing new ownership, complementing the Bill of Sale in property transactions.

A Power of Attorney may seem different but shares an underlying connection with the Ohio Bill of Sale. Specifically, a Durable Power of Attorney for Finances allows an individual to appoint another to handle their financial transactions, which may include the buying or selling of property documented by a Bill of Sale. While one delegates authority, the other concludes a transfer, both playing crucial roles in the management and execution of property transactions.

Dos and Don'ts

When filling out the Ohio Bill of Sale form, there are crucial steps to follow to ensure the process is completed correctly. It's important for both the seller and the buyer to understand what to do and what to avoid doing. Here are some guidelines to help navigate the process smoothly:

Things You Should Do:

- Provide accurate information: Double-check that all the details about the transaction are correct, including the names of the buyer and seller, the sale price, and a detailed description of the item being sold.

- Include the date of the sale: Always write down the exact date when the sale takes place. This is important for record-keeping and possibly for tax purposes.

- Sign and date the form: Ensure both the buyer and seller sign and date the form to make it legally binding. The signatures are critical for the document's validity.

- Keep copies of the completed form: Both parties should keep a copy of the signed Bill of Sale. It serves as a receipt and a legal document proving the transfer of ownership.

Things You Shouldn't Do:

- Avoid leaving blank spaces: Make sure all fields on the form are filled in. Blank spaces can lead to misunderstandings or potential fraud.

- Don't forget to specify any conditions: If there are any conditions of the sale (such as 'as is' or subject to an inspection), clearly state these on the form to avoid any disputes later on.

- Do not ignore the need for a witness or notary: Depending on local requirements, a witness or notary public might need to sign the Bill of Sale. Failing to meet this requirement can affect the document's legal standing.

- Don't rush through the process: Take your time to review all the information on the Bill of Sale before signing it. Mistakes or omissions can complicate the transaction or lead to legal issues in the future.

Misconceptions

When it comes to the Ohio Bill of Sale form, there are several misconceptions that can muddy the waters for both buyers and sellers. Understanding these common misunderstandings helps ensure that transactions are handled smoothly and legally within the state. Here are nine misconceptions debunked to set the record straight:

A Bill of Sale is not necessary in Ohio. Contrary to this belief, having a Bill of Sale is crucial when it comes to private transactions. It serves as a proof of purchase and can be helpful for tax and record-keeping purposes.

Any template found online is sufficient for a Bill of Sale in Ohio. Although various templates are available online, it's important to use one that meets Ohio's specific requirements. This ensures that the document is legally valid.

A Bill of Sale must be notarized in Ohio. While notarization adds an extra layer of authenticity, Ohio law does not require a Bill of Sale to be notarized. However, it’s recommended to check if notarization is necessary based on the type of property being sold.

Only the buyer needs to keep a copy of the Bill of Sale. In reality, both the buyer and the seller should retain a copy of the Bill of Sale. This protects both parties in case any disputes or discrepancies arise.

A Bill of Sale is the only document you need to transfer vehicle ownership. This is a misconception. A Bill of Sale is part of the documentation needed for transferring vehicle ownership in Ohio, but other documents, such as the title transfer, are also required.

Writing your own Bill of Sale is too complex and unnecessary. Writing a Bill of Sale need not be complex; it just needs to fulfill the required elements, such as a detailed description of the item, the sale price, and the parties' signatures. It's a simple yet critical document in a sales transaction.

A Bill of Sale does not need to include the condition of the item being sold. Including the condition of the item is actually very important, as it provides clarity on what exactly is being sold and what state it is in at the time of the sale.

Bill of Sale forms are the same for all types of properties. This is incorrect. Different properties might require different types of information. For example, a vehicle Bill of Sale often includes the VIN (Vehicle Identification Number) and odometer reading.

You can't use a Bill of Sale for trading items in Ohio. A Bill of Sale can definitely be used for trades, not just outright sales. It should detail the items being exchanged and any additional conditions agreed upon by the trading parties.

Understanding the true requirements and benefits of a Bill of Sale in Ohio ensures that individuals can confidently engage in private sales and purchases. It's all about protecting your interests and ensuring that transactions are conducted legally and effectively.

Key takeaways

The Ohio Bill of Sale form is an essential document for transferring ownership of a personal property from a seller to a buyer in the state of Ohio. It acts as a legal receipt that confirms the sale and purchase of the item. Here are some key takeaways to keep in mind when filling out and using this form:

- The form should include a detailed description of the item being sold. This description can help identify the item and should include any serial numbers, model numbers, or specific features.

- Both the seller and the buyer must provide their full names and addresses to ensure that the bill of sale accurately represents the parties involved in the transaction.

- The date of the sale is crucial and must be included on the form. This date marks when the ownership of the item officially transfers from the seller to the buyer.

- A clear statement of the sale price agreed upon by both parties should be included on the form. This serves as proof of the transaction value and can be useful for tax purposes.

- Signatures from both the seller and the buyer are required to validate the bill of sale. The signatures legally bind the document, making it a credible piece of evidence should any disputes arise.

- If the item being sold is a vehicle, additional information such as the make, model, year, and vehicle identification number (VIN) must be included in the bill of sale.

- For the sale of a vehicle, it is often required to notarize the bill of sale in Ohio. Notarization adds an additional layer of legal protection by verifying the identities of the signing parties.

- It's advisable for both parties to keep a copy of the bill of sale. Having a personal copy can be very helpful in resolving any future disputes or for record-keeping purposes.

- The Ohio Bill of Sale form is not a title. If a title is required for the item being sold (like a vehicle), the seller must provide an official title transfer to the buyer alongside the bill of sale.

Understanding and properly using the Ohio Bill of Sale form can provide peace of mind for both the buyer and seller, ensuring that the transaction is recognized legally and that both parties have a clear record of the transfer of ownership.

More Bill of Sale State Forms

North Carolina Vehicle Bill of Sale - Utilizing a Bill of Sale reaffirms the principle of good faith in private sales, fostering trust and accountability.

Bill of Sales Dmv - In addition to the actual sale, the document may outline terms of payment if not conducted as a single transaction.

Bill of Sale Illinois Template - In disputes over ownership or entitlements, a bill of sale is a potent piece of evidence in court proceedings.

Can You Do a Title Transfer Online - Depending on the item's value, a Bill of Sale might also need to be notarized, adding an extra layer of legal validity to the document.