Fillable Motor Vehicle Bill of Sale Document for Texas

When buying or selling a vehicle in Texas, the transaction isn't just about exchanging keys and money; it involves paperwork that legally documents the exchange. Among the crucial documents required is the Texas Motor Vehicle Bill of Sale form. This legal document plays a pivotal role in confirming the sale and transfer of ownership of a vehicle from the seller to the buyer. It meticulously records essential details such as the vehicle's description, the agreed-upon purchase price, and the identities of the involved parties. Beyond serving as a sales receipt, it acts as a protective measure for both seller and buyer, providing a written record that can help resolve any future disputes over the vehicle's condition or ownership. The form is not just a mere formality; it's a necessary step in ensuring that the vehicle's sale complies with Texas law, potentially required for the vehicle's registration and titling process. With its importance spanning legal, financial, and bureaucratic domains, the Texas Motor Vehicle Bill of Sale form is a cornerstone of any vehicle transaction within the state.

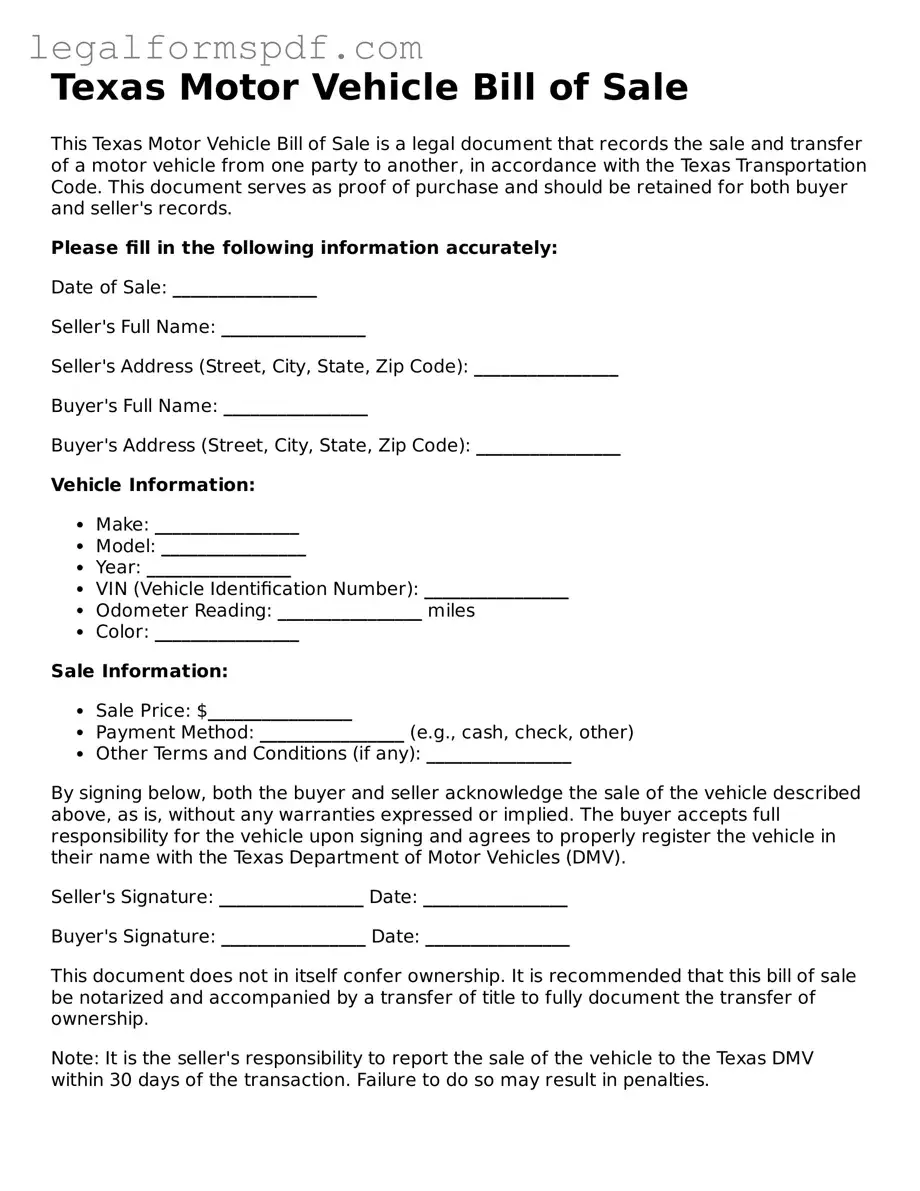

Document Example

Texas Motor Vehicle Bill of Sale

This Texas Motor Vehicle Bill of Sale is a legal document that records the sale and transfer of a motor vehicle from one party to another, in accordance with the Texas Transportation Code. This document serves as proof of purchase and should be retained for both buyer and seller's records.

Please fill in the following information accurately:

Date of Sale: ________________

Seller's Full Name: ________________

Seller's Address (Street, City, State, Zip Code): ________________

Buyer's Full Name: ________________

Buyer's Address (Street, City, State, Zip Code): ________________

Vehicle Information:

- Make: ________________

- Model: ________________

- Year: ________________

- VIN (Vehicle Identification Number): ________________

- Odometer Reading: ________________ miles

- Color: ________________

Sale Information:

- Sale Price: $________________

- Payment Method: ________________ (e.g., cash, check, other)

- Other Terms and Conditions (if any): ________________

By signing below, both the buyer and seller acknowledge the sale of the vehicle described above, as is, without any warranties expressed or implied. The buyer accepts full responsibility for the vehicle upon signing and agrees to properly register the vehicle in their name with the Texas Department of Motor Vehicles (DMV).

Seller's Signature: ________________ Date: ________________

Buyer's Signature: ________________ Date: ________________

This document does not in itself confer ownership. It is recommended that this bill of sale be notarized and accompanied by a transfer of title to fully document the transfer of ownership.

Note: It is the seller's responsibility to report the sale of the vehicle to the Texas DMV within 30 days of the transaction. Failure to do so may result in penalties.

PDF Specifications

| Fact Number | Fact Name | Description |

|---|---|---|

| 1 | Purpose | The Texas Motor Vehicle Bill of Sale form is utilized as a legal document to record the sale and purchase of a motor vehicle in the state of Texas. |

| 2 | Governing Law | This form is governed by the Texas Transportation Code, which outlines the requirements for the sale and transfer of motor vehicles within the state. |

| 3 | Key Components | It includes essential information such as the vehicle identification number (VIN), make, model, year, sale price, and the names and signatures of both the seller and the buyer. |

| 4 | Importance of Accuracy | Accuracy in filling out this form is crucial as it serves as a legal record of the transaction and may be used to prove ownership and resolve disputes. |

| 5 | Notarization | In Texas, notarization of the Bill of Sale is not required by law but is highly recommended as it adds a layer of validation to the document. |

| 6 | Additional Documentation | Completing the sale often requires additional documentation, such as a title transfer form, to legally complete the transfer of ownership. |

| 7 | Use in Registration | The Bill of Sale can also be used to register the vehicle in the buyer's name at the Texas Department of Motor Vehicles (DMV). |

| 8 | Transparency and Fraud Prevention | By documenting the details of the transaction, the Bill of Sale helps in maintaining transparency and preventing fraud in motor vehicle transactions. |

Instructions on Writing Texas Motor Vehicle Bill of Sale

Completing the Texas Motor Vehicle Bill of Sale form is a crucial step in the process of buying or selling a vehicle in the state of Texas. This document ensures that the transaction between the buyer and the seller is recorded officially, laying down the terms and conditions of the sale, and providing essential information about the vehicle and the parties involved. It acts as a receipt for the transaction and is an essential part of transferring vehicle ownership. Following these straightforward steps will help you fill out the form correctly and ensure a smooth transition.

- Begin by entering the date of the sale at the top of the form.

- Write the full legal name of the seller(s) and the buyer(s) in the designated sections. Include addresses for both parties.

- Provide the vehicle identification details such as the make, model, year, and vehicle identification number (VIN).

- Include the odometer reading at the time of sale to certify the vehicle’s mileage.

- State the sale price of the vehicle. Be sure to specify the currency if other than U.S. dollars.

- Outline any additional terms and conditions of the sale that both parties have agreed upon. This section is optional and may be left blank if not applicable.

- Have the seller(s) sign and date the form. If there is more than one seller, make sure all sellers sign.

- Have the buyer(s) sign and date the form. Similar to the seller section, if more than one buyer is involved, all must sign the document.

After filling out the form, it’s important that both the buyer and the seller keep a copy for their records. The buyer will need this document for registering the vehicle in their name at the Texas Department of Motor Vehicles. Remember, completing this form is just one step in the process of legally buying or selling a vehicle. Make sure to follow through with all other required steps and documents as stipulated by Texas law to ensure the transaction complies with state regulations.

Understanding Texas Motor Vehicle Bill of Sale

What is a Texas Motor Vehicle Bill of Sale?

A Texas Motor Vehicle Bill of Sale is a legal document that records the sale and transfer of ownership of a motor vehicle from a seller to a buyer in the state of Texas. It typically includes details such as the make, model, year, vehicle identification number (VIN), and the sale price of the vehicle, along with the names and signatures of both the seller and the buyer.

Is a Motor Vehicle Bill of Sale required in Texas?

In Texas, a Motor Vehicle Bill of Sale is not mandatory for the transfer of a vehicle’s title, but it is highly recommended. It serves as a record of the transaction for both parties and may be required for tax purposes or to resolve any future disputes or discrepancies.

What information needs to be included on a Texas Motor Vehicle Bill of Sale?

A comprehensive Texas Motor Vehicle Bill of Sale should include the date of the sale, the full names and addresses of both the buyer and the seller, a detailed description of the vehicle (including make, model, year, VIN), the sale price, and the signatures of both parties involved in the transaction. Including odometer reading is also advised to confirm the vehicle's condition at the time of sale.

Does the Motor Vehicle Bill of Sale need to be notarized in Texas?

No, Texas law does not require the notarization of a Motor Vehicle Bill of Sale. However, having it notarized can add an extra layer of legal protection and authenticity to the document, making it a good practice even if it’s not mandatory.

Who should keep a copy of the Motor Vehicle Bill of Sale?

Both the buyer and the seller should keep a signed copy of the Motor Vehicle Bill of Sale. This document serves as a receipt and a legal record of the transaction, which can be crucial for title transfer, registration, or insurance purposes in the future.

How does a Motor Vehicle Bill of Sale protect the buyer and seller?

For the seller, a Motor Vehicle Bill of Sale provides proof that the vehicle was legally sold and transferred to the buyer, releasing them from liability related to future use or ownership of the vehicle. For the buyer, it serves as proof of ownership and purchase, which is necessary for title transfer and registration. It also ensures that the details of the transaction are documented, which can help in resolving any future disputes.

Can I create a Texas Motor Vehicle Bill of Sale myself?

Yes, you can create a Texas Motor Vehicle Bill of Sale yourself. There are templates and guidelines available that can help you ensure all the necessary information is included. However, it's important to make sure that the document complies with Texas laws and includes all the required details to be considered legally binding.

Common mistakes

When filling out the Texas Motor Vehicle Bill of Sale form, individuals commonly make several errors that can complicate the transaction process or potentially nullify the document. One widespread mistake is the omission of critical information. The form requires details such as the vehicle identification number (VIN), make, model, and year, along with the sale price and the date of sale. Ignoring any of these fields or providing incomplete information jeopardizes the validity of the bill of sale, potentially leading to disputes or complications in establishing ownership.

Another frequent error is failure to verify the accuracy of the information provided. Sellers and buyers may inadvertently enter incorrect details, such as typos in the VIN or mistakes in the buyer's or seller's name and address. Such inaccuracies can lead to significant issues, including delays in the registration process and challenges in asserting ownership or responsibility in legal situations. Ensuring the precision of each entry on the form is crucial for the document to fulfill its purpose effectively.

Additionally, parties often neglect the requirement for signatures. The Texas Motor Vehicle Bill of Sale form must be signed by both the seller and the buyer to certify the accuracy of the information and the agreement to the terms of the sale. Failure to include these signatures means the document may not be legally binding. This oversight can have severe consequences, especially if discrepancies or conflicts arise later concerning the sale's terms or the vehicle’s condition.

Last but not least, overlooking the necessity of witness signatures or a notary public’s seal is a common mistake. Depending on the specific requirements of the local jurisdiction or the financial institutions involved, having the bill of sale witnessed or notarized can be crucial for its legal standing. While not always mandatory, securing a witness or notarization can add a layer of protection and authenticity to the transaction, facilitating a smoother transfer of ownership and minimizing potential legal hurdles.

Documents used along the form

When transferring the ownership of a vehicle in Texas, several documents, in addition to the Motor Vehicle Bill of Sale, play a critical role. These forms ensure a seamless and legally compliant process, providing both the buyer and the seller with a clear record of the transaction and protecting their rights. The following is a list of documents commonly used together with the Motor Vehicle Bill of Sale form during vehicle transactions in Texas.

- Vehicle Title: This is the primary document that establishes the legal ownership of the vehicle. When a vehicle is sold, the title must be transferred to the new owner, who will then need to apply for a new title in their name.

- Application for Texas Title and/or Registration (Form 130-U): This form is required for registering the vehicle and applying for a title in the new owner’s name. It captures essential details about the buyer, seller, and the vehicle itself.

- Odometer Disclosure Statement: Federal law requires that the seller disclose the vehicle’s mileage during the sale. This statement is often part of the title but if not, a separate form is required to comply with the law.

- Vehicle Inspection Report: In Texas, most vehicles must undergo a safety inspection annually. When a used vehicle is sold, the buyer will need the most recent inspection report to register the vehicle.

- Proof of Insurance: The State of Texas requires all drivers to carry a minimum amount of auto insurance. Proof of insurance must be provided when registering and titling a vehicle.

- Release of Lien: If the vehicle was previously financed, a Release of Lien may be required to prove the loan has been fully paid off and the lienholder has released their interest in the vehicle. This ensures the buyer receives a clear title.

Together, these documents provide the necessary legal framework to transfer ownership of a vehicle in Texas effectively. They confirm the buyer's legal right to own and operate the vehicle and ensure all state requirements are fulfilled. It's important for both parties to understand what each document represents and to ensure they are accurately completed and filed with the appropriate state agencies.

Similar forms

The Texas Motor Vehicle Bill of Sale form shares similarities with the Vehicle Title Transfer. Both documents serve as official records that document the change of ownership of a vehicle. They typically contain information about the vehicle, the sale price, and the names and signatures of both the seller and buyer. However, the Vehicle Title Transfer is often a formal step required by the state to legally transfer ownership and update the vehicle's registration, whereas the Bill of Sale may serve more as a receipt of the transaction.

Another similar document is the Warranty of Title, which is particularly akin to the Texas Motor Vehicle Bill of Sale form when it includes guarantees that the seller has the legal right to sell the vehicle and that the vehicle is free from any liens or claims. This parallels the Bill of Sale in assuring the buyer of the validity and legality of the transaction, offering a layer of protection against future disputes over ownership or undisclosed encumbrances.

A Promissory Note often accompanies the Texas Motor Vehicle Bill of Sale form in transactions where the buyer agrees to pay the seller for the vehicle in installments. The promissory note outlines the terms of repayment, including interest rates, payment schedule, and consequences of default. While the Bill of Sale acknowledges the transaction, the Promissory Note details the financial obligations that arise from it.

The General Receipt is another document similar to the Texas Motor Vehicle Bill of Sale form, as both serve as proof of transaction. The General Receipt is a simple document acknowledging that a payment has been made and received. Although less detailed regarding the specific terms and conditions of a sale compared to the Bill of Sale, it is crucial for the buyer and seller to have a record of the payment.

The Sales Contract shares similarities with the Texas Motor Vehicle Bill of Sale form, as it is another form of agreement between a buyer and seller regarding the sale of an item, in this case, a vehicle. The Sales Contract, however, is typically more comprehensive, including detailed terms of the sale such as warranties, delivery details, and terms of payment, which lay out the obligations and rights of each party more thoroughly than a Bill of Sale.

The Texas Motor Vehicle Bill of Sale form is also akin to the Lease Agreement in transactions where a vehicle is not sold outright but leased. The Lease Agreement details terms under which the lessee agrees to pay the lessor for the use of the vehicle over a set period. While fundamentally different in purpose—leasing versus outright selling—the documents similarly formalize an agreement between two parties regarding the use and payment for a vehicle.

Another related document is the Quitclaim Deed, typically used in real estate transactions to transfer any ownership interest the grantor may have in a property, without guaranteeing that the title is clear. Like the Texas Motor Vehicle Bill of Sale form, it is a means to transfer rights, though the Bill of Sale specifically pertains to vehicles and includes guarantees about the seller's right to sell and the vehicle's lien status.

Finally, a Gift Letter for a vehicle, similar to the Texas Motor Vehicle Bill of Sale form, is used when a vehicle is transferred as a gift rather than sold. While no financial transaction is recorded, the Gift Letter serves a similar function in officially documenting the transfer of ownership, identifying the giver and recipient, and stating the vehicle’s details. However, unlike the Bill of Sale, it typically includes a statement asserting that the transfer is a gift, thus not subject to sales tax.

Dos and Don'ts

In Texas, when completing a Motor Vehicle Bill of Sale form, it's crucial to adhere to specific guidelines to ensure the process is both legal and hassle-free. Here are some recommended dos and don'ts to follow:

What you should do:

- Double-check all vehicle information (e.g., make, model, year, VIN) for accuracy.

- Ensure both the seller and the buyer provide complete and legible information.

- Include the sale date and the agreed-upon sale price.

- Make sure both parties sign and date the form, validating the transaction.

- Keep a copy of the bill of sale for your records.

- Notify the Texas Department of Motor Vehicles (DMV) about the sale, if required.

What you shouldn't do:

- Leave any sections of the form blank.

- Use pencil or any erasable ink to fill out the form.

- Forget to check whether the form requires notarization in your area.

- Overlook any disclosures required by Texas law, such as odometer readings.

- Ignore the necessity to provide any additional documentation that may accompany the bill of sale.

- Rely solely on verbal agreements — ensure everything is documented.

Misconceptions

Many people have misconceptions about the Texas Motor Vehicle Bill of Sale form. Understanding these can make the process of buying or selling a vehicle in Texas clearer and more straightforward. Here are five common misconceptions:

- It serves as legal ownership proof. A common misconception is that the Texas Motor Vehicle Bill of Sale form alone proves legal ownership. In reality, the vehicle's title transfer is what legally signifies ownership change. The bill of sale is more of a sales receipt, documenting the transaction between the buyer and the seller.

- It's required by the state for a private sale. While it's highly recommended to have a bill of sale when conducting private vehicle transactions as it provides a written record of the sale, the state of Texas does not legally require it. However, it can be invaluable for personal records or a dispute resolution.

- There’s only one standard form. People often think there’s a single, standard form for the Texas Motor Vehicle Bill of Sale. The truth is, while there are common elements you'd expect to find in any bill of sale, such as the buyer's and seller's information, the vehicle details, and the sale price, the actual format can vary. It’s important that all necessary information is included.

- All the information on the form is legally binding. It’s a misconception that every detail listed on the bill of sale is legally binding. While the bill of sale documents the agreement between buyer and seller and includes significant details like price and vehicle condition, not all provisions added to the bill of sale may be enforceable. For instance, verbal promises not included in the bill of sale likely won't be upheld in court.

- Notarization is required for it to be valid. Another misconception is that the bill of sale must be notarized to be valid. In Texas, notarization is not a requirement for a bill of sale to be valid. However, having it notarized can add an extra layer of authenticity and may be beneficial for record-keeping or if disputes arise.

Key takeaways

When it comes to buying or selling a vehicle in Texas, the Motor Vehicle Bill of Sale form is a critical document that legally documents the transaction. This form not only provides proof of sale but also offers protection to both the buyer and seller. Understanding how to correctly fill out and use this form is essential. Here are four key takeaways that every buyer and seller in Texas should be aware of:

- Complete Information is Crucial: The Texas Motor Vehicle Bill of Sale form requires detailed information about both the buyer and seller, as well as the vehicle being sold. This includes names, addresses, the vehicle’s make, model, year, VIN (Vehicle Identification Number), and the sale price. Accurate and complete information ensures the legality of the document and aids in the transfer of ownership without obstacles.

- Signature Requirements: For the form to be legally binding, it must be signed by both the seller and the buyer. In some cases, a witness or notarization may also be required. These signatures formally acknowledge the agreement to the terms of the sale, solidifying the transfer of ownership. Always check the most current requirements as these can change.

- The Importance of an Accurate Sale Date: The sale date on the Texas Motor Vehicle Bill of Sale form is the official transfer date of the vehicle's ownership. This date is important for registration, tax purposes, and to protect both parties in case of any liabilities that arise after the sale. It is essential that the sale date reflects when the transaction actually occurred.

- Keep Records for Future Reference: Both the buyer and seller should keep a copy of the fully completed and signed Motor Vehicle Bill of Sale form. This document serves as a receipt for the transaction and may be required for registration by the buyer or for tax purposes by the seller. It's also a crucial piece of evidence if any disputes or questions about the sale or vehicle history arise at a later date.

Understanding and following these key points when filling out and using the Texas Motor Vehicle Bill of Sale form can facilitate a smoother vehicle transaction process. It’s a straightforward form, but its importance can’t be understated—it's the foundation of a legal and successful sale and purchase of a vehicle.

More Motor Vehicle Bill of Sale State Forms

Do Both Parties Have to Be Present to Transfer a Car Title in Ohio - When buying a vehicle from another state, this form can be vital for meeting registration requirements of the new state.

Used Car Bill of Sale - This form serves as proof of purchase and includes key information like the car’s make, model, year, and VIN.