Fillable Bill of Sale Document for North Carolina

In the state of North Carolina, the Bill of Sale form serves as a pivotal document in the process of buying and selling personal property. It acts as a formal record of the transaction, providing proof of the change in ownership from the seller to the buyer. This document, while not always mandated by law for every transaction, is highly recommended as it safeguards the rights and obligations of both parties involved. The form typically includes crucial details such as the description of the item being sold, the sale price, and the date of the transaction. Additionally, it contains the personal information of the buyer and seller, ensuring transparency and accountability. Its use spans a wide range of items, from vehicles to smaller valuables, underlining its versatility and importance in facilitating private sales. By meticulously filling out a Bill of Sale, participants in such transactions can significantly mitigate potential disputes, making it an essential component of a smooth and secure exchange of goods.

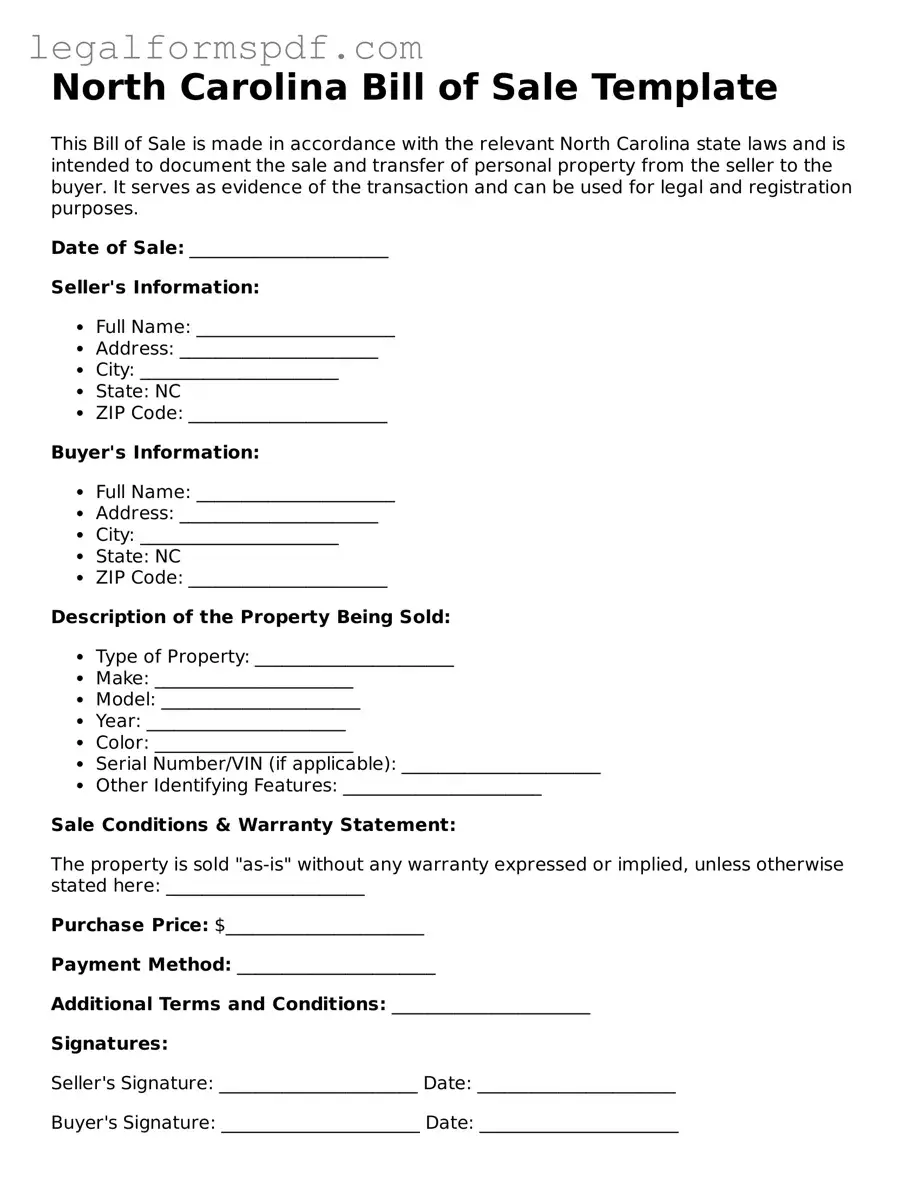

Document Example

North Carolina Bill of Sale Template

This Bill of Sale is made in accordance with the relevant North Carolina state laws and is intended to document the sale and transfer of personal property from the seller to the buyer. It serves as evidence of the transaction and can be used for legal and registration purposes.

Date of Sale: ______________________

Seller's Information:

- Full Name: ______________________

- Address: ______________________

- City: ______________________

- State: NC

- ZIP Code: ______________________

Buyer's Information:

- Full Name: ______________________

- Address: ______________________

- City: ______________________

- State: NC

- ZIP Code: ______________________

Description of the Property Being Sold:

- Type of Property: ______________________

- Make: ______________________

- Model: ______________________

- Year: ______________________

- Color: ______________________

- Serial Number/VIN (if applicable): ______________________

- Other Identifying Features: ______________________

Sale Conditions & Warranty Statement:

The property is sold "as-is" without any warranty expressed or implied, unless otherwise stated here: ______________________

Purchase Price: $______________________

Payment Method: ______________________

Additional Terms and Conditions: ______________________

Signatures:

Seller's Signature: ______________________ Date: ______________________

Buyer's Signature: ______________________ Date: ______________________

This document is executed in good faith and acknowledges the transfer of ownership of the property described herein from the seller to the buyer. Both parties are advised to retain a copy of this Bill of Sale for their records and any future verification requirements.

PDF Specifications

| Fact Number | Description |

|---|---|

| 1 | A North Carolina Bill of Sale form is used to document the sale and transfer of ownership of personal property from a seller to a buyer. |

| 2 | This document is often required for the registration of a vehicle or boat in North Carolina. |

| 3 | It typically includes details such as the date of sale, purchase price, and descriptions of the items being sold. |

| 4 | Both the buyer and seller's names and addresses are required on the form. |

| 5 | For vehicle sales, it should include the make, model, year, and Vehicle Identification Number (VIN). |

| 6 | The Bill of Sale acts as proof of purchase and can be used as a legal document in case of disputes. |

| 7 | While not all sales require a Bill of Sale in North Carolina, it is always recommended to complete one for the records of both parties. |

| 8 | North Carolina does not provide a state-specific Bill of Sale form but accepts a generic form as long as it contains all necessary information. |

| 9 | Adding a notary's signature is not mandatory but can provide additional legal validation. |

| 10 | Governing Law: The North Carolina Bill of Sale is governed by North Carolina General Statutes. Relevant statutes include those covering the sale of personal property and motor vehicle transactions. |

Instructions on Writing North Carolina Bill of Sale

When purchasing or selling a vehicle or other personal property in North Carolina, individuals might consider creating a Bill of Sale. This document serves as proof of the transaction and includes details such as the sale price and a description of the item. Completing the North Carolina Bill of Sale form accurately is crucial for both parties to ensure the legality of the transaction and to safeguard their respective rights. Here are the steps necessary to fill out the form:

- Gather all relevant information about the item being sold, including make, model, year, and serial number or vehicle identification number (VIN), if applicable.

- Include the full names and contact information of both the seller and the buyer.

- Write down the selling price of the item in United States dollars.

- Specify the date when the sale will take place or has taken place.

- Describe the condition of the item, including any defects or issues that the buyer should be aware of.

- Both the buyer and seller should read through the completed form to ensure all information is accurate and complete.

- Have the seller sign and date the form. In some cases, it's also advisable for the buyer to sign the form, although this may not be a legal requirement.

- Lastly, make copies of the completed form. Provide one to the buyer, keep one for the seller, and consider having an additional copy for legal records or registration processes.

Completing the North Carolina Bill of Sale form is a straightforward process that provides a written record of the sale of an item. By following these steps, both parties can ensure that the transaction is documented properly, which can be crucial for ownership records, registration, or in the event of any future disputes.

Understanding North Carolina Bill of Sale

What is a North Carolina Bill of Sale form?

A North Carolina Bill of Sale form is a legal document that records the transfer of ownership of a personal property item, such as a car, boat, firearm, or piece of equipment, from a seller to a buyer. It typically includes critical details like the names and addresses of the parties involved, a description of the item being sold, the sale price, and the date of sale. This document can serve as proof of purchase and may be required for registration or taxation purposes.

Is a Bill of Sale legally required in North Carolina?

In most cases, North Carolina does not legally require a Bill of Sale for private transactions. However, it is highly recommended as a record of the sale for both the buyer and the seller. For motor vehicles, North Carolina requires a title transfer when ownership changes hands, but a Bill of Sale can complement this process by providing additional documentation.

What information should be included in a North Carolina Bill of Sale?

A comprehensive North Carolina Bill of Sale should include the full names and addresses of both the seller and the buyer, a detailed description of the item being sold (including make, model, year, and serial number, if applicable), the sale price, the date of the sale, and signatures of both parties. It is also recommended to include the item's condition and any warranties or "as-is" status at the time of sale.

Does a Bill of Sale need to be notarized in North Carolina?

While notarization is not a statewide requirement for Bills of Sale in North Carolina, having the document notarized can add an additional layer of protection for both parties by verifying the authenticity of the signatures. For certain transactions, such as those involving a lien or a high-value item, notarization may be advisable.

Can I create a Bill of Sale form myself?

Yes, individuals can create their own Bill of Sale form. There are templates available online, but it is important that the document you produce includes all necessary information to accurately reflect the transaction. Ensure it is clearly written and understandable to both parties and any legal authorities who might review it.

How do I obtain a North Carolina Bill of Sale form?

North Carolina Bill of Sale forms can be downloaded from various legal, governmental, and non-profit websites. The North Carolina Department of Motor Vehicles (DMV) website is a reliable source for a vehicle Bill of Sale form. Always ensure that the form you use complies with the requirements of North Carolina law.

What happens after the Bill of Sale is signed?

After the Bill of Sale is signed, the buyer should keep a copy as proof of purchase and for their records. The seller should also retain a copy. If the sold item is a vehicle, the buyer may need to present the Bill of Sale as part of the registration process. Both parties should also ensure that any other requirements, such as title transfers and release of liability, are completed.

Are electronic Bills of Sale accepted in North Carolina?

In North Carolina, electronic Bills of Sale may be accepted as valid documentation for certain items, particularly if they include all necessary information and are signed by both parties. However, for transactions involving vehicles, the DMV may require a printed copy with original signatures for registration purposes. Always check the current requirements with the relevant local authority.

Common mistakes

When completing the North Carolina Bill of Sale form, one common mistake is not providing detailed information about the item or property being sold. This detail is crucial for the legitimacy of the document, ensuring both buyer and seller agree on the exact condition and specifications of the item. Items poorly described can lead to disagreements or legal issues down the line.

Another error often made is failing to include both parties' full details. This includes the full legal names, addresses, and contact information of both the buyer and seller. Skipping these details can render the document less effective for legal protection or contact purposes if disputes arise after the transaction.

Many people also forget to sign and date the document in the presence of a notary. Though not always mandatory, having the form notarized adds a layer of verification and authenticity, making it harder for either party to dispute the validity of the document or the transaction. This oversight can significantly impact the enforceability of the bill of sale.

Last but not least, individuals often neglect to keep a copy of the bill of sale for their records. Retaining a copy is essential for both buyer and seller. It serves as proof of transaction, ownership transfer, and can be crucial for tax purposes or legal verification if any issues arise post-sale. Without a copy, proving the details of the transaction can become a complex challenge if needed in the future.

Documents used along the form

Completing the sale of a vehicle or property in North Carolina often involves more than just the Bill of Sale form. This document serves as a critical piece in the transaction, certifying the change of ownership. However, to fully comply with legal requirements and ensure a smooth transition, several additional documents might be necessary. These documents help to further detail the transaction, confirm identities and ownership, and fulfill state-specific legal obligations.

- Certificate of Title: This document is essential for the sale of vehicles, as it officially signifies ownership of the vehicle. It includes vital information such as the vehicle identification number (VIN), the year, make, and model, and the names and addresses of both the seller and the buyer. Before the transfer is considered complete, the seller must fill out the relevant sections and the buyer must submit the certificate to the state's Department of Motor Vehicles (DMV).

- Odometer Disclosure Statement: A requirement for selling vehicles that are less than 10 years old, this form documents the mileage on the vehicle at the time of sale. Accurate mileage is crucial for the buyer's awareness and for maintaining transparent records. This statement can also help to identify potential issues or discrepancies with the vehicle's history.

- Release of Liability Form: This form is not always mandatory but is highly recommended. It serves to protect the seller from liability for any incidents involving the vehicle after the sale has been completed. By submitting this form to the DMV, the seller can help ensure they are not inaccurately held responsible for future violations or accidents.

- Notarization: While not a separate form, getting the Bill of Sale (and sometimes other documents) notarized can be a critical requirement or simply add an extra layer of authenticity to the transaction. Notarization formally certifies that the signing parties are indeed who they claim to be, offering an additional level of security and legal validity to the process.

When individuals engage in buying or selling property or vehicles in North Carolina, equipping themselves with these documents can foster a compliant and secure exchange. The integration of these forms with the Bill of Sale ensures that all aspects of the transaction are properly documented, minimizing future risks and disputes. This foundational paperwork is instrumental in safeguarding the interests of all parties involved.

Similar forms

The North Carolina Bill of Sale form shares a close resemblance with the Vehicle Title Transfer form. Both documents are crucial when ownership of a vehicle changes hands. Where the Bill of Sale serves as proof of a transaction, listing the price and other transaction details, the Vehicle Title Transfer legally changes the vehicle's ownership in the state registry. Each step ensures both the buyer's and seller's rights are protected during the transfer process.

Similarly, the Warranty Deed often parallels the functions of a Bill of Sale but in the real estate domain. This document is used when transferring property ownership, ensuring the new owner receives the title free from liens or claims. Like a Bill of Sale, a Warranty Deed details the transaction, solidifying the transfer of ownership, but it specifically pertains to real estate property.

The Promissory Note is another document akin to the Bill of Sale, primarily focusing on transactions involving loans or financing. While the Bill of Sale acknowledges that a transaction has occurred and documents the terms, a Promissory Note records a promise to pay a specified sum of money to someone under agreed conditions. Both forms are instrumental in providing a written record of the terms agreed upon by the parties involved.

The General Contract for Services bears similarity to the Bill of Sale but in the context of service provision. This contract outlines the terms under which services will be provided, fees, and other crucial transaction details. The Bill of Sale does much the same for goods, making sure all parties are clear about what's being exchanged and under what conditions.

Power of Attorney forms share a fundamental similarity with Bills of Sale in that they both involve granting rights. While a Bill of Sale grants a buyer ownership rights to property, a Power of Attorney can grant someone the right to act on another’s behalf in legal or financial matters. Each document specifies the parameters of the rights being transferred, whether it’s ownership or decision-making powers.

The Quitclaim Deed, often used in transferring real estate between family members or as part of divorce settlements, is somewhat similar to a Bill of Sale. It serves the purpose of transferring ownership without making any guarantees about the property's title, much like a Bill of Sale transfers ownership of personal property with or without warranties, depending on its terms.

Finally, the Receipt serves as a simple counterpart to the more detailed Bill of Sale. While a Bill of Sale provides comprehensive details about a transaction including the parties involved, descriptions of the items, and transaction terms, a Receipt is typically a straightforward document acknowledging that payment has been made. Both documents, however, play critical roles in confirming transactions and establishing proof of purchase or sale.

Dos and Don'ts

When completing the North Carolina Bill of Sale form, it's critical to proceed with care and attention to detail. This document serves as proof of transaction and can have legal implications. Below are the do's and don'ts to ensure the process is completed accurately and efficiently.

Do:

- Ensure that all the information provided on the form is accurate and truthful. This includes details such as the make, model, and year of the vehicle, the sale price, and the names and addresses of both the buyer and the seller.

- Both parties should review the form for completeness and accuracy before signing. This review process helps prevent misunderstandings and ensures that both the buyer and the seller agree on the terms of the sale.

- Use ink to fill out the form. This makes the document more durable and prevents alterations, which could potentially lead to disputes or legal issues down the line.

- Keep a copy of the completed Bill of Sale for both the buyer and the seller. Having a record of the transaction is essential for future reference, whether for tax purposes, legal reasons, or personal record-keeping.

Don't:

- Leave any fields blank. If a particular section does not apply to your sale, it is advisable to write "N/A" (not applicable) instead of leaving it empty. This approach indicates that the section was considered but determined to be irrelevant to the current transaction.

- Forget to include the vehicle identification number (VIN) and the exact sale date. These details are crucial for identifying the specific transaction and the vehicle involved.

- Rely solely on verbal agreements. While oral agreements can sometimes be legally binding, having all terms detailed in writing on the Bill of Sale form protects both parties if there are any disputes or misunderstandings in the future.

- Use pencil or erasable ink to complete the form. These can be easily altered or smudged, raising questions about the document's authenticity and potentially invalidating it.

Misconceptions

Many people harbor misconceptions about the North Carolina Bill of Sale form. This document is crucial in recording the details of a transaction between a seller and a buyer, usually for personal property like a car. Understanding the facts can help individuals navigate their transactions more effectively. Let's clear up some common misunderstandings.

- A Bill of Sale is the same as a title. This is not true. The Bill of Sale serves as evidence of a transaction. It describes the item being sold, the sale price, and the parties involved. However, a title is a legal document that demonstrates ownership of the property in question. In many cases, for vehicles, both documents are required to legally transfer ownership but serve different purposes.

- Notarization is always required for the form to be valid. In North Carolina, notarization of a Bill of Sale is not a mandatory requirement for its validity. However, having it notarized can add a layer of legal protection and authenticity to the document, especially in significant transactions or if disputed later.

- You only need a Bill of Sale for motor vehicle transactions. Another misconception is that Bills of Sale are exclusively for the sale of motor vehicles. While commonly used in these transactions, they are equally important for other types of personal property sales, such as boats, motorcycles, and even high-value items like jewelry or art.

- The Bill of Sale is only beneficial for the buyer. This is incorrect. The document provides protection for both the buyer and the seller. For the buyer, it serves as proof of ownership transfer and the terms of the sale. For the seller, it confirms that the item was legally sold and can release them from future liability related to the item.

- There is only one standard form for all transactions. While there is a general format for a Bill of Sale, different types of transactions may require specific information. For example, a vehicle Bill of Sale may include details like the make, model, year, and VIN number, which wouldn't be necessary for the sale of a piece of artwork. Tailoring the document to the transaction ensures all relevant details are documented.

- You can't use a Bill of Sale for trade transactions. Contrary to this belief, a Bill of Sale can document a trade of goods between two parties. In such cases, the form should detail the items being exchanged and may note any additional payment that balances out the trade’s value. This versatility makes the Bill of Sale useful in a variety of transactions, beyond simple cash sales.

- A verbal agreement is as legally binding as a written Bill of Sale in North Carolina. While verbal agreements may hold some weight in courts, a written Bill of Sale is far more robust in proving the details of the transaction. It provides a clear, enforceable record of what was agreed upon, making it much harder to dispute the terms or existence of a sale.

Dispelling these misconceptions helps ensure that individuals entering into personal property transactions in North Carolina do so with the correct information, protecting all parties involved.

Key takeaways

When completing and utilizing the North Carolina Bill of Sale form, there are essential considerations to keep in mind. This document facilitates the transfer of ownership for various items, including vehicles, boats, and personal property, ensuring a smooth and legally compliant transaction. The following key takeaways ensure that individuals are informed about the process and requirements:

- Both the seller and buyer must provide accurate and complete information on the form. This includes full names, addresses, and identifying details of the item being sold, such as make, model, year, and serial number (if applicable).

- The Bill of Sale must include the sale price and the date of the transaction. Stating the sale price on the document is crucial for tax purposes and to confirm the terms of the agreement between the parties.

- Signatures of both the seller and the buyer are required to validate the Bill of Sale. In some cases, North Carolina may require the document to be notarized, especially for transactions involving high-value items or motor vehicles. It is advisable to check the latest requirements with local authorities.

- Keeping a copy of the completed Bill of Sale is important for both parties. It serves as a receipt for the buyer and proof of transfer of ownership for the seller. Having this document readily available will assist in resolving any future disputes or inquiries regarding the transaction.

Following these guidelines will ensure that the Bill of Sale is filled out correctly and serves its purpose as a legal document in the state of North Carolina. It provides security and peace of mind for both parties involved in the transaction.

More Bill of Sale State Forms

Selling a Car in Florida - It acts as a receipt for personal property sold, like a vehicle, boat, or furniture.

Bill of Sale Pennsylvania - Signing a Bill of Sale also releases the seller from liability, transferring it to the new owner.

Bill of Sales Dmv - By signing this document, both buyer and seller agree to the terms of the sale, making it a binding agreement.

Printable:onqmighvyqw= Bill of Sale - It works as a safeguard against fraud, detailing the transaction in writing to verify the sale's legitimacy.